Académique Documents

Professionnel Documents

Culture Documents

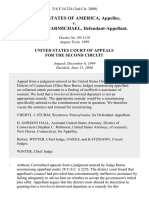

United States v. Strong, 4th Cir. (1997)

Transféré par

Scribd Government DocsCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States v. Strong, 4th Cir. (1997)

Transféré par

Scribd Government DocsDroits d'auteur :

Formats disponibles

UNPUBLISHED

UNITED STATES COURT OF APPEALS

FOR THE FOURTH CIRCUIT

UNITED STATES OF AMERICA,

Plaintiff-Appellee,

v.

No. 96-4897

GERALD D. STRONG,

Defendant-Appellant.

Appeal from the United States District Court

for the District of Maryland, at Baltimore.

Herbert N. Maletz, Senior Judge, sitting by designation.

(CR-96-91-DKC)

Submitted: September 30, 1997

Decided: November 17, 1997

Before LUTTIG and WILLIAMS, Circuit Judges, and

BUTZNER, Senior Circuit Judge.

_________________________________________________________________

Affirmed by unpublished per curiam opinion.

_________________________________________________________________

COUNSEL

Joseph J. Gigliotti, Fulton, Maryland, for Appellant. Loretta C.

Argrett, Assistant Attorney General, Robert E. Lindsay, Alan Hechtkopf, Gregory Victor Davis, UNITED STATES DEPARTMENT OF

JUSTICE, Washington, D.C., for Appellee.

_________________________________________________________________

Unpublished opinions are not binding precedent in this circuit. See

Local Rule 36(c).

_________________________________________________________________

OPINION

PER CURIAM:

Gerald D. Strong was convicted by a jury of willfully failing to file

income tax returns for 1989, 1990, and 1991, in violation of 26 U.S.C.

7203 (1994), and received a sentence of twelve months imprisonment. He was acquitted on three counts of tax evasion. Strong appeals

his conviction, arguing that the district court abused its discretion in

excluding testimony concerning a stroke he suffered in late August

1993 and in its response to a jury question about a tax "amnesty" program. He also contends that the district court clearly erred in denying

him an adjustment for acceptance of responsibility under U.S. Sentencing Guidelines Manual, 3E1.1 (1995). We affirm the conviction

and sentence.

Strong applied for extensions of time to file his tax returns for each

of the years in question, but each time falsely represented that he

owed no tax. The extensions were granted, giving Strong an extra

year to file each return. However, he never filed them. Internal Revenue Service Agent John Robertson testified at trial that he met with

Strong in June 1993 and advised him that he was the subject of a

criminal investigation. Subsequently, Strong completed his tax returns

for the years 1988, 1989, 1990, and 1991 and delivered them to Robertson. Under cross-examination by defense counsel, Robertson testified that Strong delivered the 1988 and 1989 returns in mid-August

1993 and delivered the 1990 and 1991 returns in October 1994. When

Strong's attorney asked why the 1990 and 1991 returns were delivered over a year later, the government objected. Defense counsel proffered that Strong had suffered a stroke and was unable to complete

the last two returns until he had sufficiently recovered. The government argued that the stroke was not relevant because it occurred well

after the crimes had been completed. The district court sustained the

government's objection.

2

The trial court's evidentiary decisions are reviewed for abuse of

discretion. See United States v. Hassan El, 5 F.3d 726, 731 (4th Cir.

1993). Evidence is relevant if it has "any tendency to make the existence of any fact that is of consequence to the determination of the

action more probable or less probable than it would be without the

evidence." Fed. R. Evid. 401. "Evidence which is not relevant is not

admissible." Fed. R. Evid. 402. Because Strong's 1993 stroke did not

make his willful failure to timely file tax returns for the years 198991 any more or less probable, it was irrelevant to the issue before the

jury. Consequently, the district court did not abuse its discretion in

excluding this evidence.

Strong maintained at trial that his failure to file was negligent

rather than willful. He testified that in 1992 or 1993 he read about an

"amnesty" program for delinquent filers and at that time decided to

complete and submit his tax returns. He said he was working on his

returns when Agent Robertson contacted him. Other than his testimony, there was no evidence of any amnesty program for delinquent

filers1 or that he had actually begun work on his returns when he was

first interviewed by Agent Robertson. During jury deliberations, the

jury sent out a note asking for more information about the "Amnesty

Period." The district court responded that the amnesty program

involved a matter of law and was not a matter of concern for the jury.2

When a jury makes clear that it is having difficulties, the trial court

should "clear them away with concrete accuracy." United States v.

