Académique Documents

Professionnel Documents

Culture Documents

Final Report On OPRC Format

Transféré par

Manoj DasTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Final Report On OPRC Format

Transféré par

Manoj DasDroits d'auteur :

Formats disponibles

PUNJAB STATE ROAD SECTOR PROJECT

CONSULTANCY SERVICES AND PROJECT

PREPARATORY STUDIES FOR PACKAGE II

(PHASE II)

Draft Final Report on Contract Format for

Output and Performance Based Contracts for

Roads.

PUNJAB STATE ROAD SECTOR

PROJECT LOAN # 4843-IN

Consultancy Services and Project Preparatory Studies for

Package II (Phase II)

Draft Final Report on Contract Format for Output and

Performance Based Contracts for Roads.

Terms of Reference Task A6: Development of Contract Format

Released By

Prepared By

Opus International Consultants Limited

Robert Fergerstrom

Team Leader

Napier Office

215 Hastings Street

Private Bag 6019

Rowan Kyle

Supporting Procurement Specialist

Napier, New Zealand

Reviewed By

Tony Porter

Highway Specialist

Opus International Consultants Limited 2008

Telephone:

+64 6 833 5100

Facsimile:

+64 6 835 0881

Date:

Reference:

Status:

December 08

8-00719.0A / A61NC

Final V.3

Punjab State Road Project: Final Report on Contract Format

Contents

1

Executive Summary ............................................................................................................. 1

1.1 Introduction ................................................................................................................... 1

1.2 Assets to be Included ................................................................................................... 1

1.3 End of Contract Residual Road Condition .................................................................... 1

1.4 Recommended Procedure for Joint Inspections Prior to Network Hand Back ............... 2

1.5 Financial Arrangements for Performance Guarantees .................................................. 3

1.6 Compliance Framework ................................................................................................ 4

1.7 Tender Evaluation Procedures ..................................................................................... 6

Introduction.......................................................................................................................... 7

2.1 Summary Discussion on Contractor Capacity ............................................................... 7

Extent of Assets to be Maintained. ..................................................................................... 9

3.1 Summary of Assets Recommended to be Maintained within the OPRC Pilot. ............ 11

End of Contract Residual Road Condition ....................................................................... 25

4.1 Introduction ................................................................................................................. 25

4.2 Residual Life for Non Pavement Assets...................................................................... 28

Recommended Procedure for Joint Inspections Prior to Network Hand Back. ............ 29

5.1 Proposed Procedure ................................................................................................... 29

Financial Arrangements for Performance Guarantees ................................................... 31

6.1 Background and Options ............................................................................................ 31

6.2 Other Performance Guarantees ................................................................................. 33

6.3 General....................................................................................................................... 33

Compliance Framework .................................................................................................... 34

7.1 Contract Management Board ...................................................................................... 35

7.2 Payment Penalties for Durability, Road User Service and Comfort and Management

Performance Measure Non-Conformance .................................................................. 36

7.3 Liquidated Damages for Late Completion of Defined Separable Portions................... 41

7.4 Transfer of Work between Adjacent Contracts ........................................................... 41

7.5 Regular Contractor Performance Evaluation .............................................................. 42

The Tender Evaluation Procedures .................................................................................. 44

8.1 Contractor Prequalification ......................................................................................... 44

8.2 Proposed Tender Evaluation Procedure ..................................................................... 46

Contract Duration .............................................................................................................. 51

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

10

Payment for Planned Upgradation Works........................................................................ 52

11

Contract Format Related Issues to be Confirmed ........................................................... 53

8-00719.0A / A61NC

December 08

ii

Punjab State Road Project: Final Report on Contract Format

Executive Summary

1.1

Introduction

1.2

1.3

(i)

The World Bank Sample Bidding Documents will provide only a basis for the final contract

structure however it is anticipated that a number of amendments will be necessary to

reflect both the specific and unique needs of this pilot and to incorporate the

recommendations of this report.

(ii)

The reviews of Contractor Capacity undertaken under Task A4 indicate that the

Contracting Industry within the State and nationally has the capabilities to undertake the

scope of work required.

Assets to be Included

(iii)

It is recommended that the majority of the assets within the road RoW and administered

by the PRBDB, the PWD and the Forest Department are included in the pilot OPRC, with

the only exclusions being the structural repairs to bridges, large culverts or retaining

structures and the maintenance of traffic lights and street lights.

(iv)

The policy for the maintenance of network sections that are currently under construction

or maintenance through the PMGSY or NABARD schemes requires further consideration

from both an administrational and legal perspective. However handing over the

maintenance of these sections of the network to the OPRC contractor at the

commencement of the OPRC pilot or as soon as current construction work has been

completed is considered to be preferred option.

(v)

Where existing asset inventories are incomplete, the OPRC Contractor will be required to

record and update the existing inventory or populate a new inventory (where none exists)

and submit this information to the Client within a reasonable time frame from the

commencement of the contract. On-going auditing of the accuracy and completeness of

this data is strongly recommended.

(vi)

The verification of all existing inventory data and the collection of new inventory data in

the field should be linked to GPS coordinates at the time of data collection.

End of Contract Residual Road Condition

(vii)

All of the current Output and Performance based Road Contracts (OPRC) that Opus

2

International Group are aware of have specified minimum annual quantities (m ) of

pavement rehabilitation and surfacing renewal as the basis for managing the risk of

unintended pavement asset consumption. This concept is also provided for within the

World Banks Sample Bidding Documents for OPRC.

(viii)

While further international research into alternative ways of measuring and managing this

risk will be on-going, there is presently still insufficient confidence over the use of

condition measures or pavement strength assessment tools to allow us to recommend

them as the only mechanism for ensuring unintended consumption has not occurred.

i. It is therefore recommended that both field observations and HDM modelling outputs

2

be used to determine a minimum annual quantity (m ) of surfacing renewal and

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

pavement rehabilitation that will be specified in the Contract documents to be

undertaken by the Contractor. It will remain the responsibility of the Contractor to

identify the location of this work along with the detail of the proposed design.

ii. In addition it is also recommended that a mechanism is developed that will permit

substitution between surfacing renewal and rehabilitation quantities to be agreed by

the CMB. This would account for the level of variability that is likely to occur between

years, or where there is a reduction in the need for the specified annual quantities as

a result of better than expected performance delivered from the OPRC Contractors

pavement and surfacing treatments. However any substitution will be limited to a

percentage (e.g. 10%) of the specified annual quantities and will need to be fully

justified by the Contractor before being submitted for approval.

1.4

(ix)

It is recommended that a Client funded programme of network wide pavement deflection

testing utilising a Falling Weight Deflectometer is undertaken at an appropriate frequency

and that through analysis of this information over time, network specific calibration factors

determined so that this approach can be used in the future to monitor pavement

consumption.

