Académique Documents

Professionnel Documents

Culture Documents

United States Court of Appeals Second Circuit.: Nos. 202, 203, 204, Dockets 23332, 23333, 23334

Transféré par

Scribd Government DocsDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States Court of Appeals Second Circuit.: Nos. 202, 203, 204, Dockets 23332, 23333, 23334

Transféré par

Scribd Government DocsDroits d'auteur :

Formats disponibles

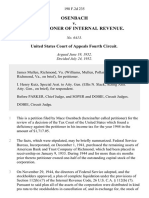

221 F.

2d 252

55-1 USTC P 9335

Ernest F. BECHER, Petitioner on Review,

v.

COMMISSIONER OF INTERNAL REVENUE, Respondent

on Review.

Chester H. KENT, Petitioner on Review,

v.

COMMISSIONER OF INTERNAL REVENUE, Respondent

on Review.

Lois S. DOREMUS, as Executrix of the Will of Howard I.

Doremus, deceased, Petitioner on Review.

v.

COMMISSIONER OF INTERNAL REVENUE, Respondent

on Review.

Nos. 202, 203, 204, Dockets 23332, 23333, 23334.

United States Court of Appeals Second Circuit.

March 16, 1955.

Decided March 31, 1955.

Daniel G. Yorkey, Buffalo, N.Y., for petitioners on review.

H. Brian Holland, Ellis N. Slack, Hilbert P. Zarky and Grant W. Wiprud,

Washington, D.C., for respondent.

Before CLARK, Chief Judge, FRANK, Circuit Judge, and GALSTON,

District judge.

FRANK, Circuit Judge.

Taxpayers appeal from a decision of the Tax Court of the United States, 22

T.C. 932, holding that cash distributions received by them were taxable as

ordinary income, pursuant to I.R.C. 115(g), 26 U.S.C.A. 115(g). Petitioners

had all owned stock in the Sponge-Aire Seat Co., Inc., which had been in the

sponge rubber and canvas-product manufacturing business, particularly active

during the war. After the war, it was decided to enter into the manufacture of

upholstered furniture, and Chandler Industries, Inc., was formed. Sponge-Aire

was left with just enough assets to cover the liabilities it retained; 25.33% of its

assets and 9.1% of its liabilities were transferred to Chandler. All the Chandler

stock was distributed pro rata to the Sponge-Aire stockholders. About the same

time, the Sponge-Aire stockholders received a cash distribution of $500 per

share. It is this distribution which is at issue here. The facts are more fully

stated in the opinion of the Tax Court.

2

The Tax Court found that the organization of Chandler was a reorganization

under Sec. 112(g), 26 U.S.C.A. 112(g), so that, under Sec. 112(b)(3), no tax

was now due on the receipt of the Chandler stock for the Sponge-Aire shares.

Taxpayers argue that this was incorrect under the doctrine of Gregory v.

Helvering, 293 U.S. 465, 55 S.Ct. 266, 79 L.Ed. 596. That case demanded a

business purpose for the reorganization, but the Tax Court here correctly held

that a business purpose does not require an indentity of business before and

after the reorganization. Thus the fact that Chandler products are not the same

as Sponge-Aire products is irrelevant. Nor should it be of importance that a

partial liquidation accompanied the reorganization. There is no such limitation

in the statute and we should not interpolate one.

The next question, then, is whether the cash distributions, admittedly out of

earnings and profits, are taxable as ordinary income under Secs. 112(c)(2) or

115(g), or as capital gains under Sec. 115(c) and Sec. 117,26 U.S.C.A. 117.

The Tax Court held that they were not within Sec. 112(c), since they were not

'in pursuance of' the reorganization, which, so it held, related solely to the

stock, the cash distributions being merely 'incidental to the plan of liquidation'

and constituting a 'separate partial distribution.' But the Tax Court held they

came within Sec. 115(g) because they were 'essentially equivalent to' the

distributions of taxable dividends, and thus taxable as ordinary income.

We think the distributed cash is covered by Sec. 112(c)(2): It resulted directly

from, and as a very part of, and was therefore, we think, clearly in 'pursuance

of,' the reorganization. To break up the transaction into distinct steps, as the

Tax Court did, is, we think, to artificialize what actually occurred.

