Académique Documents

Professionnel Documents

Culture Documents

Lords Landing Village Condominium Council of Unit Owners v. The Continental Insurance Company, 92 F.3d 1179, 4th Cir. (1996)

Transféré par

Scribd Government DocsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Lords Landing Village Condominium Council of Unit Owners v. The Continental Insurance Company, 92 F.3d 1179, 4th Cir. (1996)

Transféré par

Scribd Government DocsDroits d'auteur :

Formats disponibles

92 F.

3d 1179

NOTICE: Fourth Circuit Local Rule 36(c) states that citation

of unpublished dispositions is disfavored except for establishing

res judicata, estoppel, or the law of the case and requires

service of copies of cited unpublished dispositions of the Fourth

Circuit.

LORDS LANDING VILLAGE CONDOMINIUM COUNCIL

OF UNIT OWNERS,

Plaintiff-Appellant,

v.

The CONTINENTAL INSURANCE COMPANY, DefendantAppellee.

No. 95-2568.

United States Court of Appeals, Fourth Circuit.

Argued May 6, 1996.

Decided Aug. 6, 1996.

Appeal from the United States District Court for the District of Maryland

at Greenbelt. Peter J. Messitte, District Judge. (CA-94-3377-PJM)

ARGUED: Kevin Thornton, KAPLAN & KAPLAN, P.A., Baltimore,

Maryland, for Appellant. Gregory Ryder Black, SAUNDERS &

SCHMIELER, Silver Spring, Maryland, for Appellee. ON BRIEF: Jeffrey

R. Schmieler, SAUNDERS & SCHMIELER, Silver Spring, Maryland, for

Appellee.

D.Md.

AFFIRMED.

Before WIDENER and NIEMEYER, Circuit Judges, and PHILLIPS,

Senior Circuit Judge.

OPINION

PER CURIAM:

The unit owners of Lords Landing Village Condominium ("unit owners"),

having obtained a $1.1 million judgment against the condominium developer,

filed this action against the developer's insurance company, Continental

Insurance Company ("Continental") to compel Continental to pay the judgment.

Applying Maryland law, the district court concluded that the policy issued by

Continental did not cover the loss because it did not arise from an "occurrence"

within the meaning of the policy. We affirm.

In the underlying action, the unit owners sued the condominium developer,

Wellington Homes, for numerous defects in the condominium complex,

including a faulty fire protection sprinkler system, faulty insulation, and rotted

wood resulting from a subcontractor's failure to prime wood components prior

to painting. A jury rendered a verdict in favor of the unit owners against

Wellington Homes for breach of express and implied warranties and

misrepresentations and awarded the unit owners $1.1 million.

To collect the judgment, the unit owners instituted this action against

Continental because it had issued a general liability policy covering Wellington

during the applicable period. That policy provides payment for "those sums that

[Wellington] becomes legally obligated to pay as damages because of 'bodily

injury' or 'property damage' to which this insurance applies." And property

damage is covered only if it is caused by an "occurrence," defined as "an

accident, including continuous or repeated exposure to substantially the same

general harmful conditions."

The district court held that as a matter of law, property damage that is the

natural, probable consequence of poor workmanship and omissions is not

caused by an occurrence as defined by the policy. The court noted that there

was no occurrence whether it was the subcontractor or a general contractor that

was involved.

Appealing the district court's judgment, the unit owners contend that "the

accident component of an occurrence must be viewed subjectively, and where

the injury is not expected or intended from the standpoint of the insured an

occurrence takes place." This contention, however, is based on the policy's

exclusions and fails to take into account the policy's threshold requirement that

property damage be caused by an "occurrence." If we were to interpret the

policy as urged by the unit owners, we would be collapsing one of the policy's

business risks exclusions into a threshold requirement for coverage. The policy

in question does not provide coverage for all property damage, but only

property damage that is caused by an "occurrence." Only if that threshold

coverage is crossed must the exclusion alluded to by the unit owners be

addressed, i.e. the exclusion for property damage that was "expected or

intended from the standpoint of the insured." Accordingly, we must first

address whether the loss was caused by an occurrence or accident.

