Académique Documents

Professionnel Documents

Culture Documents

Capital Structure

Transféré par

Sivaraman P. S.Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Capital Structure

Transféré par

Sivaraman P. S.Droits d'auteur :

Formats disponibles

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 1 -

Capital Structure Decisions

- Relevant textbook pages

- none

- Relevant eoc-problems

- none

- Other relevant material

- None

- Assignments

- None

- Other information

- None

Corporate Finance

MBA 8135

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 2 -

Corporate Finance

MBA 8135

Fundamentals of Capital Structure Theory

The Capital Structure Decision

- Firms regularly raise capital to invest in assets

- Each time there is a choice between debt and equity, and this

choice is influenced among other things - by the firms

dividend policy

there is no general overall optimal capital structure

Target Capital Structure

- Using more debt raises the risk borne by stockholders (which

usually lowers the stock price)

- but usually also leads to a higher ROE (which usually raises

the stock price)

- Therefore: The optimal capital structure is based on a balance

between risk and return, so that the stock price of the firm is

being maximized

Actual capital structure can vary from the target

capital structure and is mainly influenced by

- Business risk (riskiness of the unleveraged firms operations

(i.e. if it used no debt)

Tax situation level of the effective tax rate

Financial flexibility (ability to raise capital)

Managerial attitude towards risk

Growth opportunities vs. assets-in-place

etc.

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 3 -

Corporate Finance

MBA 8135

Business Risk and Financial Risk

Business Risk

- Riskiness of the firms stock if it uses no debt

- Inherent in firms operations

- Business risk of a leverage-free (i.e. debt-free) firm can be

measured by the standard deviation of its ROIC (return on

invested capital, for a debt-free company comparable to ROE)

Business Risk mainly depends on

- Variability of demand, sales prices, input costs

- Market power, i.e. ability to adjust output prices

- Ability to develop new products

- Exposure to foreign risk (exchange rate risk, interest rate risk,

political risk, etc.)

- Operating Leverage (extent to which costs are fixed):

If a high percentage of a firms total costs are fixed

high degree of operating leverage

a relatively small change in revenues results in a large

change in earnings and ROE

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 4 -

Corporate Finance

MBA 8135

Financial Risk

- Additional risk placed on the common stockholders as a result of

debt financing, usually measured by the standard deviation of its

levered RoE minus the standard deviation of its unlevered RoE

Financial Leverage usually leverages up the expected

ROE, but also increases the standard deviation (i.e. also

increases the risk) of the levered RoE

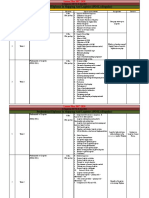

Example:

- Assets = $175,000; EBIT = $35,000; Interest rate = 10%;

- Taxes = 40%, standard deviation of ROE = 8%.

- The company changes the capital structure from 100% equity-financing

to 50% equity and 50% debt.

- Effects on ROE, business risk, financial risk? Tax shield?

Before (100% Equity)

After (50% equity/50% debt)

Exp.

Exp.

35,000

35,000

8,750

EBT

35,000

26,250

Tax

14,000

10,500

NI

21,000

15,750

EBIT

Interest

RoE

Total expected

return to investors

The use of debt shields a portion of a companys earnings from the tax collector

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 5 -

Corporate Finance

MBA 8135

Estimating the Optimal Capital Structure

General Aspects

- The optimal capital structure is the one that maximizes the

price of the firms stock

- Higher debt levels usually raise expected earnings per share,

but also increase the firms risk

WACC and Capital Structure

- Corporate valuation model:

Value of a firm = PV of future free cash flows, discounted at the

WACC:

(FreeCashFlows )t

(1 + WACC )t

t =1

Value =

- The maximum value occurs with the capital structure that

minimizes the WACC

Hamada Equation

- Increase in debt ratio also increases the risk faced by

shareholders, which can be measured with Beta

- Hamada Equation shows the effect of financial leverage on

Beta:

D

Betalevered = Bunlevered 1 + (1 t )

E

Betaunlevered = Betalevered

1

D

1 + (1 t )

E

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 6 -

Corporate Finance

MBA 8135

Example (1)

D/E

k(d)

0.25

0.67

10

1.5

12

15

k(d) a/tax

Beta*

1.2

* Using the Hamada equation

** k(s) = 5 + Beta*6

*** WACC= (D/(D+E)) * k(d) a/tax + (E/(D+E)) * k(s)

k(s)**

WACC***

GSU, Department of Finance, AFM

Spring 2009

Example (2):