(x)

It is recommended that an acceptable distribution of pavement deflection values to be

achieved through post construction testing on all rehabilitation and upgradation works be

developed. This will assist in encouraging the Contractor to apply adequate Quality

Control in all pavement construction works which will give greater confidence that the

expected design life of the rehabilitated pavements has actually been achieved. To

calibrate the test results it is recommended that previously re-constructed pavements

using verified construction practices and materials be tested and the distribution of

deflection results correlated with expected pavement design lives. Because the testing

results can be influenced by both the time between construction and testing as well as

antecedent weather conditions, it will be necessary to plan the post construction testing

well in advance in an effort to mitigate these effects on the overall results.

(xi)

The application of Durability Performance Measures and Road User Service and Comfort

Measures can be expected to control pavement repair and construction workmanship

issues.

Recommended Procedure for Joint Inspections Prior to Network Hand Back

(xii)

The requirement for the Contractor to develop and operate a defects recording system is

to be monitored by the Client through regular joint inspections.

(xiii)

This list is to form the basis of formal inspections of the network and the identification of

any uncompleted work at 1 year and at 6 months from the due date for the end of the

contract. In addition a further joint inspection is recommended at 2 months from the expiry

of the maintenance defects period.

(xiv)

We will ensure the contract documents also require the Client and the outgoing and

incoming Contractors to complete a joint inspection within two weeks of taking possession

of the network. This requirement will then avoid the potential for a dispute between the

new Contractor and Client over the quality of repairs and/or condition of the network

presented by the out-going Contractor.

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

1.5

Financial Arrangements for Performance Guarantees

(xv)

The preferred alternative would be for the Contractor to obtain a Performance Guarantee

(Performance Bond) to a value that would provide the same level of security to the Client

as retentions would but with a reduced potential for financial hardship and

administrational complexity than that associated with retentions. This performance

guarantee would have three components:

i. Construction Guarantee:

This bond needs to cover the estimated value of all of the planned upgradation works

during the term of the OPRC pilot. It is recommended that 50% of the bond is

released following completion of all of the planned upgradation works and the

balance upon acceptance of all post construction inspection and subsequent

pavement deflection testing.

ii. Operation and Maintenance Guarantee:

This bond needs to cover the risk of inadequate maintenance or re-work arising from

poor pavement rehabilitation construction or maintenance activities. The value of this

guarantee would be expected to be to the same value as the estimated aggregated

sum of the retentions plus another 10% to allow for the risk associated with a fixed

value based upon the contract estimate rather than on a percentage of actual physical

works claims which may include the value of any additional services. However it is

recommended that this value be reviewed on a 2 yearly basis and if necessary the

value amended in line with the actual contract value and to ensure its value is

sufficient to cover the full cost of repairing any defective workmanship and backlog of

uncompleted maintenance. This bond would be released at the end of the contract

term.

iii. Pre-transfer Guarantee:

This bond would need to be provided by the OPRC Contractor at 3 years from the end

of the contract duration and must remain valid for 2 years after the end of the

contract. This bond is to ensure that the Contractor complies with his obligation to

carry out the required level of maintenance right through to the end of the full contract

term. It should be for an amount equivalent to the average annual cost of the

maintenance activities (including pavement rehabilitation) completed over the

previous 7 years. This bond would be called in by the Client in the event that the

average number of Durability and Road User and Comfort Performance Measure

Non-conformances over the last 3 years of the contract exceeded the average annual

number of non-conformances for the previous 7 years by more than 5%.

(xvi)

Interviews held with Contractors during the preparation of the report on Contractor

Capacity under Task A4 indicated that the Contracting Industry was familiar with the use

of Performance Bonds and they did not foresee any problems with the application of this

to the OPRC pilot format.

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

1.6

Compliance Framework

(xvii) It is recommended that a Contract Management Board (CMB) comprising an Executive

committee of senior management personnel from both the Contractors and Client

organisation is established. This Board would meet at regular (at least 6 monthly)

intervals to review performance, and who would have the authority to agree necessary

actions to address any issues threatening the successful outcome of the OPRC pilot.

(xviii) To facilitate and maximise the involvement of the communities being served by the OPRC

network, it is recommended that CMB be responsible for developing a communication

strategy for consulting with the heads of the village or townships (Sapanch) within the

OPRC network on a regular basis. This would then provide a forum for specific concerns

relating to the way the network was being operated and maintained to be raised and if

necessary addressed by the Contractor.

(xix)

It is proposed that the contract performance system is divided into three key groups being

Management Performance Measures, Road User Service and Comfort Performance

Measurers and Durability Performance Measures.

(xx)

To provide an appropriate level of tolerance to the Contractor failing to achieve full

compliance at all times that a bucket system of allowing a prescribed maximum number

of Non-Conformances (NCs) to be accumulated at any time before payment penalties

are applied.

(xxi)

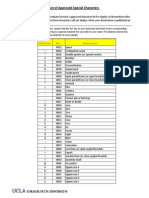

The following table outlines how the proposed payment adjustment regime will

accumulate points based upon the NCs recorded and how these will then result in the

applied payment reductions.

Item

Repeat NonConformance

Report

Failure to

identify and

record defects

Road User

Service and

Comfort

Performance

Measures

breached

Durability

Performance

Measures

breached

Standard

NC Multiplication Factor

Weighting

Sub-weighting

Consecutive

nonConformance Reports relating

to the same occurrence in a

rolling 3 month period

Inspection and recording

regimes as set out in the

maintenance specifications

and any amendments agree to

by the CMB

Any one of the RPMs set out

in the maintenance

specifications and any

amendments agree to by the

CMB

Any one of the performance

measures set out in the

maintenance specifications

and any amendments agree to

by the CMB

1, 2

1,2,3

8-00719.0A / A61NC

December 08

No. of Months

Notes

Sub -weighting

increased in the

last year of the

Contract

Sub-weighting

increased

progressively

during the last

year of the

Contract

Sub-weighting

relates to the

number of full

calendar months

DPM is breached.

Punjab State Road Project: Final Report on Contract Format

Item

Standard

NC Multiplication Factor

Management

Performance

Measures

breached

Any one of the performance

measures (including safety)

set out in the maintenance

specifications and any

amendments agree to by the

CMB

All other verified

NonConformances

Any other breach of the

specifications or any other

failure to meet contractual

obligations not specifically

covered in the above sections

Aggregate NonConformance

Report Score for

the Month

30 Full Performance Payment is made

No. Weeks

Notes

Sub-weighting

relates to the

number of Weeks

(7 days) the MPM

is breached. Part

weeks would be

countered as a

full week.

31 or more No performance payment is made .

Table 1: Proposed Table of Non-Conformance Scores and Payment Reductions

(xxii)

Given the uncertainty surrounding the sensitivity of this proposed scoring mechanism on

the local network it will be necessary to carry out a series of tests on representative

sections to see how difficult it would be to trigger a payment reduction. The final score

may then need to be adjusted to provide a fair balance between acceptable levels of nonconformance and the Contractors risk.

