Académique Documents

Professionnel Documents

Culture Documents

Scarboro Muffler CTR., Inc. v. State of Maine, CUMap-07-026 (Cumberland Super. CT., 2008)

Transféré par

Chris BuckDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Scarboro Muffler CTR., Inc. v. State of Maine, CUMap-07-026 (Cumberland Super. CT., 2008)

Transféré par

Chris BuckDroits d'auteur :

Formats disponibles

'. . . , .

STATE OF MAINE SUPERIOR COURT

CUMBERLAND, ss Civil Action

Docket No. AP-07-026

/I'"- -,

J

I ,

",

SCARBRORO MUFFLER CENTER, INC.,

Plaintiff / Petitioner

v. DECISION AND JUDGMENT

STATE OF MAINE, TAX ASSESSOR

Defendant / Respondent

I. BEFORE THE COURT

This matter comes before the court on the State Tax Assessor's motion for

summary judgment and the cross-motion for summary judgment by the petitioner,

Scarboro Muffler center, Inc.

II. PROCEDURAL HISTORY AND BACKGROUND

Scarboro Muffler Center, Inc. (SMC) brought this petition for a review of an

assessment for State of Maine use tax for the years 2003 to 2006 on a 2003 50th

Anniversary Limited Edition Chevrolet Corvette (the Vehicle).

SMC is an automobile repair center and automobile dealer in Scarborough,

Maine. SMC was and is currently licensed by the State to sell new or used vehicles.

In July 2003, SMC purchased the Corvette as a new vehicle from Pape Chevrolet

for $50,000. SMC paid no sales taxes on the transaction based on certification that the

Vehicle was being purchased for resale. When SMC purchased the Vehicle its odometer

reflected only 17 miles.

During the three years that SMC owned the Vehicle, the Vehicle was operated

with an affixed dealer plate. Although SMC's President, Randy P. Sargent's (Sargent),

did not display a "for sale" sign on the Vehicle, there was a used vehicle disclosure

notice on or in the Vehicle at all times. The Vehicle was kept at various locations,

including SMC's business location, Sargent's horne located approximately 3 1;2 miles

from SMC, and the garage of an acquaintance of Sargent, located in Scarborough,

Maine. Sargent sometimes drove the Vehicle to and from work, and on one occasion he

took the Vehicle to car show in Buxton, Maine.

In June 2006, SMC sold the Vehicle to James and Judi Czimbal for $41,500, after

having advertised the Vehicle's sale in the Portland Press Herald. 1 Prior to

consummating the sale, SMC permitted James Czimbal to test drive the Vehicle for

approximately ten miles. This was the one and only time that any person took the

Vehicle for a test drive. At the time of sale the Vehicle's odometer reflected 6,700 miles.

Following an audit of SMC's business records, the Assessor assessed use tax,

interest, and penalties on the Vehicle, corning to a total tax of $3,935.92 due. The

assessed tax was based on the Assessor's determination that SMC withdrew the Vehicle

from inventory for SMC's and Sargent's own use. SMC timely requested

reconsideration of the assessment, which upheld the assessment in full.

SMC timely appealed the Reconsideration Decision to this court. The Assessor

filed a motion for summary judgment and SMC filed a cross-motion for summary

judgment.

1 The petitioner produced no evidence for the record of the number of times, the period of time covered

or the nature or type of advertisements placed for the vehicle.

- - 2

III. DISCUSSION

A. SUMMARY JUDGMENT

1. Standard of Review

Title 36 M.R.S.A. § 151 governs judicial review of decisions by the Assessor and

"provides that the Superior Court 'shall conduct a de novo hearing and make a de novo

determination of the merits of the case.'" Foster v. State Tax Assessor, 1998 ME 205, P 7,

716 A.2d 1012, 1014; 36 M.R.S.A. § 151. Summary judgment, however, is proper where

there exist no genuine issues of material fact such that the moving party is entitled to

judgment as a matter of law. M.R. Civ. P. 56(c); see also Levine v. R.B.K. Caly Corp., 2001

ME 77, <]I 4, 770 A.2d 653, 655. A genuine issue is raised "when sufficient evidence

requires a fact-finder to choose between competing versions of the truth at trial."

Parrish v. Wright, 2003 ME 90, <]I 8, 828 A.2d 778, 781. A material fact is a fact that has

"the potential to affect the outcome of the suit." Burdzel v. Sobus, 2000 ME 84, <]I 6, 750

A.2d 573, 575. "If material facts are disputed, the dispute must be resolved through

fact-finding." Curtis v. Porter, 2001 ME 158, <]I 7, 784 A.2d 18, 22.