6

"Under Maryland law in the context of insurance law 'accident' means an

'undesigned, sudden and unexpected event, usually of an afflictive or

unfortunate character, and often accompanied by a manifestation of force, but it

does not mean the natural and ordinary consequences of a negligent act.' " IA

Construction Corp. v. T & T Surveying, Inc., 822 F.Supp. 1213, 1215

(D.Md.1993) (quoting Ed. Winkler & Son, Inc. v. Ohio Casualty Ins. Co., 441

A.2d 1129, 1132 (Md.App.1980) (quoting 7A Appleman, Insurance Law and

Practice 4492 at 17 (Berdal ed.1979))) (holding that claims against contractor

for work performed in reliance upon negligent work of another contractor did

not constitute "occurrence" under general liability policy). Occurrence "does

not include the normal, expected consequences of poor workmanship."

Reliance Ins. Co. v. Mogavero, 640 F.Supp. 84, 86 (D.Md.1986).

We agree with the district court that the damages awarded in the underlying

action for breach of warranties and misrepresentations allegedly resulting from

the poor workmanship of a subcontractor were not caused by an "occurrence"

within the meaning of Continental's policy. "This is the stuff of the construction

trade (and profes sional malpractice insurance), not a risk protected against by a

general liability policy." IA Construction Corp., 822 F.Supp. at 1215 (referring

to one contractor's negligence causing liability for another contractor); see also

Mogavero, 640 F.Supp. at 85 ("[t]his case turns upon one overriding principle:

that [insurer] issued a general liability policy, not a performance bond"); cf.

American Home Assurance Co. v. Osbourn, 422 A.2d 8, 13 (Md.App.1980)

(holding that action against service station operator for trespass and conversion

did not constitute "occurrence").

Accordingly, we affirm the judgment of the district court.

AFFIRMED.

Vous aimerez peut-être aussi

- U.S. Court of Appeals, Fifth CircuitDocument15 pagesU.S. Court of Appeals, Fifth CircuitScribd Government DocsPas encore d'évaluation

- UnpublishedDocument11 pagesUnpublishedScribd Government DocsPas encore d'évaluation

- Travelers Indemnity v. Tower-Dawson, LLC, 4th Cir. (2008)Document13 pagesTravelers Indemnity v. Tower-Dawson, LLC, 4th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- Lime Tree Village Community Club Association, Inc. v. State Farm General Insurance Company, 980 F.2d 1402, 11th Cir. (1993)Document8 pagesLime Tree Village Community Club Association, Inc. v. State Farm General Insurance Company, 980 F.2d 1402, 11th Cir. (1993)Scribd Government DocsPas encore d'évaluation

- UnpublishedDocument23 pagesUnpublishedScribd Government DocsPas encore d'évaluation

- Burnham Shoes, Inc. v. West American Insurance Company and American Fire and Casualty Company, 813 F.2d 328, 11th Cir. (1987)Document8 pagesBurnham Shoes, Inc. v. West American Insurance Company and American Fire and Casualty Company, 813 F.2d 328, 11th Cir. (1987)Scribd Government DocsPas encore d'évaluation

- Linda Gilchrist v. State Farm Mutual, 390 F.3d 1327, 11th Cir. (2004)Document12 pagesLinda Gilchrist v. State Farm Mutual, 390 F.3d 1327, 11th Cir. (2004)Scribd Government DocsPas encore d'évaluation

- Causation in Insurance LawDocument6 pagesCausation in Insurance LawMukama DhamuzunguPas encore d'évaluation

- French v. Assurance Company, 4th Cir. (2006)Document21 pagesFrench v. Assurance Company, 4th Cir. (2006)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument4 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- United States Stove Company v. Steadfast Insurance Company, 11th Cir. (2012)Document7 pagesUnited States Stove Company v. Steadfast Insurance Company, 11th Cir. (2012)Scribd Government DocsPas encore d'évaluation