Ellis, ___ F.3d ___, 1997 WL 438752, at *14 (4th Cir. Aug. 6, 1997)

(quoting Bollenbach v. United States, 326 U.S. 607 (1946)). At the

same time, "the court must be careful not to invade the jury's prov_________________________________________________________________

1 The government asserts on appeal that the IRS has a voluntary disclosure program which was publicized in 1992. The program does not provide immunity from prosecution, but the voluntary disclosure is a factor

which is taken into consideration, as a matter of internal IRS practice, in

deciding whether to recommend criminal prosecution.

2 The parties have not chosen to include this portion of the trial transcript in the joint appendix or supplemental appendix. Because they

appear to be in general agreement about the question and the court's

response, we have not resorted to the original transcript to resolve the

issue.

3

ince as fact finder." Ellis, 1997 WL 438752 at *14 (quoting United

States v. Blumberg, 961 F.2d 787, 790 (8th Cir. 1992)). Here,

although the government did not object to Strong's testimony about

the supposed "amnesty" program, the existence of such a program

was not relevant to the issue of his guilt or innocence because Strong

learned of it only after he completed the crime of failing to file his

tax returns in a timely fashion. The court thus properly instructed the

jury that it was not a matter for them to consider.

Last, Strong maintains that the district court clearly erred in finding

that an adjustment for acceptance of responsibility would be "totally

inappropriate." The court cited the commentary to guideline section

3E1.1, which provides that the adjustment is not intended to apply to

a defendant who goes to trial maintaining his factual innocence as

Strong did. See USSG 3E1.1, comment. (n.2). Strong argues that he

earned the adjustment by offering to enter into plea negotiations concerning the failure to file counts. He maintains that he did not plead

to those counts because of the government's intention to charge him

with tax evasion as well. In any event, Strong did go to trial asserting

his innocence on all counts. In this circumstance, we find that the district court did not clearly err in denying him the adjustment.

The sentence is therefore affirmed.3 We dispense with oral argument because the facts and legal contentions are adequately presented

in the materials before the court and argument would not aid the decisional process.

AFFIRMED

_________________________________________________________________

3 Strong's sentencing range was 12-18 months. The statutory maximum

for each of the three counts of conviction was 12 months. The district

court imposed a 12-month sentence in the belief that it could not impose

more. Had the court wished to impose a higher sentence, it had authority

under U.S.S.G. 5G1.2(d) to impose a consecutive sentence on one of

the counts to the extent necessary to produce a sentence of up to 18

months. However, the government has not claimed error in this regard.

4

Vous aimerez peut-être aussi

- U.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)D'EverandU.S. v. Sun Myung Moon 532 F.Supp. 1360 (1982)Pas encore d'évaluation

- United States v. Prince, 204 F.3d 1021, 10th Cir. (2000)Document6 pagesUnited States v. Prince, 204 F.3d 1021, 10th Cir. (2000)Scribd Government DocsPas encore d'évaluation

- United States v. Green, 4th Cir. (1996)Document4 pagesUnited States v. Green, 4th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument9 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. John J. Urbanek, 930 F.2d 1512, 10th Cir. (1991)Document6 pagesUnited States v. John J. Urbanek, 930 F.2d 1512, 10th Cir. (1991)Scribd Government DocsPas encore d'évaluation

- Eldon D. and Kathy A. Anthony v. United States, 987 F.2d 670, 10th Cir. (1993)Document7 pagesEldon D. and Kathy A. Anthony v. United States, 987 F.2d 670, 10th Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Jose Noesi, 4th Cir. (1999)Document5 pagesUnited States v. Jose Noesi, 4th Cir. (1999)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals Tenth Circuit: Patrick FisherDocument10 pagesPublish United States Court of Appeals Tenth Circuit: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Document3 pagesUnited States v. William M. Bottenfield, and Evelyn G. Bottenfield, Frankstown Land Development Company, Inc, 442 F.2d 1007, 3rd Cir. (1971)Scribd Government DocsPas encore d'évaluation

