Académique Documents

Professionnel Documents

Culture Documents

Deutsche Bank and The Road To Basel III

Transféré par

Adharsh R NairDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Deutsche Bank and The Road To Basel III

Transféré par

Adharsh R NairDroits d'auteur :

Formats disponibles

Deutsche Bank and the Road to Basel III

Adharsh R

Deutsche bank was founded in Germany. The objective was to promote trade relations between Germany

and rest of the world. It was established as a universal bank providing both investment banking and

commercial banking. After the World War I, German economy inflation rates were higher. Deutsche Bank

lost most of its foreign assets and borrowers failed to pay back debts. During the depression the Germans

invaded countries and by the end of World War II, Deutsche bank had transferred money and holdings

from Jews to the German Government. Post World War II, Deutsche bank was split into ten different

banks, however 10 years later 4 parts of Deutsche Bank were merged and allowed to operate under the

name of Deutsche Bank.

With the recovery of financial situations in Germany and across the world, Deutsche Bank started

expanding into new territories and by 2001 it was operating in 70 countries. Deutsche Bank increased

their focus on investment banking activities and commercial banking took a back seat. Around 62% of

total revenue was contributed by Investment banking activities in 2007 hence the bank was focused on

increasing its asset base dedicated to investment banking activities.

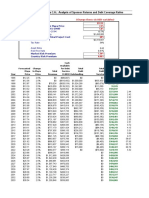

By the end of 2002, Deutsche Bank derived a significant portion of its revenues from Investment Banking

activities. Revenues from sales and trading increased from 30%-42% of total revenues between 20022007. Between 2002-2012, Deutsche Bank had significantly increased its assets dedicated to Investment

Banking activities from EUR 640 billion at year end 2002 to EUR 1860 billion. Until 2008, Deutsche

Bank achieved remarkable growth in per share earnings, from EUR 0.63 to EUR 13.05 from 2002-07 83% annual growth rate. Deutsche Banks increased profits came from increased leverage and not from

productive assets.

To improve the regulatory framework for banks, Basel III was introduced in 2009 as per which the banks

were required to increase minimum Tier 1 equity capital from 4% of risk weighted assets to 9.5% - 13.5%

of risk weighted assets. Also, the risk weights assigned to certain classes of assets were required to be

increased as per Basel III. The banks have to gradually start abiding by Basel III norms from 2013 and

have to comply with it mandatorily by 2019.

To finance asset growth on balance sheet, banks primarily use one of the following methods: 1. Use

profits used in the previous years, 2. issue new equity capital thereby diluting the equity value of the

existing shareholders, 3. borrow debt capital thereby increasing leverage. In 2012, Deutsche bank had risk

weighted assets around EUR488 billion and core tier 1 ratio of 7.2%. To, comply with Basel III norms,

Deutsche Bank can go ahead by issuing hybrid securities like convertible bonds or warrants and reducing

the asset base in order to maintain a balance between ROE and ROA and provide a realistic picture to its

investors and customers.

Vous aimerez peut-être aussi

- Group 3 - Deutsche Bank and The Road To Basel IIIDocument14 pagesGroup 3 - Deutsche Bank and The Road To Basel IIIAmit Meshram0% (1)

- Deutsche Bank and The Road To Basel IiiDocument2 pagesDeutsche Bank and The Road To Basel IiiNEERAJ N RCBS100% (1)

- Deutsche Bank and The Road To Basel - IIIDocument20 pagesDeutsche Bank and The Road To Basel - IIISHASHANK CHOUDHARY 22Pas encore d'évaluation

- Deutche Bank Doc 1 - Deutsche Bank at A GlanceDocument14 pagesDeutche Bank Doc 1 - Deutsche Bank at A GlanceUriGrodPas encore d'évaluation

- Negative Rates The Bank of Japan ExperienceDocument8 pagesNegative Rates The Bank of Japan ExperienceYash BhasinPas encore d'évaluation

- Global Financial CrisisDocument9 pagesGlobal Financial CrisisMohit Ram KukrejaPas encore d'évaluation

