Académique Documents

Professionnel Documents

Culture Documents

Ona Vs CIR Digest

Transféré par

annamariepagtabunanTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ona Vs CIR Digest

Transféré par

annamariepagtabunanDroits d'auteur :

Formats disponibles

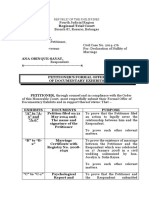

G.R. No.

L-19342 May 25, 1972

LORENZO T. OA and HEIRS OF JULIA BUALES

INTERNAL REVENUE

vs.

THE COMMISSIONER OF

FACTS

Julia Buales died on March 23, 1944, leaving as heirs her surviving spouse, Lorenzo

T. Oa and her five children. A case was filed for the settlement of her estate. Later, Lorenzo

T. Oa the surviving spouse was appointed administrator of the estate. Oa then submitted

the project of partition, which was approved by the Court. The Court appointed Oa to be

guardian of the persons and property of the 3 minor children. No attempt was made to

divide the properties which remained under the management of Oa who used said

properties in business by leasing or selling them and investing the income derived from

them. As a result, petitioners' properties and investments gradually increased. The children

usually comes back to Oa for payment of the taxes.

Respondent CIR decided that the petitioners formed an unregistered partnership and

therefore, subject to the corporate income tax and was assessed. Petitioners protested

against the assessment and asked for reconsideration which was denied. They then filed a

Petition for review of the decision of the Court of Tax Appeals

ISSUE

W/N the petitioners formed an unregistered partnership and thus subject to corporate

taxes.

RULING

Yes. The petitioners formed an unregistered partnership.

The project of partition was approved in 1949 yet, the properties remained under the

management of Oa who used said properties in business by leasing or selling them and

investing the income derived from it which increased the value of the properties.

The corporate tax law states that in cases of inheritance, there should be a period

when the heirs can be considered as co-owners rather than unregistered co-partners.

For tax purposes, the co-ownership of inherited properties is automatically converted

into an unregistered partnership the moment the said common properties and/or the

incomes derived therefrom are used as a common fund with intent to produce profits for the

heirs in proportion to their respective shares in the inheritance as determined in a project

partition either duly executed in an extrajudicial settlement or approved by the court in the

corresponding testate or intestate proceeding.

From the moment of such partition, the heirs are entitled already to their respective

definite shares of the estate and the incomes thereof, for each of them to manage and

dispose of as exclusively his own without the intervention of the other heirs, therefore he

becomes liable individually for all taxes in connection with his share. If after such partition,

he allows his share to be held in common with his co-heirs under a single management to be

used with the intent of making profit, even if no document or instrument were executed for

that purpose, an unregistered partnership is formed.

Vous aimerez peut-être aussi

- Partnership Digest Obillos Vs CIRDocument2 pagesPartnership Digest Obillos Vs CIRJeff Cadiogan Obar100% (9)

- (Digest) Obillos V CIRDocument2 pages(Digest) Obillos V CIRGR100% (3)

- Ona Vs CIR DigestDocument2 pagesOna Vs CIR Digesthmn_scribd100% (2)

- Digest - Evangelista vs. CIRDocument1 pageDigest - Evangelista vs. CIRPaul Vincent Cunanan100% (4)

- #20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsDocument1 page#20 Reyes V. Cir G.R. NO. L-24020-21, July 29, 1968 FactsClaire Derecho100% (1)

- Digest LIM TONG LIM Vs Phil FishingDocument1 pageDigest LIM TONG LIM Vs Phil FishingMalolosFire Bulacan100% (4)

- Pascual VS Cir Case DigestDocument1 pagePascual VS Cir Case DigestSheena Juarez100% (2)

- Mod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestDocument2 pagesMod1 - 4 - G.R. No. 78133 Pascual V CIR - DigestOjie Santillan100% (1)

- Litonjua Jr. v. Litonjua SRDocument3 pagesLitonjua Jr. v. Litonjua SRGia DimayugaPas encore d'évaluation

- Arbes Vs Polistico Case DigestDocument2 pagesArbes Vs Polistico Case DigestKaren Yvette Victoriano67% (3)

