Académique Documents

Professionnel Documents

Culture Documents

D

Transféré par

ανατολή και πετύχετεTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

D

Transféré par

ανατολή και πετύχετεDroits d'auteur :

Formats disponibles

http://quotes.wsj.com/PH/XPHS/atn/historical-prices/download?

mod_view=page&num_rows=180&range_days=180&sta

http://quotes.wsj.com/PH/XPHS/web/historical-prices/download?mod_view=page&

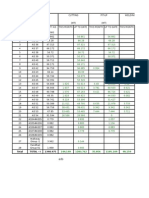

BEST FIRM DAILY ANALYSIS

Wednesday, March 23, 2016

2GO

Close

7.34

ABS

59.3

AC

SYMBOL

10 day SMA Vol Analysis

186700

CMF

50 SMA

HH,HL,LL

RSI

STS

Bearish

Bullish

Bearish

65.18

80.49

7.32

7.45

76679

Bearish

Bullish

Bullish

80.62

92.92

59.07

59.60

749.5

473064

Bearish

Bullish

65.99

71.82

746.14

751.87

AEV

63.8

1606180

Bullish

Bullish

74.07

84.82

61.83

64.50

AGF

2.97

210200

Bullish

Bullish

54.01

30.65

2.96

3.03

AGI

16.06

8713740

Bullish

Bullish

72.42

84.00

16.00

16.09

ALI

36.2

13061830

Bearish

Bullish

Bearish

64.15

63.74

35.77

36.69

ANI

4.94

1451950

Bearish

Bullish

Bullish

40.30

42.86

4.87

4.97

AP

43.5

2652630

Bearish

Bullish

Bearish

55.71

38.46

43.17

44.23

APC

0.56

1184600

#DIV/0!

Bullish

64.29

80.95

0.56

0.56

AR

0.005

77600000

#DIV/0!

Bullish

60.05 100.00 0.00428

ARA

1.62

535400

Bullish

Bullish

Bearish

62.75

70.27

1.56

1.63

ATN

0.285

2253000

#DIV/0!

Bullish

Bearish

84.44

91.53

0.28

0.29

BDO

105

2976476

Bearish

Bullish

Bearish

69.92

83.33

104.60

105.60

BHI

0.073

2253000

Bullish

Bullish

Bullish

76.14

92.00

0.07

0.07

BLOOM

5.29

11453550

Bullish

Bullish

74.16

75.96

5.18

5.37

BSC

0.24

419000

Bullish BIG #DIV/0!

Bullish

Bearish

41.23

44.44

0.24

0.25

CAL

3.38

584300

Bearish BIG Bearish

Bullish

Bearish

62.00

58.49

3.36

3.50

CEI

0.128

7754000

#DIV/0!

Bullish

Bearish

58.50

60.00

0.128

0.128

CNPF

18.6

1390400

Bearish

Bullish

Bearish

70.30

71.25

18.51

18.88

COAL

0.475

2170000

#DIV/0!

Bullish

Bearish

60.44

45.00

0.47

0.48

COSCO

7.35

2143280

Bearish

Bullish

Bearish

52.38

22.73

7.31

7.45

CPG

0.55

4770400

Bearish

Bullish

42.13

50.00

0.55

0.56

CROWN

2.47

1093200

Bearish

Bullish

60.32

66.67

2.43

2.53

CYBR

0.49

11133400

#DIV/0!

