Académique Documents

Professionnel Documents

Culture Documents

Indian Stock Market PE Ratio

Transféré par

rjg_vijayCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Indian Stock Market PE Ratio

Transféré par

rjg_vijayDroits d'auteur :

Formats disponibles

Name

INDIAN STOCK MARKET P/E RATIOS

Authors

Dr. L. C. Gupta, P.K. Jain, C.P. Gupta

Year

1998

CONTENTS

1.

OBJECT AND SCOPE

Specific objectives of study

Definition

The Indian situation

Coverage of study

Layout of study

INDIAN MARKETS P/E RATIO: A HISTORICAL

PERSPECTIVE

Introduction

Method of analysis

The markets P/E ratio

Market segments

Actively traded group defined

Data required about each company

Why yearly P/E ratio?

Market P/E ratio: how computed

Market P/E ratio on combined basis

Exclusion of loss-making companies

Market P/E ratio as median value

Quartiles

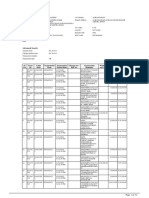

Results of analysis

Actively traded group

Entire group

Observed long-term changes

Factors underlying long-term change

Indian markets upwards revaluation

Demand-side change

Position before the 1980s

Shares popularised by FERA issues

Attitudinal shift towards equities

Allowing entry to overseas investors

Supportive policy environment

Concluding comments

International perspective

BEHAVIOUR OF INDIAN MARKETS

P/E RATIO: FOCUS ON 1990S

Object of analysis

Short-term movements of market P/E ratio

Method of analysis

Quarterly analysis

BSE P/E ratios

Results of analysis

Period of bubbles

First bubble of 1990s

Bubbles become bigger

The market turns full circle

Market P/E ratio falls to 10-year low

Governments response

Concluding comments

Investors problems unresolved

Role of speculation

Abnormal P/E ratio and bubbles

USING MARKET P/E RATIO AS MARKET SIGNAL

Understanding the market P/E ratio

Fund managers ineptness

Best indicator of markets state

Looking at individual company

P/E ratios not enough

Company P/E ratio has no norm

The norm for market P/E ratio

Using market P/E ratio as signal

Suggested bench-marks for P/E ratio

Four states of the market

Actual bench-marks suggested

Investors viewpoint

Market bubbles

No bench-marks for company

P/E ratio

Considerations in fixing bench-marks

EVALUATING INDIVIDUAL COMPANY

P/E RATIO: A NEW APPROACH

Components of over-all return

Effect of purchase price on return

Interpreting the P/E ratio: a caution

Concept of justifiable P/E ratio

Varying assumptions

How to compute justifiable P/E ratio

Illustration

P/E RATIO AND COMPANY SIZE

Segment-wise P/E ratio and investment strategy

Applications of size analysis

Measures of company size

Results of analysis

Company size and P/E ratio

Market capitalization size criterion superior

How company size has changed

Concluding comments

Influence of market arrangements

Small companies ignored

Arrangements for small company shares

EARNINGS YIELD, DIVIDEND YIELD AND

DIVIDEND PAYOUT RATIO

Object of analysis

Study of inter-relationships

Result of analysis

Earnings yield

Dividend yield

Payout ratio

Effect of company-size

Concluding comments

Emphasis shifts from dividend yield to capital

appreciation

WITHIN-YEAR SHARE PRICE FLUCTUATIONS IN INDIA:

MAGNITUDE AND IMPLICATIONS

Object of analysis

Results of analysis

Indian market too volatile

Our method vs. the one-day returns

method of measuring volatility

Price fluctuation and company size

A great fallacy

Concluding comments

Risky money game

Reforms needed to strengthen the

influence of fundamental factors

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Calculate Curve Lengths and Superelevation RatesDocument9 pagesCalculate Curve Lengths and Superelevation Ratesrjg_vijayPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Volume Spread Analysis ExamplesDocument55 pagesVolume Spread Analysis Examplesthinkscripter82% (11)

- ### Traffic Management PlanDocument19 pages### Traffic Management PlanTAHER AMMAR86% (7)