- William W. Cowdell, Administrator of The Estate of William Robert Cowdell v. Cambridge Mutual Insurance Company, 808 F.2d 160, 1st Cir. (1986)Document5 pagesWilliam W. Cowdell, Administrator of The Estate of William Robert Cowdell v. Cambridge Mutual Insurance Company, 808 F.2d 160, 1st Cir. (1986)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals For The Eighth CircuitDocument8 pagesUnited States Court of Appeals For The Eighth CircuitScribd Government DocsPas encore d'évaluation

- Advantage Home v. Assurance Company, 470 F.3d 1003, 10th Cir. (2006)Document21 pagesAdvantage Home v. Assurance Company, 470 F.3d 1003, 10th Cir. (2006)Scribd Government DocsPas encore d'évaluation

- Ethlyn O. Williams v. United States Fidelity and Guaranty Company, 358 F.2d 799, 4th Cir. (1966)Document6 pagesEthlyn O. Williams v. United States Fidelity and Guaranty Company, 358 F.2d 799, 4th Cir. (1966)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument11 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Mclouth Steel Corp. v. Mesta Machine Co. FOSTER Et Al. v. Hartford Accident & Indemnity Co. (Landis Tool Co., Third-Party Defendant)Document6 pagesMclouth Steel Corp. v. Mesta Machine Co. FOSTER Et Al. v. Hartford Accident & Indemnity Co. (Landis Tool Co., Third-Party Defendant)Scribd Government DocsPas encore d'évaluation

- Allied Steel Construction Co. v. Employers Casualty Company, 422 F.2d 1369, 10th Cir. (1970)Document4 pagesAllied Steel Construction Co. v. Employers Casualty Company, 422 F.2d 1369, 10th Cir. (1970)Scribd Government DocsPas encore d'évaluation

- Smith Bell & Co V CADocument13 pagesSmith Bell & Co V CABianca LaderaPas encore d'évaluation

- Insurance Bad Faith Set-UpsDocument304 pagesInsurance Bad Faith Set-UpsMOHAN KUMARPas encore d'évaluation

- Aetna Casualty & Surety Company, Cross-Appellee v. General Time Corporation and Talley Industries, Inc., Cross-Appellants, 704 F.2d 80, 2d Cir. (1983)Document7 pagesAetna Casualty & Surety Company, Cross-Appellee v. General Time Corporation and Talley Industries, Inc., Cross-Appellants, 704 F.2d 80, 2d Cir. (1983)Scribd Government DocsPas encore d'évaluation

- RIMS 2015 - When Is An Occurrence Not An Occurrence - FINALDocument53 pagesRIMS 2015 - When Is An Occurrence Not An Occurrence - FINALDavid SucharPas encore d'évaluation

- Jakobson Shipyard, Inc. v. The Aetna Casualty and Surety Company and The Aetna Life & Casualty Company, 961 F.2d 387, 2d Cir. (1992)Document4 pagesJakobson Shipyard, Inc. v. The Aetna Casualty and Surety Company and The Aetna Life & Casualty Company, 961 F.2d 387, 2d Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Utmost Good Faith Principle & Cause ProximaDocument4 pagesUtmost Good Faith Principle & Cause ProximaTONG SHU ZHEN100% (1)

- Town of Springfield, Vermont v. United States Fidelity and Guaranty Company, and The Employers Mutual and Casualty Company, 794 F.2d 802, 2d Cir. (1986)Document6 pagesTown of Springfield, Vermont v. United States Fidelity and Guaranty Company, and The Employers Mutual and Casualty Company, 794 F.2d 802, 2d Cir. (1986)Scribd Government DocsPas encore d'évaluation

- Nancy Bailey O'Neal v. Planet Insurance Company and United Pacific Insurance Company, Defendant, 848 F.2d 185, 4th Cir. (1988)Document6 pagesNancy Bailey O'Neal v. Planet Insurance Company and United Pacific Insurance Company, Defendant, 848 F.2d 185, 4th Cir. (1988)Scribd Government DocsPas encore d'évaluation

