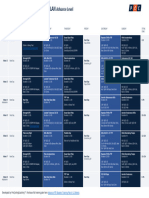

Académique Documents

Professionnel Documents

Culture Documents

Anup Deka: Areas of Expertise

Transféré par

Yash JalanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Anup Deka: Areas of Expertise

Transféré par

Yash JalanDroits d'auteur :

Formats disponibles

ANUP DEKA

House No 13, Ashok Nagar

No. +91 - 9864047687

Near Income-Tax Residential Complex

anupdeka@rediffmail.com

Bongaon, Beltola

Assam, India

Mobile

Email ID:

Guwahati-781038,

__

AREAS OF EXPERTISE

Sales Tax Value Added Tax and Central Sales Tax (Indirect Tax)

Monthly Sales Bills, Credit Notes, Debit Notes reconciliation

Monthly / Annual Accounts closing with Tax reconciliation

Tax Deducted at Source (TDS) of Salary & Non Salary (Direct Tax)

Tax Assessment under VAT, CST, Service Tax

Income-Tax of Individual (Direct Tax)

Service Tax (Indirect Tax)

Garnering and collecting C-Forms, F-forms, Way Bills

Tax computation under Income Tax & TDS, Service Tax, VAT, CST

Filing returns of Income-Tax, Service Tax, TDS, VAT, CST

Liaison with different taxation authority

Preparing and maintaining registers/utilizations of Govt. forms.

Vouchers, Ledgers postings their reconciliations

Observations of different accounting policies related to taxations when

making any entries in the books (both tally and ERP)

Helping purchase dept. to deliver their Statutory responsibilities

VAT Audit

Other statutory compliances

WORK EXPERIENCE

STAR Cement, Guwahati, India

Executive ( Finance & Accounts)

Dec 2013 to Present

Reporting to Deputy Manager (F& A) (R1), Sr.AGM (F & A) (R2)

Responsibilities:

Responsible for all VAT, CST, Entry Tax assessment matters of all India (9 states)

Responsible for all VAT, CST, ET details preparation and their reconciliation

Responsible for all VAT,CST, ET Returns matters

Monthly Tax Reconciliation

Monthly Sales bills , Credit Notes, Debit notes reconciliation

Responsible for helping Sales Tax Audit (VAT Audit)

Responsible for Way Bills/Road Permits

Responsible for Sales Tax Liaisoning

Responsible for all issues (major & minor) of Sales Tax related matters

Responsible for differential tax calculations of C-form parties and their debit note

Responsible for maintenance and dispatch of all C-forms relating to CST Sales (all India)

Responsible for maintenance and dispatch of all F-forms relating to Stock transfer (9

states) etc.

Responsible for collecting all the C-forms relating to Sales (all India)

Responsible for collecting all the F-forms relating to Sales (all India)

J.U.D. Cements Ltd., Guwahati, India

Executive (Finance & Accounts-Taxation)

May 2011 to Dec 2013

Reporting to AGM (Finance & Accounts), CFO

Responsibilities:

Responsible for Income-Tax computation sheet of all employees (both Plant & H.O.)

Responsible for computation of TDS of Non salary assesses & their details preparation

for 26Q

Filing TDS return (salary & non-salary)-vide NSDLs RPU

Responsible for preparing Value Added Tax (VAT) & Central Sales Tax (CST) details

(for the State of Assam, Tripura,Meghalaya,Mizoram)

Responsible for filing return of VAT & CST (both month /quarterly of Assam, Meghalaya

Tripura, Mizoram)

Responsible for filing Annual return of VAT & CST of Assam and VAT Audit Report of

Assam,

Tripura, Meghalaya, Mizoram

Responsible for preparing complete Service Tax details considering all POT Rule and

POP Rule

Responsible for Input service tax credit details for Excise dutys CENVAT

Responsible for filing return of Service Tax return (ST3)

Responsible for assessment under Income-Tax, Sales Tax & Service Tax (both Concurrent

& Tax Audit)

Responsible for CAG Audit of Service Tax (when audit of Excise is made annually)

Responsible for generating TDS (16 & 16A from tdscpc.gov.in and also manually

certificate of all

assesses

Responsible for garnering different declaration forms from Taxation authority e.g.Form-C/F/Delivery Notes/Road Permit/Way bills/Delivery Permit etc.

Preparation of utilization of waybills/ road permits/C-forms/F-forms etc.

Preparation of details of Cess payable on Limestone/MT for Labour Welfare & their

returns etc.

