Académique Documents

Professionnel Documents

Culture Documents

79528annex A

Transféré par

Jane Alambra AlombroTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

79528annex A

Transféré par

Jane Alambra AlombroDroits d'auteur :

Formats disponibles

Bureau of Internal Revenue

INTEGRITY POLICY

I.

SCOPE

The 1987 Philippine Constitution provides that public office is a public trust

and that public officers and employees must at all times serve the people with utmost

integrity.1

In keeping with this mandate, this policy shall be observed by all officers and

employees of the Bureau of Internal Revenue in the conduct of their official duties

within and without Bureau premises, as well as in their private conduct when public

interest is involved.

Likewise, a culture of performance with integrity shall be observed in all

offices of the Bureau and shall be assimilated in all processes required for operation

and support functions.

II.

INTEGRITY POLICY STATEMENT

The BIR shall maintain and continuously improve the integrity of its officials

and employees along with taking appropriate measures to promote transparency and

service excellence in the discharge of its singular mandate to assess and collect all

internal revenue taxes that are necessary for nation building.

This Integrity Policy of the Bureau is designed to help safeguard the Filipino

taxpayers trust in the Philippines internal revenue system along with strengthening

the honor and legacy of the Bureau and its officers and employees.

The Bureau will never tolerate corruption in all its forms and is committed

and devoted to its prevention, detection, and control through the following:

1. The cultivation of patriotic, effective, and ethical leadership wherein

integrity is ingrained in all actions by the Bureaus senior officers and all

heads of sections, divisions, services, groups, district, and regional offices.

Section 1 Article XI, 1987 Constitution of the Republic of the Philippines

2. The continuous development of policies that empower all Bureau officers

and employees to enable them to sincerely and diligently adhere to the

Bureaus high standards of integrity.

3. The strict adherence to rules and policies that prevent loss, minimize waste,

or otherwise conserve Bureau assets, properties, and accountabilities.

4. The active promotion of efficient and transparent rendition of services to

taxpayers.

5. Perpetual vigilance towards ensuring the accountability of Bureau

personnel for their violations of integrity standards and anti-corruption

policies provided in relevant laws and regulations.

6. The continuous management of corruption risks and their many, varied,

and emergent permutations.

III.

INTEGRITY POLICY FRAMEWORK

This policy is anchored on, and shall therefore, be referenced with the

following statutes, regulations, and policies that uphold the integrity of public

servants and ensure their accountability along with other anti-corruption measures:

1.

Republic Act No. 3019 Anti-Graft and Corrupt Practices Act

2.

Republic Act No. 6713 - Code of Conduct and Ethical Standards for

Public Officials and Employees

3.

Revised Uniform Rules on Administrative Cases in the Civil Service

(CSC Resolution No. 99136 dated August 31, 1999)

4.

BIR Revised Code of Conduct For Revenue Officials and EmployeesRevenue Memorandum Order (RMO) No. 53-2010

5.

BIR Citizens Charter adopted in accordance with Republic Act No.

9485

2

6.

BIR Customized Procurement Manual approved in GPPB Resolution

No. 10-2007 through Revenue Memorandum Circular No. 43-07

7.

RMOs on Policies on Recruitment, Hiring, Selection and Promotion

such as RMO No. 10-96 (Policies and Procedures in Appointment

Preparation); RMO No. 25-2003 (Prescribing the Policies and

Guidelines on the Selection of Candidates for Promotion); RMO No.

4-2005 (Recruitment and Selection Process); RMO No.3-93 and RMO

No. 16-94 (institutionalizing the National and Regional Selection

Boards)

8.

BIR Revised Rules of Procedures in the Investigation/Hearing of

Administrative Cases (RMO No. 19-2011); Guidelines and Procedures

in the implementation of decisions/orders on administrative cases

involving BIR official/employee (RMO No. 1-2011)

9.

Implementing Rules and Regulations of National Internal Revenue

Code, as amended

10.

BIR Strategy Roadmap

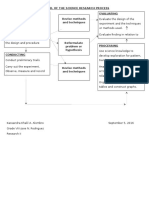

The Bureaus Strategy Roadmap, provided below, shows that the

improvement of the integrity of its officers and employees is clearly

essential to the attainment of the Bureaus goals and the fulfillment of

its mandate. The improved integrity of the revenue personnel directly

leads to: (i) the improvement of the Bureaus assistance, compliance

and enforcement of process, (ii) optimized management of resources,

and (iii) improvement of knowledge management all of which are

conditions necessary to the Bureaus goal of strengthening its good

governance policies, the improvement of taxpayer satisfaction and

compliance, and the attainment of collection targets and sustainable

collection growth.

IV.

ROLES AND RESPONSIBILITIES

A.

