Académique Documents

Professionnel Documents

Culture Documents

Purpose of Final Project MGT 499

Transféré par

WajidSyed0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues2 pagesCopyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

14 vues2 pagesPurpose of Final Project MGT 499

Transféré par

WajidSyedDroits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

Purpose of Project:

1- The purpose of project is performance evaluation of BANK ISLAMI PAKISTAN

LTD in Pakistan. It means how well the company performs.

2- The main data collection will be done from the annual financial reports of

BANK ISLAMI PAKISTAN LTD from 2013 to 2015.

3- Different financial ratio will evaluated such liquidity ratios, asset management

ratios, profitability ratios and finally measure the best performance of the

company. The mathematical calculation will be established for ratio analysis

from 2013-2015

4- Differences between Islamic Banking and conventional Banking will be

discussed in this project.

5- Over all contribution of Islamic Banking will be evaluated in Modern financial

system.

6- Different modes of Islamic finance will be discussed briefly.

7- Recommendation to improve Islamic Banking system will be discussed.

8- Conclusion: Bank Islami Pakistan Ltd is 2nd largest full-fledged Islamic Bank

in Pakistan. Bank Islami Pakistan is growing very fast in Pakistani financial

system. Bank Islami Pakistan ltd has more potential to grow further. Bank

Islami Bank ltd with other Islamic Banks is playing very important role in the

growth of Economic system. All accept the prohibition of Riba as the platform

to base the implementation of Islamic banking. There is major difference

between in Islamic Banking system and Conventional Banking system. As we

know that interest based banking system contradict with Islamic Shariah in

which case the parts that contradict Shariah is to be rejected and replaced

with parts that comply with Shariah. Many Shariah scholars on Shariah Board

of Islamic Banks who have issued fatwas to support and promote Islamic

Banking and finance in Muslim Countries. In this project we will come to

conclusion that how Islamic Banking and Islamic Financial system is playing

pivotal role in the growth of modern economic and financial system. Growth

of Islamic Banking and Islamic financial system is very essential to eradicate

the root of interest from whole financial system. There are a few weak areas

in Islamic financial system which needs to be eliminated. It can be done

through different strategies as described in this project.

9- The objectives of the study are outlined below: To Discussed the Financial

ratio measurement and analysis. To analyze National Bank trading recent

years. To measure profitability, liquidity and credit management of National

Bank To show the financial stability analysis consists of (profitability and

liquidity). To analyze the balance sheet and income statement.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Capstone Case PDFDocument3 pagesCapstone Case PDFmostafa said21% (14)

- The Future of Online Banking Amidst CrisesDocument7 pagesThe Future of Online Banking Amidst CrisesJep TangPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- ITRS User ManualDocument49 pagesITRS User ManualWajidSyed100% (1)

- GCash OrientationDocument27 pagesGCash OrientationArmiel SarmientoPas encore d'évaluation

- Course Outline: General Information About The ExamDocument2 pagesCourse Outline: General Information About The ExamWajidSyedPas encore d'évaluation

- Al Baraka SOC July To Dec 2020Document10 pagesAl Baraka SOC July To Dec 2020WajidSyedPas encore d'évaluation

- Wajid Ali: Career ObjectiveDocument3 pagesWajid Ali: Career ObjectiveWajidSyedPas encore d'évaluation

- Province and City Wise List of Saturday Operative Branches and Sub Branches With Contact NumbersDocument2 pagesProvince and City Wise List of Saturday Operative Branches and Sub Branches With Contact NumbersWajidSyedPas encore d'évaluation

- No Registry Document FoundDocument1 pageNo Registry Document FoundWajidSyedPas encore d'évaluation

- Quiz MGT-403 PDFDocument5 pagesQuiz MGT-403 PDFWajidSyedPas encore d'évaluation

- Degree Attestation CH All An FormDocument1 pageDegree Attestation CH All An FormWajidSyedPas encore d'évaluation

- Schedule of Bank Charges: January To June 2020Document10 pagesSchedule of Bank Charges: January To June 2020WajidSyedPas encore d'évaluation

- High TreasonDocument1 pageHigh TreasonWajidSyedPas encore d'évaluation

- The Timmons Model: UncertaintyDocument1 pageThe Timmons Model: UncertaintyWajidSyedPas encore d'évaluation

- 2-Planning Justification ReportDocument52 pages2-Planning Justification ReportWajidSyedPas encore d'évaluation

- SR No Date Previous CurrentDocument2 pagesSR No Date Previous CurrentWajidSyedPas encore d'évaluation

