Académique Documents

Professionnel Documents

Culture Documents

Acc 01

Transféré par

NothingTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Acc 01

Transféré par

NothingDroits d'auteur :

Formats disponibles

10 1

PART IINTERMIDATE ACCOUNTING

Multiple Choice (42%):

1. According to the FASB conceptual framework, which of the following situations violates the

concept of reliability?

a. Data on segments having the same expected risks and growth rates are reported to analysts

estimating future profits.

b. Financial statements are issued nine months late.

c. Management reports to stockholders regularly refer to new projects undertaken, but the

financial statements never report project results.

d. Financial statements include property with a carrying amount increased to managements

estimate of market value.

2. Amar Farms produced 300,000 pounds of cotton during the 2001 season. Amar sells all of its

cotton to Brye Co., which has agreed to purchase Amars entire production at the prevailing

market price. Recent legislation assures that the market price will not fall below $.70 per pound

during the next two years. Amars costs of selling and distributing the cotton are immaterial and

can be reasonably estimated. Amar reports its inventory at expected exit value. During 2001,

Amar sold and delivered to Brye 200,000 pounds at the market price of $.70. Amar sold the

remaining 100,000 pounds during 2002 at the market price of $.72. What amount of revenue

should Amar recognize in 2001?

a. $140,000

b. $144,000

c. $210,000

d. $216,000

3. The first examination of Rudd Corp.s financial statements was made for the year ended

December 31, 2001. The auditor found that Rudd had purchased another company in January

1999 and had recorded goodwill of $100,000 in connection with this purchase. It was determined

that the goodwill had an estimated useful life of only five years because of obsolescence. No

amortization of goodwill had ever been recorded. For the December 31, 2001 financial

statements, Rudd should debit

Amortization expense

Retained earnings

a.

$0

$100,000

b.

$20,000

$ 40,000

c.

$33,333

$0

d.

$60,000

$0

Items 4 and 5 are based on the following:

10 2

During 2001, Orca Corp. decided to change from the FIFO method of inventory valuation to

the weighted-average method. Inventory balances under each method were as follows:

FIFO

Weighted-average

January 1, 2001

$71,000

$77,000

December 31, 2001

79,000

83,000

Orcas income tax rate is 30%.

4. In its 2001 financial statements, what amount should Orca report as the cumulative effect of this

accounting change?

a. $2,800

b. $4,000

c. $4,200

d. $6,000

5. Orca should report the cumulative effect of this accounting change as a(n)

a. prior period adjustment.

b. component of income from continuing operations.

c. extraordinary item.

d. component of income after extraordinary items.

Items 6 and 7 are based on the following:

A company buys ten shares of securities at $2,000 each on December 31, 1999. The securities

are classified as available for sale. The fair value of the securities increases to $2,500 on December

31, 2000, and to $2,750 on December 31, 2001. On December 31, 2001, the company sells the

securities. Assume no dividends are paid and that the company has a tax rate of 30%.

6. In 2001, what is the amount of the reclassification adjustment for other comprehensive income?

a. $7,500

b. ($7,500)

c. $5,250

d. ($5,250)

7. What is the amount of the holding gain arising during the period that is classified in other

comprehensive income for the period ending December 31, 2001?

a. 0

b. $7,500

c. $2,500

d. $1,750

8. Reporting inventory at the lower of cost or market is a departure from the accounting principle of

a. historical cost.

b. consistency.

c. conservatism.

d. full disclosure.

9. Brock Co. adopted the dollar-value LIFO inventory method as of January 1, 2000. A single

inventory pool and an internally computed price index are used to compute Brocks LIFO

inventory layers. Information about Brocks dollar-value inventory follows:

Inventory

At base

At current

At dollar

10 3

Date

year cost

year cost

value LIFO

1/1/00

$40,000

$40,000

$40,000

2000layer

5,000

14,000

6,000

12/31/00

$45,000

$54,000

$46,000

2001layer

15,000

26,000

?

12/31/01

$60,000

$80,000

?

