Académique Documents

Professionnel Documents

Culture Documents

Three Basic Candlestick Formations To Improve Your Timing PDF

Transféré par

mr12323Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Three Basic Candlestick Formations To Improve Your Timing PDF

Transféré par

mr12323Droits d'auteur :

Formats disponibles

Trading Strategies

Three Basic Candlestick Formations to

Improve Your Timing

By Michael C. Thomsett

Article Highlights

You may be able to improve your timing by focusing only on a short list of reversal candlesticks.

Three of the strongest reversal candlestick patterns are the abandoned baby, white soldiers and black crows, and the engulng pattern.

The smart use of candlesticks includes picking high-quality companies and making sure there is a trend.

The study of candle-

stick charts is mysterious to

many. You might recognize

the basic significance of the

chart patterns, but not know

how to spot strong and reliable reversal signals.

This article demonstrates and

explains three of the strongest candlestick reversal patterns.

These are the bullish or bearish abandoned baby, the bullish

white soldiers and the bearish black crows, and the bullish

and bearish engulfing pattern.

These simple but powerful indicators are formed as chart

patterns, giving you a lot of information just with a glance.

The more time you spend studying candlestick patterns,

the more comfortable you are going to be. The origin of

candlesticks traces back several hundred years. Candlesticks

originally were developed in Japan to track rice futures. Many

of the early candlestick experts were able to demonstrate an

ability to anticipate market trends and reversals.

In the U.S. candlesticks were first introduced by Steve

Nison, who has written several books on the topic. However,

the candlestick has become popular only after the Internet

made charting fast and easy. Before they were available on

the Internet, charting services had to be purchased, often

consisting of open/high/low/close charts (those vertical

sticks for the trading range with smaller horizontal limbs

for opening and closing prices). These services could be

quite expensive, especially if you also paid for advice and

interpretation.

April 2012

With automated and free

online charting services (such as

StockCharts.com), you can now

get candlestick charts instantly by

just punching in a trading symbol.

Some sites also allow you to tailor

your charts by choosing the date

range and adding the volume;

many offer technical indicators

and volume or momentum indicators as well. So no matter

how much information you want to use to time entry or

exit, todays candlestick chart is accessible and easy to use.

Four Steps to Using Candlesticks

Among the dozens of candlestick indicators consisting

of a single session or multiple sessions, you can rely on a few

very strong ones. A study of hundreds of charts by Thomas

Bulkowski (Encyclopedia of Candlestick Charts, John Wiley

& Sons, 2008) has concluded that some candlestick patterns

lead to reversal more often than not. If you focus only on a

short list of highly reliable reversal candlesticks, you may be

able to improve the timing of your buys and sells.

The smart use of candlestick indicators requires four

steps:

1. Pick high-quality companies. Identify companies

whose fundamentals justify investment, and then track them

regularly through chart analysis. The use of fundamentals to

narrow down your search is a method for limiting your risk

to the highest-quality companies. Among the best fundamentals are revenue and earnings (why invest in a company with

29

Figure 1. Candlestick Attributes

close

high

open

upper

shadow

real

body

lower

shadow

open

low

close

Because no signal is reliable all by itself

all of the time, finding confirmation in

one form or another just makes sense.

And many are surprised to discover that

confirmation among the components of

trends (price, volume, and momentum)

is going to occur most of the time. In

addition to confirming reversal, some

confirming indicators contradict what

the candlestick foreshadows. In this

case, dont act until you get additional

confirmation or contradiction, or pick

the indicator you believe to be the most

reliable.

Following these four basic rules

vastly improves your timing and adds to

overall profits. Many of the candlestick

formations that appear frequently were

described as being highly reliable in the

Bulkowski study. These are among the

indicators worth adding to your charting strategy.

