Académique Documents

Professionnel Documents

Culture Documents

Session 5a Handout PDF

Transféré par

Chin Hung YauDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Session 5a Handout PDF

Transféré par

Chin Hung YauDroits d'auteur :

Formats disponibles

06/01/2014

Accounting Principles

Receivables

Learning objectives

Define and explain common types of receivables and review

internal controls for receivables

Describe how bad debts arise

Use the allowance method to account for bad debts

Use the direct write-off method to account for bad debts

Journalise credit card and debit card sales

Account for bills receivable

Report receivables on the balance sheet and evaluate a business

using the acid-test ratio, days sales in receivables and the

accounts receivable turnover ratio

Receivables: An introduction

A receivable arises when a business (or person) sells goods or

services to a second business (or person) on credit

The receivable is the sellers claim against the buyer for the

amount of the transaction

The creditor sells goods or a service and obtains a receivable

The debtor makes the purchase and takes on an

obligation/payable (a liability)

The two main types of receivables are accounts receivable and

bills receivable

06/01/2014

Receivables: An introduction

Accounts receivable, sometimes called trade receivables or

trade debtors, are amounts to be collected from customers from

sales made on credit

Bills (and notes) receivable are more formal than accounts

receivable. The debtor in a bill or note receivable arrangement

promises in writing that the creditor will be paid a definite sum

at a specific future date

A promissory note is a special type of bill receivable

Accounting for bad debts (uncollectable accounts)

Some customers do not pay, and that creates an expense called

a bad debt expense, doubtful debt expense or uncollectable

account expense

There are two methods of accounting for uncollectable

receivables, namely the allowance method and the direct writeoff method

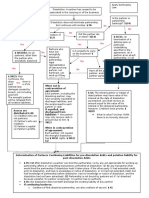

The allowance method

It is based on the matching principle, which requires that the

bad debts expense is recorded in the same period as the sales

revenue

The offset to the expense is a contra account called Allowance

for doubtful debts (or the Allowance for bad debts)

The Allowance account shows the amount of the receivables

that the business expects not to collect and reduces Accounts

receivable

06/01/2014

The allowance method

The more accurate the estimate of bad debts, the more reliable

the information in the financial statements

Businesses use their past experience as well as considering the

economy, the industry they operate in and other variables

There are two basic ways to estimate bad debts, namely

percentage of sales method and ageing of accounts receivable

method

The allowance method

The percentage of sales method calculates bad debts expense

as a percentage of net credit sales

This method is also called the income statement approach

because it focuses on the amount of expense to be reported on

the income statement

Bad debts expense is recorded as an adjusting entry at the end

of the period

Date

Account title

Dr

Mar 31

Bad debts expense (E+)

300

GST clearing (L)

30

Allowance for doubtful debts (CA+)

Cr

330

Recorded bad debts expense for the period.

The allowance method

The ageing of accounts method is also called the balance sheet

approach because it focuses on the actual age of the accounts

receivable and determines a target allowance balance from that

age

06/01/2014

The allowance method

The allowance method

When a specific customer account is identified as uncollectible, it is

written off to the allowance account

Date

Account title

Dr

Jul 15

Allowance for doubtful debts (CA)

200

Cr

Accounts receivableAndrews (A)

80

Accounts receivableJones (A)

120

Wrote off doubtful debts.

The allowance method

Sometimes a customer will pay the amount owed after the

customers account is written off. To account for this recovery, the

business must reverse the effect of the earlier write-off to the

Allowance account and record the cash collection.

Date

Account title

Dr

Sep 4

Accounts receivableAndrews (A+)

80

Allowance for doubtful debts (CA+)

Cash (A+)

Accounts receivableAndrews (A)

Cr

80

80

80

06/01/2014

The direct write-off method

Under the direct write-off method of accounting for bad debts,

the business waits until it decides that a customers account

receivable is uncollectable

The accountant then debits Bad debts expense and credits the

customers Account receivable to write off the account

Date

Account title

Dr

Jul 15

Bad debts expense (E+)

200

Cr

Accounts receivableAndrews (A)

80

Accounts receivableJones (A)

120

Wrote off a bad debt.