What was Brocks dollar-value LIFO inventory at December 31, 2001?

a. $80,000

b. $74,000

c. $66,000

d.$60,000

Items 10 and 11 are based on the following:

During 2001, Pitt Corp. incurred costs to develop and produce a routine, low-risk computer

software product, as follows:

Completion of detailed program design

$13,000

Costs incurred for coding and testing to establish technological feasibility

10,000

Other coding costs after establishment of technological feasibility

24,000

Other testing cost after establishment of technological feasibility

20,000

Costs of producing product masters for training materials

15,000

Duplication of computer software and training materials from product

masters (1,000 units)

Packaging product (500 units)

25,000

9,000

10. In Pitts December 31, 2001 balance sheet, what amount should be reported in inventory?

a. $25,000

b. $34,000

c. $40,000

d.$49,000

11. In Pitts December 31, 2001 balance sheet, what amount should be capitalized as software cost,

subject to amortization?

a. $54,000

b. $57,000

c. $59,000

d. $69,000

Items 12 and 13 are based on the following:

On January 2, 2001, Emme Co. sold an equipment with a carrying amount of $480,000 in

exchange for a $600,000 noninterest-bearing note due January 2, 2004. There was no established

exchange price for the equipment. The prevailing rate of interest for a note of this type at January

2, 2001, was 10%. The present value of $1 at 10% for three periods is 0.75.

12. In Emmes 2001 income statement, what amount should be reported as interest income?

a. $9,000

b. $45,000

c. $50,000

d. $60,000

13. In Emmes 2001 income statement, what amount should be reported as gain(loss) on sale of

machinery?

10 4

a. ($30,000) loss.

c. $120,000 gain.

b. $ 30,000 gain.

d. $270,000 gain.

Items 14 and 15 are based on the following:

The following information pertains to the transfer of real estate pursuant to a trouble debt

restructuring by Knob Co. to Mene Corp. in full liquidation of Knobs liability to Mene:

Carrying amount of liability liquidated

$ 150,000

Carrying amount of real estate transferred

100,000

Fair value of real estate transferred

90,000

14. What amount should Knob report as a pretax extraordinary gain(loss) on restructuring of

payables?

a. ($10,000)

b. $0

c. $50,000

d. $60,000

15. What amount should Knob report as ordinary gain(loss) on transfer of real estate?

a. ($10,000)

b. $0

c. $50,000

d. $60,000

16. Which of the following differences would result in future taxable amounts?

a. Expenses or losses that are deductible after they are recognized in financial income.

b. Revenues or gains that are taxable before they are recognized in financial income.

c. Expenses or losses that are deductible before they are recognized in financial income.

d. Revenues or gains that are recognized in financial income but are never included in taxable

income.

17. In 1999, Fogg, Inc. issued $10 per value common stock for $25 per share. No other common

stock transactions occurred until March 31, 2001, when Fogg acquired some of the issued

shares for $20 per share and retired them. Which of the following statements correctly states an

effect of this acquisition and retirement?

a. 2001 net income is decreased.

b. 2001 net income is increased.

c. Additional paid-in capital is decreased.

d. Retained earnings is increased.

18. On June 30, 2000, Lomond, Inc. issued twenty $10,000, 7% bonds at par. Each bond was

convertible into 200 shares of common stock. On January 1, 2001, 10,000 shares of common

stock were outstanding. The bondholders converted all the bonds on July 1, 2001. The

following amounts were reported in Lomonds income statement for the year ended December

31, 2001:

Revenues

Operating expenses

Interest on bonds

$977,000

(920,000)

( 7,000)

Income before income tax

Income tax at 30%

Net income

10 5

$50,000

( 15,000)

$35,000

What is Lomonds 2001 diluted earnings per share?

a. $2.50

b. $2.85

c. $2.92

d. $3.50

Items 19 through 21 are based on the following:

Grant, Inc. acquired 30% of South Co.s voting stock for $200,000 on January 2, 2000.

Grants 30% interest in South gave Grant the ability to exercise significant influence over Souths

operating and financial policies. During 2000, South earned $80,000 and paid dividends of

$50,000. South reported earnings of $100,000 for the six months ended June 30, 2001, and

$200,000 for the year ended December 31, 2001. On July 1, 2001, Grant sold half of its stock in

South for $150,000 cash. South paid dividends of $60,000 on October 1, 2001.

19. Before income taxes, what amount should Grant include in its 2000 income statement as a result

of the investment?

a. $15,000

b. $24,000

c. $50,000

d. $80,000

20. In Grants December 31, 2000 balance sheet, what should be the carrying amount of this

investment?

a. $200,000

b. $209,000

c. $224,000

d. $230,000

21. In its 2001 income statement, what amount should Grant report as gain from the sale of half of

its investment?

a. $24,500

b. $30,500

c. $35,000

d. $45,500

Problem 1 (8%)

The following information pertains to Sparta Co.s defined benefit pension plan.