- Capital Structure / page 7 -

Corporate Finance

MBA 8135

GSU, Department of Finance, AFM

Spring 2009

- Capital Structure / page 8 -

Corporate Finance

MBA 8135

Capital Structure Theory

Trade-off theory

- Debt is useful because interest is tax-deductible

- Debt brings costs associated with actual or potential

bankruptcy

- The optimal capital structure strikes a balance between the tax

benefits of debt and the costs associated with bankruptcy

Signaling theory

- A firms decision to use debt or stock to raise new capital gives

a signal to investors

- A stock issue according to this theory sets off a negative

signal, using debt is perceived as a positive (or neutral) signal

- Therefore companies are reluctant to issue new stock by

maintaining a reserve borrowing capacity, which means that in

normal times less debt is used than the trade-off theory would

suggest

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- PDSL Fundamentals of Logistics Lesson PlanDocument12 pagesPDSL Fundamentals of Logistics Lesson PlanSivaraman P. S.Pas encore d'évaluation

- Pet Bottles Flakes - RoughDocument19 pagesPet Bottles Flakes - RoughSivaraman P. S.100% (1)

- Building A Learning OrganizationDocument13 pagesBuilding A Learning OrganizationAshashwatmePas encore d'évaluation

- Contents PDFDocument4 pagesContents PDFSivaraman P. S.Pas encore d'évaluation

- Jones5e Chap07studDocument54 pagesJones5e Chap07studSivaraman P. S.Pas encore d'évaluation

- Logistics and Supply Chain Management - OriginalDocument76 pagesLogistics and Supply Chain Management - OriginalSivaraman P. S.Pas encore d'évaluation

- Peter Senge's Five Disciplines of a Learning OrganizationDocument20 pagesPeter Senge's Five Disciplines of a Learning Organizationrambo7799Pas encore d'évaluation

- Session 19 Fall 2008Document24 pagesSession 19 Fall 2008Sivaraman P. S.Pas encore d'évaluation

- Learning Organizations Concepts and ExamplesDocument20 pagesLearning Organizations Concepts and ExamplesSivaraman P. S.Pas encore d'évaluation

- Learning OrganizationDocument15 pagesLearning OrganizationSivaraman P. S.Pas encore d'évaluation

- QP - ModelDocument4 pagesQP - ModelSivaraman P. S.Pas encore d'évaluation

- Learning Organisations: A Quantitative Assessment at the European LevelDocument17 pagesLearning Organisations: A Quantitative Assessment at the European LevelSivaraman P. S.Pas encore d'évaluation

- The Impact of Culture On An OrganizationDocument4 pagesThe Impact of Culture On An OrganizationSivaraman P. S.Pas encore d'évaluation

- International BusinessDocument50 pagesInternational BusinessAishvarya RajendranPas encore d'évaluation

- So G Credit Risk ManagementDocument3 pagesSo G Credit Risk ManagementSivaraman P. S.Pas encore d'évaluation

- Building World Class CompetenceDocument37 pagesBuilding World Class CompetenceSivaraman P. S.Pas encore d'évaluation

- Marico IndustriesDocument6 pagesMarico Industrieslucky_rishikPas encore d'évaluation

- Detailed Notes - Mind MapsDocument31 pagesDetailed Notes - Mind MapsSivaraman P. S.100% (1)

- India Norway JWG 31 May 2013Document22 pagesIndia Norway JWG 31 May 2013Sivaraman P. S.Pas encore d'évaluation

- Presentation On Port Sector Issues Challenges by Mr. Arvind Kr. Sr. Adv. TR Mort HDocument43 pagesPresentation On Port Sector Issues Challenges by Mr. Arvind Kr. Sr. Adv. TR Mort HSivaraman P. S.Pas encore d'évaluation

- CSIS Education PresentationDocument17 pagesCSIS Education Presentationsandeepsingh_1108Pas encore d'évaluation

- Shipping in Logistics and SupplychainDocument12 pagesShipping in Logistics and SupplychainSivaraman P. S.Pas encore d'évaluation

- 02 MaritimeLaw PDFDocument18 pages02 MaritimeLaw PDFSivaraman P. S.Pas encore d'évaluation

- Dress For Success: A Guide For Women Entering The WorkplaceDocument20 pagesDress For Success: A Guide For Women Entering The Workplacesmelissah1Pas encore d'évaluation

- Overview of Containers: Standard Template Language (STL) Organizes Its Classes Into 3 CategoriesDocument34 pagesOverview of Containers: Standard Template Language (STL) Organizes Its Classes Into 3 CategoriesSivaraman P. S.Pas encore d'évaluation

- Indian Maritime Doctrine 2009 UpdatedDocument188 pagesIndian Maritime Doctrine 2009 Updatedankitpanda0% (1)

- Overview of Containers: Standard Template Language (STL) Organizes Its Classes Into 3 CategoriesDocument34 pagesOverview of Containers: Standard Template Language (STL) Organizes Its Classes Into 3 CategoriesSivaraman P. S.Pas encore d'évaluation