Commissioner of Internal Revenue, Deputy Commissioners,

Assistant Commissioners, Regional Directors

As the head of the agency, the Commissioner of Internal Revenue shall

have overall responsibility for the complete and comprehensive implementation

of the Bureau of Internal Revenues Integrity Management Program (IMP).

The Deputy Commissioners shall be responsible for the implementation of

the IMP in their respective Groups.

The Assistant Commissioners shall be responsible for the implementation

of the IMP in their respective Services.

The Regional Directors shall be responsible for the implementation of the

IMP in their respective Regional Offices.

B.

Internal Affairs Service

The Internal Affairs Service shall be responsible for ensuring the strict

accountability of the Bureaus personnel to the IMP through the performance of

its functions relative to the Bureaus internal control, including the following:

1.

Conduct of preliminary fact-finding investigation and prosecution of

administrative cases filed against revenue personnel.

2.

Service of approved formal charges and preventive suspension orders

to the respondents.

3.

Conduct of formal investigation/hearing of administrative charges

formally filed against erring revenue personnel.

4.

Preparation and recommendation of appropriate actions/decisions on

administrative cases heard.

C.

Performance Evaluation Division

The Performance Evaluation Division shall be responsible for measuring,

auditing, and appraising the Bureaus implementation of and compliance with the

IMP through:

1. Conduct of regular, special fiscal, performance and computer audits

based on internal reports and verified denunciations.

2. Review and appraisal of internal controls of existing systems and

procedures.

3. Spot-checks of cash and property accountabilities of all collection,

administrative and accountable officers.

D.

All Heads of Offices

The various national, regional, district, division and section heads of offices

of the Bureau shall be primarily responsible for the faithful implementation of the

IMP in their respective functional and operational areas. They are likewise expected

to exhibit the necessary ethical leadership that would inspire the improved integrity

of their subordinates.

E.

All Revenue Officers and Employees

All revenue officers and employees, as holders of public offices reposed with

public trust, are expected to prove their worthiness to such trust, and thus are

personally responsible and accountable for strict compliance and adherence to the

IMP and all of its policies, orders, and issuances.

Vous aimerez peut-être aussi

- Word Bank (Unit 2)Document5 pagesWord Bank (Unit 2)Jane Alambra AlombroPas encore d'évaluation

- Time Table 2Document1 pageTime Table 2Jane Alambra AlombroPas encore d'évaluation

- CrimPro - Cases For Oct. 4, 2016.JudgeCammanongDocument18 pagesCrimPro - Cases For Oct. 4, 2016.JudgeCammanongJane Alambra AlombroPas encore d'évaluation

- Word Bank (Temporary)Document35 pagesWord Bank (Temporary)Jane Alambra AlombroPas encore d'évaluation

- 185 91 1 PBDocument14 pages185 91 1 PBJane Alambra AlombroPas encore d'évaluation

- DemianDocument16 pagesDemianAngeline Qianhua0% (1)

- Property Digest Partone Sept1,2016Document8 pagesProperty Digest Partone Sept1,2016Jane Alambra AlombroPas encore d'évaluation

- Man Made DisasterDocument3 pagesMan Made DisasterJane Alambra AlombroPas encore d'évaluation

- Ra 8371 FulltextDocument14 pagesRa 8371 FulltextinvictusincPas encore d'évaluation

- Ownership Syllabus.2016Document1 pageOwnership Syllabus.2016Jane Alambra AlombroPas encore d'évaluation

- CrimPro - Cases For Oct. 4, 2016.JudgeCammanongDocument18 pagesCrimPro - Cases For Oct. 4, 2016.JudgeCammanongJane Alambra AlombroPas encore d'évaluation

- A Model of The Science Research ProcessDocument2 pagesA Model of The Science Research ProcessJane Alambra AlombroPas encore d'évaluation

- 7 Tribes of BukidnonDocument15 pages7 Tribes of BukidnonJane Alambra Alombro50% (8)

- ElectionLaw - Case.digest.1 15Document23 pagesElectionLaw - Case.digest.1 15Jane Alambra AlombroPas encore d'évaluation

- Republic v. Remman Enterprises Inc.Document11 pagesRepublic v. Remman Enterprises Inc.Jane Alambra AlombroPas encore d'évaluation

- Activity 1-Where Do I BelongDocument4 pagesActivity 1-Where Do I BelongJane Alambra AlombroPas encore d'évaluation

- Comets and AsteroidsDocument32 pagesComets and AsteroidsJane Alambra AlombroPas encore d'évaluation

- Alcantara - v. - DENR PDFDocument13 pagesAlcantara - v. - DENR PDFJane Alambra AlombroPas encore d'évaluation

- Taste Asia, Taste Africa (Kessa)Document3 pagesTaste Asia, Taste Africa (Kessa)Jane Alambra AlombroPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- UN Billing FMTDocument2 pagesUN Billing FMTowiecho1234Pas encore d'évaluation

