Académique Documents

Professionnel Documents

Culture Documents

Auditing 3 Class Notes I. Auditing 3: © 2009 Devry/Becker Educational Development Corp. All Rights Reserved

Transféré par

Darwin Competente LagranTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Auditing 3 Class Notes I. Auditing 3: © 2009 Devry/Becker Educational Development Corp. All Rights Reserved

Transféré par

Darwin Competente LagranDroits d'auteur :

Formats disponibles

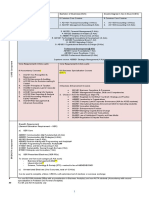

Becker CPA Review Auditing 3 Class Notes

AUDITING 3 CLASS NOTES

I.

AUDITING 3

Auditing 3 primarily deals with two key areas on the exam, planning (which includes consideration

of fraud/illegal acts) and risk assessment (which includes consideration of internal control).

A.

B.

PRE-ENGAGEMENT ACCEPTANCE ACTIVITIES

1.

You must be familiar with the specific procedures an auditor performs before

deciding to accept a client.

2.

You must separate these procedures from the procedures that are performed after

acceptance.

3.

Pre-acceptance activities:

Make inquiries of the predecessor auditor.

b.

Assess the auditablity of the client.

(1)

Evaluate management's integrity.

(2)

Consider the availability and adequacy of the client's accounting records.

(3)

Determine whether the audit firm is capable of performing the audit

(knowledge, staffing, etc.).

(4)

Consider whether an audit is the most appropriate form of engagement.

c.

Assess the client's business risk and the CPA's business risk.

d.

Evaluate compliance with ethical requirements (i.e., independence; quality

control procedures).

ESTABLISH AN UNDERSTANDING WITH THE CLIENT

1.

C.

a.

The auditor must establish an understanding with the client regarding the services to

be performed.

a.

Be aware of the general contents of the letter.

b.

An engagement letter is required in most circumstances.

PLANNING PHASE OF THE AUDIT

1.

The objective of this phase is to develop an overall strategy for the audit.

2.

The following are required during the planning stage of the audit:

a.

Obtain a sufficient understanding of the entity and its environment, including its

internal control.

b.

Obtain knowledge of the client's industry and business (tour facilities, review

financial history, etc.).

c.

Perform analytical procedures.

d.

Develop an overall audit strategy, and develop and document a written audit

plan.

e.

Consider materiality and audit risk so that an overall low level of audit risk is

attained.

1

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

D.

DEVELOPING THE AUDIT PLAN

1.

2.

An audit plan is a list of procedures to be performed. The audit plan must be in

writing and should include the nature, extent, and timing of:

a.

Risk assessment procedures, to assess the risk of material misstatement.

b.

Planned further audit procedures (i.e., tests of controls, substantive tests).

c.

Other required procedures.

The auditor should consider the need to utilize other professionals.

a.

b.

c.

Internal Auditor The auditor may choose to make use of the client's internal

auditor.

(1)

The internal auditor must be objective and competent.

(2)

The auditor cannot share responsibility with the internal auditor.

Specialist The auditor may need to utilize a specialist.

(1)

The specialist must be competent and objective.

(2)

If the specialist is related to the client, additional procedures may be

necessary.

(3)

A specialist is not mentioned in the auditor's report unless a report

modification relates to the work of the specialist.

Service Organization A service organization used by the client may, in

effect, form part of the client's information system.

(1)

E.

F.

The client's auditor (user auditor) may utilize the service auditor's report

in this situation.

MATERIALITY

1.

Know the terms known misstatement (specifically identified during the audit), likely

misstatement (an estimate of the misstatement that is likely to exist), and tolerable

misstatement (maximum error the auditor will accept).

2.

Know the definition of materiality (reasonable person standard).

3.

A preliminary level of materiality is typically based on historical or interim financial

statements, and may be revised during the audit.

4.

Materiality may be assessed in quantitative or qualitative terms.

5.

The auditor should document planned levels of materiality and tolerable

misstatement, changes in these amounts, and known and likely misstatements

(whether corrected or uncorrected).

AUDIT RISK

1.

You must know the definition of audit risk: financial statements are materially

misstated but the opinion is not appropriately modified.

2.

You must know the two elements of audit risk.

a.

