Académique Documents

Professionnel Documents

Culture Documents

Atm Work

Transféré par

Sozo Net WorkTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Atm Work

Transféré par

Sozo Net WorkDroits d'auteur :

Formats disponibles

1

ABSTRACT

Security measures at banks can play a critical, contributory role in preventing attacks on

customers. These measures are of paramount importance when considering vulnerabilities and

causation in civil litigation. Banks must meet certain standards in order to ensure a safe and

secure banking environment for their customers. This paper focuses on vulnerabilities and the

increasing wave of criminal activities occurring at Automated Teller Machines (ATMs) where

quick cash is the prime target for criminals rather than at banks themselves. A biometric and

GSM measure as a means of enhancing the security has emerged from the discourse.

CHAPTERONE

INTRODUCTION

1.1

BACKGROUND OF THE STUDY

Automated teller machine is a mechanical device that has its roots embedded in the accounts and

records of a banking institution. It is a machine that allows the banks customers carry out

banking

transactions

like,

deposits,

transfers,

balance

enquiries,

and

withdrawal.

Notwithstanding, we lived in a world where people no longer want to encounter long queues for

any reason, they dont not want to wait on queue for too long a time before they are attended to

and this has led to the increasing services being rendered by banks to further improve the

convenience of banking through the means of electronic banking. On this note the advent of

ATM is imperative, although with its own flaws. Crime at ATMs has become a nationwide issue

that faces not only customers, but also bank operators. Security measures at banks can play a

critical, contributory role in preventing attacks on customers. These measures are of paramount

importance when considering vulnerabilities and causation in civil litigation and banks must

meet certain standards in order to ensure a safe and secure banking environment for their

customers. Basically, the ATM scam involves thieves putting a thin, clear, rigid plastic sleeve

into the ATM card slot. When you insert your card, the machine can't read the strip, so it keeps

asking you to re-enter your PIN number. Meanwhile, someone behind you watches as you tap in

your number. Eventually you give up, thinking the machine has swallowed your card and you

walk away. The thieves then remove the plastic sleeve complete with card, and empty your

account. The way to avoid this is to run your finger along the card slot before you put your card

in. The sleeve has a couple of tiny prongs that the thieves need to get the sleeve out of the slot,

and you'll be able to feel them. The primary focus of this work is on developing a biometric

strategy (Fingerprint) and GSM to enhance the security features of the ATM for effective

banking transaction.

1.2

STATEMENT OF THE PROBLEM

In recent years, in line with global trends, the banking sector has faced rising levels of cash card

fraud resulting in the subsequent illegal withdrawal of funds from customer accounts. The

account-holder is normally held responsible for the loss of funds from their accounts and, as

such, the impact of this fraud could be potentially far-reaching. As a result of this, the banking

sector has to embrace biometrics as the solution to the growing problem of counterfeit ATM

cards and ID theft. Among others include

1. Fraudulent card readers, called skimmers are placed over the authentic reader to transfer

numbers and codes to nearby thieves.

2. Spy cameras are also used by password voyeurs to collect access codes.

3. In cases of card lost, if the loss is not noticed immediately, consumers may loose all

funds in an account.

4. If you forget your pin number, you cannot use the card.

5. The machine can retain your card when the machine malfunctions, when you forget your

secret number or if the card is damaged.

1.3

AIM AND OBJECTIVES

The aim of this project work is to simulate an embedded fingerprint authentication system, which

is used for ATM security applications. The specific objectives include:

I.

II.

To design a module that will collect customers finger print.

To design a module that will collect customers phone number and store them in a

III.

centralized database.

To design a module that will forward 4-digit number to their mobile when the finger print

IV.

reading matches.

To design a module that allows the customer to run his transaction after the system

V.

accepts the code generated.

To create a platform that will be able to analyze biometric data in the global image

analysis.

1.4

SCOPE OF THE STUDY

This study is on development of a secured ATM System for Nigeria Banks which will be

implemented using the finger print and GSM for securing the ATM System.There is a centralized

database to take care of customers personal and biometric data. The system is designed to query

the database by inputting a user finger print and if it matches with the one in a system it will

generate a 4-digit number that will enable the user to continue with his transactions.

1.5

SIGNIFICANCE OF THE STUDY

The current system of passwords and pin numbers needed to access financial services has drawn

a lot of criticism of late due to the increasing incidents of hacking. The system is at the mercy of

hackers, who use the hacked data to draw funds from the victims account. This is where

Biometrics with its foolproof system comes in. some of the reasons for building this system

include:

* Increase security - Provide a convenient and low-cost additional tier of security.

* Reduce fraud by employing hard-to-forge technologies and materials. For e.g. Minimize the

opportunity for ATM fraud.

* Eliminate problems caused by lost ATMs or forgotten passwords by using physiological

attributes. For e.g. prevent unauthorized use of lost, stolen or "borrowed" ATM cards.

* Replace hard-to-remember secret digits which may be shared or observed.

* Integrate a wide range of biometric solutions and technologies, customer applications and

databases into a robust and scalable control solution for facility and network access

* Make it possible, automatically, to know WHO did WHAT, WHERE and WHEN!

CHAPTER TWO

LITERATURE REVIEW

2.1

THE EVOLUTION OF THE COMPUTERISED BANKING SYSTEM

During the 1990s researchers at the Stanford Institute invented ERMA according to Molina

(1990) the Electronic Recording Method of Accounting is a computer processing system. ERMA

began as a project for the bank of America in an effort to computerize the banking industry.

ERMA computerized the manual processing of checks and account management and

automatically updated and posted checking accounts. Because of the historical evolution and

peculiarities, engendered taking into account the model of the European structure of a banking

system, a banking system n two levels has been created; the National Bank of Romania, as the

Central Bank, and the Commercial Banks(Vossen,1991). Considering the role and importance

held by the banks as regards the good operation of the economic agents and the requirements of

all the categories of economic agents in the market economy, as well as of the physical persons

beneficiaries of credits, depositors etc.. The computers security system should be sound enough

to maintain privacy of personal information. But still, we can that computerized banking is really

a boom to the customers in accessing and managing their account effectively, anytime and almost

anywhere. (Lewis, 2001). Recent media attention to information privacy issues has shown that

citizens are increasingly concerned about information privacy and their right to it. Governmental

and other organizations have been collecting data about individuals t an increasing and to many,

alarming rate. The ability to gather so much information on individuals is largely because of

advances in information technology (Renon, 1997).

