Académique Documents

Professionnel Documents

Culture Documents

R FP Document

Transféré par

Syed Sultan MansurTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

R FP Document

Transféré par

Syed Sultan MansurDroits d'auteur :

Formats disponibles

RFP for Management Information System for Oriental Bank of Commerce

RFP Reference No: OBC/HO/DIT/RFP-MIS/26/2009-10

Request for Proposal

for Complete and

Centralized Solution

for

MANAGEMENT

INFORMATION SYSTEM (MIS)

for

Oriental Bank of Commerce

Department of Information Technology

Head Office, New Delhi

RFP for Management Information System for Oriental Bank of Commerce

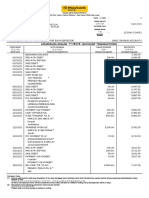

BID DETAILS

S.

No.

1.

2.

3.

Activity

Date

10.11.2009

16.11.2009

30.11.2009

4.

5.

Date of commencement of Bidding Process

Date and Time of Pre Bid meeting

Last Date and time of sale of Bidding

Documents and Bid submission

Date and time of Technical Bid opening

Place of Pre-Bid Meeting and Opening Bids

6.

Address for Communication

7.

8.

9.

EMD (Earnest Money Deposit)

Cost of RFP

Contact Persons

01.12.2009 at 3.00 p.m.

Oriental Bank of Commerce

Head Office

Dept. of Information Technology

4th Floor, F 14, Competent House

Connaught Place

New Delhi 110001

As above

Tele. 011-23325590

011-23358467

Fax. 011-23310013

Rs. 500000.00

Rs. 10000.00

In case any clarification is required in

the matter email at dit@obc.co.in

Note: Bids shall be opened in the presence of Bidders representative who may choose to

attend, but persons attending must have clear cut authorization to attend.

RFP for Management Information System for Oriental Bank of Commerce

1.

OBJECTIVE

Oriental Bank of Commerce is a leading Public Sector Bank with around 1600 (SOLs)

Branches / Administrative Offices / Departments spread across the country. The Bank has a

three tier organizational setup Branches, Regional Offices & Head Office. Presently, there

are 30 Regional Offices reporting to the Head Office.

OBC requires a comprehensive MANAGEMENT INFORMATION SYSTEM for the BANK

The Objective of this RFP is to select technically competent and commercially competitive

bidder for supply, installation, operationalization and maintenance of completely

centralized MANAGEMENT INFORMATION SYSTEM for the Bank

TECHNOLOGY ENVIRONMENT OF THE BANK

All the Branches / Offices of the Bank already stand migrated (100% CBS Coverage) to Core

Banking Solution (FINACLE from M/S Infosys Technologies Ltd.) CBS environment including

Surround Applications of the Bank are as under:

Application System Type

Core Banking Solution FINACLE: 7.017

Operating System

Sun Solaris

Database

Oracle 9i

(being shortly upgraded to 7.019)

(being upgraded to 10)

(being upgraded to

10g)

RTGS / NEFT: IBM

Windows 2000

Internet Banking: Wipro Net power

Windows 2000

Oracle9i / Weblogic

/ MQ Series(IBM)

MS SQL 2005

Solaris 9

Oracle 9i

Windows 2003

Enterprise Server

Oracle 9i

Govt. Business Module GBM: SUN E6900

Pension

Other IT Systems:a) The Treasury, Investments and FOREX Operations of the Bank are currently supported

at the Investment & International Banking Divisions, Delhi by the package IDEAL - IDEALFX,

running on Wipro Netpower Linux 5.3 / Oracle 10g.

b) Besides, there are other applications as well viz. for ATMs (Card Management System),

CMS (Cash Management System), QLM, regarding ALM, IMAC

2.

BIDDERS ELIGIBILITY CRITERIA

Following are the Bidders basic Eligibility Qualification Criteria and the bank reserves right

to disqualify straight away Technical Bids not complying with the same1.

The Bidder should have been engaged as a Vendor for implementing MIS Solution

atleast in three Public Sector Banks for atleast last two years.

