Académique Documents

Professionnel Documents

Culture Documents

Trading The TUT Spread-CME

Transféré par

JaphyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Trading The TUT Spread-CME

Transféré par

JaphyDroits d'auteur :

Formats disponibles

interest rate products

Trading the TUT Spread: Capitalizing on

Changes in the Yield Curve

Spreading 2-Year and 10-Year U.S. Treasury futures helps you

capture your outlook on the U.S. Treasury yield curve.

U.S. Treasury futures provide cost-effective If you expect the steepening to continue, On December 31, the 2-Year T-Note futures

and efficient means of capitalizing on you can capitalize on this outlook by buying contract was trading at 105-04 and had a DV01

anticipated changes in the shape of the yield the yield curve using 2-Year and 10-Year of $38.77. This indicates that a 1 bp shift in

curve. For example, recent upheaval in the T-Note futures. Note that with a futures the yield of the underlying Treasury note will

slope of the Treasury yield curve suggests there strategy of this kind, you buy or sell the move the price of one 2-Year T-Note futures

may be opportunities to trade the 10-Year yield curve in terms of what you do with the contract $38.77 in the opposite direction.

under 2-Year (TUT) spread, using 2-Year and shorter maturity futures contract. Thus, if (Note that the 2-Year T-Note contract has

10-Year Treasury Note futures contracts. you anticipate a steeper yield curve (i.e., a $200,000 notional value, whereas other

widening yield spread), then you would buy Treasury futures, including the flagship

The Current Market Context

the curve by buying 2-Year T-Note futures and 10-Year T-Note contract, have $100,000

The 2-year to 10-year segment of the

selling 10-Year T-Note futures. Conversely, if notional value.) The 10-Year T-Note futures

on-the-run U.S. Treasury yield curve has

you expect the yield curve to flatten (i.e., a contract was trading at 113-12+ and had a

steepened sharply. From December 31, 2007

narrowing yield spread), you would sell the DV01 of $68.61. A 1 bp shift in the yield of the

to February 15, 2008 the spread between the

curve by selling 2-Year T-Note futures and underlying Treasury note will move the price

cheapest-to-deliver (CTD) 2-Year and 10-Year

buying 10-Year T-Note futures. of one 10-Year T-Note contract $68.61 in the

notes widened by nearly 70 basis points. (The

opposite direction.

CTD and its impact on the TUT spread is Structuring a TUT Spread

discussed later in this paper.) With a properly constructed TUT spread, gains You can determine the appropriate ratio for this

or losses on the spread should be the result strategy by dividing the 10-Year T-Note futures

In early 2008, with the Fed expressing

of changes in the yield curve as opposed to DV01 by the 2-Year T-Note futures DV01. In

determination to continue lowering its fed

changes in the direction of interest rates. To this case, $68.61/38.77 = 1.77 contracts. That

funds target rate for the foreseeable future,

filter out this directional effect, you can ratio is, for every 100 10-Year T-Note contracts sold,

and with the U.S. Federal deficit seeming to

a yield curve spread using the dollar value of a you must buy 177 2-Year T-Note contracts to

grow with each new report, some analysts

basis point (DV01) for each contract to assure establish a DV01-neutral spread position.

have been calling for continued yield curve

that each leg will respond equally, in dollar

steepening.

terms, to a given yield change.

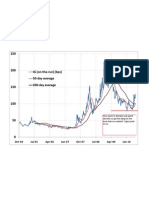

Possible Spread Results

This kind of ratioed spread should produce essentially no result if both Assume you had bought the TUT on December 31 in this 177-100

yields change by the same amount. It should produce a significant gain ratio. Note that the minus sign in the “Number of Contracts” column

only if the yield curve steepens, as it did during the December 31 to indicates the short leg of the spread. The table shows that from

February 15 interval. The following chart shows how the spread would December 31 to February 15, the TUT steepening would have generated

have performed. $408,844. (This does not take into account transaction costs.)