- Credit Suisse (Incl. NPV Build Up)Document23 pagesCredit Suisse (Incl. NPV Build Up)rodskogjPas encore d'évaluation

- Brown-Forman Initiating CoverageDocument96 pagesBrown-Forman Initiating CoverageRestructuring100% (1)

- Long Term Capital Management Case StudyDocument6 pagesLong Term Capital Management Case Studysatyap127Pas encore d'évaluation

- LTCMDocument6 pagesLTCMAditya MaheshwariPas encore d'évaluation

- Berkshire Hathaway Dividend Policy ParadigmDocument12 pagesBerkshire Hathaway Dividend Policy ParadigmsdPas encore d'évaluation

- Case Analysis - Petrolera ZuataDocument8 pagesCase Analysis - Petrolera ZuataAnupam Sharma0% (1)

- Deutsche Bank Dr. Josef AckermannDocument32 pagesDeutsche Bank Dr. Josef AckermannLuis Rguez. Del BarrioPas encore d'évaluation

- JPM BanksDocument220 pagesJPM BanksÀlex_bové_1Pas encore d'évaluation

- Investor Day IB FINALDocument24 pagesInvestor Day IB FINALamadeo1985Pas encore d'évaluation

- Q: Why and How Was Libor Manipulated?: FDRM AssignmentDocument5 pagesQ: Why and How Was Libor Manipulated?: FDRM Assignmentrai19Pas encore d'évaluation

- Moody's Corporate Default and Recovery Rates, 1920-2010. Moody's. February 2011Document66 pagesMoody's Corporate Default and Recovery Rates, 1920-2010. Moody's. February 2011VizziniPas encore d'évaluation

- UBS - Year Ahead 2021Document63 pagesUBS - Year Ahead 2021Jayaraman Rathnam100% (1)

- Case StudyDocument2 pagesCase StudybombyĐPas encore d'évaluation

- Lehman Brothers and LIBOR ScandalDocument16 pagesLehman Brothers and LIBOR Scandalkartikaybansal8825Pas encore d'évaluation

- 3P Memo 11.36.58 AMDocument2 pages3P Memo 11.36.58 AM王葳蕤Pas encore d'évaluation

- Deutsche BankDocument23 pagesDeutsche Bankmichelerovatti0% (1)

- Innocents Abroad: Currencies and International Stock ReturnsDocument24 pagesInnocents Abroad: Currencies and International Stock ReturnsGragnor PridePas encore d'évaluation

- Long Term Capital Management - Case StudyDocument10 pagesLong Term Capital Management - Case StudyAnas GodilPas encore d'évaluation

- UBS Debt Investr PresentationDocument36 pagesUBS Debt Investr PresentationNacho DalmauPas encore d'évaluation

- Basel I II IIIDocument20 pagesBasel I II IIISachin TodurPas encore d'évaluation

- Eurozone Debt Crisis 2009 FinalDocument51 pagesEurozone Debt Crisis 2009 FinalMohit KarwalPas encore d'évaluation

- JPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011Document16 pagesJPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011ishfaque10Pas encore d'évaluation

- Global Logistic Properties: Logistics Leader, With GrowthDocument68 pagesGlobal Logistic Properties: Logistics Leader, With GrowthGustav OwenPas encore d'évaluation

- UbsDocument14 pagesUbskevindsizaPas encore d'évaluation

- Petrozuata and Articles Handout 2020Document12 pagesPetrozuata and Articles Handout 2020Darshan Gosalia0% (1)

- Petrolera Zuata: A Project Finance Case StudyDocument15 pagesPetrolera Zuata: A Project Finance Case StudySaathwik ChandanPas encore d'évaluation

- LTCM Case PresentationDocument18 pagesLTCM Case PresentationAdityaPas encore d'évaluation

- China Fire Case AssignmentDocument3 pagesChina Fire Case AssignmentTony LuPas encore d'évaluation

- Loeb HLFDocument9 pagesLoeb HLFZerohedge100% (1)

- Discussion at Markel 2Document35 pagesDiscussion at Markel 2mirceaPas encore d'évaluation