- ### Traffic Management PlanDocument19 pages### Traffic Management PlanTAHER AMMAR86% (7)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Anchored VWAP IPO Beyond MeatDocument5 pagesAnchored VWAP IPO Beyond MeatalphatrendsPas encore d'évaluation

- Eskimo PieDocument30 pagesEskimo PieMing Yang100% (1)

- NCFM Tecnical Analusis ModuleDocument172 pagesNCFM Tecnical Analusis ModuleDeepali Mishra83% (6)

- Securitization in India: Key Concepts and StructuresDocument31 pagesSecuritization in India: Key Concepts and StructuresAbhishek MalikPas encore d'évaluation

- Cost of Capital Answer KeyDocument8 pagesCost of Capital Answer KeyLady PilaPas encore d'évaluation

- Nhai - Dpr-crrr1Document307 pagesNhai - Dpr-crrr1rjg_vijay100% (1)

- Irc SP 19-2001Document116 pagesIrc SP 19-2001rjg_vijayPas encore d'évaluation

- IRC SP 100 - 2014 Cold Mix Technology in Construction PDFDocument95 pagesIRC SP 100 - 2014 Cold Mix Technology in Construction PDFrjg_vijay50% (2)

- Guidelines for Structural Evaluation and Strengthening of Flexible Road Pavements Using FWDDocument44 pagesGuidelines for Structural Evaluation and Strengthening of Flexible Road Pavements Using FWDp09tp451Pas encore d'évaluation

- Dividend Policy and ValuationDocument49 pagesDividend Policy and ValuationAnkitaBansal100% (2)

- Kase StatWareDocument7 pagesKase StatWareTradingCLoudPas encore d'évaluation

- Module #6 Railway Alignment Design and Geometry REES 2010Document35 pagesModule #6 Railway Alignment Design and Geometry REES 2010Muhammed AliPas encore d'évaluation

- Module #6 Railway Alignment Design and Geometry REES 2010Document35 pagesModule #6 Railway Alignment Design and Geometry REES 2010Muhammed AliPas encore d'évaluation

- 922 - File716935851 - RFP Tunnel PDFDocument329 pages922 - File716935851 - RFP Tunnel PDFrjg_vijayPas encore d'évaluation

- RFP PKG Vii PDFDocument94 pagesRFP PKG Vii PDFrjg_vijayPas encore d'évaluation

- 922 - File716935851 - RFP Tunnel PDFDocument329 pages922 - File716935851 - RFP Tunnel PDFrjg_vijayPas encore d'évaluation

- CH6 HIL6 Annexure FFSRVol IMain ReportDocument351 pagesCH6 HIL6 Annexure FFSRVol IMain ReportAsif MuhammadPas encore d'évaluation

- CH6 HIL6 Annexure FFSRVol IMain ReportDocument351 pagesCH6 HIL6 Annexure FFSRVol IMain ReportAsif MuhammadPas encore d'évaluation

- RFP PKG ViDocument95 pagesRFP PKG Virjg_vijayPas encore d'évaluation

- CH6 HIL6 Annexure FFSRVol IMain ReportDocument351 pagesCH6 HIL6 Annexure FFSRVol IMain ReportAsif MuhammadPas encore d'évaluation

- CH6 HIL6 Annexure FFSRVol IMain ReportDocument351 pagesCH6 HIL6 Annexure FFSRVol IMain ReportAsif MuhammadPas encore d'évaluation

- VOl-I Notice of Intimation of RFP Package IDocument4 pagesVOl-I Notice of Intimation of RFP Package Irjg_vijayPas encore d'évaluation

- Life Cycle Cost Per Kilometre: Option - 1Document1 pageLife Cycle Cost Per Kilometre: Option - 1rjg_vijayPas encore d'évaluation

- Autocadexcelvba 130727075544 Phpapp01Document15 pagesAutocadexcelvba 130727075544 Phpapp01cpiconjPas encore d'évaluation

- Final NH22 Main Report Part 2Document57 pagesFinal NH22 Main Report Part 2rjg_vijayPas encore d'évaluation

- Cross SectionsDocument15 pagesCross Sectionsrjg_vijayPas encore d'évaluation

- Final NH22 Main Report Part 1Document197 pagesFinal NH22 Main Report Part 1rjg_vijayPas encore d'évaluation