The TUT Steepens

Underlying Contract December 31 February 15 Change Change ($) Number of Result

Price Price (32nds) Contracts (nearest $)

2-Year T-Note Futures 105-04 107-04+ 64.5 $4,031.25 177 $713,531

10-Year T-Note Futures 113-12+ 116-14 97.5 $3,046.87 -100 ($304,687)=

Net Result $408,844

Impact of the CTD Cost-Effective and Efficient

This kind of spread should generate a positive result any time the yield Trading TUT spreads is a practical way to take a position on your

curve changes in keeping with your forecast; however, this trade is forecast of changes in the shape of the yield curve. Again, this spread

speculative and will generate a loss if the spread narrows. will generate essentially no result in the case of a parallel yield curve

shift. Furthermore, because TUT spreads implemented with U.S.

One factor that can affect spread trade performance is a change in the

Treasury futures receive margin credits, this kind of trade can be a

CTD. Each Treasury futures contract tracks the CTD issue, which may

low-cost means to capitalize on your yield curve outlook. For example,

or may not be the on-the-run cash Treasury security. In other words,

based on exchange margins as of March 1, 2008, a TUT spread initiated

changes in the steepness of the cash curve may not correspond on a

at a ratio of five 10-Year T-Note futures to eight 2-Year T-Note futures

one-to-one basis with changes in the futures. During the seven weeks

would be eligible for a spread credit of 80 percent.

of this example, the CTD did not change for either the 2-Year T-Note or

the 10-Year T-Note. Moreover, because these two key benchmark products are now listed on

CME Globex, you have virtually 24 hour access to initiate, reverse, or

adjust your position.

For more information on trading CME Group Interest Rate products, please visit www.cmegroup.com,

or contact the Interest Rate Products Team at 866 501 3646 or interestrates@cmegroup.com.

CME Group headquarters CME Group global offices

20 South Wacker Drive Chicago Hong Kong London

Chicago, Illinois 60606 312 930 1000 852 3101 7696 44 20 7796 7100

cmegroup.com info@cmegroup.com asiateam@cmegroup.com europe@cmegroup.com

Sydney Tokyo Washington D.C.

61 2 9231 7475 81 3 5403 4828 312 930 1000

asiateam@cmegroup.com asiateam@cmegroup.com info@cmegroup.com

Futures trading is not suitable for all investors, and involves the risk of loss. Futures are a leveraged investment, and because only a percentage of a contract’s value is required to trade, it is possible to lose more than the amount of money

deposited for a futures position. Therefore, traders should only use funds that they can afford to lose without affecting their lifestyles. And only a portion of those funds should be devoted to any one trade because they cannot expect to

profit on every trade.

The information within this brochure has been compiled by CME Group for general purposes only. CME Group assumes no responsibility for any errors or omissions. Although every attempt has been made to ensure the accuracy of the

information within this brochure, CME Group assumes no responsibility for any errors or omissions. Additionally, all examples in this brochure are hypothetical situations, used for explanation purposes only, and should not be considered

investment advice or the results of actual market experience.

The Globe logo, CME Group® and Globex® are trademarks of Chicago Mercantile Exchange Inc.

© 2008 CME Group Inc. All rights reserved.

IR166/0/0308

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Banks Use of Credit Derivatives and Pricing LoansDocument31 pagesBanks Use of Credit Derivatives and Pricing LoansJaphyPas encore d'évaluation

- Two Models of Land Overvaluation and Their Implications: October 2010Document33 pagesTwo Models of Land Overvaluation and Their Implications: October 2010JaphyPas encore d'évaluation

- Coupon Destruction Dec 2010 - FinalDocument40 pagesCoupon Destruction Dec 2010 - FinalJaphyPas encore d'évaluation

- Wang - Quantitative Tactical Asset AllocationDocument26 pagesWang - Quantitative Tactical Asset AllocationJaphyPas encore d'évaluation

