Académique Documents

Professionnel Documents

Culture Documents

Section F - Questions

Transféré par

Ahmed Raza MirTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Section F - Questions

Transféré par

Ahmed Raza MirDroits d'auteur :

Formats disponibles

SECTION F

OTHERS - QUESTIONS

QUESTION 100

(a)

Cash is no different from any other assetif it is not being utilized properly it is going to result in

lower profits.

Discuss this statement in particular referring to the motives for holding cash.

(b)

The AB Credit Collection Co. Ltd employs agents who collect hire purchase installments and

other outstanding accounts on a door-to-door basis from Monday to Friday. The agents bank the

cash collected to be remitted to head office once per week at the end of the week. The budget for

next year shows that the total collections will be of the order of Rs 5,200,000 and that the

estimated bank overdraft rate is 9%. The collection manager has suggested that a daily remitting

system should be introduced for collectors.

You are required to comment on the significance of this, stating clearly any assumptions you are required

to make. (20 marks)

QUESTION 101

The Thornton Co., a small manufacturing business, was experiencing a short-term liquidity crisis at the

end of 19-9. Its management estimated that the company would need by the end of February 19-10 an

extra Rs 100,000 of funds. It would be six months' after receipt of the funds before it would be able to

repay. The company is already heavily in debt and its normal banker will not advance any more money.

The company has made losses for the last two years and has unused capital allowances. Consequently it

is not thought it will have any corporation tax to pay for a number of years. The accountant has suggested

three possible short-term solutions to the liquidity problem. They are:

(a)

A Rs 100,000 short-term loan at an annual interest rate of 18%. This can be obtained from a local

finance company, and no finding charge will need to be paid.

(b)

The company could forego the cash discounts it has been obtaining on its purchases of materials.

The company purchases approximately Rs 50,000 of materials each month, and has in the past

been paying for these within a month of purchase and obtaining a 2% cash discount, the

discounts are only offered for payment within 30 days. If Thornton takes longer than 90 days to

pay it could endanger its relationship with suppliers.

(c)

The company could factor its trade debtors. A factor has been found who will advance Thornton

75% of the value of the invoices, less the deduction of all factoring charges, immediately upon

receipt of the invoices. The factor will take responsibility for collecting the debts, and pay over to

the company the balance of the value of the invoices, upon receipt of the cash from customers.

On average Thornton's customers pay at the end of the first month following the month in which

the sales took place. The average level of sales of Thornton is Rs 150,000 per month and this

level is expected to remain steady over the next year.

The factor's interest charge is 15% per annum on the amount of money advanced, calculated on

a day-to-day basis. The factoring fee is a charge of 2% of the turnover of Thornton. Thornton

estimate that as a result of the factor's managing the collecting of debts, it will save on bad debts

and the cost of credit control, an amount of Rs 2,000 per month. Surprisingly, the factor would

enter into an agreement with Thornton to cover just the first six months of 19-10. It would begin

with the factoring of January 19-10 sales. The company can use any surplus funds available to

reduce its overdraft which is costing 1% per month.

Required:

(a) Advise the company as to which of these three possibilities is cheapest. (10 marks)

F- 1

SECTION F

OTHERS - QUESTIONS

(b) Assuming Thornton enters into the factoring arrangement, using the information given in the

question, sow the cash flow position for each of the first nine months of 19-10. (6 marks)

(c) What else besides cost would you advise the company to take into account when deciding

between these three possibilities? (4 marks)

(Total 20 marks)

QUESTION 102

Jack Ltd expects to have available only a limited amount of capital during each of the next five years. It

also expects restrictions on its supplies of skilled labour and raw materials type AFC during this period.

The accountant of Jack Ltd has prepared a linear programme, covering the company's activities for the

next five years. The objective function of the programme involves the maximization of the present value of

ordinary dividends, subject to the following constraints:

(1)

that cash payments each year must not exceed cash receipts. .

(2)

that skilled labour hours required each year must not exceed the quantity available for that year,

(3)

the materials type AFC required each year must not exceed the quantity available for that year,

(4)

that no project may be undertaken more than once (although fractions of projects may be

accepted), and

(5)

that negative quantities of projects may not be undertaken, nor may negative dividends be paid.