It is important for managers and professionals to understand the issues surrounding personal

information privacy in order to protect the rights of those from and about whom they collect

data. The speed employed by the computerized banking for executing and confirming the

transactions is faster than the traditional speed of the ATM processing. (Bergstrom, 1994).

2.2

OVERVIEW OF ATM

According to Renon, (1997), an automated teller machine or automatic teller machine, also

known as an automated banking machine (ABM), cash machine, cashpoint, cashline, or

colloquially hole in the wall, is an electronic telecommunications device that enables the

customers of a financial institution to perform financial transactions without the need for a

human cashier, clerk or bank teller.

On most modern ATMs, the customer is identified by inserting a plastic ATM card with a

magnetic stripe or a plastic smart card with a chip that contains a unique card number and some

security information such as an expiration date, name and serial number. Authentication is

provided by the customer entering a personal identification number (PIN).Using an ATM,

customers can access their bank deposit or credit accounts in order to make a variety of

transactions such as cash withdrawals, check balances, transfer money, pay bills or credit mobile

phones. If the currency being withdrawn from the ATM is different from that in which the bank

account is denominated the money will be converted at an official exchange rate. Thus, ATMs

often provide the best possible exchange rates for foreign travelers, and are widely used for this

purpose(Renon, 1997). ATMs may be found in stores and shopping malls. Sometimes, they can

be found in bars or restaurants. Other times, at special events, people may set one up so the

guests can use the machine, like at a fundraiser. People need a debit card or credit card in order

to use an ATM. They will also need to have a Personal Identification Number (PIN), which is a

code that lets them get into their account.There are a number of scams with ATMs. In one scam,

con artists look over the victim's shoulder and find their PIN; this is known as shoulder surfing.

In another, they may install a video camera and get PIN numbers from that way. They then make

cards using the PIN number and account number to be able to use that person's account(Renon,

1997)

2.3

OVERVIEW OF BIOMETRICS

Biometric recognition, or biometrics, refers to the automatic identification of a person based on

his/her anatomical (e.g., fingerprint, iris) or behavioral (e.g., signature) characteristics or traits.

Renon, (1997), this method of identification offers several advantages over traditional methods

involving ID cards (tokens) or PIN numbers (passwords) for various reasons: (i) the person to be

identified is required to be physically present at the point-of-identification; (ii) identification

based on biometric techniques obviates the need to remember a password or carry a token. With

the increased integration of computers and Internet into our everyday lives, it is necessary to

protect sensitive and personal data. By replacing PINs (or using biometrics in addition to PINs),

biometric techniques can potentially prevent unauthorized access to ATMs, cellular phones,

laptops, and computer networks. Unlike biometric traits, PINs or passwords may be forgotten,

and credentials like passports and driver's licenses may be forged, stolen, or lost. As a result,

biometric systems are being deployed to enhance security and reduce financial fraud. Various

biometric traits are being used for real-time recognition, the most popular being face, iris and

fingerprint. However, there are biometric systems that are based on retinal scan, voice, signature

and hand geometry. In some applications, more than one biometric trait is used to attain higher

security and to handle failure to enroll situations for some users. Such systems are called

multimodal biometric systems.

According to Bergstrom, (1994). A biometric system is essentially a pattern recognition system

which recognizes a user by determining the authenticity of a specific anatomical or behavioral

characteristic possessed by the user. Several important issues must be considered in designing a

practical biometric system. First, a user must be enrolled in the system so that his biometric

template or reference can be captured. This template is securely stored in a central database or a

smart card issued to the user. The template is used for matching when an individual needs to be

identified. Depending on the context, a biometric system can operate either in a verification

(authentication) or an identification mode.

2.4

MODELS OF BIOMETRICS

There are different models of biometric systems. The models include

Iris Recognition

Charp, S.

(1994), With the integration of digital cameras that could acquire images at

increasingly high resolution and the increase of cell phone computing power, mobile phones

have evolved into networked personal image capture devices, which can perform image

processing tasks on the phone itself and use the result as an additional means of user input and a

source of context data (Charp, S. 1994). this image acquisition and processing capability of

mobile phones could be ideally utilized for mobile iris biometric. Recently, iris recognition

technology has been utilized for the security of mobile phones. As a biometric of high reliability

and accuracy, iris recognition provides high level of security for cellular phone based services for

example bank transaction service via mobile phone. One major challenge of the implementation

10

of iris biometric on mobile phone is the iris image quality, since bad image quality will affect the

entire iris recognition process. Previously, the high quality of iris images was achieved through

special hardware design. For example, the Iris Recognition Technology for Mobile Terminals

software once used existing cameras and target handheld devices with dedicated infrared

cameras (Fluaghter, R. 1990)). To provide more convenient mobile iris recognition, an iris

recognition system in cellular phone only by using built-in mega-pixel camera and software

without additional hardware component was developed (Glass, H. 2000)). Considering the

relatively small CPU processing power of cellular phone, in this system, a new pupil and iris

localization algorithm apt for cellular phone platform was proposed based on detecting dark

pupil and corneal specular reflection by changing brightness & contrast value. Results show that

this algorithm can be used for real-time iris localization for iris recognition in cellular phone.