- IRC 086-1983 Geometric Design Standards For Urban Roads in PlainsDocument18 pagesIRC 086-1983 Geometric Design Standards For Urban Roads in Plainsrjg_vijay100% (2)

- 5 Cell A1 Holds A Dummy Formula That Triggers A Recalc When A Cell in The Cellstocheck Range Is ModifiedDocument1 page5 Cell A1 Holds A Dummy Formula That Triggers A Recalc When A Cell in The Cellstocheck Range Is Modifiedrjg_vijayPas encore d'évaluation

- Life Cycle CostDocument86 pagesLife Cycle Costrjg_vijayPas encore d'évaluation

- Circular Stress CheckDocument3 pagesCircular Stress Checkrjg_vijayPas encore d'évaluation

- IRC Catalogue of PublicationsDocument12 pagesIRC Catalogue of Publicationsrjg_vijayPas encore d'évaluation

- FM-BINUS-AA-FPU-78/V2R0: Verified By, Tommy Andrian (D6181) and Sent To Department/Program On MARCH 29, 2022Document3 pagesFM-BINUS-AA-FPU-78/V2R0: Verified By, Tommy Andrian (D6181) and Sent To Department/Program On MARCH 29, 2022Saladin JaysiPas encore d'évaluation

- Chapter 1 Analysing and Interpreting FSDocument15 pagesChapter 1 Analysing and Interpreting FSKE XIN NGPas encore d'évaluation

- Finance Research Letters: Yanglin Li, Shaoping Wang, Qing ZhaoDocument6 pagesFinance Research Letters: Yanglin Li, Shaoping Wang, Qing ZhaoAnjali SoniPas encore d'évaluation

- Relative ValuationDocument29 pagesRelative ValuationOnal RautPas encore d'évaluation

- Regulatory Notice 15-09Document7 pagesRegulatory Notice 15-09simha1177Pas encore d'évaluation

- FCFE valuation model equity value XYZ LtdDocument12 pagesFCFE valuation model equity value XYZ LtdDr Sakshi SharmaPas encore d'évaluation

- Equity Valuation ThesisDocument5 pagesEquity Valuation ThesisJose Katab100% (2)

- Detailed StatementDocument33 pagesDetailed Statementwolf8585.inPas encore d'évaluation

- Strengthen Your HeartDocument40 pagesStrengthen Your HeartSabatino RuntuPas encore d'évaluation

- Problem Set Ch09 and Solutions'Document5 pagesProblem Set Ch09 and Solutions'ChelseyPas encore d'évaluation

- Benefits of Listing On BseDocument7 pagesBenefits of Listing On BseTarun LoharPas encore d'évaluation

- Our Distinctive Approach To Equity ResearchDocument11 pagesOur Distinctive Approach To Equity ResearchBubblyDeliciousPas encore d'évaluation

- Analysis of Indian Derivatives MarketDocument6 pagesAnalysis of Indian Derivatives MarketEhsaan IllahiPas encore d'évaluation

- Presentation Acquisition of GLGDocument43 pagesPresentation Acquisition of GLGAkshayPas encore d'évaluation

- GIS Form for JSF Skylink Lending CorporationDocument9 pagesGIS Form for JSF Skylink Lending Corporationmarianne capina de jesus100% (1)

- Kid Deriv CFD Synthetic IndicesDocument5 pagesKid Deriv CFD Synthetic IndicesSamir Ciro Acosta100% (1)

- DRHP220620181 PDFDocument411 pagesDRHP220620181 PDFskandPas encore d'évaluation

- Corporate Finance Report On LegoDocument8 pagesCorporate Finance Report On LegoAnna StoychevaPas encore d'évaluation

- Behavioural Factors and Stock Market PuzzleDocument30 pagesBehavioural Factors and Stock Market PuzzleJayesh RathodPas encore d'évaluation

- Tutorial 3 Week 3 Chapter 2Document3 pagesTutorial 3 Week 3 Chapter 2drgaanPas encore d'évaluation

- CISI - Financial Products, Markets & Services: Topic - Investment Funds Lesson: Introduction To Investment FundsDocument11 pagesCISI - Financial Products, Markets & Services: Topic - Investment Funds Lesson: Introduction To Investment FundsSewale AbatePas encore d'évaluation