Preparation of details of Cess payable on Cement Production/MT for Cement Industry

development

Responsible for audit under Service Tax, VAT, Income-Tax

Responsible for preparing details of Professional Tax of employees of all employees

(plant & H.O.) and filing their return with token of payment.

Responsible for liaison with taxation authorities for different matters

Responsible for maintenance and implementation of TDS, Income-Tax, Service Tax

software

Taxation - Income tax, sales tax (VAT & CST),p-tax, service tax, TDS, Cess against Limestone

extraction and Cess against cement production, Tax Remission matters of Assam &

Meghalaya for VAT & CST

TRP/STRP (Tax Return Preparer/Service Tax Return Preparer) [self practicing

profession]

(Ref:- A.R. Choudhury-Chartered Accountant, Guwahati, Mobile -+919864109702)

Self Profession- November 2006 to December 2010

Responsibilities:

Responsible for computation of Service Tax, Income-Tax & TDS of individual

Preparing different ITRs of Income-Tax and ST3 of Service Tax & 24Q and 26Q of TDS

Registering different ST1 of Service Tax

Liaisoning with different taxation authority for different matter (

After preparing the return embossing the Signature with my license ID given by

Ministry of

Finance, CBDT & CBEC, GOI on the return

Informing the Finance Ministry regarding my return by uploading the details in

www.trpscheme.com

Attending different classes and reading different updates uploaded by the Finance

Ministry

in trpscheme portal

Attending different summons and queries of taxation authorities

Preparing TDS details and filing their return (both 24Q & 26Q) etc.

M/s A.K. Computers, Beltola, Guwahati, Assam, India [Owned business]

(Ref:- A.R. Choudhury-Chartered Accountant, Guwahati, Ph-9864109702)

Proprietor - January 2003 to November 2010

Responsibilities:

Responsible for purchase and sales and credit disposals

Responsible for servicing matters of all computer peripherals and their management

Responsible for Liaisoning with different debtors (both govt. deptt. and private)

Responsible for computation of Service Tax, Sales Tax, Income-Tax & TDS

Responsible for filing return of Income-Tax, Value Added Tax, Service Tax & TDS

Responsible for assessment of Income-Tax, Sales Tax, Service Tax and their order

Liaison with tax authorities litigating different matters

Responsible to maintain proper stock register and their reporting

Responsible for purchases their indent, PO, quotations, challans and tax invoices

Responsible for sales- their DO, sales incentive calculation, sales promoters security

interest

Responsible for maintaining and liaison with bankers

Monthly stock statement preparation and submission and BRS with bankers

Liaison with bankers for garnering STL, CC etc. and conforming their requirements

Responsible for AMCs of different customers, their timely redressal of different technical

Problems and arranging proper engineer/ technician in time.

Responsible to liaison with different companies, their schemes, incentives etc.

Responsible for Computer assembling and their OS and other software loading

Responsible to implement small local network in different organization.

Responsible for timely renewal of different distributor licenses of different MNCs

E-Meditek Solution Ltd.(TPA), GK-II, New Delhi

Software/Office Assistant June 2002 to December 2002

Reporting to Managing Director

Responsibilities:

Responsible for making and handling customized software for the company

Responsible for helping accounts department and field assistants implementing

their already existing software

Responsible for drafting different commercial letters

Attending clients and implementing and demonstrating our software to them

Responsible for helping our WAN provider maintain our networks

Responsible to help accounts department preparing their software module

Responsible for implementing Tally

Responsible for maintaining different ledgers and their voucher posting

Responsible for keeping track of different voucher entries w.r.t. final a/c

R. Jagota & Co. (Chartered Accountant) - Sonia Complex, Vikashpuri, New

Delhi

C.A. Articleship July 1999 to October 2000

Responsibilities:

Responsible for making voucher, their entries in tally and their verification

Responsible for preparing PL, PL appropriation and Balance Sheet of Individuals,

partnership

Firm and small companies

Responsible for statutory audit and concurrent audit of different companies

Responsible for Bank audit for two branches of PNB at Himachal Pradesh (Nalti &

Galian-Hamirpur

Division)

Responsible for drafting different letters to different authorities

Responsible for bank transactions

Responsible for different company matters related to ROC etc.

M.L. Singhi & Associates (Chartered Accountant) Azadpur Comm.