Risk of Material Misstatement risk that the financial statements are

materially misstated. This risk is itself composed of two risks.

(1)

Inherent Risk based on the nature of the financial statement assertion.

(2)

Control Risk risk that controls fail to prevent/detect a material

misstatement in a financial statement assertion.

2

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

b.

Detection Risk risk that the auditor does not detect a material misstatement

in a financial statement assertion.

(1)

3.

It is imperative that you understand that audit risk needs to stay relatively low.

a.

G.

H.

This is the only element that the auditor can control, by varying the

nature, extent, or timing of audit procedures.

If the auditor's assessment of the risk of material misstatement increases

(usually through an increase in inherent risk or control risk), then the auditor

must reduce detection risk to keep overall audit risk low. The auditor may:

(1)

Change the nature of substantive tests from a less effective to a more

effective procedure.

(2)

Change the extent of substantive tests (i.e., use a larger sample size)

(3)

Change the timing of substantive tests (i.e., perform substantive tests at

year-end rather than at interim)

b.

The risk of material misstatement (inherent risk and control risk) has an inverse

relationship to detection risk if you don't understand this, memorize it.

c.

Remember that the auditor can change his or her assessment of the risk of

material misstatement (inherent and control risks), but cannot change the

actual risks.

AUDIT RISK AND MATERIALITY

1.

Audit risk and materiality must be considered together in designing audit procedures.

2.

Audit risk and materiality must be considered at both the financial statement level and

at the individual account balance, transaction class, or disclosure item level.

3.

There is an inverse relationship between materiality and audit risk.

FINANCIAL STATEMENT ASSERTIONS

1.

There are three categories of financial statement assertions and thirteen assertions

within those categories (CPA CO CARE CURV).

a.

b.

Assertions related to transactions and events:

(1)

Completeness

(2)

Cutoff (proper period)

(3)

Accuracy

(4)

Classification

(5)

Occurrence

Assertions related to account balances:

(1)

Completeness

(2)

Allocation and valuation

(3)

Rights and obligations

(4)

Existence

3

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

c.

2.

I.

Assertions related to presentation and disclosure:

(1)

Completeness

(2)

Understandability and classification

(3)

Rights and obligations, and occurrence

(4)

Valuation and accuracy

You need to know the assertions and what they mean, and understand how relevant

assertions may be used by the auditor to develop audit procedures.

SUPERVISION

Proper supervision of assistants is required; disagreements among staff should be

documented.

J.

FRAUD

1.

2.

3.

There are two types of fraud:

a.

Fraudulent Financial Reporting Intentional misstatements or omission of

amounts and disclosures in the financial statements

b.

Misappropriation of Assets theft of an entity's assets

There are three fraud risk factors their presence indicates a greater possibility of

fraud.

a.

Incentives/Pressures (e.g., trying to meet an EPS target to receive stock

options)

b.

Opportunity (e.g., the ability to steal from the company due to a lack of

controls)

c.

Rationalization/Attitude (e.g., employees who steal from the company

because they believe they are not paid enough)

You must understand management's responsibility with respect to fraud versus the

auditor's responsibility.

a.

It is management's responsibility to design and implement programs and

controls to prevent, detect, and deter fraud.

b.

The auditor has a responsibility to obtain reasonable assurance about whether

the financial statements are free of material misstatement. The auditor must:

(1)

Exercise professional skepticism.

(2)

Discuss fraud risk with engagement personnel.

(3)

Obtain information regarding fraud risk (inquiry, analytical procedures,

etc.).

(4)

Assess fraud risk and develop an appropriate response.

(5)

(a)

Improper revenue recognition and management override are

presumed to exist.

(b)

Both a general (overall) response and a response to specific areas

of risk are required.

Evaluate evidence.

4

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

(6)

K.

L.

(a)

Discuss fraud with management one level above those involved.

(b)

Fraud causing material misstatement or involving senior

management should be reported to the audit committee/those

charged with governance.

(c)

Know when it is acceptable to communicate fraud to outside

parties.

(d)

Know the specific documentation requirements for fraud.

ILLEGAL ACTS

1.

If the illegal act has a direct and material effect on the financial statements, the

auditor has a reasonable responsibility to detect it.

2.

