Académique Documents

Professionnel Documents

Culture Documents

DJ21 KeyInvestorInformation - PDF.HTM

Transféré par

Marius AngaraTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DJ21 KeyInvestorInformation - PDF.HTM

Transféré par

Marius AngaraDroits d'auteur :

Formats disponibles

Key Investor Information

This document provides you with the key investor information about this fund. It is not marketing material. The information

is required by law to help you understand the nature and the risks of investing in this fund. You are advised to read it so you

can make an informed decision about whether to invest.

The Navajo Fund, Accumulation Shares,

(ISIN: GB0030678204)

The fund is managed by Capita Financial Managers Limited, part of the Asset Services Division of Capita plc.

Objectives and investment policy

Objective

The fund aims to provide long term capital growth.

Investment Policy

The fund invests in shares of global companies as well as collective

investment schemes.

You can buy and sell shares in the fund on the 15th and last

business day of each month.

Essential features of the fund:

Income from the fund will be added to the value of your

investment.

The fund has the discretion to invest in a range of investments

as described above with no need to adhere to a particular

benchmark.

The fund's performance is measured against the FTSE World

TR GBP Index .

Derivatives can be used for investment purposes and to

manage the risk profile of the fund. The fund does not

currently intend to use derivatives for either purpose.

Recommendation: This fund may not be appropriate for

investors who plan to withdraw their money within 5 years.

This indicator is based on historical data and may not be a

reliable indication of the future risk profile of this fund.

The risk and reward profile shown is not guaranteed to remain

the same and may shift over time.

This indicator shows how much a fund has risen and fallen in

the past, and therefore how much a fund's returns have

varied. It is a measure of a fund's volatility. The higher a

fund's past volatility the higher the number on the scale and

the greater the risk that investors in that fund may have made

losses as well as gains. The lowest number on the scale does

not mean that a fund is risk free.

Currency Risk: As the fund invests in global securities and

collective investment schemes that invest in global securities,

movements in exchange rates may, when not hedged, cause

the value of your investment to increase or decrease.

The fund has no specific targets in relation to markets, asset

classes or geographical sectors.

Risk and reward profile

The fund has been classed as 5 because its volatility has been

measured as above average.

Version 7.0

For full details of the fund's risks, please see the prospectus

which may be obtained from the address in `Practical

information' overleaf.

Charges for this Fund

The charges you pay are used to pay the costs of running the fund. These charges reduce the potential growth of your investment.

The entry charge shown is a maximum figure. In some cases

investors may pay less. You can find out the actual charges

from your financial advisor or distributor.

One-off charges taken before or after you invest

Entry Charge

10%

This is the maximum that might be taken out of your money

before it is invested.

The ongoing charges figure is based on expenses for the year

ended 31st March 2015. This figure may vary from year to year.

The ongoing charges are taken from the income of the fund.

They exclude portfolio transaction costs, except in the case of

an entry/exit charge paid by the fund when buying or selling

units in another collective investment undertaking.

Exit Charge

None

Charges taken from the fund over the year

Ongoing Charges

1.38%

Charges taken from the fund under certain specific conditions

Performance Fee

None

You may also be charged a dilution levy on entry to or exit

from the fund.

For more information about charges, please see the prospectus

Sections 3.5 & 7, which may be obtained free of charge from

the address in 'Practical Information' below.

Past performance

Past performance is not a guide to future performance.

The past performance in the chart shown opposite is net of

tax and charges but excludes the entry charge that may be

paid on the purchase of an investment.

The fund was launched in March 2002.

Performance is calculated in Pounds Sterling.

Practical information

Documents

Copies of the fund's prospectus and the latest annual and semi annual reports for the fund may be obtained from

www.capitafinancial.co.uk or Capita Financial Managers Limited, 2 The Boulevard, City West One Office Park, Gelderd

Road, Leeds, LS12 6NT. These documents are available in English and are free of charge.

Prices of shares and

further information

The latest published prices of shares in the fund and other information, including how to buy and sell shares are

available from www.capitafinancial.co.uk or during normal business hours from Capita Financial Managers Limited, 2

The Boulevard, City West One Office Park, Gelderd Road, Leeds, LS12 6NT or by calling 0345 922 0044.

Depositary

BNY Mellon Trust & Depositary (UK) Limited

Tax

UK tax legislation may have an impact on your personal tax position.

Liability

Capita Financial Managers Limited may be held liable solely on the basis of any statement contained in this document

that is misleading, inaccurate or inconsistent with the relevant parts of the prospectus for The Navajo Fund.