Complex, New Delhi

C.A. Articleship April 1998 to July 1999

Responsibilities:

Responsible for making voucher, their entries in tally and their verification

Responsible for ledger, balance sheet etc. their printing etc. as and when needed

Responsible for preparing PL, PL appropriation and Balance Sheet of Individuals,

partnership

Firm and small companies etc.

Responsible for statutory audit and concurrent audit of different companies

Responsible for drafting different letters to different authorities

Responsible for bank transactions

Responsible for preparing and maintain different minutes books and statutory books of

different

companies

Filing annual return of different companies in the ROC

Preparing different resolutions, their corrections and their updations in ROC

Liasoning in ITO, their correspondence etc.

Concurrent audit of Gangoor Foods (P) Ltd., Kapasera Border, Gurgaon

Voucher, ledger, cash book maintenance of Tosha India Ltd, Prashid India Ltd etc.

of Connaught Palace, New Delhi etc.

PROJECTS:

Project Title: Service Tax Return Preparer Scheme 2009-Govt. of India

Clients applicable: Individual & HUF (who is not covered within section 44AB)

Employment Type: Full-Time

Duration: Jul 2009 to Oct 2009

Project Location: Guwahati, Assam

Site: Onsite

Team Size: 26

Skilled Used: Theoretical knowledge of Service Tax under Finance Act, 1994 and TDS

& Income Tax Act, 1961 and knowledge of Microsoft different software

products.

Role Description: To learn and help the assessees to file return of TDS, Income Tax

and Service Tax. Litigating their taxation problems with the respective

departments etc. against a fee. Training was imparted by Chartered

Accountant selected and entrusted by CBEC. At the end of the whole

session appear for the final written and online test put forth by Finance

Ministry, Govt. of India

Project Details: Service Tax under Finance Act, 1994 and TDS & Income Tax

Project Title: Tax Return Preparer Scheme 2006-Govt. of India

Clients applicable: Individual & HUF (who is not covered within section 44AB)

Employment Type: Full-Time

Duration: Nov 2006 to Feb 2007

Project Location: Dibrugarh, Assam

Site: Onsite

Team Size: 26

Skilled Used: Theoretical knowledge of Income Tax under Income Tax Act, 1961 and

also Microsoft software products.

Role Description: To learn and submit question answer (online) put forth daily by

Finance Ministry, CBDT, Govt. of India relating to Income-Tax being trained

by Chartered Accountants selected and entrusted by the Deptt. Of

Revenue, Ministry of Finance, Govt. of India. At the end of the whole

session appear for the final written and online test put forth by Finance

Ministry, Govt. of India

Project Details: Service Tax under Finance Act, 1994 and TDS & Income Tax

EDUCATION:

1995 1998

B.Com. (Hons.) in Management

Gauhati Commerce College, Gauhati University

2001

Post Graduation Diploma in Computer Application

CMC Ltd., New Delhi, India

ACHIEVEMENTS:

Passed Tax Return Preparer (TRP) examination under Ministry of Finance, CBDT,

Govt. of India

In 2006 and got license to work as an Income Tax/TDS practitioner under

TRP Scheme 2006

.

Passed Service Tax Return Preparer (STRP) examination under Ministry of

Finance, CBEC, Govt.

of India in 2009 and got license to work as an Service Tax practitioner

under STRP Scheme 2009

COMPUTER SKILLS:

Power User in Matrix ERP 9.1.0 & its implementation at JUD Cements Ltd,

Guwahati, India

Well versed in Accounting Packages such as Tally 4.5, Tally 5.4 & 9.1 etc.

Well versed in all Operating Systems such as Windows, and MS Office

Well versed in installing & implementing different software like VB, c++, SQL etc.

Ability to install different operating systems

Have intermediate knowledge of computer hardware

DATE OF BIRTH:

GENDER:

HOBBY:

Favorite

1.9.1977

Male

Listening classical western rock music & blues and Football.

Band is U2.

PASSPORT No.