The direct write-off method

To account for this recovery, the business must reverse the effect

of the earlier write-off to the Bad debts expense account and

record the cash collection

Date

Account title

Dr

Sep 4

Accounts receivableAndrews (A+)

80

Bad debts expense (E)

Cash (A+)

Accounts receivableAndrews (A)

Cr

80

80

80

Credit and debit card sales

Credit card sales are an alternative form of receiving payment

from a customer

There are two main types of credit cards, namely credit cards

that are issued by a financial institution (bank or credit union)

and credit cards that are issued by a credit card company

Credit cards offer customers the convenience of buying without

having to pay the cash immediately

Debit cards are fundamentally different from credit cards

Businesses hire a third-party processor to process credit and

debit card transactions

Transactions are usually entered into an electronic terminal

(card scanner) that the business either purchases or rents from

the processor

06/01/2014

Bills receivable

Bills of exchange are commonly used where foreign trade is

concerned, with businesses selling goods or services in

exchange for bills receivable

A promissory note is defined as an unconditional promise in

writing, signed by the maker, engaging to pay, on demand or at

a fixed or determinable future time, a sum certain in money, to

or to the order of a specified person, or to bearer

A bill of exchange is defined as as an unconditional order in

writing, addressed by one person to another, signed by the

person giving it, requiring the person to whom it is addressed to

pay on demand, or at a fixed or determinable future time, a

sum certain in money to or to the order of a specified person or

bearer

Bills receivable

Identifying a bills maturity date

Maturity date can be a specific date

Maturity date can be stated in terms of number of months

Maturity date can be stated in terms of number of days

The formula for calculating interest is

Principal

Interest

rate

Time

Amount

of

interest

06/01/2014

Recording bills receivable

Date

Account title

Dr

Oct 20

Bill receivable - Dorman Builders (A+)

15000

Cr

Sales revenue (R+)

15000

To record sale.

Jan 18

Cash (A+)

15 370

Bill receivableDorman Builders (A)

15 000

Interest revenue

($15 000 0.10 90/365) (R+)

370

To record collection at maturity.

Recording bills receivable

A business may, by agreement, draw a bill receivable on a trade

customer who fails to pay an account receivable within the

customary 3060 days

Date

Account title

Dr

Oct 1

Bill receivableInterlogic (A+)

2400

Accounts receivableInterlogic (A)

Cr

2400

To draw a bill on account on a customer.

Accruing interest revenue

Date

Account title

Dec 31 Interest receivable

($2 400 0.09 3/12) (A+)

Dr

Cr

54

Interest revenue (R+)

54

To accrue interest revenue earned in

2015 but not yet received.

Sep 30 Cash [$2 400 + ($2 400 0.09)] (A+)

Bill receivableInterlogic (A)

2616

2400

Interest receivable (A)

54

Interest revenue (R+)

162

To collect bill receivable on which

interest has been previously accrued.

06/01/2014

Discounting a bill receivable

Dishonoured bills receivable

If the debtor of a bill doesnt pay a bill receivable at maturity,

the debtor is said to dishonour, or default on, the bill

As the term of the bill has expired, the original agreement is no

longer in force, and no one will buy the bill

However, the payee still has a claim against the debtor and

usually transfers the claim from the Bills receivable account to

Accounts receivable

The payee records interest revenue earned on the bill and

debits Accounts receivable for the full maturity value of the bill

Using accounting information for decision making

In making decisions, owners and managers use some ratios

based on the relative liquidity of assets

A measure of the firms ability to pay current liabilities is the

acid-test (or quick) ratio

The acid-test ratio tells whether the entity could pay all its

current liabilities if they came due immediately

Acid-test ratio = (Cash + Short-term + Net current investments

receivables) / Total current liabilities

The higher the acid-test ratio, the better the business is able to

pay its current liabilities

06/01/2014

Using accounting information for decision making

After a business makes a credit sale, the next critical event in

the business cycle is collection of the receivable

Days sales in receivables, also called the collection period,

indicates how many days it takes to collect the average level of

receivables

The number of days in average accounts receivable should be

close to the number of days customers are allowed to pay

The shorter the collection period, the more quickly the

organisation can use cash for operations

Using accounting information for decision making

The accounts receivable turnover ratio measures the number of

times the business sells and collects the average receivables

balance in a year

The higher the ratio, the faster the cash collections

Accounts receivable turnover ratio = Net credit sales / Average

net accounts receivable

Summary:

A receivable arises when a business (or person) sells goods or

services to a second business (or person) on credit

The two main types of receivables are accounts receivable and

bills receivable

There are two methods of accounting for uncollectable

receivables, namely the allowance method and the direct writeoff method

The allowance method is based on the matching principle, which

requires that the bad debts expense is recorded in the same

period as the sales revenue

Under the direct write-off method of accounting for bad debts,

the business waits until it decides that a customers account

receivable is uncollectable

06/01/2014

Summary:

