Académique Documents

Professionnel Documents

Culture Documents

Updates On Financial Results For June 30, 2016 (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Updates On Financial Results For June 30, 2016 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

ffnmphor & ffiltisd Prndu*h.

t-hd

Corporate & Regd. Office : 133 Jehangir Building, 2nd Floor M.G.Road, Mumbai - 400 001 (Maharashtra)

Tel No. +91 224321 4000 Fax No, +91 224321 4099

Email . grievance@camphor-allied.com

CIN: L'l 7299GJ1 972P1C01 1 626

Date: 31" August, 2016

To

The Manager- Listing

BSE Limited,

Phiroze Jeejeebhoy'Iower, 1t' Floor

Dalal Street,

Mumbai - 400 001

Scrip ID: CAMPHOR

Scrip Code: 500078

Sub: Submission of Rectified Un-au$ited Finanqial Results fgr the Qu?rter ended lQth

June,2016

Dear Sir,

This is with reference to your e-mail dated 26th August,2016 whereby you have advised us to

Rectify the Unaudited Financial Results for the quarter ended 30th June 2016 by specifying

the denominations of the Financials and upload the same in the prescribed format through

BSE online portal.

In view of the same we hereby submit the Rectified Un-audited Financial Results along with

the Limited Review Report for the quarter ended June 2016 in pursuant to the provisions of

Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Kindly take the above 3rr r..ord.

Thanking you,

Yours faithfully,

For Camphor and Allied Products Limited

Company Secretary

& Compliance Officer

Factory : Plot No. 3,G|DC Ind. Estate, Nandesari, Vadodara-391 340

T:91 265 284}2il F:91 265 2840224

Factory : P.O. Clutterbuckganj, Dist. Bareilly (U.P.) 243 502.

T : 91 581 2561115 | 2561128 F : 9'1 581 2561112

www.camphor-allied.com

9001

tso

14001

oHsAs

180

CAMPHOR & ALLIED PRODUCTS LIMITED

Registered Office :-Plot No.3 GIDC lndustrial Estate, Nandesari

391340.

Dist. Vadodara, Gujarat

ctN L17299GJl 972PLC01 1 626

Financial Results for the

PART

ended 30th June, 2016.

(

in Lakhs Except

Shares Data)

Quarter Ended

>articu lars

Sr.No.

30.06.2016

31.03.2016

30.06.201 5

Un-audited

Audited

Un-audited

from Operations

llncome

la) Net Sales / Income from Operations (net of Excise duty)

ted

a ?7c ot

8537.01

QA 2A

31.08

94.45

8,816.28

9,409.99

8,631.46

35,309.46

5,608.75

5,792.24

ccJo.3/

348.11

649.1 6

99.84

21,634.53

837.42

2,840.25

1,547.36

941.88

3,265.35

lb) Other Operating Income

I

lTotal Income from Operations (Net)

31.03.2016

35,091.76

217.70

lExpenses

la) Cost of materials consumeo

lb) Change in Inventories of Finished goodsMork in Progress

lc) Power & Fuel

ld) Employee benefits expense

le) Depreciation & Amortization expense

lf) Other expenses

I

Total Expenses

/4 ?E eAl

424.29

283.50

t aY-zJ

361.81

YOY.ZJ

419.47

299.17

1,046.46

7,829.96

8,554.61

7,639.41

31,066.80

986.32

855.38

992.05

4,242.70

z.zo

4.51

202.97

678.99

ProfiU(Loss) from operations before other income, finance

cost and exceptional ltems (1-2)

Other

z.zJ

9.05

ProfiU (Loss) before finance cost & exceptional items (3+4)

988.58

859.89

994.34

4,251.75

Finance costs

ZZJ.VU

160.30

255.91

946.36

ProfiU (Loss) after finance cost & before exceptional items(s-

762.68

699.59

738.43

3,305.39

8.54

14.21

28.06

766.49

Exceptional ltems - Gain / (Loss) (MTM Reversal on Interest

Rate Swap Derivative)

ProfiU(Loss) Before Tax (7+8)

771.22

713.80

10

Tax Expense

tcc.Jv

297.61

11

Profit /(Loss) after Tax (9-{0)

515.83

416.19

12

Paid-up Equity Share Capital

(Face Value of tl 0 per share)

All ?7

513.37

12

Reserves excluding Revaluation Reserves as.per

balance sheet of previous accounting year

14

Earnings per Share (EPS)

- Basic & Diluted EPS Before Exceptional items ( t)

- Basic & Diluted EPS After Exceptional items ( t)

254.24

512.25

4.{

? 37

86.46

3,391.85

1,123.21

2,268.64

513.37

15,054.36

9.88

0.05

7.83

8.1

9.43

9.98

42.51

44.19

See accompanying notes to the financial results

Notes

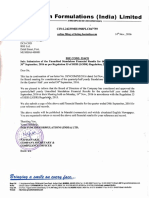

The above financial results have been taken on'record by the Audit Committee and subsequently approved by the Board of Directors

in its meeting held on 12th August, 20 16. The statutory auditors qf the company have carried out limited review of the above

flnancial results.