This fund is authorised in the United Kingdom by the Financial Conduct Authority. Capita Financial Managers Limited is authorised in the United

Kingdom and regulated by the Financial Conduct Authority.

This key investor information is accurate as at 02/09/2015.

Version 7.0

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Purpose and Goals of A Call Center Audit Colin TaylorDocument102 pagesThe Purpose and Goals of A Call Center Audit Colin TaylorMarius AngaraPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- MaRS Sample Preferred Term Sheet 201010281Document5 pagesMaRS Sample Preferred Term Sheet 201010281Peter WigginPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Purpose and Goals of A Call Center Audit Colin TaylorDocument5 pagesThe Purpose and Goals of A Call Center Audit Colin TaylorboulfrPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoreline Equity Partners Finder Fee EngagementDocument5 pagesShoreline Equity Partners Finder Fee EngagementMarius AngaraPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- File Nassiry Wheeler Green Venture Fund FINALDocument40 pagesFile Nassiry Wheeler Green Venture Fund FINALMarius AngaraPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Rep 2206053724Document8 pagesRep 2206053724Marius AngaraPas encore d'évaluation

- ChelseaFund - TermSheet - May 10-VMADocument2 pagesChelseaFund - TermSheet - May 10-VMAMarius AngaraPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Advanced Math HandbookDocument88 pagesAdvanced Math HandbookNikka LopezPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- 2016 3A Anatomy of A Loan TR PDFDocument24 pages2016 3A Anatomy of A Loan TR PDFMarius AngaraPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- IAAE PaperNo16930 - Tee Et Al 190512 2142Document30 pagesIAAE PaperNo16930 - Tee Et Al 190512 2142Marius AngaraPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- 8 Japan Structured Products Forum 2007Document10 pages8 Japan Structured Products Forum 2007Marius AngaraPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- 2015 - AFS - Steel Asia Manufacturing CorpDocument58 pages2015 - AFS - Steel Asia Manufacturing CorpMarius Angara100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- ADB Support For Bond Market DevelopmentDocument15 pagesADB Support For Bond Market DevelopmentMarius AngaraPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- Developing Domestic Capital Markets IFC World Bank Group IATF Issue BriefDocument5 pagesDeveloping Domestic Capital Markets IFC World Bank Group IATF Issue BriefMarius AngaraPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- 11.06.14 - Rama Operating AgreementDocument17 pages11.06.14 - Rama Operating AgreementMarius Angara100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Linear Fund Introduction Profile PV001 Credit Long ShortDocument2 pagesLinear Fund Introduction Profile PV001 Credit Long ShortMarius AngaraPas encore d'évaluation

- Uk Investingintheuk Sa Sixaguidetomergersandacquistionsintheuk PDFDocument21 pagesUk Investingintheuk Sa Sixaguidetomergersandacquistionsintheuk PDFMarius AngaraPas encore d'évaluation

- Coral - Commitment LetterDocument283 pagesCoral - Commitment LetterMarius AngaraPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Letter of Intent SummaryDocument4 pagesLetter of Intent SummaryKaloyana Georgieva100% (2)

- Accenture Banking ATM Benchmarking 2016Document28 pagesAccenture Banking ATM Benchmarking 2016Marius AngaraPas encore d'évaluation

- Sirv 06 Letter-Request Form For Conversion of Probationary To Indefinite SirvDocument3 pagesSirv 06 Letter-Request Form For Conversion of Probationary To Indefinite SirvEzzedin TagoPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- SIRV Annual Report FormDocument2 pagesSIRV Annual Report FormMarius AngaraPas encore d'évaluation

- EY Hedge Fund Launch WhitepaperDocument8 pagesEY Hedge Fund Launch WhitepaperMarius AngaraPas encore d'évaluation

- Accenture Banking ATM Benchmarking 2016Document28 pagesAccenture Banking ATM Benchmarking 2016Marius AngaraPas encore d'évaluation

- Corporate Finance Chapter10Document55 pagesCorporate Finance Chapter10Marius Angara100% (1)

- Hedge Fund Strategies - PHD ThesisDocument456 pagesHedge Fund Strategies - PHD Thesismiroslaw.plak8278100% (4)

- Merger TermsDocument5 pagesMerger TermsMarius AngaraPas encore d'évaluation

- Frisco Financial Bank Strategies GroupDocument12 pagesFrisco Financial Bank Strategies GroupMarius AngaraPas encore d'évaluation

- Hedge Fund Business Plan PDFDocument98 pagesHedge Fund Business Plan PDFMarius AngaraPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- EY Hedge Fund Launch WhitepaperDocument8 pagesEY Hedge Fund Launch WhitepaperMarius AngaraPas encore d'évaluation