- JpmorganDocument2 pagesJpmorganDaryaBokach100% (2)

- Leveraged BuyoutDocument9 pagesLeveraged Buyoutbharat100% (1)

- PZ Financial AnalysisDocument2 pagesPZ Financial AnalysisdewanibipinPas encore d'évaluation

- Case Questions Swedish MatchDocument1 pageCase Questions Swedish MatchSaskia Schakel0% (1)

- LTCM Final PresentationDocument16 pagesLTCM Final PresentationAtul JainPas encore d'évaluation

- Mexico 101 (2011 Report)Document84 pagesMexico 101 (2011 Report)jennifer4217Pas encore d'évaluation

- LTCMDocument18 pagesLTCMAbhirupa DebroyPas encore d'évaluation

- U.S. Large-Cap & Mid-Cap Banks - Drilling Into Energy ExposureDocument39 pagesU.S. Large-Cap & Mid-Cap Banks - Drilling Into Energy ExposureMartin TsankovPas encore d'évaluation

- Repos A Deep Dive in The Collateral PoolDocument7 pagesRepos A Deep Dive in The Collateral PoolppatePas encore d'évaluation

- JPM Midyear Emerging Mar 2018-06-08 2686356Document79 pagesJPM Midyear Emerging Mar 2018-06-08 2686356rumi mahmoodPas encore d'évaluation

- Chasecase PaperDocument10 pagesChasecase PaperadtyshkhrPas encore d'évaluation

- Swedish MatchDocument6 pagesSwedish MatchMechanical DepartmentPas encore d'évaluation

- LIBOR ScandalDocument16 pagesLIBOR ScandalAnun P. Basil RajPas encore d'évaluation

- Banc One Case My SolutionDocument5 pagesBanc One Case My SolutionБорче Шулески67% (3)

- Gundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedDocument73 pagesGundlach 6-14-16 Total Return Webcast Slides - Final - UnlockedZerohedge100% (1)

- Walt DisneyDocument10 pagesWalt DisneystarzgazerPas encore d'évaluation

- Hbs Case - Ust Inc.Document4 pagesHbs Case - Ust Inc.Lau See YangPas encore d'évaluation

- Paulson & Co. 3Q LetterDocument22 pagesPaulson & Co. 3Q LetterDealBook100% (6)

- M&M PizzaDocument3 pagesM&M PizzaAnonymous 2LqTzfUHY0% (3)

- LTCM Case - Study PDFDocument7 pagesLTCM Case - Study PDFEdward Fernand50% (2)

- Debt Policy at Ust IncDocument7 pagesDebt Policy at Ust IncIrfan Mohd0% (1)

- CBM Assignment-4: Critical Analysis of Deutsche Bank CaseDocument2 pagesCBM Assignment-4: Critical Analysis of Deutsche Bank CasePrash SPas encore d'évaluation

- Bond Buyback at Deutsche Bank: Running Head: 1Document10 pagesBond Buyback at Deutsche Bank: Running Head: 1NarinderPas encore d'évaluation

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument50 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsAdharsh R NairPas encore d'évaluation

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument34 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsAdharsh R NairPas encore d'évaluation

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument31 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsAdharsh R NairPas encore d'évaluation

- Statistics For Business and Economics: Anderson Sweeney WilliamsDocument47 pagesStatistics For Business and Economics: Anderson Sweeney WilliamsAdharsh R NairPas encore d'évaluation

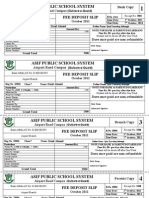

- 'Helw$Ffrxqw'Hwdlov: $Ffrxqw1R $Ffrxqw7/Sh %udqfk $PRXQW &RPPLVVLRQ$PRXQW 7Udqvdfwlrq7/Sh 8751XPEHUDocument1 page'Helw$Ffrxqw'Hwdlov: $Ffrxqw1R $Ffrxqw7/Sh %udqfk $PRXQW &RPPLVVLRQ$PRXQW 7Udqvdfwlrq7/Sh 8751XPEHUAdharsh R NairPas encore d'évaluation

