Académique Documents

Professionnel Documents

Culture Documents

Customs Tariff Notifications No.30/2016 Dated 5th May, 2016

Transféré par

stephin k jCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Customs Tariff Notifications No.30/2016 Dated 5th May, 2016

Transféré par

stephin k jDroits d'auteur :

Formats disponibles

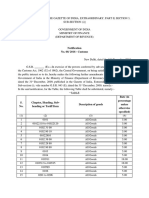

[TO BE PUBLISHED IN THE GAZETTE OF INDIA, EXTRAORDINARY, PART II,

SECTION 3, SUB-SECTION (i)]

GOVERNMENT OF INDIA

MINISTRY OF FINANCE

(DEPARTMENT OF REVENUE)

Notification

No. 30/2016-Customs

New Delhi, the 5th May, 2016

G.S. R.

(E).In exercise of the powers conferred by sub-section (1) of section 25

of the Customs Act, 1962 (52 of 1962), the Central Government being satisfied that it is

necessary in the public interest so to do, hereby makes the following further amendments in the

notification of the Government of India in the Ministry of Finance (Department of Revenue) No.

12/2012-Customs, dated the 17th March, 2012, published in the Gazette of India, Extraordinary,

Part II, Section 3, Sub-section (i) vide number G.S.R. 185 (E), dated the 17th March, 2012,

namely:In the said notification,(A)

in the Table,-

(i)

in serial number 163A, for the entry in column (3), the entry Medical use fission

Molybdenum-99 (Mo-99) for use in the manufacture of radio pharmaceuticals shall be

substituted;

(ii)

after serial number 305A and the entries relating thereto, the following serial number and

entries shall be inserted, namely :(1)

(2)

(3)

(4)

(5)

(6)

305B

70

Preform of silica for use in the manufacture of 5%

5;

telecommunication grade optical fibres or

optical fibre cables.

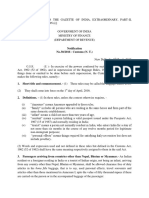

(iii)

after serial number 430 and the entries relating thereto, the following serial number and

entries shall be inserted, namely :(1)

(2)

(3)

(4)

(5)

(6)

430A

Any

Charger or adapter, battery, wired headsets for Nil

5;

Chapter use in manufacture of mobile handsets

including cellular phones

(iv)

against serial number 431, in column (3), in item (i), the words and speakers shall be

omitted;

(v)

serial number 431D and entries relating thereto shall be omitted;

(vi)

against serial number 431E, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(vii)

against serial number 431F, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(viii)

against serial number 431G, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(ix)

against serial number 431H, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(x)

against serial number 431-I, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(xi)

against serial number 431J, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(xii)

against serial number 431K, in column (3), in item (a), after the words Parts,

components and accessories, the brackets and words (except populated printed circuit

boards) shall be inserted;

(xiii)

after serial number 431K and the entries relating thereto, the following serial number and

entries shall be inserted, namely :(1)

(2)

(3)

(4)

(5)

(6)

431L

Any Chapter (a) Parts or components for use in Nil

5

manufacture of populated printed circuit

board of,(i) Lithium-ion battery other than

battery for mobile handset [tariff

item 8507 60 00];

(ii) Broadband modem [tariff item 8517

62 30];

(iii) Router [tariff item 8517 69 30];

(iv) Set-top box for gaining access to

internet [tariff item 8517 69 60];

(v) Digital

Video

Recorder

(DVR)/Network Video Recorder

(NVR) [tariff item 8521 90 90];

(vi) CCTV Camera/IP Camera [tariff

item 8525 20 80];

(vii) Reception apparatus for television

but not designed to incorporate a

video display [tariff item 8528 71

00];

(b) Sub-parts for use in the manufacture of

the parts or components in item (a) above.

