Académique Documents

Professionnel Documents

Culture Documents

FAQ MEABF and Water-Sewer Tax Revised Final

Transféré par

The Daily LineCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FAQ MEABF and Water-Sewer Tax Revised Final

Transféré par

The Daily LineDroits d'auteur :

Formats disponibles

FAQ on Water-Sewer Tax for Municipal Pension Fund

How often are residents and businesses billed for water and sewer? And what are the current water and

sewer rates?

Residences and businesses will continue to be billed at the same frequency as their current billing cycle.

Metered properties are billed for water and sewer services every other month for the previous two

months of water and sewer usage. Current meter rates are $3.81 per 1,000 gallons, and sewer charges are

100 percent of the water bill.

Non-metered properties are billed for water and sewer service twice a year at a flat rate. Current nonmetered rates are an estimate of water usage based on the lot size, number of fixtures, and other factors.

Sewer charges are 100 percent of the water bill.

o Non-metered properties are billed from April through September for May-October (6 months) of

water and sewer use

o Non-metered properties are billed from October through March for November through April (6

months) of water and sewer use

How will Chicagos water-sewer rate compare to other large cities water and sewer fees and the

surrounding suburbs?

Chicagos water and sewer rates will continue to compare favorably to those of other major cities in

the Great Lakes region and nationally.

Further, assuming Chicagos suburban neighbors do not raise water rates over the next five years,

Chicagos water rate in 2021 will still be comparatively lower than 104 of 126 suburban customers

residential rates. This is based on 2015 suburban rates.

o Water rates in surrounding suburbs:

Harvey: $7.60 per 1,000 gallons of water

Maywood: $14.53 per 1,000 gallons of water

Oak Park: $8.37 per 1,000 gallons of water

Berwyn: $7.98 per 1,000 gallons of water

The charts below compare the single family residence cost per 7,500 gallons of water in Chicago to the

rates charged for the same level of usage in other U.S. cities.

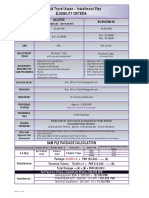

How much will non-metered and metered residential accounts pay?

The chart below provides the water-sewer tax for the median metered and non-metered residential

accounts.

MEDIAN ANNUAL CHARGES

METERED

Year

Current

2017

2018

2019

2020

2021

Utility

Tax Per

1,000

gals

Tax

Rate

$$0.59

$1.28

$2.01

$2.51

$2.51

0%

7.7%

16.8%

26.4%

32.9%

32.9%

NON-METERED

Total

Annual

Charges

with

Utility

Tax

YearOverYear

Change

Total

Annual

Charges

with

Utility

Tax

YearOverYear

Change

$407.67

$439.24

$476.15

$515.21

$541.96

$541.96

$$31.57

$36.92

$39.05

$26.75

$-

$834.39

$899.00

$974.55

$1,054.49

$1,109.24

$1,109.24

$$64.61

$75.55

$79.94

$54.75

$-

Is the City providing any additional protections for seniors similar to the 50 percent reduction in the garbage

fee?

Seniors who receive the senior citizen sewer exemption (seniors who live in their own home and are

individually metered) will continue to receive the exemption.

This exemption reduces eligible seniors total water and sewer bill by 50 percent by removing sewer

charges. With this exemption, seniors will also see a 50 percent reduction in the tax on water-sewer usage

as the tax will only be charged to the water portion of a seniors bill.

Seniors that live in a condominium, co-op or townhouse without an individual meter may qualify for a

refund, in lieu of an exemption. Currently, the amount of the refund is $50.00 per qualified residence, per

calendar year.

How will non-metered accounts be taxed?

Non-metered properties will be charged the water-sewer tax based on assumed usage. This is the same

method used to calculate their water and sewer charges.

The City encourages all non-metered accounts to transition their properties to a water meter.

Chicagos MeterSave program installs residential water meters free of charge to promote water

conservation and save customers as much as 50 percent on their water and sewer costs. Homeowners

participating in MeterSave are eligible for seven-year guarantee that their home water bill will be no

higher than it would have been if the meter had not been installed.