Candlestick Indicators to Watch

falling revenues or net losses?); dividend yield (and a record of increasing

dividends over many years), moderate

price-earnings ratio (meaning between

10 and 25, and tracked as a long-term

trend); and finally, the trend of the debt

ratio (the portion of total capitalization

in debt compared to the overall debt

and equity, remembering that a high and

growing debt ratio is a danger signal).

2. Look for strong reversal signals. Find exceptionally strong reversal

signals at the top of an uptrend and

time your exit, or at the bottom of a

downtrend and time your entry. Reversal

signals come in many shapes and sizes,

in candlesticks as well as other forms.

To give you an idea of the range of

reversals, there are approximately 100

different candlestick indicators. You

cannot possibly expect to look for all

of these, and some are more easily

spotted than others. For this reason, it

makes sense to identify the more reliable

reversal signals and focus on looking for

those. Some indicators work as price

reversal signals about half the time and

as price continuation signals the other

half of the time. Given this fact, they

are not very useful for timing buys and

30

sells. You can do as well by guessing,

and you might be right half the time.

3. Make sure there is a trend to

reverse. Remember, reversal only works

if there is a trend to reverse. You cannot

expect to find a bullish reversal unless a

downtrend is in effect, and you cannot

find a bearish reversal unless the current

trend is moving upward. When you find

those signals in the wrong places, they

usually are continuation patternsa

sign that the price trend will continue

in its current direction. The fact that the

same indicator can be either a reversal

or a continuation signal should not be

confusing. It is just a matter of where

it appears within the existing trend. But

what if the price is moving sideways and

no clear trend has been set? In this case,

the prudent course is to wait patiently

for some kind of movement to appear.

If you act too quickly, you will be right

half the time and wrong the other half.

4. Always look for confirmation

before you act. Before acting, find independent confirmation of the predicted

reversal. Only when you have confirmation should you take action. Confirmation is one of the basic techniques used

by technicians to time entry and exit.

A candlestick formation reveals a

great amount of information in a mere

glance: the range between open and

close, the extension of trading range,

and the direction of movement. Many

additional signals have meaning, such as

unusually long or short trading ranges,

and extended moves above or below the

open/close range. All of this shows up in

the basic candlestick, as Figure 1 shows.

The white candlestick is found

when prices move up during the session,

and the black candlestick represents a

downward-moving session. The real

body defines the distance between opening and closing price, and the upper and

lower shadows (the thin lines at the top

and bottom of a candlestick) represent

the complete trading range. When you

see a very long upper or lower shadow,

it reveals lost momentum among buyers

(upper) or sellers (lower). This loss of

momentum is one of the most important

aspects of trends and how they exhaust

and then reverse.

The Abandoned Baby

Candlesticks often have imaginative

names. The abandoned baby is one of

these, and it can be either bullish or

AAII Journal

Trading Strategies

bearish. The bullish version (shown on

the left in Figure 2) signals the end of a

downtrend. The key here is in the gaps

and the doji session (the abandoned

segment with little or no distance between opening and closing.

In this three-session indicator, note

the gaps between sessions 12 and 23.

The middle session is the doji, and this

signals a likely end of the downtrend

and the start of a new uptrend. According to Bulkowskis research, the bullish

abandoned baby often leads to a reversal.

The bearish variety has the same

formation, but with the gaps moving in

the opposite directions. This is shown

on the right in Figure 2. The pattern is a

strong forecast of the end to the current

uptrend and signals a bearish reversal.

Figure 2. Abandoned Baby

White Soldiers and Black Crows

The white soldiers and black crows

are three-session indicators that appear

quite often. The white soldiers pattern

is bullish and consists of three upwardmoving sessions. Each session opens

within the real body of the previous

session and then closes higher, as shown

in Figure 3.

Also referred to as three white soldiers, this pattern can actually continue

beyond the three sessions. The consecutive higher lows and higher highs is a

very strong reversal signal as long as it

shows up after a period of downtrend

movement. This signal can be a reliable

reversal sign.

