Académique Documents

Professionnel Documents

Culture Documents

Strategy GE

Transféré par

Raghav ArroraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Strategy GE

Transféré par

Raghav ArroraDroits d'auteur :

Formats disponibles

DIVERSIFICATION

STRATEGY IN M-FORM

(INCONTEXT OF

GENERAL ELECTIC)

BY: Vaibhav Kumar

Raghav Arora

Amrit Routray

Aditya Kumar

Ayan maity

About the Company

General Electric Company or GE, is an American multinational conglomerate corporation

incorporated in Schenectady, New York and headquartered in Fairfield, Connecticut, United

States. The history of General Electric Company is a significant part of the history of technology

in the United States. General Electric (GE) has evolved from Thomas Edisons home laboratory

into one of the largest companies in the world, following the evolution of electrical technology

from the simplest early applications into the high-tech wizardry of the early 21st century.

In 1896, General Electric was one of the original 12 companies listed on the newly formed Dow

Jones Industrial Average. After 120 years, it is the only one of the original companies still listed

on the Dow index.

The company has also evolved into a conglomerate, with an increasing shift from technology to

services, and with 11 main operating units: GE Advanced Materials GE Consumer &

Industrial, GE Energy, GE Equipment Services, GE Healthcare, GE Infrastructure, GE

Transportation, NBC Universal (80 percent owned by GE), GE Commercial Finance, GE

Consumer Finance, GE Insurance

The staggering size of General Electric, which ranked fifth in the Fortune 500 in 2003, became

even more evident through the revelation that each of the companys 11 operating units, if listed

separately, would qualify as a Fortune 500 company. GE operates in more than 100 countries

worldwide and generates approximately 45 percent of its revenues outside the United States.

Over the course of its 110-plus years of innovation, General Electric has amassed more than

67,500 patents, and the firms scientists have been awarded two Nobel Prizes and numerous

other honors.

Ability to sustain through capabilities

Leadership:

core competencies provide new market accessibility and VAS to

company, every other capability is imitable but not the leadership. Immelts motivational and

democratic leadership has successfully reshaped the bureaucratic culture into innovative culture

hence it now stands to its slogan of Imagination at work this differentiates it from other

companies. High level of motivation and high standard of quality providing ample opportunities

to employees which makes them productive. Much priority is now given in maintaining the

relationships with the third party suppliers as well as investors this is the major factor for GEs

success.

Human resource Development: high skilled training and development of employees

known as GE global learning has facilitated the high level and exceptional quality of

management within the organization. The structure of training of development process known as

GE branded enables structural change. GE leverages community colleges to get trained and

certified skills in advanced manufacturing within six weeks and more emphasis is paid on

graduating engineers. The expansion and motivation growth through innovation is cheaper and

more effective that buying from outside which is cheaper than buying from outside hence the

competency to improve the business model.

Organizational structure: Earlier the structure was based on portfolio of business units

which has now been changed according to the core competencies, GE had highly centralized

bureaucracy which is now broken up into individual units which facilitates cross cultural

integration. This increased the market value from 12 billion to 37 billion in 10 years. As it

complements the core competency easy communication and reducing delegation has helped GE

grow and gain an edge over that of its competitors.

Technology: Since GE culture has changed from six sigma the bottom line driven

organization to being an innovation driven. In response to growing demands, technical

innovations for instance processing mapping workouts well with companys image. It is G

commitment towards the environmental issues that they came up with the technology phrase as

Ecomagination and benefit customer and society at large. Approximately $100billion has been

spent on innovation in last 80 years.

Product portfolio: under the leadership of welch it has been highly seen that company

has leveraged its diverse product portfolio in the various fields of the business to create synergies

and achieve economies of scale and scope it is said no company has gone global so aggressively

than GE division managers acted like owners and familiar with customers need produced and

innovated products which satisfied them. GE established good relationships with governments

and leveraged their ties in international market such as in India and china. This improved its

brand value and reputation and gave them the advantage of cheap labor in India and china.

Customer service: Welch Era From 81 To 2001 focused on productivity and boundary

less structure for process improvement, further it adopted CAP change acceleration process

which lead to the road to customer impact which has now become the DNA for GE. The

continual investment in technology has enabled GE to develop new products and enter new

markets which executed through sequences of divestments and acquisitions in various sectors. It

created a differentiation advantage for the company by creating products focusing on customer

focus.

General Electrics business model consists of two parts, namely Industrial and Finance with its

Industrial wing contributing a whopping 90% to its overall business in 2015 while its finance

wing generating 10% of revenue for the company in 2015.

