Académique Documents

Professionnel Documents

Culture Documents

SCC RRF 2004

Transféré par

L. A. PatersonTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SCC RRF 2004

Transféré par

L. A. PatersonDroits d'auteur :

Formats disponibles

Orn

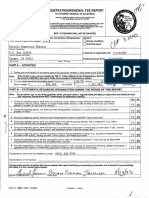

REGISTRATION/RENEWAL FEE REPORT

MAIL TO:

Registry of Charitable Trusts

P.O. Box 903447

Sacramento, CA 94203-4470

Telephone: (916) 445-2021

WEB SITE ADDRESS:

http://actca.eovicharities/

TO ATTORNEY GENERAL OF CALIFORNIA

Sections 12586 and 12587, California Government Code

II CCR Sections 311 and 312

Failure to submit this report annually no later than four months and fifteen days after

the end of the organization's accounting period may result In the loss of tax exemption

and the assessment of a minimum tax of $800, plus interest, and/or fines or filing

penalties as defined in Government Code Section 12586.1.

IRS FORM 990 EXTENSIONS WILL BE HONORED. PLEASE SUBMIT WITH RRF-1 ALL IRS

EXTENSION REQUESTS AND, WHERE APPLICABLE, IRS EXTENSION APPROVALS.

State Charity Registration Number

.-("9-1-49\

2.2\ 2--

si

Check if:

Change of address

Sunset Cultural Center, Inc.

Name of Organization

1 I)

Amended report

PO Box 1950

Address (Number and Street)

Corporate or Organization No

Carmel-by-the-Sea, CA 93921 -1 950

Federal Employer I D No

City or Town, State and ZIP Code

2554779

52-2404864

Yes

PART A - ACTIVITIES

1.

c3 I

No

ran

During your most recent full accounting period did your gross receipts or total assets equal $100,000 or more?

Note: If the answer is yes, you are required by Title 11 of the California Code of Regulations, H311 and 312, to attach a check In the amount of

$25.00 to this report Make check payable to Department of Justice.

2

10 i

For your most recent full accounting period (beginning

Gross receipts $

105,901

Total assets $

03

ending

30 /

04

) list:

223,646

PART B - STATEMENTS REGARDING ORGANIZATION DURING THE PERIOD OF THIS REPORT

if you answer "yes" to any of the questions below, you must attach a separate sheet providing an explanation and details

for each "yes" response. Please review RRF-1 instructions for information required.

Note:

Yes

No

1.

During this reporting period, were there any contracts, loans, leates or other financial transactions between the organization and any

officer, director or trustee thereof either directly or with an entity in which any such officer, director or trustee had any financial interest?

2.

During this reporting period, was there any theft, embezzlement, diversion or misuse of the organization's charitable property or funds?

um

3.

During this reporting period, did non-program expenditures exceed 50% of gross revenues?

In Ini

4.

During this reporting period, were any organization funds used to pay any penalty, fine or judgment? If you filed a Form 4720 with the

During this reporting period, were the services of a professional fundraiser or fundraising counsel used? If 'yes," provide an attachment

listing the name, address, and telephone number of the service provider.

During this reporting period, did the organization receive any governmental funding? If so, provide an attachment listing the name of

the agency, mailing address, contact person, and telephone number.

OM

7.

During this reporting period, did the organization hold a raffle for charitable purposes? If "yes," provide an attachment indicating the

number of raffles and the date(s) they occurred.

5 113.

6.

Does the organization conduct a vehicle donation program? If "yes," provide an attachment indicating whether the program is operated

by the charity or whether the organization contracts with a commercial fundraiser.

Eli

jr3/

Internal Revenue Service, attach a copy.

Organization's area code and telephone number (

831

620

la

2040

Organization's e-mail address

I declare under penalty of perjury that I have examined this report, including accompanying documents, and to the best of my knowledge and belief,

It is true, correct and complete.

Treasurer

__E-Akty(5243tbikkan2_ Sarah Brown

Signature of authorized officer

Printed Name

/1/01/0#

Title

te

/ RRF 1 (5 2004)

-

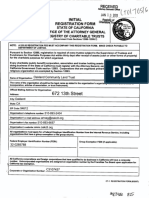

REGISTRATION /RENEWAL FEE REPORT FRF-11

Sunset Cultural Center, Inc.

Attachment re Part B

1.

Each of the initial nine trustees contributed $100 to the organization.

6.