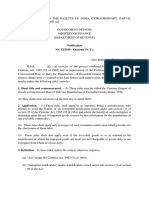

(xiv)

Nil

5;

against serial number 448, in column (3), for the exisiting entry, the following entry shall

be substituted, namely:Parts, testing equipment, tools and tool-kits for maintenance, repair, and overhauling

of,(i) aircraft falling under heading 8802; or

(ii) components or parts, including engine, of aircrafts of heading 8802,

by the units engaged in such activities.

(xv) after serial number 448A and the entries relating thereto, the following serial number and

entries shall be inserted, namely:(1)

(2)

(3)

(4)

(5)

(6)

448B 8803

Components or parts, including engines,

Nil

Nil 73B;

of aircraft of heading 8802

(B)

(i)

in the ANNEXURE,for Condition No. 73, the following Condition shall be substituted, namely:Condition

No.

73.

Condition

If,(A) imported by units approved by Director General of Civil

Aviation in the Ministry of Civil Aviation, for maintenance, repair,

or overhauling of(a) aircraft registered in India; or

(b) aircraft not registered in India, which are brought into

India for the purpose of flight to or across India, or for the

purpose of maintenance, repair or overhauling and which are

intended to be removed from India within six months or for

such periods as extended by the Director General of Civil

Aviation, as the case may be; or

(c) aircraft components or parts, including engines of

aircrafts;

(B) the importer submits documents duly certified by the Director

General of Civil Aviation approved Quality Managers of aircraft

maintenance organisations indicating such parts, testing equipment,

tools and tool-kits;

(C) the importer maintains a proper account of import, use and

consumption of the specified goods imported for the purpose of

servicing, repair and maintenance of aircrafts, aircraft components,

parts including engines of aircrafts and submits such account

periodically to the Commissioner of Customs in such manner as

may be specified by the said Commissioner;

(D) the importer, by the execution of bond, in such form and for

such sum as may be specified by the said Commissioner, binds

himself to pay on demand an amount equal to the duty leviable,(i) on parts, tools and tool kits as are not proved to the

satisfaction of the said Commissioner to have been used or

consumed for the aforesaid purpose;

(ii) on the testing equipment, as are not proved to the

satisfaction of the said Commissioner to have been installed

or otherwise used for the aforesaid purposes,

within a period of three years from the date of importation thereof

or within such extended period as that Commissioner, on being

satisfied that there is sufficient cause for not installing, using or

consuming as the case may be, for the aforesaid purposes within the

said period, allow.;

(ii) after Condition No. 73A, the following Condition shall be inserted, namely:Conditio

Conditions

n No.

73B

If the components or parts, including engines, of aircraft of heading 8802, is

imported for maintenance, repair or overhauling by units approved by the

Director General of Civil Aviation in the Ministry of Civil Aviation for the said

purpose and such components or parts, including engines, of aircraft of heading

8802 are exported subsequent to such maintenance, repair or overhauling..

[F. No. 334/8/2016-TRU]

(Anurag Sehgal)

Under Secretary

Note.- The principal notification No. 12/2012-Customs, dated the 17th March, 2012 was

published in the Gazette of India, Extraordinary, Part II, Section 3, Sub-section (i) vide number

G.S.R. 185(E), dated the 17th March, 2012 and last amended by notification No. 29/2016Customs, dated the 26th April, 2016, published in the Gazette of India, Extraordinary, Part II,

Section 3, Sub-section (i) vide, number G.S.R 444(E), dated the 26th April, 2016.