J8665650 (Date of expiry-17/04/2022)

CURRENT CTC

Rs.23000/- p.m. in hand

EXPECTED CTC

Rs.27000/- p.m. in hand

Sd//(ANUP DEKA)

Date: 29.10.2015

Place: Guwahati

Vous aimerez peut-être aussi

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthD'EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthPas encore d'évaluation

- Modified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Document28 pagesModified Tax Calculator With Form-16 - Version 8.2.2 (T) For 2013-14Bijender Pal ChoudharyPas encore d'évaluation

- Augusta Issue 1145 - The Jail ReportDocument24 pagesAugusta Issue 1145 - The Jail ReportGreg RickabaughPas encore d'évaluation

- Comprehensive Guide For Income Tax Returns FY 20-21Document34 pagesComprehensive Guide For Income Tax Returns FY 20-21mayuresh pingale100% (1)

- PS-8955 Zinc Alloy ElectrodepositedDocument8 pagesPS-8955 Zinc Alloy ElectrodepositedArturo Palacios100% (1)

- PA SystemDocument4 pagesPA SystemSnehal DambharePas encore d'évaluation

- Academic Qualification:-: Sap & Erp Implementation (Finsys)Document5 pagesAcademic Qualification:-: Sap & Erp Implementation (Finsys)Vikas BhardwajPas encore d'évaluation

- Amal RajDocument6 pagesAmal Rajdr_shaikhfaisalPas encore d'évaluation

- Wa0000.Document2 pagesWa0000.www.taxontrackPas encore d'évaluation

- Senior Accounts/Audit & Taxation Professional: Chetan KhambhaytaDocument3 pagesSenior Accounts/Audit & Taxation Professional: Chetan Khambhaytalala habibiPas encore d'évaluation

- Page 1 of 4Document4 pagesPage 1 of 4Anonymous gCSy6NhEPas encore d'évaluation

- Resume For Accounts DepartmentDocument5 pagesResume For Accounts DepartmentYubaraj BhattacharyaPas encore d'évaluation

- XXXXX ResumeDocument3 pagesXXXXX ResumekotisanampudiPas encore d'évaluation

- JagguDocument3 pagesJagguAnonymous 5p2dyVEpPas encore d'évaluation

- Subhadeep Ghosh CVDocument2 pagesSubhadeep Ghosh CVTabishPas encore d'évaluation

- CV-Lelin Roul - EcommerceDocument2 pagesCV-Lelin Roul - Ecommercewww.taxontrackPas encore d'évaluation

- Uni Mpa ResumeDocument3 pagesUni Mpa ResumeAnonymous WSOturvK3dPas encore d'évaluation

- CA Sunil Kumar Bommisetty ResumeDocument2 pagesCA Sunil Kumar Bommisetty Resumedileep.jcmPas encore d'évaluation

- Jayesh Khate CV 2024Document2 pagesJayesh Khate CV 2024Niraj HPas encore d'évaluation

- Aakash Rana: Professional ExperienceDocument1 pageAakash Rana: Professional ExperienceCHANDRAKANT RANAPas encore d'évaluation

- F-34, Khanpur, New Delhi-110062: Nitin Kumar Email: Ca Mobile No.: +91-AddressDocument3 pagesF-34, Khanpur, New Delhi-110062: Nitin Kumar Email: Ca Mobile No.: +91-AddressThe Cultural CommitteePas encore d'évaluation

- Mobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalDocument2 pagesMobile: +91-xxx E-Mail: XX: Accomplished Indirect Taxation ProfessionalSunilDoraPas encore d'évaluation

- CV - Abhishek SinglaDocument4 pagesCV - Abhishek SinglaMoHiT chaudharyPas encore d'évaluation

- Himanshu SinghalDocument2 pagesHimanshu SinghalThe Cultural CommitteePas encore d'évaluation

- Resume Sunaina+GoyalDocument2 pagesResume Sunaina+GoyalThe Cultural CommitteePas encore d'évaluation

- Bangalore 10.00 YrsDocument4 pagesBangalore 10.00 YrsDeepthi VasanthakumarPas encore d'évaluation

- Naukri SrinivasAnumala (12y 0m)Document3 pagesNaukri SrinivasAnumala (12y 0m)Ashwani KumarPas encore d'évaluation

- Sunny ResDocument3 pagesSunny ResSuneet DavgotraPas encore d'évaluation

- Resume Malay Kumar SinghaDocument3 pagesResume Malay Kumar SinghaDRIVECUREPas encore d'évaluation

- CV Achmad NoviantoDocument7 pagesCV Achmad NoviantoBDE Eko PurmintoPas encore d'évaluation

- ContactOne Bookkeeping Fee Quote Preparatory Form ClientDocument2 pagesContactOne Bookkeeping Fee Quote Preparatory Form Clientmappu08Pas encore d'évaluation

- Be Nguyen ThiDocument3 pagesBe Nguyen ThimuiPas encore d'évaluation

- Jai Prakashatnur: CA With Two Years of Post Qualification ExperiencesDocument3 pagesJai Prakashatnur: CA With Two Years of Post Qualification Experiencesmohammed zubairPas encore d'évaluation