The auditor has no responsibility to detect indirect effect illegal acts, but cannot

ignore such acts that come to his or her attention.

3.

You should understand the implications of illegal acts on the evaluation of

management integrity, the auditor's report, etc.

4.

You should also know when it is acceptable to communicate illegal acts to outside

parties.

RISK ASSESSMENT

1.

The auditor must obtain an understanding of the entity and its environment, including

its internal control, and assess the risk of material misstatement.

a.

Inquiry, analytical procedures, observation, inspection, and discussion among

the audit team are some procedures used to assess risk.

b.

The auditor must obtain an understanding of industry, regulatory, and other

external factors, the nature of the entity, the entity's objectives, strategies, and

risks, the entity's financial performance, and the entity's internal control.

c.

A significant risk requires special audit consideration. Be familiar with the

factors indicative of significant risks.

d.

The auditor should obtain an understanding of controls and determine whether

they have been implemented.

(1)

2.

If the auditor's risk assessment is based on the effective operation of

controls, the operating effectiveness of those controls will also need to

be tested.

Know the documentation requirements surrounding the auditor's risk assessment.

a.

The auditor should document the audit team's discussion, key elements of the

understanding of the entity and its environment, including its internal control,

the risk assessment procedures performed, the basis for the risk assessment,

and the identified risks and related controls evaluated by the auditor.

b.

Flowcharts, internal control questionnaires/checklists, narratives, or decision

tables may be used.

(1)

M.

Communicate and document conclusions.

Occasional exam questions require knowledge of flowcharting symbols.

CONSIDERATION OF INTERNAL CONTROL IN A FINANCIAL STATEMENT AUDIT

1.

As part of the auditor's risk assessment process, the auditor must obtain an

understanding of the entity's internal control.

5

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

2.

The purpose of internal control is to help a company meet its objectives (reliable

financial statements, effective/efficient operations, compliance).

3.

There are five components of internal control (CRIME). Know the basic definition of

each, and be familiar with the factors included in each component.

Control environment.

b.

Risk assessment (this is the company's assessment, not the auditor's).

c.

Information and communication systems.

d.

Monitoring.

e.

Existing control activities.

3.

The auditor studies internal control to assess the risk of material misstatement and to

determine the nature, extent, and timing of further audit procedures.

4.

The auditor should:

5.

N.

a.

a.

Evaluate the design of controls.

b.

Determine whether controls have been implemented (i.e., are being used).

Be familiar with the inherent limitations of internal control (i.e., the reasons why

errors may occur in spite of an effective system of internal control).

CONTROL ACTIVITIES

When there is a strong system of internal control, control activities implemented by the

client might include (PAID TIPS):

O.

P.

1.

Prenumbering of documents.

2.

Authorization of transactions.

3.

Independent checks to maintain asset accountability.

4.

Documentation.

5.

Timely and appropriate performance reviews.

6.

Information processing controls.

7.

Physical controls for safeguarding assets.

8.

Segregation of duties (ARC: separate authorization, recordkeeping, and custodial

functions).

INFORMATION TECHNOLOGY (IT)

1.

Use of information technology may impact any of the five components of internal

control.

2.

There are both benefits (faster processing, improved consistency) and risks

(unauthorized access to data or programs) associated with the use of information

technology.

3.

Segregation of duties within the IT department is important. (Know the specific

breakout of duties for an IT department.)

RESPONDING TO ASSESSED RISKS

1.

The auditor must respond to the assessed level of risk at two levels:

a.

The financial statement level an overall response is required, such as

assigning more experienced staff or increasing the level of supervision.

6

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Becker CPA Review Auditing 3 Class Notes

b.

2.

The relevant assertion level the nature, extent, and timing of specific audit

procedures is based on the assessed level of risk for the relevant assertions.

The auditor may choose between two audit approaches:

a.

A substantive approach only substantive procedures will be performed

(controls are nonexistent or it would be inefficient to test them).

(1)

b.

A combined approach tests of controls are performed, in the hope that

effective controls will allow a reduction in substantive testing.

(1)

3.

Even if controls are effective, substantive tests are always required to

some extent for each material transaction class, account balance, or

disclosure item.

Tests of Controls

a.

Tests of controls are used to evaluate the operating effectiveness of controls.

(1)

4.