Vous aimerez peut-être aussi

- Customs Circular No.10/2016 Dated 15th March, 2016Document4 pagesCustoms Circular No.10/2016 Dated 15th March, 2016stephin k jPas encore d'évaluation

- Customs Circular No.03/2015 Dated 3rd February, 2016Document4 pagesCustoms Circular No.03/2015 Dated 3rd February, 2016stephin k jPas encore d'évaluation

- Customs Circular No.05/2015 Dated 9th February, 2016Document21 pagesCustoms Circular No.05/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 25/2015 Dated 15th October, 2015Document10 pagesCustoms Circular No. 25/2015 Dated 15th October, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 27/2015 Dated 23rd October, 2015Document13 pagesCustoms Circular No. 27/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No.04/2015 Dated 9th February, 2016Document5 pagesCustoms Circular No.04/2015 Dated 9th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 28/2015 Dated 23rd October, 2015Document3 pagesCustoms Circular No. 28/2015 Dated 23rd October, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 18/2015 Dated 9th Jun, 2015Document2 pagesCustoms Circular No. 18/2015 Dated 9th Jun, 2015stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.66/2016 Dated 31st December, 2016Document26 pagesCustoms Tariff Notifications No.66/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 06/2015 Dated 11th February, 2015Document1 pageCustoms Circular No. 06/2015 Dated 11th February, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 20/2015 Dated 31st July 2015Document15 pagesCustoms Circular No. 20/2015 Dated 31st July 2015stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.67/2016 Dated 31st December, 2016Document34 pagesCustoms Tariff Notifications No.67/2016 Dated 31st December, 2016stephin k j100% (2)

- Customs Circular No. 03/2015 Dated 16th January, 2015Document2 pagesCustoms Circular No. 03/2015 Dated 16th January, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 16/2015 Dated 19th May, 2015Document6 pagesCustoms Circular No. 16/2015 Dated 19th May, 2015stephin k jPas encore d'évaluation

- Customs Circular No. 13/2014 Dated 18th November, 2014Document3 pagesCustoms Circular No. 13/2014 Dated 18th November, 2014stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.34/2016 Dated 29th February, 2016Document2 pagesCustoms Non Tariff Notifications No.34/2016 Dated 29th February, 2016stephin k jPas encore d'évaluation

- Customs Circular No. 10/2014 Dated 17th October, 2014Document3 pagesCustoms Circular No. 10/2014 Dated 17th October, 2014stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.22/2016 Dated 8th February, 2016Document9 pagesCustoms Non Tariff Notifications No.22/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.64/2016 Dated 31st December, 2016Document22 pagesCustoms Tariff Notifications No.64/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.63/2016 Dated 31st December, 2016Document38 pagesCustoms Tariff Notifications No.63/2016 Dated 31st December, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.11/2016 Dated 12th January, 2016Document3 pagesCustoms Non Tariff Notifications No.11/2016 Dated 12th January, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.30/2016 Dated 1st March, 2016Document6 pagesCustoms Non Tariff Notifications No.30/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.54/2016 Dated 3rd October, 2016Document6 pagesCustoms Tariff Notifications No.54/2016 Dated 3rd October, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.32/2016 Dated 1st March, 2016Document5 pagesCustoms Non Tariff Notifications No.32/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.31/2016 Dated 1st March, 2016Document2 pagesCustoms Non Tariff Notifications No.31/2016 Dated 1st March, 2016stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.26/2016 Dated 16th February, 2016Document11 pagesCustoms Non Tariff Notifications No.26/2016 Dated 16th February, 2016stephin k jPas encore d'évaluation

- Customs Tariff Notifications No.37/2014 Dated 29th December, 2014Document60 pagesCustoms Tariff Notifications No.37/2014 Dated 29th December, 2014stephin k jPas encore d'évaluation

- Customs Non Tariff Notifications No.20/2016 Dated 8th February, 2016Document4 pagesCustoms Non Tariff Notifications No.20/2016 Dated 8th February, 2016stephin k jPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Siddaganga Institute of Technology, Tumakuru - 572 103.: Provisional Results of Even Semester End Examinations May 2016Document3 pagesSiddaganga Institute of Technology, Tumakuru - 572 103.: Provisional Results of Even Semester End Examinations May 2016Divyanshu AnandPas encore d'évaluation

- Handbook: E LightingDocument1 pageHandbook: E LightingreacharunkPas encore d'évaluation