The opposite of white soldiers is

the black crows pattern. It is a strong

bearish reversal when it is found at the

top of an uptrend. Each session opens

within the real body range of the previous one and then moves lower. Lower

highs and lower lows characterize this

pattern, as shown in Figure 4. This is

another exceptionally strong reversal

signal.

Engulng Pattern

The engulfing pattern is so named

because the first session is engulfed

by the second. In other words, the real

body extends higher and lower. This is

always a two-session development and

appears frequently. When confirmed,

April 2012

Bull

Figure 3. White Soldiers

it is one of the most reliable of the

candlestick reversal signals.

In the bullish version of the engulfing pattern, a black session is followed

by the engulfing white session. There is

a price gap between the first sessions

close and the lower opening of the

Bear

Figure 4. Black Crows

second session. This is shown on the

left in Figure 5.

The bullish engulfing pattern is

easy to spot, and it will mark the end

of the downtrend and the start of a

31

Figure 5. Engulng Pattern

Bull

new uptrend.

The bearish engulfing pattern is the

opposite of the bullish one, as shown

on the right in Figure 5.

This pattern is even more reliable

as a reversal than the bullish one. The

bearish engulfing pattern can lead to a

reversal in which a price decline occurs.

The Basic Rules

When you find often-appearing

candlestick indicators with high reliability, you can proceed with confidence,

assuming that you also seek and find

confirmation. This is an essential part

of the process for improving entry and

Bear

exit. Candlesticks can serve as the first

signals to be confirmed by another;

they can also serve as confirmation for

another signal.

Nothing works 100% of the time,

of course, but even conservative and

fundamental investors can vastly improve the timing of entry and exit in

long stock positions by studying and

confirming candlesticks. Forms of

confirmation include:

Doji sessions, also called narrowrange days (NRDs), often signal

the end of the current trend.

Volume spikes, a signal of possible

exhaustion after a trend, often appear on the same session as other

reversal signs.

Unusually long shadows, those

sticks above and below the real

body. A big upper shadow is a sign

of lost momentum among buyers,

meaning sellers will probably take

the lead next; a long lower shadow

means the same thing among sellers.

Traditional western indicators, such

as gapping price action, head and

shoulders, double tops or bottoms,

and other well-known signals based

on price patterns.

Volume indicators, such as onbalance volume (OBV), track dominance among buyers or sellers and,

as this shifts, indicate a change in

price direction.

Momentum oscillators are among

the most valuable confirming signs.

The strongest of these include

the moving average convergencedivergence (MACD), which tracks

changes in two moving averages;

and the relative strength index

(RSI), which measures the strength

and direction of price movement.

You do not have to know how to

calculate these, as many free charting sites allow you to add them to

charts.

You can learn a lot about candlestick

trading by applying what you already

know and then expanding your knowledge base through reading books and going online to various websites, where you

can find free and fast learning tools for

candlesticks and methods for improving

your basic skills. Analysis of charting

of all types is improved with practice,

whether you are a very conservative

value investor or a speculative trader.

Michael C. Thomsett (www.MichaelThomsett.com) wrote the recently released Bloomberg Visual Guide to Candlestick Charting

(John Wiley & Sons, 2012) and also authored Trading with Candlesticks (FT Press, 2010). He blogs on several sites and has

written over 70 books. Find out more at www.aaii.com/authors/michael-thomsett.

32

AAII Journal

Vous aimerez peut-être aussi

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- Chifbaw Oscillator User GuideDocument12 pagesChifbaw Oscillator User GuideHajar Aswad KassimPas encore d'évaluation

- Deepak Chopra The 7 Laws of SuccessDocument6 pagesDeepak Chopra The 7 Laws of Successmr12323Pas encore d'évaluation

- HEAVEN AND THE ANGELS by H.A. BakerDocument138 pagesHEAVEN AND THE ANGELS by H.A. Bakermannalinsky100% (3)

- Pro Finance Group Inc.: GraphDocument1 pagePro Finance Group Inc.: Graphmr12323Pas encore d'évaluation