RFP for Management Information System for Oriental Bank of Commerce

2.

The Bidder should be a Solution Provider for providing Complete MIS Solution as

envisaged in this RFP.

3.

The Bidder should have experience of handling large database of the size of about 2

TBs, which may further increase upto 4 TBs in next 3 4 years.

4.

The Bidder should necessarily have proven track-record of developing complete and

comprehensive MIS Solution using database of FINACLE and a few Applications

similar to those listed in this RFP. The offered Solution should necessarily have been

introduced in FINACLE environment and the same must be working satisfactorily for

a period of at least last two years and a Certificate to the effect from the Banks must

be submitted along with the Bid. Experience with Public Sector Banks only will be

reckoned for this purpose.

5.

The Bidder will be single point of contact to provide Complete MIS Solution to the

bank.

6.

The Bidder should be atleast a 5 year old Company, financially solvent and a Profit

Making entity. The Vendor should have strong Organizational strength for

implementing the Solution including Hardware, Software, Disaster Recovery, System

Integration, Implementation, etc. System Integration should be based on Industry

Best Practices

7.

Bidder must not be a blacklisted company declared by any Regulator/ Statutory

Organization / Public Sector Companies / Banks in India

3.

SCOPE OF WORK

Broad scope of work includes but not limited to:-

1.

Development, Customization, Installation,

Management of Centralized MIS solution.

Implementation,

Integration

and

2.

System Integration for complete MIS including Supply, Installation and maintenance

of MIS Solution based on latest technology.

3.

The Bank may look at a readymade MIS Solution which meets MIS Requirements of

the Bank or the Solution offered is customizable to meet specific requirements of the

Bank.

4.

Complete Sizing of the solution including Hardware, Software, Operating System,

and Servers etc based on the Sizing Parameters given in this RFP, with proper

justification shall be provided by the Selected Bidder within 30 Days of Completion of

the SRS and the Selected Bidder shall be responsible for the functioning of the MIS

System as envisaged in this RFP.

5.

The offered Solution should support high uptime of 99% per week for which

adequate redundancies in the complete solution be built up to avoid any single point

of failure.

6.

Entire Solution should work in failure mode and ensure high uptime

RFP for Management Information System for Oriental Bank of Commerce

7.

Understanding MIS requirements of the Bank based on the list of Reports as per

Annexure-I, which reflects present position of Reports being sent by the Branches to

their Regional Offices and the consolidated ones from Regional Offices to Branches.

Besides, Reports / Information / Data are being generated at Head Office also.

Further Reports may be added / substituted during the Study for complete

assessment of MIS Requirements / System Study to better understand the banks

requirements and Customization in Software, if required, accordingly with a

provision to further fine tune during Product Development and Implementation

within the accepted architecture.

8.

The scope may further increase / decrease based on the Requirement Study. Vendor

should also be prepared to provide enhancements / modifications keeping in view

the fresh / future requirements of the Regulator / Statutory Authorities.

9.

The Solution should generate Bi-lingual Report Headers viz. in English and Hindi.

10. The Solution should provide Data Extraction Tools for capturing data already resident

in the Systems of the Bank mainly FINACLE. Bank may decide to integrate all Data

Sources / Data available in other applications like GBM, IDEAS, etc. as listed in this

RFP; to have a complete centralized MIS Solution, costs may accordingly be quoted.

11. The Solution should obviate need for feeding any data / information already

available in any of the Systems / Solutions with the bank.

12. The Solution should be able to Interface / Download / incorporate data from any of

the Systems / Solutions deployed by the Bank, as listed in this RFP and mentioned

above.

13. Information regarding gaps in data etc., if any, that may be required to be fed

manually by the branches / offices, at the entry / originating points, the Solution

should support same with facility for such data entry manually, verification thereof

with maker-checker facility. The Solution should populate database gaps at the point

of entry / origination i.e. branches / offices, allowing gap data / information entries

only.