Discount rate

8%

Expected rate of return

10%

Average service life

12 years

At January 1, 2001:

Projected benefit obligation

$600,000

Fair value of pension plan assets 720,000

Unrecognized prior service cost 240,000

Unamortized prior pension gain

96,000

At December 31, 2001:

Projected benefit obligation

910,000

Fair value of pension plan assets 825,000

Service cost for 2001 was $90,000. There were no contributions made or benefits paid during

10 6

the year. Spartas unfounded accrued pension liability was $8,000 at January 1, 2001. Sparta uses

the straight-line method of amortization over 12 years, the average service life of the employees.

Required:

For items 1 through 4, calculate the amounts to be recognized as components of Spartas

unfounded accrued pension liability at December 31, 2001.

1. Interest cost.

2. Expected return on plan assets.

3. Actual return on plan assets.

4. Amortization of prior service costs.

Problem 2 (8%)

On January 2, 2001, Elsee Co. leased equipment from Grant, Inc. Lease payments are

$100,000, payable annually every December 31 for twenty years. Title to the equipment passes to

Elsee at the end of the lease term. The lease is noncancelable.

Additional facts

The equipment has a $750,000 carrying amount on Grants books. Its estimated economic life

was twenty-five years on January 2, 2001.

The rate implicit in the lease, which is known to Elsee, is 10%. Elsees incremental borrowing

rate is 12%.

Elsee uses the straight-line method of depreciation.

The rounded present value factors of an ordinary annuity for twenty years are as follow:

12%

7.5

10%

8.5

Required:

Prepare the necessary journal entries, without explanations, to be recorded by Elsee for

1. entering into the lease on January 2, 2001.

2. making the lease payment on December 31, 2001.

3. expenses related to the lease for the year ended December 31, 2001.

Show supporting calculations for all entries.

Problem 3 (12%)

Chester Company has the following contingencies:

A threat of expropriation exists for one of its manufacturing plants located in foreign country.

Expropriation is deemed to be reasonably possible. Any compensation from the foreign

government would be less than the carrying amount of the plant.

Potential costs exist due to the discovery of a safety hazard related to one of its products.

These costs are probable and can be reasonably estimated.

One of its warehouses located at the base of a mountain could no longer be insured against

10 7

rock slide losses. No rock slide losses have occurred.

Required:

1. How should Chester report the threat of expropriation of assets? Why?

2. How should Chester report the potential costs due to the safety hazard? Why?

3. How should Chester report the noninsurable rock slide risk? Why?

PART II: ADVANCED ACCOUNTING

Multiple choice: Please choose the best answer (each question 3 points, total 30 points)

1. A 70%-owned subsidiary company declares and pays a cash dividend. What effect does the

dividend have on the retained earnings and minority interest balances in the parent companys

consolidated balance sheet?

a. No effect on retained earnings and a decrease in minority interest.

b. No effect on either retained earnings or minority interest.

c. A decrease in retained earnings and no effect on minority interest.

d. Decreases in both retained earnings and minority interest.

2. APB Opinion No. 16, Business Combinations, contains conditions that must be met in order for

the pooling-of-interests method of accounting to be used. Which one of the following is not a

condition that must be met to use the pooling-of-interests method to record a business

combination?

a. No constituent company may have more than a 10% ownership of the outstanding voting

common stock of another constituent company.

b. No additional capital stock must be contingently issuable to former shareholders of a

combinee after a combination has been initiated.

c. A majority of the officers of the combinee company must also be officers in the combined

enterprise after the combination.

d. At least 90% of the combinees outstanding voting common stock must be exchanged for the

combinors majority voting common stock.

3. On January 1, 2001, Chenghua Co. issued 100,000 shares of its $10 par value common stock in

exhange for all of Taichung Inc.s outstanding stock. This buiness combination was accounted for

as a pooling of interests. The fair value of Chenghuas common stock on December 31, 2000 was

$19 per share. The carrying amounts and fair values of Taichungs assets and liabilities on

10 8

December 31, 2000 were as follows:

Cash

Receivables

Inventory

Property, plant and equipment

Liabilities

Net assets

Carrying Amount

$ 240,000

270,000

435,000

1,305,000

(525,000)

$1,725,000

Fair Value

$ 240,000

270,000

405,000

1,440,000

(525,000)

$1,830,000

What is the amount of goodwill resulting from the business combination?

a. $0

b. $70,000

c. $105,000

d. $175,000

4. Honda Co. had the following transactions with affiliated parties during 2001:

1) Sales of $50,000 to Ford, Inc., with $20,000 gross profit. Ford had $15,000 of this inventory

on hand at year-end. Honda owns a 15% interest in Ford and does not exert significant

influence.