- Litton Vs Hill and Ceron (DIGEST)Document2 pagesLitton Vs Hill and Ceron (DIGEST)ckarla80100% (1)

- Philex Mining Corp Vs CIRDocument2 pagesPhilex Mining Corp Vs CIRWilliam Christian Dela Cruz100% (2)

- Aurelio Litonjua JR Vs Eduardo Litonjua SR DigestDocument3 pagesAurelio Litonjua JR Vs Eduardo Litonjua SR Digestaljimenez631933767% (3)

- ATP MORAN vs. CADocument2 pagesATP MORAN vs. CARomnick Jesalva100% (1)

- Evangelista v. Abad SantosDocument4 pagesEvangelista v. Abad Santoslucky javellana100% (1)

- Pascual V Cir DigestDocument1 pagePascual V Cir DigestDani Lynne100% (4)

- Estanislao V CA - AgencyDocument2 pagesEstanislao V CA - AgencyDawn BernabePas encore d'évaluation

- Torres Vs CA - DigestDocument2 pagesTorres Vs CA - Digest001noone75% (4)

- Moran, Jr. v. CADocument2 pagesMoran, Jr. v. CAlealdeosa100% (3)

- Estanislao, Jr. v. CA, 160 S 830Document1 pageEstanislao, Jr. v. CA, 160 S 830Aphrobit CloPas encore d'évaluation

- Bastida Vs MenziDocument2 pagesBastida Vs MenziAna AdolfoPas encore d'évaluation

- Philex Mining v. CIRDocument4 pagesPhilex Mining v. CIRSophiaFrancescaEspinosaPas encore d'évaluation

- 25Hrs Lim V Lim DigestDocument2 pages25Hrs Lim V Lim DigestXing Keet Lu100% (3)

- AFISCO Insurance Corporation Vs CADocument2 pagesAFISCO Insurance Corporation Vs CAstickygum08100% (2)

- AFISCO v. CADocument2 pagesAFISCO v. CASophiaFrancescaEspinosa100% (1)

- Emnace v. CA - DigestDocument2 pagesEmnace v. CA - Digestkathrynmaydeveza100% (4)

- Cir Vs Suter - DigestDocument1 pageCir Vs Suter - DigestXing Keet Lu100% (1)

- Digest - Ortega vs. CADocument1 pageDigest - Ortega vs. CAPaul Vincent CunananPas encore d'évaluation

- Pascual V CIRDocument4 pagesPascual V CIRFlorence UdaPas encore d'évaluation

- Digest - Villareal vs. RamirezDocument1 pageDigest - Villareal vs. RamirezPaul Vincent Cunanan100% (1)

- McDonald v. National City Bank of New YorkDocument2 pagesMcDonald v. National City Bank of New YorkCourtney TirolPas encore d'évaluation

- Evangelista Vs Abad Santos 51 Scra 416 Case DigestDocument2 pagesEvangelista Vs Abad Santos 51 Scra 416 Case DigestKate Snchz100% (2)

- Goquiolay v. SycipDocument6 pagesGoquiolay v. Sycipkim_santos_20Pas encore d'évaluation

- Digest - Heirs of Tan Eng Kee vs. CADocument1 pageDigest - Heirs of Tan Eng Kee vs. CAPaul Vincent Cunanan100% (2)

- Munasque Vs CADocument2 pagesMunasque Vs CAIsha SorianoPas encore d'évaluation

- DIGEST Guy vs. GacottDocument2 pagesDIGEST Guy vs. GacottPrecious Anne100% (2)

- Gatchalian Vs CirDocument2 pagesGatchalian Vs Cirmitsudayo_100% (2)

- Digest of Philex Mining Corp. v. CIR (G.R. No. 148187)Document2 pagesDigest of Philex Mining Corp. v. CIR (G.R. No. 148187)Rafael Pangilinan88% (8)

- 16 Jo Chung Cang Vs Pacific Commercial CompanyDocument2 pages16 Jo Chung Cang Vs Pacific Commercial CompanyJudy Ann ShengPas encore d'évaluation