Voice Recognition

Kingsbury, A. (2000), the speaker-specific characteristics of speech are due to difference in

physiological and behavioral aspects of the speech production system in humans. The main

physiological aspect of the human speech production system is the vocal tract shape. The vocal

tract modifies the spectral content of an acoustic wave as it passes through it, thereby producing

speech. Therefore, it is common in speaker verification systems to make use of features derived

only from the vocal tract. The microphone in the mobile phone captures the speech. Then, using

spectral analysis, an utterance may be represented as a sequence of feature vectors. Utterances,

spoken by the same person but at different times, result in similar yet a different sequence of

features vectors. So, the irrespective of the mood of the consumer, his transaction is accepted or

rejected. A voice signal conveys a persons physiological characteristics such as the vocal chords,

glottis, and vocal tract dimensions. Automatic speaker recognition (ASR) is a biometric method

11

that encompasses verification and identification through voice signal processing. The speech

features encompass high-level and low level parts. While the high-level features are related to

dialect, speaker style and emotion state that are not always adopted due to difficulty of

extraction, the low-level features are related to spectrum, which are easy to be extracted and are

always applied to ASR

Face Recognition

Klausmeier, J. (1984), Facial recognition is considered to be one of the most tedious among all

scans. Further, difficulty in acquisition of face and cost of equipments make it more complex.

However, some WAP enabled phones like CX 400K and LG-SD1000 manufactured by LG

electronics, have built in camera that can acquire images and can be transmitted over internet.

This it is sent to the credit card company to verify the face received matches with the face in

their database. If it matches, the goods are sent, else the order is rejected. We in our IMAGE

PROCCESSING LAB took two faces with small differences (you see a small dot in the forehead

of second face) and programmed MATLAB to find the difference between the two.

2.5

FINGER PRINT IDENTIFICATION ON MOBILE PHONE

Fingerprint biometric has been adopted widely for access control in places requiring high level of

security such as laboratories and military bases. By attaching a fingerprint scanner to the mobile

phone, this biometric could also be utilized for phone related security issues.

2.6

E-COMMERCE AND SECURITY ISSUES

Molina, J.K. (1997), whilst Australian businesses and consumers have embraced electronic

technology, there remains a substantial degree of mistrust in the confidentiality of electronically

12

filed and transferred information and the general security of e-commerce systems. These

businesses and consumers remain reticent in committing financial and private information to

electronic systems because of security issues. The issue of security, however, overlays all the

other issues of structure of commercial computer transactions and associated data transfer,

whether the transfer of funds is involved or not. Security must be of paramount importance in

any transactional based computer system. The dichotomy however, is that due to the very nature

of computers and their programming, it must be accepted that total security is not possible. The

best that can be expected is to approach the issues of security procedures, disaster recovery and

crisis management as part of a commercial risk management program in which the amount you

spend on security follows an assessment of the exposure you have to fraud. The best that can be

done is to try and keep up to date and ahead of the threats.

2.7

IMAGE MATCHING

Olea, J. and Prieto, G. (1999), image matching is a fundamental aspect of many problems in

computer vision, including object or scene recognition, solving for 3D structure from multiple

images, stereo correspondence, and motion tracking. This method describes image features that

have many properties that make them suitable for matching differing images of an object or

scene. The features are invariant to image scaling and rotation, and partially invariant to change

in illumination and 3D camera viewpoint. They are well localized in both the spatial and

frequency domains, reducing the probability of disruption by occlusion, clutter, or noise. Large

numbers of features can be extracted from typical images with efficient algorithms. In addition,

the features are highly distinctive, which allows a single feature to be correctly matched with

high probability against a large database of features, providing a basis for object and scene

recognition. The cost of extracting these features is minimized by taking a cascade filtering

13

approach, in which the more expensive operations are applied only at locations that pass an

initial test.

2.8

NEED FOR BIOMETRICS IN MOBILE PHONES:

Nowadays, shopping through the internet has become very popular and surely, a WAP enabled

mobile phone provides the facilities to consumers to shop online. Credit cards continue to be an

efficient tool for online money transactions. But, on the other hand, credit card's number can be

stolen on its way to its destination and can be misused by hackers. Thus, e-Business through a

mobile phone becomes insecure. Also anti-fraud Software, like those provided by Artic Soft and

ISC, created a back door entry and were largely involved in data spoofing. In addition to this,

many user and companies were prone to the attack of many viruses and Trojan horses. With so

much of problems faced, the service provide turned their attention towards biometrics to prevent

data spoofing and to provide secure e-Transactions

2.9

ONLINE AND OFF-LINE IRIS RECOGNITION SYSTEM

Sands, W. (1997), there are mainly two kinds of iris recognition attendance management system

on the market. One is on-line iris recognition attendance management sys-tem and the other is

off-line iris recognition attendance management system. On-line system always needs to connect

with a PC or workstation and all the iris recognition templates of people to be verified must be

stored in a database in the PC or workstation. Thereby, matching iris recognition needs the

support of the background PC. This kind of attendance management system is easy to paralyze in

case of malfunctions of iris recognition attendance machines, trans-mission line or PC. Once

several systems connect to form a network, burden of PC and the response time of the system

will be added.

14

By contraries, an off-line iris recognition attendance management system can finish all the

process including capturing the image of iris recognition, extracting minutiae, storing and

matching. All the operating of matching iris recognition needs no sup-port of PC and the burden

of PC is lightened. The same systems can connect to form a 485 network and finally connect to

the center PC of management sys-tem. So off-line systems are widely used in many occasions.

The shortcomings of this system are that there must be a managing PC nearly and it is difficult to

lay the transmission lines where topography is bad. With the development of wireless techniques

such as RFID, GPS, Wi-Fi, Bluetooth etc, many companies manufacture wireless modules. So

we can adopt the wireless techniques to solve the above-mentioned questions. There are mainly

two kinds of iris recognition attendance management system on the market. One is on-line iris

recognition attendance management sys-tem and the other is off-line iris recognition attendance

management system. On-line system always needs to connect with a PC or workstation and all

the iris recognition templates of people to be verified must be stored in a database in the PC or

workstation. Thereby, matching iris recognition needs the support of the background PC. This

kind of attendance management system is easy to paralyze in case of malfunctions of iris

recognition attendance machines, trans-mission line or PC. Once several systems connect to form

a network, burden of PC and the response time of the system will be added.

2.10

OVERVIEW OF THE FINGER PRINT BIOMETRICS

Fingerprint recognition or fingerprint authentication refers to the automated method of verifying

a match between two human fingerprints. Fingerprints are one of many forms of biometrics used

to identify individuals and verify their identity. The analysis of fingerprints for matching

purposes generally requires the comparison of several features of the print pattern. These include

patterns, which are aggregate characteristics of ridges, and minutia points, which are unique

15

features found within the patterns. It is also necessary to know the structure and properties of

human skin in order to successfully employ some of the imaging technologies.The three basic

patterns of fingerprint ridges are the arch, loop, and whorl:

Arch: The ridges enter from one side of the finger, rise in the center forming an arc, and

then exit the other side of the finger.