14. The Solution should be web based with all User Friendly and Security Features viz.

Audit Trail, Access Control, Password Control, and Report Extraction Control etc. in

line with such Policies of the Bank, which shall be defined and discussed with finally

selected Bidder. Bidders should have clear understanding and acceptance of same.

15. The Solution should provide BI (Business Intelligence) Tool, capable of various multidimensional analysis across parameters, periods and dimensions as may be user

defined. The analysis may be based on but not limited to Bank as a whole, Regionwise, Branch-wise, Industry wise, Activity wise, Product wise, Sector wise, Group

wise, Exposure-wise, Geography-wise, Risk Profile-wise etc. Bidders, based on their

experience in the field, are expected to suggest enhancements to improve the

analytical content.

16. The Solution should be able to provide What if" analysis on various parameters. In

case of any change in the environment, the solution must be able to provide desired

information as an effect of the change. Further, the Solution should facilitate drill-

RFP for Management Information System for Oriental Bank of Commerce

down / drill-up functionalities to enable user to analyze / forecast macro and micro

level trends.

17. The Solution should provide Users in Head Office Departments, Regional Offices and

Branches, dashboard to view and generate MIS Reports in line with the requirements

at various levels. The Solution should provide information in forms - combination of

numerical and / or graphical forms through dashboard, as the user may desire.

18. The Solution should provide a Reporting tool to facilitate report design, generation,

distribution and archiving.

19. The Solution should have Data Replication capability, in case the Bank requires same.

20. The Solution should support Backup of Data / Information / Reports etc.

21. Training of the Banks MIS Project and the User Staff. Training must cover both

Classroom and Hands on and necessary training material and documents must be

provided to the participants. Training must cover

Software Solution for 10 IT Officers

Software Implementation Training for 10 IT Officers

User Training: Trainers Training 90 Officers (In batches of 30 each)

22. There should be ETL tools to extract and upload data from the existing Systems

23. The Solution should support installation of the MIS Application on Test Environment

and assist Bank in carrying out User Acceptance Test (UAT). Selected bidder shall also

provide Test Cases and Methodology acceptable to the Bank.

24. Assisting the Bank in rolling out application in Head Office / Regional offices and

Branches of the Bank.

25. Providing comprehensive documentation of the application including application

architecture, description of the interfaces, description of the data model, database

table structure, complete description of the data elements (metadata), description

of data extraction / transformation / load operation cycles, user manual etc,

26. Providing application maintenance for error fixes, additions / modifications to the

software to cater to changes to data sources and/ or new reporting requirements

during warranty period of one year as well as during the post-warranty period.

27. The Solution should facilitate users to generate their own Reports through queries.

28. MIS Project completion should be within 8 months from the date of placing of the

Order / execution of Agreement with the Bank.

29. Solution Management: There should be atleast two on-site engineers, located

centrally at Delhi, for extending services like extraction of adhoc data, helpdesk, data

backup, user management, database management / maintenance, updating of data,

maintaining integrity of the data, loading application upgrades, technical support for

adhoc queries, archival of data etc., free of cost during one year warranty period of

the project to start after UAT sign-off of the project and for two years thereafter.

However, tenure of these technical personnel after warranty period shall be decided

RFP for Management Information System for Oriental Bank of Commerce

/ further extended on the basis of review at the end of each year, at the sole

discretion of the bank. Man Month charges for such support, after free of charges

warranty period, be quoted separately for two years, in the Commercial Bid.

30. The vendor must provide 1 Year Comprehensive On-site Warranty for Application

Software including all required Software to run the Application. The Vendor must

undertake to provide Post Warranty Maintenance Support for MIS Solution after

expiry of the Warranty Period, for which Rate of AMC shall be quoted by the Bidder

separately alongwith Commercial Bid. AMC Cost for 5 Years including 1 year

Warranty Period shall form part of Project Cost under the Commercial Bid.

31. The bidder has to submit an undertaking along with the delivered item (Annexure

VIII), signed by the official not lower than Company Secretary, certifying that all the

components/parts/assembly/software used in the MIS Solution were original/new

components/parts/assembly/software and that no refurbished/duplicate/second

hand components/parts/assembly/software were being used or would be used.