(xxiii) It is recommended that the PRBDB appoints an independent auditor who would

undertake regular reviews of the Contractors performance and would nominate the

randomly selected sections of the network to be audited by the Contractor. It is

understood that this role will be a requirement of the Consultant yet to be selected

through Part E of the T.O.R.

(xxiv) The Contractor will be required to establish and operate a monthly operational compliance

system using their own auditor, but who is independent from the operational team to

establish conformance with the specified performance measurers and contract outputs.

(xxv) The Client is to be given the ability through the contract to also instigate a Project Audit

Team. The Project Audit Team would typically consist of representatives of the Client

(and Consultant if appointed) and the Contractor. The Project Audit Team would

undertake a joint audit of the network from time to time to gauge how well the OPRC pilot

is meeting the principal objectives and whether there are aspects of the contract that

should be presented to the CMB for consideration.

(xxvi) It is recommended that regular (monthly) assessment of the Contractors performance be

undertaken and scored against predefined and agreed criteria by the Client. The criteria

would be jointly developed between the Contractor and the Client as soon as possible

after the award of the Contract, along with an agreed weighted scoring system. The

achievement of a minimum monthly performance score would then form one of the

MPMs in the Conformance Schedule. This would provide both a formal means of

communication between the Contractor and the Client and an opportunity for the Client to

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

raise any concerns or pass on acknowledgment of successful outcomes and

performance.

(xxvii) It is not anticipated that Separable Portions will be necessary within the OPRC contract

nor should Liquidated Damages apply as other mechanisms for encouraging Contractor

compliance are expected to be sufficient. However identified risks associated with the

completion of works under adverse conditions should be highlighted in the Contract

specifications. The exception to this recommendation could be where it was decided to

keep the maintenance of the network sections previously constructed, under either the

PMGSY or NABARD schemes, with the respective Contractors until the end of the

maintenance defects periods. The application of Separable Portions covering the transfer

of this maintenance to the OPRC Contractor may then be more appropriate.

1.7

Tender Evaluation Procedures

(xxviii) It is recommended that, to adequately manage the risk of securing the most suitable

Contractor(s), an Expression of Interest (EOI) be requested from all potential Contractors

and a short list of suitable Tenderers be determined who will then be invited to Tender.

(xxix) To assist with ensuring that a high level of Industry awareness is achieved prior to the

commencement of the final tendering, it is recommended that a comprehensive package

of information be made available to all short listed Contractors who have registered their

interested prior to final tender advertising. This information should include:

maps of the proposed pilot networks, GPS locations, relevant photographs and the

network video taken during the roughness survey

basic schedule descriptions and specifications covering the scope work to be

undertaken

an indicative programme and annual quantities of work

summary draft of the contractual arrangements

proposed payment mechanisms and sample bidding documents

the roles of the various parties

an outline of the tender evaluation criteria and procedures that are proposed.

(xxx) To quantify the value of the quality attributes submitted by the Tenderers to the Client it is

recommended that score applied to each tender by the Tender Evaluation Team (TET) be

separated into Price and a Non-Price (Quality) components. These two components will

be assigned on an agreed weighting, e.g. Price 60%, Non-Price 40% that will provide an

acceptable balance of risk between quality expectations and the price paid.

(xxxi) Clearly identified non-price quality attributes, that the Tenderers must provide (separately

from their Price) for evaluation by the TET, will form a component to the evaluation and

selection process. These attributes would be assigned weightings to reflect the value of

their contribution to the overall non price score.

(xxxii) The scores applied to the non-price attributes from all of the Tenderers submissions

would be used to assign a monetary value or premium that reflects the additional value of

the respective Tenderers quality to the PRBDB and the GoP.

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

Introduction

Task A6: Development of contract format in the Terms of Reference of the Punjab State Road

Sector Project Loan # 4843 IN Consultancy Services and Project Preparatory Studies for Package

II (Phase II) requires the Consultant to study and recommend an appropriate format for the Pilot

performance based contracts. The following are considered to be essential elements in the

consideration of the final contract format:

Recognises the current state of the maintenance contracting industry in the Punjab and does

not overstretch their capabilities

Provides an appropriate mix of input, output and outcome components, reflective of the road

sections selected and the assets to be included

Maximises the potential for success, without making the project so easy that no real learning

takes place

Provides as much flexibility as possible to allow the contract to evolve over time in response to

changes and the lessons learnt.

The World Banks sample bidding document Procurement of Works and Services under Output

and Performance Based Road Contracts is expected to provide a basis for structuring the final

contract documents. However we anticipate that there will also be a significant quantity of

amendments and additions to this document that will be necessary to reflect the specific and unique

needs of this pilot and to incorporate the recommended contract format options presented in this

report.

Amendments to the initial Technical proposal submitted by Opus have been indicated under those

sections where these were proposed and agreed to by both parties during the negotiation process.

The overall format of this report has been aligned with the section headings and outputs defined in

the ToR. It is therefore advisable that readers not familiar with this reference the Task description

before reviewing the report further.

2.1

Summary Discussion on Contractor Capacity

The report on Contractor Capacity prepared under Task A4 concluded that the industry had the

capability to undertake the works required for the successful management of an OPRC pilot. As a

result of the interviews held with the individual Contractors and the feedback received during the

first industry workshop it was apparent that

There was already a reasonably well developed awareness over the aspects of performance

based contracts

The industry already had the resources and experience to construct much of the required

pavement and surfacing works to a reasonably good standard (within the context of the current

delivery model)

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

The industry understood the risk transfer that was embodied in the OPRC approach and

appeared willing to carry a fair proportion of this

There was strong desire by the Industry to be empowered through the OPRC concept and they

were willing to look for innovations where these could result in better outcomes.

These aspects strongly suggest that the implementation of the OPRC pilot should not have to face

the associated difficulties of having to establish both resource capacity or construction skills while

also having to adjust to the performance based contracting environment.

Consequently there is sufficient confidence to move beyond the basic concepts embodied in the

sample bidding documents in an effort to incorporate some of the more recent performance based

contract developments. The principal aims of introducing these concepts will be to:

Ensure the contracts are well tailored to the unique characteristics of the Indian environment

along with providing a fair basis and price for achieving the desired outcomes

Ensure that there is a fair level of risk transfer, and especially over the aspect of residual road

condition

Manage service level creep thereby avoiding the risk that, over time, the costs become

unaffordable or the service levels begin to be out of context with those in place on other

networks within the State

Maximise the value for money being achieved through the performance based philosophy by

ensuring high compliance achievement and good quality control

Ensure there is sufficient flexibility is built into the contracts to cater for inevitable changes and

refinements that will occur over their duration.

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

Extent of Assets to be Maintained.

This report has initially given consideration to the extent of the road network assets that should be

maintained within this contract as required by the following Terms of Reference Section:

Task A6: Extent of the assets, in addition to the pavement, that are to be maintained

24.