- The Revelation of HellDocument18 pagesThe Revelation of HellEric Dacumi100% (12)

- Tims Trading MaximsDocument1 pageTims Trading Maximsmr12323Pas encore d'évaluation

- At ActiveDocument3 pagesAt Activemr12323Pas encore d'évaluation

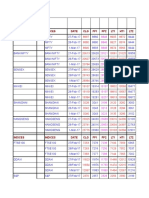

- Indices Indices Date CLG FP1 FP2 LT1 HT1 LT2Document34 pagesIndices Indices Date CLG FP1 FP2 LT1 HT1 LT2mr12323Pas encore d'évaluation

- Nifty Super Trend Back Test Results 2008 To 2013Document176 pagesNifty Super Trend Back Test Results 2008 To 2013mr12323Pas encore d'évaluation

- Details of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018Document5 pagesDetails of Daily Margin Applicable For F&O Segment (F&O) For 18.07.2018mr12323Pas encore d'évaluation

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- The Power of Habit - Charles DuhiggDocument5 pagesThe Power of Habit - Charles DuhiggmanargyrPas encore d'évaluation

- Revision of Pension (c116063)Document1 pageRevision of Pension (c116063)mr12323Pas encore d'évaluation

- Scope of AnatomyDocument25 pagesScope of Anatomymr12323Pas encore d'évaluation

- ProFx 4 User Manual PDFDocument20 pagesProFx 4 User Manual PDFMelque ResendePas encore d'évaluation

- Astro PreditDocument1 pageAstro Preditmr12323Pas encore d'évaluation

- GN 5 38Document1 pageGN 5 38mr12323Pas encore d'évaluation

- BitcoinsDocument45 pagesBitcoinsSwadhin Sonowal100% (1)

- GN 5 41Document1 pageGN 5 41mr12323Pas encore d'évaluation

- Chart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4Document4 pagesChart Pattern Dashboard Indicator User Guide: Chartpatterndashboard - Ex4mr12323100% (1)

- Traders World 20101Document10 pagesTraders World 20101satish sPas encore d'évaluation

- Cheatsheet Fib ElliottDocument12 pagesCheatsheet Fib ElliottYano0% (1)

- 0510 ColeDocument21 pages0510 Colemr12323Pas encore d'évaluation

- Addition 03.2013. TS LSFA BS PDFDocument1 pageAddition 03.2013. TS LSFA BS PDFmr12323Pas encore d'évaluation

- Tradeonix 2.0: (An Updated Version of Tradeonix)Document17 pagesTradeonix 2.0: (An Updated Version of Tradeonix)mr12323100% (1)

- F9D1 ManualDocument18 pagesF9D1 Manualmr12323Pas encore d'évaluation

- Trading Manual PDFDocument24 pagesTrading Manual PDFmr12323Pas encore d'évaluation

- Barclay and Hendershott-Price Discovery and Trading After HoursDocument33 pagesBarclay and Hendershott-Price Discovery and Trading After HoursPulkit GoelPas encore d'évaluation

- WolfeWaveDashboard UserGuideDocument4 pagesWolfeWaveDashboard UserGuidemr12323Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- AQA Music A LevelDocument10 pagesAQA Music A LevelHindy LaiPas encore d'évaluation

- Anxiety DisordersDocument10 pagesAnxiety DisordersAhmed AntarPas encore d'évaluation

- Portel's Value Chain AnalysisDocument3 pagesPortel's Value Chain AnalysisNivedPas encore d'évaluation

- CaseDocument2 pagesCaseKimi Walia0% (2)

- Effect of Boron Content On Hot Ductility and Hot Cracking TIG 316L SSDocument10 pagesEffect of Boron Content On Hot Ductility and Hot Cracking TIG 316L SSafnene1Pas encore d'évaluation

- Checkpoint PhysicsDocument12 pagesCheckpoint PhysicsRishika Bafna100% (1)