- First Insurance Company of Hawaii, LTD., A Hawaii Corporation v. Continental Casualty Company, An Illinois Corporation, 466 F.2d 807, 1st Cir. (1972)Document6 pagesFirst Insurance Company of Hawaii, LTD., A Hawaii Corporation v. Continental Casualty Company, An Illinois Corporation, 466 F.2d 807, 1st Cir. (1972)Scribd Government DocsPas encore d'évaluation

- Aetna Casualty and Surety Company v. Ocean Accident & Guarantee Corporation, LTD., 386 F.2d 413, 3rd Cir. (1967)Document4 pagesAetna Casualty and Surety Company v. Ocean Accident & Guarantee Corporation, LTD., 386 F.2d 413, 3rd Cir. (1967)Scribd Government DocsPas encore d'évaluation

- UnpublishedDocument15 pagesUnpublishedScribd Government DocsPas encore d'évaluation

- Sea Insurance Company, Limited v. Westchester Fire Insurance Company, 51 F.3d 22, 2d Cir. (1995)Document9 pagesSea Insurance Company, Limited v. Westchester Fire Insurance Company, 51 F.3d 22, 2d Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument7 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- Antonio Romano, Kathryn Romano v. Liberty Mutual Insurance Company, A Massachusetts Corporation, Defendant, 854 F.2d 1317, 4th Cir. (1988)Document5 pagesAntonio Romano, Kathryn Romano v. Liberty Mutual Insurance Company, A Massachusetts Corporation, Defendant, 854 F.2d 1317, 4th Cir. (1988)Scribd Government DocsPas encore d'évaluation

- Jerome Greenspan v. Adt Security Services Inc, 3rd Cir. (2011)Document12 pagesJerome Greenspan v. Adt Security Services Inc, 3rd Cir. (2011)Scribd Government DocsPas encore d'évaluation

- Mindex Resources Vs Morillo G.R. No. 138123Document11 pagesMindex Resources Vs Morillo G.R. No. 138123Aerith AlejandrePas encore d'évaluation

- Smith Bell V CADocument9 pagesSmith Bell V CAthebluesharpiePas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument24 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Seaco Insurance Co. v. Davis-Irish, 300 F.3d 84, 1st Cir. (2002)Document5 pagesSeaco Insurance Co. v. Davis-Irish, 300 F.3d 84, 1st Cir. (2002)Scribd Government DocsPas encore d'évaluation

- National Electrical Manufacturers Association v. Gulf Underwriters Insurance Company, 162 F.3d 821, 4th Cir. (1998)Document9 pagesNational Electrical Manufacturers Association v. Gulf Underwriters Insurance Company, 162 F.3d 821, 4th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- Basic InsuranceDocument25 pagesBasic InsuranceThaliaPas encore d'évaluation

- Defences and Remedies in TortDocument6 pagesDefences and Remedies in TortDebbz SmythPas encore d'évaluation

- Lawyers Title Insurance Corporation v. Rex Title Corporation, 282 F.3d 292, 4th Cir. (2002)Document5 pagesLawyers Title Insurance Corporation v. Rex Title Corporation, 282 F.3d 292, 4th Cir. (2002)Scribd Government DocsPas encore d'évaluation

- Commercial Union Insurance Co. v. Bituminous Casualty Corp, 851 F.2d 98, 3rd Cir. (1988)Document9 pagesCommercial Union Insurance Co. v. Bituminous Casualty Corp, 851 F.2d 98, 3rd Cir. (1988)Scribd Government DocsPas encore d'évaluation

- Progressive Mountain Insurance Company v. Adam Duane Cason, 11th Cir. (2015)Document10 pagesProgressive Mountain Insurance Company v. Adam Duane Cason, 11th Cir. (2015)Scribd Government DocsPas encore d'évaluation

- Continental Casualty Company v. P.D.C., Inc., Donald Craig Olsen, 931 F.2d 1429, 10th Cir. (1991)Document4 pagesContinental Casualty Company v. P.D.C., Inc., Donald Craig Olsen, 931 F.2d 1429, 10th Cir. (1991)Scribd Government DocsPas encore d'évaluation