The Company is exclusively engaged in the business of manufacture of Fine Chemicals, which is considered to constitute onlv one

business segment and all its assets located in India.

TheBoardofDirectorsattheirmeetingheldon4thApril,20l6hasapprovedaScheme

pursuanttosections3glto3g4andother

relevant provisions of the Companies Act, 1 956 and such other applicable provisions of the Companies Act, 201 3 as may be notified

from time to time to amalgamate its holding company viz., Oriental Aromatics Limited, the-appointed date being .ist April, 2016.

Scheme has been approved by the Bombay Stock Exchange. Necessary accounting entries arising out of the Scheme will be passed

as and when shareholders and other approvals are obtained as also the approvals of Hon'ble High Court of Bombay.

a)The figures of quarter ended 3'lst March, 2016 are the balancing figures between audited figures in respect of the full financial year

and the published year to date figures upto the third quarter-of"the r.elavant financial year.

b)The Figures of the previous periods have been regrou-ped and reclassifled wherever necessary to make them comparable with the

figures for the current periods.

f-\$

i(uurrmrog'*

Place

Date

Mumbai

12-Aug-2016

Q';t:,'9

&co

6, Karim Chambers, 40, A. Doshi Marg' (Hamam Street),

Mumbai 400 001 INDIA

Telephone : OAil-22-2269 1414i 2269 1515

aa91-22-4A02 1140 I 4002 1414

0091-22-2261 9983

Fax

Chartered Accountants

LODHA

mumbai@lodhaco.com

To,

The Board of Directors

CAMPHOR & ALLIED PRODUCTS LIMITED

Wehavereviewedtheaccompanyingstatementofunaudiiedstanda|onefinancialresu|tsof

the qr"rarter ended 30th June, 2016' This

cAMpHoR & ALLIED pRoDUcTS LtfvltTED for

the

management and has been approved by

statement is the responsibility of the company's

on

u ,"potion these financial statements based

of Directors. Our responsibility is to Lsue

Board

our review.

WeconductedourreviewinaccordancewiththeStandardonReviewEngagement(SRE)2410'

..R'eviewof|nterimFinancial|nformationPerformedbythelndependentAuditoroftheEntity,'

plan and

of lndia' This standard requires that we

issued by the lnstituie of chartered Accountants

free

as to whether the financial statements are

perform the review to obtain moderate assurance

and

personnel

primarily to inquiries of cornpany

of materiar misstatement. A review is rimited

we

and.thulnrov]le less assurance than an audit'

analytical procedures applied to financiai data

we do not express an audit opinion'

have not performed an audit and accordingly,

us to

nothing has-come to our attention that causes

Based on our review, conducted as above,

financiar resurts prepared in accordance

that the accompanying statement of unaudited

berieve

withtheapp|icableAccountingstandardsundersectionl33oftheCompaniesAct,20l3read

and other recognized accounting

with Rule 7 of the qompanies (Accounts) Rules, 3AM

of

the information required to be disclosed in terms

practicesand policie-s fi"*lr* disclosed

Dj,tt1u.:ure Requirements) Regulations' 2015

Regulation gsot tne sEBl (Listing obligation "y

or that it contains any materiar misstatement'

incruding the manner in which it is to be lisctosed,

For Lodha and Co.

Chartered Accountants

Firm Registration No. 301 05{ E

Mumbai

12thAugust,20{6

_;:

- ':r

,:-:-

,.;'.."1;l:-"

';*.'

::{'{\'\

{

..a,..\:-.

t

.

!,. li

'\-rj

i:

,' , .. lrt'- . : :..'

,

'l

/' ji::! t;

'\

r ..

1,.

ir't

..

:j

,.