Affirmed.

Vous aimerez peut-être aussi

- Petition for Certiorari Denied Without Opinion: Patent Case 98-1151D'EverandPetition for Certiorari Denied Without Opinion: Patent Case 98-1151Pas encore d'évaluation

- Mills Estate, Inc. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Mills Estate, Inc, 206 F.2d 244, 2d Cir. (1953)Document4 pagesMills Estate, Inc. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Mills Estate, Inc, 206 F.2d 244, 2d Cir. (1953)Scribd Government DocsPas encore d'évaluation

- Television Industries, Inc. v. Commissioner of Internal Revenue, 284 F.2d 322, 2d Cir. (1960)Document5 pagesTelevision Industries, Inc. v. Commissioner of Internal Revenue, 284 F.2d 322, 2d Cir. (1960)Scribd Government DocsPas encore d'évaluation

- General Stores Corporation, Debtor-Appellant v. Max Shlensky and Securities and Exchange Commission, 222 F.2d 234, 2d Cir. (1955)Document6 pagesGeneral Stores Corporation, Debtor-Appellant v. Max Shlensky and Securities and Exchange Commission, 222 F.2d 234, 2d Cir. (1955)Scribd Government DocsPas encore d'évaluation

- Osenbach v. Commissioner of Internal Revenue, 198 F.2d 235, 4th Cir. (1952)Document5 pagesOsenbach v. Commissioner of Internal Revenue, 198 F.2d 235, 4th Cir. (1952)Scribd Government DocsPas encore d'évaluation

- David Wise v. Commissioner of Internal Revenue, 311 F.2d 743, 2d Cir. (1963)Document2 pagesDavid Wise v. Commissioner of Internal Revenue, 311 F.2d 743, 2d Cir. (1963)Scribd Government DocsPas encore d'évaluation

- Rosamond Underwood Smith Wilson, Thomas W. Smith and Frank Stapleton, As Executors of The Estate of Cothran P. Smith v. United States, 257 F.2d 534, 2d Cir. (1958)Document6 pagesRosamond Underwood Smith Wilson, Thomas W. Smith and Frank Stapleton, As Executors of The Estate of Cothran P. Smith v. United States, 257 F.2d 534, 2d Cir. (1958)Scribd Government DocsPas encore d'évaluation

- Helvering v. Southwest Consolidated Corp., 315 U.S. 194 (1942)Document6 pagesHelvering v. Southwest Consolidated Corp., 315 U.S. 194 (1942)Scribd Government DocsPas encore d'évaluation

- Arrowsmith v. Commissioner, 344 U.S. 6 (1952)Document5 pagesArrowsmith v. Commissioner, 344 U.S. 6 (1952)Scribd Government DocsPas encore d'évaluation

- United States v. Walker, 234 F.3d 780, 1st Cir. (2000)Document14 pagesUnited States v. Walker, 234 F.3d 780, 1st Cir. (2000)Scribd Government DocsPas encore d'évaluation

- Bondholders Committee v. Commissioner, 315 U.S. 189 (1942)Document4 pagesBondholders Committee v. Commissioner, 315 U.S. 189 (1942)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals Second Circuit.: No. 374, Docket 23920Document4 pagesUnited States Court of Appeals Second Circuit.: No. 374, Docket 23920Scribd Government DocsPas encore d'évaluation

- City Bank Farmers Trust Co. v. Helvering, 313 U.S. 121 (1941)Document3 pagesCity Bank Farmers Trust Co. v. Helvering, 313 U.S. 121 (1941)Scribd Government DocsPas encore d'évaluation

- Helvering v. Alabama Asphaltic Limestone Co., 315 U.S. 179 (1942)Document4 pagesHelvering v. Alabama Asphaltic Limestone Co., 315 U.S. 179 (1942)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. Oxford Paper Co, 194 F.2d 190, 2d Cir. (1952)Document3 pagesCommissioner of Internal Revenue v. Oxford Paper Co, 194 F.2d 190, 2d Cir. (1952)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Document4 pagesCommissioner of Internal Revenue v. Adam, Meldrum & Anderson Co., Inc, 215 F.2d 163, 2d Cir. (1954)Scribd Government DocsPas encore d'évaluation

