Académique Documents

Professionnel Documents

Culture Documents

Chart of Accounts For Small Business Template V 1.0

Transféré par

molateam2Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chart of Accounts For Small Business Template V 1.0

Transféré par

molateam2Droits d'auteur :

Formats disponibles

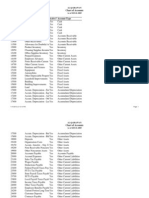

Small Business Chart of Accounts

Account Name

Code

Financial Statement

Group

Sub-Group

Bank checking account

1000

Balance sheet

Current assets

Cash and cash equivalents

Debit

Bank savings account

1010

Balance sheet

Current assets

Cash and cash equivalents

Debit

Online savings account

1020

Balance sheet

Current assets

Cash and cash equivalents

Debit

Petty cash account

1030

Balance sheet

Current assets

Cash and cash equivalents

Debit

Paypal account

1040

Balance sheet

Current assets

Cash and cash equivalents

Debit

Accounts receivable

1200

Balance sheet

Current assets

Accounts receivable

Debit

Allowance for doubtful debts account

1210

Balance sheet

Current assets

Accounts receivable

Credit

Inventory

1400

Balance sheet

Current assets

Inventory

Debit

Prepayments

1600

Balance sheet

Current assets

Other current assets

Debit

Property

1800

Balance sheet

Long term assets

Property, plant and equipment

Debit

Property Depreciation

1810

Balance sheet

Long term assets

Property, plant and equipment

Credit

Plant

1820

Balance sheet

Long term assets

Property, plant and equipment

Debit

Plant depreciation

1830

Balance sheet

Long term assets

Property, plant and equipment

Credit

Equipment

1840

Balance sheet

Long term assets

Property, plant and equipment

Debit

Equipment depreciation

1850

Balance sheet

Long term assets

Property, plant and equipment

Credit

Accounts payable

2000

Balance sheet

Current liabilities

Accounts payable

Credit

Payroll payable

2200

Balance sheet

Current liabilities

Other current liabilities

Credit

Interest payable

2210

Balance sheet

Current liabilities

Other current liabilities

Credit

Accrued expenses

2220

Balance sheet

Current liabilities

Other current liabilities

Credit

Unearned revenue

2230

Balance sheet

Current liabilities

Other current liabilities

Credit

Sales Tax payable

2240

Balance sheet

Current liabilities

Other current liabilities

Credit

Purchase Tax payable

2250

Balance sheet

Current liabilities

Other current liabilities

Credit

Payroll tax payable

2260

Balance sheet

Current liabilities

Other current liabilities

Credit

Income tax payable

2270

Balance sheet

Current liabilities

Other current liabilities

Credit

Mortgage loan

2400

Balance sheet

Long-term liabilities

Mortgages

Credit

Other loans

2600

Balance sheet

Long-term liabilities

Loans

Credit

Owners contributions

3000

Balance sheet

Equity

Capital

Credit

Owners draw

3010

Balance sheet

Equity

Capital

Credit

Retained earnings

3020

Balance sheet

Equity

Retained earnings

Credit

Retail sales

4000

Income Statement

Income

Revenue

Credit

Services

4010

Income Statement

Income

Revenue

Credit

Discounts allowed

4020

Income Statement

Income

Revenue

Debit

Materials purchased

4400

Income Statement

Cost of sales

Cost of sales

Debit

Packaging

4410

Income Statement

Cost of sales

Cost of sales

Debit

Discounts taken

4420

Income Statement

Cost of sales

Cost of sales

Debit

Shipping costs

4430

Income Statement

Cost of sales

Cost of sales

Debit

Import duty

4440

Income Statement

Cost of sales

Cost of sales

Debit

Opening inventory

4450

Income Statement

Cost of sales

Cost of sales

Debit

Closing inventory

4460

Income Statement

Cost of sales

Cost of sales

Credit

Productive Labour

4470

Income Statement

Cost of sales

Cost of sales

Debit

Research and development

4800

Income Statement

Expense

Research and development

Debit

Sales commissions

5000

Income Statement

Expense

Sales and marketing

Debit

Sales promotion

5010

Income Statement

Expense

Sales and marketing

Debit

Advertising

5020

Income Statement

Expense

Sales and marketing

Debit

Gifts & samples

5030

Income Statement

Expense

Sales and marketing

Debit

Marketing expenses

5040

Income Statement

Expense

Sales and marketing

Debit

Payroll

5200