Issue to be addressed in the study include the extent of the assets, in addition to the

pavement, that is to be maintained under the contract, for example, in addition to the pavements

should the contract include the management and maintenance of all:

Signage

Delineation

Lighting

Vegetation

Bus/heavy vehicle rest stops

Slopes

Retaining Structures

Drainage Works

Bridge Structure

Road Right of Way (i.e. control and preservation)

The methodology for this is outlined in the Opus Technical submission as follows:

Opus has pioneered the development of OPRC-based contracts, including the provision of

specialist input to World Banks Sample Bidding Documents In addition, Opus has had roles in the

supervision and execution of many forms of term maintenance contract, which has given our key

personnel significant insight into approaches that meet agency expectations but are also highly

deliverable in a practical sense. This makes Opus uniquely qualified to produce documents that fully

reflect the requirements in the Punjab situation. Consideration would also be given to the

requirement for joint PRBDB/Contractor management structures (e.g. performance boards) in the

OPRC document(s) that would provide a governance role and potentially enable a speedy resolution

to any disputes, along with the role of external advisors that may add value over the duration of the

contract.

As required by the TOR, aspects to be covered include:

Signage, delineation, lighting, vegetation, rest areas, slopes, retaining structures, drainage

works, bridges, road right of way

Risk profile issues

Boundary between policing/enforcement and operational requirements

Proposed performance criteria (refer also Task A1)

Long-term asset performance measures

Road User Service and Comfort performance measures

Management performance measures

In addressing these issues, the Opus Team will pay special attention to the following aspects:

8-00719.0A / A61NC

December 08

Punjab State Road Project: Final Report on Contract Format

The scope of infrastructure assets that will fall under the OPRC umbrella; selecting the

assets to be managed under a performance-based regime will be a function of:

(i)

the potential benefits of the OPRC approach to the GoP and PRBDB (i.e. as compared with

the resources required to administer such a contract)

(ii)

the industry capacity to maintain the assets

(iii)

what is practically viable in terms of both the OPRC and the remaining network

(iv)

Balancing the level of contractual risk embodied in the contract form at a level that meets the

performance expectations of the PRBDB, whilst acknowledging the learning curve of the

contractor

There were no negotiated amendments to this.

The basis for deciding on whether assets should be included in the OPRC should be made on

following criteria:

The extent of knowledge held about the nature / quantity of the asset

The extent of knowledge held over the condition of the asset and its future maintenance needs

The level of risk associated with the transfer of the maintenance responsibility to the Contractor

(this aspect will considered in more detail within Task A8 report on Risk Allocation)

The ability to specify the nature of the maintenance work required

The ability of the Contracting Industry to manage this risk and to complete the work required.

Within the limitations imposed by the above bullet points, it is none the less desirable to have as

many of the networks assets included as possible. This desire was also stated during the OPRC

1

Consultation Workshop #1 and included in the summary from Groups B and B1. It is considered

that this will:

Maximise the efficiency of the overall management of the network as there are fewer separate

contracts which then have to be administered outside the OPRC, and reduces the number of

obstacles to communication between various parties responsible for their maintenance.

Reduce the potential for conflict between separate Contractors.

Enable an increased level of internal efficiency to be achieved by the Contractor by aligning

inspection and maintenance activities across asset groups.

The above workshop also identified reluctance by the Contracting Industry to carry the responsibility

for managing the Right of Way, as they considered the difficulties in dealing with adjacent

landowners would be too great. None the less it is recommended that the OPRC Contractor does

carry some limited responsibility for ensuring the RoW remains free of obstacles or impediments to

the unrestricted movement of vehicles and pedestrians. To this extent the Contractor should feel

1

OPRC Consultation Workshop # 1 Summary Report

8-00719.0A / A61NC

December 08

10

Punjab State Road Project: Final Report on Contract Format

empowered to observe and report back to the Client any potential threats to the future maintenance

of the RoW or to his ability to achieve the prescribed Performance Measures (refer section 7.2)

under the contract.

The identification of respective Sapanch (village heads) and the development of a consultation

strategy with them by the CMB is another effective mechanism through which the Contractor can

communicate concerns and issues that may be adversely impacting upon the way the RoW is being

managed and maintained.

2

The preliminary findings of the legal review have also been captured under the respective sections

of this report.

3.1

Summary of Assets Recommended to be Maintained within the OPRC Pilot.

Asset Type

Data

Confidence

Grading

Pavement and Surfacing

Signage

Delineation

Lighting / Traffic Lights

Vegetation Control

Heavy Vehicle Rest Stops

Slopes and Shoulders

Retaining Structures

Drainage Facilities

Bridge Structures

Guardrails and Pedestrian Barriers

Road RoW

Assessed Level of Risk in

Transferring to the

Contractor

B/C*

D

C

C

C

D**

B*

C

B*

B*

C

C

Include in OPRC Pilot

Medium

Low

Low

High

Medium

Low

Medium

Medium

Medium

Medium

Medium

High

Yes

Yes

Yes

No

Yes

Yes

Yes

Yes

Yes

Only routine maintenance repairs

Yes

Limited level of management

Table 2: Summary of Assets Recommended for Inclusion

* Some inventory information is available for the network sections where these overlap with the 86 road sections included in the Phase I Preliminary Report

** Do not currently exist but areas for parking of Heavy Commercial Vehicles may be able to be established and maintained.

Grade

Label

Description

Accuracy

A

B

C

D

Good

Adequate

Poor

Non Existent

Data based on reliable and verified documents

Data based on some supporting documentation

Data based on limited records or local knowledge

Data based on best guess of experienced person

5%

15%

30%

50%

Table 3: Inventory of Data Confidence Levels.

3.1.1 Pavement and Surfacing

Records of recent pavement and surfacing renewal construction details do exist but may not

cover the full extent of the pilot network area, and therefore it will be necessary for the

Contractor to make a visual assessment of the nature of the existing surfacing material

along with the condition of both the surface and underlying pavement during the tendering

phase.

Refer attached Draft Preliminary Report on Legal Issues Raised on the Procurement of Works under OPRC.

8-00719.0A / A61NC

December 08

11

Punjab State Road Project: Final Report on Contract Format

The risk to the Contractor as a result of any lack of long term pavement records can be

mitigated through the requirement of the OPRC contract to complete a minimum quantity of

surfacing renewal and pavement rehabilitation within each year of the contract. However our

experience in the New Zealand environment is that these minimum quantities become the

maximum by default as there is little incentive for them to complete any additional quantities,

even when Road User Service and Comfort Performance Measures (RPMs) or Durability

Performance Measures (DPMs) indicate that they should do so.

To better manage this risk and to enable an increased degree of flexibility in ensuring the

quantities to be completed remain well aligned with the needs of the network, we

recommend a review of these quantities is undertaken every 3 years by the Contract

Management Board. These reviews would give careful consideration to the following

aspects:

The outcome of the Contractors Forward Work Programme review in identifying the needs

of the network

RPM and DPM compliance measures

The results of the network deflection testing programme

The results of on-going (and increasingly refined) annual pavement deterioration

modelling by the Clients Consultant

Quality and performance outcomes achieved from previously constructed upgradation,

rehabilitation and surface renewal work.

