Académique Documents

Professionnel Documents

Culture Documents

Q6 Standard Costing

Transféré par

Jeepee JohnDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Q6 Standard Costing

Transféré par

Jeepee JohnDroits d'auteur :

Formats disponibles

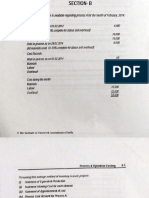

COST ACCOUNTING AND COST MANAGEMENT 2

Take Home Quiz on Standard Costing

July 13, 2016

Problem 1 2 points each

Deines, Inc. manufactures one product called tybos. The company uses a standard cost system and sells

each tybo for 8. At the start of monthly production, Deines estimated 8,000 tybos would be produced in

March. Deines has established the following material and labor standards to produce one tybo:

Standard Quantity

Standard Price

Direct materials

2.5 pounds

3 per pound

Direct labor

0.6 hours

10 per hour

During March 2016, the following activity was recorded by the company relating to the production of

tybos:

1.

2.

3.

4.

The company produced 7,500 units during the month.

A total of 20,000 pounds of materials were purchased at a cost of 55,000.

A total of 20,000 pounds of materials were used in production.

4,000 hours of labor were incurred during the month at a total wage cost of 44,000.

Instructions

Calculate the following variances for March for Deines, Inc.

(a) Materials price variance

(b) Materials quantity variance

(c) Labor price variance

(d) Labor quantity variance

Problem 2 2 points each

Hite Company has developed the following standard costs for its product for 2016:

HITE COMPANY

Standard Cost Card

Product A

Cost Element

Standard Quantity

Direct materials

4 pounds

Direct labor

3 hours

Manufacturing overhead

3 hours

Standard Price

3

8

4

Standard Cost

12

24

12

48

The company expected to produce 25,000 units of Product A in 2016 and work 75,000 direct labor hours.

Actual results for 2016 are as follows:

26,000 units of Product A were produced.

Actual direct labor costs were 630,800 for 76,000 direct labor hours worked.

Actual direct materials purchased and used during the year cost 283,500 for 105,000 pounds.

Actual variable overhead incurred was 130,000 and actual fixed overhead incurred was 170,000.

Instructions

Compute the following variances showing all computations to support your answers. Indicate whether the

variances are favorable or unfavorable.

(a) Materials quantity variance.

(b) Total direct labor variance.

(c) Direct labor quantity variance.

(d) Direct materials price variance.

(e) Total overhead variance.

Problem 3 2 points each

Feeney Company developed the following standard costs for its product for 2016:

FEENEY COMPANY

Standard Cost Card

Cost Elements

Direct materials

Direct labor

Variable overhead

Fixed overhead

Standard Quantity

4 pounds

2 hours

2 hours

2 hours

Standard Price

5

10

4

2

Standard Cost

20

20

8

4

52

The company expected to work at the 60,000 direct labor hours level of activity and produce 30,000 units

of product.

Actual results for 2016 were as follows:

28,400 units of product were actually produced.

Direct labor costs were 546,000 for 56,000 direct labor hours actually worked.

Actual direct materials purchased and used during the year cost 554,400 for 115,500 pounds.

Total actual manufacturing overhead costs were 340,000.

Instructions

Compute the following variances for Feeney Company for 2016 and indicate whether the variance is

favorable or unfavorable.

1. Direct materials price variance.

2. Direct materials quantity variance.

3. Direct labor price variance.

4. Direct labor quantity variance.

5. Overhead controllable variance.

6. Overhead volume variance.

Vous aimerez peut-être aussi

- 2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportD'Everand2017 International Comparison Program in Asia and the Pacific: Purchasing Power Parities and Real Expenditures—A Summary ReportPas encore d'évaluation

- Cost & Managerial Accounting II EssentialsD'EverandCost & Managerial Accounting II EssentialsÉvaluation : 4 sur 5 étoiles4/5 (1)

- Variance Analysis WorksheetDocument8 pagesVariance Analysis WorksheetLeigh018Pas encore d'évaluation

- Standard Costing Exercises Problem 1Document5 pagesStandard Costing Exercises Problem 1sehun ohPas encore d'évaluation

- ACC108 Assignment No. 1 (Standard Costing)Document5 pagesACC108 Assignment No. 1 (Standard Costing)John Andrei ValenzuelaPas encore d'évaluation

- MAS Problem VarianceDocument19 pagesMAS Problem VarianceMaria ZarinaPas encore d'évaluation

- Practice - Chapter 7 - ACCT - 401Document8 pagesPractice - Chapter 7 - ACCT - 401mohammed azizPas encore d'évaluation