- Goquiolay vs. Sycip Case DigestDocument4 pagesGoquiolay vs. Sycip Case DigestDiannee Romano100% (1)

- Goquiolay Vs SycipDocument1 pageGoquiolay Vs Sycipabethzkyyyy100% (1)

- Agad Vs Mabato DigestDocument1 pageAgad Vs Mabato DigestAngeline Taňedo Chaves100% (4)

- Idos V CADocument2 pagesIdos V CARussell Marquez Manglicmot100% (2)

- Aguila V Ca DigestDocument1 pageAguila V Ca Digestralph louie salanoPas encore d'évaluation

- Digest of Yu v. NLRC (G.R. No. 97212)Document2 pagesDigest of Yu v. NLRC (G.R. No. 97212)Rafael Pangilinan100% (5)

- Digest - Rojas Vs MaglanaDocument2 pagesDigest - Rojas Vs MaglanaremrasePas encore d'évaluation

- Ortega v. CA - DigestDocument3 pagesOrtega v. CA - DigestJaysieMicabalo100% (1)

- CIR V CA, CTA and A. Soriano CorpDocument1 pageCIR V CA, CTA and A. Soriano Corpearl0917100% (1)

- Tocao Vs Court of AppealsDocument2 pagesTocao Vs Court of AppealsDave Jonathan Morente100% (4)

- Arbes Vs Polistico - digeSTDocument1 pageArbes Vs Polistico - digeSTXing Keet Lu100% (1)

- Ang Pue Co Vs Secretary DigestDocument1 pageAng Pue Co Vs Secretary DigestMarry LasherasPas encore d'évaluation

- 1 Agad vs. Mabato, G.R. No. L-24193, June 28, 1968Document4 pages1 Agad vs. Mabato, G.R. No. L-24193, June 28, 1968Francis Leo TianeroPas encore d'évaluation

- Saludo, Jr. vs. Philippine National Bank DigestDocument4 pagesSaludo, Jr. vs. Philippine National Bank DigestEmir Mendoza100% (2)

- OBILLOS Vs CIRDocument1 pageOBILLOS Vs CIRKrisjan Marie Sedillo OsabelPas encore d'évaluation

- The Leyte-Samar Sales Co. vs. Sulpicio v. Cea (93 Phil 100, May 20, 1953)Document2 pagesThe Leyte-Samar Sales Co. vs. Sulpicio v. Cea (93 Phil 100, May 20, 1953)Marilyn BachillerPas encore d'évaluation

- Mod1 - 5 - G.R. No. L-19342 Ona V CIRDocument2 pagesMod1 - 5 - G.R. No. L-19342 Ona V CIROjie SantillanPas encore d'évaluation

- Ona Vs CIRDocument2 pagesOna Vs CIRFlorence UdaPas encore d'évaluation

- Ona V CirDocument2 pagesOna V CirpaulPas encore d'évaluation

- Tax Case Digest - Lorenzo Oña vs. CirDocument2 pagesTax Case Digest - Lorenzo Oña vs. CirYourLawBuddyPas encore d'évaluation

- Ona V CIR - TaxDocument2 pagesOna V CIR - TaxKayee KatPas encore d'évaluation

- 193 Myers V USDocument2 pages193 Myers V USannamariepagtabunanPas encore d'évaluation

- People of The Philippines, PlaintiffDocument2 pagesPeople of The Philippines, PlaintiffannamariepagtabunanPas encore d'évaluation

- Case 182 - Limitations On Revenue, Appropriations and Tariff MeasuresDocument3 pagesCase 182 - Limitations On Revenue, Appropriations and Tariff MeasuresannamariepagtabunanPas encore d'évaluation

- 138 Aquino III V ComelecDocument7 pages138 Aquino III V ComelecannamariepagtabunanPas encore d'évaluation

- Formal Offer - SayatDocument4 pagesFormal Offer - SayatannamariepagtabunanPas encore d'évaluation

- Republic of The Philippines: (Attached To The Records of The Honorable Court)Document3 pagesRepublic of The Philippines: (Attached To The Records of The Honorable Court)annamariepagtabunanPas encore d'évaluation