Loop: The ridges enter from one side of a finger, form a curve, and then exit on that same

side.

Whorl: Ridges form circularly around a central point on the finger.

Scientists have found that family members often share the same general fingerprint patterns,

leading to the belief that these patterns are inherited.

2.11

BENEFITS OF USING FINGERPRINT BIOMETRIC

Biometrics is a unique approach to identity management that offers userconvenience, increased

security, cost-effective provisioning and a non-repudiated,compliant audit trail for the system

operator. Traditional credentials or specialized knowledge tokens or passwords cannot guarantee

that the person using thesystem is the authorized individual. In addition, these forms of

identification can befrustrating for users and expensive for system operators.Given the benefits

of biometrics, why is it not pervasive or preferred? Simply put,the knowledge required to design

and deploy a successful biometric system is notwidely available. And, until recently, the

technology was not reliable enough toprovide the expected return on investment (ROI).This

paper encapsulates the best practices associated with the design and deploymentof fingerprint

16

biometric systems. The reader will learn how to avoid common pitfalls,ensure the system meets

user and operator expectations, and deliver the required ROI.Frost & Sullivan intends this paper

to be approachable, informative, andunderstandable to senior executives that want to know more

about what it takesto deploy biometrics in their organizations and reap the benefits of

theirinvestment. It is not a technical cookbook, but rather is a basis for asking questionsand

evaluating design choices to ensure that each fingerprint biometric deploymentproduces the

expected returns from the first day of deployment.

2.12

FINGERPRINT

BIOMETRICS

AS

SOLUTION

TO

IDENTITY

MMANAGEMENT CHALLENGES

In his own rendering Wise, S. and Kingsbury, G. (2000)stated that, fingerprint biometrics

identifies a user in a non-repudiated way. It can enhanceuser convenience, reduce (or even

eliminate) credential management costsand provide user-specific provisioning. Biometric

transactions are auditable andnon-repudiated. As a result of these benefits, many organizations

are adoptingfingerprint biometrics for identity management.A fingerprint is uniqueand copies

can be detected and prevented. This is in sharpcontrast to user IDs and passwords, which can be

easily replicated and usedinstantaneously by sophisticated electronic programs to gain access to

valuableenterprise assets. Combining a credential (i.e., a badge or other token) with apassword is

much more secure. The credential can be perfectly identified with someelectronic means to

detect presence and authenticity.

17

SECTION THREE

METHODOLOGY AND SYSTEM ANALYSIS

3.1

METHODOLOGY

The project methodology can be simply defined as the set of procedure that is followed from the

beginning to the completion of the software development process. The nature of the

methodology is dependent on a number of factors, including the software development

environment, the organizations practices, the nature or type of the software being developed, the

requirements of the users, the qualification and training of the software development team, the

available hardware software resources, the availability of existing design modules, and even the

budget and the time schedule. There are two broad categories of design methodologies used the

systematic and the formal types. As the name imply, the formal type makes extensive use of

mathematical notations for the object transformations and for checking consistencies. The

systematic type is less mathematical and it consists of the procedural component, which

prescribes what action or task to perform and the representation component, which prescribes

how the software structure should be represented.The research methodology is an orderly

manner or steps in which a close and careful study is carried out to find out what type of data is

maintained, its organization, storage and retrieval. The methods adopted for this software

engineering design are;

a. The structured systems analysis and design methodology (SSADM)

18

b. The object oriented analysis and design methodology (OOADM)

c. Prototyping

3.1.1

Structured Systems Analysis and Design Method

Structured Systems Analysis and Design Method (SSADM) is a systems approach to the analysis

and design of information systems. SSADM is a model by which an Information system design

can be arrived at. SSADM is one particular implementation which builds on the work of different

schools of structured analysis and development methods. The three most important techniques

that are used in SSADM are:

Stages of SSADM

SSADM involves the application of a sequence of analysis, documentation and design tasks

(Goodland &Riha, 1999). It has the following steps.

a.

Feasibility Study

This is a form of investigation into the goals and implications of state management company in

order to determine whether or not the given project is feasible or not, if the project is technically

possible, financially and socially justifiable, and acceptable to the organization. The project of

this stage is a formal feasibility study document. .

b.

Investigation of the Current Environment

This involves investigation and fact recording to understand the existing system i.e. the

operations of the ATM system and to identify the basic information requirements. This involves

19

knowing how the system operates, problems of the system and volumes of work done by the

system and operating cost. This involves interviewing employees, circulating questionnaires,

observations and reviewing existing documentation about the system under review.

c.

Business System Option (BSOs)

This is done using the outputs of the previous stage to develop a set of business system options.

This stage describes possible new systems in terms of functionality and implementation issues.

This involves developing alternative new system solutions.

d.

Requirements specification

Detailed functional and non-functional requirements are identified and new techniques are

introduced to define the required processing and data structure.

e.

Technical System Options

This describes the costs, benefits, and constraints of implementing the specification.

f.

Logical design

This defines how data is processed by theATM System and describes user dialogs. The logical

design specifies the main methods of interaction in terms of menu structures and command

structures. These are the main interfaces with which the user will interact with the system.

g.

Physical design

20

This involves developing user interface structures and implementing logical processes. This is

the final state where all the logical specifications of the system are converted to descriptions of

the system in terms of real hardware and software. The logical data structure is converted into a

physical architecture in terms of database structures.

3.1.2

Object-Oriented Analysis and Design Method (OOADM)

Object-oriented Analysis and Design (OOAD) software engineering approach models the ATM

System as a group of interacting objects. Each object represents some entity of interest in the

system being modeled, and is characterized by its class, its state (data elements), and its

behavior. The steps to undergo are;

Object-oriented Analysis

Object-oriented analysis (OOA) looks at the problem domain, with the aim of producing a

conceptual model of the information that exists in the area being analyzed. The sources for the

analysis can be a written requirements statement, a formal vision document, and interviews with

stakeholders or other interested parties.

a. Object-oriented Design

The result of object-oriented analysis is used in object-oriented design. This involves a

description of what the system is functionally required to do, in the form of a conceptual model.