Can the City tax all suburban customers the water-sewer tax?

Under State law, the City does not have the authority to tax activities that do not take place within its

corporate limits.

What is the Citys legal authority to impose a water-sewer tax?

Home rule municipalities, such as the City of Chicago, have the authority to impose various taxes, including

taxes on the sale, purchase, transfer or use of tangible personal property. This authority is set out in Article

VII Section 6 of the Illinois Constitution.

A State statute preempts home rule authority to impose certain taxes based on a percentage of selling

price, but the statute does not preempt the Citys home rule authority to impose per unit taxes.

The water and sewer tax is a per unit tax imposed on the use or consumption of water in Chicago, and on

the transfer of wastewater to the City sewer system from properties located in Chicago.

This tax is consistent with other home rule per unit taxes currently imposed by the City, including the Gas

Use Tax, Vehicle Fuel Tax, Liquor Tax and Bottled Water Tax.

Is it possible to increase water and sewer rates to all customers and abate the increased charges for only

Chicago residents?

The City is not allowed to charge suburban customers more per gallon for water usage than we charge

Chicago users.

The City may charge differential rates to Chicago users provided the charges are reasonable and

nondiscriminatory. However, all water and sewer fees are required to remain in the water and sewer funds

and cannot be used to meet the Citys pension obligations.

What are the next steps in Springfield?

The City will be introducing legislation in Springfield this fall during the veto session.

The legislation will seek authorization for increased employer contributions for the MEABF along with

increased contributions for new hires and a choice option for employees hired between January 1, 2011

and January 1, 2017.

Are the changes to benefit structure constitutional?

Yes, under State law, benefits may be adjusted for new hires.

With respect to current Tier II employees, these employees are given a choice to exchange a lower

retirement age for a higher contribution. These employees have the choice to take this option; they are by

no means required to take the option.

How much will the additional 3 percent in employee contributions generate in savings to Chicago

taxpayers?

Taxpayers will benefit as new employees pay for a larger share of their pension benefits. These savings will

accrue over time as current employees leave City service and new employees replace them.

Over the 40-year ARC, taxpayers will save approximately $2 billion with the increase in employee

contributions.

How will these ramp payments differ from SB1922?

Both this proposal and SB1922 increase the Citys contribution over a 5 year period (the ramp) and then

transition to an actuarially determined amount in the sixth year.

The Citys contribution during the ramp under SB1922 was determined by increasing the multiplier over a

five year period.

Under this proposal the Citys contribution during the ramp will be a set amount that increases each year

without regard for the multiplier.

3

Vous aimerez peut-être aussi

- CCHR Opening StatementDocument4 pagesCCHR Opening StatementThe Daily LinePas encore d'évaluation

- Emergency City EO2020-1Document6 pagesEmergency City EO2020-1The Daily LinePas encore d'évaluation

- Divvy Case DismissalDocument20 pagesDivvy Case DismissalThe Daily LinePas encore d'évaluation

- Woodlawn Housing Preservation Ordinance DRAFTDocument26 pagesWoodlawn Housing Preservation Ordinance DRAFTThe Daily LinePas encore d'évaluation

- COFA Analysis of Chicago's 2020 Expenditure PrioritiesDocument24 pagesCOFA Analysis of Chicago's 2020 Expenditure PrioritiesThe Daily Line100% (2)

- COVID-19 Telework PolicyDocument3 pagesCOVID-19 Telework PolicyThe Daily LinePas encore d'évaluation

- Consultant's 3rd Report On ISRsDocument139 pagesConsultant's 3rd Report On ISRsThe Daily LinePas encore d'évaluation

- Legal Memo in Support of D4 Complaint SignedDocument6 pagesLegal Memo in Support of D4 Complaint SignedThe Daily LinePas encore d'évaluation