Tests of controls may be required when there is extensive use of

technology, even if a completely substantive approach would otherwise

have been utilized.

The auditor may, purposefully or incidentally, obtain evidence regarding

the operating effectiveness of controls while obtaining an understanding

of the entity and its environment.

b.

Inquiry, inspection, observation, and reperformance are used to test the

operating effectiveness of controls. (Note that inquiry alone is insufficient, and

observation relates only to a specific point in time.)

c.

Be familiar with the factors that affect the nature, extent, and timing of tests of

controls.

d.

Evidence from prior years about operating effectiveness may be used as long

as it is still relevant and it is not too old (tests should be reperformed at least

once every three years).

Substantive Tests

a.

Substantive tests include tests of details and analytical procedures.

b.

The financial statements should be agreed to the underlying accounting

records, and material journal entries or adjustments should be examined.

c.

Be familiar with the factors that affect the nature, extent, and timing of

substantive tests.

(1)

In particular, understand that the extent of substantive testing is affected

by the risk of material misstatement (which in turn is affected by inherent

and control risks).

(2)

Be familiar with the factors affecting a decision to perform substantive

tests at interim instead of year-end.

5.

In responding to the assessed level of risk, the auditor may discover that the initial

risk assessment needs to be modified, and the audit plan should be revised

accordingly.

6.

The auditor must use judgment to evaluate the sufficiency and appropriateness of

audit evidence.

7.

Be familiar with the documentation requirements, especially the need to demonstrate

how audit procedures are linked in some way to the assessed level of risk.

7

2009 DeVry/Becker Educational Development Corp. All rights reserved.

Vous aimerez peut-être aussi

- Financial Accounting Reviewer - FinalsDocument2 pagesFinancial Accounting Reviewer - FinalsYvette Pauline Joven100% (1)

- Ab1301 SummaryDocument33 pagesAb1301 SummaryjonathanPas encore d'évaluation

- CH01SMDocument43 pagesCH01SMHuyenDaoPas encore d'évaluation

- Unit 2 MANAGEMENT ACCOUNTINGDocument43 pagesUnit 2 MANAGEMENT ACCOUNTINGSANDFORD MALULU100% (1)

- Job Analysis Questionnaire With Answers, Assignment 1, Naveed Abbas 2011250Document5 pagesJob Analysis Questionnaire With Answers, Assignment 1, Naveed Abbas 2011250Naveed AbbasPas encore d'évaluation

- Chapter 5 HRMDocument43 pagesChapter 5 HRMAnacristina Pinca100% (1)

- Accounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Document428 pagesAccounting Technicians Scheme (West Africa) : Basic Accounting Processes & Systems (BAPS)Ibrahim MuyePas encore d'évaluation

- Introduction To Strategic ManagementDocument31 pagesIntroduction To Strategic ManagementRatchana VasudevPas encore d'évaluation

- Managerial Accounting PDFDocument20 pagesManagerial Accounting PDFMister GamerPas encore d'évaluation

- Click Here For Answers: ACC 400 Final ExamDocument4 pagesClick Here For Answers: ACC 400 Final Examclickme12Pas encore d'évaluation

- 6.4-Case Study APA Paper 15-2 and 16-1 - Document For Financial Accounting TheoryDocument11 pages6.4-Case Study APA Paper 15-2 and 16-1 - Document For Financial Accounting TheorySMWPas encore d'évaluation

- Management Accounting - Lecture 1Document15 pagesManagement Accounting - Lecture 1Farzana AkhterPas encore d'évaluation

- The Goal Setting Theory Was Proposed by Prof. Edwin Locke and Prof. Gary LathamDocument10 pagesThe Goal Setting Theory Was Proposed by Prof. Edwin Locke and Prof. Gary LathamCupcakes&KnivesPas encore d'évaluation

- Management: A Practical Introduction: Try A Free SampleDocument2 pagesManagement: A Practical Introduction: Try A Free SampleAfshan Zehgeer0% (1)

- Kế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênDocument56 pagesKế Toán Quốc Tế 1: Nguyễn Đình Hoàng UyênHồ Đan ThụcPas encore d'évaluation

- Accounting For ManagersDocument286 pagesAccounting For ManagersSatyam Rastogi100% (1)