Income Statement

Expense

General and administrative

Debit

Contract labor

5210

Income Statement

Expense

General and administrative

Debit

Payroll expenses

5220

Income Statement

Expense

General and administrative

Debit

Payroll benefits

5230

Income Statement

Expense

General and administrative

Debit

Payroll taxes

5240

Income Statement

Expense

General and administrative

Debit

Computer and internet

5250

Income Statement

Expense

General and administrative

Debit

Software

5260

Income Statement

Expense

General and administrative

Debit

Website

5270

Income Statement

Expense

General and administrative

Debit

Rent

5280

Income Statement

Expense

General and administrative

Debit

Property taxes

5290

Income Statement

Expense

General and administrative

Debit

Utilities

5300

Income Statement

Expense

General and administrative

Debit

Motor expenses

5310

Income Statement

Expense

General and administrative

Debit

Travelling

5320

Income Statement

Expense

General and administrative

Debit

Hotels

5330

Income Statement

Expense

General and administrative

Debit

Meals and entertainment

5340

Income Statement

Expense

General and administrative

Debit

Printing

5350

Income Statement

Expense

General and administrative

Debit

Postage & carriage

5360

Income Statement

Expense

General and administrative

Debit

Telephone

5370

Income Statement

Expense

General and administrative

Debit

Office supplies

5380

Income Statement

Expense

General and administrative

Debit

Professional fees

5390

Income Statement

Expense

General and administrative

Debit

Equipment hire

5400

Income Statement

Expense

General and administrative

Debit

Repairs & maintenance

5410

Income Statement

Expense

General and administrative

Debit

Housekeeping supplies and cleaning

5420

Income Statement

Expense

General and administrative

Debit

Bad debt expense

5430

Income Statement

Expense

General and administrative

Debit

Dues and membership fees

5440

Income Statement

Expense

General and administrative

Debit

Research and professional development

5450

Income Statement

Expense

General and administrative

Debit

Insurance

5460

Income Statement

Expense

General and administrative

Debit

Security

5470

Income Statement

Expense

General and administrative

Debit

Suspense account

5480

Income Statement

Expense

General and administrative

Debit

2015 www.double-entry-bookkeeping.com

Normally

322946781.xlsx

Small Business Chart of Accounts

Account Name

Code

Financial Statement

Group

Sub-Group

Normally

Depreciation

5600

Income Statement

Expense

Depreciation

Debit

Interest expense

5800

Income Statement

Expense

Finance costs

Debit

Bank fees

5810

Income Statement

Expense

Finance costs

Debit

Interest income

4200

Income Statement

Income

Other Income

Credit

Rent income

4210

Income Statement

Income

Other Income

Credit

Income tax expense

5900

Income Statement

Expense

Income tax expense

Debit

2015 www.double-entry-bookkeeping.com

322946781.xlsx

Notes and major health warnings

Users use this template at their own risk. We make no warranty or representation as to its accuracy an

are covered by the terms of our legal disclaimer, which you are deemed to have read.

This is an example. It is purely illustrative. This is not intended to reflect general standards or targets

any particular company or sector.

If you do spot a mistake in the template, please let us know and we will try to fix it.

Additional templates are available for download at our website

http://www.double-entry-bookkeeping.com/

Vous aimerez peut-être aussi

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Standard Chart of AccountsDocument6 pagesStandard Chart of AccountsAArif SShuvrooPas encore d'évaluation

- Chart of AccountsDocument3 pagesChart of AccountsOzioma Ihekwoaba0% (1)

- Sample Manufacturing Business Chart of Accounts PDFDocument3 pagesSample Manufacturing Business Chart of Accounts PDFMamun Kabir73% (15)

- Chart of Accounts (Sole Proprietorship) Account No. Account Title AssetsDocument16 pagesChart of Accounts (Sole Proprietorship) Account No. Account Title Assetselaine galvezPas encore d'évaluation

- Charts of AccountsDocument112 pagesCharts of AccountsTodorán Laci100% (1)

