Académique Documents

Professionnel Documents

Culture Documents

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

ANUIULB^*,N

COMMEEGI.*.L

HIITTED

Regd.Office:6145, Old Anand Nugat, OffWestern Express Highway, Santacruz (East), Mumbai-400055

Date: 11108/2016

BSE LIMITED

25, PJ Towers Dalal Street,

Mumbai - 4OOOO1,,

Dear Sir/Madam,

Ref. Scrip Code: 512355

Sub: Outcome of Board Meeting held on Thursday, 11th August, 2OL6.

We are pleased to inform you that at the meeting of Board of Directors of the Company held

today, the Unaudited Financial Results for the quarter ended 30th June, 2OL6, has been

approved.

Pursuant to Regulation 33 of Securities and Exchange Board of India (Listing Obligations and

Disclosure Requirements) Regulations, 2015, we enclosed herewith as Annexure containing the

said results.

Kindly accept the same and acknowledge for our records.

Yours Faithfully,

Thanking You,

For

Anukaran Commercial Enterprises Limited

SIIAII

DIRE(CTOR

ANUKARAN COMMERCIAL ENTERPRISES LIA{ITED

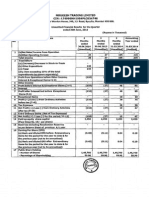

UNAUDITED FINANC|AL REsuLTs FoR THE QUARTER ENDED 30th June, 2016

(Rs

in Lakhs except per share data)

Quarter Ended

Sr. No.

Year Ended

Particulars

30.06.2016

(Unaudited)

31.03.2016

(Audited)

30.06.2015

(Unaudited)

31

.03.201 6

(Audited)

lncome from Operationi

a) Revenue from operatlons

=_D) other OpeiEEng InEohe

I

oral tncome rrom Uperations

r.xpenses

a) Lost of mateiials

consuhEil-

L" rurcnase oT )tocK-tn- I rade

c) Changes in inventories of finished

goods, work-in-progress and Stock-in-

Trade

d) Lmptoyee benefit

expenSe-

1.16

t,54

0.85

5.26

3.34

88.39

0.17

88.97

4.50

92.73

1.O2

94.23

(4.50)

(e2.73)

,1.t I

(1.02)

(e4.23

9.'.|1

106.14

(4.s0)

1.98

8.09

(4.50)

1.98

8.09

11.90

203.35

6.23

209.58

(2o1.37)

1.86

(197.68

e) Depreciation and amoiEiiEoi

3xpense

T,l

utner expenses

lotal Expensei

Profit from Operations before Other

lncome and Finance costs (1-2)

4 utner lncome

5

Profit before FinanEe

rrnance Losts

CojfjlF[}-

1.90

Profit from Ordinary Activities after

but before exceptional

7 Finance costs

items (5-6)

8

9

10

11

EXcepttonat ltems

Profit from Ordinary lctlvltles

tax (7-8)

r

UEfrF

lctivities after tax (9-10)

Extraordinaiy ltems (net of tax expense)

13

Net Profit/(/Loss) for the period(1 1-12)

5nare of profit/ (tosS)-TEsEoEiEtF-Mrnonty hterest

15

16

3.to

3.70

Net Profit/(/Loss) from ordinary

1?

14

(4.50)

ax txpenses

(4.50

(2O5.O7

1.86

(201.38)

(4.s0)

(205.07)

1.86

(201.38)

(4.50)

(2O5.O71

1.86

(201.38)

Net Profit/(Loss) after taxes, minority

interest and share of profit/(loss) of

associates (13-14-15)

17

Paid up equity share capital. (Face Value

of the Share shatt indicated)

1,936.90

1,936.90

1,936.80

1,936.80

Reserves excluding Revaluation Reserves

18

1e (i)

(as per balance sheet of previous

accounting year)

Earnings per share (before

extraordinary items)

(not annualised)

(a) Basic

(o) uttuted

(0.00

(0.1

0.0(

(0.10,

(0.00

(0.11

0.0(

(0.10)

Earnings per share (after extraordinary

items)

1e (ii)

(not annualised)

--i

1q, uq)tL

(o.oo)l

.T{;1

(0.-r-r,

----

o.0ol

n nnl

Notes:

The above unaudited Financiat resutts have been taken on record by the Boaid

of Directors at meeting held on

lnterest Income is recorded as and when received from the concerned parties.

2

Previous Year's figure have been regrouped and rearranged, wherever

'a presentation.

4

For and on behatf of the

Date: 1 1.08.2016

.0g.2016

necessary to conform to the current period's

There were no investor complaints pending at the beginning and end of quarter.