- Greetings TO Delegates at The Launch Meeting On Mekong Project HanoiDocument30 pagesGreetings TO Delegates at The Launch Meeting On Mekong Project HanoiSivaraman P. S.Pas encore d'évaluation

- International Maritime LAWDocument36 pagesInternational Maritime LAWSivaraman P. S.Pas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Retained Earnings1Document11 pagesRetained Earnings1Rowena RogadoPas encore d'évaluation

- Ratios and financial analysisDocument6 pagesRatios and financial analysismail2ncPas encore d'évaluation

- Risk and Return Analysis of Nepalese Bank StocksDocument115 pagesRisk and Return Analysis of Nepalese Bank Stockssaroj maharjanPas encore d'évaluation

- Risk & Return and The Cost of Capital Class Exercise PDFDocument2 pagesRisk & Return and The Cost of Capital Class Exercise PDFCarissa KusumaPas encore d'évaluation

- Banking and Insurance PPT Unit-2,3 and 4Document88 pagesBanking and Insurance PPT Unit-2,3 and 4d Vaishnavi OsmaniaUniversityPas encore d'évaluation

- Chapter 3 Answer KeyDocument1 pageChapter 3 Answer KeyStefanie SaphiraPas encore d'évaluation

- Stock Timeframe Avg Roe Avg P/E BPS DPS DPR RIR Franking Price EPS MR RRDocument2 pagesStock Timeframe Avg Roe Avg P/E BPS DPS DPR RIR Franking Price EPS MR RRRational InvestingPas encore d'évaluation

- Module 2 Intermediate Accounting 2Document52 pagesModule 2 Intermediate Accounting 2Andrei GoPas encore d'évaluation

- Tesla Capital Investment AnalysisDocument6 pagesTesla Capital Investment AnalysisKhoa HuỳnhPas encore d'évaluation

- Inventory Valuation and CostingDocument7 pagesInventory Valuation and CostingMelyssa Dawn Gullon0% (1)

- Gann Trend LinesDocument4 pagesGann Trend LinesAravind Tr100% (1)

- Accounting Standards (As) and International Financial Reporting StandardsDocument34 pagesAccounting Standards (As) and International Financial Reporting StandardsSD gamingPas encore d'évaluation

- Strategic Financial Management - Investment Appraisal - Tax and Inflation - Dayana MasturaDocument19 pagesStrategic Financial Management - Investment Appraisal - Tax and Inflation - Dayana MasturaDayana MasturaPas encore d'évaluation

- Assignment 1571227167 SmsDocument20 pagesAssignment 1571227167 SmsRawlot BhatiPas encore d'évaluation

- CLIX2Document2 pagesCLIX2Digi CreditPas encore d'évaluation

- Corporate Income TaxDocument14 pagesCorporate Income Tax36. Lê Minh Phương 12A3Pas encore d'évaluation

- Guslits Grunwald CaseDocument2 pagesGuslits Grunwald CaseArmin Joel Dimalibot100% (1)

- Ready Products Inc Operates Two Divisions Each With Its OwnDocument2 pagesReady Products Inc Operates Two Divisions Each With Its OwnAmit PandeyPas encore d'évaluation

- LCM Summer Training Project Religare Broking HouseDocument31 pagesLCM Summer Training Project Religare Broking HouseManoj Kumar YadavPas encore d'évaluation

- Investor ReportDocument36 pagesInvestor ReportAlexandre CauetPas encore d'évaluation

- ACC-ACF2100 Topic 7 Presentation Question SolutionDocument3 pagesACC-ACF2100 Topic 7 Presentation Question SolutionDanPas encore d'évaluation

- Financial Management September 2010 Marks Plan ICAEWDocument10 pagesFinancial Management September 2010 Marks Plan ICAEWMuhammad Ziaul HaquePas encore d'évaluation

- This Study Resource Was: Operating Segments - TheoriesDocument1 pageThis Study Resource Was: Operating Segments - Theoriesvenice cambryPas encore d'évaluation

- Valuation ALLDocument107 pagesValuation ALLAman jhaPas encore d'évaluation

- Aeecd4ce 1592190070352 PDFDocument2 pagesAeecd4ce 1592190070352 PDFcykenPas encore d'évaluation

- Chapter 13Document43 pagesChapter 13YukiPas encore d'évaluation

- 2020 Expenses: What SUP, Inc. Income Statement For The Year EndedDocument5 pages2020 Expenses: What SUP, Inc. Income Statement For The Year EndedRi BPas encore d'évaluation

- CFAS - Final Exam ADocument11 pagesCFAS - Final Exam AKristine Esplana ToraldePas encore d'évaluation

- Dissolution 1 7Document7 pagesDissolution 1 7ShekarKrishnappaPas encore d'évaluation

- Certain Investments in Debt and Equity SecuritiesDocument101 pagesCertain Investments in Debt and Equity SecuritiesMark Lester M. MagnayePas encore d'évaluation