- United States v. Molak, 276 F.3d 45, 1st Cir. (2002)Document8 pagesUnited States v. Molak, 276 F.3d 45, 1st Cir. (2002)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument30 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- Gonzales v. United States, 97 F.3d 1464, 10th Cir. (1996)Document2 pagesGonzales v. United States, 97 F.3d 1464, 10th Cir. (1996)Scribd Government DocsPas encore d'évaluation

- United States v. Feldman, 83 F.3d 9, 1st Cir. (1996)Document10 pagesUnited States v. Feldman, 83 F.3d 9, 1st Cir. (1996)Scribd Government DocsPas encore d'évaluation

- United States v. Halliday, 665 F.3d 1219, 10th Cir. (2011)Document11 pagesUnited States v. Halliday, 665 F.3d 1219, 10th Cir. (2011)Scribd Government DocsPas encore d'évaluation

- United States v. Huguenin, 30 F.3d 127, 1st Cir. (1994)Document4 pagesUnited States v. Huguenin, 30 F.3d 127, 1st Cir. (1994)Scribd Government DocsPas encore d'évaluation

- United States v. Neale Misquitta, 3rd Cir. (2014)Document7 pagesUnited States v. Neale Misquitta, 3rd Cir. (2014)Scribd Government DocsPas encore d'évaluation

- Bruns v. CIR, 10th Cir. (2004)Document5 pagesBruns v. CIR, 10th Cir. (2004)Scribd Government DocsPas encore d'évaluation

- Filed: Patrick FisherDocument8 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States v. John Baird, 218 F.3d 221, 3rd Cir. (2000)Document13 pagesUnited States v. John Baird, 218 F.3d 221, 3rd Cir. (2000)Scribd Government DocsPas encore d'évaluation

- United States v. Gutierrez-Vasquez, 10th Cir. (2010)Document7 pagesUnited States v. Gutierrez-Vasquez, 10th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- United States v. Martinez, 10th Cir. (2008)Document6 pagesUnited States v. Martinez, 10th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- United States v. Felix-Santos, 50 F.3d 1, 1st Cir. (1995)Document4 pagesUnited States v. Felix-Santos, 50 F.3d 1, 1st Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. Debra L. Jones, 958 F.2d 520, 2d Cir. (1992)Document3 pagesUnited States v. Debra L. Jones, 958 F.2d 520, 2d Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Robert Carpenter v. United States, 101 F.3d 686, 2d Cir. (1996)Document5 pagesRobert Carpenter v. United States, 101 F.3d 686, 2d Cir. (1996)Scribd Government DocsPas encore d'évaluation

- Gerald B. Shreiber v. Robert A. Mastrogiovanni The Internal Revenue Service Gerald B. Shreiber, 214 F.3d 148, 3rd Cir. (2000)Document10 pagesGerald B. Shreiber v. Robert A. Mastrogiovanni The Internal Revenue Service Gerald B. Shreiber, 214 F.3d 148, 3rd Cir. (2000)Scribd Government DocsPas encore d'évaluation

- United States v. Clinton O. McMullin McMullin Family Trust, and Laura J. McMullin, 948 F.2d 1188, 10th Cir. (1991)Document6 pagesUnited States v. Clinton O. McMullin McMullin Family Trust, and Laura J. McMullin, 948 F.2d 1188, 10th Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States v. Olbres, 61 F.3d 967, 1st Cir. (1995)Document13 pagesUnited States v. Olbres, 61 F.3d 967, 1st Cir. (1995)Scribd Government DocsPas encore d'évaluation

- Diversified Metal Products The IRS Is Not A Government AgencyDocument9 pagesDiversified Metal Products The IRS Is Not A Government AgencyHorsetail GoatsfootPas encore d'évaluation

- United States v. Peter Collorafi, 876 F.2d 303, 2d Cir. (1989)Document5 pagesUnited States v. Peter Collorafi, 876 F.2d 303, 2d Cir. (1989)Scribd Government DocsPas encore d'évaluation

- United States v. Johnson, 4th Cir. (1998)Document6 pagesUnited States v. Johnson, 4th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- United States v. Joshua Alan Aven, 992 F.2d 1223, 10th Cir. (1993)Document5 pagesUnited States v. Joshua Alan Aven, 992 F.2d 1223, 10th Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Filed: Patrick FisherDocument15 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States v. Emery, 1st Cir. (1993)Document23 pagesUnited States v. Emery, 1st Cir. (1993)Scribd Government DocsPas encore d'évaluation