A party wishing to avoid summary judgment must present a prima facie case for

the claim or defense that is asserted. Reliance National Indemnity v. Knowles Industrial

Services, 2005 ME 29, <]I 9, 868 A.2d 220, 224-25. At this stage, the facts are reviewed "in

the light most favorable to the non-moving party." Lightfoot v. Sch. Admin. Dist. No. 35,

2003 ME 24, <]I 6, 816 A.2d 63, 65.

2. Sufficiency of the Evidence

A tax is imposed "on the storage, use or other consumption in this State of

tangible personal property or a service, the sale of which would be subject to tax under

section 1764 or 1811. 36 M.R.S. § 1861. When tangible personal property is withdrawn

from inventory by the retailer for the retailer's own use, use tax liability accrues as of

- - 3

the date of withdrawal. Id. Use is defined to include "the exercise in this State of any

right or power over tangible personal property incident to its ownership." 36 M.R.S. §

1752(21). The statute does not specify a minimum amount of use by the retailer that

will result in withdrawal of the property from inventory for resale. 36 M.R.S. § 1752(21);

36 M.R.S. § 1861; Maine Revenue Services Sales, Fuel & Special Tax Division

Instructional Bulletin No. 24 (Bulletin No. 24). The burden of proving that a transaction

was not taxable is on the person charged with the tax liability. 36 M.R.S. § 1763.

The Assessor published Bulletin No. 24, to provide guidance for vehicle dealers

about use tax liability on vehicles purchased for resale. Section 7(A) of Bulletin No. 24

provides that no tax is imposed on vehicles used by dealers for demonstration or

display purposes only. Section 7(£) further states that a seller who purchases "property

tax-free for resale, but subsequently withdraws the property from inventory for use

inconsistent with holding the property solely for demonstration and sale, becomes

liable for use tax on the cost of the property." The operation of a vehicle with dealer's

plates is "considered presumptive evidence of use for demonstration only." § 7(A).

The Assessor argues that the record is more than sufficient to rebut the

presumption that SMC used the Vehicle for demonstration purposes only. The

Assessor contends that in viewing all of the circumstances collectively, there are

numerous factors that support its finding that SMC removed the Vehicle from its

inventory for personal use; those factors include (1) the length of time SMC owned the

Vehicle; (2) the 6,700 miles SMC put on the Vehicle; (3) that Sargent was driving the

Vehicle for his own personal use; (4) that Sargent often stored the Vehicle outside of

SMC's business location; (5) that SMC only took the car to one car show during the

three years it had the Vehicle; (6) that SMC did not put a "for sale" sign on the Vehicle;

- - 4

and, that (7) the record fails to show any advertisement at any time that the Vehicle

was for sale.

SMC argues that the Assessor has failed to overcome the presumption, created

by § 7(A) of Bulletin No. 24, that the car was used for display and demonstration

purposes because of the affixed dealer plates. SMC contends that the Assessor relies on

alleged facts without any standard or context to explain why those alleged facts indicate

removal of a vehicle from inventory. According to SMC, Sargent was displaying the

Vehicle for sale when he drove it around town and at all times SMC owned the car it

was trying to sell it. SMC argues that it promoted the sale of the Vehicle by advertising

the Vehicle in the newspaper, displaying the Vehicle on its lot, and operating the

Vehicle around town and to Sargent's residence. SMC also took the Vehicle to a car

show and parked it with other vehicles that were being offered for sale. SMC further

contends that it only stored the Vehicle off its business premises because Sargent was

not comfortable leaving such a valuable part of SMC's inventory in its unattended lot.

Although SMC is correct in its assertion that the dealer plates created a

presumption in its favor, this presumption is rebuttable and not conclusive.

Presumptive evidence is defined as "prima facie evidence or evidence which is not

conclusive and admits of explanation or contradiction." BLACK'S LAW DICTIONARY 1186

(6th ed. 1990). The record reflects sufficient evidence to refute the initial presumption

that the Vehicle was used exclusively for demonstration purposes, and the Assessor's

decision was reasonable.

Because this matter is considered de novo, 36 M.R.S. § lSI, the court applies the

usual rules of summary judgment rather than examining whether the Assessor's

decision is supported by the record as in the case of a Rule 80C appeal without the

statutory prescription of a de novo hearing.

- - 5

Considering all of the evidence in the light most favorable to the petitioner, the

court concludes that there is no dispute as to material facts. The respondent is entitled

to summary judgment.

B. Waiver of the Assessor's Opposition

The Assessor filed its opposition to SMC's cross-motion for summary judgment

two days after the due date pursuant to M.R. Civ. P. 7(c)(2). SMC argues that the court

should rule on SMC's cross-motion as an unopposed motion because the Assessor's

opposition was not timely filed. SMC also contends that the court should not consider

the Assessor's response to SMC's Statement of Additional Material Facts and the

Assessor's Additional Statement of Material Facts.