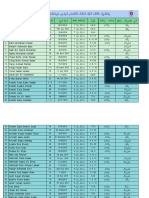

The solution to the linear programme reveals the following dual prices:

Year

Cash per Rs

1

2

3

4

5

Rs

2.10

1.65

1.30

1.05

0.90

Skilled labour

Per hour

Rs

0.90

1.30

0.00

1.10

0.00

Raw material

AFC per unit

Rs

9.30

8.40

6.50

4.80

1.60

The present total market value of the ordinary shares of Jack Ltd is Rs 17.5 million. The directors

estimate that the minimum return required by ordinary shareholders from their investment in the company

is 10% per annum.

Since the linear programme was formulated, the directors of Jack Ltd have learnt of a new machine which

could be used on several of the projects included in the optimal plan. Purchase of the machine would

result in cash savings of Rs 30,000 in each of the years 2 to 5. Jack Ltd would also save 15,000 skilled

labour hours in years 2, 3, 4 and 5. On the other hand, use of the machine would require 1,000 extra units

of raw material AFC in each of the years 2 to 5.

You are required to:

(a)

Explain the earning of the dual prices given for cash, skilled labour and raw material AFC.

(5 marks)

(b)

Prepare calculations showing the maximum price Jack Ltd should be willing to pay for the new

machine, if payment has to be made in year 1. (10 marks)

(c)

Discuss the usefulness and limitations of dual prices in situations such as that described in the

question. (10 marks)

Ignore taxation.

(Total 25 marks)

F- 2

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Ifrs11 Joint ArrangementsDocument1 pageIfrs11 Joint ArrangementsAhmed Raza MirPas encore d'évaluation

- Financial AccountingDocument42 pagesFinancial AccountingAhmed Raza MirPas encore d'évaluation

- Grant Thornton Ifrs 10 Financial StatementsDocument104 pagesGrant Thornton Ifrs 10 Financial StatementsAhmed Raza MirPas encore d'évaluation

- Advanced Accounting and Financial ReportingDocument6 pagesAdvanced Accounting and Financial ReportingAhmed Raza MirPas encore d'évaluation

- p4 Summary BookDocument35 pagesp4 Summary BookAhmed Raza MirPas encore d'évaluation

- Section e - AnswersDocument7 pagesSection e - AnswersAhmed Raza MirPas encore d'évaluation

- E Voting Guide (ICAP - Overseas Members)Document10 pagesE Voting Guide (ICAP - Overseas Members)Ahmed Raza MirPas encore d'évaluation

- Suggested Answers Intermediate Examination - Spring 2012: Realization AccountDocument7 pagesSuggested Answers Intermediate Examination - Spring 2012: Realization AccountAhmed Raza MirPas encore d'évaluation

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDocument32 pagesFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirPas encore d'évaluation

- Section e - QuestionsDocument4 pagesSection e - QuestionsAhmed Raza MirPas encore d'évaluation

- Stock ValuationDocument2 pagesStock ValuationAhmed Raza MirPas encore d'évaluation

- Solution: Part (A)Document12 pagesSolution: Part (A)Ahmed Raza MirPas encore d'évaluation

- Solution: Part (A)Document12 pagesSolution: Part (A)Ahmed Raza MirPas encore d'évaluation

- PC EDocument24 pagesPC EAhmed Raza MirPas encore d'évaluation

- Introduction To Economics & Finance: Page 1 of 8Document8 pagesIntroduction To Economics & Finance: Page 1 of 8Ahmed Raza MirPas encore d'évaluation

- 4.albania Frosina GjinoDocument7 pages4.albania Frosina GjinoAhmed Raza MirPas encore d'évaluation

- Exchange GainsDocument1 pageExchange GainsAhmed Raza MirPas encore d'évaluation

- December 2010 TC4A1Document10 pagesDecember 2010 TC4A1Ahmed Raza MirPas encore d'évaluation

- December 2010 FA3Q1Document4 pagesDecember 2010 FA3Q1Ahmed Raza MirPas encore d'évaluation

- December 2010 TC6ADocument7 pagesDecember 2010 TC6AAhmed Raza MirPas encore d'évaluation

- December 2010 FA2ADocument9 pagesDecember 2010 FA2AAhmed Raza MirPas encore d'évaluation

- December 2010 FA1ADocument5 pagesDecember 2010 FA1AAhmed Raza MirPas encore d'évaluation

- December 2010 FA3ADocument7 pagesDecember 2010 FA3AAhmed Raza MirPas encore d'évaluation