- McClain v. Commissioner, 311 U.S. 527 (1941)Document3 pagesMcClain v. Commissioner, 311 U.S. 527 (1941)Scribd Government DocsPas encore d'évaluation

- Manufacturers Hanover Trust Co., Robert P. Payne and Charles C. Parlin, As Trustees U/i 6/4/32 by Anne D. Dillon, As Grantor v. Commissioner of Internal Revenue, 431 F.2d 664, 2d Cir. (1970)Document6 pagesManufacturers Hanover Trust Co., Robert P. Payne and Charles C. Parlin, As Trustees U/i 6/4/32 by Anne D. Dillon, As Grantor v. Commissioner of Internal Revenue, 431 F.2d 664, 2d Cir. (1970)Scribd Government DocsPas encore d'évaluation

- Bard-Parker Company, Inc. v. Commissioner of Internal Revenue, 218 F.2d 52, 2d Cir. (1955)Document8 pagesBard-Parker Company, Inc. v. Commissioner of Internal Revenue, 218 F.2d 52, 2d Cir. (1955)Scribd Government DocsPas encore d'évaluation

- Milliken v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Milliken, 196 F.2d 135, 2d Cir. (1952)Document7 pagesMilliken v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Milliken, 196 F.2d 135, 2d Cir. (1952)Scribd Government DocsPas encore d'évaluation

- John S. Lucas Et Ux. v. Commissioner of Internal Revenue, 388 F.2d 472, 1st Cir. (1967)Document6 pagesJohn S. Lucas Et Ux. v. Commissioner of Internal Revenue, 388 F.2d 472, 1st Cir. (1967)Scribd Government DocsPas encore d'évaluation

- Helvering v. Cement Investors, Inc., 316 U.S. 527 (1942)Document6 pagesHelvering v. Cement Investors, Inc., 316 U.S. 527 (1942)Scribd Government DocsPas encore d'évaluation

- Helvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Document7 pagesHelvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Scribd Government DocsPas encore d'évaluation

- Central Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Document6 pagesCentral Cuba Sugar Co. v. Commissioner of Internal Revenue. Commissioner of Internal Revenue v. Central Cuba Sugar Co, 198 F.2d 214, 2d Cir. (1952)Scribd Government DocsPas encore d'évaluation

- Kann v. Commissioner of Internal Revenue. Kann's Estate v. Commissioner of Internal Revenue, 210 F.2d 247, 3rd Cir. (1954)Document13 pagesKann v. Commissioner of Internal Revenue. Kann's Estate v. Commissioner of Internal Revenue, 210 F.2d 247, 3rd Cir. (1954)Scribd Government DocsPas encore d'évaluation

- Charles Francisco Cecilia Francisco v. United States, 267 F.3d 303, 3rd Cir. (2001)Document27 pagesCharles Francisco Cecilia Francisco v. United States, 267 F.3d 303, 3rd Cir. (2001)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument6 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Ovider Realty Co. v. Commissioner of Internal Revenue, 193 F.2d 266, 4th Cir. (1951)Document4 pagesOvider Realty Co. v. Commissioner of Internal Revenue, 193 F.2d 266, 4th Cir. (1951)Scribd Government DocsPas encore d'évaluation

- Briggs v. United States. Clark v. United States, 214 F.2d 699, 4th Cir. (1954)Document5 pagesBriggs v. United States. Clark v. United States, 214 F.2d 699, 4th Cir. (1954)Scribd Government DocsPas encore d'évaluation

- Kinkel v. McGowan Collector of Internal Revenue, 188 F.2d 734, 2d Cir. (1951)Document5 pagesKinkel v. McGowan Collector of Internal Revenue, 188 F.2d 734, 2d Cir. (1951)Scribd Government DocsPas encore d'évaluation