Whether or not to consider the late response is discretionary with the court. It is

immaterial in this case because the court is granting the Assessor's motion and makes

the petitioner's motion moot.

IV. DECISION AND JUDGMENT

The clerk will make the following entries as the Decision and Judgment of the

court:

A. The plaintiff's Motion for Summary Judgment is denied.

B. The decision of the State tax assessor is affirmed.

C. The defendant's Motion for Summary Judgment is granted and

judgment is entered for defendant.

D. No costs are awarded.

SO ORDERED.

Dated: October 21, 2008

- - 6

Date Filed 05-08-07 CUMBERLAND Docket No. ---,A~P,-----,0!....!7_-..!=2",,6 _

County

Action 80C APPEAL

SCARBORO MUFFLER CENTER INC MAINE STATE TAX ASSESSOR

Ys.

Plaintiff's Attorney Defendant's Attorney

JOHN J WALL III ESQ KELLY L TURNER AAG

MONAGHAN LEAHY DEPARTMENT OF THE ATTORNEY GENERAL

PO BOX 7046 6 STATE HOUSE STATION

PORTLAND ME 04112-7046 AUGUSTA ME 04333-0006

(207) 774-3906

Date of

Entry

Vous aimerez peut-être aussi

- TownsendDocument10 pagesTownsendChris BuckPas encore d'évaluation

- SchulzDocument9 pagesSchulzChris BuckPas encore d'évaluation

- BallDocument6 pagesBallChris BuckPas encore d'évaluation

- JK S RealtyDocument12 pagesJK S RealtyChris BuckPas encore d'évaluation

- C C B J.D./M.B.A.: Hristopher - UckDocument2 pagesC C B J.D./M.B.A.: Hristopher - UckChris BuckPas encore d'évaluation

- BondDocument7 pagesBondChris BuckPas encore d'évaluation

- Claus OnDocument12 pagesClaus OnChris BuckPas encore d'évaluation

- NicholsonDocument4 pagesNicholsonChris BuckPas encore d'évaluation

- MoussaDocument19 pagesMoussaChris BuckPas encore d'évaluation

- HollenbeckDocument14 pagesHollenbeckChris BuckPas encore d'évaluation

- MarchandDocument9 pagesMarchandChris BuckPas encore d'évaluation

- Great American InsuranceDocument9 pagesGreat American InsuranceChris BuckPas encore d'évaluation

- Om Ear ADocument12 pagesOm Ear AChris BuckPas encore d'évaluation

- Philip MorrisDocument8 pagesPhilip MorrisChris BuckPas encore d'évaluation

- City ConcordDocument17 pagesCity ConcordChris BuckPas encore d'évaluation

- Al WardtDocument10 pagesAl WardtChris BuckPas encore d'évaluation

- DaviesDocument6 pagesDaviesChris BuckPas encore d'évaluation

- MooreDocument4 pagesMooreChris BuckPas encore d'évaluation

- Barking DogDocument7 pagesBarking DogChris BuckPas encore d'évaluation

- Reporter@courts - State.nh - Us: The Record Supports The Following FactsDocument6 pagesReporter@courts - State.nh - Us: The Record Supports The Following FactsChris BuckPas encore d'évaluation

- AtkinsonDocument8 pagesAtkinsonChris BuckPas encore d'évaluation

- Ba Kun Czy KDocument3 pagesBa Kun Czy KChris BuckPas encore d'évaluation

- Pha NeufDocument9 pagesPha NeufChris BuckPas encore d'évaluation

- FranchiDocument7 pagesFranchiChris BuckPas encore d'évaluation

- PoulinDocument5 pagesPoulinChris BuckPas encore d'évaluation

- Reporter@courts State NH UsDocument21 pagesReporter@courts State NH UsChris BuckPas encore d'évaluation

- JefferyDocument7 pagesJefferyChris BuckPas encore d'évaluation

- Boso Net ToDocument9 pagesBoso Net ToChris BuckPas encore d'évaluation

- Dil BoyDocument8 pagesDil BoyChris BuckPas encore d'évaluation

- Lebanon HangarDocument8 pagesLebanon HangarChris BuckPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Jyotsna G. Singh - Shakespeare and Postcolonial Theory (2019)Document265 pagesJyotsna G. Singh - Shakespeare and Postcolonial Theory (2019)luisaPas encore d'évaluation

- KodalyDocument11 pagesKodalySally Di Martino100% (3)