These models are as a set of use cases, one or more UML class diagrams, and a number of

interaction diagrams.

b. Object-oriented Implementation

21

This step is involved with defining classes, creating objects, calling operations, implanting

inheritance and association.

3.1.3

Prototyping

A prototype is an original type, form, or instance of something serving as a typical example,

basis, or standard for other things of the same category. Software prototyping, an activity during

certain software development, is the creation of prototypes, i.e., incomplete versions of the

software program being developed.

Prototyping Stages

The process of prototyping involves the following steps

a.

Identify Basic Requirements

Determine basic requirements including the input and output information desired. Details, such

as security, can typically be ignored.

b.

Develop Initial Prototype

The initial prototype is developed that includes only user interfaces.

c.

Review

The customers, including end-users, examine the prototype and provide feedback on additions or

changes.

d.

Revise and Enhance the Prototype

22

Using the feedback both the specifications and the prototype can be improved. Negotiation about

what is within the scope of the contract/product may be necessary. If changes are introduces,

then, repeating developing initial prototype and review may be needed

3.2

INFORMATIONGATHERING

The methods used in data collection in this research are:

Observation: I observed how people go about their business while conducting ATM

transaction and notes were taken, I used this method with the view of setting an insight

of ways in which activities in the ATM system is actually carried out.

Internet: I obtained information relating to Finger print biometric with the help of the

internet. This method is one of my important sources of information gathering.

PersonalInterview: I interviewedsome of the staffs in the banking sector and some

customers that conduct some transactions using ATM. This helped to gather necessary

information.

3.3

ANALYSIS OF THE EXISTING SYSTEM

The existing system as I gathered operates as stated below:

A bank customer comes to an ATM machine, inserts the ATM card and selects a language. The

customer will enter his/her four digit secret number and press enter. Select the type of transaction

the customer wants to perform, withdraw or deposit money, then the customer will choose

23

whether to perform another transaction, if no the customer will choose whether to collect receipt

for the transaction. When the machine beeps at you, take your card, cash and receipt (if

applicable). You can use the receipt to record the transaction in your check register or passbook.

3.4

LIMITATIONS OF THE EXISTING SYSTEM

With the current upsurge and nefarious activities of Automated Teller Machine (ATM) ranging

from ATM card theft, skimming, pin theft, card reader techniques, pin pad techniques, force

withdrawals and lot more, fraudster is threatening electronic payment system in the nations

banking sector, users are threatening massive dumping of the cards if the unwholesome act is not

checked. In summary:

They are not safe since they are located outside the bankhall.

If one forgets the pin number he or she will not be able to withdraw money from their

accounts.

If one makes mistakes three times in entering the pin number the card will be swallowed

down the machine and it takes time to retrieve it.

3.7

OVERVIEW OF THE PROPOSED SYSTEM

A biometric system is essentially a pattern recognition system that operates by

acquiringbiometric data from an individual, extracting a feature vector from the acquired data,

comparingthis feature vector from the database feature vector. Person authentication has always

been anattractive goal in computer vision. Authentication systems based on human

characteristics suchas face, finger, iris and voice are known Biometrics systems. The basis of

every biometric systemis to get the input image and generate prominent feature vectors like

color, texture, etc.

3.8

JUSTIFICATION OF THE PROPOSED SYSTEM

24

Password and PINs have been the most frequently used authentication method. Their use

involves controlling access to a building or a room, securing access to computers, network, the

applications on the personal computers and many more. In some higher security applications,

handheld tokens such as key fobs and smart cards have been deployed. Due to some problems

related to these methods, the suitability and reliability of these authentication technologies have

been questioned especially in this modern world with modern applications. Biometrics offer

some benefits compare to these authentication technologies.

Increased Security

Biometric technology can provide a higher degree of security compared to traditional

authentication methods. Biometrics is preferred over traditional methods for many reasons which

include the fact that the physical presence of the authorized person is required at the point of

identification. This means that only the authorized person has access to the resources.Effort by

people to manage several passwords has left many choosing easy or general words, with

considerable number writing them in conspicuous places. This vulnerability leads to passwords

easily guessed and compromised. Also, tokens can be easily stolen as it is something you have.

By contrast, it is almost impossible for biometrics data to be guessed or even stolen in the same

manner as token or passwords. Some biometric systems can be broken under certain conditions,

today's biometric systems are highly unlikely to be fooled by a picture of a face.

Increased Convenience

One major reason passwords are sometimes kept simple is because they can be easily forgotten.

To increase security, many computer users are mandated to manage several passwords and this

25

increases the tendency to forget them. Card and tokens can be stolen and forgotten as well even

though attaching them to keyholders or chains can reduce the risk. Because biometric

technologies are based on something you are, it makes them almost impossible to forgot or

manage. This characteristic allows biometrics to offer much convenience than other systems

which are based on having to keep possession of cards or remembering several passwords.

Biometrics can greatly simplify the whole process involved in authentication which reduces the

burden on user as well as the system administrator (For PC applications where biometrics

replaces multiple passwords).Biometric authentication also allows for the association of higher

levels of rights and privileges with a successful authentication. Information of high sensitivity

can be made more readily available on a network which is biometrically protected than one

which is password protected. This can increase convenience as a user can access otherwise

protected data without any need of human intervention.

Increased Accountability

Traditional authentication methods such as tokens, passwords and PINs can be shared thereby

increasing the possibility of unaccountable access, even though it might be authorized. Many

organizations share common passwords among administrators for the purpose of facilitating

system administration. Unluckily, because there is uncertainty as to who at a particular point in

time is using the shared password or token, accountability of any action is greatly reduced. Also,

the user of a shared password or token may not be authorized and sharing makes it even hard to

verify, the security (especially confidentiality and integrity) of the system is also

reduced.Increase in security awareness in organizations and the applications being used has led

to the need for strong and reliable auditing and reporting. Deploying biometrics to secure access

26

to computers and other facilities eliminates occurrence such as buddy-punching and therefore

provides a great level of certainty as to who accessed what computer at what point in time.