Bills of exchange are commonly used where foreign trade is

concerned, with businesses selling goods or services in

exchange for bills receivable

In making decisions, owners and managers use some ratios

based on the relative liquidity of assets

Common ratios are acid-test (or quick) ratio, collection period,

and accounts receivable turnover ratio

10

Vous aimerez peut-être aussi

- Financial Accounting - Want to Become Financial Accountant in 30 Days?D'EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Évaluation : 5 sur 5 étoiles5/5 (1)

- Accounting For ReceivablesDocument16 pagesAccounting For ReceivablesAnna RosePas encore d'évaluation

- Topic7 Ch12 ReceivablesDocument29 pagesTopic7 Ch12 ReceivablesCẩm TúPas encore d'évaluation

- Unit 9 OA Accounts and Financial ServicesDocument21 pagesUnit 9 OA Accounts and Financial ServicesKaydee ChadbandPas encore d'évaluation

- AR - Work FlowDocument14 pagesAR - Work FlowVinayPas encore d'évaluation

- ReceivablesDocument58 pagesReceivablesHannah OrosPas encore d'évaluation

- Chapter 7Document39 pagesChapter 7juls100% (1)

- Debit and CreditDocument32 pagesDebit and CreditBasma ShaalanPas encore d'évaluation

- 05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsDocument40 pages05.02.2020, 1. S.srinivas Sir, Chartered Accountant, Accounting FundamentalsAradhana AndrewsPas encore d'évaluation

- ReceivableDocument24 pagesReceivableMaria MushtaquePas encore d'évaluation

- Chapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsDocument5 pagesChapter 4 - Income Measurement & Accrual Accounting: Recognition & Measurement in Financial StatementsHareem Zoya WarsiPas encore d'évaluation

- Session 4 PDFDocument42 pagesSession 4 PDFmilepnPas encore d'évaluation

- Accounting Chapter 5: Internal Control, Cash and Receivables 1. Accounts & Notes ReveivableDocument7 pagesAccounting Chapter 5: Internal Control, Cash and Receivables 1. Accounts & Notes ReveivableMarine De CocquéauPas encore d'évaluation

- Accounting FundamentalsDocument40 pagesAccounting FundamentalsPriyanka GoswamiPas encore d'évaluation

- Chapter 4 The Bookkeeping Process and Transaction AnalysisDocument17 pagesChapter 4 The Bookkeeping Process and Transaction AnalysisMarwa ElnasharPas encore d'évaluation

- Debit and CreditDocument33 pagesDebit and CreditBasma ShaalanPas encore d'évaluation

- Account Recivable Bet Teacher NoteDocument39 pagesAccount Recivable Bet Teacher NoteHaftom YitbarekPas encore d'évaluation

- Accounting FundamentalsDocument40 pagesAccounting Fundamentalsakon sanPas encore d'évaluation

- Working Capital, Credit and Accounts Receivable ManagementDocument28 pagesWorking Capital, Credit and Accounts Receivable ManagementVinodh Kumar LPas encore d'évaluation

- Billing and CollectionDocument24 pagesBilling and CollectionRoby IbePas encore d'évaluation

- Welcomeback: Workshop SixDocument55 pagesWelcomeback: Workshop SixLeah StonesPas encore d'évaluation

- Accounting - Basics - Deloitte. 1Document56 pagesAccounting - Basics - Deloitte. 1Shubh100% (1)

- Chapter 7: Receivables: Principles of AccountingDocument50 pagesChapter 7: Receivables: Principles of AccountingRohail Javed100% (1)

- Chapter 7 - Receivables & Investments: Accounts ReceivableDocument10 pagesChapter 7 - Receivables & Investments: Accounts ReceivableHareem Zoya WarsiPas encore d'évaluation

- Session 5 and 6 - Accounting For RevenueDocument47 pagesSession 5 and 6 - Accounting For RevenueKashish Manish JariwalaPas encore d'évaluation

- 12 - ReceivablesDocument18 pages12 - ReceivablesNMCartPas encore d'évaluation

- Revenue Recognition PDFDocument6 pagesRevenue Recognition PDFObilesu RekatlaPas encore d'évaluation

- Fundamentals of Accounting PDFDocument52 pagesFundamentals of Accounting PDFomid sangarPas encore d'évaluation

- Accounts Receivable Is The Balance of MoneyDocument16 pagesAccounts Receivable Is The Balance of MoneyRaffay MaqboolPas encore d'évaluation

- Accounts Receivable ManagementDocument21 pagesAccounts Receivable ManagementNeris SaturdayPas encore d'évaluation

