Académique Documents

Professionnel Documents

Culture Documents

United States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)

Transféré par

Scribd Government DocsDescription originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States v. Richard A. Gellman, 677 F.2d 65, 11th Cir. (1982)

Transféré par

Scribd Government DocsDroits d'auteur :

Formats disponibles

677 F.

2d 65

10 Fed. R. Evid. Serv. 794

UNITED STATES of America, Plaintiff-Appellee,

v.

Richard A. GELLMAN, Defendant-Appellant.

No. 81-5481.

United States Court of Appeals,

Eleventh Circuit.

May 27, 1982.

Sidney A. Soltz, Miami, Fla., Bruce Rogow, Ft. Lauderdale, Fla., for

defendant-appellant.

Hans G. Tanzler, III, Asst. U. S. Atty., Miami, Fla., Ellen Byers, Margaret

Miller, Dept. of Justice, Washington, D. C., for plaintiff-appellee.

Appeal from the United States District Court for the Southern District of

Florida.

Before TUTTLE, FAY and JOHNSON, Circuit Judges.

PER CURIAM:

This is an appeal from a conviction on two misdemeanor counts of failure to

file an income tax return in violation of 26 U.S.C. 7203.1 Appellant relies on

two contentions, both dealing with the admission at the trial of evidence

claimed by him to have been inadmissible. The first alleged error was that

when the witness who testified that he had formerly been a friend of the

appellant's was on the stand, he stated that Mr. Gellman told him repeatedly:

"He always needed $100,000 a year to maintain his current lifestyle and he also

made $100,000 a year." No objection was made to this testimony when it was

received in evidence. Even if it would have been error, upon proper objection

made, for the trial court to admit it, we do not consider it on appeal except

under the "plain error" doctrine.2 We conclude that the admission of this

evidence in a case in which the burden was on the United States to prove

wilfulness was not plain error.

The second ground of appeal was the refusal of the trial court to prevent the

Government from cross-examining a defense witness who had been convicted

of a similar violation of section 7203. This witness had formerly been the

defendant's counsel. He had been called on his behalf to testify to the

disorganized state of the defendant's records. The precise question, objected to

by the defendant, was whether the witness had not been prosecuted for failure

to file tax returns and whether he had not in fact served a prison sentence as a

result. He testified in the affirmative.

Appellant's criticism of the court's permitting this cross-examination is based

on his contention that a witness may not be questioned, under the excuse of

testing his credibility, about any offense which is not either a felony or comes

within rule 609(a)(2) which involves "dishonesty or false statement, regardless

of the punishment." He contends that the crime of failing to file a federal

income tax return under section 7201 does not meet this standard. He relies

principally upon the decision by the Court of Appeals for the Fifth Circuit in

United States v. Ashley, 569 F.2d 975 (5th Cir. 1978), holding that the crime of

shoplifting did not meet this standard.

We conclude that the decision of the Court of Appeals for the Fourth Circuit

that the violation of this federal criminal statute is "sufficiently reprehensible to

meet the exception of Rule 609(a)(2)" is correct, Zukowski v. Dunton, 650 F.2d

30 (4th Cir. 1981), although based only upon a decision by the United States

District Court for the Southern District of New York in United States v. Klein,

438 F.Supp. 485 (S.D.N.Y.1977).

The judgment is AFFIRMED.

Section 7203. Wilful Failure to File Return, Supply Information, or Pay Tax

Any person required by this Title to pay any estimated tax or tax or required by

this Title or regulations made under authority thereof to make a return ..., who

wilfully fails to ... make such return, ... at the time or times required by law or

regulations, shall, in addition to other penalties provided by law, be guilty of a

misdemeanor and upon conviction thereof shall be fined not more than

$10,000, or imprisoned not more than one year, or both, together with the cost

of prosecution.

Rule 103(d). Plain Error. Nothing in this Rule precludes taking notice of plain

errors affecting substantial rights although they were not brought to the

attention of the Court

Vous aimerez peut-être aussi

- Patricia Cree v. Kim Allen Hatcher, M.D., 969 F.2d 34, 3rd Cir. (1992)Document7 pagesPatricia Cree v. Kim Allen Hatcher, M.D., 969 F.2d 34, 3rd Cir. (1992)Scribd Government DocsPas encore d'évaluation

- United States v. Leonard L. Payne, 800 F.2d 227, 10th Cir. (1986)Document4 pagesUnited States v. Leonard L. Payne, 800 F.2d 227, 10th Cir. (1986)Scribd Government DocsPas encore d'évaluation