START

3.9

FLOWCHART

OFATM

THECARD

EXISTING SYSTEM

INSERT

ENTER YOUR PIN

NO

IS PIN CORRECT

?

YES

SELECT TRANSACTION

WITHDRAW OR DEPOSIT MONEY

ANOTHER TRANSACTION

?

?

YES

NO

TAKE YOUR CASH, CARD AND RECEIPT

END

27

3.10

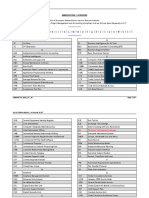

A HIGH LEVEL MODEL OF THE PROPOSED SYSTEM

FINGERPRINT ATM SYSTEM

HOME

ATM

NEW PIN

BANKER LOGIN

ENTER ACCOUNT NUMBER

USERNAME

FINGERPRINT SCAN

PASSWORD

ADD NEW ACCOUNT

DEPOSIT

SMS PORT

28

CHAPTER FOUR

SYSTEM DESIGN

4.1

GENERAL SYSTEM FUNCTION

The system will generally perform the following function:

There is a module that enables the banker/system administrator to take customers details

including their fingerprint scan and open account for them.

There is a module that enables the users to make deposits.

The system enables the customer to have access to their account when they produce their

account number and fingerprint scan.

When customers enter their account number, the system displays a prompt for finger print

reading, upon which a 4-digit number is forwarded to the customers phone.

There is a module that allows the customer to run his transaction after accepting the 4-

digit that was sent to the mobile phone.

The system generates a 4-digit random number for user authentication each time the

scanned finger print matches with the account number.

4.2

SYSTEM SPECIFICATION

This section shows the requirement of the system and what it is supposed to contain for effective

design.

29

4.2.1

Home Page Specification

Banker login: to login an administrative staff or the CEO admin to perform an

administrative functions like adding new account and deposits.

Home: to display the default page of the system.

Deposit: this enables the administrator to enter new deposits to the system.

Sms port: responsible for the forwarding of messages to customers mobile phone.

Atm: enables the customers to conduct their transactions after the correct authentication.

Add new account: enables the system administrator to open/add new customer account.

4.2.2

User Interface Specification

It is the specification for the user interface which is also path of the software that the user

interacts with, whether it is for input or output purposes.

4.2.2.1

Input Form Specification

The input form and their specification are shown below

A. Banker login form: this form enables the system administrator to login into the

system. The fields here are;

Username

Password

B. Add new account form: this form enables the administrator to collect and add new

customers data into the system. The fields here are:

Account name

Address

Phone number

Account number

Account type

Amount

30

Register

Exit

Place your finger print

C. Account deposit form: this form enables one to deposit money to the system. The

fields here are:

Account number

Amount

Deposit

Exit

D. Banker login form: this form enables the administrator/banker to login to the system.

The fields here are:

Username

Password

Login

Exit

E. Form port: this form handles the Sms sending information in the system. The fields

here are:

Enter your port number

Update

Close

4.2.2.2 Output Form specification

The output form here is the form that shows the details of the input processed by the biometric

atm authentication system. The output form is the transaction page that displays after the system

authentication. The fields here are:

4.2.3

Withdrawal

Balance enquiry

Mtn top up

Ministatement

Cancel

Database Specification

31

There is a database named atm to handle all the details of the finger print ATMsystem. The

database is designed with Microsoft access and incorporated into visual basic 6.0 platform. It has

four tables, we are going to look at the four tables. They includes:

a.

Admin: this table has the information needed for any admin staff to login. The fields

b.

in it includes:

Id

int(11)

Username

varchar(20) null

Password

varchar(20) null

Account: this table contains all the information about all the registered account. the

c.

fields here are:

Id

int(11)

Accountno

varchar(50)

Account_name varchar(200)

Amount

varchar(20)

Address

varchar(200)

Phoneno

varchar(20)

Passport

varchar(200)

Date_Of_Opened varchar(200)

Account_type

varchar(200)

Fingerprint_Id

varchar(6)

Sms

varchar(7)

Smsport

varchar(8)

Transaction: this table contains all the information about customers transaction and

d.

the type of transaction carried out. The fields here are:

Id

int(11)

Accountno

varchar(50)

Amount

varchar(11)

Purpose

varchar(200)

Date_no

varchar(20)

Enroll: this table contains the data of all the enrolled customers. The fields here are:

Id

int(11)

Template

blob

32

4.2.4

Program Module Specification

The program module specification describes the specification of what the program would do to

enhance good design guide during the process. As it concerns this particulars application

package, it describes different activities involved in the program modules. The classifications of

the modules are vividly described under the subsections below.

There are total of seven modules in this system specified according to their functions. They

include:

i.

ii.

Home:this module displays the default page of the system anytime a user click on it.

Add new account: this module allows the system administrator/banker to register/add

iii.

iv.

v.

new customers to the system.

Deposit: this module enables a deposit to be made in the system.

New pin: this module allows customers to obtain new pin to run their transactions.

Banker login: this module allow banker/system administrator to have access to the

vi.

administrator restricted area.

Atm: this module enables bank customers to run their transactions after the accurate

vii.

authentication.

Sms port: this module is responsible for forwarding messages (4-digit secret number) to

the customers after putting their account number and fingerprint scanning.

4.3

MAIN MENU DESIGN

4.3.1

Home Page Design

33

This subsection is responsible for contents in the main menu interface. Based on the fulfillment

of this project application package software, the main menu was designed to have a link to all the

form interfaces within the application. The figure below has a descriptive explanatory diagram of

the sketch of the main menu design. Different information that will enable the user, understand

the procedure as well as a guide for the software.