4.

FUNCTIONAL REQUIREMENTS

Oriental Bank of Commerce presently has around 1600 (SOLs) Branches and Administrative /

Controlling Offices. At present MIS Data is compiled at CBS - MIS Cell, Head Office and

provided to Branches / Departments in the shape of Reports / Returns / Statements / Data

The requirement for the Centralized MIS Solution and the functions as detailed in this RFP,

should support, in brief but not limited to, as under:

1.

Segregate MIS functions from the present transactional CBS System, so that MIS

functions can be carried independently with increased efficiency

2.

Remove possible data inconsistencies through cross validations in the MIS Solution

to achieve Consistency, flow of accurate Information / Data between various levels

of Administration / Offices

3.

Generate Comprehensive MIS Reports as required by the bank from time to time

facilitating Industry-wise, Sector-wise, Activity-wise, Area-wise etc analysis of

Exposures and Progress.

4.

Handle all Compliance / Statutory / Monitoring Reports like BSR, DSB, PS Advances,

Sectoral Classification of the Loans and Advances etc, required to be submitted to

External Agencies, Regulator, and Internal Consumption etc.

5.

Generate all Returns for Audit at Branches, Regional Offices and Head Office based

on Transactional Data from CBS System.

6.

Record and create database for pre-disbursal stages of Advances, so as to facilitate

monitoring of flow of loan applications and their disposal as well, information / data

regarding which is not taken care in the CBS System.

7.

Generation of validated and uploadable data for submission to CIBIL

8.

Facilitate system driven Asset Classification and handling of provisioning and post

MOCs position in MIS in totality.

RFP for Management Information System for Oriental Bank of Commerce

9.

Facilitate Credit Monitoring- Standard and Potential NPA accounts

10.

Monitoring of legal Suit Filed Cases, SERFASI Act proceedings, performance under

compromised accounts, restructured NPA accounts, partially written off accounts

etc,

11.

Provide Basel II RW calculation on Credit Risk / RWA computation on Credit Risk

supported by Auditable Verification Reports to enable multilevel (Branch / RO / HO)

Audit of the Risk Weight Computation under Credit Risk as per Basel II Guidelines.

12.

Maintenance of historical data representation

13.

Generate Reports relating to Liability side of the Balance Sheet, as well.

14.

Executive Dash Boards to enable provision of Executive Dash Board on various

business parameters of the Bank or as decided by the bank from time to time.

15.

Validate existing database for transfer to MIS Solution. The Selected Vendor will

provide Gaps in the Data including Gap Reports regarding data not available in CBS

but critical to MIS and also Gap Screens at the Data / Information Entry level viz.

Branches / Offices giving Gap Reports / Gap Information to the Users, for filling the

Gaps. Business Rules for Validation of Data will be discussed and finalized with the

Selected Vendor

16.

Till the time of stabilization of MIS Solution i.e. before all MIS related functions are

carried through the MIS Solution only, for which this RFP is being floated,

a)

All New Borrowal Accounts are to be opened in the CBS System only after

validation of the Account Details / MIS Details in the MIS Solution to maintain

MIS Consistency from the very beginning of an account i.e. from Application

Receipt time and

b) Validated MIS Details / Information, for the Existing Database and the New

Accounts have to be uploaded back on the CBS System at specified frequency

in line with the CBS Parameters. Frequency and Parameters i.e. MIS Solution

should take care of the CBS fields as well by Coding / Mapping / Fields, which

shall be arrived at with the Selected Vendor.

c)

There shall be no double entry of data and information in CBS System and the

MIS Solution

17. Frequency for Data extraction from the Systems shall depend on the Periodicity of

Reports / Returns / Information / Adhoc Requirements to be met / generated,

generally on weekly, fortnightly, monthly basis. Some Adhoc Requirements /

Dashboard Information are required on Daily basis, as well. Frequency shall be

discussed, in detail with the Selected Vendor.