-,-'

.i.):.-/

fc,,

i,:it)..' :.., .-rrij

"'

:jr

Partner

MembershiP No.44{01

Vous aimerez peut-être aussi

- Pre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesDocument2 pagesPre104: Auditing and Assurance: Specialized Industries 1. Overview of Auditing in Specialized IndustriesCristina ElizaldePas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- SOP - HOtel Credit Policy and PRoceduresDocument4 pagesSOP - HOtel Credit Policy and PRoceduresImee S. YuPas encore d'évaluation

- Expansion and Financial RestructuringDocument50 pagesExpansion and Financial Restructuringvikasgaur86100% (5)

- Financial Management at Maruti SuzukiDocument77 pagesFinancial Management at Maruti Suzukimanu100% (1)

- Financial Management Question Bank 2019 PDFDocument384 pagesFinancial Management Question Bank 2019 PDFtsere butserePas encore d'évaluation

- Management Accounting Chapter 9Document57 pagesManagement Accounting Chapter 9Shaili SharmaPas encore d'évaluation

- Problems On Cash Flow StatementsDocument12 pagesProblems On Cash Flow Statementsdevvratrajgopal73% (11)

- Nifty Doctor Simple SystemDocument5 pagesNifty Doctor Simple SystemPratik ChhedaPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- Implementing a Balanced Scorecard for Strategic Performance MeasurementDocument11 pagesImplementing a Balanced Scorecard for Strategic Performance MeasurementMarvin CorpinPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document3 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Revised Financial Results For June 30, 2016 (Result)Document4 pagesRevised Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document10 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document11 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Buku Teks David L.Debertin-293-304Document12 pagesBuku Teks David L.Debertin-293-304Fla FiscaPas encore d'évaluation

- Supervisory Management - Planning and ControlDocument9 pagesSupervisory Management - Planning and ControlArilesere SodeeqPas encore d'évaluation

- Jun 2003 - AnsDocument15 pagesJun 2003 - AnsHubbak KhanPas encore d'évaluation

- From press-to-ATM - How Money Travels - The Indian ExpressDocument14 pagesFrom press-to-ATM - How Money Travels - The Indian ExpressImad ImadPas encore d'évaluation

- Audit Cash Investments TitleDocument7 pagesAudit Cash Investments TitleIulia BurtoiuPas encore d'évaluation

- Annual ReportDocument36 pagesAnnual Reporttcwalling2Pas encore d'évaluation

- SMA - Role ProfileDocument5 pagesSMA - Role ProfilePrakriti GuptaPas encore d'évaluation

- Final Exam Spr2011Document5 pagesFinal Exam Spr2011Austin Holmes50% (4)

- Act1110 Quiz No. 1 Legal Structures QuestionnaireDocument9 pagesAct1110 Quiz No. 1 Legal Structures QuestionnaireKhloe Nicole AquinoPas encore d'évaluation

- Short-Term Financing: After Studying This Chapter, You Will Be Able ToDocument13 pagesShort-Term Financing: After Studying This Chapter, You Will Be Able ToMohammad Salim HossainPas encore d'évaluation

- For A New Coffe 2 6Document2 pagesFor A New Coffe 2 6Chanyn PajamutanPas encore d'évaluation

- Sukuk Al-SalamDocument5 pagesSukuk Al-SalamHasan Ali BokhariPas encore d'évaluation

- 19 KPIsDocument54 pages19 KPIsNadia QuraishiPas encore d'évaluation

- KKD Major ProjectDocument22 pagesKKD Major Projectvivek1119Pas encore d'évaluation

- Comparative Analysis of D-Mart and Big BazaarDocument50 pagesComparative Analysis of D-Mart and Big BazaarBhamini AgrawalPas encore d'évaluation

- Week 7 Class Exercises (Answers)Document4 pagesWeek 7 Class Exercises (Answers)Chinhoong OngPas encore d'évaluation

- As Discussed in Phone Call Please Find Below Details For Job Fair and Profile. Urgent Action RequiredDocument3 pagesAs Discussed in Phone Call Please Find Below Details For Job Fair and Profile. Urgent Action RequiredPradeep KumbharePas encore d'évaluation

- Major Parts in A Business Plan - Home WorkDocument3 pagesMajor Parts in A Business Plan - Home Workأنجز للخدمات الطلابيةPas encore d'évaluation

- Intermediate Accounting 1 Module - The Accounting ProcessDocument16 pagesIntermediate Accounting 1 Module - The Accounting ProcessRose RaboPas encore d'évaluation

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDocument19 pagesTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatPas encore d'évaluation

- Afonso 2012Document33 pagesAfonso 2012Nicolas CopernicPas encore d'évaluation