- WEF Consumption Dilemma Sustainable Growth Report 2011Document64 pagesWEF Consumption Dilemma Sustainable Growth Report 2011JaphyPas encore d'évaluation

- SSRN-Id1629688 Interest Rate Modeling With Multiple Yield CurvesDocument27 pagesSSRN-Id1629688 Interest Rate Modeling With Multiple Yield CurvesJaphyPas encore d'évaluation

- SSRN-Id1520618 Fujii Shimada TakahashiDocument25 pagesSSRN-Id1520618 Fujii Shimada TakahashiJaphyPas encore d'évaluation

- Natixis ECB ReportDocument4 pagesNatixis ECB ReportJaphyPas encore d'évaluation

- ICMA Euro Repo Survey - 2Q10Document38 pagesICMA Euro Repo Survey - 2Q10JaphyPas encore d'évaluation

- Rehypothecation in The Shadow Banking SystemDocument16 pagesRehypothecation in The Shadow Banking SystemJaphy100% (1)

- Seven Faces of Peril Final Jul28Document24 pagesSeven Faces of Peril Final Jul28Douglas FunkPas encore d'évaluation

- Hist Panel EURIBOR Jul 2010Document12 pagesHist Panel EURIBOR Jul 2010JaphyPas encore d'évaluation

- MCE of LogNorm Int Rate Models - SchloglDocument14 pagesMCE of LogNorm Int Rate Models - SchloglJaphyPas encore d'évaluation

- Hist Panel EURIBOR Jun 2010Document19 pagesHist Panel EURIBOR Jun 2010JaphyPas encore d'évaluation

- Fitch - Spanish Banks Stress TestsDocument7 pagesFitch - Spanish Banks Stress TestsJaphyPas encore d'évaluation

- Lecture11 Duration MismatchDocument5 pagesLecture11 Duration MismatchJaphyPas encore d'évaluation

- Rajan and Bird - Maturity MismatchesDocument10 pagesRajan and Bird - Maturity MismatchesJaphyPas encore d'évaluation

- An Embellished IG MA ChartDocument1 pageAn Embellished IG MA ChartJaphyPas encore d'évaluation

- Thoughts About FTPDocument10 pagesThoughts About FTPJaphyPas encore d'évaluation

- BBA LIBOR Strengthening PaperDocument15 pagesBBA LIBOR Strengthening PaperJaphyPas encore d'évaluation

- Keen Are We It Yet Paper FinalDocument54 pagesKeen Are We It Yet Paper FinalJaphy100% (2)

- US CMBS Loss Study - 2009Document11 pagesUS CMBS Loss Study - 2009JaphyPas encore d'évaluation

- Financial Stability Review Summary 201006enDocument6 pagesFinancial Stability Review Summary 201006enJaphyPas encore d'évaluation

- Pce-Monthly Ccaroc (Sa)Document1 pagePce-Monthly Ccaroc (Sa)JaphyPas encore d'évaluation

- Cpi-Monthly Ccaroc (Sa)Document1 pageCpi-Monthly Ccaroc (Sa)JaphyPas encore d'évaluation

- 2010 0602 FroebaDocument19 pages2010 0602 FroebaJaphyPas encore d'évaluation

- 10 YrDocument1 page10 Yrapi-25887578Pas encore d'évaluation

- GDP Velocity MZM 5-30-10Document2 pagesGDP Velocity MZM 5-30-10JaphyPas encore d'évaluation

- 10 YrDocument1 page10 Yrapi-25887578Pas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Solution Homework 5Document5 pagesSolution Homework 5AtiaTahira100% (1)

- Lehman Futures ModelDocument12 pagesLehman Futures ModelzdfgbsfdzcgbvdfcPas encore d'évaluation

- Financial Institutions Management - Chap024Document20 pagesFinancial Institutions Management - Chap024Wendy YipPas encore d'évaluation

- Life ContingenciesDocument70 pagesLife ContingenciesRoshith Mele AreekkalPas encore d'évaluation