- What Is BudgetDocument4 pagesWhat Is BudgetDhanvanthPas encore d'évaluation

- Cost Accounting Methods Practiced by The Infomal Sector in Nigeria2 ReviewDocument18 pagesCost Accounting Methods Practiced by The Infomal Sector in Nigeria2 ReviewAnonymous D8PyLCPas encore d'évaluation

- Case Study South Dakota MicrobreweryDocument1 pageCase Study South Dakota Microbreweryjman02120Pas encore d'évaluation

- Bir Rulings - Rmo - No. 1-2019Document5 pagesBir Rulings - Rmo - No. 1-2019Romela Eleria GasesPas encore d'évaluation

- Project ReportDocument86 pagesProject ReportavnishPas encore d'évaluation

- 611 Banker Resignations CREDIT: AMERICAN KABUKIDocument58 pages611 Banker Resignations CREDIT: AMERICAN KABUKIE1ias100% (1)

- Redemption of Preference SharesDocument19 pagesRedemption of Preference SharesAshura ShaibPas encore d'évaluation

- Chapter 8Document3 pagesChapter 8kish MishPas encore d'évaluation

- The Garden PlaceDocument2 pagesThe Garden Placeaayushi dubeyPas encore d'évaluation

- PMP Formulas EnglishDocument2 pagesPMP Formulas EnglishArash SadeghipourPas encore d'évaluation

- Dance School Summer Events Application FormDocument8 pagesDance School Summer Events Application FormHeinz Gilbert DenoyoPas encore d'évaluation

- Rusa Presentation PDFDocument87 pagesRusa Presentation PDFRakeshPas encore d'évaluation

- Form For Filing FDCPA Law SuitDocument18 pagesForm For Filing FDCPA Law Suitnutech18100% (2)

- Individual Assignment 1Document2 pagesIndividual Assignment 1Getiye LibayPas encore d'évaluation

- Brief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical AnalysisDocument67 pagesBrief Curriculum Vitae: Specialisation: (P Ea 1. 2. 3. Statistical Analysisanon_136103548Pas encore d'évaluation

- DeKalb FreePress: 06-14-19Document24 pagesDeKalb FreePress: 06-14-19Donna S. SeayPas encore d'évaluation

- Chapter-1: Submitted By: Bipin SahooDocument48 pagesChapter-1: Submitted By: Bipin SahooAshis Sahoo100% (1)

- Name: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Document4 pagesName: Nurul Sari NIM: 1101002048 Case 7.1 7.2 7.7: Case 7.1: Investment Center Problems (A)Eigha apriliaPas encore d'évaluation

- Service Tax NotesDocument24 pagesService Tax Notesfaraznaqvi100% (1)

- Bar Questions - Obligations and ContractsDocument6 pagesBar Questions - Obligations and ContractsPriscilla Dawn100% (9)

- Bhaichung BhutiyaDocument8 pagesBhaichung BhutiyaPriyankaSinghPas encore d'évaluation

- A Great Volatility TradeDocument3 pagesA Great Volatility TradeBaljeet SinghPas encore d'évaluation

- Fintechresearchreport 181002173055Document6 pagesFintechresearchreport 181002173055Seth KlarmanPas encore d'évaluation

- Dac 318 AssignmentDocument6 pagesDac 318 AssignmentLenny MuttsPas encore d'évaluation

- Ann Research ProposalDocument8 pagesAnn Research ProposalNatala WillzPas encore d'évaluation

- DiscussionDocument1 pageDiscussionstella avrilPas encore d'évaluation

- Project Submission of Internal Atkt Oct 2022Document18 pagesProject Submission of Internal Atkt Oct 2022vinit tandelPas encore d'évaluation

- Asif Public School System: Fee Deposit SlipDocument1 pageAsif Public School System: Fee Deposit SlipIrfan YousafPas encore d'évaluation

- HDFC Fact SheetDocument1 pageHDFC Fact SheetAdityaPas encore d'évaluation

- Food Cost ManualDocument105 pagesFood Cost ManualVivek Sharma100% (12)