2) Purchases of raw materials totaling $240,000 from Kent Corp., a wholly owned subsidiary.

Kents gross profit on the sale was $48,000. Honda had $60,000 of this inventory remaining

on December 31, 2001.

Before eliminating entries, Honda had consolidated current assets of $320,000. What amount

should Honda report in its December 31, 2001 consolidated balance sheet for current assets?

a. $302,000 b. $308,000 c. $314,000 d. $320,000

5. Paisa, Inc. owns 80% of Leo, Inc.s outstanding common stock. Leo, in turn, owns 10% of Paisas

outstanding common stock. What percentage of the common stock cash dividends declared by

the individual companies should be reported as dividends declared in the consolidated financial

statements?

a.

b.

c.

d.

Dividends Declared

By Paisa

90%

90%

100%

100%

Dividends Declared

by Leo

0%

20%

0%

20%

6. Which represents the proper journal entry for a periodic inventory system that should be made on

the books of the branch when goods that cost the home office $100,000 to manufacture are

shipped to the branch at a price of $125,000?

10 9

a.Shipments from home office

$100,000

Home office

$100,000

b.Shipments from home office

$125,000

Home office

$125,000

c.Shipments from home office

$125,000

Unrealized profit

$ 25,000

Hone office

100,000

d.Shipments to branch

$100,000

Unrealized profit

25,000

Shipments from home office

$125,000

7. Sharp Corp. had a realized foreign currency transaction loss of $15,000 for the year ended

December 31, 2001 and must also determine whether the following items will require year-end

adjustment:

1) Sharp had an $8,000 loss resulting from the translation of the accounts of its wholly owned

foreign subsidiary for the year ended December 31, 2001.

2) Sharp had an account payable to an unrelated foreign supplier payable in the suppliers local

currency. The U.S. dollar equivalent of the payable was $64,000 on the October 31, 2001

invoice date and $60,000 on December 31, 2001. The invoice is payable on January 30,

2002.

In Sharps 2001 consolidated income statement, what amount should be included as foreign

currency transaction loss?

a. $23,000

b. $19,000

c. $15,000

d. $11,000

8.George Company had net assets according to its books of $1 million on January 1, 2001. On the

same date, Bluce Company owned 9,000 of the 12,000 outstanding shares of Georges only class

of stock, and its investment in George Company account had a balance of $795,000. If, on

January 1, 2001, George repurchased 2,000 shares from Bluce for $200,000, the gain on the sale

of the stock recognized by Bluce was

a. $23,333

b. $10,000

c. $7,000

d. $3,000

9. Nissen Co.s planned combination with Toyota Co. on January 1, 2001 can be structured as either

a purchase or a pooling of intrests. In a purchase, Nissen would acquire Toyotas identifiable net

10 10

assets for less than their book values. These book values approximate fair values. Toyotas assets

consist of current assets and depreciable noncurrent assets. How would the combined entitys

2001 net income and operating cash flows under purchase accounting compare to those under

pooling-of-interests accounting? Ignore costs required to effect the combination and income tax

expense.

Purchase Accounting

Purchase Accounting

Net Income

Operating Cash Flows

a. Equal to pooling

Greater than pooling

b. Equal to pooling

Equal to pooling

c. Greater than pooling

Greater than pooling

d. Greater than pooling

Equal to pooling

10. A foreign subsidiarys functional currency is its local currency, which has not experienced

significant inflation. The weighted-average exchange rate for the current year is the appropriate

exchange rate for translating

Wages Expense

Sales to Customers

a.

No

No

b.

No

Yes

c.

Yes

Yes

d.

