Académique Documents

Professionnel Documents

Culture Documents

Carline Merisier v. Bank of America, N.A., 11th Cir. (2012)

Transféré par

Scribd Government DocsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Carline Merisier v. Bank of America, N.A., 11th Cir. (2012)

Transféré par

Scribd Government DocsDroits d'auteur :

Formats disponibles

Case: 11-11036

Date Filed: 07/31/2012

Page: 1 of 19

[PUBLISH]

IN THE UNITED STATES COURT OF APPEALS

FOR THE ELEVENTH CIRCUIT

________________________

No. 11-11036

________________________

D.C. Docket No. 0:10-cv-61340-PCH

CARLINE MERISIER,

Plaintiff - Appellant,

versus

BANK OF AMERICA, N.A.,

a national association,

Defendant - Appellee.

________________________

Appeal from the United States District Court

for the Southern District of Florida

________________________

(July 31, 2012)

Before TJOFLAT, PRYOR and RIPPLE,* Circuit Judges.

*

Honorable Kenneth F. Ripple, United States Circuit Judge for the Seventh Circuit,

sitting by designation.

Case: 11-11036

Date Filed: 07/31/2012

Page: 2 of 19

TJOFLAT, Circuit Judge:

This is a case under the Electronic Fund Transfer Act (EFTA), 15 U.S.C.

1693 et seq. A bank customer sued her bank to recover for unauthorized

withdrawals from her checking account, made using her check card and personal

identification number (PIN). EFTA requires a bank to investigate such disputed

transactions, to notify the customer if it has verified the transactions as authorized,

and to recredit the account if the withdrawals were unauthorized; failure to do so

renders the bank liable to the customer for up to treble damages.1 The bank

investigated the withdrawals at issue in this case, found that they were the product

of a scheme to defraud the bank, and denied liability for the withdrawals.

The customer, represented by counsel, brought suit. By the time the case

was tried to the United States District Court for the Southern District of Florida,

the customer was pro se. After a two-day bench trial, the District Court rejected

the customers EFTA claims and entered judgment for the bank. Specifically, the

District Court found that the transactions were authorized because they were part

of a scheme to defraud the bank. The customer appealed pro se. Although the

briefs are inartfully drawn, she appears to challenge the District Courts finding as

clearly erroneous. After thorough review, we find no error and therefore affirm.

1

These provisions are discussed further in part II.A, infra.

2

Case: 11-11036

Date Filed: 07/31/2012

Page: 3 of 19

I.

In 2009, Carline Merisier was a new Bank of America checking-account

customer. So were Erna Guerrier, Rivelino Richard, and Vandamme Jeanty.

These were individuals of Haitian descent, living in South Florida, who had all

attended North Miami High School together. They opened their accounts within

six months of one another; Jeanty sourced some of the funds, others were

untraceable cash deposits. At one time or another, Merisier and Guerrier were

dating Jeanty; Jeanty was the only person Merisier had dated since divorcing her

husband, Dexter Oliver. When Oliver confronted Merisier about that relationship,

she said the man she was seeing was a con artist who was stealing money.

Merisier knew that Jeanty was also dating Guerrier. At one point, Jeanty had

studied law at the University of Miami. In 2007, however, Jeanty, a noncitizen,

was ordered removed in absentia after failing to appear for an immigration

hearing; this court upheld that removal order in 2008. Jeanty was arrested near a

bank in April 2010 in Naples, Florida, for loitering and for obstructing an officer;

in his possession was a clone of Merisiers check card. He has been wanted by the

Collier County Sheriffs Department since November 2010.

On March 5, 2010, Merisier went to a South Florida gas station where she

attempted to use her Bank of Americaissued check card. It was rejected because

3

Case: 11-11036

Date Filed: 07/31/2012

Page: 4 of 19

of a fraud block. Bank personnel instructed Merisier to complete a fraud affidavit,

which she submitted on March 5; she flagged transactions totaling $15,775.76 as

unauthorized withdrawals from her account.2

By submitting this fraud affidavit to Bank of America, Merisier triggered an

investigation into the disputed transactions. Bank of America investigated

The transactions were described as follows:

Transaction Date

Amount

03/03/10

$300.00

03/03/10

$600.00

03/03/10

$600.00

03/03/10

$1001.78

03/03/10

$1503.57

03/03/10

$1504.38

03/02/10

$300.00

03/02/10

$600.00

03/02/10

$600.00

03/01/10

$300.00

03/01/10

$600.00

03/01/10

$600.00

02/27/10

$500.00

02/27/10

$500.00

02/27/10

$500.00

02/26/10

$300.00

02/26/10

$600.00

02/26/10

$600.00

02/25/10

$66.03

02/25/10

02/25/10

02/25/10

02/24/10

02/24/10

02/24/10

02/24/10

$300.00

$600.00

$600.00

$300.00

$600.00

$600.00

$600.00

Description

BofA ATM

BofA ATM

BofA ATM

Publix Super Market

Publix Super Market

Publix Super Market

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

BofA ATM

0224 Sunshine [Gas

Station] 109

[BofA ATM]

[BofA ATM]

[BofA ATM]

[BofA ATM]

[BofA ATM]

[BofA ATM]

[BofA ATM]

Case: 11-11036

Date Filed: 07/31/2012

Page: 5 of 19

Merisiers claim and denied it, in part because it had verified the earliest of the

withdrawals as legitimate. On February 24, 2010the date of the first allegedly

unauthorized transactionan attempt to withdraw $600.00 at an ATM triggered a

fraud alert; the card was restricted pending verification. Someone claiming to be

the cardholder called in and answered three security queries correctly: the date and

dollar amount of a recent deposit, the email address associated with the account,

and the government-issued ID number associated with the account. The caller

also raised the ATM withdrawal limit from $350.00 to $1500.00. Someone then

attempted several cash withdrawals from the same ATM and was successful each

time.

On reviewing Merisiers claims, Bank of America determined that this

activity indicated that the transactions were in fact authorized. Merisier had

affirmed that she never lost possession of her card. Thus, the fact that transactions

had been made using her card indicated that the card had been counterfeited or

skimmed. The disputed transactions, however, had all been PIN-based

transactions, meaning that whoever had counterfeited Merisiers card also knew

her PIN. A third party could have intercepted Merisiers PIN as she attempted to

use it at an ATMbut in that event, the scammer would not have known the

answers to the banks security questions. By process of elimination, then,

5

Case: 11-11036

Date Filed: 07/31/2012

Page: 6 of 19

Merisiers was a sold accountshe had exchanged account access for money.

The source and timing of deposits to Merisiers account was also

suspicious: each withdrawal immediately followed a large and out-of-the-ordinary

cash deposit. Merisiers account balance typically averaged a few hundred

dollars. Then, between February 16 and March 3, 2010, Merisier made eight cash

deposits totaling $36,700.00.3 These facts indicated that whoever made the

deposits was inflating the account balance while avoiding federal cash-deposit

reporting requirements.4 Although each disputed withdrawal shortly followed a

deposit, there were no balance inquiries on Merisiers account. Bank of America

concluded that Merisier had colluded with whoever had drawn down her account

and had authorized the withdrawals.

On September 8, 2010, Merisier filed the instant action against Bank of

The deposits were as follows:

Deposit

Date Posted

Counter Credit

02/16/10

Counter Credit

02/22/10

Counter Credit

02/24/10

Counter Credit

02/26/10

Counter Credit

03/01/10

Counter Credit

03/01/10

Counter Credit

03/02/10

Counter Credit

03/03/10

Amount ($)

3300.00

6300.00

5000.00

1000.00

9000.00

1100.00

5000.00

6000.00

Generally, banks must report cash transactions in excess of $10,000.00. See 31 U.S.C.

5331(a). It is a federal crime to structure cash deposits in such a way that the deposits do not

trigger federal reporting requirements. Id. 5324(b).

6

Case: 11-11036

Date Filed: 07/31/2012

Page: 7 of 19

America. Merisier contended that Bank of America failed to conduct a reasonable

investigation of her claim, failed to follow EFTAs claim-resolution procedures,

and unlawfully held her liable for unauthorized transactions. Accordingly,

Merisier claimed that she was entitled to recover actual damagesthe $15,775.76

withdrawn from her accounttrebled for willful EFTA violation. Bank of

America denied liability and claimed that Merisier schemed with Jeanty, Richard,

and Guerrier to defraud the bank.

The case was tried on March 1, 2011; the following evidence was presented.

First, Bank of America employee Todd Holt, the claims investigator assigned to

Merisiers case, reviewed Merisiers unauthorized-transaction claim. Holt

recommended denial based on (1) security verification following the fraud block,

(2) the security of Merisiers debit card and PIN, (3) the exclusively PIN-based

transactions, and (4) the structured deposits into the account before the

withdrawals were made. Particularly, the claim was suspicious because seemingly

structured deposits accompanied the withdrawals claimed to be fraudulent.5

Second, Robin Nicorvo, a senior investigator for Bank of America,

At the time he denied Merisiers claim, Holt had also become aware that Richard had

filed an unauthorized-transactions claim. He was impressed by similarities between the Richard

and Merisier claims, including inflated balances before withdrawals, multiple withdrawals, and

the raising of withdrawal limits. Holt also discovered that Richard knew Jeanty.

7

Case: 11-11036

Date Filed: 07/31/2012

Page: 8 of 19

investigated the claims made by Richard, Guerrier, and Jeanty. Her investigation

revealed that Richard and Guerrier reported unauthorized debits on their

respective cards and that their accounts had low balances that spiked before

allegedly unauthorized activity. Among the documents she reviewed were letters

on behalf of Guerrier and Richard, respectively, that Bank of America had

received from a purported law firm. No such law firm or attorney existed,

howeverthe address and telephone number provided were Jeantys.

Third, Merisier testified that she opened her Bank of America account in

2008 to receive child support payments from ex-husband Dexter Oliver. Then,

just before the transactions she reported as unauthorized, she deposited

approximately $36,000.00 in cash. Merisier claimed that the deposits represented

profits from her real estate company: she purportedly received commission checks

at closings, cashed them at check cashing stores, and then deposited the cash.

Merisier claimed she did not know who had compromised her account when

she filed her claim. Admittedly, by the time of her deposition she had realized that

her account had been compromised by an ex-boyfriend and acknowledged dating

Jeanty. Moreover, Merisiers telephone records indicated that in the months

Case: 11-11036

Date Filed: 07/31/2012

Page: 9 of 19

leading up to her filing suit she had called Jeantys number 76 times.6 It was

undisputed that Jeanty used Merisiers card or a clone thereof and that Jeanty did

know Merisiers PIN. Nevertheless, Merisier maintained that she never authorized

Jeanty to use her card, never gave him her card, never gave him her PIN, and never

wrote down her PIN anywhere. Merisier denied having given Jeanty any personal

information, including the answers to Bank of Americas security questions.

Fourth, Bank of Americas expert, a white-collar crime investigator, opined

that Jeanty directed an organized scheme to defraud Bank of America and that

Merisier and two other individuals were willing participants in this scheme.

Although unable to testify at trial, his report, which was admitted into evidence,

laid out the scheme in which Merisier had acted with Jeanty to defraud the bank.

At the conclusion of the trial, in an oral ruling, the District Court explained

that its findings were based on the live witnesses testimony; on the deposition

testimony of Guerrier, Richard, and Oliver; on exhibits submitted by the parties;

and on the bank experts report. Regarding the reasonableness of the investigation

Bank of America performed, the District Court reasoned,

Similarly, Merisier denied knowing Guerrier, even though her phone records showed

that she called Guerrier on several occasions around the time she filed her claim. She also denied

knowing Richardeven when presented with a warranty deed she and Richard had both signed.

She explained the similarity of her complaint to those filed by Guerrier and Richard by admitting

that she had access to Guerriers and Richards Bank of America files and complaints.

9

Case: 11-11036

Date Filed: 07/31/2012

Page: 10 of 19

I think any reasonable person would have concluded that there was

fraud here. . . . [T]he claims were not by mistake but they were

authorized either directly or indirectly by [Merisier] . . . . So, I am

going to deny the [unreasonable-investigation] claim.

Merisier v. Bank of America, 10-61340-CV-PCH, Tr. at 1213 (S.D. Fla. Mar. 2,

2011). The court therefore rejected Merisiers treble-damages EFTA claim.

The District Court then made the following findings:

[Merisier] had a balance that was historically low and . . . a few

days prior to the subject transactions . . . [she] deposited

approximately $36,000 in cash . . . .

[T]his is a pattern that is consistent with a fraudulent claim against

the bank for a couple of reasons.

One, the funds were . . . made in cash under circumstances that

while they were explained by the plaintiff I find to be not credible.

Second, they were patterns such as they seemed to be

structured, that is to be cash deposits of less than $10,000. . . .

....

[O]n February 28th, 2010 . . . an attempt was made by someone

to withdraw $600 from the bank account. . . .

[B]ecause of indications or badges of fraud the bank . . . put a

block on the plaintiffs account . . . . Later that day after

that . . . attempt to withdraw $600 was denied, within

minutes . . . someone called the bank, and answered three security

questions . . . .

....

10

Case: 11-11036

Date Filed: 07/31/2012

Page: 11 of 19

Apparently that was accepted by the bank and the next attempt

to withdraw $600 was approved. Subsequently on March the fifth

plaintiff submitted . . . a fraud affidavit, which gives rise to [this suit].

Also . . . someone . . . increased not only the amount of money that

was available to be withdrawn but [also] . . . increased the withdrawal

limit.

That was done suspiciously, I might add, just before these

subject withdrawals were made. And the obvious purpose of this was

so that larger withdrawals could be made from the account. . . .

....

[E]ither deliberately or inadvertently Ms. Merisier . . . provided

this information to Mr. Jeanty such that he or someone at his behest

made those withdrawals.

I find the plaintiff is responsible for those, or at least she has

not proven by the greater weight of the evidence that these transfers

were unauthorized transfers.

I find the evidence suggests that they were in fact authorized

transfers. The plaintiff was either a knowing participant or was

duped by Mr. Jeanty . . . . [S]he provided him with the information

that allowed those withdrawals to be made. And I find they were not

the result of a mistake but they were, in fact, authorized . . . .

....

I find that theres been compliance by the bank with its

obligations under the EFTA. I find that based on the numerous

badges or indicia of fraud . . . that the bank concluded in good faith

that they were fraudulent transfers.

I find that the plaintiff has not proven her case by the greater

weight of the evidence and I am ruling in favor of defendant.

11

Case: 11-11036

Date Filed: 07/31/2012

Page: 12 of 19

Id. at 2427. Thus, the District Court found that Bank of America was not liable

for the amount withdrawn from Merisiers account.

On appeal, Merisier contends that the District Court erred in finding that

Bank of America did not violate any provision of EFTA. In this respect, Merisier

argues that the District Court applied the wrong burden of proof to her at trial,

contending that, under EFTA, Bank of America bore the burden to demonstrate

the transfers were authorized. Essentially, she maintains that the District Courts

finding that the subject transactions were authorized was clearly erroneous. She

contends the District Court mistakenly considered the following factors because

they were mischaracterized by the trial judge or irrelevant: (a) evidence of a

scheme to defraud; (b) ostensible evasion of cash-deposit reporting requirements;

and (c) the source of the deposits to Merisiers account.7

7

Merisier also argues that the District Court erred by failing to find an EFTA violation

based on a request for documents used in the banks investigation. We reject this argument out

of hand. She contends that Bank of America violated EFTA when, upon request of the

consumer, it failed to promptly deliver . . . all documents which the financial institution relied

on to conclude that such error did not occur. 15 U.S.C. 1693f(d). Merisier testified that she

requested in writing the documents upon which Bank of America found no error on her account.

At trial, she produced no evidence of such a request and admitted that she did not keep a copy of

her letter requesting the documents. Apparently, that letter was included with her complaint, but

was never produced at trial or admitted into evidence. The District Court found that Merisier did

not request the documents. Inasmuch as the District Court based its finding on the evidence

adduced at trial, the District Court did not err in concluding that Merisier had not requested the

documents. We give due regard to the District Courts credibility determination in impliedly

rejecting Merisiers trial testimony. See In re Chalik, 748 F.2d 616, 619 (11th Cir. 1984) ([T]he

trial judge is best able to assess the credibility of the witnesses before him and thus the

evidentiary content of their testimony.). And the District Court did not err in refusing to

12

Case: 11-11036

Date Filed: 07/31/2012

Page: 13 of 19

II.

Merisier believes that Bank of America did not do what EFTA required it to

do with respect to transactions she claimed were in error because they were

unauthorized. EFTA, in turn, requires banks to follow one of two paths in

response to such an alleged error on an account: (1) to investigate and correct the

error if an unauthorized transfer has occurred, or (2) to investigate and inform the

customer that no error occurred if the transfer was authorized by the customer.

The bank followed the steps of path (2) after it determined that Merisier had in

fact authorized the transactions at issue. Merisier thinks the bank ought to have

followed path (1) because she insists to this day that the disputed transactions

were unauthorized. She thinks the District Court improperly forced her to prove

the bank ought to have followed path (1) and found for the bank when she did not.

The District Courts fact findings, however, foreclose Merisiers position.

The District Court found that the bank complied with EFTA because the disputed

transactions were authorizedthey were an attempt to defraud the bank. Merisier

has advanced no reason why the District Courts findings were clearly erroneous.

We therefore have no occasion to disturb the District Courts conclusion that Bank

of America did not violate EFTA.

consider matters not in evidence.

13

Case: 11-11036

Date Filed: 07/31/2012

Page: 14 of 19

A.

Various EFTA provisions govern the transactions at issue. EFTA applies to

any transfer of funds . . . which is initiated through an electronic terminal . . . so

as to . . . authorize a financial institution to debit or credit an account, such as

ATM and PIN-based point-of-sale cash withdrawals. 15 U.S.C. 1693a(7).

When a customer believes that an ATM withdrawal was unauthorized and thus in

error, and notifies her bank, the bank has a duty to investigate the alleged error,

determine whether an error has occurred, and report or mail the results of such

investigation and determination to the consumer within ten business days. Id.

1693f(a). The bank must correct any detected error within one business day

after such determination. Id. 1693f(b)(c).8 A bank that does not so comply

may be liable to the customer for damages.9

Correction is subject to the consumers limited liability for unauthorized transfers

under 1693g. 15 U.S.C. 1693f(b). Section 1693g provides as follows:

A consumer shall be liable for any unauthorized electronic fund transfer . . . only

if the card . . . utilized for such transfer was an accepted card . . . and if the issuer

of such card . . . has provided a means whereby the user of such card . . . can be

identified as the person authorized to use it . . . .

Id. 1693g(a). If these conditions are met, EFTA limits customer liability to the lesser of

$50 or the amount withdrawn before the customer alerted the bank to unauthorized

transactions. Id. 1693g(a)(1)(2).

9

A bank that violates EFTA is liable to such consumer in an amount equal to the sum

of any actual damage sustained by such consumer as a result of such failure [and,] in the case of

an individual action, an amount not less than $100 nor greater than $1,000. 15 U.S.C.

14

Case: 11-11036

Date Filed: 07/31/2012

Page: 15 of 19

A withdrawal does not become an error simply because a customer later

disputes itparticularly when the error was manufactured as part of a fraudulent

scheme. EFTA defines an error, for purposes relevant to this case, as an

unauthorized electronic fund transfer. Id. 1693f(f)(1). An unauthorized

electronic fund transfer is an electronic transfer initiated by a third party without

actual authority to do so and from which the customer derives no benefit. Id.

1693a(12). EFTA, however, excludes two pertinent classes of transactions from

this definition: those (A) initiated by a person other than the consumer who was

furnished with the card, code, or other means of access to such consumers

account by such consumer, unless the customer alerts her bank that the transferor

is no longer authorized to make transfers; and those (B) initiated with fraudulent

intent by the consumer or any person acting in concert with the consumer. Id.

In any action which involves a consumers liability for an unauthorized electronic

1693m(a)(1)(2)(A). If a court finds that

(1) the financial institution did not provisionally recredit a consumers account

within . . . [ten days] and the financial institution

(A) did not make a good faith investigation of the alleged error, or

(B) did not have a reasonable basis for believing that the

consumers account was not in error; or

(2) the financial institution knowingly and willfully concluded that the consumers

account was not in error when such conclusion could not reasonably have been

drawn . . . ,

then the court may award treble damages. Id. 1693f(e).

15

Case: 11-11036

Date Filed: 07/31/2012

Page: 16 of 19

fund transfer, the burden of proof is upon the financial institution to show that the

electronic fund transfer was authorized. Id. 1693g(b).

B.

It is irrelevant whether the District Court improperly placed on Merisier the

burden to prove that the transactions were unauthorized. Although EFTA may

place the burden on banks to show that claims are unauthorized before denying

claims, see id., Merisiers transactions were authorized as a matter of fact. The

District Court did not find for Bank of America because Merisier had failed to

prove that the transactions were unauthorized. Rather, the District Court, as the

trier of fact, merely determined that the greater weight of the evidence showed that

the transactions were authorized. In short, because the District Court found that

the withdrawals were authorized as part of a fraudulent scheme, Bank of America

effectively carried its burden under 1693g(b) to show that the withdrawals at

issue were authorized.

Based on the District Courts finding, Bank of America was not liable for

the withdrawals for at least one of two reasons. Merisier furnished the means of

access to her account voluntarily, either as a willing participant in a fraudulent

scheme or as one duped by Jeanty; Merisier admitted the information could not

have fallen into Jeantys hands by mistake or accident. First, therefore, Merisier

16

Case: 11-11036

Date Filed: 07/31/2012

Page: 17 of 19

furnished Jeanty with access to her account without notifying Bank of America

that she did not intend him to withdraw funds. See id. 1693a(12)(A).

Alternatively, Merisier collaborated with Jeanty, which would have brought the

disputed transactions squarely under 1693a(12)(B), which excludes transfers

initiated with fraudulent intent by the consumer or any person acting in concert

with the consumer. Either way, EFTAs error-correction protocols did not apply

to these transactions.10

On appeal, Merisier has advanced no reason to disturb the District Courts

findings. That the transactions were authorized is a factual determination that we

will reverse only for clear error. See Proudfoot Consulting Co. v. Gordon, 576

F.3d 1223, 1230 (11th Cir. 2009). A finding is clearly erroneous when although

there is evidence to support it, the reviewing court on the entire evidence is left

with the definite and firm conviction that a mistake has been committed.

Newmann v. United States, 938 F.2d 1258, 1262 (11th Cir. 1991) (quoting

Anderson v. City of Bessemer City, 470 U.S. 564, 573, 105 S. Ct. 1504, 1511, 84

L. Ed. 2d 518 (1985)). Merisier has failed to make such a showing; her arguments

10

Rather, Bank of America promptly complied with the EFTA provisions that did apply

to Merisiers claims. Bank of America investigate[d] the alleged error, determine[d] whether an

error ha[d] occurred, and . . . mail[ed] the results of such investigation and determination to

[Merisier] within ten business days. 15 U.S.C. 1693f(a). The bank also deliver[ed] . . . to

[Merisier] an explanation of its findings within 3 business days after the conclusion of its

investigation. Id. 1693f(d).

17

Case: 11-11036

Date Filed: 07/31/2012

Page: 18 of 19

focus on her perception that the District Court erroneously required her to prove

that the withdrawals were unauthorized. It is thus undisputed that substantial

evidence supports the District Courts finding that the transactions were

authorized. See id. We are thus left with no definite and firm conviction that a

mistake has been committed. Id. The District Court therefore did not err in

finding that the transactions were authorized and, consequently, that Bank of

America had not violated EFTA.11

III.

For the foregoing reasons, we conclude that the District Court did not err by

denying Merisiers EFTA claims against Bank of America. Accordingly, the

judgment of the District Court is

11

We reject Merisiers argument that District Court premised its factual conclusions on

irrelevant information. According to Merisier, the District Court ought not to have considered

evidence suggesting a scheme to defraud, evidence suggesting the skirting of cash-deposit

reporting requirements, or evidence raising suspicions about the source of the funds in Merisiers

account. These facts are all relevant because they suggest the withdrawals were authorized. See

Fed. R. Evid. 401 (Evidence is relevant if: (a) it has any tendency to make a fact more or less

probable than it would be without the evidence; and (b) the fact is of consequence in determining

the action.). Thus, Merisier has failed to show error on the District Courts part for considering

such evidence. See United States v. Vincent, 648 F.2d 1046, 1051 (5th Cir. 1981) (The trial

judge has broad discretion as to relevance and materiality of evidence, and his rulings regarding

such will not be disturbed on appeal absent a clear showing of an abuse of discretion.).

We also reject Merisiers argument that, essentially, the District Courts findings were

erroneously colored by Bank of Americas investigation, which Merisier believes was

unsatisfactory. The District Courts findings, however, were based on an allegedly insufficient

investigation. If this investigation was too cursory, further development of this case has yielded

only additional evidence of fraud.

18

Case: 11-11036

Date Filed: 07/31/2012

Page: 19 of 19

AFFIRMED.12

12

Merisiers remaining arguments are without merit and warrant no discussion.

19

Vous aimerez peut-être aussi

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)D'EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Pas encore d'évaluation

- PrecedentialDocument23 pagesPrecedentialScribd Government DocsPas encore d'évaluation

- United States v. Bolarinwa Adeyale, 4th Cir. (2014)Document22 pagesUnited States v. Bolarinwa Adeyale, 4th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- Bonnici V US Bank FDCPA Verified ComplaintDocument30 pagesBonnici V US Bank FDCPA Verified Complaintghostgrip100% (1)

- Commercial Credit Equipment Corp., A Corporation v. The First Alabama Bank of Montgomery, N.A., A National Banking Association, 636 F.2d 1051, 1st Cir. (1981)Document8 pagesCommercial Credit Equipment Corp., A Corporation v. The First Alabama Bank of Montgomery, N.A., A National Banking Association, 636 F.2d 1051, 1st Cir. (1981)Scribd Government DocsPas encore d'évaluation

- BK 77 (27-41) de 8 (2-ECF) Def Emergency Motion TRODocument15 pagesBK 77 (27-41) de 8 (2-ECF) Def Emergency Motion TROlarry-612445Pas encore d'évaluation

- United States v. Thomas S. Orr, 68 F.3d 1247, 10th Cir. (1995)Document9 pagesUnited States v. Thomas S. Orr, 68 F.3d 1247, 10th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Filed U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn ClerkDocument35 pagesFiled U.S. Court of Appeals Eleventh Circuit NOV 25, 2008 Thomas K. Kahn Clerkhakan.sengezenPas encore d'évaluation

- USA v. Cedeno Et Al Doc 3-1Document24 pagesUSA v. Cedeno Et Al Doc 3-1scion.scionPas encore d'évaluation

- United States v. Albert Pick and Jordan Mittler, 724 F.2d 297, 2d Cir. (1983)Document6 pagesUnited States v. Albert Pick and Jordan Mittler, 724 F.2d 297, 2d Cir. (1983)Scribd Government DocsPas encore d'évaluation

- United States v. Christo, 129 F.3d 578, 11th Cir. (1997)Document5 pagesUnited States v. Christo, 129 F.3d 578, 11th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- Prenda Sealed Motion RedactedDocument197 pagesPrenda Sealed Motion RedactedJ DoePas encore d'évaluation

- United States v. Salvatore Giordano, 489 F.2d 327, 2d Cir. (1973)Document10 pagesUnited States v. Salvatore Giordano, 489 F.2d 327, 2d Cir. (1973)Scribd Government DocsPas encore d'évaluation

- Not PrecedentialDocument7 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- Fidelity & Deposit Company of Maryland, A Corporation of The State of Maryland v. Hudson United Bank, A Banking Corporation of The State of New Jersey, 653 F.2d 766, 3rd Cir. (1981)Document18 pagesFidelity & Deposit Company of Maryland, A Corporation of The State of Maryland v. Hudson United Bank, A Banking Corporation of The State of New Jersey, 653 F.2d 766, 3rd Cir. (1981)Scribd Government DocsPas encore d'évaluation

- Remijas Vs Neiman MarcusDocument17 pagesRemijas Vs Neiman MarcusMichael LindenbergerPas encore d'évaluation

- United States v. Morris, 4th Cir. (2000)Document3 pagesUnited States v. Morris, 4th Cir. (2000)Scribd Government DocsPas encore d'évaluation

- United States v. Major, 4th Cir. (2008)Document11 pagesUnited States v. Major, 4th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- Skeeter Manos Sentencing MemoDocument15 pagesSkeeter Manos Sentencing MemoMatt DriscollPas encore d'évaluation

- Beattie v. Nations Credit, 4th Cir. (2003)Document10 pagesBeattie v. Nations Credit, 4th Cir. (2003)Scribd Government DocsPas encore d'évaluation

- Florida Couple File Second Lawsuit Against Bank of America - New LawsuitDocument2 pagesFlorida Couple File Second Lawsuit Against Bank of America - New LawsuitIsabel Santamaria100% (1)

- United States v. Eddie C. Wilson, SR., 81 F.3d 1300, 4th Cir. (1996)Document13 pagesUnited States v. Eddie C. Wilson, SR., 81 F.3d 1300, 4th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Bangladesh Bank v Rizal Commercial Banking Corp. (2024 NY Slip Op 01112)Document2 pagesBangladesh Bank v Rizal Commercial Banking Corp. (2024 NY Slip Op 01112)Maria KarlaPas encore d'évaluation

- Oriental Imports and Exports, Inc., A Florida Corporation, Cross-Appellant v. Maduro & Curiel's Bank, N v. A Foreign Banking Corporation, Cross-Appellee, 701 F.2d 889, 11th Cir. (1983)Document8 pagesOriental Imports and Exports, Inc., A Florida Corporation, Cross-Appellant v. Maduro & Curiel's Bank, N v. A Foreign Banking Corporation, Cross-Appellee, 701 F.2d 889, 11th Cir. (1983)Scribd Government DocsPas encore d'évaluation

- Debt Collection AbusesDocument15 pagesDebt Collection Abusesecharlip7944Pas encore d'évaluation

- United States v. Ismael Rodriguez-Alvarado, 952 F.2d 586, 1st Cir. (1991)Document8 pagesUnited States v. Ismael Rodriguez-Alvarado, 952 F.2d 586, 1st Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States v. Samuel Andrew Lindstrom, JR., United States of America v. Samuel Andrew Lindstrom, SR., 222 F.2d 761, 3rd Cir. (1955)Document5 pagesUnited States v. Samuel Andrew Lindstrom, JR., United States of America v. Samuel Andrew Lindstrom, SR., 222 F.2d 761, 3rd Cir. (1955)Scribd Government DocsPas encore d'évaluation

- United States v. Santo A. Giordano, 444 F.2d 1350, 2d Cir. (1971)Document4 pagesUnited States v. Santo A. Giordano, 444 F.2d 1350, 2d Cir. (1971)Scribd Government DocsPas encore d'évaluation

- United States v. Marie v. Cyr, 712 F.2d 729, 1st Cir. (1983)Document8 pagesUnited States v. Marie v. Cyr, 712 F.2d 729, 1st Cir. (1983)Scribd Government DocsPas encore d'évaluation

- Class Action IL Amended Complaint FinalDocument75 pagesClass Action IL Amended Complaint FinalrodclassteamPas encore d'évaluation

- Austin Davidson AffidavitDocument8 pagesAustin Davidson AffidavitEmily BabayPas encore d'évaluation

- United States v. Ehizele Seignious, 4th Cir. (2014)Document26 pagesUnited States v. Ehizele Seignious, 4th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals: Opinion On Rehearing UnpublishedDocument11 pagesUnited States Court of Appeals: Opinion On Rehearing UnpublishedScribd Government DocsPas encore d'évaluation

- United States v. Wood, 10th Cir. (2004)Document11 pagesUnited States v. Wood, 10th Cir. (2004)Scribd Government DocsPas encore d'évaluation

- ShdjahsjdDocument2 pagesShdjahsjdMillcen UmaliPas encore d'évaluation

- United States v. Leonard W. Evans, 42 F.3d 586, 10th Cir. (1994)Document11 pagesUnited States v. Leonard W. Evans, 42 F.3d 586, 10th Cir. (1994)Scribd Government DocsPas encore d'évaluation

- United States v. Earl L. Kramer, 500 F.2d 1185, 10th Cir. (1974)Document5 pagesUnited States v. Earl L. Kramer, 500 F.2d 1185, 10th Cir. (1974)Scribd Government DocsPas encore d'évaluation

- Jerome Daly CaseDocument5 pagesJerome Daly CaseValerie LopezPas encore d'évaluation

- Jerome Daly CaseDocument5 pagesJerome Daly Casecomputax53Pas encore d'évaluation

- United State District Court Todd Adderly Not in ForeclosureDocument88 pagesUnited State District Court Todd Adderly Not in ForeclosureTaipan KinlockPas encore d'évaluation

- United States v. R. Peter Stanham, 11th Cir. (2010)Document44 pagesUnited States v. R. Peter Stanham, 11th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- United States v. Fraza, 1st Cir. (1997)Document42 pagesUnited States v. Fraza, 1st Cir. (1997)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument6 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Kathy Mills Lee, 427 F.3d 881, 11th Cir. (2005)Document19 pagesUnited States v. Kathy Mills Lee, 427 F.3d 881, 11th Cir. (2005)Scribd Government DocsPas encore d'évaluation

- Banco Industrial v. Credit Suisse, 99 F.3d 1045, 11th Cir. (1996)Document9 pagesBanco Industrial v. Credit Suisse, 99 F.3d 1045, 11th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Alimamy Barrie AffidavitDocument7 pagesAlimamy Barrie AffidavitEmily BabayPas encore d'évaluation

- United States v. Dennis Gray Williams, 11th Cir. (2015)Document24 pagesUnited States v. Dennis Gray Williams, 11th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- Case 3 Can There Be Fraud If No Money Is Lost?Document2 pagesCase 3 Can There Be Fraud If No Money Is Lost?Nikita Eunice NdyagendaPas encore d'évaluation

- Metropolitan Bank and Trust Company, The vs. Rosales, 713 SCRA 75, G.R. No. 183204 January 13, 2014Document8 pagesMetropolitan Bank and Trust Company, The vs. Rosales, 713 SCRA 75, G.R. No. 183204 January 13, 2014CherPas encore d'évaluation

- United States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Document15 pagesUnited States v. Benjamin, 252 F.3d 1, 1st Cir. (2001)Scribd Government DocsPas encore d'évaluation

- Indemnity Insurance Company of North America v. The First National Bank at Winter Park, Florida, 351 F.2d 519, 1st Cir. (1965)Document6 pagesIndemnity Insurance Company of North America v. The First National Bank at Winter Park, Florida, 351 F.2d 519, 1st Cir. (1965)Scribd Government DocsPas encore d'évaluation

- Poliak Seizure WarrantDocument41 pagesPoliak Seizure WarrantJ RohrlichPas encore d'évaluation

- The Metropolitan Bank and Trust CompanyDocument3 pagesThe Metropolitan Bank and Trust CompanyNadiel FerrerPas encore d'évaluation

- United States v. Richard Dennis Lynn, 461 F.2d 759, 10th Cir. (1972)Document5 pagesUnited States v. Richard Dennis Lynn, 461 F.2d 759, 10th Cir. (1972)Scribd Government DocsPas encore d'évaluation

- Bank of America Complaint For Wrongful Foreclosure On Beneficiary of A TrustDocument10 pagesBank of America Complaint For Wrongful Foreclosure On Beneficiary of A TrustLenoreAlbertPas encore d'évaluation

- United States v. George M. Michals, 469 F.2d 215, 10th Cir. (1972)Document5 pagesUnited States v. George M. Michals, 469 F.2d 215, 10th Cir. (1972)Scribd Government DocsPas encore d'évaluation

- ATM ComplaintDocument6 pagesATM ComplaintKUTV2NewsPas encore d'évaluation

- Robert Rivernider Files Motion To Dimiss Indictment Due To Egregious Prosecutorial MisconductDocument96 pagesRobert Rivernider Files Motion To Dimiss Indictment Due To Egregious Prosecutorial MisconductBob RiverniderPas encore d'évaluation

- United States v. Meehan, 4th Cir. (2000)Document4 pagesUnited States v. Meehan, 4th Cir. (2000)Scribd Government DocsPas encore d'évaluation

- PrecedentialDocument44 pagesPrecedentialScribd Government Docs100% (1)

- Payn v. Kelley, 10th Cir. (2017)Document8 pagesPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Greene v. Tennessee Board, 10th Cir. (2017)Document2 pagesGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Wilson v. Dowling, 10th Cir. (2017)Document5 pagesWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Brown v. Shoe, 10th Cir. (2017)Document6 pagesBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Webb v. Allbaugh, 10th Cir. (2017)Document18 pagesWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Document10 pagesNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- 2GD9U9Y128664633Document1 page2GD9U9Y128664633Snow girlPas encore d'évaluation

- LLM-5104: Law of International OrganizationsDocument1 pageLLM-5104: Law of International OrganizationsEfaz Mahamud AzadPas encore d'évaluation

- Philippine Supreme Court Upholds Security of TenureDocument2 pagesPhilippine Supreme Court Upholds Security of TenureNelly Louie CasabuenaPas encore d'évaluation

- 580-060 Real Property PDFDocument5 pages580-060 Real Property PDFGirmaye HailePas encore d'évaluation

- Estate dispute over late Roberto ChuaDocument9 pagesEstate dispute over late Roberto ChuaNunugom SonPas encore d'évaluation

- Chapter 1Document136 pagesChapter 1Jeffrey MangsatPas encore d'évaluation

- Road Transport and Safety Agency V First National Bank Zambia LTD and Anor (Appeal 127 of 2016) 2019 ZMSC 311 (28 May 2019)Document27 pagesRoad Transport and Safety Agency V First National Bank Zambia LTD and Anor (Appeal 127 of 2016) 2019 ZMSC 311 (28 May 2019)AbrahamPas encore d'évaluation

- Case Digest Module 3 Civil LawDocument53 pagesCase Digest Module 3 Civil LawGreggy LawPas encore d'évaluation

- Original Petition AffidavitDocument13 pagesOriginal Petition AffidavitMarc BoyerPas encore d'évaluation

- Manila Bulletin (G.R. No. 170341, July 05, 2017) CleanDocument25 pagesManila Bulletin (G.R. No. 170341, July 05, 2017) CleanClarinda MerlePas encore d'évaluation

- Vda. de Abeto vs. PALDocument5 pagesVda. de Abeto vs. PALaldinPas encore d'évaluation

- Welcome Wagon, Inc., A Corporation v. Nancy Rankin Morris, 224 F.2d 693, 4th Cir. (1955)Document11 pagesWelcome Wagon, Inc., A Corporation v. Nancy Rankin Morris, 224 F.2d 693, 4th Cir. (1955)Scribd Government DocsPas encore d'évaluation

- International Environment Law - Moot MemorialDocument27 pagesInternational Environment Law - Moot MemorialKabir ChichiriyaPas encore d'évaluation

- 02 Case Digest Banawa Vs Mirano 97 SCRA 517Document1 page02 Case Digest Banawa Vs Mirano 97 SCRA 517Jonjon BeePas encore d'évaluation

- Floreza V EvangelistaDocument2 pagesFloreza V EvangelistaLeo TumaganPas encore d'évaluation

- In The Matter of J. F., Petitioner, v. L. F., Respondent.Document10 pagesIn The Matter of J. F., Petitioner, v. L. F., Respondent.Talia SchwartzPas encore d'évaluation

- 2 The Nature of Legal ReasoningDocument26 pages2 The Nature of Legal ReasoningAilyn Bagares AñanoPas encore d'évaluation

- Letter Head SanaDocument4 pagesLetter Head SanaSana ParveenPas encore d'évaluation

- Au Kean Hoe V Persatuan Penduduk D'villa Equestrian (2015) 4 MLJ 204Document2 pagesAu Kean Hoe V Persatuan Penduduk D'villa Equestrian (2015) 4 MLJ 204A random humanPas encore d'évaluation

- BrokerDocument63 pagesBrokerEriq GardnerPas encore d'évaluation

- BI FORM V-NI-026-Rev 1.1 PDFDocument1 pageBI FORM V-NI-026-Rev 1.1 PDFkokatuPas encore d'évaluation

- Section 3. - Alternative Obligations: The Right of Choice of The Debtor Is Subject To Limitations. ThusDocument6 pagesSection 3. - Alternative Obligations: The Right of Choice of The Debtor Is Subject To Limitations. ThusGaza Jemi GadePas encore d'évaluation

- ONGSUCO V MALONESDocument4 pagesONGSUCO V MALONESSuzyPas encore d'évaluation

- Insurance Law PrinciplesDocument5 pagesInsurance Law PrinciplesJanus MariPas encore d'évaluation

- United States Court of Appeals, Fourth CircuitDocument11 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsPas encore d'évaluation

- PsipopDocument12 pagesPsipopAnonymous 90OUfqo3mQPas encore d'évaluation

- Family LawDocument2 pagesFamily Lawguytdy100% (1)

- Last Minute Tips Labor 2015Document3 pagesLast Minute Tips Labor 2015Mildred PagsPas encore d'évaluation

- Module 5 MahajanDocument53 pagesModule 5 MahajanSushma ChoubeyPas encore d'évaluation

- The 7 Habits of Highly Effective People: The Infographics EditionD'EverandThe 7 Habits of Highly Effective People: The Infographics EditionÉvaluation : 4 sur 5 étoiles4/5 (2475)

- The Age of Magical Overthinking: Notes on Modern IrrationalityD'EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityÉvaluation : 4 sur 5 étoiles4/5 (13)

- LIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionD'EverandLIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionÉvaluation : 4 sur 5 étoiles4/5 (402)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeD'EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BePas encore d'évaluation

- Why We Die: The New Science of Aging and the Quest for ImmortalityD'EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- The Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsD'EverandThe Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Permission to Be Gentle: 7 Self-Love Affirmations for the Highly SensitiveD'EverandPermission to Be Gentle: 7 Self-Love Affirmations for the Highly SensitiveÉvaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesD'EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesÉvaluation : 5 sur 5 étoiles5/5 (1631)

- Maktub: An Inspirational Companion to The AlchemistD'EverandMaktub: An Inspirational Companion to The AlchemistÉvaluation : 5 sur 5 étoiles5/5 (2)

- The Mountain is You: Transforming Self-Sabotage Into Self-MasteryD'EverandThe Mountain is You: Transforming Self-Sabotage Into Self-MasteryÉvaluation : 4.5 sur 5 étoiles4.5/5 (873)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelD'EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelÉvaluation : 5 sur 5 étoiles5/5 (2)

- Breaking the Habit of Being YourselfD'EverandBreaking the Habit of Being YourselfÉvaluation : 4.5 sur 5 étoiles4.5/5 (1454)

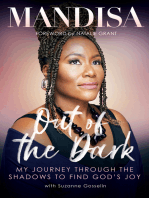

- Out of the Dark: My Journey Through the Shadows to Find God's JoyD'EverandOut of the Dark: My Journey Through the Shadows to Find God's JoyÉvaluation : 4.5 sur 5 étoiles4.5/5 (10)

- Crazy Love, Revised and Updated: Overwhelmed by a Relentless GodD'EverandCrazy Love, Revised and Updated: Overwhelmed by a Relentless GodÉvaluation : 4.5 sur 5 étoiles4.5/5 (1000)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedÉvaluation : 5 sur 5 étoiles5/5 (78)

- The Stoic Mindset: Living the Ten Principles of StoicismD'EverandThe Stoic Mindset: Living the Ten Principles of StoicismPas encore d'évaluation

- Tired of Being Tired: Receive God's Realistic Rest for Your Soul-Deep ExhaustionD'EverandTired of Being Tired: Receive God's Realistic Rest for Your Soul-Deep ExhaustionÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipD'EverandHow to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipÉvaluation : 4.5 sur 5 étoiles4.5/5 (1135)

- The Power of Now: A Guide to Spiritual EnlightenmentD'EverandThe Power of Now: A Guide to Spiritual EnlightenmentÉvaluation : 4.5 sur 5 étoiles4.5/5 (4120)

- Becoming Supernatural: How Common People Are Doing The UncommonD'EverandBecoming Supernatural: How Common People Are Doing The UncommonÉvaluation : 5 sur 5 étoiles5/5 (1476)

- Out of the Dark: My Journey Through the Shadows to Find God's JoyD'EverandOut of the Dark: My Journey Through the Shadows to Find God's JoyÉvaluation : 5 sur 5 étoiles5/5 (5)

- Now and Not Yet: Pressing in When You’re Waiting, Wanting, and Restless for MoreD'EverandNow and Not Yet: Pressing in When You’re Waiting, Wanting, and Restless for MoreÉvaluation : 5 sur 5 étoiles5/5 (4)