- Forum Discussion #7 UtilitarianismDocument3 pagesForum Discussion #7 UtilitarianismLisel SalibioPas encore d'évaluation

- Book Review "The TKT Course Clil Module"Document8 pagesBook Review "The TKT Course Clil Module"Alexander DeckerPas encore d'évaluation

- Nail DisordersDocument123 pagesNail DisordersyaraamadoPas encore d'évaluation

- THE PROTAGONIST OF LIFE OF GALILEO by Shreeya MalhotraDocument2 pagesTHE PROTAGONIST OF LIFE OF GALILEO by Shreeya MalhotraSHREEYA MALHOTRAPas encore d'évaluation

- Intensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsDocument278 pagesIntensive Care Fundamentals: František Duška Mo Al-Haddad Maurizio Cecconi EditorsthegridfanPas encore d'évaluation

- Frontpage: Don'T Befriend Brutal DictatorsDocument16 pagesFrontpage: Don'T Befriend Brutal DictatorsFrontPageAfricaPas encore d'évaluation

- 01.performing Hexadecimal ConversionsDocument11 pages01.performing Hexadecimal ConversionsasegunloluPas encore d'évaluation

- Gremath Set8-1Document48 pagesGremath Set8-1uzairmetallurgistPas encore d'évaluation

- Harry Potter and The Prisoner of Azkaban: Chapter 3-1 Owl PostDocument20 pagesHarry Potter and The Prisoner of Azkaban: Chapter 3-1 Owl PostodfasdPas encore d'évaluation

- FSU7533 Digital Marketing & Social Media Career Advancement Certification (Including Voucher) ETPDocument2 pagesFSU7533 Digital Marketing & Social Media Career Advancement Certification (Including Voucher) ETPcPas encore d'évaluation

- Eapp Las Q3 Week 1Document8 pagesEapp Las Q3 Week 1Maricel VallejosPas encore d'évaluation

- G.R. No. 178511 - Supreme Court of The PhilippinesDocument4 pagesG.R. No. 178511 - Supreme Court of The PhilippinesJackie Z. RaquelPas encore d'évaluation

- Yoder 2000Document12 pagesYoder 2000Ignacio VeraPas encore d'évaluation

- Constantin Floros, Kenneth Chalmers - New Ears For New Music-Peter Lang GMBH, Internationaler Verlag Der Wissenschaften (2014)Document242 pagesConstantin Floros, Kenneth Chalmers - New Ears For New Music-Peter Lang GMBH, Internationaler Verlag Der Wissenschaften (2014)paperocamillo100% (3)

- Rubrics On Video Analysis - 2022Document2 pagesRubrics On Video Analysis - 2022jovenil BacatanPas encore d'évaluation

- The Next Generation: DSD Rotary Screw CompressorsDocument2 pagesThe Next Generation: DSD Rotary Screw CompressorsВасилий ЗотовPas encore d'évaluation

- 9 - Report & NarrativeDocument1 page9 - Report & NarrativeTri WahyuningsihPas encore d'évaluation

- Swiggy Performance MetricsDocument8 pagesSwiggy Performance MetricsB Divyajit ReddyPas encore d'évaluation

- Class 10 Science Super 20 Sample PapersDocument85 pagesClass 10 Science Super 20 Sample PapersParas Tyagi100% (1)

- Simple Vocabulary Vs IELTS VocabularyDocument7 pagesSimple Vocabulary Vs IELTS VocabularyHarsh patelPas encore d'évaluation

- Prayer Points 7 Day Prayer Fasting PerfectionDocument4 pagesPrayer Points 7 Day Prayer Fasting PerfectionBenjamin Adelwini Bugri100% (6)

- Naskah IschialgiaDocument9 pagesNaskah IschialgiaPuspo Wardoyo100% (1)

- Narrative ReportDocument13 pagesNarrative ReportfrancePas encore d'évaluation

- Part DDocument6 pagesPart DKaranja KinyanjuiPas encore d'évaluation

- Halai Entu: Kohhrana Thuhril (Sermon) Chungchang - IiDocument4 pagesHalai Entu: Kohhrana Thuhril (Sermon) Chungchang - IiRollick LalnuntluangaPas encore d'évaluation

- Grammar Summary Unit 8Document2 pagesGrammar Summary Unit 8Luana Suarez AcostaPas encore d'évaluation

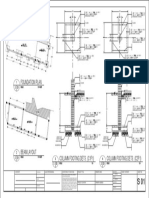

- Foundation Plan: Scale 1:100 MTSDocument1 pageFoundation Plan: Scale 1:100 MTSJayson Ayon MendozaPas encore d'évaluation

- 1404 1284 PDFDocument150 pages1404 1284 PDFJohannRoaPas encore d'évaluation