Bullish

Bearish

63.73

55.56

0.49

0.50

DAVIN

5.83

8530140

Bearish

Bullish

Bearish

68.84

67.83

5.77

5.99

DD

39.35

3472490

Bullish

Bullish

Bearish

90.65

96.09

38.95

39.45

DIZ

7.99

92910

Bullish

Bullish

Bullish

64.16

79.00

7.92

8.06

DMC

13.4

6319440

Bearish BIG Bearish

Bullish

Bearish

61.94

70.51

13.29

13.73

DMPL

11.4

217000

Bullish

Bearish

Bearish

48.31

3.23

11.37

11.46

DNL

9.39

5536060

Bullish

Bullish

61.27

88.66

9.26

9.40

EDC

5.95

18243760

Bullish BIG Bearish

Bullish

52.70

12.28

5.93

5.99

EEI

7.19

435670

Bearish

Bullish

50.92

55.38

7.12

7.20

EMP

7.2

4455380

Bearish

Bearish

44.75

6.48

7.19

7.31

FGEN

20.75

4586560

Bullish

Bullish

Bearish

51.31

48.21

20.48

21.12

FLI

1.75

20411200

Bullish

Bullish

Bearish

72.10

71.88

1.74

1.80

FNI

0.82

54021900

Bearish

Bullish

Bearish

60.79

63.16

0.82

0.84

FOOD

0.76

90600

#DIV/0!

Bullish

Bullish

66.57

88.89

0.74

0.77

Bearish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bearish

Bearish

FibSupport FibResistance

0.005049

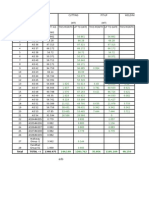

FPI

0.213

142000

#DIV/0!

Bullish

35.47

23.81

0.21

0.21

GEO

0.285

2547000

Bullish

Bullish

44.82

14.29

0.28476

0.288577

GERI

1.04

6041000

Bearish

Bullish

Bearish

63.88

61.90

1.02

1.06

GLO

2166

187907

Bearish

Bullish

Bearish

68.87

87.92

2118.08

2200.59

GMA7

6.92

228830

Bullish

Bullish

66.03

86.05

6.92

6.94

GSMI

11.5

2470

#DIV/0!

Bearish

Bullish

60.45

30.16

11.40

12.10

H2O

3.36

11800

Bullish BIG #DIV/0!

Bullish

Bearish

94.99

76.27

3.10

3.38

HOLCM

13.8

32370

#DIV/0!

Bearish

49.16

42.86

13.80

13.81

HOUSE

7.72

483660

Bullish

Bullish

Bearish

74.56

67.39

7.56

7.75

IDC

3.53

1891400

Bearish

Bullish

Bullish

76.82

89.83

3.49

3.62

IMI

5.63

288600

Bearish

Bullish

Bullish

57.57

50.00

5.62

5.75

ION

2.89

8391600

Bearish BIG Bearish

Bullish

Bullish

66.20

50.70

2.81

3.14

IS

0.29

117909000

Bearish

Bullish

Bullish

73.89

82.61

0.28236

0.29764

ISM

1.31

3662900

Bearish

Bullish

Bearish

61.56

50.00

1.29

1.34

LC

0.285

52609000

Bullish

Bullish

43.64

11.11

0.28118

0.28882

LIB

3.63

981400

Bullish

Bearish

Bearish

41.07

35.33

3.58

3.63

LPZ

6.5

6283280

Bullish

Bullish

Bearish

80.17

94.31

6.38

6.54

LTG

15.8

4706730

Bearish BIG Bearish

Bullish

Bearish

42.88

46.67

15.78

15.90

MAC

2.8

46900

#DIV/0!

Bullish

84.07 100.00

2.76

2.80

MACAY

37.4

#DIV/0!

Bearish

31.43

81.36

37.40

37.40

MARC

2.09

579900

Bearish

Bullish

Bearish

58.57

26.92

2.09

2.12

MAXS

21.6

1393840

Bullish BIG Bearish

Bullish

Bullish

82.61

92.28

21.22

21.91

MB

0.55

49000

#DIV/0!

Bullish

47.69

50.00

0.55

0.55

MBT

87.2

3510440

Bullish

Bullish

Bearish

83.84

96.28

86.44

87.36

MCP

2.71

32515400

Bearish

Bullish

Bearish

68.84

67.82

2.70

2.80

MED

0.57

1334700

#DIV/0!

Bullish

Bearish

58.15

18.18

0.57

0.58

MEG

4.12

38734800

Bullish

Bullish

Bearish

70.96

81.13

4.05

4.17

MER

318

300588

Bearish

Bullish

Bullish

47.69

17.65

317.66

323.01

MPI

5.95

33428340

Bullish

Bullish

Bearish

54.87

67.57

5.93

5.99

MRC

0.097

8365000

#DIV/0!