- Lecture On Nature of ReceivablesDocument3 pagesLecture On Nature of ReceivablesSara AlbinaPas encore d'évaluation

- Accounts Payable ExplanationDocument14 pagesAccounts Payable ExplanationBony ThomasPas encore d'évaluation

- Accounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonDocument6 pagesAccounting 101 Chapter 7 - Accounts and Notes Receivable Prof. JohnsonbikilahussenPas encore d'évaluation

- Receivable Financing: Pledge, Assignment and FactoringDocument35 pagesReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASPas encore d'évaluation

- ACC101 Chapter7new PDFDocument23 pagesACC101 Chapter7new PDFJana Kryzl DibdibPas encore d'évaluation

- Accounting Mid Term Revision Note.Document9 pagesAccounting Mid Term Revision Note.Thin Zar Tin WinPas encore d'évaluation

- Accounts Receivable Collection PolicyDocument9 pagesAccounts Receivable Collection PolicyEuneze Lucas100% (1)

- Receivables ManagementDocument11 pagesReceivables ManagementPuneet JindalPas encore d'évaluation

- Accounting For Receivables: Weygandt - Kieso - KimmelDocument49 pagesAccounting For Receivables: Weygandt - Kieso - KimmelHaftom YitbarekPas encore d'évaluation

- Part 4 AdjustingDocument31 pagesPart 4 AdjustingDONALD GUTIERREZPas encore d'évaluation

- Assignments of Financial ManagementDocument6 pagesAssignments of Financial ManagementNavneet KaurPas encore d'évaluation

- Lec7 - Account ReceivablesDocument33 pagesLec7 - Account ReceivablesDylan Rabin PereiraPas encore d'évaluation

- Types of Accounting AccountsDocument44 pagesTypes of Accounting AccountsAzhar Hussain100% (2)

- Resume CH 8 IFRSDocument5 pagesResume CH 8 IFRSDeswita CeisiPas encore d'évaluation

- Current and NonDocument4 pagesCurrent and NonAbel BerhanuPas encore d'évaluation

- Accounting For ReceivablesDocument49 pagesAccounting For Receivablesdwi studyPas encore d'évaluation

- Chap 1 Acct For ReceivablesDocument34 pagesChap 1 Acct For ReceivablesEthiopia NismPas encore d'évaluation

- Financial Accounting - Information For Decisions - Session 2 - Chapter 3 PPT nEq1Kb24KqDocument37 pagesFinancial Accounting - Information For Decisions - Session 2 - Chapter 3 PPT nEq1Kb24Kqmukul3087_305865623Pas encore d'évaluation

- 03 Transaction AnalysisDocument85 pages03 Transaction AnalysisJennifer Mae Langaman100% (1)

- Accounting Basics Using Quickbooks: Presented by Mike KimutaiDocument17 pagesAccounting Basics Using Quickbooks: Presented by Mike KimutaiMike Kimutai 'Sonko'Pas encore d'évaluation

- (ACCT 317) Chapter 8 - Reporting and Analyzing ReceivablesDocument1 page(ACCT 317) Chapter 8 - Reporting and Analyzing Receivablesp.a.Pas encore d'évaluation

- Irrecoverable DebtsDocument12 pagesIrrecoverable DebtsALIPas encore d'évaluation

- AR Accounts ReceivableDocument3 pagesAR Accounts ReceivableImran HassanPas encore d'évaluation

- Debet and Credit 1Document23 pagesDebet and Credit 1Jemal SeidPas encore d'évaluation

- Chapter 9Document45 pagesChapter 9mziabdPas encore d'évaluation

- Accounts ReceivableDocument21 pagesAccounts ReceivableMurtaza Hussain SyedPas encore d'évaluation

- Accts Rec Est of DADocument38 pagesAccts Rec Est of DAvanessasumagdon8Pas encore d'évaluation

- Intermediate Financial Accounting: Submited By, Kayes Arman ID: 192-11-6265Document33 pagesIntermediate Financial Accounting: Submited By, Kayes Arman ID: 192-11-6265TAWHID ARMANPas encore d'évaluation

- Introduction To AccountingDocument14 pagesIntroduction To AccountingAAr MahadevnPas encore d'évaluation

- Accounts ReceivableDocument3 pagesAccounts ReceivableVishal DahiwalPas encore d'évaluation

- Written Assignment (Class Presentation)Document4 pagesWritten Assignment (Class Presentation)Chin Hung YauPas encore d'évaluation