Brief about all these above mentioned sectors are given below to have a better understanding

about various businesses of GE and how they are performing as compared to one another.

Power/Water and Renew Segment: This sector contributed around 18% to the overall market

share of GE but in the last quarter of 2015, it went up to 29% as it contributed a profit of $1.65

billion with the overall revenue coming to around $5.5 billion.

Major products in this segment include gas turbines, in which GE is a market leader, engine and

generators, wind turbines, power generator services, steam turbines and so on. Revenue from

services in this sector was 63% whereas the rest 37% came from sale of equipment.

Demand driver for this segment include good demand of H technology turbines, good growth in

natural gas and strong demand for renewables.

Some of the concerns here are excess capacity prevalent in developed markets due to demand

variations which resulted in less than optimal use of machineries and equipment.

Oil and Gas Segment: This segment has been struggling due to fall in prices of crude oil in

recent years. Also, due to weaker oil prices and volatility in currency exchange which has a huge

impact on this industry has impacted it badly. But, it has still maintained steady profits and

contributed around $715 billion which ranks as the fourth highest contributor for GE in terms of

profits in last quarter of 2015.

Energy Management: This segment contributed around 4% to General Electrics 2015 last

quarter profit and stood at $33 million. Expectations are high from this sector as it is expected to

grow at a rapid pace in future and can be one of the growth drivers for the company in times to

come.

Also, the acquisition of Alstom should further escalate growth of this segment and is a great

boost for the company and would further enhance its reputation with GE already a global

technology leader in transmission, distribution and conversion of electric power.

A challenge for this segment can be slow movement and recovery of European economy which

forms 18% of total energy sector revenue for General Electric.

Aviation Segment: The global aviation industry is dominated by 4 prominent players. For

aircraft manufacturing, 2 big names which immediately come to mind are Boeing and Airbus and

they heavily dominate this area. As for engine manufacturing, GE and Rolls Royce are the forces

to reckon with.

GE aviation wing is giving handsome returns with a total profit of $1.5 billion in 2015 last

quarter which contributes to around 28% of their total revenue in that quarter.

Growth in this sector is expected due to lower fuel prices and growth in passenger traffic and

freight as well. Also, there is a high replacement demand of equipment which forms 40% of its

total revenue in this segment while the rest is formed by the actual growth of the segment.

Healthcare Segment: This segment includes investment in diagnostic equipment, money spent

on discovery of new drugs as well as research and development put in for disease research with

US forming 45% of total revenue of $938 million followed by Europe and Asia with 23% and

22% respectively.

Good growth and demand is expected in this segment due to advent of GE in developing markets

with great potential which are expected to provide robust results and increased profits for the

company.

Transportation segment: This segment provided a profit of $339 million dollars mainly

dominated by US market with a major chunk of it coming from their i.e. 68% revenues. It is

followed by a distant second rest of America market, Asian market and European market with

contributions of 13%, 9% and 4% respectively.

Growth in North America is largely expected due to superb demand in rail and locomotives. The

only disadvantage is the continuous disruption in global mining segment as a result of which,

there has been a decline in consumer expenditure which can have adverse effects on the

transportation segment of GE.

Appliances and Lighting: GE has sold this segment to Haier for a huge gain of $5.4 billion

even though it was giving good profits. Major products in this segment were refrigerators, water

heater, dishwashers etc.

The decision to sell this segment was made as GE did not consider it as its core strength. Also,

they did not have a favorable competitive position in market in regards to the same.

Capital Segment: It forms part of the financial services unit of GE and includes services like

commercial loans, commercial leases, commercial real estate, credit cards etc.

It was expected to be a growth driver for the company but they have recently decided to divest

from this sector as they do not consider this as one of their core strengths. They have already

started doing the same by initiating spin-off of Synchrony Financial into a stand-alone company

to reduce investments in non-core assets.

Acquisitions made by General Electrics (GE)

Company goes for acquisition due to the following reasons

Synergy: Companies goes for synergy to attain cost, operational synergies by using their

complementary strengths and weaknesses.

Diversification / Sharpening Business Focus: One of the major reasons that a company goes

for diversification is diversification through which a company can increase its market share.

Growth: Companies goes for acquisition as they can promote growth and increase the market

share through proper growth.

Increase Supply: Increase supply always helps in cost synergies as they helps to promote the

business through vertical mergers.

Eliminate Competition: By acquiring a company a company can also eliminate competition and

hence can improve on its market share and facilitate growth.

Please find below details of few of the acquisitions made by general electric (GE)

GE acquires Metem Corporation

GE acquisition of Metem Corporation a US based company to achieve operational synergies.