FINGERPRINT ATM SYSTEM

HOME

Input Data

ATM

NEW PIN

BANKER LOGIN

ENTER ACCOUNT NUMBER

USERNAME

Input From the Keyboard

FINGERPRINT SCAN

PASSWORD

DISPLAY REPORT

CPU

ADD NEW ACCOUNT

DEPOSIT

SMS PORT

Fig 2 user interface design

4.3.2

Program Module Design

4.3.2.1 System Flowchart

DATABASE

Output

34

START

DISPLAY BANKER LOGIN FORM

ENTER USERNAME AND PASSWORD

NO

IS USERNAME AND PASSWOR CORRECT ?

Fig. 7 system flowchart

YES

DISPLAY ADMINISTRATOR AREA

4.3.2.2 PROGRAM FLOWCHART

BANKER MODULE

ADD NEW ACCOUNT

ENTER DEPOSIT

SMS PORT

END

35

Fig. 8 banker module

ATM USER MODULE

36

37

38

CHAPTER FIVE

SUMMARY, CONCLUSION AND RECOMMENDATION

5.1

SUMMARY OF ACHIEVEMENTS

Rapid development of banking technology has changed the way banking activities are dealt with.

One banking technology that has impacted positively and negatively to banking activities and

transactions is the advent of automated teller machine (ATM). With an ATM, a customer is able

to conduct several banking activities such as cash withdrawal, money transfer, paying phone and

electricity bills beyond official hours and physical interaction with bank staff. In a nutshell, ATM

provides customers a quick and convenient way to access their bank accounts and to conduct

financial transactions.

The system will generally perform the following function:

There is a module that enables the banker/system administrator to take customers details

including their fingerprint scan and open account for them.

There is a module that enables the users to make deposits.

The system enables the customer to have access to their account when they produce their

account number and fingerprint scan.

When customers enter their account number, the system displays a prompt for finger print

reading, upon which a 4-digit number is forwarded to the customers phone.

There is a module that allows the customer to run his transaction after accepting the 4-

digit that was sent to the mobile phone.

The system generates a 4-digit random number for user authentication each time the

scanned finger print matches with the account number.

5.2

PROBLEMS ENCOUNTERED

39

There was some constraints encountered during collection of data, poor data collection becomes

apparent due to interviewing of banking organizations and their customers. Many of them were

reluctant to disclose important information and statistical data which otherwise would have been

relevant to this research, due to some banking secrets which breeds some indifferent attitudes

towards that effect.It takes a long time and large commitment of resources to get a good result,

unavailability of text and materials on this topic, made gathering of facts very difficult, some of

the facts were gathered from the internet, which is quite expensive.

5.3

CONCLUSSION AND RECOMMENDATION

The growth in electronic transactions has resulted in a greater demand for fast and accurate user

identification and authentication. Access codes for buildings, banks accounts and computer

systems often use PIN's for identification and security clearances. Conventional method of

identification based on possession of ID cards or exclusive knowledge like a social security

number or a password are not all together reliable. ID cards can be lost, forged or misplaced;

passwords can be forgotten or compromised, but ones biometric is undeniably connected to its

owner. It cannot be borrowed, stolen or easily forged. Using the proper PIN gains access, but the

user of the PIN is not verified. When credit and ATM cards are lost or stolen, an unauthorized

user can often come up with the correct personal codes. Despite warning, many people continue

to choose easily guessed PIN's and passwords - birthdays, phone numbers and social security

numbers. Recent cases of identity theft have heightened the need for methods to prove that

someone is truly who he/she claims to be. Biometric authentication technology using fingerprint

identifier may solve this problem since a persons biometric data is undeniably connected to its

owner, is nontransferable and unique for every individual. Biometrics is not only a fascinating

pattern recognition research problem but, if carefully used, could also be an enabling technology

40

with the potential to make our society safer, reduce fraud and lead to user convenience by

broadly providing the following three functionalities (a) positive identification (b) large scale

identification and (c) screening.

REFERENCES

Bergstrom, R. (1994), ATM attached importance and techniques, London: Pitman

publication ltd.

41

Charp, S.(1994), Networking and Telecommunications. Technical Horizons in Education, New

York: John Publishing.

Fluaghter, R. (1990), Computerized Adaptive Testing, Hillsdale, New York: ACM press.

Glass, H. (2000), Interpretation of international banking system, New Jersey: Vintage

publication.

Kingsbury, A. (2000), Mobilebanking services and operations, Birmingham: Morgan Kaufmann

Publishers.

Klausmeier, J. (1984), Networking and Microcomputers Eric Digest NY, Clearing House on

Information Resources, New York: Academic press.

Lewis, I. (2001), Computerization of banking systems, New York: Pearson Publication.

Molina, J.K. (1997), Item Banks Information Storage and Management; Analysis of a Computer

System,Megrowhill, New York: Vintage books.

Olea, J. and Prieto, G. (1999), Tests Information: Fundamental Application. Educational

Research, Washington DC: DP Publication ltd.

Renom, J. (1997), Perspective Tests Adaptive Information, New York: Yarchi Press.

Sands, W. (1997), Computerized Adaptive Testing, American Psychological association,

Washington DC: McGraw Hill.

Vossen, G. (1991), Data models, Database Languages. And Database Management Systems

Adison-Wesley Publishing, New Orleans: Pitman Publication.

Wise, S. and Kingsbury, G. (2000), Practical Issues in Developing and Maintaining a

Computerized Adaptive Test: Fundamental Application, New York: ACM Press.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- E PostOffice SRSDocument12 pagesE PostOffice SRSSozo Net WorkPas encore d'évaluation

- PCB Reverse EngineeringDocument2 pagesPCB Reverse Engineeringbill1022Pas encore d'évaluation

- Web Based Research InfoDocument44 pagesWeb Based Research InfoSozo Net WorkPas encore d'évaluation

- Crime Diary Yyy YyyDocument41 pagesCrime Diary Yyy YyySozo Net WorkPas encore d'évaluation

- Integrated Database Management System For A Multilocation Enterprise FullDocument51 pagesIntegrated Database Management System For A Multilocation Enterprise FullSozo Net WorkPas encore d'évaluation

- Online NewsDocument77 pagesOnline NewsSozo Net WorkPas encore d'évaluation

- E PaymentDocument56 pagesE PaymentSozo Net Work0% (1)

- 3D Internet and Network MediaDocument24 pages3D Internet and Network MediaSozo Net Work100% (1)