- Formatted Accounting Finance For Bankers AFB 1 PDFDocument6 pagesFormatted Accounting Finance For Bankers AFB 1 PDFSijuPas encore d'évaluation

- Interest Rates MishkinDocument8 pagesInterest Rates MishkinSherri BonquinPas encore d'évaluation

- Project Management 3Document14 pagesProject Management 3Shraddha BorkarPas encore d'évaluation

- 6.1 - Module 6 - Valuation of BondsDocument23 pages6.1 - Module 6 - Valuation of BondsBINDYAPas encore d'évaluation

- Chapter-10 Market Risk Math Problems and SolutionsDocument6 pagesChapter-10 Market Risk Math Problems and SolutionsruponPas encore d'évaluation

- Edu 2015 Exam FM Ques TheoryDocument44 pagesEdu 2015 Exam FM Ques TheoryLueshen WellingtonPas encore d'évaluation

- Financial Engineering and Structured FinanceDocument88 pagesFinancial Engineering and Structured Financevarun_kakkar76Pas encore d'évaluation

- Basic Duration Calculation: Year C T C / Price (1+YTM) C T C / Price (1+YTM)Document13 pagesBasic Duration Calculation: Year C T C / Price (1+YTM) C T C / Price (1+YTM)Syed Ameer Ali ShahPas encore d'évaluation

- MR Revision QuesDocument25 pagesMR Revision QueskheriaankitPas encore d'évaluation

- FIN4002 LQ 2122s2Document15 pagesFIN4002 LQ 2122s2YMC SOEHKPas encore d'évaluation

- BNP Derivs 101Document117 pagesBNP Derivs 101hjortsberg100% (2)

- Cross Currency RiskDocument21 pagesCross Currency RiskManish AnandPas encore d'évaluation

- Investment Analysis and Portfolio Management: Lecture 6 Part 2Document35 pagesInvestment Analysis and Portfolio Management: Lecture 6 Part 2jovvy24Pas encore d'évaluation

- Corporate Finance CompanionDocument369 pagesCorporate Finance CompanioncmtinvPas encore d'évaluation

- Drivers of Liquidity in Corp BondsDocument38 pagesDrivers of Liquidity in Corp BondssoumensahilPas encore d'évaluation

- FMV CheatsheetDocument2 pagesFMV CheatsheetAlexandre AlcântaraPas encore d'évaluation

- Understanding The Yield Curve Part 3 Salomon Brothers 1995Document20 pagesUnderstanding The Yield Curve Part 3 Salomon Brothers 1995Zoe Yang100% (3)

- Horizontal and Vertical Dis AllowanceDocument12 pagesHorizontal and Vertical Dis Allowancesuhaspujari93Pas encore d'évaluation

- Answers: FRM Part 1: Mock Exam - SolutionsDocument18 pagesAnswers: FRM Part 1: Mock Exam - SolutionsipeeterPas encore d'évaluation

- Session 1 - Bond Valuation and RisksDocument69 pagesSession 1 - Bond Valuation and RisksManuel TapiaPas encore d'évaluation

- Ch. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFDocument43 pagesCh. 3 (Interest Rates) FMI (Mishkin Et Al) (8th Ed.) PDFRahul NagrajPas encore d'évaluation

- Bond ImmunisationDocument29 pagesBond ImmunisationVaidyanathan RavichandranPas encore d'évaluation

- CH 09Document24 pagesCH 09Farhan MamasarayaPas encore d'évaluation

- Alm TheoryDocument87 pagesAlm Theorydavid AbotsitsePas encore d'évaluation

- Excel Modeling in Investments 4th Edition Holden Solutions ManualDocument87 pagesExcel Modeling in Investments 4th Edition Holden Solutions Manualvictoriawaterswkdxafcioq100% (16)

- Final Practice Questions and SolutionsDocument12 pagesFinal Practice Questions and Solutionsshaikhnazneen100Pas encore d'évaluation