Please Note: the above are illustrative requirements and detailed scope of the project shall

be assessed by the Selected Bidder through comprehensive System Study of the Bank,

further reports and Queries which are to be generated will need to be discussed &

crystallized as per Banks requirements.

RFP for Management Information System for Oriental Bank of Commerce

5.

SIZING AND SCALABILITY REQUIREMENTS

It is most important that MIS Solution with all its components should be scalable to handle

additional MIS Reports as the bank may require, from time to time. Scalability must be in

terms of Hardware, Software, Additional MIS Reports, ETL Tools etc. keeping in view to next

5 Year MIS requirements. MIS Solution will be used as under:

Maximum Number of users:

5000

Maximum Number of Concurrent Users:

3000

Number of Reports / Returns / Statements: 400

Period of Storage of Data:

4 Years

1.

The Sizing of the Solution should be done keeping in view all the above points,

including next 5 Year requirements and a detailed Sizing Document incorporating

proposed System Architecture, Parameters and Justification thereof must be

submitted by the Selected Bidder within 30 Days of Completion of SRS and the

Bidder shall be responsible to ensure generation of desired output as finalized

through SRS Process and that the System doesnt demand any enhancement in Sizing

during next 5 years.

2.

The Bank requires web-based Management Information System Solution with

Centralized Architecture customized to automate all MIS Processes specified in this

RFP document.

3.

The solution must be sized to provide a reasonably good response time on the User

Terminal with about 3000 Concurrent Users.

4.

Proposed solution should ensure all Security Aspects viz. Database Security,

Application Access Security, Communication Channel Security, User level Security,

etc and Compliance of all Terms and Conditions of this RFP.

5.

It would be Vendor responsibility to ensure that the Sizing of the Hardware,

Software, Middleware etc meet complete requirement of the Bank within the

stipulated performance parameters.

6.

In would be Vendor responsibility to ensure that the performance of the Solution

delivered i.e. MIS Application Software, etc. (other than RDBMS and O/S) meets

specified performance parameters as detailed in this RFP. It would be sole

responsibility of the Vendor to upgrade the Software etc so as to meet the stipulated

performance parameters without any cost to the Bank.

7.

Interface with the Banks Core Banking Solution viz. FINACLE 7.0.19 (Presently 7.0.17

being upgraded shortly) and others Applications / Solutions, if decided by the Bank,

including necessary support during future upgrading of the Core Solutions.

8.

The successful bidder shall be required to put in place Master Creation Utilities as

per requirement of the Bank before the Project goes live and provide necessary

training to Banks team on Administration of the System and User Training to Staff as

detailed in this RFP.

RFP for Management Information System for Oriental Bank of Commerce

6.

DATA CAPTURING

The MIS Report, presently being sent by the Branches to their Regional Offices or to Head

Office or Outside Agencies and consolidated Returns being sent by the Regional Offices to

Head Office or Outside Agencies are given in Annexure-I. Besides, there are Reports /

Returns / Adhoc Data being generated centrally at Head Office. MIS Solution - Scope /

Requirements, in detail, have been specified in this RFP. In line with the Requirements,

a.

While major portion of the data/information will be available in the FINACLE

System,

b.

Data that has to be captured / entered a fresh at the Branch / Regional Office

levels shall be based on the Parameters of the MIS Solution being offered as

well as MIS Requirements / Gap Reports relating to data / Information critical

to MIS but not available in FINACLE, and

c.

Some data requirements will have to be met by incorporating data /

information already residing / available in other surround applications subject

to decision in this regard by the bank to integrate such data / information as

well in the MIS Solution.

Depending on the future requirements the number of both the MIS Reports and the Fields

where and what data has to be captured may increase, which shall be discussed with the

Selected Vendor and decided after conducting System Study as specified in this RFP during

the course of implementation of the MIS Solution

7.

SYSTEM REQUIREMENTS

1.

MIS Solution / Application should be based on a Centralized MIS Database to be

created centrally for the purpose as part of the MIS Solution, and the Users will be

located in various Head Office Departments at Delhi, Regional Offices, Regional

Inspectorates / Offices, Branches and Extension Counters spread across the country.