Metem Corporation is a whole manufacturing company of turbines. GE was facing a problem

with unnecessary emission from the turbine holes which was increasing cycle time and

decreasing efficiency. So making Metem Corporation in house, GE was able to reduce costs and

decreasing emission and hence increasing operational efficiency.

General Electrics acquires Alstom

GE acquisition of Alstom was one of the largest acquisition by general electrics .If was an

acquisition from the general electric power where general electrics utilized the assets of the

Alstom like plants and machinery and hence was able to achieve cost synergies. After making

Alstom in-house GE was able to realize cost synergies which make the power cheap. The

technology which Alstom used was advanced in nature so by using the asset of Alstom power

became more reliable and sustainable.

General Electrics acquires Bio-safe group

GE acquired Bio-safe Corporation an integrated cell bioprocessing system. Which has a very

good operational process which helps in cell therapy. Cell therapy is a technology which helps in

treatment in deadly diseases specially cancer. Many of the cancer patient got rectified after using

of the cell therapy. This advanced bioprocessing system has developed the cell therapy to a

greater extent. The percentage of cured patients and hence the bioprocessing system helped

General electric to provide more customer satisfaction which helped to increase the customer

base and hence the market share and henceforth the profit.

General Electrics is very close in acquiring Adwen

GE is looking to acquire Adwen Corporation which will be an acquisition of GE from the power

vertical and hence it will help GE to develop cost synergies and hence make energy production

more cost effective, reliable. And sustainable.

Merger

General Electric was set to take over Honeywell International Inc. this was set to become the

biggest merger in industrial history, when the European Commission barred it from taking place.

One of the biggest establishments in the world, General Electric was attracted by Honeywell's

aerospace businesses which fit neatly with GE's own businesses in the area, thus creating

excellent synergies for both companies. The merger had been passed by the United States

Department of Justice, with the recommendation that GE divest itself of Honeywell's military

helicopter unit, to protect the US military. However, approval from the EC was not so easy to

obtain

After conducting a thorough investigation, the EC and its Competition Commissioner Mario

Monti, determined that a merger between GE and Honeywell would create an extremely

powerful entity this consequently would have adverse effects on the competitive position in the

aerospace industry. The merger would give the two companies an enormous market share in the

common markets in which they operated. This also meant that they could bundle their

complementary products in future. This would harm competitors as well as customers by

creating a near monopoly market.

The EC demanded that substantial amount (amounting to almost $ 7 billion) be divested by the

two companies, and restrictions be imposed on the operation of the highly profitable GE Capital

Services arm. The demands were far more than GE was ready to concede, and the deal fell

through. The GE-Honeywell merger case marked the first time that transatlantic regulatory

authorities differed in their decision on a merger approval.

Honeywell

Honeywell produced a basket of aeronautical products including avionics, starter motors,

auxiliary power supplies, engine accessories, wheels, brakes, etc. it did not produce engines

however. It achieved market prominence through a series of mergers and acquisitions. More than

half of its revenue in 2001 came from the aeronautical business.

The merger

Analysts said that GE's offer for Honeywell was prompted by the fact that Honeywell's

businesses in aircraft engines, industrial systems, and plastics, were a good fit with GE's own

businesses.

When Welch found out in mid-2000 that Honeywell's board was on the point of deciding on a

merger with UTC, a rival of GE in the aerospace market, he lost no time in making a bid of his

own. Honeywell's management also felt that a merger with GE would be more desirable than one

with

UTC

and

aborted

talks

with

UTC

immediately.

As the merger talks were in progress, GE began exercising control over all aspects of

Honeywell's operations and Honeywell's management was expected to take approval from GE on

all important matters such as hiring new employees and major operational decisions...

Outcome

The GE and Honeywell merger was blocked by the European commission. Block was based on

concerns that bundling would flourish, causing competition to decline .later claims of bundling

were dismissed. Still the EC ruled that bundling was the primary reason to stop the merger.

CFM International

CFMI is a 50/50 joint company between GE and Safran Aircraft Engines (SNECMA).

On 24 September 1974 GE and SNECMA formed CFMI as a 50/50 joint venture.

On April 1979 CFMI launched its first engine "DC-8".

On March 1981 CFM56-3 became the sole engine for what would become Boeing

737Classic aircraft.

On 24 April 1982 CFM56 engine enters commercial service with Delta Air Lines.

On April 1984 United States Air Force(USAF) receives first re-engine KC-135R tanker

aircraft.

Today, USAF is still CFMI's largest customer.

On July 2008 GE and SNECMA renewed the CFMI partnership to the year 2040.

CFMI has sold more than 20,000 aircraft engines by 2009.