- French CuisineDocument25 pagesFrench CuisineChin Hung YauPas encore d'évaluation

- Tute 3b PDFDocument7 pagesTute 3b PDFChin Hung YauPas encore d'évaluation

- Session 6b Handout PDFDocument7 pagesSession 6b Handout PDFChin Hung YauPas encore d'évaluation

- Session 3b Handout PDFDocument7 pagesSession 3b Handout PDFChin Hung YauPas encore d'évaluation

- Session 2a Handout PDFDocument7 pagesSession 2a Handout PDFChin Hung YauPas encore d'évaluation

- 7110 s14 Ms 21Document8 pages7110 s14 Ms 21Muhammad UmairPas encore d'évaluation

- Mickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Document37 pagesMickeystartsatextilebusinessaccontacyppt 150824161312 Lva1 App6891Sandeep ManipatruniPas encore d'évaluation

- Measuring Macroeconomic Activity: © 2014 Pearson Education, IncDocument22 pagesMeasuring Macroeconomic Activity: © 2014 Pearson Education, IncchooisinPas encore d'évaluation

- Sampa Video Group 5Document6 pagesSampa Video Group 5Ankit MittalPas encore d'évaluation

- HyperinflationDocument2 pagesHyperinflationDanix Acedera50% (2)

- Telecom Due Diligence and Benchmarks in Developing CountriesDocument10 pagesTelecom Due Diligence and Benchmarks in Developing CountriesJean-Marie Lalanne100% (1)

- BSP Selected Economic Financial IndicatorsDocument8 pagesBSP Selected Economic Financial IndicatorsGlenPas encore d'évaluation

- Receivables ManagementDocument4 pagesReceivables ManagementVaibhav MoondraPas encore d'évaluation

- Installment Promissory Note With Balloon PaymentDocument3 pagesInstallment Promissory Note With Balloon PaymentkennjrPas encore d'évaluation

- Exam1 WS1213Document10 pagesExam1 WS1213Faisal AzizPas encore d'évaluation

- Class 12th Paper 2017Document4 pagesClass 12th Paper 2017AkankshaPas encore d'évaluation

- Lecture 3 2015Document31 pagesLecture 3 2015Ashish MathewPas encore d'évaluation

- The Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillDocument36 pagesThe Accounting Cycle: Preparing An Annual Report: Irwin/Mcgraw-HillJumma KhanPas encore d'évaluation

- CH 02 SolsDocument2 pagesCH 02 SolsHạng VũPas encore d'évaluation

- Bharat ElectronicsDocument12 pagesBharat Electronicsnafis20Pas encore d'évaluation

- ICAB Knowledge Level Accounting May-Jun 2016Document2 pagesICAB Knowledge Level Accounting May-Jun 2016Bizness Zenius HantPas encore d'évaluation

- Commercial Banks in India..Document21 pagesCommercial Banks in India..Dakshata GadiyaPas encore d'évaluation

- Financial Management - 2 Marks Questions and AnswersDocument2 pagesFinancial Management - 2 Marks Questions and AnswersKumara Kannan Rengasamy100% (4)

- Eop (Bop)Document36 pagesEop (Bop)Mohsan SheikhPas encore d'évaluation

- Fin 22Document6 pagesFin 22Princess AduanaPas encore d'évaluation

- Corp Bank Monsoon Offer PDFDocument2 pagesCorp Bank Monsoon Offer PDFMasroorHussainPas encore d'évaluation

- Money CollocationsDocument4 pagesMoney CollocationsTaoufik RadiPas encore d'évaluation

- Classification, Rescheduling, Write OffDocument17 pagesClassification, Rescheduling, Write OffismailabtiPas encore d'évaluation

- 2009 MFI BenchmarksDocument281 pages2009 MFI BenchmarksRogelio CuroPas encore d'évaluation

- Specimen H1 Econs Paper 1Document1 pageSpecimen H1 Econs Paper 1tengkahsengPas encore d'évaluation

- Exercise Cash BookDocument3 pagesExercise Cash BookAjay Kumar Sharma33% (3)

- Chap 6 and 8 Midterm Review SeatworkDocument2 pagesChap 6 and 8 Midterm Review SeatworkLouina Yncierto0% (1)

- The Determination of Exchange RatesDocument20 pagesThe Determination of Exchange RatesSauryadeep DwivediPas encore d'évaluation

- Basics of EconomicsDocument15 pagesBasics of EconomicsAprvaPas encore d'évaluation

- UPA DissolutionDocument1 pageUPA DissolutionNiraj ThakkerPas encore d'évaluation