Governmental funding was received from:

Name:

Address:

Contact:

Telephone:

City of Carmel-by-the-Sea

PO Box CC

Carmel-by-the-Sea CA 93921

Richard Guillen

831-620-2000

Vous aimerez peut-être aussi

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonPas encore d'évaluation

- SCC RRF 2011Document2 pagesSCC RRF 2011L. A. PatersonPas encore d'évaluation

- SCC RRF 2005Document3 pagesSCC RRF 2005L. A. PatersonPas encore d'évaluation

- Fomtnp RRF 2013Document2 pagesFomtnp RRF 2013L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonPas encore d'évaluation

- Caa RRF 2004Document2 pagesCaa RRF 2004L. A. PatersonPas encore d'évaluation

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonPas encore d'évaluation

- FTG RRF 2001Document2 pagesFTG RRF 2001L. A. PatersonPas encore d'évaluation

- Pacrep RRF 2014Document1 pagePacrep RRF 2014L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2002Document2 pagesPac Rep RRF 2002L. A. PatersonPas encore d'évaluation

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonPas encore d'évaluation

- Caa RRF 2001Document2 pagesCaa RRF 2001L. A. PatersonPas encore d'évaluation

- FTG RRF 2012Document1 pageFTG RRF 2012L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2005Document2 pagesPac Rep RRF 2005L. A. PatersonPas encore d'évaluation

- Caa RRF 2010Document1 pageCaa RRF 2010L. A. PatersonPas encore d'évaluation

- Caa RRF 2014Document1 pageCaa RRF 2014L. A. PatersonPas encore d'évaluation

- C SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageC SBTT (: Annual Registration Renewal Fee Report To Attorney General of CaliforniaL. A. PatersonPas encore d'évaluation

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonPas encore d'évaluation

- Caa RRF 2012Document1 pageCaa RRF 2012L. A. PatersonPas encore d'évaluation

- Istration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELDocument1 pageIstration/Renewal Fee Retort: JEL EL JEL JEL JEL JEL JEL JELL. A. PatersonPas encore d'évaluation

- FTG RRF 2004Document2 pagesFTG RRF 2004L. A. PatersonPas encore d'évaluation

- Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pageAnnual Registration Renewal Fee Report To Attorney General of CaliforniaagbufzbfPas encore d'évaluation

- FTG RRF 2009Document1 pageFTG RRF 2009L. A. PatersonPas encore d'évaluation

- SCC RRF 2009Document2 pagesSCC RRF 2009L. A. PatersonPas encore d'évaluation

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonPas encore d'évaluation

- Carmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportDocument1 pageCarmel Art Association PO BOX 2271 CARMEL, CA 93 921: Registration/Renewal Fee ReportL. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2009Document2 pagesPac Rep RRF 2009L. A. PatersonPas encore d'évaluation

- FTG RRF 2007Document1 pageFTG RRF 2007L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2006Document1 pagePac Rep RRF 2006L. A. PatersonPas encore d'évaluation

- Pac Rep RRF 2007Document1 pagePac Rep RRF 2007L. A. PatersonPas encore d'évaluation

- FTG RRF 2013Document1 pageFTG RRF 2013L. A. PatersonPas encore d'évaluation

- 2014 2015 Annual Registration Renewal Form RRF 1Document2 pages2014 2015 Annual Registration Renewal Form RRF 1Nyi Lwin HtetPas encore d'évaluation

- FTG RRF 2000Document1 pageFTG RRF 2000L. A. PatersonPas encore d'évaluation

- FTG RRF 2006Document1 pageFTG RRF 2006L. A. PatersonPas encore d'évaluation

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointPas encore d'évaluation

- Oakland Community Land Trust - Founding Documents 1999Document75 pagesOakland Community Land Trust - Founding Documents 1999auweia1Pas encore d'évaluation

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonPas encore d'évaluation

- Pac Rep RRF 2004Document4 pagesPac Rep RRF 2004L. A. PatersonPas encore d'évaluation

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationPas encore d'évaluation

- ST Ending:: CincinnatiDocument3 pagesST Ending:: CincinnatiMassiPas encore d'évaluation

- Request For Copy of Personal Income or Fiduciary Tax ReturnDocument2 pagesRequest For Copy of Personal Income or Fiduciary Tax ReturnAsjsjsjsPas encore d'évaluation

- Breast Cancer Survivors FoundationDocument48 pagesBreast Cancer Survivors FoundationthereadingshelfPas encore d'évaluation

- Dispute To Creditor For Charge OffDocument4 pagesDispute To Creditor For Charge Offrodney76% (21)