- Bpms Form - MaxDocument7 pagesBpms Form - MaxNikhil KhobragadePas encore d'évaluation

- Desktop SolutionDocument7 pagesDesktop SolutionAmira Nur Afiqah Agus SalimPas encore d'évaluation

- MADS 6601 Course Outline Spring 2012Document6 pagesMADS 6601 Course Outline Spring 2012arjkt564Pas encore d'évaluation

- PGM Structure - For Year 1 Students Admitted in 2019Document5 pagesPGM Structure - For Year 1 Students Admitted in 2019C.TangiblePas encore d'évaluation

- ACC 201 Financial Statement Analysis Project ModifiedDocument3 pagesACC 201 Financial Statement Analysis Project ModifiedAnonymous 6V5QyM1M3LPas encore d'évaluation

- Coordination - Doc FinalDocument13 pagesCoordination - Doc FinalMoses KibetPas encore d'évaluation

- Introduction To Accounting and BusinessDocument42 pagesIntroduction To Accounting and BusinessCris LuPas encore d'évaluation

- Management Reporting A Complete Guide - 2019 EditionD'EverandManagement Reporting A Complete Guide - 2019 EditionPas encore d'évaluation

- Audit ProceduresDocument15 pagesAudit Proceduresrohail51Pas encore d'évaluation

- Foundations of Accounting-2Document89 pagesFoundations of Accounting-2SWAPNIL BHISE100% (1)

- Auditing and PrinciplesDocument16 pagesAuditing and PrinciplesMilena RancicPas encore d'évaluation

- Sas 1-18Document165 pagesSas 1-18btee2Pas encore d'évaluation

- Chapter 3 AccountingDocument11 pagesChapter 3 AccountingĐỗ ĐăngPas encore d'évaluation

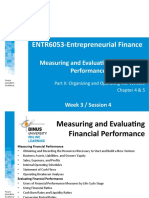

- PPT3-Measuring and Evaluating Financial PerformanceDocument70 pagesPPT3-Measuring and Evaluating Financial PerformanceAbdul AzizPas encore d'évaluation

- Chapter 3-Adjusting The AccountsDocument26 pagesChapter 3-Adjusting The Accountsbebybey100% (1)

- Chapter 01Document5 pagesChapter 01Alima Toon Noor Ridita 1612638630Pas encore d'évaluation

- Test Bank Ch6 ACCTDocument89 pagesTest Bank Ch6 ACCTMajed100% (1)

- Acct 220 Final Exam UmucDocument10 pagesAcct 220 Final Exam UmucOmarNiemczyk0% (2)

- ATR Answers - 5Document43 pagesATR Answers - 5Christine Jane AbangPas encore d'évaluation

- Lecture 21Document18 pagesLecture 21Anaya MalikPas encore d'évaluation

- Accounting and Financial Management NotesDocument72 pagesAccounting and Financial Management NotesShani BitonPas encore d'évaluation

- The Sarbanes-Oxley Act: costs, benefits and business impactsD'EverandThe Sarbanes-Oxley Act: costs, benefits and business impactsPas encore d'évaluation

- ACCT220 Supplemental Syllabus June 2020Document7 pagesACCT220 Supplemental Syllabus June 2020melissa adkinsPas encore d'évaluation

- TOPIC 3d - Audit PlanningDocument29 pagesTOPIC 3d - Audit PlanningLANGITBIRUPas encore d'évaluation

- Corporate Governance PillarsDocument13 pagesCorporate Governance PillarsM.dherPas encore d'évaluation

- 07 - Positive Accounting TheoryDocument15 pages07 - Positive Accounting TheoryMohammad AlfianPas encore d'évaluation

- Chapter 1 Audit f8 - 2.3Document25 pagesChapter 1 Audit f8 - 2.3JosephineMicheal17Pas encore d'évaluation

- 1.0 Review of Financial StatementsDocument25 pages1.0 Review of Financial Statementsmujuni brianmjuPas encore d'évaluation

- Adjusting Accounts For Financial Statements: Wild and Shaw Fundamental Accounting Principles 24th EditionDocument61 pagesAdjusting Accounts For Financial Statements: Wild and Shaw Fundamental Accounting Principles 24th EditionAudrey BienPas encore d'évaluation