- Liberty Financial Services and First Capital Securities, Inc. v. United States, 778 F.2d 1390, 1st Cir. (1985)Document5 pagesLiberty Financial Services and First Capital Securities, Inc. v. United States, 778 F.2d 1390, 1st Cir. (1985)Scribd Government DocsPas encore d'évaluation

- United States v. Kahan, 415 U.S. 239 (1974)Document8 pagesUnited States v. Kahan, 415 U.S. 239 (1974)Scribd Government DocsPas encore d'évaluation

- United States v. Nancy Gertner, Etc., John Doe, Intervenor, 65 F.3d 963, 1st Cir. (1995)Document15 pagesUnited States v. Nancy Gertner, Etc., John Doe, Intervenor, 65 F.3d 963, 1st Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. William M. Metcalf, A/K/A Pete Metcalf, 532 F.2d 752, 4th Cir. (1976)Document3 pagesUnited States v. William M. Metcalf, A/K/A Pete Metcalf, 532 F.2d 752, 4th Cir. (1976)Scribd Government DocsPas encore d'évaluation

- United States v. Parrino, 212 F.2d 919, 2d Cir. (1954)Document12 pagesUnited States v. Parrino, 212 F.2d 919, 2d Cir. (1954)Scribd Government DocsPas encore d'évaluation

- United States v. Charles W. Pilcher, 672 F.2d 875, 11th Cir. (1982)Document5 pagesUnited States v. Charles W. Pilcher, 672 F.2d 875, 11th Cir. (1982)Scribd Government DocsPas encore d'évaluation

- Government of The Virgin Islands v. Meliah Bell, 392 F.2d 207, 3rd Cir. (1968)Document4 pagesGovernment of The Virgin Islands v. Meliah Bell, 392 F.2d 207, 3rd Cir. (1968)Scribd Government DocsPas encore d'évaluation

- United States v. David, 4th Cir. (1996)Document18 pagesUnited States v. David, 4th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- United States v. Philip Milestone, 626 F.2d 264, 3rd Cir. (1980)Document9 pagesUnited States v. Philip Milestone, 626 F.2d 264, 3rd Cir. (1980)Scribd Government DocsPas encore d'évaluation

- United States v. Harland L. Radue, 707 F.2d 493, 11th Cir. (1983)Document5 pagesUnited States v. Harland L. Radue, 707 F.2d 493, 11th Cir. (1983)Scribd Government DocsPas encore d'évaluation

- United States v. Herve Wilmore, JR., 11th Cir. (2015)Document7 pagesUnited States v. Herve Wilmore, JR., 11th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- United States v. Carol Birney, 686 F.2d 102, 2d Cir. (1982)Document8 pagesUnited States v. Carol Birney, 686 F.2d 102, 2d Cir. (1982)Scribd Government DocsPas encore d'évaluation

- United States v. Robert Lee Green, A/K/A Hope, 636 F.2d 925, 4th Cir. (1980)Document12 pagesUnited States v. Robert Lee Green, A/K/A Hope, 636 F.2d 925, 4th Cir. (1980)Scribd Government DocsPas encore d'évaluation

- James T. Eicher v. United States, 774 F.2d 27, 1st Cir. (1985)Document4 pagesJames T. Eicher v. United States, 774 F.2d 27, 1st Cir. (1985)Scribd Government DocsPas encore d'évaluation

- United States v. James R. Wagstaff, 572 F.2d 270, 10th Cir. (1978)Document4 pagesUnited States v. James R. Wagstaff, 572 F.2d 270, 10th Cir. (1978)Scribd Government DocsPas encore d'évaluation

- In The Matter of Thomas Di Bella, A Witness Before A Special May, 1974 Grand Jury in The Eastern District of New York, 499 F.2d 1175, 2d Cir. (1974)Document5 pagesIn The Matter of Thomas Di Bella, A Witness Before A Special May, 1974 Grand Jury in The Eastern District of New York, 499 F.2d 1175, 2d Cir. (1974)Scribd Government DocsPas encore d'évaluation

- United States v. Saavedra-Villasenor, 10th Cir. (2008)Document7 pagesUnited States v. Saavedra-Villasenor, 10th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- United States v. Clifton, 127 F.3d 969, 10th Cir. (1997)Document6 pagesUnited States v. Clifton, 127 F.3d 969, 10th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- United States v. Erica Jacovia Bryant, 11th Cir. (2015)Document9 pagesUnited States v. Erica Jacovia Bryant, 11th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- United States v. Peter C. Pesano, 293 F.2d 229, 2d Cir. (1961)Document5 pagesUnited States v. Peter C. Pesano, 293 F.2d 229, 2d Cir. (1961)Scribd Government DocsPas encore d'évaluation