- Chapter-7 Investment ManagementDocument7 pagesChapter-7 Investment Managementhasan alPas encore d'évaluation

- Sample Audit ReportsDocument3 pagesSample Audit Reportsvivek1119100% (1)

- Ifnotes PDFDocument188 pagesIfnotes PDFmohammed elshazaliPas encore d'évaluation

- Chapter No.02: Costs, Concepts, Uses and ClassificationsDocument20 pagesChapter No.02: Costs, Concepts, Uses and ClassificationsNaqibwafaPas encore d'évaluation

- BBVA OpenMind Libro El Proximo Paso Vida Exponencial2Document59 pagesBBVA OpenMind Libro El Proximo Paso Vida Exponencial2giovanniPas encore d'évaluation

- Reconstitution: Russell 3000 Index - AdditionsDocument10 pagesReconstitution: Russell 3000 Index - AdditionsepbeaverPas encore d'évaluation

- Zalando Prospectus PDFDocument446 pagesZalando Prospectus PDFVijay AnandPas encore d'évaluation

- The Determinants of Venture Capital: Research PaperDocument12 pagesThe Determinants of Venture Capital: Research PaperSehar SajjadPas encore d'évaluation

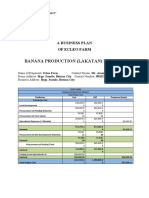

- Banana Production (Lakatan) Project: A Business Plan of Ecleo FarmDocument20 pagesBanana Production (Lakatan) Project: A Business Plan of Ecleo Farmmarkgil1990Pas encore d'évaluation

- Fuel Hedging in The Airline IndustryDocument55 pagesFuel Hedging in The Airline IndustryZorance75100% (2)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Bank ManagementDocument4 pagesBank ManagementsujathalaviPas encore d'évaluation

- 1.1 Conceptual Framework (Student Guide)Document19 pages1.1 Conceptual Framework (Student Guide)Nikka Hazel MendozaPas encore d'évaluation

- CDP CDP Complaint-1Document20 pagesCDP CDP Complaint-1Scott JohnsonPas encore d'évaluation

- MCMP Construction Corp., Petitioner, vs. Monark Equipment CorpDocument5 pagesMCMP Construction Corp., Petitioner, vs. Monark Equipment CorpCessy Ciar KimPas encore d'évaluation

- RBC US Dream HomeDocument36 pagesRBC US Dream HomeJuliano PereiraPas encore d'évaluation

- N - Chandrasekhar Naidu (Pronote)Document3 pagesN - Chandrasekhar Naidu (Pronote)raju634Pas encore d'évaluation

- FAR Handout Depreciation Part 2Document7 pagesFAR Handout Depreciation Part 2Chesca Marie Arenal Peñaranda100% (1)

- Chapter 3Document24 pagesChapter 3Irene Mae BeldaPas encore d'évaluation

- Chapter 20 - Shareholder's EquityDocument9 pagesChapter 20 - Shareholder's EquityLiana LopezPas encore d'évaluation

- Executive Order 1035 Streamlines Gov't Land AcquisitionDocument5 pagesExecutive Order 1035 Streamlines Gov't Land Acquisitionahsiri22Pas encore d'évaluation

- The Constitutional Corporation - Rethinking Corporate GovernanceDocument200 pagesThe Constitutional Corporation - Rethinking Corporate Governancedanyboy80100% (2)

- Finance For Non-Financial Managers Final ReportDocument11 pagesFinance For Non-Financial Managers Final ReportAli ImranPas encore d'évaluation

- 10 Grammar Empower. PassiveDocument1 page10 Grammar Empower. PassiveMariola Buendía VivoPas encore d'évaluation

- Bayquen v. Balaoro (LTD)Document2 pagesBayquen v. Balaoro (LTD)noonalawPas encore d'évaluation

- US Double Taxation TreatiesDocument1 pageUS Double Taxation TreatiesOnline Trading PlatformsPas encore d'évaluation

- IITK Parental Income CertificateDocument3 pagesIITK Parental Income CertificateSaket DiwakarPas encore d'évaluation

- Freeman Status PapersDocument18 pagesFreeman Status PapersDavid BrysonPas encore d'évaluation

- Saka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFDocument18 pagesSaka 1h Presentation 2019 - 2 5d67a0eea24d1 PDFAnurag RayPas encore d'évaluation

- HFM PresentationDocument31 pagesHFM PresentationLakshmiNarasimhan RamPas encore d'évaluation

- 2 Forex Question CciDocument50 pages2 Forex Question CciRavneet KaurPas encore d'évaluation