- MCS - Unit IDocument145 pagesMCS - Unit ISubin RajPas encore d'évaluation

- Operational Auditing A Complete Guide - 2019 EditionD'EverandOperational Auditing A Complete Guide - 2019 EditionPas encore d'évaluation

- Chapter 38 Revenue From Contracts With CustomersDocument10 pagesChapter 38 Revenue From Contracts With CustomersEllen MaskariñoPas encore d'évaluation

- Solvency Ratio AnalysisDocument20 pagesSolvency Ratio AnalysispappunaagraajPas encore d'évaluation

- Chapter 3 Performance Management and Strategic PlanningDocument3 pagesChapter 3 Performance Management and Strategic PlanningDeviane CalabriaPas encore d'évaluation

- Property, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Document37 pagesProperty, Plant and Equipment: By:-Yohannes Negatu (Acca, Dipifr)Eshetie Mekonene AmarePas encore d'évaluation

- Working Capital Management 15Document75 pagesWorking Capital Management 15Vany AprilianiPas encore d'évaluation

- Auditing NotesDocument65 pagesAuditing NotesTushar GaurPas encore d'évaluation

- Chap002 AccountingMBADocument49 pagesChap002 AccountingMBAaliceaharp_621918018Pas encore d'évaluation

- Examples of Control DeficienciesDocument4 pagesExamples of Control DeficienciesAsis KoiralaPas encore d'évaluation

- Master Budget Case: Turabi LTDDocument4 pagesMaster Budget Case: Turabi LTDFarwa SamreenPas encore d'évaluation

- Generally Accepted Auditing Standards A Complete Guide - 2020 EditionD'EverandGenerally Accepted Auditing Standards A Complete Guide - 2020 EditionPas encore d'évaluation

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?D'EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Pas encore d'évaluation

- Wiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesD'EverandWiley Not-for-Profit GAAP 2017: Interpretation and Application of Generally Accepted Accounting PrinciplesPas encore d'évaluation

- Appointment Slip: 2 X 2 ID PictureDocument1 pageAppointment Slip: 2 X 2 ID PictureDarwin Competente LagranPas encore d'évaluation

- 6tb Sched 1Document43 pages6tb Sched 1Darwin Competente LagranPas encore d'évaluation

- 33 8708903 9 PDFDocument1 page33 8708903 9 PDFDarwin Competente LagranPas encore d'évaluation

- 34 3584935 4 PDFDocument1 page34 3584935 4 PDFDarwin Competente LagranPas encore d'évaluation

- Appointment Slip: 2 X 2 ID PictureDocument1 pageAppointment Slip: 2 X 2 ID PictureDarwin Competente LagranPas encore d'évaluation

- Appointment Slip: 2 X 2 ID PictureDocument1 pageAppointment Slip: 2 X 2 ID PictureDarwin Competente LagranPas encore d'évaluation

- 34 3584935 4 PDFDocument1 page34 3584935 4 PDFDarwin Competente LagranPas encore d'évaluation

- 34 5062057 4 PDFDocument1 page34 5062057 4 PDFDarwin Competente LagranPas encore d'évaluation

- Appointment Slip: 2 X 2 ID PictureDocument1 pageAppointment Slip: 2 X 2 ID PictureDarwin Competente LagranPas encore d'évaluation

- 6130.september - Not UpdatedDocument63 pages6130.september - Not UpdatedDarwin Competente LagranPas encore d'évaluation

- 240 480 1 SM PDFDocument7 pages240 480 1 SM PDFDarwin Competente LagranPas encore d'évaluation

- 2016 SOAR PK and Selling Performance - SeptemberDocument16 pages2016 SOAR PK and Selling Performance - SeptemberDarwin Competente LagranPas encore d'évaluation

- Accounting Information System (Chapter 3)Document50 pagesAccounting Information System (Chapter 3)Cassie67% (6)

- San Beda ObliconDocument28 pagesSan Beda ObliconLenard Trinidad67% (3)

- ACT103 - Topic 1Document3 pagesACT103 - Topic 1Juan FrivaldoPas encore d'évaluation

- Jawaban UTS Auditing IDocument7 pagesJawaban UTS Auditing IInsos Putri Agustina SimanjuntakPas encore d'évaluation