- Norman E. Albers, Executors, Estate of Joseph Miele v. Commissioner of Internal Revenue, 414 U.S. 982 (1973)Document6 pagesNorman E. Albers, Executors, Estate of Joseph Miele v. Commissioner of Internal Revenue, 414 U.S. 982 (1973)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Fifth CircuitDocument10 pagesUnited States Court of Appeals, Fifth CircuitScribd Government DocsPas encore d'évaluation

- Robert Newbill v. United States, 4th Cir. (2011)Document14 pagesRobert Newbill v. United States, 4th Cir. (2011)Scribd Government DocsPas encore d'évaluation

- In Re Challenge Air International, Inc., Debtor. United States of America v. Challenge Air Int'l Inc., American Express Bank International, 952 F.2d 384, 11th Cir. (1992)Document7 pagesIn Re Challenge Air International, Inc., Debtor. United States of America v. Challenge Air Int'l Inc., American Express Bank International, 952 F.2d 384, 11th Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Lykes v. United States, 343 U.S. 118 (1952)Document9 pagesLykes v. United States, 343 U.S. 118 (1952)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. Adelaide D. J. Burgwin, 277 F.2d 395, 3rd Cir. (1960)Document3 pagesCommissioner of Internal Revenue v. Adelaide D. J. Burgwin, 277 F.2d 395, 3rd Cir. (1960)Scribd Government DocsPas encore d'évaluation

- Jordan Marsh Company v. Commissioner of Internal Revenue, 269 F.2d 453, 2d Cir. (1959)Document8 pagesJordan Marsh Company v. Commissioner of Internal Revenue, 269 F.2d 453, 2d Cir. (1959)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Fourth CircuitDocument9 pagesUnited States Court of Appeals, Fourth CircuitScribd Government DocsPas encore d'évaluation

- Spear Box Co., Inc. v. Commissioner of Internal Revenue, 182 F.2d 844, 2d Cir. (1950)Document4 pagesSpear Box Co., Inc. v. Commissioner of Internal Revenue, 182 F.2d 844, 2d Cir. (1950)Scribd Government DocsPas encore d'évaluation

- Morco Corporation, Successor To Oceanic Investing Corporation v. Commissioner of Internal Revenue, 300 F.2d 245, 2d Cir. (1962)Document3 pagesMorco Corporation, Successor To Oceanic Investing Corporation v. Commissioner of Internal Revenue, 300 F.2d 245, 2d Cir. (1962)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. Valentine E. MacY JR., Commissioner of Internal Revenue v. J. Noel MacY and Elena Kohler MacY, 215 F.2d 875, 2d Cir. (1954)Document6 pagesCommissioner of Internal Revenue v. Valentine E. MacY JR., Commissioner of Internal Revenue v. J. Noel MacY and Elena Kohler MacY, 215 F.2d 875, 2d Cir. (1954)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. The Bagley & Sewall Co., 221 F.2d 944, 2d Cir. (1955)Document9 pagesCommissioner of Internal Revenue v. The Bagley & Sewall Co., 221 F.2d 944, 2d Cir. (1955)Scribd Government DocsPas encore d'évaluation

- Waterman's Estate v. Commissioner of Internal Revenue, 195 F.2d 244, 2d Cir. (1952)Document5 pagesWaterman's Estate v. Commissioner of Internal Revenue, 195 F.2d 244, 2d Cir. (1952)Scribd Government DocsPas encore d'évaluation

- Clark v. Commissioner of Internal Revenue, 205 F.2d 353, 2d Cir. (1953)Document2 pagesClark v. Commissioner of Internal Revenue, 205 F.2d 353, 2d Cir. (1953)Scribd Government DocsPas encore d'évaluation

- United States v. Daniel K. Kaye, 23 F.3d 50, 2d Cir. (1994)Document7 pagesUnited States v. Daniel K. Kaye, 23 F.3d 50, 2d Cir. (1994)Scribd Government DocsPas encore d'évaluation

- Commissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncDocument8 pagesCommissioner of Internal Revenue v. Glenshaw Glass Co. Commissioner of Internal Revenue v. William Goldman Theatres, IncScribd Government DocsPas encore d'évaluation