- LTR Comm Empl Stop WithholdingDocument17 pagesLTR Comm Empl Stop WithholdingBar RiPas encore d'évaluation

- 2010 One Caribbean Exempt App RedactedDocument43 pages2010 One Caribbean Exempt App RedactedJimmy VielkindPas encore d'évaluation

- CDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Document27 pagesCDC Director Thomas Frieden, COO Sherri Berger apparently covering-up misappropriated $3.33 million awarded to scandal-ridden Chicago nonprofit whose corporate treasurer was a career CDC executive; correspondence to date (8/30/12)Peter M. HeimlichPas encore d'évaluation

- Ag990 AnnualreportDocument2 pagesAg990 AnnualreportDaniel_Johnson_1322Pas encore d'évaluation

- SPR 23637 N 7204Document10 pagesSPR 23637 N 7204Balaramkishore GangireddyPas encore d'évaluation

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachPas encore d'évaluation

- Irs Tax ExemptDocument59 pagesIrs Tax ExemptPopeye2112100% (1)

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsPas encore d'évaluation

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindPas encore d'évaluation

- IRS Complaint Against NH District Corporation 11-18-19Document26 pagesIRS Complaint Against NH District Corporation 11-18-19Roberto RoldanPas encore d'évaluation

- Public Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaDocument1 pagePublic Health Council Annual Registration Renewal Fee Report To Attorney General of CaliforniaWAKESHEEP Marie RNPas encore d'évaluation

- Period Covered Filing DeadlineDocument10 pagesPeriod Covered Filing DeadlineHaftari HarmiPas encore d'évaluation

- Filled 139092Document2 pagesFilled 139092doomcomplexPas encore d'évaluation

- Form CRI 200 Short Form Registration Verification Statement PDFDocument5 pagesForm CRI 200 Short Form Registration Verification Statement PDFWen' George BeyPas encore d'évaluation

- TCF-ICEE Credit Application 11 081Document1 pageTCF-ICEE Credit Application 11 081jasonparker80Pas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- Agenda City Council Special Meeting 12-03-18Document3 pagesAgenda City Council Special Meeting 12-03-18L. A. PatersonPas encore d'évaluation

- Minutes City Council Special Meeting November 5, 2018 12-03-18Document1 pageMinutes City Council Special Meeting November 5, 2018 12-03-18L. A. PatersonPas encore d'évaluation

- Appointments FORA 12-03-18Document2 pagesAppointments FORA 12-03-18L. A. PatersonPas encore d'évaluation

- Councilmember Announcements 12-03-18Document1 pageCouncilmember Announcements 12-03-18L. A. PatersonPas encore d'évaluation

- Appointments Monterey-Salinas Transit Board 12-03-18Document2 pagesAppointments Monterey-Salinas Transit Board 12-03-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument2 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- Proclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18Document2 pagesProclamation Celebrating AMBAG' Fiftieth Anniversary 11-06-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument3 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- Agenda City Council 03-21-18Document2 pagesAgenda City Council 03-21-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council AgendaDocument5 pagesCity of Carmel-By-The-Sea City Council AgendaL. A. PatersonPas encore d'évaluation

- MPRWA Agenda Packet 11-08-18Document18 pagesMPRWA Agenda Packet 11-08-18L. A. PatersonPas encore d'évaluation

- Destruction of Certain Records 11-05-18Document41 pagesDestruction of Certain Records 11-05-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument8 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument5 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved By: SubjectL. A. PatersonPas encore d'évaluation

- Monthly Reports September 2018 11-05-18Document55 pagesMonthly Reports September 2018 11-05-18L. A. PatersonPas encore d'évaluation

- MPRWA Agenda Closed Session 10-25-18Document1 pageMPRWA Agenda Closed Session 10-25-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument30 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- Minutes Mprwa September 27, 2018Document2 pagesMinutes Mprwa September 27, 2018L. A. PatersonPas encore d'évaluation

- MPRWA Agenda Packet 10-25-18Document6 pagesMPRWA Agenda Packet 10-25-18L. A. PatersonPas encore d'évaluation

- Monthly Reports August 10-02-18Document48 pagesMonthly Reports August 10-02-18L. A. PatersonPas encore d'évaluation

- Special Meeting Minutes October 1, 2018 11-05-18Document1 pageSpecial Meeting Minutes October 1, 2018 11-05-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument7 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- City Council Agenda 10-02-18Document3 pagesCity Council Agenda 10-02-18L. A. PatersonPas encore d'évaluation