- Health - Opening Statement-2020 Budget - FinalDocument3 pagesHealth - Opening Statement-2020 Budget - FinalThe Daily LinePas encore d'évaluation

- DOF Opening StatementDocument3 pagesDOF Opening StatementThe Daily LinePas encore d'évaluation

- OBM Opening StatementDocument3 pagesOBM Opening StatementThe Daily LinePas encore d'évaluation

- Chicago Consent Decree Year One Monitoring PlanDocument78 pagesChicago Consent Decree Year One Monitoring PlanThe Daily LinePas encore d'évaluation

- CPD Opening Statement FinalDocument5 pagesCPD Opening Statement FinalThe Daily LinePas encore d'évaluation

- CFO Opening StatementDocument3 pagesCFO Opening StatementThe Daily LinePas encore d'évaluation

- June 20, 2019 Cook County Democrats Pre-Slating ScheduleDocument2 pagesJune 20, 2019 Cook County Democrats Pre-Slating ScheduleThe Daily LinePas encore d'évaluation

- 2019 09 23 Working Toward A Healed City FINALDocument16 pages2019 09 23 Working Toward A Healed City FINALThe Daily LinePas encore d'évaluation

- Dkt. 23 Second Amended ComplaintDocument22 pagesDkt. 23 Second Amended ComplaintThe Daily LinePas encore d'évaluation

- Cfwo Draft - 07172019Document10 pagesCfwo Draft - 07172019The Daily LinePas encore d'évaluation

- FWW 072219Document12 pagesFWW 072219The Daily LinePas encore d'évaluation

- 2019-08-02 Uber V Chicago ComplaintDocument16 pages2019-08-02 Uber V Chicago ComplaintThe Daily LinePas encore d'évaluation

- June 21, 2019 Cook County Democrats Pre-Slating ScheduleDocument2 pagesJune 21, 2019 Cook County Democrats Pre-Slating ScheduleThe Daily LinePas encore d'évaluation

- Grant Thornton Audit AppendicesDocument51 pagesGrant Thornton Audit AppendicesThe Daily LinePas encore d'évaluation

- Advancing Equity 2019 - FINALBOOKDocument26 pagesAdvancing Equity 2019 - FINALBOOKThe Daily LinePas encore d'évaluation

- Mlel Sixtyday RPRT FinalDocument46 pagesMlel Sixtyday RPRT FinalThe Daily LinePas encore d'évaluation

- Cook County 2020 Preliminary Budget PresentationDocument23 pagesCook County 2020 Preliminary Budget PresentationThe Daily LinePas encore d'évaluation

- Assessor Listening Tour SlidesDocument22 pagesAssessor Listening Tour SlidesThe Daily LinePas encore d'évaluation

- MAY 30 Final Proposal Memo Press ReleaseDocument21 pagesMAY 30 Final Proposal Memo Press ReleaseThe Daily LinePas encore d'évaluation

- 5.28.19 - City Club Speech - FINALDocument16 pages5.28.19 - City Club Speech - FINALThe Daily LinePas encore d'évaluation

- Enhancing Our Culture Anti-Harassment Working Group Report 5-30-19Document32 pagesEnhancing Our Culture Anti-Harassment Working Group Report 5-30-19The Daily LinePas encore d'évaluation

- Stakeholder Letter On SB 1379 IIDocument3 pagesStakeholder Letter On SB 1379 IIThe Daily LinePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Case 1Document8 pagesCase 1Pratibha SeshamPas encore d'évaluation

- Corporate Social Responsibility at Bharat Petroleum Corporation Limited IJERTCONV1IS02003Document4 pagesCorporate Social Responsibility at Bharat Petroleum Corporation Limited IJERTCONV1IS02003siddhartha karPas encore d'évaluation

- Terms and Conditions For Advertisement and ProformaDocument3 pagesTerms and Conditions For Advertisement and ProformaMallikarjunayya HiremathPas encore d'évaluation

- Labor Bar Syllabus 2020Document13 pagesLabor Bar Syllabus 2020Ronaldo ValladoresPas encore d'évaluation