- United States v. L. Shyrl Brown, 600 F.2d 248, 10th Cir. (1979)Document16 pagesUnited States v. L. Shyrl Brown, 600 F.2d 248, 10th Cir. (1979)Scribd Government DocsPas encore d'évaluation

- United States of America and Frank Camp, Special Agent, Internal Revenue Service v. Windel R. Carroll, 567 F.2d 955, 10th Cir. (1977)Document4 pagesUnited States of America and Frank Camp, Special Agent, Internal Revenue Service v. Windel R. Carroll, 567 F.2d 955, 10th Cir. (1977)Scribd Government DocsPas encore d'évaluation

- Billy Smith v. United States, 3rd Cir. (2012)Document5 pagesBilly Smith v. United States, 3rd Cir. (2012)Scribd Government DocsPas encore d'évaluation

- United States v. Seymour Rosenfield, 469 F.2d 598, 3rd Cir. (1972)Document5 pagesUnited States v. Seymour Rosenfield, 469 F.2d 598, 3rd Cir. (1972)Scribd Government DocsPas encore d'évaluation

- Filed: Patrick FisherDocument7 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States v. Tyrone B. Johnson, 108 F.3d 341, 10th Cir. (1997)Document4 pagesUnited States v. Tyrone B. Johnson, 108 F.3d 341, 10th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- United States v. Edward Richard Eggert, 624 F.2d 973, 10th Cir. (1980)Document4 pagesUnited States v. Edward Richard Eggert, 624 F.2d 973, 10th Cir. (1980)Scribd Government DocsPas encore d'évaluation

- United States v. Herbert E. Otto, 742 F.2d 104, 3rd Cir. (1984)Document7 pagesUnited States v. Herbert E. Otto, 742 F.2d 104, 3rd Cir. (1984)Scribd Government DocsPas encore d'évaluation

- United States v. Thomas J. Curtis, JR., 70 F.3d 113, 4th Cir. (1995)Document3 pagesUnited States v. Thomas J. Curtis, JR., 70 F.3d 113, 4th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. Michael William Strand, 617 F.2d 571, 10th Cir. (1980)Document12 pagesUnited States v. Michael William Strand, 617 F.2d 571, 10th Cir. (1980)Scribd Government DocsPas encore d'évaluation

- United States v. Melvin Smith, 446 F.2d 200, 4th Cir. (1971)Document5 pagesUnited States v. Melvin Smith, 446 F.2d 200, 4th Cir. (1971)Scribd Government DocsPas encore d'évaluation

- Cross Brothers Meat Packers, Inc. v. United States, 705 F.2d 682, 3rd Cir. (1983)Document5 pagesCross Brothers Meat Packers, Inc. v. United States, 705 F.2d 682, 3rd Cir. (1983)Scribd Government DocsPas encore d'évaluation

- United States v. James M. Albert, 773 F.2d 386, 1st Cir. (1985)Document7 pagesUnited States v. James M. Albert, 773 F.2d 386, 1st Cir. (1985)Scribd Government DocsPas encore d'évaluation

- United States v. Norbert K. Lachmann, 469 F.2d 1043, 1st Cir. (1972)Document6 pagesUnited States v. Norbert K. Lachmann, 469 F.2d 1043, 1st Cir. (1972)Scribd Government DocsPas encore d'évaluation

- United States v. Robert Antonelli, 439 F.2d 1068, 1st Cir. (1971)Document3 pagesUnited States v. Robert Antonelli, 439 F.2d 1068, 1st Cir. (1971)Scribd Government DocsPas encore d'évaluation

- Mid-America's Process Service and Lynn Whitefield v. Honorable James O. Ellison, Terry Rhine v. Honorable James O. Ellison, 767 F.2d 684, 10th Cir. (1985)Document4 pagesMid-America's Process Service and Lynn Whitefield v. Honorable James O. Ellison, Terry Rhine v. Honorable James O. Ellison, 767 F.2d 684, 10th Cir. (1985)Scribd Government DocsPas encore d'évaluation

- United States v. Arthur A. Coia, Arthur E. Coia, Albert J. Le Pore, and Joseph J. Vacarro, JR., 719 F.2d 1120, 11th Cir. (1983)Document7 pagesUnited States v. Arthur A. Coia, Arthur E. Coia, Albert J. Le Pore, and Joseph J. Vacarro, JR., 719 F.2d 1120, 11th Cir. (1983)Scribd Government DocsPas encore d'évaluation