- Burnet v. Commonwealth Improvement Co., 287 U.S. 415 (1932)Document4 pagesBurnet v. Commonwealth Improvement Co., 287 U.S. 415 (1932)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument5 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Joseph B. and Josephine L. Simon v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Joseph B. and Josephine L. Simon, 285 F.2d 422, 3rd Cir. (1961)Document6 pagesJoseph B. and Josephine L. Simon v. Commissioner of Internal Revenue, Commissioner of Internal Revenue v. Joseph B. and Josephine L. Simon, 285 F.2d 422, 3rd Cir. (1961)Scribd Government DocsPas encore d'évaluation

- Commissioner v. PG Lake, Inc., 356 U.S. 260 (1958)Document7 pagesCommissioner v. PG Lake, Inc., 356 U.S. 260 (1958)Scribd Government DocsPas encore d'évaluation

- Louis Freeman, Trustee in Bankruptcy of Brokol Manufacturing Company v. Joseph F. J. Mayer, District Director of Internal Revenue For The District of New Jersey, 253 F.2d 295, 3rd Cir. (1958)Document4 pagesLouis Freeman, Trustee in Bankruptcy of Brokol Manufacturing Company v. Joseph F. J. Mayer, District Director of Internal Revenue For The District of New Jersey, 253 F.2d 295, 3rd Cir. (1958)Scribd Government DocsPas encore d'évaluation

- Mary O'Hara Alsop v. Commissioner of Internal Revenue, 290 F.2d 726, 2d Cir. (1961)Document5 pagesMary O'Hara Alsop v. Commissioner of Internal Revenue, 290 F.2d 726, 2d Cir. (1961)Scribd Government DocsPas encore d'évaluation

- Guerin v. Weil, Gotshal & Manges, 205 F.2d 302, 2d Cir. (1953)Document4 pagesGuerin v. Weil, Gotshal & Manges, 205 F.2d 302, 2d Cir. (1953)Scribd Government DocsPas encore d'évaluation

- Blau v. Mission Corp., 212 F.2d 77, 2d Cir. (1954)Document6 pagesBlau v. Mission Corp., 212 F.2d 77, 2d Cir. (1954)Scribd Government DocsPas encore d'évaluation

- Commissioner v. Gillette Motor Transport, Inc., 364 U.S. 130 (1960)Document5 pagesCommissioner v. Gillette Motor Transport, Inc., 364 U.S. 130 (1960)Scribd Government DocsPas encore d'évaluation

- CC&F Western Operati v. IRS, 273 F.3d 402, 1st Cir. (2001)Document9 pagesCC&F Western Operati v. IRS, 273 F.3d 402, 1st Cir. (2001)Scribd Government DocsPas encore d'évaluation

- In Re International Match Corp. Ehrhorn v. International Match Realization Co., Limited, 190 F.2d 458, 2d Cir. (1951)Document21 pagesIn Re International Match Corp. Ehrhorn v. International Match Realization Co., Limited, 190 F.2d 458, 2d Cir. (1951)Scribd Government DocsPas encore d'évaluation

- Waynesboro Knitting Company v. Commissioner of Internal Revenue, 225 F.2d 477, 3rd Cir. (1955)Document6 pagesWaynesboro Knitting Company v. Commissioner of Internal Revenue, 225 F.2d 477, 3rd Cir. (1955)Scribd Government DocsPas encore d'évaluation

- Flora v. United States, 362 U.S. 145 (1960)Document42 pagesFlora v. United States, 362 U.S. 145 (1960)Scribd Government DocsPas encore d'évaluation

- John A. Nelson Co. v. Helvering, 296 U.S. 374 (1935)Document3 pagesJohn A. Nelson Co. v. Helvering, 296 U.S. 374 (1935)Scribd Government DocsPas encore d'évaluation

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Dissertation Report On Issue and Success Factors in Micro FinancingDocument73 pagesDissertation Report On Issue and Success Factors in Micro FinancingArchit KhandelwalPas encore d'évaluation

- Libta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingDocument21 pagesLibta - Technical Analysis Library - Free Books & Trading Courses On Cryptos, Forex and InvestingAlexandru BogdanPas encore d'évaluation