- Nautilus Insurance v. Our Camp Inc., 10th Cir. (2005)Document9 pagesNautilus Insurance v. Our Camp Inc., 10th Cir. (2005)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument6 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- Basic Rules and Principles On Quasi-DelictDocument4 pagesBasic Rules and Principles On Quasi-DelictMay Lann LamisPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument6 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- Industrial Indemnity Company v. Continental Casualty Company, Continental Casualty Company v. Industrial Indemnity Company, 375 F.2d 183, 10th Cir. (1967)Document4 pagesIndustrial Indemnity Company v. Continental Casualty Company, Continental Casualty Company v. Industrial Indemnity Company, 375 F.2d 183, 10th Cir. (1967)Scribd Government DocsPas encore d'évaluation

- Worldwide Underwriters Insurance Company v. Robert P. Brady, Jr. Robert P. Brady, Sr. Gary Moros, 973 F.2d 192, 3rd Cir. (1992)Document8 pagesWorldwide Underwriters Insurance Company v. Robert P. Brady, Jr. Robert P. Brady, Sr. Gary Moros, 973 F.2d 192, 3rd Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Business Interiors, Inc. v. The Aetna Casualty and Surety Company, 751 F.2d 361, 10th Cir. (1984)Document5 pagesBusiness Interiors, Inc. v. The Aetna Casualty and Surety Company, 751 F.2d 361, 10th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- Higinio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Document4 pagesHiginio Aponte v. American Surety Company of New York, Etc., 276 F.2d 678, 1st Cir. (1960)Scribd Government DocsPas encore d'évaluation

- Insurance Co. of North America v. Continental Casualty Company, 575 F.2d 1070, 3rd Cir. (1978)Document6 pagesInsurance Co. of North America v. Continental Casualty Company, 575 F.2d 1070, 3rd Cir. (1978)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument9 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Regional Bank of Colorado, N.A. v. St. Paul Fire and Marine Insurance Company, 35 F.3d 494, 10th Cir. (1994)Document7 pagesRegional Bank of Colorado, N.A. v. St. Paul Fire and Marine Insurance Company, 35 F.3d 494, 10th Cir. (1994)Scribd Government DocsPas encore d'évaluation

- Warren S. Griffin v. Continental American Life Insurance Company, 722 F.2d 671, 11th Cir. (1984)Document5 pagesWarren S. Griffin v. Continental American Life Insurance Company, 722 F.2d 671, 11th Cir. (1984)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Eleventh CircuitDocument5 pagesUnited States Court of Appeals, Eleventh CircuitScribd Government DocsPas encore d'évaluation

- United States Court of Appeals Third CircuitDocument5 pagesUnited States Court of Appeals Third CircuitScribd Government DocsPas encore d'évaluation

- Payn v. Kelley, 10th Cir. (2017)Document8 pagesPayn v. Kelley, 10th Cir. (2017)Scribd Government Docs50% (2)

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Greene v. Tennessee Board, 10th Cir. (2017)Document2 pagesGreene v. Tennessee Board, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Wilson v. Dowling, 10th Cir. (2017)Document5 pagesWilson v. Dowling, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Brown v. Shoe, 10th Cir. (2017)Document6 pagesBrown v. Shoe, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Webb v. Allbaugh, 10th Cir. (2017)Document18 pagesWebb v. Allbaugh, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Northglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Document10 pagesNorthglenn Gunther Toody's v. HQ8-10410-10450, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Reating Harmony IN Arbitration Under Msme ACT AND Contractual Arbitration Under Arbitration AND Conciliation ACTDocument9 pagesReating Harmony IN Arbitration Under Msme ACT AND Contractual Arbitration Under Arbitration AND Conciliation ACTMedha DwivediPas encore d'évaluation

- 3Document14 pages3Chel FelicianoPas encore d'évaluation

- UNIT 7crime. Types of Crime. RedactataDocument16 pagesUNIT 7crime. Types of Crime. RedactataION STEFANETPas encore d'évaluation

- Forest - Case Law PDFDocument15 pagesForest - Case Law PDFPreetha PPas encore d'évaluation