Place: Mumbai

11

Vous aimerez peut-être aussi

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results For June 30, 2016 (Result)Document2 pagesStandalone & Consolidated Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document9 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document4 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For December 31, 2015 (Result)Document3 pagesFinancial Results For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document2 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawD'EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Operating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16D'EverandOperating a Business and Employment in the United Kingdom: Part Three of The Investors' Guide to the United Kingdom 2015/16Pas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- BrochureDocument10 pagesBrochureSaurabh SahaiPas encore d'évaluation

- Kalmar Care For Material Handling, EN PDFDocument9 pagesKalmar Care For Material Handling, EN PDFAki MattilaPas encore d'évaluation

- 03 - UndercityDocument28 pages03 - UndercityJames Bayhylle100% (1)

- HSE RMO and Deliverables - Asset Life Cycle - Rev0Document4 pagesHSE RMO and Deliverables - Asset Life Cycle - Rev0Medical Service MPIPas encore d'évaluation

- Jo LibbeDocument4 pagesJo LibbejacPas encore d'évaluation

- AcadinfoDocument10 pagesAcadinfoYumi LingPas encore d'évaluation

- Bhuri Nath v. State of J&K (1997) 2 SCC 745Document30 pagesBhuri Nath v. State of J&K (1997) 2 SCC 745atuldubeyPas encore d'évaluation

- Cambridge IGCSE™: Information and Communication Technology 0417/12Document9 pagesCambridge IGCSE™: Information and Communication Technology 0417/12Ibrahim Abdi ChirwaPas encore d'évaluation

- Women and Globalization PDFDocument12 pagesWomen and Globalization PDFrithikkumuthaPas encore d'évaluation

- Jacques Maritain - Man and The State-University of Chicago Press (1966)Document230 pagesJacques Maritain - Man and The State-University of Chicago Press (1966)Gabriel Viana Silveira100% (1)

- 10ca Contract Manual 2005Document4 pages10ca Contract Manual 2005Kavi PrakashPas encore d'évaluation

- Regulus Astrology, Physiognomy - History and SourcesDocument85 pagesRegulus Astrology, Physiognomy - History and SourcesAntaresdeSuenios100% (3)

- Philippine Law A Tapestry of Justice and HeritageDocument2 pagesPhilippine Law A Tapestry of Justice and HeritageKaren Faith MallariPas encore d'évaluation

- Donor's Tax Return: O, Kerwin Michael Cheng 195-773-545Document2 pagesDonor's Tax Return: O, Kerwin Michael Cheng 195-773-545Ackie ValderramaPas encore d'évaluation

- Application For DiggingDocument3 pagesApplication For DiggingDhathri. vPas encore d'évaluation

- Litonjua JR Vs Litonjua SRDocument17 pagesLitonjua JR Vs Litonjua SRRubyPas encore d'évaluation

- Khilafat Movement 1919-1924Document17 pagesKhilafat Movement 1919-1924Grane FramePas encore d'évaluation

- Case Study of Asahi Glass CompanyDocument22 pagesCase Study of Asahi Glass CompanyJohan ManurungPas encore d'évaluation

- 07 Chapter1Document19 pages07 Chapter1zakariya ziuPas encore d'évaluation

- Intra-Class Moot Court 2021 B.A.Ll.B 3 Year: DwelhiDocument17 pagesIntra-Class Moot Court 2021 B.A.Ll.B 3 Year: DwelhiDinesh SharmaPas encore d'évaluation

- BARD 2014 Product List S120082 Rev2Document118 pagesBARD 2014 Product List S120082 Rev2kamal AdhikariPas encore d'évaluation

- 12 Business Combination Pt2 PDFDocument1 page12 Business Combination Pt2 PDFRiselle Ann SanchezPas encore d'évaluation

- 121 Diamond Hill Funds Annual Report - 2009Document72 pages121 Diamond Hill Funds Annual Report - 2009DougPas encore d'évaluation

- Geopolitical Assemblages and ComplexDocument17 pagesGeopolitical Assemblages and ComplexCarmen AguilarPas encore d'évaluation

- Fungal Infections: September 2021Document270 pagesFungal Infections: September 2021NormanPas encore d'évaluation

- Hispanic Heritage MonthDocument2 pagesHispanic Heritage Monthapi-379690668Pas encore d'évaluation

- 1.1.1partnership FormationDocument12 pages1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Sayyid Mumtaz Ali and 'Huquq Un-Niswan': An Advocate of Women's Rights in Islam in The Late Nineteenth CenturyDocument27 pagesSayyid Mumtaz Ali and 'Huquq Un-Niswan': An Advocate of Women's Rights in Islam in The Late Nineteenth CenturyMuhammad Naeem VirkPas encore d'évaluation

- Test Bank OB 221 ch9Document42 pagesTest Bank OB 221 ch9deema twPas encore d'évaluation

- Specpro 4Document12 pagesSpecpro 4Venice SantibañezPas encore d'évaluation