All available and current pavement deflection information should be provided to the

Contractor to assist him with the identification where weaker pavement sections exist that

may require rehabilitation during the term of the contract.

The maintenance of the sections within the pilot area that have been recently reconstructed

under either the PMGSY or NABARD schemes, and are still under maintenance by the

respective Contractor must be clarified. The lack of routine maintenance within these

sections as a result of insufficient funding or enforcement has the potential to create a

problem of in-consistent Levels of Service within the OPRC network. This outcome then runs

the risk of compromising the pilots objective of improving the condition of the network from

the road users perspective.

Options for mitigating this risk are to:

(i)

Exclude these sections from the OPRC pilot, and then through a series of Separable

Portions add them progressively as their maintenance periods expire. During this

phase it would be necessary to enforce the existing maintenance requirements for

these previously constructed sections through to the expiry of the maintenance period

before formally handing these over to the OPRC Contractor. This option runs the risk

of the respective PMGSY or NAMBARD Contractor still avoiding the required

maintenance inputs; especially where they consider a lack of payment for this is

probable. Where this may occur, the OPRC Contractor will also have to manage the

risk of pricing in the cost of a potential backlog of uncompleted maintenance work,

unless this catch-up maintenance work can be agreed as a variation to the LS. If this

option is pursued then enabling the OPRC Contractor to claim a variation for any

8-00719.0A / A61NC

December 08

12

Punjab State Road Project: Final Report on Contract Format

jointly agreed catch-up maintenance work is recommended. The preliminary

outcomes of the legal review have suggested that the Sample Bidding Documents

already outline under Clause 63 the mechanism for managing changes of this nature.

(ii)

Seek through mutual agreement with the respective PMGSY (if applicable link roads

are included) or NABARD Contractors to an early termination of any outstanding

maintenance periods, thereby enabling the future maintenance of these sections to be

the responsibility of the OPRC Contractor from the start of the pilot. This would enable

the OPRC Contactor to more easily price this work into the Lump Sum and would

avoid the risk of potentially expensive variations having to be negotiated post contract

award. This option is preferred to i) above as it also presents less risk of variable

Levels of Service across the pilot network.

Option (ii) is therefore considered preferable on the basis that any administrational,

contractual and legal issues can be easily resolved.

3.1.2 Signage

The quantity of existing signage within the proposed networks is not extensive, but it is

expected that there will be opportunities under this pilot for the OPRC Contractor to install

additional signage to address identified safety concerns or improve the level of information

provided to road users.

The risk in transferring the maintenance of the signage to the Contractor will be the

uncertainty surrounding level of damage arising from accidents and deliberate vandalism or

theft requiring sign cleaning and replacement. In addition this work is unlikely to have been

undertaken by those Contractors specialising in pavement and surfacing work, and therefore

they are likely to subcontract this out to others who specialise in both sign fabrication and

installation.

However as the existing numbers are relatively low, then the overall extent and cost for this

work is not expected to be large unless there is a significant differential between the existing

and specified standard for signage on the network. To manage this risk it is proposed to

have the Tenderers specify unit rates for the supply and installation of a range of standard

signs in a separate schedule from the OPRC Lump Sum. The OPRC Contractor would then

be required to prepare a schedule of the additional signage required to bring the network up

to the minimum standard and following the Clients approval, he would then undertake this

work and would be paid (at his nominated unit rates) for this work as a variation.

The OPRC Contractor would only be required to include in his price the installation of

replacement or renewed signage and any additional signage specifically identified as being

necessary to achieve the recommended level of Safety Improvements.

The maintenance of all signage within the road Right of Way is therefore recommended.

This component of the contract should also include:

(i)

(ii)

(iii)

(iv)

All regulatory, information and advisory signage, including those relating to

intersection controls on side roads

All warning and hazard signage

All place name and street name signs

All bridge and structure name and location signage

8-00719.0A / A61NC

December 08

13

Punjab State Road Project: Final Report on Contract Format

(v)

(vi)

All related information signage

All kilometre posts, related displacement signage and markers.

As part of maintaining this asset, it is recommended the OPRC Contractor should also

undertake an initial verification of the signage stock records and update the existing signs

inventory within the first 6 months of the OPRC pilot commencing. He should then remain

responsible for regular (monthly) inventory updates where new signs have been installed, or

existing signage has been upgraded or installed.

Maintenance is to include all separate supporting structures such as poles, gantries and

foundation elements.

3.1.3 Delineation and Pavement Marking

The Contractor will need to include in his price only the cost of maintaining the current

quantity of pavement markings to the specified performance standard.

However where there is a significant difference between the existing delineation, and the

standard required by the PWD/PRBDB then again the Contractor would be required to

complete an inspection of the network and provide a schedule of additional pavement

marking and delineation that would be completed as a variation following the Clients

acceptance.

In addition any further delineation recommended as being necessary to meet identified and

specified safety improvements will have to be included under the LS.

Although performance based methods based upon inspection and measured retroreflectively exist, it is recommended that the following input based approach be adopted:

The Contract specifies a minimum number of annual remarks each year to be

undertaken and the Contractor will be required to confirm when each remark had been

completed

The OPRC Contractor be responsible for the inspection and reporting on the condition of

all pavement markings once annually

Any specific areas of high wear or loss identified either from the Contractors audit or that

of the Independent Auditor are remarked within the prescribed response time. An NC

would only be registered where there was failure to achieve either the annual remark

programme or the response time criteria for addressing identified areas of high wear.

Performance criteria would be based simply upon being clearly visible during daylight

hours and for a prescribed minimum distance at night time under full headlights.

8-00719.0A / A61NC

December 08

14

Punjab State Road Project: Final Report on Contract Format

It is therefore recommended that the OPRC Contractor be responsible for the maintenance

of all of the following:

(i)

existing and new pavement markings, including those identifying the location of

underground utility services

(ii)

where installed retro-reflective raised pavement markers (cats eyes)

(iii)

pavement edge markers

(iv)

painted timber rails or similar structures where these are used primarily for delineation

As part of maintaining this asset, it is recommended the OPRC Contractor should also

undertake an initial verification of the delineation inventory records and update the existing

inventory within the first 6 months of the OPRC pilot commencing. He should then remain

responsible for regular (monthly) inventory updates where new markings or delineation have

been installed, or existing markings have been upgraded, installed or removed.

3.1.4 Lighting / Traffic Lights

Currently the lighting within the network is administered by the PSEB. The maintenance of

street lights is considered to be a specialist activity and if included it is highly likely the work

will be sub-contracted out as a result.

Although it would be possible to have performance based specifications based on luminosity

prepared, most contracts specifications simply require the Contractor to intervene to replace

bulbs and light support columns when damaged, as it perceived the extra work involved in

further compliance measurement does return sufficient benefits.