SNECMA

SNECMA produced M56. SNECMA specialized in manufacturing fan, gearbox, transmission,

exhaust and low pressure turbine engines. They were more into engine components.

SYNERGY

CFMI combined and tried to obtain synergy between GE and SNECMA by sharing the

production. GE's engines were manufactured and assembled at Evendale, Ohio. While

SNECMA's engines and components were manufactured and assembled in Villaroche, France.

CFMI manufactured engines both at Ohio and France depending upon the functionality of the

engine. And the final assembly was done at Evendale, Ohio. And the final product was branded

under CFMI. Some components were manufactured by Avio of Italy.

Initially, CFMI faced some import and export issues, but latter they were able to tackle it and

resolve it. In the present market, CFMI is the largest player and has the highest market share.

Conclusion:

One of the most diversified conglomerate in the world GE has been on the top of the revenue

chart in the fortune 500 list of companies the major reason for the same are its capabilities and

management, the future sightseeing, the kind of diversification strategies it has formulated in

integrating different businesses to create synergies out of the given resources. Tis all have led to

the emergence of the behemoth in the market that it is right now.

Vous aimerez peut-être aussi

- Dos and Donts For CitizensDocument1 pageDos and Donts For CitizensRaghav ArroraPas encore d'évaluation

- CCP Fee Change SetDocument5 pagesCCP Fee Change SetRaghav ArroraPas encore d'évaluation

- Ma'Cellus: Marcellus Investment Managers Private LimitedDocument8 pagesMa'Cellus: Marcellus Investment Managers Private LimitedRaghav ArroraPas encore d'évaluation

- Sahara IndiaDocument5 pagesSahara IndiaRaghav ArroraPas encore d'évaluation

- CASE 2 Piedmont Trailer Manufacturing CompanyDocument1 pageCASE 2 Piedmont Trailer Manufacturing CompanyRaghav ArroraPas encore d'évaluation

- Common Application Form: Sole / First Applicant Second Applicant Third ApplicantDocument4 pagesCommon Application Form: Sole / First Applicant Second Applicant Third ApplicantRaghav ArroraPas encore d'évaluation

- GrasimDocument1 pageGrasimRaghav ArroraPas encore d'évaluation

- MIGA - InsuranceDocument2 pagesMIGA - InsuranceRaghav ArroraPas encore d'évaluation

- Eco AsssDocument7 pagesEco AsssRaghav ArroraPas encore d'évaluation

- 8899422138471044assignment1201Document10 pages8899422138471044assignment1201Raghav ArroraPas encore d'évaluation

- CB RaghavDocument2 pagesCB RaghavRaghav ArroraPas encore d'évaluation

- Assignment: Assessment Item Brief Description Weighting Due Date Related Learning OutcomesDocument3 pagesAssignment: Assessment Item Brief Description Weighting Due Date Related Learning OutcomesRaghav ArroraPas encore d'évaluation

- IctDocument4 pagesIctRaghav ArroraPas encore d'évaluation

- Case BasicPricingDocument1 pageCase BasicPricingRaghav ArroraPas encore d'évaluation

- MIGA - InsuranceDocument2 pagesMIGA - InsuranceRaghav ArroraPas encore d'évaluation

- Synopsis (13050)Document1 pageSynopsis (13050)Raghav ArroraPas encore d'évaluation

- International Management Institute Bhubaneswar Prof. Bindu Chhabra Chairperson (Programme)Document2 pagesInternational Management Institute Bhubaneswar Prof. Bindu Chhabra Chairperson (Programme)Raghav ArroraPas encore d'évaluation

- Ram Big Bazar Case AnalysisDocument12 pagesRam Big Bazar Case AnalysisRaghav ArroraPas encore d'évaluation

- LookupDocument3 pagesLookupRaghav ArroraPas encore d'évaluation

- Attitude and Job SatisfactionDocument12 pagesAttitude and Job SatisfactionRaghav ArroraPas encore d'évaluation

- Group GDocument1 pageGroup GRaghav ArroraPas encore d'évaluation

- Rameswar MathamaticsDocument6 pagesRameswar MathamaticsRaghav ArroraPas encore d'évaluation

- 0112052Document4 pages0112052Raghav ArroraPas encore d'évaluation

- Management Information System (IM502) - UpdatedDocument4 pagesManagement Information System (IM502) - UpdatedRaghav ArroraPas encore d'évaluation

- Students Details Roll No Name Address Marks1 Marks2 Total Percentage ResultDocument1 pageStudents Details Roll No Name Address Marks1 Marks2 Total Percentage ResultRaghav ArroraPas encore d'évaluation