Yes

No

Vous aimerez peut-être aussi

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)D'EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Wiley - Practice Exam 3 With SolutionsDocument15 pagesWiley - Practice Exam 3 With SolutionsIvan BliminsePas encore d'évaluation

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)D'EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- Assignment # 4Document4 pagesAssignment # 4Butt ArhamPas encore d'évaluation

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)D'EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- 2024 Becker CPA Financial (FAR) Mock Exam QuestionsDocument19 pages2024 Becker CPA Financial (FAR) Mock Exam QuestionscraigsappletreePas encore d'évaluation

- Series 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)D'EverandSeries 65 Exam Practice Question Workbook: 700+ Comprehensive Practice Questions (2023 Edition)Pas encore d'évaluation

- Winter 2016 - ACC 1100 Sample FinalDocument16 pagesWinter 2016 - ACC 1100 Sample FinalCourtyPas encore d'évaluation

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020D'EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Pas encore d'évaluation

- Que 01 12Document13 pagesQue 01 12Cosovliu RamonaPas encore d'évaluation

- Using Economic Indicators to Improve Investment AnalysisD'EverandUsing Economic Indicators to Improve Investment AnalysisÉvaluation : 3.5 sur 5 étoiles3.5/5 (1)

- 207B 3rd Preboard ActivityDocument12 pages207B 3rd Preboard ActivityJERROLD EIRVIN PAYOPAYPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- ACCA F3-FFA LRP Revision Mock - Questions S15Document18 pagesACCA F3-FFA LRP Revision Mock - Questions S15Kiri chrisPas encore d'évaluation

- Make Money With Dividends Investing, With Less Risk And Higher ReturnsD'EverandMake Money With Dividends Investing, With Less Risk And Higher ReturnsPas encore d'évaluation

- ACCT101 Sample Paper - With SolutionDocument24 pagesACCT101 Sample Paper - With SolutionBryan Seow100% (1)

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)D'EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Évaluation : 5 sur 5 étoiles5/5 (1)

- CupDocument7 pagesCupJerauld BucolPas encore d'évaluation

- Private Debt: Yield, Safety and the Emergence of Alternative LendingD'EverandPrivate Debt: Yield, Safety and the Emergence of Alternative LendingPas encore d'évaluation

- f3 LSBF ExamDocument12 pagesf3 LSBF ExamIlam Acca Kotli AKPas encore d'évaluation

- CMA MCQ Self Entrance-1Document2 pagesCMA MCQ Self Entrance-1Ava DasPas encore d'évaluation

- Accounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsD'EverandAccounting for Real Estate Transactions: A Guide For Public Accountants and Corporate Financial ProfessionalsPas encore d'évaluation

- Cash Flow and InterpretationDocument9 pagesCash Flow and InterpretationPriya NairPas encore d'évaluation

- Asset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissanceD'EverandAsset Rotation: The Demise of Modern Portfolio Theory and the Birth of an Investment RenaissancePas encore d'évaluation

- J G S M: Sample Accounting Exemption Exam QuestionsDocument7 pagesJ G S M: Sample Accounting Exemption Exam QuestionsShiloh JinPas encore d'évaluation

- ACCT 5103 OL Sample Final ExamDocument7 pagesACCT 5103 OL Sample Final ExamEsther MpyisiPas encore d'évaluation

- Inventory & Bad DebtsDocument5 pagesInventory & Bad DebtsshahabPas encore d'évaluation

- Level 3 Accounting Update Text 2022Document105 pagesLevel 3 Accounting Update Text 2022KhinMgLwin100% (1)

- Wiley - Practice Exam 2 With SolutionsDocument11 pagesWiley - Practice Exam 2 With SolutionsIvan BliminsePas encore d'évaluation

- Financial Statements Types Presentation Limitations UsersDocument20 pagesFinancial Statements Types Presentation Limitations UsersGemma PalinaPas encore d'évaluation

- Worksheet For Financial Acc. IDocument5 pagesWorksheet For Financial Acc. IFantay100% (1)

- Financial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleDocument19 pagesFinancial Accounting (International) : Fundamentals Pilot Paper - Knowledge ModuleNguyen Thi Phuong ThuyPas encore d'évaluation

- Far Aicpa Questions 2020Document54 pagesFar Aicpa Questions 2020Jon100% (1)

- Assign. 2 Module 2Document9 pagesAssign. 2 Module 2Kristine VertucioPas encore d'évaluation

- Exam 1 8Document9 pagesExam 1 8Kenneth DelacruzPas encore d'évaluation

- Exam 1 5Document6 pagesExam 1 5Alex Schuldiner0% (1)

- Discontinued Operations Acctg. Test BankDocument12 pagesDiscontinued Operations Acctg. Test BankDalrymple CasballedoPas encore d'évaluation

- Bac 315Document11 pagesBac 315maisie lanePas encore d'évaluation

- Mcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Document14 pagesMcboard - 2Nd Year (191) and 3Rd Year (181) : Financial Accounting and Reporting (Board Exam Subject)Vonna TerriblePas encore d'évaluation