As result of the specialist nature of this work, and limited, if any, benefit to the PWD/PRBDB

in transferring the risk of their maintenance to the OPRC Contractor it is recommended that

this asset is not included under this pilot.

However the Contractor should still have role in observing and reporting any lighting

outages, especially where these may present a potential safety hazard to road users. In

addition, where additional lighting needs to be installed for identified safety improvements,

then the OPRC Contractor will need to liaise with the contractors responsible for its

installation to ensure that there is no conflict with the operation of the RoW or other assets

under their control.

3.1.5 Vegetation Control

The maintenance of the vegetation on the verges and intersections is principally required for

safety (maintenance of sight distance) and to ensure there is no obstruction to drainage from

the sealed pavement surface or within other drainage facilities. However there may also be

an additional side benefit of providing improved accessibly to the network shoulders for

pedestrian traffic.

In addition the control of vegetation around drainage facilities is required to ensure the free

and unobstructed flow of water.

8-00719.0A / A61NC

December 08

15

Punjab State Road Project: Final Report on Contract Format

Performance based specifications exist that are based upon the maintenance of the

vegetation within maximum or minimum heights mechanically or effectively vegetation free

conditions with herbicides.

The Sample Bidding Documents require the OPRC Contractor to be required to maintain the

vegetation in the RoW to within the specified height tolerances or standards any side roads,

railway crossings and bridge approaches where this vegetation may restrict sight distance of

drivers approaching the pilot network road. This is to include control of the following items:

(i)

Vegetation on all verges and shoulders including the trimming of any branches

overhanging into the carriageway envelop or obscuring site distance or sign visibility

(ii)

The trimming or removal of all shrubs or saplings from within the envelop

(iii)

The control of vegetation around all signs, guardrails, side delineation posts, culvert

inlets and outlets, the sealed pavement surface, kerb and channel, centre median and

bridge structures

(iv)

The removal of any fallen tree and tree branches from the RoW.

It is also recommended that a very low weighting applied to any observed first time nonconformances to reflect the difficulty often experienced by Contractors in achieving full

compliance across the whole of the network at all times. However any repeat NCs resulting

from the Contractors failure to respond to the initial observation should be weighted much

higher.

It is also likely that the Contractor will be required to maintain a minimum level of vegetation

cover on areas that might otherwise be prone to erosion or scour such as steep drain inverts

or batter slopes. In these situations it would expected that the Contractor may have to carry

out some re-vegetation to replace dead vegetation inadvertently killed off by sprays or new

shoulder construction.

In some situations it may not be practical for the Contractor to use herbicides for control

(e.g. the close proximity of side drains to crops) and therefore the Contractor will be required

to include in his price for a higher level of manual labour for vegetation removal to maintain

the required standards.

Where any trees are required to be removed for planned upgradation works, the OPRC

Contractor should also be responsible for the identification of the trees and seeking approval

from the Forest Department sufficiently in advance of the works to prevent any unnecessary

delay.

3.1.6 Heavy Vehicle Rest Stops

These facilities do not currently exist within the pilot network. Existing roadside dhabas (tea

houses) currently provide an alternative service, but these may currently lack the necessary

parking spaces for heavy vehicles to avoid potential obstruction to other road users.

8-00719.0A / A61NC

December 08

16

Punjab State Road Project: Final Report on Contract Format

Where appropriate upgrades to parking areas adjacent to alternative facilities can be clearly

identified prior to tendering and these are specified within the Contract, then it is

recommended that the Contractor be required to price in the LS for their construction and

maintenance including

(i)

The construction and maintenance of any new access from the roadway, pavements

and surfacing within the parking area

(ii)

Removal of posters and illegal signage from adjacent structures or walls

(iii)

Removal of litter and detritus from within the parking area and its immediate

surrounds

Any additional improvement works subsequently identified would be treated a variation to the

contract.

3.1.7 Slopes and Shoulders

A large percentage of the networks carriageway earth shoulders slope down to side drains

or shallower surface water channels. On bridge approaches these side slopes may be

steeper and extend down into river or irrigation canal channels.

These supporting shoulders and slopes are prone to erosion as a result of vehicle, stock and

pedestrian traffic as well as runoff from adjacent sealed surfaces. Where shoulders remain

well vegetated the risk of scour damage is reduced.

It is recommended that the OPRC Contractor be given the responsibility for the maintenance

and repair to all new and existing carriageway formation slopes and shoulders including:

(i)

The repair and re-vegetation of all scour and erosion channels, with special attention

given to those shoulders and slopes constructed as part of completed upgradation

works.

(ii)

The repair of any subsidence impacting or potentially impacting the sealed

carriageway or associated drainage facilities

(iii)

The repair of any shoulder edge wear or rutting resulting in a drop-off from the sealed

carriageway surface

(iv)

The removal of any build-up in material on the shoulder impeding the free flow of

drainage water away from the sealed carriageway.

Extensive damage to these slopes and shoulders arising from unforeseen events, including

the heavy rainfall events or actions of adjacent landowners, would be excluded and

managed under the Emergency Works provisions once a pre-determined limit of expenditure

within the LS per event had been exceeded by the Contractor.

8-00719.0A / A61NC

December 08

17

Punjab State Road Project: Final Report on Contract Format

3.1.8 Retaining Structures

Where the network road runs adjacent to drainage channels, rivers and canals, or large

drainage and irrigation channels traverse the carriageway, various earth retaining structures

will be used to support the road formation.

The adequate maintenance and repair of these structures is fundamental to the long term

security of the pavement and road formation.

It is therefore recommended that the OPRC Contractor be responsible for the maintenance

and repair to all such structures including all shoulder retaining walls, side drain retaining

walls, culvert and bridge abutment headwalls.

Specifically this work would involve

(i)

Checking and cleaning of all associated drainage structure outlets

(ii)

Repair to earth erosion or scour

(iii)

Minor repairs to cracked and spalled concrete surfaces

(iv)

Repairs to damaged gabion baskets

(v)

Protection of the faces of earth reinforced slopes

(vi)

Removal of slip or flood debris

(vii)

Removal of rubbish, graffiti and illegal posters or signs

Extensive damage to these structures arising from unforeseen events, including the heavy

rainfall events, would be excluded and managed under the Emergency Works provisions

once a pre-determined limit of expenditure within the LS per event had been exceeded by

the Contractor.

As part of maintaining this asset, it is recommended the OPRC Contractor should also

undertake an initial verification of all of the existing retaining structures to confirm and

update the existing inventory information database within 6 months of the OPRC Contract

commencing.

3.1.9 Drainage Facilities

The network will contain an extensive quantity of drainage facilities necessary to the long

term stability of the formation and pavement. The adequate maintenance of these facilities is

seen as the key to maximising the lifecycle of both the pavement and surfacing throughout

the network.