- Description of Medical Specialties Residents With High Levels of Workplace Harassment Psychological Terror in A Reference HospitalDocument16 pagesDescription of Medical Specialties Residents With High Levels of Workplace Harassment Psychological Terror in A Reference HospitalVictor EnriquezPas encore d'évaluation

- Case Study Method: Dr. Rana Singh MBA (Gold Medalist), Ph. D. 98 11 828 987Document33 pagesCase Study Method: Dr. Rana Singh MBA (Gold Medalist), Ph. D. 98 11 828 987Belur BaxiPas encore d'évaluation

- Persuasive SpeechDocument2 pagesPersuasive SpeechAngel Zachary RayyanPas encore d'évaluation

- Decretals Gregory IXDocument572 pagesDecretals Gregory IXDesideriusBT100% (4)

- AIW Unit Plan - Ind. Tech ExampleDocument4 pagesAIW Unit Plan - Ind. Tech ExampleMary McDonnellPas encore d'évaluation

- Christiane Nord - Text Analysis in Translation (1991) PDFDocument280 pagesChristiane Nord - Text Analysis in Translation (1991) PDFDiana Polgar100% (2)

- Stripper Bolt, Coil Spring, Dowel PinDocument3 pagesStripper Bolt, Coil Spring, Dowel Pinmuhamad laaliPas encore d'évaluation

- How To Read A Research PaperDocument16 pagesHow To Read A Research PaperHena Afridi100% (1)

- Bootstrap Aggregating Multivariate Adaptive Regression Spline For Observational Studies in Diabetes CasesDocument8 pagesBootstrap Aggregating Multivariate Adaptive Regression Spline For Observational Studies in Diabetes CasesTika MijayantiPas encore d'évaluation

- A Guide To Conducting A Systematic Literature Review ofDocument51 pagesA Guide To Conducting A Systematic Literature Review ofDarryl WallacePas encore d'évaluation

- 02 - Nature and Role of Science in SocietyDocument10 pages02 - Nature and Role of Science in SocietyMarcos Jose AvePas encore d'évaluation

- Simple Past TenseDocument6 pagesSimple Past Tenseanggun muslimahPas encore d'évaluation

- La FolianotesDocument4 pagesLa Folianoteslamond4100% (1)

- Interpret Market Trends and Developments TASk 1Document7 pagesInterpret Market Trends and Developments TASk 1Raí SilveiraPas encore d'évaluation

- Correct Translation of 2-16Document19 pagesCorrect Translation of 2-16muhammad_zubair708110Pas encore d'évaluation

- TestFunda - Puzzles 1Document39 pagesTestFunda - Puzzles 1Gerald KohPas encore d'évaluation

- LP.-Habitat-of-Animals Lesson PlanDocument4 pagesLP.-Habitat-of-Animals Lesson PlanL LawlietPas encore d'évaluation

- The Saving Cross of The Suffering Christ: Benjamin R. WilsonDocument228 pagesThe Saving Cross of The Suffering Christ: Benjamin R. WilsonTri YaniPas encore d'évaluation

- 2013 03 01 Maurizio Di Noia PresentationDocument80 pages2013 03 01 Maurizio Di Noia PresentationRene KotzePas encore d'évaluation

- Final DemoDocument14 pagesFinal DemoangiePas encore d'évaluation

- Analysis of The SPM QuestionsDocument5 pagesAnalysis of The SPM QuestionsHaslina ZakariaPas encore d'évaluation

- BTCTL 17Document5 pagesBTCTL 17Alvin BenaventePas encore d'évaluation

- The Impact of Climatic and Cultural Factors On Openings in Traditional Houses in MaharashtraDocument14 pagesThe Impact of Climatic and Cultural Factors On Openings in Traditional Houses in Maharashtracoldflame81Pas encore d'évaluation

- Kuo SzuYu 2014 PHD ThesisDocument261 pagesKuo SzuYu 2014 PHD ThesiskatandePas encore d'évaluation