Académique Documents

Professionnel Documents

Culture Documents

KB

Transféré par

owaishazaraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

KB

Transféré par

owaishazaraDroits d'auteur :

Formats disponibles

KHUSHALI BANK LIMITED

Vision: To be a premier microfinance bank providing service to micro-enterprise & low

income households across Pakistan.

Mission: To strengthen the economic base of low-income populace & microentrepreneurs by improving their accessibility to financial services.

Value: Empower, Excel, Ethics

Name

Rayomond Kotwal

Syed Javed

Geert Peetermans

Ms.Aatiqa Lateef

BOARD OF DIRECTORS

Designation

Name

Chairman

M.Ghalib Nishtar

Director

Lisa.G.Thomas

Director

Peter Kooi

Independent Director

Designation

President/Director

Director

Director

MANAGEMENT

Name

Ghalib Nishtar

Muhammad Farooq

Saleem Akhtar Bukhari

Amina Hassan

Syed Nasir Abbas Naqvi

Ms Lubna Azam Tiwana

Syed Ali Imran Bukhari

Wajid Ali

Sarah Anjam

OOC

KIM

GLP

NPL

EMI

DPD

Designation

President & CEO

Head Operation

Chief Financial Officer

Head Retail Banking

Chief Information Officer

Chief Risk Officer

Chief Compliance Officer

Head Human Resource

Company Secretary & Legal Counsel

ABBREVIATIONS

Operation Officer Cash

OOCS

Khushali Instruction Manual

LP

Gross Loan Portfolio

NLP

Non-Performance Loan

CRR

Equal Monthly Installment

TPP

Day Pass Due

KIC

Operation Officer Client Services

Loan Portfolio

Net Loan Portfolio

Cash Recovery Receipt

Temper Proof Pouch

Khushali Izafa Certificate

Name

Initial Deposit

Profit Margin

Minimum Balance

Other Advantage

KHUSHALI SAVING ACCOUNT

Mehfooz Account

Behtreen Bachat Account

Rs.500

Rs.5000

06 % Per Annum

Up to 10 % Per Annum

No Minimum Balance required

Avg Monthly Balance 25000

--Free Life Insurance

Name

Minimum Investment

Profit Paid

Tenure

KHUSHALI TERM DEPOSIT

Amandani Certificate

Izafa Certificate

Rs.5000

Rs.25000

At Maturity

At Monthly

06 & 12 Months

12 Months

Default: Failure to make obligation.

Loan Loss Reserve: A provision set aside to cover potential losses.

Net Loan Portfolio: Gross Loan Portfolio less the Loan Loss Reserve.

Working Capital: Difference between current assets and current liabilities.

Delinquent: Payment that has been made payable and is overdue and unpaid.

Active Clients: The number of clients with loans outstanding on any given date.

Bad Debt: A debt that is not collectible and is therefore worthless to the creditor.

Collateral: Asset pledged by a borrower to secure a loan, which can be repossessed in

the case of default.

Disbursement: Transfer of financial resources. The disbursement of a micro loan reflects

the transfer of the loan amount from the lending institution to the borrower.

Gross Loan Portfolio: All outstanding principal for all outstanding client loans,

including current, delinquent and restructured loans, but not loans that have been written

off. It does not include interest receivable.

Portfolio at Risk > 30 days: The value of all loans outstanding that have one or more

installments of principal past due more than 30 days. This includes the entire unpaid

principal balance, including both the past due & future installments, but not accrued

interest.

Write off: When an investment, such as a loan, becomes seriously delinquent or in

default and is determined to be uncollectible, the lender may choose to charge the

outstanding investment amount as an expense or a loss.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Banks! It'S Time To Change Your Game in Sme Lending Why and HowDocument8 pagesBanks! It'S Time To Change Your Game in Sme Lending Why and HowowaishazaraPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Beneficial To Well-BeingDocument23 pagesBeneficial To Well-BeingowaishazaraPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Annexure A-Vaccination of COVID-19Document2 pagesAnnexure A-Vaccination of COVID-19owaishazaraPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- M.phil Approved Rules and RegulationsDocument16 pagesM.phil Approved Rules and RegulationsowaishazaraPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Govt of Khyber Pakhtukhwa Trade Testing Board Located Inside Govt Technical & Vocational Centre Gulbahar PeshawarDocument1 pageGovt of Khyber Pakhtukhwa Trade Testing Board Located Inside Govt Technical & Vocational Centre Gulbahar PeshawarowaishazaraPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Role of Leaders' Idealized Influence and Inspirational Motivation On Employees' Job SatisfactionDocument7 pagesRole of Leaders' Idealized Influence and Inspirational Motivation On Employees' Job SatisfactionowaishazaraPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Work Behavior & Turnover Intention The Mediating Role of Work EngagementDocument25 pagesWork Behavior & Turnover Intention The Mediating Role of Work EngagementowaishazaraPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Measuring Islamic Work Ethics and Its Consequences On OC PDFDocument13 pagesMeasuring Islamic Work Ethics and Its Consequences On OC PDFowaishazaraPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Authentic Leadership, Work Engagement & OCBDocument25 pagesAuthentic Leadership, Work Engagement & OCBowaishazaraPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- OJ, What Remain The Change (R)Document18 pagesOJ, What Remain The Change (R)owaishazaraPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Housing Decision: Factors and Finances: Sajid MehmudDocument34 pagesThe Housing Decision: Factors and Finances: Sajid Mehmudmana gPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- E-Banking in India: Current and Future Prospects: January 2016Document14 pagesE-Banking in India: Current and Future Prospects: January 2016Varsha GuptaPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Purchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousDocument2 pagesPurchasing Procurement Construction Facilities in Fort Lauderdale FL Resume Joseph SousJosephSousPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