- Grid Tie Inverter MarketDocument8 pagesGrid Tie Inverter MarketSubhrasankha BhattacharjeePas encore d'évaluation

- How Does The Sample Size Affect GARCH Model?: H.S. NG and K.P. LamDocument4 pagesHow Does The Sample Size Affect GARCH Model?: H.S. NG and K.P. LamSurendra Pal SinghPas encore d'évaluation

- Multination Finance Butler 5th EditionDocument3 pagesMultination Finance Butler 5th EditionUnostudent2014Pas encore d'évaluation

- International Banking & Foreign Exchange ManagementDocument12 pagesInternational Banking & Foreign Exchange ManagementrumiPas encore d'évaluation

- Process of Procuring RTA Clearance by Motorela DriversDocument2 pagesProcess of Procuring RTA Clearance by Motorela DriversJas Em BejPas encore d'évaluation

- Sunanda Jha & Dinabandhu BagDocument4 pagesSunanda Jha & Dinabandhu Bagdinabandhu_bagPas encore d'évaluation

- Procedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarDocument57 pagesProcedure On Financing of Two-Wheeler Loan at Centurian Bank by Sneha SalgaonkarAarti Kulkarni0% (2)

- Confirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Document3 pagesConfirmatory Order Against Mohit Aggarwal in The Matter of Radford Global Ltd.Shyam SunderPas encore d'évaluation

- The Price Revolution of The Sixteenth Century - BarkanDocument27 pagesThe Price Revolution of The Sixteenth Century - BarkanhalobinPas encore d'évaluation

- 2017 18 - S1 24894 15 Andreia - BichoDocument33 pages2017 18 - S1 24894 15 Andreia - BichotalithatiffPas encore d'évaluation

- Project Lotus - Certificate On Key Financial and Operational Parameters - August 22, 2021Document4 pagesProject Lotus - Certificate On Key Financial and Operational Parameters - August 22, 2021Utkarsh bajajPas encore d'évaluation

- Go.22 Da Arrears of CPS Account in CashDocument4 pagesGo.22 Da Arrears of CPS Account in CashVenkatadurgaprasad GopamPas encore d'évaluation

- 2009 Taxation Law ReviewerDocument203 pages2009 Taxation Law ReviewerDoctorGreyPas encore d'évaluation

- Formulas PDFDocument1 pageFormulas PDFsugandhaPas encore d'évaluation

- Factors Affecting Land ValueDocument3 pagesFactors Affecting Land ValueBGSSAP 2017100% (1)

- Ifrs 13 Fair Value Measurement: Guidance OnDocument4 pagesIfrs 13 Fair Value Measurement: Guidance Onmusic niPas encore d'évaluation

- International Trade and Finance GuidanceMultipleChoiceQuestionsDocument12 pagesInternational Trade and Finance GuidanceMultipleChoiceQuestionsBhagyashree DevPas encore d'évaluation

- Eclectica FundDocument5 pagesEclectica FundZerohedge100% (9)

- Financial DerivativeDocument2 pagesFinancial DerivativearmailgmPas encore d'évaluation

- B170219B BBFN3323 InternationalfinanceDocument23 pagesB170219B BBFN3323 InternationalfinanceLIM JEI XEE BACC18B-1Pas encore d'évaluation

- DBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018Document10 pagesDBM Dof Dilg Joint Memorandum Circular No 2018 1 Dated July 12 2018barangay08 can-avidesamarPas encore d'évaluation

- NDPLDocument84 pagesNDPLsiddhoo2000100% (1)

- Capital Structure: Basic ConceptsDocument25 pagesCapital Structure: Basic ConceptsThuyDuongPas encore d'évaluation

- RM PrelimDocument14 pagesRM PrelimJazper InocPas encore d'évaluation

- VP Director Strategic Marketing in New York City Resume Valerie ObenDocument2 pagesVP Director Strategic Marketing in New York City Resume Valerie ObenValerieObenPas encore d'évaluation

- Advocacy Strategy ManualDocument53 pagesAdvocacy Strategy ManualINFID JAKARTA100% (1)