- Chart of Accounts For Small Business Template V 1.1Document3 pagesChart of Accounts For Small Business Template V 1.1Zubair Alam100% (1)

- Chart of AccountDocument6 pagesChart of AccountSophath Sky100% (1)

- Chart of AccountsDocument21 pagesChart of AccountsJayRellvic Guy-ab100% (1)

- Standard Chart of Accounts For Manufacturing OperationsDocument31 pagesStandard Chart of Accounts For Manufacturing Operationswpentinio67% (15)

- GL Chart of Accounts by ClassificationDocument5 pagesGL Chart of Accounts by ClassificationJack777100Pas encore d'évaluation

- Unique Share Management LTD.: Chart of AccountsDocument34 pagesUnique Share Management LTD.: Chart of AccountsFarida YesminPas encore d'évaluation

- The Chart of Accounts For Companies PDFDocument14 pagesThe Chart of Accounts For Companies PDFEmir Ademovic100% (1)

- Accounting and Bookkeeping SOPDocument22 pagesAccounting and Bookkeeping SOPJessa Mae Cac100% (2)

- Chart of Accounts: Assets Account Titles DescriptionDocument5 pagesChart of Accounts: Assets Account Titles DescriptionKent Dela Cruz Castillo100% (2)

- Sample Chart of AccountsDocument12 pagesSample Chart of AccountsjeffryPas encore d'évaluation

- Account ClassificationDocument2 pagesAccount ClassificationMary96% (23)

- Chart of AccountsDocument4 pagesChart of AccountsMohammed Aslam100% (2)

- REAL Chart of AccountsDocument4 pagesREAL Chart of Accountsllerry racuya100% (1)

- Diagram of Accounting EquationDocument1 pageDiagram of Accounting EquationMary100% (3)

- XL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Document686 pagesXL JournalSHEET - Accounting System V3.43 - Merchandise - Lite V3Satria ArliandiPas encore d'évaluation

- 4 Chart of AccountsDocument115 pages4 Chart of Accountsresti rahmawatiPas encore d'évaluation

- Chart of AccountsDocument61 pagesChart of AccountsSoehermanto Dody80% (5)

- Balance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionDocument5 pagesBalance Sheet Chart of Accounts For Small Businesses Numb Er Account Title Balance Sheet SectionmakahiyaPas encore d'évaluation

- Basic Impact of Everyday Journal Entries On The Income StatementDocument2 pagesBasic Impact of Everyday Journal Entries On The Income StatementMary100% (1)

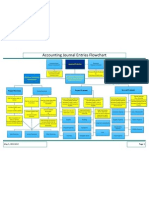

- Accounting Journal Entries Flowchart PDFDocument1 pageAccounting Journal Entries Flowchart PDFMary75% (4)

- Journal Entries For Long Lived AssetsDocument2 pagesJournal Entries For Long Lived AssetsMary100% (20)

- Chart of Accounts With DescriptionsDocument8 pagesChart of Accounts With DescriptionsKhan Mohammad100% (2)

- Chart of Accounts - BuilderDocument3 pagesChart of Accounts - BuilderPeter West40% (5)

- BookkeepingDocument63 pagesBookkeepingRheneir Mora100% (12)

- Journal EntriesDocument63 pagesJournal EntriesTwinkle Kashyap50% (2)

- Accounting CycleDocument18 pagesAccounting CycleLeslie Sparks100% (6)

- Classification of AccountsDocument3 pagesClassification of AccountsSaurav Aradhana100% (1)

- Ifrs Chart of AccountDocument168 pagesIfrs Chart of AccountPrivilege Mudzinge50% (4)

- Chart of Accounts PolicyDocument13 pagesChart of Accounts PolicyMazhar Ali JoyoPas encore d'évaluation

- Accounts Payable ProcessDocument29 pagesAccounts Payable Processhhap411Pas encore d'évaluation

- Financial and Accounting Procedures ManualDocument60 pagesFinancial and Accounting Procedures ManualjewelmirPas encore d'évaluation

- Proposal To ZentechDocument5 pagesProposal To ZentechMarvin Celedio100% (2)

- Accounts Payable SOPDocument12 pagesAccounts Payable SOPPunitha Malar100% (2)