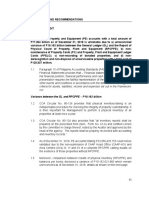

- 2018 9 Audit Observations and RecommendationsDocument76 pages2018 9 Audit Observations and RecommendationsMOTC INTERNAL AUDIT SECTIONPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Assignment No 1: Role of Business LetterDocument5 pagesAssignment No 1: Role of Business LetterSAIMA SHAHZADIPas encore d'évaluation

- Isp 1Document25 pagesIsp 1Francis LeoPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Ethical Issues in Various DepartmentsDocument9 pagesEthical Issues in Various Departmentsimnatila pongenPas encore d'évaluation

- CEO or Head of Sales & MarketingDocument3 pagesCEO or Head of Sales & Marketingapi-78902079Pas encore d'évaluation

- Categorized List of Certified CompaniesDocument17 pagesCategorized List of Certified CompaniesNLainie OmarPas encore d'évaluation

- Chapter 18 Multinational Capital BudgetingDocument15 pagesChapter 18 Multinational Capital Budgetingyosua chrisma100% (1)

- 2015 UBS IB Challenge Corporate Finance OverviewDocument23 pages2015 UBS IB Challenge Corporate Finance Overviewkevin100% (1)

- Gmail - Thanks For Your Order (Order# 1101830340)Document3 pagesGmail - Thanks For Your Order (Order# 1101830340)Luis Vargas AvalosPas encore d'évaluation

- Final Exam SampleDocument11 pagesFinal Exam SampleFelixEternityStabilityPas encore d'évaluation

- Ghaleb CV Rev1Document5 pagesGhaleb CV Rev1Touraj APas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Arrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupDocument2 pagesArrowroot Advisors Advises Reach Analytics On Its Sale To Datadecisions GroupPR.comPas encore d'évaluation

- HAC AeroOverview 2018 Feb enDocument45 pagesHAC AeroOverview 2018 Feb enAnonymous KaoLHAktPas encore d'évaluation

- Subcultures and Consumer BehaviorDocument12 pagesSubcultures and Consumer BehaviorRaghavendra.K.APas encore d'évaluation

- Tally ERP 9: Shortcut Key For TallyDocument21 pagesTally ERP 9: Shortcut Key For TallyDhurba Bahadur BkPas encore d'évaluation

- Page 1 - Curriculum Vitae of PAKER, Ahmet SaimDocument4 pagesPage 1 - Curriculum Vitae of PAKER, Ahmet SaimSaim PAKERPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Document23 pagesThe Theory of Constraints: Now That We Know The Goal, How Do We Use It To Improve Our System?Sanjay ParekhPas encore d'évaluation

- Nit 1Document7 pagesNit 1AnilKChoudharyPas encore d'évaluation

- BuisinessmanDocument57 pagesBuisinessmanLourencoPas encore d'évaluation

- International Institute of Professional Studies, Devi Ahilya VishwavidyalayaDocument51 pagesInternational Institute of Professional Studies, Devi Ahilya VishwavidyalayaPratiksha RajaniPas encore d'évaluation

- Digital TwinDocument35 pagesDigital TwinpPas encore d'évaluation

- PPP in MP TourismDocument1 pagePPP in MP TourismPrathap SankarPas encore d'évaluation

- APE Author Publisher EntrepreneurDocument401 pagesAPE Author Publisher Entrepreneurevanwillms100% (1)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Lean and Six Sigma - Not For AmateursDocument6 pagesLean and Six Sigma - Not For AmateursmsasgesPas encore d'évaluation

- Commercial Dispatch Eedition 1-27-19Document28 pagesCommercial Dispatch Eedition 1-27-19The DispatchPas encore d'évaluation

- Pegboard Minutes MeetingDocument2 pagesPegboard Minutes MeetingSuparman StPas encore d'évaluation