- Research Proposal of Bba 7th SemesterDocument10 pagesResearch Proposal of Bba 7th SemesterAhmed MumtazPas encore d'évaluation

- Labbaik Travel Asaan - Installment Plan Eligibility CriteriaDocument1 pageLabbaik Travel Asaan - Installment Plan Eligibility CriteriamuhammadTzPas encore d'évaluation

- Unit 1 Business and Its EnvironmentDocument28 pagesUnit 1 Business and Its EnvironmentMaham ButtPas encore d'évaluation

- An Overview of Labour Law in RwandaDocument12 pagesAn Overview of Labour Law in Rwandap pPas encore d'évaluation

- LPA120 Fees Exemptions RemissionsDocument4 pagesLPA120 Fees Exemptions RemissionssriharshamysuruPas encore d'évaluation

- Chapter 6 - Income TaxDocument12 pagesChapter 6 - Income TaxlovelyrichPas encore d'évaluation

- Business Annals. Willard Long Thorp 8Document16 pagesBusiness Annals. Willard Long Thorp 8kirchyPas encore d'évaluation

- LM A1.1Document17 pagesLM A1.1Dat HoangPas encore d'évaluation

- Conference Board of Canada ReportDocument230 pagesConference Board of Canada ReportcaleyramsayPas encore d'évaluation

- Commissioned Officer's HandbookDocument133 pagesCommissioned Officer's HandbookBONDCK88507100% (2)

- Truth About TrustsDocument6 pagesTruth About TrustsCathy Reed100% (5)

- Public AdminstrationDocument19 pagesPublic AdminstrationUjjwal AnandPas encore d'évaluation

- HRMS QuestionnaireDocument16 pagesHRMS Questionnairearif61400% (1)

- NASSCOM Annual Report 2011-2012Document41 pagesNASSCOM Annual Report 2011-2012Devarsh YagnikPas encore d'évaluation

- CSR of Exim Bank of BanhladeshDocument10 pagesCSR of Exim Bank of BanhladeshZahid HasanPas encore d'évaluation

- International Journal of Organisational Innovation Final Issue Vol 7 Num 3 January 2015Document161 pagesInternational Journal of Organisational Innovation Final Issue Vol 7 Num 3 January 2015Vinit DawanePas encore d'évaluation

- DDUGKY - DARPG - Goa - Anil SubramaniamDocument24 pagesDDUGKY - DARPG - Goa - Anil SubramaniamRS ShekhawatPas encore d'évaluation

- US Passport ApplicationDocument6 pagesUS Passport ApplicationThe Slang Market100% (9)

- 6-Confederation For Unity, Et. Al. vs. Bureau of Internal and RevenueDocument6 pages6-Confederation For Unity, Et. Al. vs. Bureau of Internal and RevenueLandrel MatagaPas encore d'évaluation

- TWP 93272105 IffcoTokioDocument2 pagesTWP 93272105 IffcoTokioSudeep Kumar67% (3)

- L05 Occupational Health & Safety in SchoolsDocument63 pagesL05 Occupational Health & Safety in SchoolsJapsay Francisco GranadaPas encore d'évaluation

- Project Report On Employee SatisfactionDocument75 pagesProject Report On Employee SatisfactionNavpreet Singh100% (1)

- Study On Compensation and Benefits Its Influence oDocument8 pagesStudy On Compensation and Benefits Its Influence oStha RamabelePas encore d'évaluation

- E Ch6 Mathis Job AnalysisDocument64 pagesE Ch6 Mathis Job AnalysisNatik Bi IllahPas encore d'évaluation

- Anfin208 Mid Term AssignmentDocument6 pagesAnfin208 Mid Term Assignmentprince matamboPas encore d'évaluation

- Labor Case Digests (Doctrines) - Rhapsody P. JoseDocument8 pagesLabor Case Digests (Doctrines) - Rhapsody P. JoseRhapsody JosePas encore d'évaluation