The lack of adequate drainage within a number of the urban zones is considered to be the

primary reason for the very poor condition of the adjacent pavement sections. In rural zones,

excessive and prolonged ponding of drainage water either as result of monsoon rains or the

ponding of irrigation water is also expected to contribute to the short pavement lifecycles.

8-00719.0A / A61NC

December 08

18

Punjab State Road Project: Final Report on Contract Format

It is therefore recommended that the OPRC Contractor be responsible for the cleaning and

maintenance of all drainage facilities associated with the road formation including:

(i)

All culvert structures including those under entranceways and side roads

(ii)

All surface water channels and side drains within the RoW

(iii)

The identification and reporting of any drainage impediments beyond the RoW (i.e.

across private property) adversely impacting upon the maintenance of adequate

drainage from the RoW.

(iv)

All kerb and channel

(v)

All drainage ports and associated discharge structures on all bridges, retaining

structures and subsurface drainage pipes.

As part of maintaining this asset, it is recommended the OPRC Contractor should also

undertake an initial verification of all of the existing drainage structures to confirm and

update the existing inventory information database within 6 months of the OPRC Contract

commencing. The entire network should also be inspected at least once during the first 12

months during the monsoon season to specifically re-confirm areas of surface flooding

arising from insufficient road culvert and/or side drain capacity.

Where this inspection identifies structural defects necessitating either significant repair or

replacement is going to be necessary during the term of the OPRC then the Contractor will

be required to prepare a justification report, a programme (timing) for this and a price.

Following acceptance of this the Contractor would then undertake this work as a variation to

the contract.

Information from the Phase I feasibility reports and from field observations suggest that

there is likely to be a significant backlog of routine drainage maintenance work the OPRC

will need to price for.

It is therefore recommended that the tender documents stress the importance of a careful

and detailed network inspection that will need to be undertaken by all Tenderers so that they

can appraise and evaluate the extent of this work against the prescribed level of service

requirements. The time to be provided to the Contractor to address this backlog is

anticipated to be quite extensive and this phase will need to be recognised in the time frame

provided before any performance measure based payment reduction mechanism is applied.

While routine maintenance needs (i.e. cleaning, vegetation removal etc) can be reasonably

assessed through visual inspection, significant restrictions in terms of drainage capacity (i.e.

side drain or culvert water way area limitations) can not be readily determined unless

observed during high or extreme rainfall conditions. Where such restrictions are known to

the PRBDB or the PWD as a result of historical flooding events, and it would be reasonable

to have any improvement works included within the OPRC LS, then these sites should be

brought to the attention of the Tenderers during the pre-tender workshops and the tender

documents.

However it is anticipated that there will be a number of instances where the extent of the

drainage limitations is not well understood or the corrective work requires planning (including

8-00719.0A / A61NC

December 08

19

Punjab State Road Project: Final Report on Contract Format

adjacent landowner negotiation) and design that would not be reasonable for Tenderers to

price for during the tendering phase. Under these circumstances further improvement works

identified by the OPRC Contractor should be undertaken, following approval by the Client,

through either Emergency Works provisions or as an agreed variation to the contract LS.

Extensive damage to these facilities arising from unforeseen events such as extensive

flooding would be excluded and managed under the Emergency Works provisions once a

pre-determined limit of expenditure within the LS per event had been exceeded by the

Contractor.

3.1.10 Bridge Structures

The high cost associated with the repair of bridge structural components as well as the

specialist nature of this work would make the pricing of such work within the LS extremely

difficult by the OPRC Contractor.

It is therefore recommended that the OPRC Contractor be responsible for only the routine

maintenance and repair of all bridge structures within the pilot network area. This work would

include:

(i)

The cleaning of all sills and drainage channels

(ii)

The cleaning of all expansion gaps and replacement of worn or deteriorated

expansion gap gussets and fixings

(iii)

The repair or any damaged handrails and bridge guardrails

(iv)

Minor (non-structural) repair of cracked, broken or spalled concrete surfaces

(v)

The repainting of steel handrails and other specified structural steel work

(vi)

The repair of any abutment or pier erosion and scour directly as a result from runoff

from the carriageway or adjacent land

(vii)

The re-levelling of the pavement and abutment interface to maintain a smooth ride on

and off the bridge deck.

(viii)

The removal of flood debris from the bridge piers, abutments or substructure following

a flood event.

(ix)

The observation and reporting to the Client of any significant damage to the bridge

structure as a result of vehicle impact, vehicle overloading or flood damage.

This work would specifically exclude the following:

(i)

Detailed structural inspections

(ii)

The repair of the bridge structural elements such as deck, beams, bearings, piers or

piles.

(iii)

The repair of major scour resulting directly from river or canal flows.

8-00719.0A / A61NC

December 08

20

Punjab State Road Project: Final Report on Contract Format

These activities would be more appropriately managed through separate specialist

professional service or physical works contracts outside the OPRC.

The Opus Technical Submission also recommended that the design and construction of

bridge deck widening as a result of adjacent upgradation work should be undertaken under a

separate TOR and managed externally to the OPRC pilot. However the OPRC Contractor

will still liaise with any other specialist contractors over the timing of this work so that any

potential for programme misalignment is avoided. The work to identify and report upon the

affected structures should commence as soon as the networks to be included in the OPRC

pilot are confirmed along with the sections to be included within the planned upgradation

works.

3.1.11 Guardrails and Pedestrian Barriers

It anticipated that there will be a quantity of existing guardrails and barriers throughout the

network that will need to be repaired and maintained over the duration of the contract. The

construction of new guardrails to protect both pedestrians at vulnerable locations (e.g.

defined road crossing points) and vehicles from adjacent obstacles (e.g. bridge abutments,

concrete monuments, large trees, hazardous drains etc) are expected to feature in

recommended safety improvement initiatives due to them providing a relatively cheap and

effective means of hazard mitigation.

It is therefore recommended that the OPRC Contractor be responsible for the repair or

replacement of all damaged guardrails or similar protection barriers including pedestrian

barriers on medians or walkways.

Where improvement works clearly identify opportunities for the installation of new barriers to

address safety deficiencies at known black spots, then the OPRC Contractor will need to

price into the LS the construction of these new barriers.

As part of maintaining this asset, it is recommended the OPRC Contractor should also

undertake an initial inspection and verification of all of the existing guardrails and barriers to

confirm and update the existing inventory information database within 6 months of the

OPRC Contract commencing.

While pricing for the quantity of any existing backlog of repairs will be relatively straight

forward, Tenderers may find it more difficult to determine the extent and cost of future

maintenance repairs over the duration of the contract. It is recommended that the PRBDB

make available any are historical expenditure figures that may exist to assist with this.

An alternative option would be to include this item under the Emergency Works section of

the contract with the Client carrying the risk beyond a pre-defined annual expenditure value.

3.1.12 Protection and Maintenance of Road Right of Way

The comments from the Contracting Industry during the Industry Consultation Workshop # 1

suggested they were uncomfortable with the role of formally policing the RoW protection.