Bullish

Bullish

60.77

60.00

0.09342

0.097243

MWC

26.8

958010

Bullish

Bullish

45.55

69.23

26.59

26.81

NIKL

5.55

5651510

Bullish

Bullish

62.03

23.94

5.51

5.60

NOW

0.87

11310700

Bearish BIG Bearish

Bullish

58.65

65.38

0.87

0.92

OM

0.52

22100

#DIV/0!

Bearish

14.95

0.00

0.52

0.52

OPM

0.01

20300000

#DIV/0!

Bullish

51.30

50.00

0.01

0.01

ORE

1.27

173900

#DIV/0!

Bullish

53.29

61.11

1.27

1.31

OV

0.013

128390000

#DIV/0!

Bullish

64.34 100.00

0.01

0.01

PA

0.033

106480000

Bullish

Bullish

53.00

42.86

0.03

0.03

PCOR

10.58

9864830

Bullish

Bullish

70.09

96.58

10.31

10.63

PF

166

17327

#DIV/0!

Bullish

68.16

88.20

162.28

168.39

PGOLD

36.4

3962460

Bearish

Bullish

58.92

68.89

36.08

36.92

PHA

0.45

1224000

#DIV/0!

Bullish

65.60

54.55

0.44

0.45

Bearish BIG

Bullish BIG

Bullish BIG

Bullish BIG

Bullish

Bearish

Bearish

Bearish

PHES

0.235

886000

#DIV/0!

Bullish

54.66

73.68

0.23

0.24

PIP

3.99

548300

Bullish

Bullish

82.54

95.60

3.92

4.02

PLC

0.96

37374400

Bearish

Bullish

64.51

75.00

0.95

0.97

PNX

4.34

507100

#DIV/0!

Bullish

90.50

98.21

4.30

4.35

POPI

1.97

669000

Bearish

Bearish

Bearish

33.86

22.22

1.96

2.00

PPC

2.7

269700

Bearish

Bullish

Bullish

47.77

18.87

2.67

2.77

PSPC

1.75

357100

Bearish

Bullish

Bullish

45.69

81.48

1.73

1.79

PX

5.86

4295084.2

Bullish

Bullish

Bearish

67.94

68.64

5.78

5.96

PXP

2.21

8859500

Bearish

Bullish

Bearish

59.62

49.56

2.18

2.38

REG

2.75

5100

#DIV/0!

Bullish

78.26 100.00

2.75

2.75

RFM

4.17

3514500

Bearish

Bullish

66.81

80.65

4.16

4.19

RLC

28.55

2980550

Bearish

Bullish

62.12

59.30

28.36

29.24

RLT

0.46

60000

#DIV/0!

Bullish

65.08 100.00

0.46

0.46

ROCK

1.5

421800

#DIV/0!

Bullish

53.21

63.64

1.50

1.50

ROX

4.8

35440

#DIV/0!

Bearish

51.34

40.98

4.78

5.05

RRHI

69.25

2369109

Bearish

Bullish

Bearish

62.74

70.33

68.99

70.51

RWM

3.92

6808900

Bullish

Bullish

Bullish

57.59

53.33

3.86

4.02

SBS

6.16

1664000

Bullish

Bullish

Bearish

62.12

28.18

6.13

6.19

SCC

130.8

709505

Bearish

Bullish

Bearish

59.19

41.61

128.52

132.88

SECB

162

1256264

Bullish

Bullish

Bearish

86.79

93.55

158.36

163.24

SEVN

100

119571

#DIV/0!

Bearish

43.85

16.67

99.78

103.22

SFI

0.157

6791000

Bearish

Bullish

52.98

40.00

0.16

0.16

SGI

1.1

495200

#DIV/0!

Bullish

54.10

45.45

1.10

1.11

SLI

0.86

2041400

Bullish

Bullish

65.68 100.00

0.83

0.86

SM

989.5

347207

Bearish

Bullish

SMC

76.9

675134

Bullish

Bullish

SMPH

22.55

17315840

Bullish

Bullish

SOC

0.77

111000

#DIV/0!