- United States v. Murphy-Cordero, 1st Cir. (2013)Document8 pagesUnited States v. Murphy-Cordero, 1st Cir. (2013)Scribd Government DocsPas encore d'évaluation

- United States v. Joseph G. Lease, 346 F.2d 696, 2d Cir. (1965)Document10 pagesUnited States v. Joseph G. Lease, 346 F.2d 696, 2d Cir. (1965)Scribd Government DocsPas encore d'évaluation

- United States v. Lutz, 4th Cir. (2006)Document7 pagesUnited States v. Lutz, 4th Cir. (2006)Scribd Government DocsPas encore d'évaluation

- United States v. Perretta, 1st Cir. (2015)Document10 pagesUnited States v. Perretta, 1st Cir. (2015)Scribd Government DocsPas encore d'évaluation

- United States v. William J. Johnson, 992 F.2d 1223, 10th Cir. (1993)Document3 pagesUnited States v. William J. Johnson, 992 F.2d 1223, 10th Cir. (1993)Scribd Government DocsPas encore d'évaluation

- Michael E. Bowles Lynn G. Bowles v. United States, 947 F.2d 91, 4th Cir. (1991)Document5 pagesMichael E. Bowles Lynn G. Bowles v. United States, 947 F.2d 91, 4th Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States v. David W. Goldston, 11th Cir. (2009)Document8 pagesUnited States v. David W. Goldston, 11th Cir. (2009)Scribd Government DocsPas encore d'évaluation

- United States v. Motsinger, 4th Cir. (1997)Document6 pagesUnited States v. Motsinger, 4th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- United States v. Santiago Gonzalez, 66 F.3d 3, 1st Cir. (1995)Document8 pagesUnited States v. Santiago Gonzalez, 66 F.3d 3, 1st Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. Gibbens, 25 F.3d 28, 1st Cir. (1994)Document13 pagesUnited States v. Gibbens, 25 F.3d 28, 1st Cir. (1994)Scribd Government DocsPas encore d'évaluation

- United States v. Gary M. Stuver, A/K/A Gary M. Stuven, 845 F.2d 73, 4th Cir. (1988)Document6 pagesUnited States v. Gary M. Stuver, A/K/A Gary M. Stuven, 845 F.2d 73, 4th Cir. (1988)Scribd Government DocsPas encore d'évaluation

- United States v. Smith, 500 F.3d 1206, 10th Cir. (2007)Document14 pagesUnited States v. Smith, 500 F.3d 1206, 10th Cir. (2007)Scribd Government DocsPas encore d'évaluation

- United States v. Norman Cooper, Doing Business As C & H Contracting Company, 70 F.3d 563, 10th Cir. (1995)Document8 pagesUnited States v. Norman Cooper, Doing Business As C & H Contracting Company, 70 F.3d 563, 10th Cir. (1995)Scribd Government DocsPas encore d'évaluation

- United States v. Logston, 10th Cir. (2008)Document4 pagesUnited States v. Logston, 10th Cir. (2008)Scribd Government DocsPas encore d'évaluation

- United States v. Gene O. Harpster, M.D., 951 F.2d 1261, 10th Cir. (1991)Document6 pagesUnited States v. Gene O. Harpster, M.D., 951 F.2d 1261, 10th Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States v. Grant, 4th Cir. (1997)Document4 pagesUnited States v. Grant, 4th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- United States v. Anthony Carmichael, 216 F.3d 224, 2d Cir. (2000)Document6 pagesUnited States v. Anthony Carmichael, 216 F.3d 224, 2d Cir. (2000)Scribd Government DocsPas encore d'évaluation

- United States v. Darius Pettway, SR., 11th Cir. (2010)Document5 pagesUnited States v. Darius Pettway, SR., 11th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- United States v. Aniles-Marquez, 10th Cir. (2013)Document5 pagesUnited States v. Aniles-Marquez, 10th Cir. (2013)Scribd Government DocsPas encore d'évaluation