- Chart of Account Pertamina Standart For SampleDocument19 pagesChart of Account Pertamina Standart For SampleRescomsolution Pieter AuPas encore d'évaluation

- Accounting TemplatesDocument20 pagesAccounting TemplatesKirby C. Loberiza0% (1)

- Accounting Policy Procedure ManualDocument40 pagesAccounting Policy Procedure ManualImee100% (4)

- Instructions For A Cash Flows Statement Direct MethodDocument5 pagesInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- Accounting Journal Entries With Business TransactionsDocument7 pagesAccounting Journal Entries With Business TransactionsMhel DemabogtePas encore d'évaluation

- Chart of AccountsDocument8 pagesChart of AccountsMariaCarlaMañagoPas encore d'évaluation

- Bookkeeping Engagement LetterDocument5 pagesBookkeeping Engagement LetterJake YangPas encore d'évaluation

- Examples of Customized Charts of AccountsDocument33 pagesExamples of Customized Charts of AccountsDennis lugodPas encore d'évaluation

- Accounting Proposal TemplateDocument6 pagesAccounting Proposal TemplateTracy LawtonPas encore d'évaluation

- Chart of Accounts For RestaurantsDocument7 pagesChart of Accounts For RestaurantsAgri Pasca Ramdhani100% (1)

- Accounting-Adjusting Journal EntriesDocument27 pagesAccounting-Adjusting Journal EntriesMary92% (24)

- Manufacturing AccountingDocument15 pagesManufacturing AccountingKanika BakhaiPas encore d'évaluation

- Closing Journal EntriesDocument1 pageClosing Journal EntriesMary91% (11)

- Petty Cash PolicyDocument3 pagesPetty Cash PolicyTaeKook VKookPas encore d'évaluation

- Sop Accounts Payables Axiom EasyDocument16 pagesSop Accounts Payables Axiom EasyRiskyKurniasih100% (1)

- Financial StatementsDocument49 pagesFinancial StatementsManas Kumar100% (1)

- Adjusting Journal EntriesDocument1 pageAdjusting Journal EntriesMary100% (3)

- Designing An Effective Chart of Accounts StructureDocument38 pagesDesigning An Effective Chart of Accounts StructureMuqeemuddin_Kh_5020100% (1)

- General Accounting Cheat SheetDocument35 pagesGeneral Accounting Cheat SheetHectorPas encore d'évaluation

- Default Chart of AccountsDocument4 pagesDefault Chart of Accountsjmanzungu2820Pas encore d'évaluation

- Charts of Accounts of Eagle Wheels Auto Solutions For QBDocument16 pagesCharts of Accounts of Eagle Wheels Auto Solutions For QBMuhammad UsmanPas encore d'évaluation

- RS002 Villa MR Salih Revised RS002 Villa MR Salih RevisedDocument4 pagesRS002 Villa MR Salih Revised RS002 Villa MR Salih Revisedmolateam2Pas encore d'évaluation

- International Supply Contract Template SampleDocument6 pagesInternational Supply Contract Template Samplemolateam20% (2)

- Item No. Description Unit Quantity Amount: Embassy BuildingDocument24 pagesItem No. Description Unit Quantity Amount: Embassy Buildingmolateam2Pas encore d'évaluation

- C# Framework Design PDFDocument84 pagesC# Framework Design PDFmolateam2100% (1)

- Structural Break-Up Int'l Corporate Sukuk Issuances (Jan 2001-March 2015, USD Millions)Document7 pagesStructural Break-Up Int'l Corporate Sukuk Issuances (Jan 2001-March 2015, USD Millions)molateam2Pas encore d'évaluation

- Safety Procedures For Water and SanitationDocument26 pagesSafety Procedures For Water and Sanitationmolateam2Pas encore d'évaluation

- Floow UpDocument20 pagesFloow Upmolateam2Pas encore d'évaluation

- Thinking Cycle::main Diagram Problem Cycle ProcessDocument5 pagesThinking Cycle::main Diagram Problem Cycle Processmolateam2100% (1)

- Aia Cher Private RoomDocument6 pagesAia Cher Private Roommolateam2Pas encore d'évaluation

