Académique Documents

Professionnel Documents

Culture Documents

FIN534 Homework Set 1 PDF

Transféré par

ghassanhatemTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

FIN534 Homework Set 1 PDF

Transféré par

ghassanhatemDroits d'auteur :

Formats disponibles

FIN 534 Homework Set #1

Directions: Answer the following questions on a separate document. Explain how you reached the answer

or show your work if a mathematical calculation is needed, or both. Submit your assignment using the

assignment link in the course shell. This homework assignment is worth 100 points.

Use the following information for Questions 1 through 4:

Assume that you recently graduated and have just reported to work as an investment advisor at the one

of the firms on Wall Street. You have been presented and asked to review the following Income

Statement and Balance Sheets of one of the firms clients. Your boss has developed the following set of

questions you must answer.

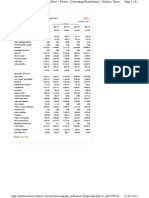

Income Statements and Balance Sheet

Balance Sheet

2012

2013

2014

Cash

$9,000

$7,282

$14,000

Short-term investments

48,600

20,000

71,632

Accounts receivable

351,200

632,160

878,000

Inventories

715,200

1,287,360

1,716,480

$1,124,000

$1,946,802

$2,680,112

Gross fixed assets

491,000

1,202,950

1,220,000

Less: Accumulated depreciation

146,200

263,160

383,160

$344,800

$939,790

$836,840

$1,468,800

$2,886,592

$3,516,952

$145,600

$324,000

$359,800

Notes payable

200,000

720,000

300,000

Accruals

136,000

284,960

380,000

$481,600

$1,328,960

$1,039,800

Long-term debt

323,432

1,000,000

500,000

Common stock (100,000

shares)

460,000

460,000

1,680,936

Retained earnings

203,768

97,632

296,216

$663,768

$557,632

$1,977,152

$1,468,800

$2,886,592

$3,516,952

Total current assets

Net fixed assets

Total assets

Liabilities and Equity

Accounts payable

Total current liabilities

Total equity

Total liabilities and equity

2015 Strayer University. All Rights Reserved. This document contains Strayer University Confidential and Proprietary information

and may not be copied, further distributed, or otherwise disclosed in whole or in part, without the expressed written permission of

Strayer University.

FIN 534 Homework Set #1 1156 (5-19-2015)

Page 1 of 3

FIN 534 Homework Set #1

Income Statements

Sales

2012

2013

2014

$3,432,000

$5,834,400

$7,035,600

2,864,000

4,980,000

5,800,000

18,900

116,960

120,000

340,000

720,000

612,960

$3,222,900

$5,816,960

$6,532,960

$209,100

$17,440

$502,640

62,500

176,000

80,000

$146,600

($158,560)

$422,640

58,640

-63,424

169,056

Net income

$87,960

($95,136)

$253,584

Other Data

2012

2013

2014

Cost of goods sold except depr.

Depreciation and amortization

Other expenses

Total operating costs

EBIT

Interest expense

EBT

Taxes (40%)

Stock price

$8.50

$6.00

$12.17

100,000

100,000

250,000

EPS

$0.88

($0.95)

$1.104

DPS

$0.22

0.11

0.22

40%

40%

40%

$6.64

$5.58

$7.909

$40,000

$40,000

$40,000

Shares outstanding

Tax rate

Book value per share

Lease payments

2015 Strayer University. All Rights Reserved. This document contains Strayer University Confidential and Proprietary information

and may not be copied, further distributed, or otherwise disclosed in whole or in part, without the expressed written permission of

Strayer University.

FIN 534 Homework Set #1 1156 (5-19-2015)

Page 2 of 3

FIN 534 Homework Set #1

Ratio Analysis

2012

Industry

Average

2013

Current

2.3

1.5

2.7

Quick

0.8

0.5

1.0

6.1

37.3

39.6

32.0

Fixed assets turnover

10

6.2

7.0

Total assets turnover

2.3

2.5

Debt ratio

35.60%

59.60%

32.0%

Liabilities-to-assets ratio

54.80%

80.70%

50.0%

TIE

3.3

0.1

6.2

EBITDA coverage

2.6

0.8

8.0

2.60%

1.6%

3.6%

14.20%

0.60%

17.8%

ROA

6.00%

3.3%

9.0%

ROE

13.30%

17.1%

17.9%

9.7

6.3

16.2

27.5

7.6

1.3

1.1

2.9

Inventory turnover

Days sales outstanding

Profit margin

Basic earning power

Price/Earnings (P/E)

Price/Cash flow

Market/Book

1. What is the free cash flow for 2014?

2. Suppose Congress changed the tax laws so that Berndts depreciation expenses doubled. No

changes in operations occurred. What would happen to reported profit and to net cash flow?