- United States v. Sutton, 139 F.3d 913, 10th Cir. (1998)Document5 pagesUnited States v. Sutton, 139 F.3d 913, 10th Cir. (1998)Scribd Government DocsPas encore d'évaluation

- United States v. Solorio-Mondragon, 10th Cir. (2011)Document4 pagesUnited States v. Solorio-Mondragon, 10th Cir. (2011)Scribd Government DocsPas encore d'évaluation

- Benson v. United States, 120 F.3d 270, 10th Cir. (1997)Document4 pagesBenson v. United States, 120 F.3d 270, 10th Cir. (1997)Scribd Government DocsPas encore d'évaluation

- Not PrecedentialDocument5 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- United States Court of Appeals Tenth CircuitDocument8 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States v. Hubert Michaud, 928 F.2d 13, 1st Cir. (1991)Document6 pagesUnited States v. Hubert Michaud, 928 F.2d 13, 1st Cir. (1991)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Second CircuitDocument10 pagesUnited States Court of Appeals, Second CircuitScribd Government DocsPas encore d'évaluation

- United States v. Dozier, 444 F.3d 1215, 10th Cir. (2006)Document6 pagesUnited States v. Dozier, 444 F.3d 1215, 10th Cir. (2006)Scribd Government DocsPas encore d'évaluation

- United States v. Kieffer, 10th Cir. (2017)Document20 pagesUnited States v. Kieffer, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Olden, 10th Cir. (2017)Document4 pagesUnited States v. Olden, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Garcia-Damian, 10th Cir. (2017)Document9 pagesUnited States v. Garcia-Damian, 10th Cir. (2017)Scribd Government Docs100% (1)

- Consolidation Coal Company v. OWCP, 10th Cir. (2017)Document22 pagesConsolidation Coal Company v. OWCP, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coyle v. Jackson, 10th Cir. (2017)Document7 pagesCoyle v. Jackson, 10th Cir. (2017)Scribd Government Docs100% (1)

- Harte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Document100 pagesHarte v. Board Comm'rs Cnty of Johnson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Apodaca v. Raemisch, 10th Cir. (2017)Document15 pagesApodaca v. Raemisch, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Roberson, 10th Cir. (2017)Document50 pagesUnited States v. Roberson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument10 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- City of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Document21 pagesCity of Albuquerque v. Soto Enterprises, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Pecha v. Lake, 10th Cir. (2017)Document25 pagesPecha v. Lake, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument24 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- Pledger v. Russell, 10th Cir. (2017)Document5 pagesPledger v. Russell, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Henderson, 10th Cir. (2017)Document2 pagesUnited States v. Henderson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Voog, 10th Cir. (2017)Document5 pagesUnited States v. Voog, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument14 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government Docs100% (1)

- United States v. Kearn, 10th Cir. (2017)Document25 pagesUnited States v. Kearn, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Muhtorov, 10th Cir. (2017)Document15 pagesUnited States v. Muhtorov, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Windom, 10th Cir. (2017)Document25 pagesUnited States v. Windom, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- NM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Document9 pagesNM Off-Hwy Vehicle Alliance v. U.S. Forest Service, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document27 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Kundo, 10th Cir. (2017)Document7 pagesUnited States v. Kundo, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Magnan, 10th Cir. (2017)Document4 pagesUnited States v. Magnan, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Chevron Mining v. United States, 10th Cir. (2017)Document42 pagesChevron Mining v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Publish United States Court of Appeals For The Tenth CircuitDocument17 pagesPublish United States Court of Appeals For The Tenth CircuitScribd Government DocsPas encore d'évaluation

- Robles v. United States, 10th Cir. (2017)Document5 pagesRobles v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Northern New Mexicans v. United States, 10th Cir. (2017)Document10 pagesNorthern New Mexicans v. United States, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- United States v. Purify, 10th Cir. (2017)Document4 pagesUnited States v. Purify, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Jimenez v. Allbaugh, 10th Cir. (2017)Document5 pagesJimenez v. Allbaugh, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- Coburn v. Wilkinson, 10th Cir. (2017)Document9 pagesCoburn v. Wilkinson, 10th Cir. (2017)Scribd Government DocsPas encore d'évaluation

- IMO Online. AdvtDocument4 pagesIMO Online. AdvtIndiaresultPas encore d'évaluation