- United States v. Francis J. Turano, 802 F.2d 10, 1st Cir. (1986)Document4 pagesUnited States v. Francis J. Turano, 802 F.2d 10, 1st Cir. (1986)Scribd Government DocsPas encore d'évaluation

- United States v. Nerio Zuleta, 14 F.3d 45, 1st Cir. (1993)Document4 pagesUnited States v. Nerio Zuleta, 14 F.3d 45, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Florent La Haye, 548 F.2d 474, 3rd Cir. (1977)Document3 pagesUnited States v. Florent La Haye, 548 F.2d 474, 3rd Cir. (1977)Scribd Government DocsPas encore d'évaluation

- United States v. Allen Carr, 582 F.2d 242, 2d Cir. (1978)Document7 pagesUnited States v. Allen Carr, 582 F.2d 242, 2d Cir. (1978)Scribd Government DocsPas encore d'évaluation

- Steven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Document5 pagesSteven A. Stepanian, II v. David R. Addis, 782 F.2d 902, 11th Cir. (1986)Scribd Government DocsPas encore d'évaluation

- United States v. Glen M. Stoddart, 574 F.2d 1050, 10th Cir. (1978)Document5 pagesUnited States v. Glen M. Stoddart, 574 F.2d 1050, 10th Cir. (1978)Scribd Government DocsPas encore d'évaluation

- Knight v. United States, 37 F.3d 769, 1st Cir. (1994)Document9 pagesKnight v. United States, 37 F.3d 769, 1st Cir. (1994)Scribd Government DocsPas encore d'évaluation

- Filed: Patrick FisherDocument12 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Raymond F. Brierly v. Virginia Brierly, 991 F.2d 786, 1st Cir. (1993)Document5 pagesRaymond F. Brierly v. Virginia Brierly, 991 F.2d 786, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Donald W. Dawes and Phyllis C. Dawes, 874 F.2d 746, 10th Cir. (1989)Document7 pagesUnited States v. Donald W. Dawes and Phyllis C. Dawes, 874 F.2d 746, 10th Cir. (1989)Scribd Government DocsPas encore d'évaluation

- United States v. Cedric Newton, 677 F.2d 16, 2d Cir. (1982)Document2 pagesUnited States v. Cedric Newton, 677 F.2d 16, 2d Cir. (1982)Scribd Government DocsPas encore d'évaluation

- United States v. Damon Stradwick, United States of America v. Daryl Smith, United States of America v. Personne Elrico McGhee, 46 F.3d 1129, 4th Cir. (1995)Document8 pagesUnited States v. Damon Stradwick, United States of America v. Daryl Smith, United States of America v. Personne Elrico McGhee, 46 F.3d 1129, 4th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Noel A. Brinker v. Lewis O. Guiffrida, Director of The Federal Emergency Management Agency United States of America, 798 F.2d 661, 3rd Cir. (1986)Document11 pagesNoel A. Brinker v. Lewis O. Guiffrida, Director of The Federal Emergency Management Agency United States of America, 798 F.2d 661, 3rd Cir. (1986)Scribd Government DocsPas encore d'évaluation

- Raymond Miranda v. United States, 458 F.2d 1179, 2d Cir. (1972)Document4 pagesRaymond Miranda v. United States, 458 F.2d 1179, 2d Cir. (1972)Scribd Government DocsPas encore d'évaluation

- Not PrecedentialDocument8 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- John Dececco v. United States, 338 F.2d 797, 1st Cir. (1964)Document3 pagesJohn Dececco v. United States, 338 F.2d 797, 1st Cir. (1964)Scribd Government DocsPas encore d'évaluation

- In Re William F. Poutre, 602 F.2d 1004, 1st Cir. (1979)Document4 pagesIn Re William F. Poutre, 602 F.2d 1004, 1st Cir. (1979)Scribd Government DocsPas encore d'évaluation

- R. Bruce Hartnett v. United States, 996 F.2d 311, 10th Cir. (1993)Document5 pagesR. Bruce Hartnett v. United States, 996 F.2d 311, 10th Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Jack B. Karlin, 785 F.2d 90, 3rd Cir. (1986)Document4 pagesUnited States v. Jack B. Karlin, 785 F.2d 90, 3rd Cir. (1986)Scribd Government DocsPas encore d'évaluation

- U.S. v. Sun Myung Moon 718 F.2d 1210 (1983)D'EverandU.S. v. Sun Myung Moon 718 F.2d 1210 (1983)Pas encore d'évaluation

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Nyela Dorsey - Butler Causes of WWIDocument11 pagesNyela Dorsey - Butler Causes of WWINyela DorseyPas encore d'évaluation