3. Calculate the 2014 current and quick ratios based on the projected balance sheet and income

statement data. What can you say about the companys liquidity position in 2013?

4. Use the extended DuPont equation to provide a summary and overview of companys financial

condition as projected for 2014. What are the firms major strengths and weaknesses?

2015 Strayer University. All Rights Reserved. This document contains Strayer University Confidential and Proprietary information

and may not be copied, further distributed, or otherwise disclosed in whole or in part, without the expressed written permission of

Strayer University.

FIN 534 Homework Set #1 1156 (5-19-2015)

Page 3 of 3

Vous aimerez peut-être aussi

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Key Terminology in Clearing and Sattelment Process NSEDocument9 pagesKey Terminology in Clearing and Sattelment Process NSETushali TrivediPas encore d'évaluation

- HTTP WWW - MoneycontrolDocument1 pageHTTP WWW - MoneycontrolPavan PoliPas encore d'évaluation

- IOI Group CoreDocument12 pagesIOI Group CoreSarah Emy SalmanPas encore d'évaluation

- Risk Tolerance QuestionaireDocument4 pagesRisk Tolerance QuestionaireATL3809100% (1)

- FCCB 1Document6 pagesFCCB 1krishr25Pas encore d'évaluation

- The Journey of Safal Niveshak (Vishal Khandelwal)Document28 pagesThe Journey of Safal Niveshak (Vishal Khandelwal)Vishal Safal Niveshak Khandelwal100% (1)

- Kraus & Litzenberger, 1976 Homaifar & Graddy, 1988 Fang & Lai, 1997Document2 pagesKraus & Litzenberger, 1976 Homaifar & Graddy, 1988 Fang & Lai, 1997Salman RahiPas encore d'évaluation

- ch-3 Analysis of MFDocument18 pagesch-3 Analysis of MFrgkusumbaPas encore d'évaluation

- De-Merger of Ultra Tech Cement by L&TDocument19 pagesDe-Merger of Ultra Tech Cement by L&TabhiPas encore d'évaluation

- Gagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabDocument29 pagesGagan Deep Sharma Department of Management Studies BBSB Engineering College Fatehgarh Sahib, PunjabAbdul Motaleb SaikiaPas encore d'évaluation

- Working Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionDocument5 pagesWorking Capital at Zuari Cement: Working Capital Management Is One of The Key Areas of Financial DecisionVardhan BujjiPas encore d'évaluation

- Birla Sun Life MFMDocument29 pagesBirla Sun Life MFMSiddharthaPas encore d'évaluation

- QuestionnaireDocument2 pagesQuestionnaireadriannePas encore d'évaluation

- Group Cash Flow StatementsDocument23 pagesGroup Cash Flow StatementsAmanda7Pas encore d'évaluation

- DCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveDocument4 pagesDCB Bank: Healthy Growth in Balance Sheet C/I Continues To ImproveanjugaduPas encore d'évaluation

- What Is Return Driven StrategyDocument3 pagesWhat Is Return Driven Strategycolleenf-1Pas encore d'évaluation

- ACW264 - 2019 - 2020 - FAR Group AssignmentDocument3 pagesACW264 - 2019 - 2020 - FAR Group AssignmentPeiHueiPas encore d'évaluation

- Fybcommathssem1unit1sharesandmutualfunds 2019 02-28-03 47Document5 pagesFybcommathssem1unit1sharesandmutualfunds 2019 02-28-03 47princePas encore d'évaluation

- Chapter 2 PDFDocument36 pagesChapter 2 PDFLindsay MartinPas encore d'évaluation

- Ifrs 170120102142Document10 pagesIfrs 170120102142ajayPas encore d'évaluation

- Business Accounting Standard - LithuaniaDocument9 pagesBusiness Accounting Standard - Lithuaniafleur de ViePas encore d'évaluation

- Note Purchase Agreement Template-With CapDocument14 pagesNote Purchase Agreement Template-With CapDavid Jay Mor50% (2)

- Barb William and Steven LauDocument6 pagesBarb William and Steven Lauzaidirock68Pas encore d'évaluation

- Fundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsDocument401 pagesFundamental Equity Analysis & Analyst Recommendations - STOXX Europe Mid 200 Index ComponentsQ.M.S Advisors LLCPas encore d'évaluation

- Chapter 16 Solution ManualDocument54 pagesChapter 16 Solution ManualJose Matalo67% (3)

- Deutsche BankDocument3 pagesDeutsche BankRi BudhraniPas encore d'évaluation

- CH 08Document37 pagesCH 08Azhar Septari100% (1)

- Casey Executive MagDocument6 pagesCasey Executive Magsmithcari13Pas encore d'évaluation

- Private Equity E BookDocument141 pagesPrivate Equity E BookJM Koffi100% (2)

- CMBSDocument115 pagesCMBSDesiderio Perez MayoPas encore d'évaluation