- Philippine Banking Corp. v. Judge TensuanDocument3 pagesPhilippine Banking Corp. v. Judge TensuanCHRISTY NGALOYPas encore d'évaluation

- Abubakar Ibrahim Name: Abubakar Ibrahim Adm. No 172291067 Course Code: 122 Course Title: Citizenship Education Assignment: 002Document3 pagesAbubakar Ibrahim Name: Abubakar Ibrahim Adm. No 172291067 Course Code: 122 Course Title: Citizenship Education Assignment: 002SMART ROBITOPas encore d'évaluation

- WSRC Rus Ukr Gur Social Media v1Document11 pagesWSRC Rus Ukr Gur Social Media v1PeterPas encore d'évaluation

- Qanoon e Shahadat ASSIGNMENTDocument11 pagesQanoon e Shahadat ASSIGNMENTumaima aliPas encore d'évaluation

- Women EmpowermentDocument15 pagesWomen EmpowermentMaya DevikaPas encore d'évaluation

- Countries and NationalitiesDocument5 pagesCountries and NationalitiesIsell Angulo MoscotePas encore d'évaluation

- A Be Price Auto Bio StoryDocument52 pagesA Be Price Auto Bio StoryphlebasPas encore d'évaluation

- Mock Board Examination in Criminal JurisprudenceDocument17 pagesMock Board Examination in Criminal JurisprudenceJohn Esquivel33% (3)

- Rad BrochureDocument2 pagesRad Brochureapi-360330020Pas encore d'évaluation

- Muslim Representation in Indian PoliticsDocument16 pagesMuslim Representation in Indian PoliticsFarhanPas encore d'évaluation

- Daily Lesson Log (DLL) : Grade 1 - AquinoDocument10 pagesDaily Lesson Log (DLL) : Grade 1 - AquinoEhlee Eton TubalinalPas encore d'évaluation

- TSNDocument16 pagesTSNPj Tigniman100% (6)

- Case DigestDocument2 pagesCase DigestBHEJAY ORTIZPas encore d'évaluation

- 2011 Basil PantelisDocument3 pages2011 Basil PanteliselgrecosPas encore d'évaluation

- CSC 10 - MOCK EXAM 2022 WWW - Teachpinas.com-35-47Document13 pagesCSC 10 - MOCK EXAM 2022 WWW - Teachpinas.com-35-47mnakulkrishnaPas encore d'évaluation

- L-CRLJ 66 Eff 9.1.19Document2 pagesL-CRLJ 66 Eff 9.1.19Kevin SuitsPas encore d'évaluation

- Evidence SyllabusDocument7 pagesEvidence SyllabusIcel LacanilaoPas encore d'évaluation

- Law Nego Pretest and Post TestDocument4 pagesLaw Nego Pretest and Post TestLovely Mae LariosaPas encore d'évaluation

- The New Immigrants - 14.1Document20 pagesThe New Immigrants - 14.1mrmcpheerhsPas encore d'évaluation

- Primary Jurisdiction and Exhaustion of Administrative RemediesDocument23 pagesPrimary Jurisdiction and Exhaustion of Administrative RemediesFernan Del Espiritu Santo100% (2)

- Bill of Particulars For Forfeiture of PropertyDocument18 pagesBill of Particulars For Forfeiture of PropertyKrystle HollemanPas encore d'évaluation

- UNDRIP - Human Civil and Indigenous RightsDocument15 pagesUNDRIP - Human Civil and Indigenous RightsfaarehaPas encore d'évaluation

- Asian Const and Devt Corp Vs Sumitumo Case DigestDocument1 pageAsian Const and Devt Corp Vs Sumitumo Case DigestDanGwapo Runille Mordeno AbesamisPas encore d'évaluation

- Letter To Higher AuthorityDocument3 pagesLetter To Higher Authorityapi-511248471Pas encore d'évaluation

- The Brabant KillersDocument19 pagesThe Brabant KillersAlejandro de DiegoPas encore d'évaluation

- DOJ Filing U.S. v. IgnjatovDocument7 pagesDOJ Filing U.S. v. IgnjatovDerek JohnsonPas encore d'évaluation

- P.7 Lesson Notes Term 2 SSTDocument90 pagesP.7 Lesson Notes Term 2 SSTGeraldPas encore d'évaluation

- Document (1) : Anton Piller KG V. Manufacturing Processes Ltd. and Others (1975 A. No. 6292) (1976) Ch. 55, (1976) Ch. 55Document8 pagesDocument (1) : Anton Piller KG V. Manufacturing Processes Ltd. and Others (1975 A. No. 6292) (1976) Ch. 55, (1976) Ch. 55syakirahPas encore d'évaluation

- Obc CirtificateDocument1 pageObc Cirtificatejnaneswar_125467707Pas encore d'évaluation