- Fsa 9QDocument23 pagesFsa 9Qpriyanshu.goel1710Pas encore d'évaluation

- Financial 2020 Aicpa Newly Released Mcqs and Sims: Registered To Ashley Callahan (#1047062)Document54 pagesFinancial 2020 Aicpa Newly Released Mcqs and Sims: Registered To Ashley Callahan (#1047062)Gift ChaliPas encore d'évaluation

- Fundamentals of Financial Accounting ACCDocument15 pagesFundamentals of Financial Accounting ACCjerald james montgomeryPas encore d'évaluation

- 3 Midterm A - AnswerDocument12 pages3 Midterm A - AnswerAllison0% (1)

- ACCT 3001 Exams 1 and 2 All QuestionsDocument7 pagesACCT 3001 Exams 1 and 2 All QuestionsRegine VegaPas encore d'évaluation

- Comprehensive ExamDocument37 pagesComprehensive ExamAngeline DionicioPas encore d'évaluation

- Preweek ReviewDocument31 pagesPreweek ReviewLeah Hope CedroPas encore d'évaluation

- Example Exam - QuestionsDocument10 pagesExample Exam - QuestionsBruxsoPas encore d'évaluation

- F3 CBE Mock ExamDocument21 pagesF3 CBE Mock ExamMaja Jareno GomezPas encore d'évaluation

- Identify The Choice That Best Completes The Statement or Answers The QuestionDocument5 pagesIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoPas encore d'évaluation

- CHRIST (Deemed To Be University), Bengaluru - 560 029: BIF431 - Page 1 of 9Document9 pagesCHRIST (Deemed To Be University), Bengaluru - 560 029: BIF431 - Page 1 of 9Arpit SharmaPas encore d'évaluation

- Ch9 12 6eDocument9 pagesCh9 12 6eAtif RehmanPas encore d'évaluation

- IFRS 15 Maths PDFDocument4 pagesIFRS 15 Maths PDFFeruz Sha RakinPas encore d'évaluation

- Workshop F2 May 2011Document18 pagesWorkshop F2 May 2011roukaiya_peerkhanPas encore d'évaluation

- 8919 - Consolidation Subsequent To The Date of AcquisitionDocument4 pages8919 - Consolidation Subsequent To The Date of AcquisitionFayehAmantilloBingcangPas encore d'évaluation

- Lesson 05B. Inter-Company Transactions - A.TDocument8 pagesLesson 05B. Inter-Company Transactions - A.THayes HarePas encore d'évaluation

- f9 Mock-ExamDocument15 pagesf9 Mock-ExamSarad KharelPas encore d'évaluation

- ACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFDocument19 pagesACC 109 - Intermediate Accounting 4 Mock PHINMA Exam 2S1920 PDFJenever Leo SerranoPas encore d'évaluation

- Advanced Accounting Baker Test Bank - Chap010Document67 pagesAdvanced Accounting Baker Test Bank - Chap010donkazotey50% (2)

- No 1Document6 pagesNo 1nguyễnthùy dươngPas encore d'évaluation

- Here Are Examples of BacteriaDocument2 pagesHere Are Examples of BacteriaNothingPas encore d'évaluation

- HazerDocument3 pagesHazerNothingPas encore d'évaluation

- DocxDocument12 pagesDocxNothingPas encore d'évaluation

- JackknifeDocument2 pagesJackknifeNothingPas encore d'évaluation

- Newt Pleurodelinae, Also Called Eft: Salamander Subfamily Salamandridae SemiaquaticDocument1 pageNewt Pleurodelinae, Also Called Eft: Salamander Subfamily Salamandridae SemiaquaticNothingPas encore d'évaluation

- Kristine MDocument1 pageKristine MNothingPas encore d'évaluation

- Aral PanDocument7 pagesAral PanNothingPas encore d'évaluation

- ASSIGNMENTDocument4 pagesASSIGNMENTNothingPas encore d'évaluation

- Main Article:: PeriodizationDocument5 pagesMain Article:: PeriodizationNothingPas encore d'évaluation

- Societies Have Long Been CriticizedDocument3 pagesSocieties Have Long Been CriticizedNothingPas encore d'évaluation

- EtymologyDocument3 pagesEtymologyNothingPas encore d'évaluation

- Main Articles: And: Intellectual History History of IdeasDocument6 pagesMain Articles: And: Intellectual History History of IdeasNothingPas encore d'évaluation