- Consultancy Project: Master in Business Administration (Executive)Document21 pagesConsultancy Project: Master in Business Administration (Executive)WajidSyedPas encore d'évaluation

- Consumer Bill - SNGPLDocument1 pageConsumer Bill - SNGPLWajidSyed100% (1)

- Financial ManagementDocument13 pagesFinancial ManagementWajidSyedPas encore d'évaluation

- Sboa School and Junior College - Chennai - 101 Assignment - 6 Business Studies Social Responsibility and Business EthicsDocument5 pagesSboa School and Junior College - Chennai - 101 Assignment - 6 Business Studies Social Responsibility and Business Ethicssurbhi jindalPas encore d'évaluation

- Basle Statement of Principles: AccountedDocument3 pagesBasle Statement of Principles: Accountedsilvernitrate1953Pas encore d'évaluation

- We Are Looking For A Marketing Coordinator To Join Our TeamDocument2 pagesWe Are Looking For A Marketing Coordinator To Join Our TeamNada Rocio DoublaliPas encore d'évaluation

- 16 Century Bankers and Merchants: Room 7: Fairs, Trade - 16 CDocument2 pages16 Century Bankers and Merchants: Room 7: Fairs, Trade - 16 CCésar Saldaña PuertoPas encore d'évaluation

- Repoprt On Loans & Advances PDFDocument66 pagesRepoprt On Loans & Advances PDFTitas Manower50% (4)

- 21 - 22 Business English For Banking and Finance - Dean WillisDocument3 pages21 - 22 Business English For Banking and Finance - Dean Williskath KPas encore d'évaluation

- Ewallet Terms of Use: 1. SubjectDocument14 pagesEwallet Terms of Use: 1. Subjectmartin hinostrozaPas encore d'évaluation

- Labor 2 M1&2 DigestDocument59 pagesLabor 2 M1&2 Digestrussel leah mae malupengPas encore d'évaluation

- C C CCC C CCCCCCCC CDocument45 pagesC C CCC C CCCCCCCC Cdevraj537853Pas encore d'évaluation

- CV Format For A BankerDocument2 pagesCV Format For A BankerNurun Nobi100% (1)

- Bills of ExchangeDocument2 pagesBills of Exchangesubba199533333350% (2)

- CREDIT Case Digests Art 1972-1991Document3 pagesCREDIT Case Digests Art 1972-1991andreaivydy1993Pas encore d'évaluation

- Swot Analysis in Bancassurance.Document50 pagesSwot Analysis in Bancassurance.Parag More100% (2)

- Chapter 3 Commercial Banking New - 1535523282Document13 pagesChapter 3 Commercial Banking New - 1535523282Samuel DebebePas encore d'évaluation

- Account Statement 010721 210122Document30 pagesAccount Statement 010721 210122PhanindraPas encore d'évaluation

- SPGMI Preview Fintech 2024 FINALDocument15 pagesSPGMI Preview Fintech 2024 FINALVignesh RaghunathanPas encore d'évaluation

- Exim Bank: Export-Import Bank of IndiaDocument32 pagesExim Bank: Export-Import Bank of IndiaAnand SinghPas encore d'évaluation

- AOM 2023-001 UguisDocument17 pagesAOM 2023-001 UguisKen BocsPas encore d'évaluation

- FTI Consulting GlobalDocument2 pagesFTI Consulting GlobalHatomi ShibataPas encore d'évaluation

- The Bank of PunjabDocument45 pagesThe Bank of Punjabmankera90% (10)

- NISM SERIES X-A Site Model PaperDocument4 pagesNISM SERIES X-A Site Model Paperssk1972100% (2)

- An Extraordinary Company-HDFCDocument35 pagesAn Extraordinary Company-HDFCPrachi JainPas encore d'évaluation

- Black Book (Sarika)Document56 pagesBlack Book (Sarika)Smruti VasavadaPas encore d'évaluation

- Gemini Solutions: AMC L0 - Session 4Document12 pagesGemini Solutions: AMC L0 - Session 4divya mittalPas encore d'évaluation

- Vidyadeepam Dec 2019 FinalDocument46 pagesVidyadeepam Dec 2019 FinalAjit kumarPas encore d'évaluation

- Loan and Security AgreementDocument51 pagesLoan and Security Agreementbefaj44984100% (1)

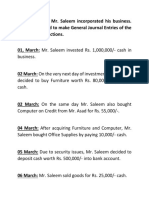

- General Journal PracticeDocument5 pagesGeneral Journal PracticeAhmedPas encore d'évaluation