- Lachaona Kervie Jay C. Bscrim-3F: Dispute Resolution and Crises/Incidents Management Question and AnswersDocument4 pagesLachaona Kervie Jay C. Bscrim-3F: Dispute Resolution and Crises/Incidents Management Question and AnswersKervie Jay LachaonaPas encore d'évaluation

- E.H. Carr's The Twenty Years' Crisis: Appearance and Reality in World PoliticsDocument12 pagesE.H. Carr's The Twenty Years' Crisis: Appearance and Reality in World PoliticsEunice D' Rennes RamosPas encore d'évaluation

- Jews in Nazi Germany 1933Document103 pagesJews in Nazi Germany 1933سید ہارون حیدر گیلانی100% (1)

- San Beda College of Arts and Sciences SC ConstitutionDocument20 pagesSan Beda College of Arts and Sciences SC ConstitutionJio SimonPas encore d'évaluation

- Aquino v. Municipality of Malay, AklanDocument2 pagesAquino v. Municipality of Malay, AklanAntonio BartolomePas encore d'évaluation

- Art 8 - The Challenges For Public AdministrationDocument4 pagesArt 8 - The Challenges For Public AdministrationRinDu BieCielLPas encore d'évaluation

- Dirty Hands: Jean Paul Sartre 1948Document24 pagesDirty Hands: Jean Paul Sartre 1948SAM Rizvi67% (3)

- Gang Stalking Flyer3Document1 pageGang Stalking Flyer3Dan Williams100% (1)

- Secretary of Justice V. LantionDocument1 pageSecretary of Justice V. LantionCharlie BartolomePas encore d'évaluation

- Lecture 6Document58 pagesLecture 6saad aliPas encore d'évaluation

- Ailet 2017 LLMDocument43 pagesAilet 2017 LLMArchit Virendra SharmaPas encore d'évaluation

- Alagappa Industrial Relations PDFDocument162 pagesAlagappa Industrial Relations PDFprabu06051984Pas encore d'évaluation

- Right To Information Act (In Medical Practice)Document25 pagesRight To Information Act (In Medical Practice)P Vinod Kumar100% (1)

- (Associated Bank vs. Pronstroller, 558 SCRA 113 (2008) )Document22 pages(Associated Bank vs. Pronstroller, 558 SCRA 113 (2008) )Jillian BatacPas encore d'évaluation

- The French Revolution (Important Questions)Document12 pagesThe French Revolution (Important Questions)5 Aditya Kr. 8CPas encore d'évaluation

- CH 10Document34 pagesCH 10Reema LaserPas encore d'évaluation

- Government Office Hours DocuDocument6 pagesGovernment Office Hours DocuChing Romero100% (1)

- Pale Privileged CommunicationDocument9 pagesPale Privileged CommunicationDiane UyPas encore d'évaluation

- People Vs JoseDocument2 pagesPeople Vs JoseFrancis Coronel Jr.100% (1)

- Department of Education: Leuteboro Elementary School Roles and Responsibilities of Bids and Awards CommitteeDocument55 pagesDepartment of Education: Leuteboro Elementary School Roles and Responsibilities of Bids and Awards CommitteeJoehan DimaanoPas encore d'évaluation

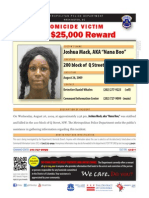

- Mack JoshuaDocument1 pageMack JoshuaKimberlyPas encore d'évaluation

- Dodds v. Law Firm Office of Bryon Barnhill Et Al - Document No. 5Document7 pagesDodds v. Law Firm Office of Bryon Barnhill Et Al - Document No. 5Justia.comPas encore d'évaluation

- 2011 Bar Q and A Political LawDocument12 pages2011 Bar Q and A Political LawMa Krishina Joy Amigo - EscobarPas encore d'évaluation

- Shehri Story 2006Document65 pagesShehri Story 2006citizensofpakistan100% (1)

- Petition For Correction of Clerical Error in The Certificate of Live BirthDocument2 pagesPetition For Correction of Clerical Error in The Certificate of Live BirthJayson Molejon67% (6)

- After Apprehension RPTDocument2 pagesAfter Apprehension RPTPaul Amigo50% (2)

- Hearing: Subcommittee On Federalism and The CensusDocument125 pagesHearing: Subcommittee On Federalism and The CensusScribd Government DocsPas encore d'évaluation

- In Re: Mallare Case DigestDocument1 pageIn Re: Mallare Case DigestJan Maxine PalomataPas encore d'évaluation

- Affidavit of Undertaking Pat - WPS PDF ConvertDocument2 pagesAffidavit of Undertaking Pat - WPS PDF ConvertSabbyna92% (13)