- Mohammed Khan (SR Accountant) KSA Wup CCDocument21 pagesMohammed Khan (SR Accountant) KSA Wup CCftimum1Pas encore d'évaluation

- 6 Month JST Programme VmeDocument8 pages6 Month JST Programme VmeHemanth Krishna RavipatiPas encore d'évaluation

- Cma NivasDocument4 pagesCma NivaskasyapPas encore d'évaluation

- Resume ShibeeshDocument4 pagesResume ShibeeshAshik AliPas encore d'évaluation

- Khurram Baig: Professional Experience (ISLAM ENGINEERING (PVT) LTD. (Feb-19 To Date) Designation (Chief Accountant)Document2 pagesKhurram Baig: Professional Experience (ISLAM ENGINEERING (PVT) LTD. (Feb-19 To Date) Designation (Chief Accountant)Wazeeer AhmadPas encore d'évaluation

- Naukri ASHISHSINGH (13y 0m)Document3 pagesNaukri ASHISHSINGH (13y 0m)ashu.mahendruPas encore d'évaluation

- Work Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied ToDocument1 pageWork Experience Sheet: Instructions: 1. Include Only The Work Experiences Relevant To The Position Being Applied ToLorainne Jenn JamisPas encore d'évaluation

- Badminton Court ProjectDocument5 pagesBadminton Court ProjectPrince GeraldPas encore d'évaluation

- Tengku Mona Mia: Personal DetailsDocument5 pagesTengku Mona Mia: Personal Detailsdanang setiawanPas encore d'évaluation

- Narendra VijayDocument2 pagesNarendra VijayThe Cultural CommitteePas encore d'évaluation

- Income Tax Practical FAQDocument4 pagesIncome Tax Practical FAQHasidul Islam ImranPas encore d'évaluation

- Nagasuresh Nanduri: Technical SkillsDocument3 pagesNagasuresh Nanduri: Technical Skillsnagasuresh nPas encore d'évaluation

- KFCDocument3 pagesKFCShivam KaushalPas encore d'évaluation

- Yatin Karwal ResumeDocument3 pagesYatin Karwal ResumeSheikh NasiruddinPas encore d'évaluation

- Muzafar Resume Tax SpecialistDocument3 pagesMuzafar Resume Tax Specialistmuzafar.takeyPas encore d'évaluation

- Ahmad Anton Nugraha: Curriculum VitaeDocument8 pagesAhmad Anton Nugraha: Curriculum VitaeAhmad Anton NugrahaPas encore d'évaluation

- Looking For Chartered Accountant (CA)Document2 pagesLooking For Chartered Accountant (CA)Supriya NayakPas encore d'évaluation

- Curriculum Vitae: Career ObjectiveDocument2 pagesCurriculum Vitae: Career ObjectiveJItender SharmaPas encore d'évaluation

- Muzafar Resume Accounts SpecialistDocument3 pagesMuzafar Resume Accounts Specialistmuzafar.takeyPas encore d'évaluation

- CV Hitesh Kumar PareekDocument4 pagesCV Hitesh Kumar PareekmadisainiPas encore d'évaluation

- Presentation FdsDocument7 pagesPresentation FdsSam Smith - 252Pas encore d'évaluation

- Barun LalDocument3 pagesBarun Lalelvee.hrPas encore d'évaluation

- Ham IdDocument4 pagesHam IdMohammed Junaid0% (1)

- Tally 9.1 NotesDocument28 pagesTally 9.1 NotesAbdulhussain Jariwala100% (2)

- Rahul Sharma ResumeDocument5 pagesRahul Sharma ResumeggmdywzbngPas encore d'évaluation

- Rajat Singhal: Career ObjectiveDocument4 pagesRajat Singhal: Career Objectiveranjan7625Pas encore d'évaluation

- Human Capital Dot Com: NAME: Amit SharmaDocument5 pagesHuman Capital Dot Com: NAME: Amit SharmaChandra KulshresthaPas encore d'évaluation

- Resume - Sikander - Gupta - (Accounts and Finance)Document2 pagesResume - Sikander - Gupta - (Accounts and Finance)Phanindra GaddePas encore d'évaluation