- Business Profile Love Hate CafeDocument21 pagesBusiness Profile Love Hate CafeAtiqah Syairah Mohd Zain100% (1)

- 02 (Michael Hudson Cornelia Wunsch (Eds) ) CreatingDocument181 pages02 (Michael Hudson Cornelia Wunsch (Eds) ) CreatingGuilherme UchimuraPas encore d'évaluation

- The 7 Habits of Highly Effective People: The Infographics EditionD'EverandThe 7 Habits of Highly Effective People: The Infographics EditionÉvaluation : 4 sur 5 étoiles4/5 (2475)

- ADHD is Awesome: A Guide to (Mostly) Thriving with ADHDD'EverandADHD is Awesome: A Guide to (Mostly) Thriving with ADHDÉvaluation : 5 sur 5 étoiles5/5 (3)

- LIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionD'EverandLIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionÉvaluation : 4 sur 5 étoiles4/5 (404)

- The Stoic Mindset: Living the Ten Principles of StoicismD'EverandThe Stoic Mindset: Living the Ten Principles of StoicismÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- Power Moves: Ignite Your Confidence and Become a ForceD'EverandPower Moves: Ignite Your Confidence and Become a ForceÉvaluation : 5 sur 5 étoiles5/5 (1)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedÉvaluation : 4.5 sur 5 étoiles4.5/5 (82)

- Love Life: How to Raise Your Standards, Find Your Person, and Live Happily (No Matter What)D'EverandLove Life: How to Raise Your Standards, Find Your Person, and Live Happily (No Matter What)Évaluation : 3 sur 5 étoiles3/5 (1)

- The Bridesmaid: The addictive psychological thriller that everyone is talking aboutD'EverandThe Bridesmaid: The addictive psychological thriller that everyone is talking aboutÉvaluation : 4 sur 5 étoiles4/5 (132)

- The Age of Magical Overthinking: Notes on Modern IrrationalityD'EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityÉvaluation : 4 sur 5 étoiles4/5 (32)

- Summary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearD'EverandSummary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearÉvaluation : 4.5 sur 5 étoiles4.5/5 (560)

- By the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsD'EverandBy the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsPas encore d'évaluation

- The Mountain is You: Transforming Self-Sabotage Into Self-MasteryD'EverandThe Mountain is You: Transforming Self-Sabotage Into Self-MasteryÉvaluation : 4.5 sur 5 étoiles4.5/5 (883)

- Master Your Emotions: Develop Emotional Intelligence and Discover the Essential Rules of When and How to Control Your FeelingsD'EverandMaster Your Emotions: Develop Emotional Intelligence and Discover the Essential Rules of When and How to Control Your FeelingsÉvaluation : 4.5 sur 5 étoiles4.5/5 (322)

- Maktub: An Inspirational Companion to The AlchemistD'EverandMaktub: An Inspirational Companion to The AlchemistÉvaluation : 5 sur 5 étoiles5/5 (4)

- The Power of Now: A Guide to Spiritual EnlightenmentD'EverandThe Power of Now: A Guide to Spiritual EnlightenmentÉvaluation : 4.5 sur 5 étoiles4.5/5 (4125)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelD'EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelÉvaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Breaking the Habit of Being YourselfD'EverandBreaking the Habit of Being YourselfÉvaluation : 4.5 sur 5 étoiles4.5/5 (1460)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesD'EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesÉvaluation : 5 sur 5 étoiles5/5 (1636)

- Habits for a Sacred Home: 9 Practices from History to Anchor and Restore Modern FamiliesD'EverandHabits for a Sacred Home: 9 Practices from History to Anchor and Restore Modern FamiliesPas encore d'évaluation

- The Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsD'EverandThe Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Discovering Daniel: Finding Our Hope in God’s Prophetic Plan Amid Global ChaosD'EverandDiscovering Daniel: Finding Our Hope in God’s Prophetic Plan Amid Global ChaosÉvaluation : 5 sur 5 étoiles5/5 (1)

- Summary of Dan Martell's Buy Back Your TimeD'EverandSummary of Dan Martell's Buy Back Your TimeÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessD'EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessÉvaluation : 5 sur 5 étoiles5/5 (456)