- 05 Solution 1Document18 pages05 Solution 1Mohar SinghPas encore d'évaluation

- Reference and RevisionDocument6 pagesReference and RevisionRohit kumar SharmaPas encore d'évaluation

- Sample Affidavit of Loss of A DiplomaDocument1 pageSample Affidavit of Loss of A DiplomaDina Pasion92% (13)

- Internship Report For Accounting Major - English VerDocument45 pagesInternship Report For Accounting Major - English VerDieu AnhPas encore d'évaluation

- Learning Module: Community Colleges of The PhilippinesDocument41 pagesLearning Module: Community Colleges of The PhilippinesGianina De LeonPas encore d'évaluation

- A Guide To: Commons in ResearchDocument7 pagesA Guide To: Commons in ResearchAna PaulaPas encore d'évaluation

- 00 Introduction ATR 72 600Document12 pages00 Introduction ATR 72 600destefani150% (2)

- Account Statement 010721 210122Document30 pagesAccount Statement 010721 210122PhanindraPas encore d'évaluation

- 2006 IBC Short ChecklistDocument1 page2006 IBC Short ChecklistBrandon VieceliPas encore d'évaluation

- Metode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumDocument24 pagesMetode Al-Qur'An Dalam Memaparkan Ayat-Ayat HukumAfrian F NovalPas encore d'évaluation

- Gmail - Bus Ticket - Sagar To Bhopal On Wed, 18 Dec 2019 and Rate Your ExperienceDocument3 pagesGmail - Bus Ticket - Sagar To Bhopal On Wed, 18 Dec 2019 and Rate Your ExperienceShivamSrivastavaPas encore d'évaluation

- Vehicle Lease Agreement TEMPLATEDocument5 pagesVehicle Lease Agreement TEMPLATEyassercarloman100% (1)

- PAS 19 (Revised) Employee BenefitsDocument35 pagesPAS 19 (Revised) Employee BenefitsReynaldPas encore d'évaluation

- Toan To Mau Addition Color by Number Ice CreamDocument2 pagesToan To Mau Addition Color by Number Ice CreamKelly阮泫妆Pas encore d'évaluation

- Republica Italiana Annual ReportDocument413 pagesRepublica Italiana Annual ReportVincenzo BrunoPas encore d'évaluation

- People's History of PakistanDocument291 pagesPeople's History of PakistanUmer adamPas encore d'évaluation

- Dawes and Homestead Act Webquest 2017Document4 pagesDawes and Homestead Act Webquest 2017api-262890296Pas encore d'évaluation

- Marijuana Prohibition FactsDocument5 pagesMarijuana Prohibition FactsMPPPas encore d'évaluation

- Model 9000: Use & Care GuideDocument12 pagesModel 9000: Use & Care GuidevicdiaPas encore d'évaluation

- Invoice: VAT No: IE6364992HDocument2 pagesInvoice: VAT No: IE6364992HRajPas encore d'évaluation

- Souper Bowl Student CaseDocument6 pagesSouper Bowl Student CaseRajabPas encore d'évaluation

- 2015-08-24 065059 4.blood RelationsDocument20 pages2015-08-24 065059 4.blood Relationsჯონ ფრაატეეკPas encore d'évaluation

- HarmanDocument10 pagesHarmanharman04Pas encore d'évaluation

- Sydeco Vs PeopleDocument2 pagesSydeco Vs PeopleJenu OrosPas encore d'évaluation

- Qcourt: 3republic of Tbe LlbilippinesDocument10 pagesQcourt: 3republic of Tbe LlbilippinesThe Supreme Court Public Information Office100% (1)

- LA Cream Air Freshener GelDocument1 pageLA Cream Air Freshener GelWellington SilvaPas encore d'évaluation

- Fares Alhammadi 10BB Death Penatly Argumentative EssayDocument7 pagesFares Alhammadi 10BB Death Penatly Argumentative EssayFares AlhammadiPas encore d'évaluation

- YehDocument3 pagesYehDeneree Joi EscotoPas encore d'évaluation

- Intermediate To Advance Electronics Troubleshooting (March 2023) IkADocument7 pagesIntermediate To Advance Electronics Troubleshooting (March 2023) IkAArenum MustafaPas encore d'évaluation