- Military HistoryDocument3 pagesMilitary HistoryNothingPas encore d'évaluation

- Historical MethodDocument3 pagesHistorical MethodNothingPas encore d'évaluation

- Technical DrawingDocument3 pagesTechnical DrawingNothingPas encore d'évaluation

- Meaning of HistoryDocument2 pagesMeaning of HistoryAravind RajPas encore d'évaluation

- Flat EarthDocument2 pagesFlat EarthNothingPas encore d'évaluation

- HistoriansDocument2 pagesHistoriansNothingPas encore d'évaluation

- Asthma BookmarkDocument1 pageAsthma BookmarkNothingPas encore d'évaluation

- History: Alexandre Saint-Yves D'alveydreDocument2 pagesHistory: Alexandre Saint-Yves D'alveydreNothingPas encore d'évaluation

- Work Can Be Defined As Transfer of Energy. in Physics We SayDocument2 pagesWork Can Be Defined As Transfer of Energy. in Physics We SayNothingPas encore d'évaluation

- Sketchup, Formerly Google Sketchup, Is ADocument1 pageSketchup, Formerly Google Sketchup, Is ANothingPas encore d'évaluation

- A Substance Containing...Document1 pageA Substance Containing...NothingPas encore d'évaluation

- Sam PhorDocument1 pageSam PhorNothingPas encore d'évaluation

- AnswerDocument1 pageAnswerNothingPas encore d'évaluation

- Jose RizalDocument2 pagesJose Rizalvern100% (1)

- AnswerDocument1 pageAnswerNothingPas encore d'évaluation

- BAGUVIXDocument4 pagesBAGUVIXNothingPas encore d'évaluation

- Personal Life, Relationships and VenturesDocument3 pagesPersonal Life, Relationships and VenturesNothingPas encore d'évaluation

- Read More at Protasio-Rizal-Mercado-Y-Alonso-2000.Php#Hgzsfwvllzxyoovi.99Document1 pageRead More at Protasio-Rizal-Mercado-Y-Alonso-2000.Php#Hgzsfwvllzxyoovi.99NothingPas encore d'évaluation

- Free Pattern Easy Animal CoasterDocument4 pagesFree Pattern Easy Animal CoasterAdrielly Otto100% (2)

- With Romulad Twardowski Prize: Warsaw 15 - 17 November 2019Document2 pagesWith Romulad Twardowski Prize: Warsaw 15 - 17 November 2019Eka KurniawanPas encore d'évaluation

- Omnibus CSC - 02232018 GUIDEDocument1 pageOmnibus CSC - 02232018 GUIDETegnap NehjPas encore d'évaluation

- ObiascoDocument6 pagesObiascoHoney BiPas encore d'évaluation

- Candidate Profile - Apprenticeship Training PortalDocument3 pagesCandidate Profile - Apprenticeship Training PortalTasmay EnterprisesPas encore d'évaluation

- Aditoriyama Land LawDocument28 pagesAditoriyama Land LawAditya Pratap SinghPas encore d'évaluation

- Ed2 Project Eklavya ApplicationForm August 2020Document23 pagesEd2 Project Eklavya ApplicationForm August 2020Shourya GargPas encore d'évaluation

- Vcs Floating-Ip - A10 CommunityDocument3 pagesVcs Floating-Ip - A10 Communitymoro2871990Pas encore d'évaluation

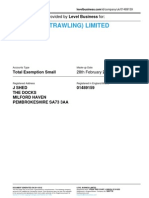

- RAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessDocument7 pagesRAWLINGS (TRAWLING) LIMITED - Company Accounts From Level BusinessLevel BusinessPas encore d'évaluation

- The Missing Children in Public Discourse On Child Sexual AbuseDocument8 pagesThe Missing Children in Public Discourse On Child Sexual AbuseJane Gilgun100% (1)

- Hugo Grotius and England - Hugh Trevor-RoperDocument43 pagesHugo Grotius and England - Hugh Trevor-RopermoltenpaperPas encore d'évaluation

- Nysc Call Up LetterDocument1 pageNysc Call Up LetterVickthor ST77% (13)

- Letter From SMEIA To British PMDocument4 pagesLetter From SMEIA To British PMpandersonpllcPas encore d'évaluation

- Edgar Cokaliong Shipping Lines vs. UCPB General InsuranceDocument6 pagesEdgar Cokaliong Shipping Lines vs. UCPB General InsuranceVincent BernardoPas encore d'évaluation