- Kasbersky LabDocument1 pageKasbersky Labmolateam2Pas encore d'évaluation

- Leave Travel Concession (LTC) Rules: Office MemorandumDocument2 pagesLeave Travel Concession (LTC) Rules: Office Memorandumchintu_scribdPas encore d'évaluation

- Nike Accuses For Child LabourDocument14 pagesNike Accuses For Child LabourDilas Zooni Meraj100% (1)

- Unit I Industrial RelationsDocument58 pagesUnit I Industrial RelationsSaravanan Shanmugam100% (2)

- Trade Facilitation Book-ASIA PacificDocument212 pagesTrade Facilitation Book-ASIA PacificjessicaPas encore d'évaluation

- CHAPTER 10 With Answer KeyDocument2 pagesCHAPTER 10 With Answer KeyAngela PaduaPas encore d'évaluation

- Sarah Kuhn ResumeDocument2 pagesSarah Kuhn Resumeapi-433846859Pas encore d'évaluation

- RetailersDocument11 pagesRetailersrakshit1230% (1)

- All India GST JurisdictionDocument2 pagesAll India GST JurisdictionCafe 31Pas encore d'évaluation

- Indoco Annual Report FY16Document160 pagesIndoco Annual Report FY16Ishaan MittalPas encore d'évaluation

- Project On SunsilkDocument11 pagesProject On Sunsilktanya sethiPas encore d'évaluation

- Case Studies On The Letters of CreditDocument3 pagesCase Studies On The Letters of Creditomi0855100% (1)

- Final COP-Section 1Document86 pagesFinal COP-Section 1Arbaz KhanPas encore d'évaluation

- MARS Brochure NewDocument13 pagesMARS Brochure NewMars FreightsPas encore d'évaluation

- Association of Differently Abled Person in The Province of AntiqueDocument2 pagesAssociation of Differently Abled Person in The Province of AntiqueLucifer MorningstarPas encore d'évaluation

- Cash Management: Strategies To Manage CashDocument6 pagesCash Management: Strategies To Manage CashRamalingam ChandrasekharanPas encore d'évaluation

- Essay BusinessDocument2 pagesEssay Businessali basitPas encore d'évaluation

- Ifc IdaDocument10 pagesIfc IdaShyama KakkatPas encore d'évaluation

- Tesla v. JohnsonDocument6 pagesTesla v. JohnsonDoctor ConspiracyPas encore d'évaluation

- Summer Training Red Project Report CocacolaDocument84 pagesSummer Training Red Project Report Cocacolagurunathambabu100% (2)

- Attorney Fee Agreement For Hourly ClientsDocument5 pagesAttorney Fee Agreement For Hourly ClientsRianPas encore d'évaluation

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionPas encore d'évaluation

- An Application of Six Sigma in Service Sector-A Case StudyDocument9 pagesAn Application of Six Sigma in Service Sector-A Case StudyblitzkrigPas encore d'évaluation

- LIP Case DigestDocument5 pagesLIP Case DigestJett LabillesPas encore d'évaluation

- Declaration of Travis Crabtree - Trademark EngineDocument4 pagesDeclaration of Travis Crabtree - Trademark EngineLegalForce - Presentations & ReleasesPas encore d'évaluation

- NetSuite Essentials Training Data SheetDocument4 pagesNetSuite Essentials Training Data SheetTaranvir KaurPas encore d'évaluation

- The-One-Day-Audit-5-Real-Life-ExamplesDocument4 pagesThe-One-Day-Audit-5-Real-Life-ExamplesDawson EllisonPas encore d'évaluation

- Local Bankruptcy Rules - COMPLETEDocument196 pagesLocal Bankruptcy Rules - COMPLETEhbs.29645Pas encore d'évaluation

- Case Study 1: Southwestern University (Topic: Forecasting)Document10 pagesCase Study 1: Southwestern University (Topic: Forecasting)sonhera sheikhPas encore d'évaluation

- Data Cleaning With SSISDocument25 pagesData Cleaning With SSISFreeInformation4ALLPas encore d'évaluation

- Ireland Soaking Tub Prices September 2017Document2 pagesIreland Soaking Tub Prices September 2017DerekSashaPas encore d'évaluation