- The 7 Habits of Highly Effective People: The Infographics EditionD'EverandThe 7 Habits of Highly Effective People: The Infographics EditionÉvaluation : 4 sur 5 étoiles4/5 (2475)

- The Age of Magical Overthinking: Notes on Modern IrrationalityD'EverandThe Age of Magical Overthinking: Notes on Modern IrrationalityÉvaluation : 4 sur 5 étoiles4/5 (32)

- The Stoic Mindset: Living the Ten Principles of StoicismD'EverandThe Stoic Mindset: Living the Ten Principles of StoicismÉvaluation : 4.5 sur 5 étoiles4.5/5 (12)

- Love Life: How to Raise Your Standards, Find Your Person, and Live Happily (No Matter What)D'EverandLove Life: How to Raise Your Standards, Find Your Person, and Live Happily (No Matter What)Évaluation : 3 sur 5 étoiles3/5 (1)

- Power Moves: Ignite Your Confidence and Become a ForceD'EverandPower Moves: Ignite Your Confidence and Become a ForceÉvaluation : 5 sur 5 étoiles5/5 (1)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedD'EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedÉvaluation : 4.5 sur 5 étoiles4.5/5 (82)

- ADHD is Awesome: A Guide to (Mostly) Thriving with ADHDD'EverandADHD is Awesome: A Guide to (Mostly) Thriving with ADHDÉvaluation : 5 sur 5 étoiles5/5 (3)

- Maktub: An Inspirational Companion to The AlchemistD'EverandMaktub: An Inspirational Companion to The AlchemistÉvaluation : 5 sur 5 étoiles5/5 (4)

- Summary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearD'EverandSummary of Atomic Habits: An Easy and Proven Way to Build Good Habits and Break Bad Ones by James ClearÉvaluation : 4.5 sur 5 étoiles4.5/5 (560)

- LIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionD'EverandLIT: Life Ignition Tools: Use Nature's Playbook to Energize Your Brain, Spark Ideas, and Ignite ActionÉvaluation : 4 sur 5 étoiles4/5 (404)

- By the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsD'EverandBy the Time You Read This: The Space between Cheslie's Smile and Mental Illness—Her Story in Her Own WordsPas encore d'évaluation

- The Mountain is You: Transforming Self-Sabotage Into Self-MasteryD'EverandThe Mountain is You: Transforming Self-Sabotage Into Self-MasteryÉvaluation : 4.5 sur 5 étoiles4.5/5 (883)

- Master Your Emotions: Develop Emotional Intelligence and Discover the Essential Rules of When and How to Control Your FeelingsD'EverandMaster Your Emotions: Develop Emotional Intelligence and Discover the Essential Rules of When and How to Control Your FeelingsÉvaluation : 4.5 sur 5 étoiles4.5/5 (322)

- No Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelD'EverandNo Bad Parts: Healing Trauma and Restoring Wholeness with the Internal Family Systems ModelÉvaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesD'EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesÉvaluation : 5 sur 5 étoiles5/5 (1636)

- The Power of Now: A Guide to Spiritual EnlightenmentD'EverandThe Power of Now: A Guide to Spiritual EnlightenmentÉvaluation : 4.5 sur 5 étoiles4.5/5 (4125)

- Think This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeD'EverandThink This, Not That: 12 Mindshifts to Breakthrough Limiting Beliefs and Become Who You Were Born to BeÉvaluation : 2 sur 5 étoiles2/5 (1)

- Summary of Dan Martell's Buy Back Your TimeD'EverandSummary of Dan Martell's Buy Back Your TimeÉvaluation : 5 sur 5 étoiles5/5 (1)

- Breaking the Habit of Being YourselfD'EverandBreaking the Habit of Being YourselfÉvaluation : 4.5 sur 5 étoiles4.5/5 (1460)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessD'EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessPas encore d'évaluation

- Becoming Supernatural: How Common People Are Doing The UncommonD'EverandBecoming Supernatural: How Common People Are Doing The UncommonÉvaluation : 5 sur 5 étoiles5/5 (1484)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessD'EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessÉvaluation : 5 sur 5 étoiles5/5 (456)

- The Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsD'EverandThe Ritual Effect: From Habit to Ritual, Harness the Surprising Power of Everyday ActionsÉvaluation : 4 sur 5 étoiles4/5 (4)