- Credit MonitoringDocument20 pagesCredit MonitoringMdramjanaliPas encore d'évaluation

- 016-7100-039-A - Raven RCM Installation Manual - Retrofit Conversion From AragDocument24 pages016-7100-039-A - Raven RCM Installation Manual - Retrofit Conversion From AragAlex RosaPas encore d'évaluation

- 48V DC - DC Converter - Mild Hybrid DC - DC Converter - EatonDocument3 pages48V DC - DC Converter - Mild Hybrid DC - DC Converter - EatonShubham KaklijPas encore d'évaluation

- 48 2 PDFDocument353 pages48 2 PDFGrowlerJoePas encore d'évaluation

- 1-CHINESE ZODIAC - RatDocument6 pages1-CHINESE ZODIAC - RatTere ChongPas encore d'évaluation

- Background Check and Consent Form For Amazon IndiaDocument3 pagesBackground Check and Consent Form For Amazon Indiaanamika vermaPas encore d'évaluation

- Sandra Revolut Statement 2023Document9 pagesSandra Revolut Statement 2023Sandra MillerPas encore d'évaluation

- Your Utilities Bill: Here's What You OweDocument3 pagesYour Utilities Bill: Here's What You OweShane CameronPas encore d'évaluation

- Australia - Prison Police State - Thanks Anthony AlbaneseDocument40 pagesAustralia - Prison Police State - Thanks Anthony AlbaneseLloyd T VancePas encore d'évaluation

- Delhi To BareliDocument3 pagesDelhi To BareliSanjeev SinghPas encore d'évaluation

- Trump Presidency 33 - May 5th, 2018 To May 14th, 2018Document513 pagesTrump Presidency 33 - May 5th, 2018 To May 14th, 2018FW040100% (1)

- Aik Minute Ka MadrasaDocument137 pagesAik Minute Ka MadrasaDostPas encore d'évaluation

- Ntf-Elcac Joint Memorandum CIRCULAR NO. 01, S. 2019Document24 pagesNtf-Elcac Joint Memorandum CIRCULAR NO. 01, S. 2019Jereille Gayaso100% (1)

- 6.1 Applications of Darcy's Law: Figure 6.1 Model For Radial Flow of Fluids To The WellboreDocument33 pages6.1 Applications of Darcy's Law: Figure 6.1 Model For Radial Flow of Fluids To The Wellborekhan.pakiPas encore d'évaluation

- A. Abstract: "Same-Sex Adoption Rights"Document12 pagesA. Abstract: "Same-Sex Adoption Rights"api-310703244Pas encore d'évaluation

- 8eeed194-a327-4f92-90a1-8ccc8dee52f0Document6 pages8eeed194-a327-4f92-90a1-8ccc8dee52f0Don RedbrookPas encore d'évaluation

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)D'EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindD'EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindÉvaluation : 5 sur 5 étoiles5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)D'EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Évaluation : 4.5 sur 5 étoiles4.5/5 (13)

- Getting to Yes: How to Negotiate Agreement Without Giving InD'EverandGetting to Yes: How to Negotiate Agreement Without Giving InÉvaluation : 4 sur 5 étoiles4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantD'EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantÉvaluation : 4.5 sur 5 étoiles4.5/5 (146)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceD'EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidencePas encore d'évaluation

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsD'EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsÉvaluation : 5 sur 5 étoiles5/5 (1)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyD'EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyÉvaluation : 4.5 sur 5 étoiles4.5/5 (37)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditD'EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditÉvaluation : 5 sur 5 étoiles5/5 (1)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyD'EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)D'EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Évaluation : 4 sur 5 étoiles4/5 (33)

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!D'EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Évaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeD'EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeÉvaluation : 4 sur 5 étoiles4/5 (21)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageD'EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageÉvaluation : 4.5 sur 5 étoiles4.5/5 (109)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)D'EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Évaluation : 4.5 sur 5 étoiles4.5/5 (24)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)D'EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Évaluation : 4.5 sur 5 étoiles4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionD'EverandFinancial Accounting For Dummies: 2nd EditionÉvaluation : 5 sur 5 étoiles5/5 (10)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetD'EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetPas encore d'évaluation

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelD'Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelPas encore d'évaluation

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineD'EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlinePas encore d'évaluation

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesD'EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesPas encore d'évaluation

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsD'EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsÉvaluation : 4.5 sur 5 étoiles4.5/5 (2)