The Draft Preliminary Report on the Legal Review has commented at some length on this

particular aspect. In particular this report highlighted the risk of public disorder arising from

8-00719.0A / A61NC

December 08

21

Punjab State Road Project: Final Report on Contract Format

the Contractor attempting to implement or address law and order issues that were clearly in

the domain of the Police to administer.

It is recommended that the OPRC Contractor assume responsibility for the following

functions and activities:

(i)

Observation and reporting to the Client the development of unapproved access to the

road corridor to or from adjacent private land

(ii)

Observation and regular reporting to the Client and the CMB on any unauthorised

encroachment or occupation of the RoW, who can either individually or jointly raise

this issue with the local Police. Communication via the identified Sapanch (village

head) may further assist in expediting a resolution.

(iii)

License approval by the Client for any commercial activity with the potential to

adversely impact upon the operation or maintenance of the RoW should only be

granted after consultation with the OPRC Contractor.

(iv)

Oversight of the maintenance or relocation of existing utility services and the

installation of new utility services within the RoW. This may extend to assisting with

the actual installation or relocation of underground utilities under a separate and

agreed commercial agreement with the utility service providers, but only where the

utility provider can agree an acceptable price for this work with the OPRC Contractor.

If a price can not be agreed, then the utility service provider will retain the right to use

their own or other resources to undertake this work.

(v)

The reporting of incidents, the physical closure (with barriers) and signing of partial or

total road closures.

3.1.13 Management of Emergency Works

Subject to the recommendations of the final report on Task A8: Allocation and Mitigation of

Risk, the management of the uncertainty surrounding unforeseen events can be undertaken

in several ways. The first issue that needs to be carefully considered is what actually

constitutes Emergency Works? In many situations the nature of any incident or event can be

preceded by a low level phase of activity often well within the capability or the Contractor to

manage within the LS. It is only after the event escalates and the amount of resource input

or damage repair exceeds a reasonable level should the risk transfer back to the Clients

organisation.

Whether or not an Emergency situation is in event can be described either objectively, i.e.

the exceedence of a predefined return interval (usually applicable for natural events such as

earthquakes or rainfall) or subjectively by decree by Government, usually in response to

potential or assessed property damage and/or loss of life.

The World Bank Sample Bidding documents allow for the Contractor to make a request to

the Client based upon the losses or damages occurring as a result of natural phenomena.

The responsibility under these circumstances lies with the Contractor to prepare a Technical

Report justifying the execution of the Emergency Works. The Clients Project Manager then

has the discretion to approve this work.

8-00719.0A / A61NC

December 08

22

Punjab State Road Project: Final Report on Contract Format

The Sample Biding Documents allow for the specification of a Provisional Sum item from

which the Contractor is entitled to be paid following instructions from the Client to proceed.

Where the nature of the corresponds with the specified Emergency Work activities outlined

in the Bill of Quantities, then the Contractor will be paid the appropriate unit rates. Where a

work item is not priced in the Bill of Quantities then the Contractor must use a price

breakdowns included in the Contractors bid to form the unit prices to be included in the

Emergency Works quotation.

While this approach is reasonably transparent for those items clearly priced in the BoQ, in

practice Contractors often argue that the nature of the work varies from that priced, and

therefore the tendered rate can not be applied. This then necessitates further negotiation in

an effort to find an acceptable rate.

For the OPRC pilot it is recommended that the following approach be adopted for the

management of Emergency Works:

(i)

Specify a maximum annual value of Emergency Works that is to be carried by the

Contractor as their risk (i.e. must be included in the Contractors LS price). A detailed

break down of this expenditure would still be submitted to and approved by the

Clients Project Manager where possible in advance of the work proceeding and

cumulative total summarised in the Contractors monthly report. This approach is

expected to limit the incentive for the Contractor to claim the costs associated with low

level events or any consequential damages in terms of routine maintenance activities

arising from low such level events. This is a risk which is considered to be best

managed by the Contractor

(ii)

This approach is expected to favour the Contractor during periods of benign weather

when they would be paid a component for Emergency Works in the LS but will not be

required to carry out any work. This in turn will enable the Contractor to build-up a

contingency fund (if they choose to) over time and will enable him to better manage

his cash-flow in completing low level Emergency Works activities.

(iii)

Only once the annual value of Emergency Works has been exceeded, would the

Contractor then be paid from the Provisional Sum item using the unit rates for

applicable work included in the Contractors BoQ, and as set out in the Sample

Bidding documents.

(iv)

The impact of escalation on the value of the Emergency Works completed by the

Contractor needs to be recognised. Over time the actual quantity of work to be carried

by the Contractor before becoming the Clients risk will diminish as a result of price

escalation, and this aspect needs to be addressed in the Contract to avoid the

proportion of risk carried by the Client increasing over its duration.

3.1.14 General Issues

To facilitate involvement of the local village and township communities in the

management of the road networks it is recommended that the CMB be required to

develop a consultation plan that would identify the heads of the village or townships

(Sapanch) within the OPRC network and a programme of regular meetings with this

8-00719.0A / A61NC

December 08

23

Punjab State Road Project: Final Report on Contract Format

group. The objectives of these meetings would be to provide a forum for discussion

over specific issues relating the operation and maintenance of the road network and

how these may be impacting upon the local communities.

The contract documents will make it mandatory that the verification of existing

inventory data and the collection of new inventory data in the field by the Contractor

include the geo-referencing of the assets by GPS at the same time.

8-00719.0A / A61NC

December 08

24

Punjab State Road Project: Final Report on Contract Format

End of Contract Residual Road Condition

4.1

Introduction

The requirements for this section of the Contract Format report are outlined within the following

paragraph:

Task A6: Development of contract format.

25.

End of contract residual road condition. To ensure that the road is returned in a fit

condition for service that will not require major capital maintenance immediately following the

end of the contract, the Consultant shall specify separate residual life for each element of the

project road. The Consultant shall review, as part of this assignment, the impact of the

contract on asset value up to the end of the contract and should advise the Client on the

inclusion of additional measures during the contract period to achieve the minimum required

asset value at the end of the contract.

The Opus Technical submission methodology is outlined below:

End of Contract Residual Road Condition: We recognise the importance of ensuring that

there is no asset consumption over the duration of the maintenance contract and that the

network is returned without the need for any major periodic maintenance immediately

following the end of the contract. Our approach to achieving this will involve both modelling

the impacts of the proposed long term Forward Works Programme and Financial Models

combined with the practical understanding of the networks needs over the next 10 years within

the context of planned improvement and maintenance works to be completed. Our experience

with these contracts has indicated that relying on condition indicators alone to encourage

contractors to carry out sufficient structural (pavement) investment is unlikely to be successful,

and we would seek to identify minimum underpinned quantities of both pavement

rehabilitation and surfacing renewal to be completed each year to ensure any risk of asset

consumption is eliminated.

During the negotiations phase the following additional steps where proposed and accepted: