Académique Documents

Professionnel Documents

Culture Documents

Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)

Transféré par

marygraceomacTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #4)

Transféré par

marygraceomacDroits d'auteur :

Formats disponibles

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

VMBM, CPA

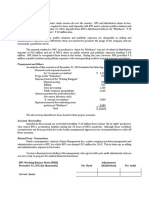

Single Entry/ Cash & Accrual Basis

1. Marilyn Company provided the following increases in account balances that occurred

during the current year:

Assets

Liabilities

Share capital

Share premium

9,000,000

3,000,000

5,000,000

500,000

Except for a P2,000,000 dividend payment, the years earnings and a P200,000 prior

period error from understatement of ending inventory, there were no other changes in

retained earnings for the year. What is the net income for the current year?

a. 2,500,000

b. 2,300,000

c. 2,700,000

d. 6,000,000

Understatement of ending invty=Overstatement of Net Income/Retained

Earnings

Equity, end (9M-3M)

Dividend payment

Prior period error

Share Capital

Share premium

Net income

6,000,000

2,000,000

(200,000)

(5,000,000)

(500,000)

2,300,000

2. Miralyn Company revealed the following changes in the accounts for 2014:

Increase(decrease)

During

the

Cash

1,000,000

current

year,

the

Accounts receivable, net of allowance

1,900,000

entity

issued

Inventory

2,200,000

10,000

ordinary

Equipment

(1,500,000)

shares

of Accounts payable

P100

par

500,000

value

for Bonds payable

P150

per

(2,000,000)

share.

Dividend

of P4,000,000 was paid in cash during the year. The entity borrowed P3,000,000 from the

bank and made interest payment of P200,000. The bank loan is unpaid on Dec 31 2014

and the interest payable on Dec 31 2014 was P100,000. There is no interest payable on

Jan 1 2014. Equipment with fair value of P500,000 was donated by a shareholder during

the year. What is the net income for the current year?

a. 2,000,000

b. 6,000,000

c. 4,500,000

d. 4,000,000

Net Changes in accounts

1M+1.9M+2.2M-1.5M-500k+2M 5,100,000

Dividend declared

4,000,000

Issuance of shares

(1,500,000)

Increase in loan

(3,000,000)

Donation (share premium)

(500,000)

Interest payable

(100,000)

Net income

4,000,000

3. She Company began operations on Jan 1 2013. The financial statements contained the

following errors:

2013

2014

Ending inventory 800,000 under

400,000 over

Depreciation

150,000 under

Insurance

50,000 over

50,000 under

expense

Prepaid

50,000 under

insurance

Page 1 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

VMBM, CPA

In addition, on Dec 31 2014, a fully depreciated equipment was sold for P100,000 cash but

the sale was not recorded until 2015. Ignore income tax. What is the total effect of errors

on

1. Net income for 2014?

a. 1,350,000 under b. 1,350,000 over c. 1,150,000 under d. 1,150,000 over

2013

2014

Ending invty

800,000

(800,000)

(400,000)

Depreciation

Insurance

expense

Sale

Net income

effects

(150,000)

50,000

(50,000)

700,000

100,000

(1,150,000)

2. Working capital on Dec 31 2014?

a. 300,000 under b. 300,000 over

Ending inventory

Cash

Working capital

Retained

earnings

(450,000)

c. 400,000 under

d. 400,000 over

(400,000)

100,000

(300,000)

3. Retained earnings on Dec 31 2014?

a. 1,150,000 over b. 700,000 under

c. 450,000 over

d. 450,000 under

4. Debbie Company reported sales revenue of P4,600,000 in the income statement for the

current year. Additional information for the current year is as follows:

January 1

December 31

Accounts receivable

1,000,000

1,300,000

Allowance for doubtful

60,000

110,000

accounts

Advances from customer

200,000

300,000

The entity wrote off uncollectible accounts totaling P50,000 during the current year.

Under cash basis, what amount should be reported as sales revenue for the current

year?

a. 4,900,000

b. 4,250,000

c. 4,350,000

d. 4,400,000

ACE-(DADA-EBBE)

Sales

Deferred, ending

Accrued, beginning

Total

Less:

Deferred, beginning

Accrued, ending

Written off accounts

Sales, cash basis

4,600,000

300,000

1,000,000

5,900,000

(200,000)

(1,300,000)

(50,000)

4,350,000

5. Faye Company has apprehensions of possible pilferage in the stock of merchandise at Dec

31 2014. The following data were available for the current year:

January 1

December 31

Physical inventory, at cost

600,000

1,000,000

Sales

4,000,000

Cost of sales

2,400,000

Accounts receivable

1,200,000

1,850,000

Page 2 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

VMBM, CPA

Accounts payable

1,500,00

1,850,000

During the current year, accounts written off amounted to P100,000. Sales returns with

credit memo were P150,000 and purchase returns, P50,000. Cash receipts from customers

after P200,000 discounts totaled P6,000,000 while cash payments to trade creditors

amounted to P4,000,000. Cash paid to customers for goods returned was P50,000. On this

transaction, accounts receivable was debited. Under accrual basis, what is the amount of

gross sales?

a. 6,600,000

b. 6,550,000

c. 6,650,000

d. 6,350,000

CAB (DADA-BEEB)

A/R, end

Written off

Cash receipts (200k+6M)

Error

Sales returns

A/R, beg

Gross sales, accrual

1,350,000

A/R

50,000

100,000

Cash

50,000

6,200,000

(50,000)

Correct entry:

150,000

S/R

50,000

(1,200,000)

Cash

50,000

6,550,000

AJE:

S/R

50,000

A/R

50,000

Statement of Cash flows

6. Jess Company provided the following information for the current year:

Dividend received

500,000

Dividend paid

1,000,000

Cash received from customers

9,000,000

Cash paid to suppliers and employees

(6,000,000)

Interest received

200,000

Interest paid on long term debt

(400,000)

Proceeds from issuing share capital

1,500,000

Proceeds from sale

of long term 2,000,000

investments

Income taxes paid

(300,000)

What is the net cash provided by operating activities?

a. 3,300,000

b. 3,000,000

c. 2,700,000

d. 2,000,000

Determination of Profits/Losses

operating

-collection of income

operating/investing

-payment of expenses

-trading securities

interest

dividends

received/interest

paidreceived-

dividends paid- financing/operating

7. During 2014, Riza Company had the following activities related to financial operations:

Payment for the early retirement of long (4,000,000)

term bonds payable (carrying amount of

bonds payable, P5,000,000)

Payment in 2014 of cash dividend declared (2,000,000)

in 2013

Preference share capital converted into 1,000,000

ordinary share capital

Proceeds from sale of treasury shares (cost 1,500,000

of treasury shares P1,000,000)

What amount should be reported as net cash used in financing activities?

a. 4,500,000

b. 3,500,000

c. 2,500,000

d. 5,500,000

-

about debt & equity

B/P

5,000,000

Page 3 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

Cash

Gain

VMBM, CPA

4,000,000

1,000,000 adjust in operating activities

8. Andrew Company had the following activities during the current year:

Acquired share capital of another entity

(2,000,000)

Sold an investment with carrying amount of 1,500,000

P2,000,000 for

Acquired one-year certificate of deposit from a (5,000,000)

bank. During the current year, interest of

P500,000 was received from the bank

Collected Dividends on share investments

300,000

Gain on sale of equipment

60,000

Proceeds from sale of equipment

100,000

Purchase of bonds with face value of (1,800,000)

P2,000,000

Amortization of bond discount

20,000

Dividends declared

450,000

Dividends paid

380,000

Proceeds from sale of treasury shares (CA of treasury 750,000

P650,000)

What amount should be reported as net cash used in investing activities?

a. 7,200,000

b. 7,260,000

c. 6,700,000

d. 6,400,000

Involve non-operating assets/activities (proceeds from sale/acquisition of assets)

-PPE,intangible

-investments (short/long term) excluding trading securities and cash equivalent

Discontinued Operation and Noncurrent Asset Held for Sale

9. Erica Company is a diversified entity with nationwide interests in commercial real estate

development, banking, mining, and food distribution. The food distribution division was

deemed to be inconsistent with the long term direction of the entity. On Oct 1 2014, the

board of directors voted to approve the disposal of this division. The sale is expected to

occur in August 2015. The food distribution had the following revenue and expenses in

2014: Jan 1 to Sept 30, revenue of P10,000,000 and expenses of P25,000,000; Oct 1 to

Dec 31, revenue of P10,000,000 and expenses of P12,000,000. The carrying amount of the

divisions assets on Dec 31 2014 was P50,000,000 and the recoverable amount was

estimated to be P55,000,000. The sale contract required the entity to terminate certain

employees incurring an expected termination cost of P1,000,000 to be paid by Dec 15,

2015. The income tax rate is 30%. What amount should be reported as income from

discontinued operations for 2014?

a. 5,600,000

b. 9,100,000

c. 4,900,000

d. 8,400,000

35M(revenues)+10M(revenues)-25M(expenses)-12M(expenses)11M(termination cost)

=7,000,000*70%= 4,900,000 Income, net of tax

No Impairment loss= CA 50,000,000> RA 55,000,000

Non current asset or disposal group classified as held for sale when the sale

is highly probable and the asset is available for immediate sale in the present

condition, CA is recovered through a sale

If abandoned asset? not considered held for sale, carrying amount is recovered

through continuing use

Measurement: lower of carrying amount or fair value less cost of disposal

Subsequent increase in FVLCD- gain to be included in P/L but not in

excess of the cumulative

impairment loss previously recognized

When entity decides not to sell the asset but to continue use it

asset should be measured at

Page 4 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

VMBM, CPA

the lower of carrying amount on the basis that it had never been

classified as held for sale and Carrying amount

Recognition: as Current asset from reclassification date, shown separately from

other assets and

Liabilities

--no depreciation of the asset while being classified as Current asset

10.Jackie Company purchased an equipment for P5,000,000 on Jan 1 2014. The equipment

had a useful life of 5 years with no residual value. On Dec 31 2014, the entity classified

the asset as held for sale. On such date, the fair value less cost of disposal of the

equipment was P3,500,000.

On Dec 31 2015, the entity believed that the criteria for classification as held for sale can

no longer be met. Accordingly, the entity decided not to sell the asset but to continue to

use it. On Dec 31 2015, fair value less cost of disposal of the equipment was P2,700,000.

1. What amount of impairment loss should be recognized in 2014?

a. 1,500,000

b. 1,000,000

c. 500,000

d.0

5,000,000*4/5= 4,000,000 (CA) vs 3,500,000 (FVLCD)= 500,000 impairment loss

2. What amount should be included in profit and loss in 2015 as a result of the

reclassification of the equipment to property, plant and equipment?

a. 800,000 gain

b. 800,000 loss

c. 300,000 gain

d.

300,000 loss

From Jan 1, 2015-Dec 31 2015 no depreciation should be recognized,

CA, per book 12/31/15

New measurement

Loss on reclassification

01/01/14

Equipment 5,000,000

Cash

5,000,000

12/31/14

Depreciation 1,000,000

Accum. Depreciation

Equipment Held for sale

Accum. Depreciation

Equipment

3,500,000

2,700,000

800,000

1,000,000

4,000,000

1,000,000

5,000,000

Impairment loss

500,000

Equipment held for sale

500,000

12/31/15

Equipment

2,700,000

Loss on reclassification

800,000

Equipment held for sale

3,500,000

12/31/16

Depreciation 900,000

Accum. Depreciation

(2,700,000/3 rem. Yrs)

900,000

Operating Segment and Interim Reporting

11.Kath Company identified the following segment for the current year:

Segment

Revenue

Profit

Asset

A

10,000,000

1,750,000

20,000,000

B

8,000,000

1,400,000

17,500,000

C

6,000,000

1,200,000

12,500,000

Page 5 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

D

E

F

VMBM, CPA

3,000,000

4,000,000

2,000,000

550,000

575,000

525,000

7,500,000

5,500,000

3,000,000

3,300,000

600,000

6,600,000

What are the reportable segments?

a. segments A,B,C

b. segments A,B,C, and D

c. segments A,B,C,D and E

d. segments A,B,C,D,E, and F

If 10% or more of the total Revenue, Profit/Loss*, Assets= reportable

*profit/loss= 10% or more of the greater between the combined profit of all profitable

segments and combined

losses of all unprofitable segments

OVERALL SIZE TEST 75% threshold

Total reportable segments must be 75% or more of total external revenue of

the entity, if not,

use the aggregate criteria

Aggregate criteria (if majority)

1. Product/service

4. Customers

2. Production

5. Regulated environment

3. Marketing

Major customers- 10% or more of the combined external revenue of all segments to be

reportable

12.Gabriel Company reported P950,000 net income for the quarter ended Sept 30 2014 which

included the following after-tax items:

A P600,000 expropriation gain realized in May 2014 was allocated equally to the

second, third and fourth quarters of 2014

A P160,000 cumulative effect loss resulting from a change in inventory valuation

method was recognized on August 31 2014.

In addition, the entity paid P480,000 on Feb 1 2014, for 2014 calendar year real

property tax. Of this amount, P120,000 was allocated to the third quarter of 2014

What is the net income for the quarter ended Sept 30 2014?

a. 1,030,000

b. 1,110,000

c. 1,150,000

d. 910,000

Interim reporting- the same acctg principles applied as with the annual reporting

1. Income statement- income/gains recognized in the interim period earned

only, and

losses/expenses recognized in the interim period incurred.

2. Expenses- direct, use cause and effect

Indirect, use systematic allocation

Net income

950,000

Expropriation gain (600,000/3 quarters)

(200,000)

Cumulative loss

, change in acctg policy

-should be at R/E not income statement 160,000

Adjusted net income

910,000

13.Daniel Company, a calendar year corporation, had the following income before tax

provision and estimated effective annual tax rates for the first three quarters:

Quarter

Income before income tax

Effective annual tax rate

First

6,000,000

40%

Second

7,000,000

40%

Third

4,000,000

45%

What is the income tax provision in the interim income statement for the third quarter?

a. 1,800,000

b. 2,450,000

c. 2,550,000

d. 7,650,000

Page 6 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

17,000,000*45%=

2nd qtr recognized tax

1st qtr recognized tax

Tax for third quarter

VMBM, CPA

7,650,000

(2,400,000)

(2,800,000)

2,450,000

Hyperinflation and Current Cost

14.Mercy Company provided the following information for the year ended Dec 31 2014

Net monetary assets-Jan1

800,000

* 300/100= 2,400,000

Sales

5,000,000 * 300/200= 7,500,000

Purchases

3,000,000 * 300/200= (4,500,000)

Expenses

1,000,000 * 300/200= (1,500,000)

Income tax

600,000

*300/200= (900,000)

Cash dividend

200,000

(200,000)

1,000,000

2,800,000

The sales, purchases, expenses and income tax accrued evenly during the year.

Selected general price index numbers are 100 on Jan 1 and 300 on Dec 31. What is the

gain or loss on purchasing power during the year?

a. 1,800,000 gain b. 1,800,000 loss c. 1,700,000 gain d. 1,700,000 loss

Constant Peso Acctg- restatement of historical financial statement through use of index

number

Monetary items- not restated

Gain/Loss on purchasing power (only for monetary items)= Net monetary assets,

restated- Net monetary

assets @ cost

Formula for restatement:

=Index number at end of reporting period x Historical cost

Index number on acquisition date*

*All items in income statement use average index

15.Juno Company reported the following information for the current year:

Units

Historical cost

Inventory- Jan 1

10,000

530,000

Purchases

45,000

2,790,000

Goods available for sale

55,000

3,320,000

Inventory- Dec 31

(15,000)

(945,000)

Cost of goods sold

40,000

2,375,000

The current cost per unit was P58 on Jan 1 and P72 on Dec 31

Under current cost accounting, what is the cost of goods sold?

a. 2,600,000

b. 2,880,000

c. 2,375,000

d. 2,320,000

40,000*(58+72/2)= 2,600,000

16.Sallyneth Company acquired an equipment on Jan 1 2014 for P5,000,000. Depreciation is

computed using the straight line method. The estimated useful life of the equipment is 5

years with no residual value. A specific price index applicable to the equipment was 150

on Jan 1 2014 and 225 on Dec 31 2014

What is the realizable holding gain on the equipment to be reported in 2014?

a. 500,000

b. 300,000

c. 250,000

d.0

225/150*5,000,000= 7,500,000

(7,500,000+5,000,000)/2=6,250,000(ave cost)/5

1,250,000

depn based

on ave CC

(1,000,000) depn based on HC

250,000

realized holding gain

Page 7 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

VMBM, CPA

17.On Jan 1 2014, Harry Company purchased land for P5,000,000. On Dec 31 2014, the land

has a current cost of P5,500,000. On Dec 31 2015, the entity sold the land for P6,500,000.

On such date, the current cost of the land is P5,900,000.

What is the realized holding gain to be reported in the income statement for 2015?

a. 1,500,000

b. 1,000,000

c. 900,000

d. 400,000

CC at time of sale

5,900,000

Historical cost

(5,000,000)

Realized holding gain in 2015

900,000

Less unrealized HG in 2014

(500,000)

Realized HG to be reported

400,000

Current cost accounting- restatement of historical cost in terms of current replacement

cost

- recognition of holding gain/loss

Use average current cost= Cost of sales and Depreciation

Realized Holding Gains/Losses

For inventory sold= COS, at average current cost- COS, at historical cost

For depreciable property= Depn based on ave. current sales- Depn based on historical

cost

For nondepreciable property= Current cost at the time of sale- Historical cost

Unrealized Holding Gains/Losses

For ending invty= Current cost @ end of the year-Historical cost

For depreciable property- Net Current cost (CC-accumulated Depn)-Carrying amount

For nondepreciable property= Current cost at end of the year-Historical Cost

Notes & Comprehensive Income

18.The financial statements of Troy Company were authorized for issue on March 31 2015 and

the end of the reporting period is Dec 31 2014.

On Dec 31 2014, the entity had an account receivable of P3,000,000 from a customer.

On Feb 1 2015, the liquidator of the said customer advised the entity in writing that the

customer was insolvent and that only P1,000,000 would be paid on Dec 31 2015.

-existing as of the end of the BS date, loss of P2,000,000

The entity had reported a contingent liability on Dec 31 2014 related to a court case. On

March 1 2015, the judge handed down a decision against the entity for damages

amounting to P2,500,000.

What total amount should be reported as adjusting events on Dec 31 2014?

a. 4,500,000

b. 2,500,000

c. 5,500,000

d. 2,000,000

19.Claus Company provided the following information for the current year:

Income from continuing operations

5,000,000

Income from discontinued operations

1,000,000

Unrealized gain on financial asset at FVTPL

2,500,000

Unrealized gain on financial asset at FVTOCI 1,500,000

Unrealized

gain

on

futures

contract 500,000

designated as a cash flow hedge

Actuarial loss during the year due to 400,000

increase in PBO

Foreign translation adjustment-debit

100,000

Loss on credit risk of a financial liability 200,000

designated at FVTPL

Revaluation surplus during the year

2,000,000

What amount should be reported as comprehensive income for the year?

a. 3,300,000

b. 9,300,000

c. 6,000,000

d. 9,500,000

Page 8 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

Net income (continuing/discontinuing)

OCI that may be reclassified to P/L:

1. Cash flow hedge derivative

2. Translation

OCI that may not be reclassified to P/L

1. FVTOCI

2. Actuarial G/L-PBO

3. Loss Credit risk

4. Revaluation surplus

Total

VMBM, CPA

6,000,000

500,000

(100,000)

1,500,000

(400,000)

(200,000)

2,000,000

400,000

2,900,000

9,300,000

SME

20.An SME prepared the following postclosing trial balance on Dec 31 2014:

Property, plant and equipment

2,300,000

Intangible assets

850,000

Investment in associate

1,100,000

Deferred tax asset

40,000

Inventory

500,000

Trade receivables

600,000

Cash on hand

1,150,000

Investment in nonputtable ordinary shares- 550,000

listed (FV can be measured,

FVTPL)

Investment in nonconvertible nonputtable

preference shares-unlisted (FV cant be

500,000

measured, cost)

Investment in term bonds

Demand deposit in bank

Loan receivable from employee-fixed term

Loan receivable from associate-on demand

Bank loans

Other long term employee benefits

Obligations under finance leases

Trade payables

Warranty obligation

Rent payable

Interest payable

Current tax liability

Bank overdraft on demand

Share capital

Retained earnings

1. What is the total amount of basic financial

a. 4,810,000

b. 3,710,000

400,000

200,000

10,000

300,000

1,100,000

250,000

400,000

550,000

20,000

10,000

20,000

210,000

40,000

4,000,000

1,900,000

assets?

c. 3,750,000

d. 3,160,000

2. What is the total amount of basic financial liabilities?

a. 2,330,000

b. 2,120,000

c. 1,720,000

d. 1,930,000

21.An SME incurred and paid the following expenditures in acquiring an administration

building and the land on which it is built during 2014:

Jan 1

Jan 1

Jan 1

20%

of

the

price

is 50,000,000

attributable to land

Nonrefundable transfer taxes 1,000,000

not

included

in

the

P50,000,000 purchase price

Legal

cost

directly 200,000

attributable

to

the

acquisition

Page 9 of 10

Father Saturnino Urios University

Accountancy Program

AIR- Cluster 1 (Drill #4)

Jan 1

Expensed

June 30

Expensed

During 2014

VMBM, CPA

Reimbursing the previous 100,000

owner for prepaying the

nonrefundable

local

government property taxes

for the six-month period

ending June 30 2014

Nonrefundable annual local 200,000

govt property taxes for the

year ending June 30 2015

Day to day repairs and 250,000

maintenance

Expensed

On Dec 31 2014, SME assessed that the useful life of the building is 40 years with residual

value of P2,000,000. On the same date, fair value less cost of disposal of the land and

building is P60,000,000. What is the initial carrying amount of the land and building,

respectively?

a. 10,240,000 and 40,960,000

b. 10,200,000 and 40,800,000

c. 10,000,000 and 40,000,000

d. 12,000,000 and 48,000,000

51,200,000*80%= 40,960,000

51,200,000*20%= 10,240,000

SME- almost same with FULL PFRS

Investment property- use cost model (by circumstance)

-presented under PPE

END OF DRILL #4

Page 10 of 10

Vous aimerez peut-être aussi

- FQ 001 Sharehoders - Equity and Retained EarningsDocument4 pagesFQ 001 Sharehoders - Equity and Retained Earningsmarygraceomac83% (6)

- Problem 1Document6 pagesProblem 1novyPas encore d'évaluation

- Accounting ForDocument18 pagesAccounting ForKriztleKateMontealtoGelogoPas encore d'évaluation

- Practical Accounting 2 4Document13 pagesPractical Accounting 2 4AB CloydPas encore d'évaluation

- 02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFDocument13 pages02 MAS Final Preboard 2018 2019 WITH ANSWER 2 PDFAshNor RandyPas encore d'évaluation

- PNB's Centennial Journey from Government Bank to Leading Private Universal BankDocument9 pagesPNB's Centennial Journey from Government Bank to Leading Private Universal BankAlliah SomidoPas encore d'évaluation

- Consolidated Statement of Financial Position - Date of Acquisition AnalysisDocument2 pagesConsolidated Statement of Financial Position - Date of Acquisition AnalysisKharen Valdez0% (1)

- Accounting for Employee Benefits, Leases and Other LiabilitiesDocument3 pagesAccounting for Employee Benefits, Leases and Other LiabilitiesmarygraceomacPas encore d'évaluation

- Salco7 12Document3 pagesSalco7 12Einstein WilliamsPas encore d'évaluation

- Tokeny Solutions ONBOARDDocument2 pagesTokeny Solutions ONBOARDJosephine BonjourPas encore d'évaluation

- BCG Matrix AirAsiaDocument9 pagesBCG Matrix AirAsiaShu Xin ChuaPas encore d'évaluation

- Midterm Exam No. 2Document1 pageMidterm Exam No. 2Anie MartinezPas encore d'évaluation

- MASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Document35 pagesMASTERY CLASS IN AUDITING PROBLEMS Part 1 Prob 1 9Mark Gelo WinchesterPas encore d'évaluation

- AccountingDocument3 pagesAccountingrenoPas encore d'évaluation

- What A ProblemDocument4 pagesWhat A ProblemEleazar SalazarPas encore d'évaluation

- Coursehero 12Document2 pagesCoursehero 12nhbPas encore d'évaluation

- Far TB2Document195 pagesFar TB2MarieJoiaPas encore d'évaluation

- Consolidation at Acquisition DateDocument29 pagesConsolidation at Acquisition DateLee DokyeomPas encore d'évaluation

- Responsibility Accounting Concepts and CalculationsDocument5 pagesResponsibility Accounting Concepts and CalculationsRenPas encore d'évaluation

- Completion of Audit Quiz ANSWERDocument9 pagesCompletion of Audit Quiz ANSWERJenn DajaoPas encore d'évaluation

- I Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouDocument9 pagesI Am Sharing 'SIM-ANSWERS - 6th-Exam-Topics - Hyperinflation - PABRES' With YouJeric TorionPas encore d'évaluation

- Balbin, Ma. Margarette P. Assignment #1Document7 pagesBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinPas encore d'évaluation

- Audit of Investments - Set ADocument4 pagesAudit of Investments - Set AZyrah Mae SaezPas encore d'évaluation

- Chapter12 - AnswerDocument26 pagesChapter12 - AnswerAubreyPas encore d'évaluation

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoPas encore d'évaluation

- ProblemsDocument9 pagesProblemsMark Angelo AlvarezPas encore d'évaluation

- ACCY 303 Midterm Exam ReviewDocument12 pagesACCY 303 Midterm Exam ReviewCORNADO, MERIJOY G.Pas encore d'évaluation

- Practice AcctngDocument7 pagesPractice AcctngRubiliza GailoPas encore d'évaluation

- MASDocument7 pagesMASHelen IlaganPas encore d'évaluation

- CORDILLERA CAREER DEVELOPMENT COLLEGE INCOME TAXATION FINAL EXAMDocument7 pagesCORDILLERA CAREER DEVELOPMENT COLLEGE INCOME TAXATION FINAL EXAMRoldan Hiano Manganip0% (1)

- Trial Balance of Entity A GovernmentDocument3 pagesTrial Balance of Entity A GovernmentPrincess NozalPas encore d'évaluation

- ACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)Document16 pagesACCO 30043: Quiz Number 1 (Introduction To Assurance and Audit Services)pat lancePas encore d'évaluation

- Abc Stock AcquisitionDocument13 pagesAbc Stock AcquisitionMary Joy AlbandiaPas encore d'évaluation

- Accounting For Special Transactions:: Corporate LiquidationDocument28 pagesAccounting For Special Transactions:: Corporate LiquidationKim EllaPas encore d'évaluation

- Construction ContractttttDocument6 pagesConstruction ContractttttMARTINEZ, EmilynPas encore d'évaluation

- Chapter 2 PDFDocument25 pagesChapter 2 PDFZi VillarPas encore d'évaluation

- Cpar - Ap 09.15.13Document18 pagesCpar - Ap 09.15.13KamillePas encore d'évaluation

- Long-Term Construction Contracts (Pfrs 15) : Start of DiscussionDocument3 pagesLong-Term Construction Contracts (Pfrs 15) : Start of DiscussionErica DaprosaPas encore d'évaluation

- Pak Enings HTDocument15 pagesPak Enings HTVincent SampianoPas encore d'évaluation

- Pre-Test 3Document3 pagesPre-Test 3BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- Chapter 4 Caselette Audit of ReceivablesDocument37 pagesChapter 4 Caselette Audit of ReceivablesXXXXXXXXXXXXXXXXXXPas encore d'évaluation

- Accounting for Special Transactions ExamDocument8 pagesAccounting for Special Transactions ExamMariefel OrdanezPas encore d'évaluation

- Ap-600S: Solutions To Quizzer On Investing Cycle - Audit of InvestmentsDocument8 pagesAp-600S: Solutions To Quizzer On Investing Cycle - Audit of InvestmentsChristine Jane AbangPas encore d'évaluation

- PAL Company Seeks Liquidation After Restructuring FailsDocument1 pagePAL Company Seeks Liquidation After Restructuring Failskat kalePas encore d'évaluation

- Acctg26: Intermediate Accounting 3Document33 pagesAcctg26: Intermediate Accounting 3Jeane Mae BooPas encore d'évaluation

- EXAM About INTANGIBLE ASSETS 2Document3 pagesEXAM About INTANGIBLE ASSETS 2BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- Partnership Accounting QuestionsDocument15 pagesPartnership Accounting QuestionsNhel AlvaroPas encore d'évaluation

- Intermediate Acctg A 1 10Document10 pagesIntermediate Acctg A 1 10Leonila RiveraPas encore d'évaluation

- Practice Problems Corporate LiquidationDocument2 pagesPractice Problems Corporate LiquidationAllira OrcajadaPas encore d'évaluation

- Advanced Financial Accounting TopicsDocument16 pagesAdvanced Financial Accounting TopicsNhel AlvaroPas encore d'évaluation

- Planning an Audit of Financial StatementsDocument10 pagesPlanning an Audit of Financial StatementsTrixie Pearl TompongPas encore d'évaluation

- Auditing Theories and Problems Quiz WEEK 2Document16 pagesAuditing Theories and Problems Quiz WEEK 2Van MateoPas encore d'évaluation

- Chapter 16 Summary: Accounting for Non-Profit OrganizationsDocument27 pagesChapter 16 Summary: Accounting for Non-Profit OrganizationsEllen MPas encore d'évaluation

- An SME Prepared The Following Post Closing Trial Balance at YearDocument1 pageAn SME Prepared The Following Post Closing Trial Balance at YearRaca DesuPas encore d'évaluation

- Cash BasisDocument4 pagesCash BasisMark DiezPas encore d'évaluation

- Advac SemifinalDocument8 pagesAdvac SemifinalDIVINE VILLENAPas encore d'évaluation

- LagunaDocument8 pagesLagunarandom17341Pas encore d'évaluation

- Audit of Investment, Do It Yourself - DiyDocument4 pagesAudit of Investment, Do It Yourself - Diymark100% (1)

- Activity 3 - CAATsDocument4 pagesActivity 3 - CAATsPaupauPas encore d'évaluation

- Audit of Receivable Wit Ans KeyDocument19 pagesAudit of Receivable Wit Ans Keyalexis pradaPas encore d'évaluation

- Acctg 2 QuizDocument4 pagesAcctg 2 QuizAshNor RandyPas encore d'évaluation

- Practical Accounting - Part 1Document17 pagesPractical Accounting - Part 1Kenneth Bryan Tegerero Tegio100% (1)

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoPas encore d'évaluation

- AUDITING PROBLEMSDocument16 pagesAUDITING PROBLEMSJustin NoladaPas encore d'évaluation

- Introduction To Management AccountingDocument5 pagesIntroduction To Management AccountingDechen WangmoPas encore d'évaluation

- Microsoft Word - 02 Quiz Bee - P1 and TOA (Average) PDFDocument5 pagesMicrosoft Word - 02 Quiz Bee - P1 and TOA (Average) PDFNora PasaPas encore d'évaluation

- P2 MaterialsDocument9 pagesP2 MaterialsmarygraceomacPas encore d'évaluation

- Chang ADocument6 pagesChang AmarygraceomacPas encore d'évaluation

- Chang CDocument3 pagesChang CmarygraceomacPas encore d'évaluation

- BLT Quizzer (Unknown) - Law On Negotiable InstrumentsDocument7 pagesBLT Quizzer (Unknown) - Law On Negotiable InstrumentsJasper Ivan PeraltaPas encore d'évaluation

- Tax Haven PDFDocument60 pagesTax Haven PDFRemon Agit RimangPas encore d'évaluation

- CH 03 Process CostingDocument19 pagesCH 03 Process CostingHadassahFayPas encore d'évaluation

- Chapter 22Document8 pagesChapter 22marygraceomacPas encore d'évaluation

- Intangible and Other AssetsDocument7 pagesIntangible and Other AssetsHope Joy Velasco AprueboPas encore d'évaluation

- Formulas in Computing Economic Order QuantityDocument13 pagesFormulas in Computing Economic Order QuantitymarygraceomacPas encore d'évaluation

- MQ 1 Receivables and InventoryDocument4 pagesMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Book Value, Earnings Per Share, Share-Based CompensationDocument3 pagesBook Value, Earnings Per Share, Share-Based CompensationmarygraceomacPas encore d'évaluation

- Ms Air 01Document9 pagesMs Air 01marygraceomacPas encore d'évaluation

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacPas encore d'évaluation

- Aggregate PlanningDocument10 pagesAggregate PlanningmarygraceomacPas encore d'évaluation

- Total Quality Management in Automotive Supply Chain in The U.S. (6!8!12)Document9 pagesTotal Quality Management in Automotive Supply Chain in The U.S. (6!8!12)marygraceomacPas encore d'évaluation

- Ms Air 01Document9 pagesMs Air 01marygraceomacPas encore d'évaluation

- Diagnostic Exam 1.1 AKDocument15 pagesDiagnostic Exam 1.1 AKmarygraceomacPas encore d'évaluation

- p1 Midterm 2012Document8 pagesp1 Midterm 2012marygraceomacPas encore d'évaluation

- MQ 1 Receivables and InventoryDocument4 pagesMQ 1 Receivables and Inventorymarygraceomac100% (2)

- Instruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedDocument6 pagesInstruction: Shade The Letter of Your Choice in The Answer Sheet Provided. No Erasures AllowedmarygraceomacPas encore d'évaluation

- Book Value, Earnings Per Share, Share-Based CompensationDocument3 pagesBook Value, Earnings Per Share, Share-Based CompensationmarygraceomacPas encore d'évaluation

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Document11 pagesFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacPas encore d'évaluation

- Diagnostic Exam 1.23 AKDocument13 pagesDiagnostic Exam 1.23 AKmarygraceomacPas encore d'évaluation

- Lease and Accounting For Income Tax DrillsDocument3 pagesLease and Accounting For Income Tax DrillsmarygraceomacPas encore d'évaluation

- 2007 - The Making of An Icon - LoDocument16 pages2007 - The Making of An Icon - LomarygraceomacPas encore d'évaluation

- 16 PDFDocument7 pages16 PDFmarygraceomacPas encore d'évaluation

- Ashtakvarga w59Document18 pagesAshtakvarga w59umaganPas encore d'évaluation

- 11 ReferencesDocument21 pages11 ReferencestouffiqPas encore d'évaluation

- Customer Satisfactionat Kotak MahindraDocument56 pagesCustomer Satisfactionat Kotak MahindraRaj KumarPas encore d'évaluation

- FATCA & CRS Compliance FormDocument2 pagesFATCA & CRS Compliance FormAakash SharmaPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document3 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Company AccountsDocument105 pagesCompany AccountsKaustubh BasuPas encore d'évaluation

- Introduction to key Indian financial markets infrastructureDocument69 pagesIntroduction to key Indian financial markets infrastructureanon_517749135Pas encore d'évaluation

- Equinix Q315 Earnings Presentation FinalDocument49 pagesEquinix Q315 Earnings Presentation FinalredchillpillPas encore d'évaluation

- Joint Venture Agreement FormDocument4 pagesJoint Venture Agreement FormDefit Archila KotoPas encore d'évaluation

- Negotiable Instruments (Word)Document74 pagesNegotiable Instruments (Word)MaanPas encore d'évaluation

- Day Trading WorkbookDocument6 pagesDay Trading WorkbookMadan Mohan ReddyPas encore d'évaluation

- Student Guide Lesson TwelveDocument7 pagesStudent Guide Lesson Twelveapi-344266741Pas encore d'évaluation

- Silkair Singapore Vs CirDocument15 pagesSilkair Singapore Vs Circode4salePas encore d'évaluation

- Chapter - 2&3 - Practice - Problems Hull Ed 10thDocument2 pagesChapter - 2&3 - Practice - Problems Hull Ed 10thAn KouPas encore d'évaluation

- Lesson 1 - Overview of Valuation Concepts and MethodsDocument5 pagesLesson 1 - Overview of Valuation Concepts and MethodsF l o w e rPas encore d'évaluation

- Bec Final 1Document16 pagesBec Final 1yang1987Pas encore d'évaluation

- Biaya Modal RevDocument25 pagesBiaya Modal RevMutiara DonikaPas encore d'évaluation

- Lecture 4: Equity Strategies: Daniel MacauleyDocument92 pagesLecture 4: Equity Strategies: Daniel MacauleymeprarthPas encore d'évaluation

- Credit AnalysisDocument3 pagesCredit AnalysisLinus ValenciaPas encore d'évaluation

- Section 5 Registration PDFDocument2 pagesSection 5 Registration PDFAnonymous YBBpXPb7VPas encore d'évaluation

- FNDM 3-1-10 Fact Sheet2Document3 pagesFNDM 3-1-10 Fact Sheet2MattPas encore d'évaluation

- Bachelor in Business Administration Semester 3: Prepared For: Lecturer's NameDocument14 pagesBachelor in Business Administration Semester 3: Prepared For: Lecturer's NameBrute1989Pas encore d'évaluation

- Business Finance - ModuleDocument33 pagesBusiness Finance - ModuleMark Laurence FernandoPas encore d'évaluation

- PRQZ 2Document31 pagesPRQZ 2Yashrajsing LuckkanaPas encore d'évaluation

- Ch12 HW SolutionsDocument16 pagesCh12 HW Solutionsgilli1tr100% (1)

- The Polaris - Orbitech Merger: AbstractDocument4 pagesThe Polaris - Orbitech Merger: Abstractsa030882Pas encore d'évaluation

- ConsignmentDocument4 pagesConsignmentmuhammaddin123100% (2)