- Chapter 4 The Internal AssessmentDocument30 pagesChapter 4 The Internal AssessmentRemy CaperochoPas encore d'évaluation

- AA-Inherent RiskDocument1 pageAA-Inherent RiskRafsan JazzPas encore d'évaluation

- Medinova Diagnostic Services Limited - AR 2013Document24 pagesMedinova Diagnostic Services Limited - AR 2013maheshvtajanePas encore d'évaluation

- Ih February 2021Document48 pagesIh February 2021Yash AggarwalPas encore d'évaluation

- The National Standard For Incident RecordingDocument36 pagesThe National Standard For Incident RecordingRachel WilsonPas encore d'évaluation

- CAPEX Audit Programme and ManualDocument19 pagesCAPEX Audit Programme and Manualpriyaannand100% (5)

- Auditing Theory - Mock Exam Midterms)Document19 pagesAuditing Theory - Mock Exam Midterms)Keith Lamera100% (1)

- Cash and Cash Equivalents - Substantive Tests of Details of BalancesDocument34 pagesCash and Cash Equivalents - Substantive Tests of Details of Balancesyen clave0% (1)

- Management Structure Indofood CBPDocument2 pagesManagement Structure Indofood CBPdwihitaPas encore d'évaluation

- Disney AuditDocument2 pagesDisney AuditQuality DeptPas encore d'évaluation

- EASJEBM 35 450-458 GjrldwaDocument9 pagesEASJEBM 35 450-458 Gjrldwatito mohamedPas encore d'évaluation

- Elon Musk Notice To Terminate Twitter AcquisitionDocument8 pagesElon Musk Notice To Terminate Twitter AcquisitionTechCrunch100% (1)

- At Quizzer 3 - 2018 Code of Ethics For Professional Accountants in The Phils T1AY2122Document15 pagesAt Quizzer 3 - 2018 Code of Ethics For Professional Accountants in The Phils T1AY2122Rena NervalPas encore d'évaluation

- Evaluation of Internal ControlsDocument3 pagesEvaluation of Internal Controlsmatifadza2Pas encore d'évaluation

- Manpower Audit BackgroundDocument6 pagesManpower Audit Backgroundmagayaprincess169Pas encore d'évaluation

- TM Ar2015Document409 pagesTM Ar2015Lavenyaa TharmamurthyPas encore d'évaluation

- COA's Observation and Recommendations (2018 Audit Report On OVP)Document38 pagesCOA's Observation and Recommendations (2018 Audit Report On OVP)VERA FilesPas encore d'évaluation

- Tutorial Letter 101/0/2012: Year Course AUI4861Document39 pagesTutorial Letter 101/0/2012: Year Course AUI4861AndiPas encore d'évaluation

- USDA NOP OILC Course OfferingsDocument7 pagesUSDA NOP OILC Course OfferingsPrabakaran RavichandranPas encore d'évaluation

- New Questions in Study MaterialDocument17 pagesNew Questions in Study MaterialVikram KumarPas encore d'évaluation

- Quiz On Introduction To AccountingDocument3 pagesQuiz On Introduction To AccountingCeejay MancillaPas encore d'évaluation

- Performing Substantive TestDocument3 pagesPerforming Substantive TestZoren De Castro100% (1)

- Fraud Training For AuditeesDocument23 pagesFraud Training For Auditeesradimkov75Pas encore d'évaluation

- HwaTai Annual Report 2021Document131 pagesHwaTai Annual Report 2021MUHAMMAD NABIL MOHD ADAM MALEKPas encore d'évaluation

- OHSMS-LAC-AUTO EXILE PRODUCTS-Case Study-JULY-20Document135 pagesOHSMS-LAC-AUTO EXILE PRODUCTS-Case Study-JULY-20ysraoPas encore d'évaluation

- CPA - Quizbowl 2008Document10 pagesCPA - Quizbowl 2008frankreedh100% (3)

- Session 2 - Board Governance in Private and Public Sector - PPT Part 1Document19 pagesSession 2 - Board Governance in Private and Public Sector - PPT Part 1Catherine Kurniawan100% (1)

- Corporate Secretaryship Paper May 2014Document9 pagesCorporate Secretaryship Paper May 2014imuranganwaPas encore d'évaluation