- City of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byDocument4 pagesCity of Carmel-By-The-Sea City Council Staff Report: TO: Submit T Ed By: Approved byL. A. PatersonPas encore d'évaluation

- Marketing in Non-Profit OrganizationsDocument32 pagesMarketing in Non-Profit Organizationsmwananzambi1850Pas encore d'évaluation

- GPTMC - 2011 990Document47 pagesGPTMC - 2011 990juliabergPas encore d'évaluation

- Naam Newsletter 2002 06Document8 pagesNaam Newsletter 2002 06api-241335034Pas encore d'évaluation

- BÀI TẬP TỰ HỌC K11 1 12 1Document2 pagesBÀI TẬP TỰ HỌC K11 1 12 128Nguyễn Khả TuyếnPas encore d'évaluation

- DILG Legal Opinion 09 Series 2011Document4 pagesDILG Legal Opinion 09 Series 2011Lou GepuelaPas encore d'évaluation

- Deduction Under Section 80GDocument2 pagesDeduction Under Section 80GsadathnooriPas encore d'évaluation

- 2013 Miami Dolphins Media GuideDocument633 pages2013 Miami Dolphins Media GuideMDolphins13Pas encore d'évaluation

- Legends Magazine 2017Document68 pagesLegends Magazine 2017CassiePas encore d'évaluation

- 3 15 12report Donation BoxesDocument24 pages3 15 12report Donation BoxesoaklocPas encore d'évaluation

- HF0222Document24 pagesHF0222elauwitPas encore d'évaluation

- A2 Journal Front PageDocument1 pageA2 Journal Front PageMichelle RogersPas encore d'évaluation

- Bodah ChargesDocument16 pagesBodah ChargesJana BarnelloPas encore d'évaluation

- Poster Writing PDFDocument6 pagesPoster Writing PDFShivanshu SiyanwalPas encore d'évaluation

- Jodi B Katzman - Additional ProjectsDocument2 pagesJodi B Katzman - Additional ProjectsjOdl3sBka7z100% (1)

- Complaint For Nullification of Deed of Donation and Reconveyance of A Parcel of Land FBDocument13 pagesComplaint For Nullification of Deed of Donation and Reconveyance of A Parcel of Land FBFidelis AijouPas encore d'évaluation

- The Prospector: From The President's Desk: Continuing A Great TraditionDocument10 pagesThe Prospector: From The President's Desk: Continuing A Great TraditionaprametrodcPas encore d'évaluation

- 05 03 17Document26 pages05 03 17Woods0% (1)

- Deed of Donation Format Church - BiayonDocument2 pagesDeed of Donation Format Church - BiayonEarl Russell S Paulican100% (1)

- Doctrine of Cy-Pres FAMILY LAWDocument18 pagesDoctrine of Cy-Pres FAMILY LAWbhaskarbanerji89% (19)

- 2008 Craigslist Foundation NY Tri-State Nonprofit Boot Camp Program (Small)Document88 pages2008 Craigslist Foundation NY Tri-State Nonprofit Boot Camp Program (Small)Craigslist Foundation100% (5)

- #MADBall15 Auction BookletDocument15 pages#MADBall15 Auction BookletMonique GeorgePas encore d'évaluation

- Art Horse InviteDocument2 pagesArt Horse InviteWayne TindallPas encore d'évaluation

- NZ Freemason 1-2013 Final 100dpi For Web 8 Mar PDFDocument52 pagesNZ Freemason 1-2013 Final 100dpi For Web 8 Mar PDFagenzia massonica internazionalePas encore d'évaluation

- Purpose of A Business LetterDocument33 pagesPurpose of A Business LetterAnif Chairun SiddiqPas encore d'évaluation

- Internal Audit of Educational Institutes PDFDocument181 pagesInternal Audit of Educational Institutes PDFVijay Roy100% (1)

- Book Ornamental Alphabets,: With NumeralsDocument28 pagesBook Ornamental Alphabets,: With NumeralsGutenberg.org100% (1)

- Price Is What You Pay, Value Is What You GetDocument11 pagesPrice Is What You Pay, Value Is What You GetBuntyPas encore d'évaluation

- Resume Lisa DavisDocument3 pagesResume Lisa Davisapi-373273350Pas encore d'évaluation

- A Dogs Purpose Complete Study GuideDocument47 pagesA Dogs Purpose Complete Study GuideAlexandra Stăncescu0% (3)

- Inspiring Leader CNN Hero Anuradha KoiralaDocument2 pagesInspiring Leader CNN Hero Anuradha Koiralaaliza puriPas encore d'évaluation