- MASQUIZDocument11 pagesMASQUIZGelyn CruzPas encore d'évaluation

- Problem Sets PDFDocument3 pagesProblem Sets PDFJcel JcelPas encore d'évaluation

- Cost Acctng ReviewerDocument9 pagesCost Acctng ReviewerLyle Abe Fuego DampogPas encore d'évaluation

- Problem-1 (Materials, Labor and Variable Overhead Variances)Document3 pagesProblem-1 (Materials, Labor and Variable Overhead Variances)Khim RamosPas encore d'évaluation

- 2 5370806713307890464 PDFDocument5 pages2 5370806713307890464 PDFMekuriawAbebawPas encore d'évaluation

- Variance QuestionsDocument11 pagesVariance QuestionskajalePas encore d'évaluation

- PracticeDocument6 pagesPracticeNgan Tran Ngoc ThuyPas encore d'évaluation

- Program Learning 2 Macctg Student ABC and BudgetingDocument8 pagesProgram Learning 2 Macctg Student ABC and BudgetingainonlelaPas encore d'évaluation

- Programmazione e Controllo Esercizi Capitolo 8Document28 pagesProgrammazione e Controllo Esercizi Capitolo 8inatrya zukniaPas encore d'évaluation

- Assignment2revised1Document5 pagesAssignment2revised1Pankaj KhannaPas encore d'évaluation

- Review ExercisesDocument5 pagesReview ExercisesThy Tran HongPas encore d'évaluation

- Standard-Costing Ex PR CasesDocument7 pagesStandard-Costing Ex PR Casesjohn condesPas encore d'évaluation

- 10 2018 12 01!09 08 35 PMDocument2 pages10 2018 12 01!09 08 35 PMأسماعيل عباسPas encore d'évaluation

- Cost AccountingDocument7 pagesCost AccountingCarl AngeloPas encore d'évaluation

- 2009-07-29 133504 MathewDocument9 pages2009-07-29 133504 MathewAarti JPas encore d'évaluation

- Finals Quiz 1 CostDocument6 pagesFinals Quiz 1 CostChloe Oberlin100% (1)

- Week 10 TUTE Chapter 7 QuestionsDocument3 pagesWeek 10 TUTE Chapter 7 QuestionsEvelyn GladysPas encore d'évaluation

- Final Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiDocument9 pagesFinal Test - MA - 2021. 06. 05. New-Đã Chuyển ĐổiHồng Đức TrầnPas encore d'évaluation

- LATIHAN Soal Uas AMDocument5 pagesLATIHAN Soal Uas AMqinthara alfarisiPas encore d'évaluation

- Comprehensive Problem Standard Costing PDFDocument2 pagesComprehensive Problem Standard Costing PDFMallet S. GacadPas encore d'évaluation

- Standard Costing Practise QuestionsDocument6 pagesStandard Costing Practise QuestionsGHULAM NABI0% (1)

- Acc1 ADocument4 pagesAcc1 AJereek EspirituPas encore d'évaluation

- Standard CostingDocument2 pagesStandard CostingsumairaPas encore d'évaluation

- Practice Material For STD CostingDocument2 pagesPractice Material For STD CostingMichael CayabyabPas encore d'évaluation

- FAS1 - STD CostDocument9 pagesFAS1 - STD CostMica Moreen GuillermoPas encore d'évaluation

- Chapter 6 Exercise AnswersDocument6 pagesChapter 6 Exercise AnswersLuong Hoang Vu100% (1)

- Practice Sheet STD CostingDocument3 pagesPractice Sheet STD CostingPrerna AroraPas encore d'évaluation

- Prelims Reviewer For Cost AccountingDocument29 pagesPrelims Reviewer For Cost AccountingPamela Cruz100% (1)

- Exercises For The Course Cost and Management Accounting IIDocument8 pagesExercises For The Course Cost and Management Accounting IIDawit AmahaPas encore d'évaluation

- Managerial Accounting Practice Problems2 PDFDocument9 pagesManagerial Accounting Practice Problems2 PDFFrank Lovett100% (1)

- Acc 0Document21 pagesAcc 0Ashish BhallaPas encore d'évaluation

- Budgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The QuestionDocument17 pagesBudgeting Quiz 2: Multiple Choice Identify The Choice That Best Completes The Statement or Answers The Questionaldrin elsisuraPas encore d'évaluation