Bullish

SPH

2.47

538300

Bullish BIG #DIV/0!

Bullish

SPM

2.3

14800

#DIV/0!

Bearish

SRDC

0.8

#DIV/0!

SSI

3.42

6776600

STI

0.54

3416700

STR

5.9

25170

SUN

1.21

3387400

TA

2.7

11282100

TECH

17.5

366470

TEL

1920

TFHI

Bearish BIG

Bullish BIG

Bearish BIG

Bullish

Bearish

Bearish

73.16

86.42

988.06

994.94

69.13

65.67

76.69

77.31

70.72 100.00

22.19

22.57

47.88

30.00

0.77

0.77

Bullish

59.36

66.67

2.47

2.49

Bullish

35.83 100.00

2.30

2.30

Bearish

100.00 #####

0.80

0.80

Bearish

Bullish

41.86

42.86

3.41

3.44

Bullish

Bullish

65.91

66.67

0.53

0.54

Bullish BIG

#DIV/0!

Bullish

54.23 100.00

5.76

5.91

Bullish BIG

Bullish

Bullish

Bullish

72.57 100.00

1.09

1.22

Bearish

Bullish

Bearish

73.50

77.78

2.66

2.72

Bearish

Bearish

Bearish

38.54

0.00

17.47

18.00

270784.5

Bullish

Bearish

Bearish

36.97

71.01

1894.97

1953.03

169.1

85104

Bearish

Bullish

Bullish

66.11

84.01

160.52

169.68

TUGS

1.25

334700

#DIV/0!

Bullish

Bearish

54.99

33.33

1.21

1.25

UNI

0.31

3904000

#DIV/0!

Bullish

Bearish

49.20

16.67

0.30642

0.310243

VITA

0.7

10539000

Bearish

Bullish

Bearish

52.35

17.24

0.70

0.76

Bearish BIG

Bullish BIG

Bearish BIG

Bearish

Bullish

VLL

4.59

6971100

Bearish

Bullish

VMC

4.68

1067200

#DIV/0!

VUL

1.14

117000

WEB

22.15

WIN

Bearish

54.80

47.06

4.59

4.66

Bullish

54.81

61.90

4.62

4.68

#DIV/0!

Bullish

58.28

15.38

1.14

1.18

213530

Bearish

Bearish

28.61

79.41

22.04

22.19

0.195

1349000

#DIV/0!

Bearish

46.89

11.54

0.19

0.20

17.02

3152520

Bearish

Bullish

Bearish

70.50

64.53

16.94

17.13

YEHEY

4.72

34000

#DIV/0!

Bullish

Bearish

49.66

39.47

4.72

4.76

ZHI

0.295

233000

#DIV/0!

Bullish

54.78

75.00

0.295

0.295

LEGEND

10 DAY VOL SMA

An analysis of 10 day simple moving average of volume of a stock.

VOLUME ANALYSIS

If today's volume exceeds the price of a 10 day sma VOLUME , the stock is bullish,if not, it is bearish

CMF(Chaikin Money Flow)

the indicator uses the difference between a 3-day exponentially-weighted moving average (EMA) of the

accumulation/distribution line and the 10-Day EMA of the Accumulation/Distribution Line

50 SMA

An analysis of 50 day simple moving average OF THE CLOSING PRICE of a stock.

HH,HL, LL

HH stands for Higher High, HL stands for Higher Low, and LL stands for Lower Low

If a stock have a HH and HL condition, it is BULLISH because it creates a new high in the HIGH and new high for the LOW of a stock for that day.

If a stock have a LL condition, this means a stock is BEARISH because it creates a new low in the HIGH and new low for the LOW of a stock for that day.

RSI(Relative Strenght Index)

a momentum oscillator that measures the speed and change of price movements. RSI oscillates between zero and 100.

Traditionally, and according to Wilder, RSI is considered overbought when above 70 and oversold when below 30.

STS(Stochastics

Readings above 80 for the 20-day Stochastic Oscillator would indicate that the underlying security was trading near the top of its 20-day high-low range

and it is considered OVERBOUGHT. Readings below 20 occur when a security is trading at the low end of its high-low range and it is considered

OVERSOLD.

SUPPORT AND RESISTANCE

SUPPORT is a level where the price tends to find support as it falls. This means the price is more likely to "bounce" off this level

rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely to

continue falling until meeting another support level

RESISTANCE is a level where the price tends to find resistance as it rises. This means the price is more likely to "bounce" off this

level rather than break through it. However, once the price has breached this level, by an amount exceeding some noise, it is likely

to continue rising until meeting another resistance level.

The Materials Contained here are for guidance & Educational Purposes Only. All Indicators are carefully

analyzed to help assist traders in getting RELIABLE RESOURCES and INFORMATIONS that they can use

in their strategy in trading and further study.Due diligence before attempting to follow the signals stated

above.Thank You

ODIELON O. GAMBOA

Vous aimerez peut-être aussi

- Bfa Dailyanalysis (1) AdaDocument4 pagesBfa Dailyanalysis (1) Adaανατολή και πετύχετεPas encore d'évaluation

- Best Firm Daily Analysis: Friday, March 18, 2016Document4 pagesBest Firm Daily Analysis: Friday, March 18, 2016ανατολή και πετύχετεPas encore d'évaluation

- Best Firm Daily Analysis: Thursday, March 17, 2016Document4 pagesBest Firm Daily Analysis: Thursday, March 17, 2016ανατολή και πετύχετεPas encore d'évaluation

- Bfa DailyanalysisDocument4 pagesBfa Dailyanalysisανατολή και πετύχετεPas encore d'évaluation

- Stock CodeDocument17 pagesStock CodeTimberevilake HardjosantosoPas encore d'évaluation

- Indices Auto Saved)Document16 pagesIndices Auto Saved)Ashu LeePas encore d'évaluation

- Best Portfolio Shares InvestmentsDocument4 pagesBest Portfolio Shares Investmentssathi2317411Pas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Technical Guide: FinancialsDocument9 pagesTechnical Guide: FinancialswindsingerPas encore d'évaluation

- Picks of The DayDocument2 pagesPicks of The DaygllugaPas encore d'évaluation

- MonitorDocument63 pagesMonitorJi YanbinPas encore d'évaluation

- Hasil Akhir Us TulisDocument3 pagesHasil Akhir Us Tulisᮔᮔ᮪ᮓᮀ ᮞᮨᮒᮤᮃ ᮔᮥᮌᮢᮠPas encore d'évaluation

- TransDocument6 pagesTransMʀ NʌʆʀɩsPas encore d'évaluation

- I - Project - Kelompok 4Document8 pagesI - Project - Kelompok 4Nadia Puspita Ayu NingtyasPas encore d'évaluation

- Fibonacci and Clouds 21 February 2016Document3 pagesFibonacci and Clouds 21 February 2016Jun GomezPas encore d'évaluation

- M 65WDocument52 pagesM 65WChelseaE82Pas encore d'évaluation

- Field 88 - Block 99 Reservoir 100: STOIIP (MM STB) : 134495941.xls - Ms - OfficeDocument20 pagesField 88 - Block 99 Reservoir 100: STOIIP (MM STB) : 134495941.xls - Ms - Officeماهر زارعيPas encore d'évaluation

- A11 KomkepDocument1 pageA11 KomkepLilis FatmawatiPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document5 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document6 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document5 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- Total Total - I 1398.975Document4 pagesTotal Total - I 1398.975sajulehPas encore d'évaluation

- ADocument8 pagesAali imranPas encore d'évaluation

- Intraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleDocument4 pagesIntraday Traing Strategies Open High Low Top Gainers Top Index Top F&O 52 High Low Day High Low Gap Up 15 Min CandleGeorge Khris DebbarmaPas encore d'évaluation

- Fassonformen Für Oboe Shaper Forms For OboeDocument5 pagesFassonformen Für Oboe Shaper Forms For Oboebaroon1234Pas encore d'évaluation

- TE Student Info FinalDocument44 pagesTE Student Info FinalSajjad HussainPas encore d'évaluation

- Bảng ESHF-tsDocument2 pagesBảng ESHF-tsThiên TrầnPas encore d'évaluation

- Table A8-10. Free-Flow Discharge Through 6-Inch Parshall MeasuringDocument1 pageTable A8-10. Free-Flow Discharge Through 6-Inch Parshall MeasuringoctatheweelPas encore d'évaluation

- 4th TranceDocument4 pages4th TranceEl ToreroPas encore d'évaluation

- Quantification of Cytokine IL-6 Expt AN 72-7Document14 pagesQuantification of Cytokine IL-6 Expt AN 72-7goutham278Pas encore d'évaluation

- Trader's Daily Digest - 19.04.2016Document7 pagesTrader's Daily Digest - 19.04.2016Sudheera IndrajithPas encore d'évaluation

- Technical Analysis For 2 CompaniesDocument6 pagesTechnical Analysis For 2 CompaniesShinchana KPas encore d'évaluation

- Date Nav Units Cashflow Amount SWP Value: SWP For Aditya Birla Sun Life Equity Hybrid'95 Fund - Regular Plan-GrowthDocument6 pagesDate Nav Units Cashflow Amount SWP Value: SWP For Aditya Birla Sun Life Equity Hybrid'95 Fund - Regular Plan-Growthkhushboo ChhajedPas encore d'évaluation

- Od Asb 2012Document4 pagesOd Asb 2012Haqim IskandarPas encore d'évaluation

- Agustus 2019Document94 pagesAgustus 2019jokoPas encore d'évaluation

- Paint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacDocument8 pagesPaint Industry Date Asian Paints Shalimar Paints Berger Paints Akzo Nobel Kansai NerolacKhushboo RajPas encore d'évaluation

- Mys May-12 Sec and CloDocument27 pagesMys May-12 Sec and CloRekha MahadevPas encore d'évaluation

- Lampiran Harga ClosingDocument5 pagesLampiran Harga ClosingIndira BrotosenoPas encore d'évaluation

- ADocument8 pagesAali imranPas encore d'évaluation

- Book 1Document48 pagesBook 1njwa6284Pas encore d'évaluation

- Pipe Schedule ThicknessDocument1 pagePipe Schedule ThicknessSaut Maruli Tua SamosirPas encore d'évaluation

- Nominal Pipe Size InchesDocument1 pageNominal Pipe Size InchesSamer BayatiPas encore d'évaluation

- MDRT Data 14.06.2023Document4 pagesMDRT Data 14.06.2023Sudeep MandalPas encore d'évaluation

- 3 - Oa All 18-23 Mar 2024 AlzDocument1 page3 - Oa All 18-23 Mar 2024 AlzMahika PrintingPas encore d'évaluation

- RVR Land Promoters: NEW LIST 11-08-2015Document32 pagesRVR Land Promoters: NEW LIST 11-08-2015speroPas encore d'évaluation

- PABS VS PFMS PRODUCTION 2022 As of 2023 01 30 FR TB 021023 JacqDocument12 pagesPABS VS PFMS PRODUCTION 2022 As of 2023 01 30 FR TB 021023 JacqPCIC R08Pas encore d'évaluation

- EcaDocument6 pagesEcaOMAR ARMANDO BAEZ PARRADOPas encore d'évaluation

- Copia de Desglose TEBCADocument3 pagesCopia de Desglose TEBCAcoralrlPas encore d'évaluation

- Veya Veya Veya 1 0 2Document7 pagesVeya Veya Veya 1 0 2Yonca GözüaçıkPas encore d'évaluation

- Hasil Ujian Kuis Ap1Document2 pagesHasil Ujian Kuis Ap1Rizky Hd-rPas encore d'évaluation

- Profitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019D'EverandProfitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019Pas encore d'évaluation

- Complaint Affidavit SampleDocument2 pagesComplaint Affidavit SampleDonna Gragasin78% (125)

- MTA Curriculum DescriptionDocument3 pagesMTA Curriculum Descriptionανατολή και πετύχετεPas encore d'évaluation

- HR-V1 WebDocument70 pagesHR-V1 WebsouPas encore d'évaluation

- 2013spr cmt1Document5 pages2013spr cmt1Nguyễn Hữu TuấnPas encore d'évaluation

- Chartered Market Technician (CMT) Program Level 2: May 2013 Reading AssignmentsDocument4 pagesChartered Market Technician (CMT) Program Level 2: May 2013 Reading Assignmentsανατολή και πετύχετεPas encore d'évaluation

- Bataclan vs. MedinaDocument2 pagesBataclan vs. Medinaανατολή και πετύχετεPas encore d'évaluation

- Civil Procedure - MwNwIo5Rs6cBBO1gwlroDocument815 pagesCivil Procedure - MwNwIo5Rs6cBBO1gwlroTaj Martin100% (13)

- Introduction To PsychologyDocument45 pagesIntroduction To PsychologyKhristine Lerie PascualPas encore d'évaluation

- Labor Law Dau SchmidtDocument49 pagesLabor Law Dau Schmidtανατολή και πετύχετεPas encore d'évaluation

- Law 125 SyllabusDocument5 pagesLaw 125 SyllabusJoshua LaronPas encore d'évaluation

- PSY Chapter 1Document83 pagesPSY Chapter 1Aedrian M LopezPas encore d'évaluation

- Labor Law ('94)Document25 pagesLabor Law ('94)NopePas encore d'évaluation

- Labor Law - Craver - Fall 2003 - 3Document45 pagesLabor Law - Craver - Fall 2003 - 3champion_egy325Pas encore d'évaluation

- PSPC Activist Shareholders Group: Presentation of Demands To The ManagementDocument19 pagesPSPC Activist Shareholders Group: Presentation of Demands To The Managementανατολή και πετύχετεPas encore d'évaluation

- CivilProcedure Memory AidDocument38 pagesCivilProcedure Memory AidIm In TroublePas encore d'évaluation

- 2labor Law ReviewerDocument152 pages2labor Law ReviewerCharnette Cao-wat LemmaoPas encore d'évaluation

- Our Top 3 Swing Trading Setups: Deron WagnerDocument36 pagesOur Top 3 Swing Trading Setups: Deron Wagnerανατολή και πετύχετεPas encore d'évaluation

- G.R. No. 89606 August 30, 1990: Supreme CourtDocument8 pagesG.R. No. 89606 August 30, 1990: Supreme Courtανατολή και πετύχετεPas encore d'évaluation

- Bfa Dailyanalysis (2) AsdadDocument4 pagesBfa Dailyanalysis (2) Asdadανατολή και πετύχετεPas encore d'évaluation

- FAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23Document5 pagesFAPHL 2016 CONFERENCE PROGRAM FORMAT As of JUNE 23ανατολή και πετύχετεPas encore d'évaluation

- G.R. No. 127899 December 2, 1999: Supreme CourtDocument7 pagesG.R. No. 127899 December 2, 1999: Supreme Courtανατολή και πετύχετεPas encore d'évaluation

- Stock Market Research QuestionnaireDocument4 pagesStock Market Research Questionnaireανατολή και πετύχετεPas encore d'évaluation

- (G.R. No. 123936. March 4, 1999) : SynopsisDocument11 pages(G.R. No. 123936. March 4, 1999) : Synopsisανατολή και πετύχετεPas encore d'évaluation

- Learning About Content Marketing: by Ric OribianaDocument5 pagesLearning About Content Marketing: by Ric Oribianaανατολή και πετύχετεPas encore d'évaluation

- Evidence: Course OutlineDocument12 pagesEvidence: Course Outlineανατολή και πετύχετεPas encore d'évaluation

- InvesujighDocument13 pagesInvesujighανατολή και πετύχετεPas encore d'évaluation

- Esteban YafghdDocument2 pagesEsteban Yafghdανατολή και πετύχετεPas encore d'évaluation

- 2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document168 pages2007-2013 Political Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh92% (85)