- Estanislao - Revocation of SPADocument2 pagesEstanislao - Revocation of SPAannamariepagtabunanPas encore d'évaluation

- 007 Nifatan Vs CIRDocument2 pages007 Nifatan Vs CIRannamariepagtabunanPas encore d'évaluation

- People of The Philippines, PlaintiffDocument2 pagesPeople of The Philippines, PlaintiffannamariepagtabunanPas encore d'évaluation

- Versus-: Grace O. DepalingDocument1 pageVersus-: Grace O. DepalingannamariepagtabunanPas encore d'évaluation

- Petition - Catacutan (Issuance of New Owner's Copy)Document3 pagesPetition - Catacutan (Issuance of New Owner's Copy)annamariepagtabunanPas encore d'évaluation

- Minutes Feb 12 Stated MeetingDocument3 pagesMinutes Feb 12 Stated MeetingannamariepagtabunanPas encore d'évaluation

- Petition For Review - BarrionDocument9 pagesPetition For Review - BarrionannamariepagtabunanPas encore d'évaluation

- Investigation Data FormDocument1 pageInvestigation Data Formannamariepagtabunan75% (4)

- Joves - Labor Case JurisprudenceDocument6 pagesJoves - Labor Case JurisprudenceannamariepagtabunanPas encore d'évaluation

- 001 People vs. PerfectoDocument2 pages001 People vs. PerfectoannamariepagtabunanPas encore d'évaluation

- Aquino, Jr. v. EnrileDocument3 pagesAquino, Jr. v. Enrileannamariepagtabunan100% (1)

- 005 Perfecto vs. MeerDocument2 pages005 Perfecto vs. Meerannamariepagtabunan100% (1)

- Insurance - Notice of LossDocument70 pagesInsurance - Notice of LossannamariepagtabunanPas encore d'évaluation

- 003 Manila Prince Hotel V GSISDocument2 pages003 Manila Prince Hotel V GSISannamariepagtabunanPas encore d'évaluation

- Appellee's Brief CA R. ChuaDocument15 pagesAppellee's Brief CA R. ChuaannamariepagtabunanPas encore d'évaluation

- Marketing Feasibility FINALDocument93 pagesMarketing Feasibility FINALannamariepagtabunan100% (3)

- Authorizatio Patricio RhenDocument1 pageAuthorizatio Patricio RhenannamariepagtabunanPas encore d'évaluation

- 006 Endencia V DavidDocument3 pages006 Endencia V DavidannamariepagtabunanPas encore d'évaluation

- Vi. Ascertaining and Controlling Risks A. Concealment: Section 26Document40 pagesVi. Ascertaining and Controlling Risks A. Concealment: Section 26annamariepagtabunanPas encore d'évaluation

- 000 01 PubCorp DigestsDocument44 pages000 01 PubCorp DigestsannamariepagtabunanPas encore d'évaluation

- Appellee's Brief AvanteDocument14 pagesAppellee's Brief AvanteannamariepagtabunanPas encore d'évaluation

- Civ Rev Cases Jan 27Document22 pagesCiv Rev Cases Jan 27annamariepagtabunanPas encore d'évaluation

- Complaint LaoDocument2 pagesComplaint LaoannamariepagtabunanPas encore d'évaluation

- 004 Victory-Liner-v.-heirs-of-andres-malecdanDocument2 pages004 Victory-Liner-v.-heirs-of-andres-malecdanannamariepagtabunan100% (1)

- CA51015 Departmentals Quiz 1, 2, and 3Document37 pagesCA51015 Departmentals Quiz 1, 2, and 3artemisPas encore d'évaluation

- Assignment 1.1 Prepare and Describe A Succession ScenarioDocument2 pagesAssignment 1.1 Prepare and Describe A Succession Scenariomikheal beyberPas encore d'évaluation

- Case Digests 2018.05.07Document33 pagesCase Digests 2018.05.07jdz1988Pas encore d'évaluation