- Curriculum Vitae: Sonal Sujay Patil. 4/2, Yashoda Kunj, Mohili Village, Pipeline Sakinaka, Mumbai-400072. ObjectiveDocument4 pagesCurriculum Vitae: Sonal Sujay Patil. 4/2, Yashoda Kunj, Mohili Village, Pipeline Sakinaka, Mumbai-400072. ObjectiveGayatri GowdaPas encore d'évaluation

- Shreesha Tantry - CVDocument3 pagesShreesha Tantry - CV476Pas encore d'évaluation

- 34P S4hana1909 BPD en UsDocument18 pages34P S4hana1909 BPD en UsBiji RoyPas encore d'évaluation

- PapernathazDocument26 pagesPapernathazAbelardo LapathaPas encore d'évaluation

- Fundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFDocument68 pagesFundamentals of Heat and Mass Transfer 7Th Edition Incropera Solutions Manual Full Chapter PDFbrainykabassoullw100% (10)

- 3rd Year. PunctuationDocument14 pages3rd Year. PunctuationmawarPas encore d'évaluation

- EASA CS-22 Certification of SailplanesDocument120 pagesEASA CS-22 Certification of SailplanessnorrigPas encore d'évaluation

- 02b. POS Learn ModuleDocument7 pages02b. POS Learn ModuleKUHINJAPas encore d'évaluation

- GE2410 Student Booklet (UpdatedDec27)Document88 pagesGE2410 Student Booklet (UpdatedDec27)markhoPas encore d'évaluation

- Hortee OromooDocument48 pagesHortee OromooAsnaafii BantiiPas encore d'évaluation

- Engineering Data: Wireway SelectionDocument3 pagesEngineering Data: Wireway SelectionFidel Castrzzo BaePas encore d'évaluation

- Authority To TravelDocument39 pagesAuthority To TraveljoraldPas encore d'évaluation

- Ricoh Aficio SP C420DN PARTS CATALOGDocument82 pagesRicoh Aficio SP C420DN PARTS CATALOGYury Kobzar100% (2)

- Catalogo Repetidor EnergyAxisDocument2 pagesCatalogo Repetidor EnergyAxisolguita22Pas encore d'évaluation

- Frequently Asked Questions - Maybank Visa DebitDocument4 pagesFrequently Asked Questions - Maybank Visa DebitholaPas encore d'évaluation

- 3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)Document6 pages3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)hsem Al EimaraPas encore d'évaluation

- JICA Helmya DCC Building FFDocument4 pagesJICA Helmya DCC Building FFMuhammad ElbarbaryPas encore d'évaluation

- Pulsating Heat Pipe ReportDocument65 pagesPulsating Heat Pipe ReportIdul Azharul HoquePas encore d'évaluation

- Mindset For IELTS Level 1 Student's Book PDF English As A Second or Foreign Language International English Language TestinDocument1 pageMindset For IELTS Level 1 Student's Book PDF English As A Second or Foreign Language International English Language TestinhiPas encore d'évaluation

- Internal Audit, Compliance& Ethics and Risk Management: Section 1) 1.1)Document6 pagesInternal Audit, Compliance& Ethics and Risk Management: Section 1) 1.1)Noora Al ShehhiPas encore d'évaluation

- Energy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)Document15 pagesEnergy Management Assignment #01: Submitted BY Shaheer Ahmed Khan (MS2019198019)shaheer khanPas encore d'évaluation

- FTP Booster Training Plan OverviewDocument1 pageFTP Booster Training Plan Overviewwiligton oswaldo uribe rodriguezPas encore d'évaluation

- Euronext Derivatives How The Market Works-V2 PDFDocument106 pagesEuronext Derivatives How The Market Works-V2 PDFTomPas encore d'évaluation

- Dinengdeng RecipeDocument1 pageDinengdeng RecipeFuPas encore d'évaluation

- Battle Cry Zulu WarDocument4 pagesBattle Cry Zulu WarPat RisPas encore d'évaluation

- Assignment 1 SolutionDocument11 pagesAssignment 1 SolutionKash TorabiPas encore d'évaluation

- 2008 IASS SLTE 2008 Chi Pauletti PDFDocument10 pages2008 IASS SLTE 2008 Chi Pauletti PDFammarPas encore d'évaluation

- Tes - 29 October 2021 UserUploadNetDocument120 pagesTes - 29 October 2021 UserUploadNetTran Nhat QuangPas encore d'évaluation

- The Eclectic (OLI) Paradigm of International Production - Past, Present and FutureDocument19 pagesThe Eclectic (OLI) Paradigm of International Production - Past, Present and FutureJomit C PPas encore d'évaluation