- Ch7 & 8 BB QuizDocument6 pagesCh7 & 8 BB QuizTammy 27Pas encore d'évaluation

- Mas - 5Document2 pagesMas - 5Rosemarie CruzPas encore d'évaluation

- Pre Assignment PracticeDocument7 pagesPre Assignment PracticeaeyPas encore d'évaluation

- Standard CostingDocument6 pagesStandard CostingNurul FaizahPas encore d'évaluation

- Standard Costing and Variance AnalysisDocument3 pagesStandard Costing and Variance AnalysisClaire0% (1)

- Chap 11, 12 - Performance Variance AnalysisDocument2 pagesChap 11, 12 - Performance Variance Analysis37. Nguyễn Lê Mỹ TiênPas encore d'évaluation

- Reviewer For STANDARD COSTINGDocument4 pagesReviewer For STANDARD COSTINGSajhieePas encore d'évaluation

- Assignment I-Cost & MGT Acc IDocument2 pagesAssignment I-Cost & MGT Acc IzewdiePas encore d'évaluation

- Joc ProbDocument10 pagesJoc ProbSoothing BlendPas encore d'évaluation

- Additional Practice Cost Classification ClassworkDocument4 pagesAdditional Practice Cost Classification ClassworkIsra GhousPas encore d'évaluation

- Act 202 Final MathsDocument4 pagesAct 202 Final MathsMahiPas encore d'évaluation

- Problems and Exercises in Introduction in Acctg and CVPDocument4 pagesProblems and Exercises in Introduction in Acctg and CVPJanellePas encore d'évaluation

- Hom WorkDocument1 pageHom WorkAla'a A ShakirPas encore d'évaluation

- ROMERO BSMA1E Standard Costing ExerciseDocument4 pagesROMERO BSMA1E Standard Costing ExerciseAliah Romero100% (1)

- CH 8 and 9Document37 pagesCH 8 and 9hamdanmakPas encore d'évaluation

- Latihan Soal Standar CostingDocument2 pagesLatihan Soal Standar Costing31 Sri RizkillahPas encore d'évaluation

- Cost Akun CHP 4 (Exer 3)Document2 pagesCost Akun CHP 4 (Exer 3)Vincent Suryajaya GuntoroPas encore d'évaluation

- Homework AssignmentDocument11 pagesHomework AssignmentHenny DeWillisPas encore d'évaluation

- Managerial Accounting HomeworkDocument6 pagesManagerial Accounting Homework王泓鈞Pas encore d'évaluation

- Demonstration ProblemsDocument3 pagesDemonstration Problemsnega guluma100% (1)

- Pre-Quali TQ 2a With Answer KeyDocument10 pagesPre-Quali TQ 2a With Answer KeyJeepee John100% (2)

- AFAR 14D Cost Accounting (Job Order, Process Costing, JIT Backflush, Activity Based Costing, Joint and ByProducts, Standard Costing)Document9 pagesAFAR 14D Cost Accounting (Job Order, Process Costing, JIT Backflush, Activity Based Costing, Joint and ByProducts, Standard Costing)Jeepee John100% (1)

- Factor Effecting Students English Speaking SkillsDocument18 pagesFactor Effecting Students English Speaking SkillsJeepee JohnPas encore d'évaluation

- Management Advisory Services Part 1 Pre-ExamDocument6 pagesManagement Advisory Services Part 1 Pre-ExamJeepee JohnPas encore d'évaluation

- AFAR 14D Cost Accounting (Job Order, Process Costing, JIT Backflush, Activity Based Costing, Joint and ByProducts, Standard Costing)Document9 pagesAFAR 14D Cost Accounting (Job Order, Process Costing, JIT Backflush, Activity Based Costing, Joint and ByProducts, Standard Costing)Jeepee John100% (1)

- AFAR 1 Partnership Accounting (Installment Liquidation)Document3 pagesAFAR 1 Partnership Accounting (Installment Liquidation)Jeepee JohnPas encore d'évaluation

- AFAR 1 Partnership Accounting (Installment Liquidation)Document3 pagesAFAR 1 Partnership Accounting (Installment Liquidation)Jeepee JohnPas encore d'évaluation

- 8 Stages of Human DevelopmentDocument4 pages8 Stages of Human DevelopmentJeepee John100% (4)

- Utilization of Scarce Resources (Problems)Document1 pageUtilization of Scarce Resources (Problems)Jeepee JohnPas encore d'évaluation

- 10 BugasPangcaPonceRoxasZeta PrintingPressDocument11 pages10 BugasPangcaPonceRoxasZeta PrintingPressJeepee JohnPas encore d'évaluation