- NGRI ManualDocument277 pagesNGRI Manualzcorneliu100% (1)

- CH 5 (2) - Business and The ConstitutionDocument4 pagesCH 5 (2) - Business and The ConstitutionMaria ForkPas encore d'évaluation

- Garcia vs. Court of Appeals (G.R. No. 83929, June 11, 1992)Document3 pagesGarcia vs. Court of Appeals (G.R. No. 83929, June 11, 1992)mshenilynPas encore d'évaluation

- Latogan v. PeopleDocument16 pagesLatogan v. PeoplecitizenPas encore d'évaluation

- State of Oregon Vs James Trent GoodbaudyDocument6 pagesState of Oregon Vs James Trent GoodbaudyThemias100% (1)

- Third Division (G.R. No. 131540, December 02, 1999) Betty King, Petitioner, VS. People of The Philippines, RespondentDocument13 pagesThird Division (G.R. No. 131540, December 02, 1999) Betty King, Petitioner, VS. People of The Philippines, RespondentXtian HernandezPas encore d'évaluation

- Letter To Chief Justice Matthew DurrantDocument2 pagesLetter To Chief Justice Matthew DurrantThe Salt Lake TribunePas encore d'évaluation

- Lozada v. Comelec (1983) Case Digest - ArcadioDocument1 pageLozada v. Comelec (1983) Case Digest - ArcadioR.D.B. ArcadioPas encore d'évaluation

- Section 53-A RiyaDocument8 pagesSection 53-A RiyaMohit MahajanPas encore d'évaluation

- Karnataka Land Reforms Karnataka Act 02 of 2015Document2 pagesKarnataka Land Reforms Karnataka Act 02 of 2015rameshpaniPas encore d'évaluation

- Digest G.R No. 107369 Manalo vs. SistozaDocument2 pagesDigest G.R No. 107369 Manalo vs. SistozaMichelle Catadman100% (1)

- Recognition of Stock ExchangeDocument5 pagesRecognition of Stock ExchangePrarthana Gupta100% (1)

- ObliCon - Chapter 2 2-4Document4 pagesObliCon - Chapter 2 2-4Mi MingkaiPas encore d'évaluation

- Rule 112 CasesDocument249 pagesRule 112 CasesEra gasperPas encore d'évaluation

- Supreme Court upholds acknowledgment of natural childDocument206 pagesSupreme Court upholds acknowledgment of natural childsheryhanPas encore d'évaluation

- Jerome Solco v. Megaworld CorporationDocument28 pagesJerome Solco v. Megaworld CorporationBeltran KathPas encore d'évaluation

- Sta. Lucia East Commercial Corp. v. Secretary of Labor - EmploymentDocument14 pagesSta. Lucia East Commercial Corp. v. Secretary of Labor - EmploymentAnnie Herrera-LimPas encore d'évaluation

- 4.-People v. Tanes y BelmonteDocument12 pages4.-People v. Tanes y BelmonteroyalwhoPas encore d'évaluation

- Chavez vs. Bonto-PerezDocument5 pagesChavez vs. Bonto-PerezKris OrensePas encore d'évaluation

- PoliDocument167 pagesPoliLegal OfficerPas encore d'évaluation

- AmlaDocument12 pagesAmlaIsko_CPAwannabePas encore d'évaluation

- Aniag vs. ComelecDocument2 pagesAniag vs. ComelecDana Denisse Ricaplaza100% (1)

- Supreme Court Rules Against Fertilizer Monopoly TaxDocument8 pagesSupreme Court Rules Against Fertilizer Monopoly TaxtwIzPas encore d'évaluation

- CRMD and SECDocument3 pagesCRMD and SECRaymart Salamida100% (1)

- Judicial Affidavit: Question No. 1: Case No. 0008 For Simple Slander Ya Planta SiDocument3 pagesJudicial Affidavit: Question No. 1: Case No. 0008 For Simple Slander Ya Planta SiMohammad Ahmad AmsawaPas encore d'évaluation