- Examination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkDocument11 pagesExamination No. - The Public Accountants Examination Council of Malawi 2010 Examinations Foundation Stage Paper 4: Organisational FrameworkAhmed Raza MirPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Dividend Discount ModelDocument54 pagesDividend Discount ModelVaidyanathan Ravichandran100% (1)

- Weight Watchers Business Plan 2019Document71 pagesWeight Watchers Business Plan 2019mhetfield100% (1)

- .. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiDocument3 pages.. Anadolu Teknik, Teknik Lise Ve Endüstri Meslek LisesiLislePas encore d'évaluation

- Financial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDocument3 pagesFinancial Report: The Coca Cola Company: Ews/2021-10-27 - Coca - Cola - Reports - Continued - Momentum - and - Strong - 1040 PDFDominic MuliPas encore d'évaluation

- Clothing Blog Posts, For Both Modern and Historic GarmentsDocument93 pagesClothing Blog Posts, For Both Modern and Historic GarmentsJeffrey HopperPas encore d'évaluation

- Ekotoksikologi Kelautan PDFDocument18 pagesEkotoksikologi Kelautan PDFMardia AlwanPas encore d'évaluation

- Nuclear Power Plants PDFDocument64 pagesNuclear Power Plants PDFmvlxlxPas encore d'évaluation

- Introduction To Anglo-Saxon LiteratureDocument20 pagesIntroduction To Anglo-Saxon LiteratureMariel EstrellaPas encore d'évaluation

- 1-Introduction - Defender (ISFJ) Personality - 16personalitiesDocument6 pages1-Introduction - Defender (ISFJ) Personality - 16personalitiesTiamat Nurvin100% (1)

- Report of Apple Success PDFDocument2 pagesReport of Apple Success PDFPTRPas encore d'évaluation

- Service Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsDocument3 pagesService Letter SL2019-672/CHSO: PMI Sensor Calibration RequirementsSriram SridharPas encore d'évaluation

- Thesis RecruitmentDocument62 pagesThesis Recruitmentmkarora122Pas encore d'évaluation

- Pre-Qualification Document - Addendum 04Document4 pagesPre-Qualification Document - Addendum 04REHAZPas encore d'évaluation

- Functional Skill: 1. Offering HelpDocument36 pagesFunctional Skill: 1. Offering HelpAnita Sri WidiyaaPas encore d'évaluation

- The Department of Education On Academic DishonestyDocument3 pagesThe Department of Education On Academic DishonestyNathaniel VenusPas encore d'évaluation

- JournalofHS Vol11Document136 pagesJournalofHS Vol11AleynaPas encore d'évaluation

- Jonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Document1 pageJonathan Bishop's Election Address For The Pontypridd Constituency in GE2019Councillor Jonathan BishopPas encore d'évaluation

- Starmada House RulesDocument2 pagesStarmada House Ruleshvwilson62Pas encore d'évaluation

- Chapter 11: Re-Situating ConstructionismDocument2 pagesChapter 11: Re-Situating ConstructionismEmilio GuerreroPas encore d'évaluation

- 11 January 2022 Dear Mohammed Rayyan,: TH TH RDDocument5 pages11 January 2022 Dear Mohammed Rayyan,: TH TH RDmrcopy xeroxPas encore d'évaluation

- Literature ReviewDocument11 pagesLiterature ReviewGaurav Badlani71% (7)

- Eicher HR PoliciesDocument23 pagesEicher HR PoliciesNakul100% (2)

- Surahduha MiracleDreamTafseer NoumanAliKhanDocument20 pagesSurahduha MiracleDreamTafseer NoumanAliKhanspeed2kxPas encore d'évaluation

- 10th Grade SAT Vocabulary ListDocument20 pages10th Grade SAT Vocabulary ListMelissa HuiPas encore d'évaluation

- A Brief Journey Through Arabic GrammarDocument28 pagesA Brief Journey Through Arabic GrammarMourad Diouri100% (5)

- Module in Sociology CSPDocument78 pagesModule in Sociology CSPJanz Vincent ReyesPas encore d'évaluation

- Open Quruan 2023 ListDocument6 pagesOpen Quruan 2023 ListMohamed LaamirPas encore d'évaluation

- GOUP GO of 8 May 2013 For EM SchoolsDocument8 pagesGOUP GO of 8 May 2013 For EM SchoolsDevendra DamlePas encore d'évaluation

- Lipura Ts Module5EappDocument7 pagesLipura Ts Module5EappGeniza Fatima LipuraPas encore d'évaluation

- Q1Document16 pagesQ1satyamPas encore d'évaluation