- Non Valuated StockDocument4 pagesNon Valuated StockGK SKPas encore d'évaluation

- Managerial Analysis and Communication PGDM-RM, Irma: Case Analysis 1-Varun Nagar Cooperative SocietyDocument4 pagesManagerial Analysis and Communication PGDM-RM, Irma: Case Analysis 1-Varun Nagar Cooperative SocietyPiyush Mahapatra100% (1)

- Garrison Lecture Chapter 3Document74 pagesGarrison Lecture Chapter 3Enelyn Rose Gigtinta100% (1)

- Bam 040 Sas Period 1Document57 pagesBam 040 Sas Period 1Lily KyuPas encore d'évaluation

- Dwnload Full Accounting For Decision Making and Control 8th Edition Zimmerman Test Bank PDFDocument36 pagesDwnload Full Accounting For Decision Making and Control 8th Edition Zimmerman Test Bank PDFdietzbysshevip813100% (16)

- Activity Based CostingDocument34 pagesActivity Based Costingbarsa_leaPas encore d'évaluation

- LandAir Paradise Travels and Tours - Feasibility StudyDocument74 pagesLandAir Paradise Travels and Tours - Feasibility StudyMarnelli CatalanPas encore d'évaluation

- Quality Costs PDFDocument9 pagesQuality Costs PDFYvonne Barton100% (1)

- RP02 Porter HBR2001-Strategy and The InternetDocument16 pagesRP02 Porter HBR2001-Strategy and The InternetJun ParkPas encore d'évaluation

- EF Lecture 1 2022Document41 pagesEF Lecture 1 2022Simon GalvizPas encore d'évaluation

- Ethics of Management 7th Edition Hosmer Solutions ManualDocument17 pagesEthics of Management 7th Edition Hosmer Solutions Manualscottmichaelojbcfapdkq100% (18)

- KROG's MetalFab IncDocument8 pagesKROG's MetalFab Incaviralsharma1711Pas encore d'évaluation

- Beams Aa13e TB 22Document37 pagesBeams Aa13e TB 22Nazia EnayetPas encore d'évaluation

- Tax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainDocument52 pagesTax Audit Taxing Audit!!... : By:-CA. Krishan Vrind JainVrind JainPas encore d'évaluation

- IEEE-Std-3001.4-2020, IEEE Recommended Practice For Estimating The Costs of Industrial and Commercial Power SystemsDocument41 pagesIEEE-Std-3001.4-2020, IEEE Recommended Practice For Estimating The Costs of Industrial and Commercial Power SystemsLuis Fernandez FernandezPas encore d'évaluation

- Fixed Asset Accounting and Management Procedures ManualDocument16 pagesFixed Asset Accounting and Management Procedures ManualSrini VasanPas encore d'évaluation

- Ruka CompleteDocument121 pagesRuka CompletePhelix O DaniyanPas encore d'évaluation

- Responsibility AccountingDocument11 pagesResponsibility AccountingSheila Mae AramanPas encore d'évaluation

- Intro To CostsDocument18 pagesIntro To CostsKenePas encore d'évaluation

- Tutorial - Financial StatementDocument18 pagesTutorial - Financial StatementmellPas encore d'évaluation

- Break Even Practice Class QuestionsDocument7 pagesBreak Even Practice Class QuestionsÃhmed AliPas encore d'évaluation

- Deposit Product PricingDocument24 pagesDeposit Product PricingPrashamsa RijalPas encore d'évaluation

- The Production Cycle 2Document45 pagesThe Production Cycle 2Desy RachmawatiPas encore d'évaluation

- Job Order Costing - Bahria (08112021)Document12 pagesJob Order Costing - Bahria (08112021)Yasir Saeed AfridiPas encore d'évaluation

- BUSINESS MATH-IDEA EXEMPLAR-DLP - FinalDocument4 pagesBUSINESS MATH-IDEA EXEMPLAR-DLP - FinalSharon May Javier100% (2)

- Cost Accounting and ControlDocument3 pagesCost Accounting and ControlRoderica RegorisPas encore d'évaluation

- Role of Managerial Accounting and Its Direction Toward A Specific FieldDocument4 pagesRole of Managerial Accounting and Its Direction Toward A Specific FieldBududut BurnikPas encore d'évaluation

- Mock D QDocument15 pagesMock D QZeeshan Shaikh100% (1)

- COST Lesson 2Document4 pagesCOST Lesson 2Christian Clyde Zacal Ching0% (1)

- Process and Operating CostingDocument20 pagesProcess and Operating CostingBHANU PRATAP SINGHPas encore d'évaluation