- Tan Jr. vs. CA finality of judgment ruleDocument2 pagesTan Jr. vs. CA finality of judgment ruleJaz SumalinogPas encore d'évaluation

- The 7 Habits of Highly Effective People: The Infographics EditionD'EverandThe 7 Habits of Highly Effective People: The Infographics EditionÉvaluation : 4 sur 5 étoiles4/5 (2475)

- The Age of Magical Overthinking: Notes on Modern IrrationalityD'EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityÉvaluation : 4 sur 5 étoiles4/5 (13)

- LIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionD'EverandLIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionÉvaluation : 4 sur 5 étoiles4/5 (402)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeD'EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BePas encore d'évaluation

- Why We Die: The New Science of Aging and the Quest for ImmortalityD'EverandWhy We Die: The New Science of Aging and the Quest for ImmortalityÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- The Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsD'EverandThe Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsÉvaluation : 3.5 sur 5 étoiles3.5/5 (3)

- Permission to Be Gentle: 7 Self-Love Affirmations for the Highly SensitiveD'EverandPermission to Be Gentle: 7 Self-Love Affirmations for the Highly SensitiveÉvaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesD'EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesÉvaluation : 5 sur 5 étoiles5/5 (1631)

- Maktub: An Inspirational Companion to The AlchemistD'EverandMaktub: An Inspirational Companion to The AlchemistÉvaluation : 5 sur 5 étoiles5/5 (2)

- The Mountain is You: Transforming Self-Sabotage Into Self-MasteryD'EverandThe Mountain is You: Transforming Self-Sabotage Into Self-MasteryÉvaluation : 4.5 sur 5 étoiles4.5/5 (874)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelD'EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelÉvaluation : 5 sur 5 étoiles5/5 (2)

- Breaking the Habit of Being YourselfD'EverandBreaking the Habit of Being YourselfÉvaluation : 4.5 sur 5 étoiles4.5/5 (1454)

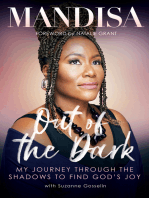

- Out of the Dark: My Journey Through the Shadows to Find God's JoyD'EverandOut of the Dark: My Journey Through the Shadows to Find God's JoyÉvaluation : 4.5 sur 5 étoiles4.5/5 (10)

- Crazy Love, Revised and Updated: Overwhelmed by a Relentless GodD'EverandCrazy Love, Revised and Updated: Overwhelmed by a Relentless GodÉvaluation : 4.5 sur 5 étoiles4.5/5 (1000)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedÉvaluation : 5 sur 5 étoiles5/5 (78)

- The Stoic Mindset: Living the Ten Principles of StoicismD'EverandThe Stoic Mindset: Living the Ten Principles of StoicismPas encore d'évaluation

- Tired of Being Tired: Receive God's Realistic Rest for Your Soul-Deep ExhaustionD'EverandTired of Being Tired: Receive God's Realistic Rest for Your Soul-Deep ExhaustionÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipD'EverandHow to Talk to Anyone: Learn the Secrets of Good Communication and the Little Tricks for Big Success in RelationshipÉvaluation : 4.5 sur 5 étoiles4.5/5 (1135)

- The Power of Now: A Guide to Spiritual EnlightenmentD'EverandThe Power of Now: A Guide to Spiritual EnlightenmentÉvaluation : 4.5 sur 5 étoiles4.5/5 (4120)

- Becoming Supernatural: How Common People Are Doing The UncommonD'EverandBecoming Supernatural: How Common People Are Doing The UncommonÉvaluation : 5 sur 5 étoiles5/5 (1476)

- Out of the Dark: My Journey Through the Shadows to Find God's JoyD'EverandOut of the Dark: My Journey Through the Shadows to Find God's JoyÉvaluation : 5 sur 5 étoiles5/5 (5)

- Now and Not Yet: Pressing in When You’re Waiting, Wanting, and Restless for MoreD'EverandNow and Not Yet: Pressing in When You’re Waiting, Wanting, and Restless for MoreÉvaluation : 5 sur 5 étoiles5/5 (4)