- Civil Law ReviewDocument434 pagesCivil Law ReviewRobert Kane Malcampo ReyesPas encore d'évaluation

- Affidavit of QuitclaimDocument2 pagesAffidavit of Quitclaimolintaha100% (6)

- Wills and Probate PDFDocument13 pagesWills and Probate PDFjunkPas encore d'évaluation

- Restoration Of: Reversion Adoptiva: A StudyDocument12 pagesRestoration Of: Reversion Adoptiva: A StudyDar CoronelPas encore d'évaluation

- Jurisprudence On PartitionDocument36 pagesJurisprudence On PartitionKristian Alicando0% (1)

- Rivera Vs Ramirez G.R. No. 189697, June 27, 2012 FactsDocument2 pagesRivera Vs Ramirez G.R. No. 189697, June 27, 2012 FactsGoodyPas encore d'évaluation

- Family Law Qustion PaperDocument6 pagesFamily Law Qustion Papervivekanand_bonalPas encore d'évaluation

- Paula Dela Cerna, Et. Al. vs. Potot, Et - Al.Document1 pagePaula Dela Cerna, Et. Al. vs. Potot, Et - Al.MhareyPas encore d'évaluation

- Law On DamagesDocument44 pagesLaw On DamagesGleir Galaez GuayPas encore d'évaluation

- Art 851 - 852 - 853 - 854 PDFDocument9 pagesArt 851 - 852 - 853 - 854 PDFEra GasperPas encore d'évaluation

- Estate Tax MalalaDocument15 pagesEstate Tax MalalaSGwannaBPas encore d'évaluation

- Spouses Salitico v. Heirs of Felix (G.R. 240199, 10 April 2019)Document5 pagesSpouses Salitico v. Heirs of Felix (G.R. 240199, 10 April 2019)Gia DimayugaPas encore d'évaluation

- Bouvier's Revised Sixth Edition, Adapted To The Constitution and Laws of The United States of America and of The Several States of The American Union, 1856Document1 570 pagesBouvier's Revised Sixth Edition, Adapted To The Constitution and Laws of The United States of America and of The Several States of The American Union, 1856Andrew RigbyPas encore d'évaluation

- Decedents' Estates Flashcards - QuizletDocument19 pagesDecedents' Estates Flashcards - QuizletseabreezePas encore d'évaluation

- Specpro DigestsssDocument133 pagesSpecpro DigestsssJimi SolomonPas encore d'évaluation

- Spec NotesDocument5 pagesSpec NotesMerideePas encore d'évaluation

- San Beda Memory AidDocument27 pagesSan Beda Memory Aidapple mae malakiPas encore d'évaluation

- Uniform Probate CodeDocument800 pagesUniform Probate CodeJeffrey SkatoffPas encore d'évaluation

- Special Proceedings DigestsDocument22 pagesSpecial Proceedings DigestsRemy Rose AlegrePas encore d'évaluation

- Aguas v. LlemosDocument2 pagesAguas v. LlemosAnne ObnamiaPas encore d'évaluation

- Utulo vs. Pasion Vda. de Garcia, 66 Phil 302Document12 pagesUtulo vs. Pasion Vda. de Garcia, 66 Phil 302ayam dinoPas encore d'évaluation

- Civil Law Bar QuestionsDocument244 pagesCivil Law Bar QuestionsRogelio Rubellano IIIPas encore d'évaluation

- Succession DigestsDocument5 pagesSuccession DigestsAnonymous XsaqDYDPas encore d'évaluation

- G.R. No. L-66574Document5 pagesG.R. No. L-66574Inter_vivosPas encore d'évaluation

- Ona V CIR - TaxDocument2 pagesOna V CIR - TaxKayee KatPas encore d'évaluation

- Testate Estate of The Late Reverend Father Pascual RigorDocument7 pagesTestate Estate of The Late Reverend Father Pascual RigorMariaPas encore d'évaluation

- Aligarh Muslim University Center Murshidabad: Hindu Law-IIDocument21 pagesAligarh Muslim University Center Murshidabad: Hindu Law-IIDaniyal sirajPas encore d'évaluation