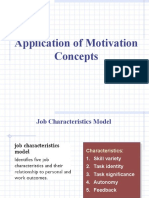

- Application of Motivation ConceptsDocument21 pagesApplication of Motivation ConceptsRaghav ArroraPas encore d'évaluation

- Conflict ResolutionDocument11 pagesConflict ResolutionRaghav ArroraPas encore d'évaluation

- HPCLDocument3 pagesHPCLRaghav ArroraPas encore d'évaluation

- Decision MakingDocument2 pagesDecision MakingRaghav ArroraPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Certification Tax PaymentDocument6 pagesCertification Tax PaymentElea AgacoscosPas encore d'évaluation

- Cities Annual Report FY 2001-02Document688 pagesCities Annual Report FY 2001-02L. A. PatersonPas encore d'évaluation

- ASorianoCorporation SEC17 A December312014 PDFDocument764 pagesASorianoCorporation SEC17 A December312014 PDFJose Navarro100% (1)

- Deed of Partnership - The Masters StitchDocument23 pagesDeed of Partnership - The Masters StitchCredenceLP AssociatesPas encore d'évaluation

- Section 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionDocument2 pagesSection 54ED, Income Tax Act, 1961 2015: Explanation.-For The Purposes of This Sub SectionSushil GuptaPas encore d'évaluation

- Basic Concept of EconomicsDocument19 pagesBasic Concept of EconomicsmitalptPas encore d'évaluation

- Case 9-47 PDFDocument5 pagesCase 9-47 PDFMicha Maalouly33% (3)

- Articles of Association of Single Member CompanyDocument7 pagesArticles of Association of Single Member CompanyM.SohailPas encore d'évaluation

- Trading Blueprint Ebook PDFDocument6 pagesTrading Blueprint Ebook PDFhoneyvijayPas encore d'évaluation

- SMEDA Poultry Farm (7,500 Broiler Birds)Document17 pagesSMEDA Poultry Farm (7,500 Broiler Birds)azy89% (36)

- Transfer Pricing Part 2 AnsDocument5 pagesTransfer Pricing Part 2 AnsDerrick de los ReyesPas encore d'évaluation

- Assignment On O.BDocument15 pagesAssignment On O.BAqsa KhanPas encore d'évaluation

- Grp3 Exercise 8Document12 pagesGrp3 Exercise 8Jessabell Delos SantosPas encore d'évaluation

- Federal Income Tax CourseDocument1 001 pagesFederal Income Tax CourseDeroy GarryPas encore d'évaluation

- Merger Case StudyDocument32 pagesMerger Case StudyAniket Lakhe100% (1)

- Toyota (Automobile) - Waqas FinalDocument55 pagesToyota (Automobile) - Waqas FinalRaza HassanPas encore d'évaluation

- ACC203 Exam I Notes-1Document7 pagesACC203 Exam I Notes-1mariamghader80Pas encore d'évaluation

- Cash Flow Another Approach To Ratio AnalysisDocument5 pagesCash Flow Another Approach To Ratio AnalysisNeeraj MishraPas encore d'évaluation

- Report PublicDocument5 pagesReport PublicIpe DimatulacPas encore d'évaluation

- Companies and PartnershipsDocument24 pagesCompanies and Partnershipsh1kiddPas encore d'évaluation

- Chapter 5 - Forms of Business Ownership and FranchisingDocument35 pagesChapter 5 - Forms of Business Ownership and FranchisingTasnim Rouf TurjoPas encore d'évaluation

- AICPA Newly Released MCQsDocument54 pagesAICPA Newly Released MCQsDaljeet SinghPas encore d'évaluation

- 9706 June 2011 Paper 41Document8 pages9706 June 2011 Paper 41Diksha KoossoolPas encore d'évaluation

- CH 5.palepuDocument34 pagesCH 5.palepuRavi OlaPas encore d'évaluation

- Facts About Social SecurityDocument14 pagesFacts About Social SecurityDavid BriggsPas encore d'évaluation

- Abstract On Budgetary ControlDocument22 pagesAbstract On Budgetary ControlIhab Hosny AhmedPas encore d'évaluation

- Resume KamleshDocument4 pagesResume KamleshMadhur BhatiaPas encore d'évaluation

- SAP Opening Trial BalanceDocument21 pagesSAP Opening Trial BalanceKrishaPas encore d'évaluation

- Chapter 18Document36 pagesChapter 18hussein harbPas encore d'évaluation

- PNV Soft Edited PDFDocument1 pagePNV Soft Edited PDFDeepak kumar M RPas encore d'évaluation