- Sales Forecasting FullDocument43 pagesSales Forecasting FullSozo Net WorkPas encore d'évaluation

- Socket LayerDocument23 pagesSocket LayerSozo Net Work100% (1)

- Credit CardDocument28 pagesCredit CardSozo Net WorkPas encore d'évaluation

- Digital PreservationDocument26 pagesDigital PreservationSozo Net WorkPas encore d'évaluation

- Youth Service Primary Assignment Deployment SystemDocument7 pagesYouth Service Primary Assignment Deployment SystemSozo Net WorkPas encore d'évaluation

- DescriptionDocument3 pagesDescriptionSozo Net WorkPas encore d'évaluation

- Registration Full Name Username Password EmailDocument4 pagesRegistration Full Name Username Password EmailSozo Net WorkPas encore d'évaluation

- UntitledDocument1 pageUntitledSozo Net WorkPas encore d'évaluation

- Inventory ManagementDocument7 pagesInventory ManagementSozo Net WorkPas encore d'évaluation

- Chapter One: Each Time The Employee Attempts To Check in or Out, If There Is A Match, The Attendance Is RecordedDocument5 pagesChapter One: Each Time The Employee Attempts To Check in or Out, If There Is A Match, The Attendance Is RecordedSozo Net WorkPas encore d'évaluation

- STA309A: Multi-Channel Digital Audio Processor With DDX®Document71 pagesSTA309A: Multi-Channel Digital Audio Processor With DDX®Uday KrishnaPas encore d'évaluation

- Implementation of Serial Port Communication Based On Modbus-RTU Communication Protocol in C#Document4 pagesImplementation of Serial Port Communication Based On Modbus-RTU Communication Protocol in C#SEP-Publisher100% (2)

- An-715 Ibis ModelDocument8 pagesAn-715 Ibis ModelDDragos GeorgePas encore d'évaluation

- Abbreviations Used in ICTDocument7 pagesAbbreviations Used in ICTរ័ត្នវិសាល (Rathvisal)Pas encore d'évaluation

- DM9368 PDFDocument8 pagesDM9368 PDFEnrique MirazoPas encore d'évaluation

- Cognos Developer Resume Bayshore Ny PDFDocument6 pagesCognos Developer Resume Bayshore Ny PDFuser659nPas encore d'évaluation

- ThinkCentre M72e DatasheetDocument4 pagesThinkCentre M72e DatasheetrogromPas encore d'évaluation

- Motorola SEMV12 SmartStream, Encryptor ModulatorDocument2 pagesMotorola SEMV12 SmartStream, Encryptor Modulatorjuanlasserre9444Pas encore d'évaluation

- (REFERENCE) MIKE11 Short Introduction - TutorialDocument94 pages(REFERENCE) MIKE11 Short Introduction - Tutorialafiqah_507Pas encore d'évaluation

- WiMAX Modeling Techniques and Applications PDFDocument133 pagesWiMAX Modeling Techniques and Applications PDFคนชายแดน ฝั่งตะวันตกPas encore d'évaluation

- MOTOBRIDGE Brochure FinalDocument4 pagesMOTOBRIDGE Brochure Finalpy5rcbPas encore d'évaluation

- Lecture05 - 8086 AssemblyDocument43 pagesLecture05 - 8086 Assemblytesfu zewduPas encore d'évaluation

- 3gwireless Secured Itlab - Com.vnDocument5 pages3gwireless Secured Itlab - Com.vnTelekom FilesPas encore d'évaluation

- List of 7400 Series Integrated CircuitsDocument15 pagesList of 7400 Series Integrated CircuitssansurePas encore d'évaluation

- DX DiagDocument13 pagesDX DiagAdrian AnghelPas encore d'évaluation

- System Bus in Computer Architecture: Goran Wnis Hama AliDocument34 pagesSystem Bus in Computer Architecture: Goran Wnis Hama AliGoran WnisPas encore d'évaluation

- RoIP Gateways Brochure For Web 2016Document8 pagesRoIP Gateways Brochure For Web 2016Jorge Casali100% (1)

- Edt GDDocument364 pagesEdt GDAre VijayPas encore d'évaluation

- Tilak Maharashtra Vidyapeeth, Pune: How To Begin A Project WorkDocument6 pagesTilak Maharashtra Vidyapeeth, Pune: How To Begin A Project WorkAdnan AnsariPas encore d'évaluation

- System Compatibility ReportDocument3 pagesSystem Compatibility ReportGendis manjaPas encore d'évaluation

- 6236 Implementing and Maintaining Microsoft SQL Server 2008 Reporting ServicesDocument444 pages6236 Implementing and Maintaining Microsoft SQL Server 2008 Reporting Servicessportiefke84Pas encore d'évaluation

- 25W - 15960 - 5 Poster Conosci HDDocument2 pages25W - 15960 - 5 Poster Conosci HDRenzo SattiPas encore d'évaluation

- Andriod Operating SystemDocument12 pagesAndriod Operating SystemHari HaranathPas encore d'évaluation

- ISO Stands For International - This Is Called A Model For Open Is Commonly Known As OSI Model. - The ISO-OSI Model Is A Seven Layer ArchitectureDocument11 pagesISO Stands For International - This Is Called A Model For Open Is Commonly Known As OSI Model. - The ISO-OSI Model Is A Seven Layer ArchitectureAmmu MolePas encore d'évaluation

- Mastering Citrix® XenDesktop® - Sample ChapterDocument63 pagesMastering Citrix® XenDesktop® - Sample ChapterPackt PublishingPas encore d'évaluation

- Database ProgrammingDocument441 pagesDatabase ProgrammingWahyu Koerniawan100% (1)

- Assignment 1Document7 pagesAssignment 1Altaf KondakamaralaPas encore d'évaluation

- How To Play HEVC (THIS FILE)Document2 pagesHow To Play HEVC (THIS FILE)BonedusterPas encore d'évaluation

- IoT Based Water Level Monitoring System With An Android ApplicationDocument4 pagesIoT Based Water Level Monitoring System With An Android ApplicationEditor IJRITCCPas encore d'évaluation