- ReportDocument13 pagesReportMamta SindhuPas encore d'évaluation

- Indonesia Rules and Regulations (CASR) For PPLDocument11 pagesIndonesia Rules and Regulations (CASR) For PPLabi_5dec94Pas encore d'évaluation

- UTM Grid Datum WGS 84 Track with Speed, Time and Position DataDocument289 pagesUTM Grid Datum WGS 84 Track with Speed, Time and Position Databenghy SoportePas encore d'évaluation

- A320 V2500 Idle IndicationDocument3 pagesA320 V2500 Idle IndicationcwzjhonPas encore d'évaluation

- Rainbow CatalougeDocument5 pagesRainbow Catalougeapi-257794235Pas encore d'évaluation

- EfS Science TextDocument2 pagesEfS Science TextPaulus Bayu Mario EgaPas encore d'évaluation

- Accident Report For Deadly 2015 Plane CrashDocument12 pagesAccident Report For Deadly 2015 Plane CrashĐàm Lee NellePas encore d'évaluation

- Airbus AIPX7 CROR Design Features and Aerodynamics - Negulescu 2013Document17 pagesAirbus AIPX7 CROR Design Features and Aerodynamics - Negulescu 2013Wouterr GPas encore d'évaluation

- Operation Manual: Turboprop EngineDocument42 pagesOperation Manual: Turboprop EngineBeka KarumidzePas encore d'évaluation

- Bensen B-8 - WikipediaDocument3 pagesBensen B-8 - Wikipediaعبدالحافظ زايدPas encore d'évaluation

- Aviation Document Booklet GuideDocument26 pagesAviation Document Booklet GuiderenebavardPas encore d'évaluation

- Giant ReportDocument9 pagesGiant ReportStephen SmithPas encore d'évaluation

- VorticityDocument9 pagesVorticitySwej ShahPas encore d'évaluation

- Civil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMDocument10 pagesCivil Engineering Important MCQ PDF-Hydraulics and Fluid Mechanics Part 3 - WWW - ALLEXAMREVIEW.COMMuhammad WaqarPas encore d'évaluation

- STEERING GEAR TEST ROUTINES CHECKLISTDocument2 pagesSTEERING GEAR TEST ROUTINES CHECKLISTIgor dos Reis MatosPas encore d'évaluation

- Sokkia 2015 Supply CatalogDocument40 pagesSokkia 2015 Supply Catalogbbutros_317684077Pas encore d'évaluation

- Hartzell Compact Propeller ManualDocument240 pagesHartzell Compact Propeller ManualJoe Pensula100% (1)

- DASH-8 SOP CompleteDocument181 pagesDASH-8 SOP CompleteNil100% (11)

- Commercial Craft Thruster Systems 2014 enDocument100 pagesCommercial Craft Thruster Systems 2014 enMefPas encore d'évaluation

- AE1102 Structures Slides 3Document26 pagesAE1102 Structures Slides 3SaraPas encore d'évaluation

- 737NG Family Specs, Fleet Developments & Fuel Burn AnalysisDocument21 pages737NG Family Specs, Fleet Developments & Fuel Burn AnalysiscypPas encore d'évaluation

- Airports Authority of India: Air Traffic Flow Management - IndiaDocument40 pagesAirports Authority of India: Air Traffic Flow Management - IndiaPrathmesh RelekarPas encore d'évaluation

- Ps 3Document3 pagesPs 3Yusuf Sahin0% (1)

- Torque SnaponDocument19 pagesTorque SnaponBilly ZununPas encore d'évaluation

- ZukasDocument33 pagesZukasahmadomar89Pas encore d'évaluation

- Carbon FibreDocument25 pagesCarbon Fibrejagadish.kvPas encore d'évaluation

- December 2012Document52 pagesDecember 2012sake1978Pas encore d'évaluation

- Coc Quick Reference GuideDocument8 pagesCoc Quick Reference Guidepknight2010Pas encore d'évaluation