2.

The Solution must facilitate Merging of Branches / Regions, Shifting of Branches from

one Region to other, Creation of New Branches and New Regions.

3.

The Solution must comply Information Security Policy of the Bank on all Security

issues like, User Level Security, Data / Information Security

4.

The web-based on-screen user interface should be through an information portal,

with standard features such as a search engine, input screens and option to generate

reports / output in various formats by the Users. The system should also support

generation of reports centrally at scheduled intervals and printouts distributable in

various File Formats viz. Text, Excel; PDF etc.

5.

Bank has a Wide Area Network connecting its Head Office, Controlling Offices and

Branches and Extension Counters.

6.

The application should be capable of scaling up and hardware configuration as per

the sizing document should be capable of catering to the requirements of the Bank

for at least next five years.

RFP for Management Information System for Oriental Bank of Commerce

7.

The MIS solution should have Data Replication capability in case Bank opts for same.

8.

The Bidder must provide on-site support during the Warranty period at no additional

cost to the Bank. The Bidder should extend necessary on-site support under Solution

Management (onsite support) during post warranty period as well, as per the

requirement of the Bank and covered in detail under the head Scope of the Work.

9.

The Bidder must provide Report writer, Report scheduler and Portal server as may

be required for delivering end-to-end solution.

10. The solution is to be implemented at Delhi.

11. The Application should preferably be based on the Hardware Platforms / Databases /

System Software in line with the ones already in use in the Bank

12. The Bidder shall provide the detailed Solution Architecture showing all the internal

components of transaction workflow.

13. The Solution should meet all system related requirements elaborated in this RFP,

covered in scope, functional and other requirements in totality.

The Bank reserves right to bring any changes in System Requirements, which if done, will

be communicated to the Bidders in time to allow them to revise their proposals

8.

BIDDERS PRESENTATION AND DEMONSTRATION OF THE SOLUTION

Bidders will be short listed first on the basis of qualifying Eligibility Criteria and then

Responsiveness of the Bid meeting Scope, Functional Requirements etc. as detailed in this

RFP Document i.e. evaluation of the Bids shall be done by the Bank on Technical, Functional

Parameters as well as experience and capability of the Bidder to implement the MIS

Solution.

The shortlisted Bidders will have to make Presentation of their MIS Solution, demonstrate

MIS Solution by arranging Product walk through, and if required, visits to the Public Sector

Banks as well i.e. where the Product is successfully implemented by them, as part of final

evaluation.

Based on the presentations the Bank shall evaluate the Vendors for their readiness of the

product and capabilities to meet the functional, operational and other requirements of the

Bank and accordingly the Bank shall take a decision for short listing of the Vendors for

Commercial Evaluation

Setting of evaluation criteria for selection purposes shall be entirely at the discretion of the

Bank. The decision of the bank in this regard shall be final and no correspondence shall be

entertained in this regard.

RFP for Management Information System for Oriental Bank of Commerce

9.

BIDDING PROCESS

9.1

RFP Purchase and Bid Submission

The interested eligible bidder may collect this RFP from the Department of Information

Technology, Head Office located at following address after depositing a non-refundable

Demand Draft / Pay Order for Rs. 10,000/- (Rupees Ten Thousand Only) favoring Oriental

Bank of Commerce. The RFP can be collected from 10:00 AM to 02:00 PM on Saturdays and

10:00 AM to 05:00 PM on weekdays from 10.11.2009 till last date for bid-submission. The

RFP can also be downloaded from the Banks website, i.e., www.obcindia.co.in. However,

the bidder shall have to submit a Demand Draft / Pay order, as mentioned above along with

the bid.

The Bank shall not consider any request for date-extension for bid-submission on account of

late receiving/downloading of RFP by any prospective bidder. The bids, not already

purchased and not accompanied by the Demand Draft / Pay Order of requisite amount shall

be out rightly rejected.

Bids duly sealed, addressed to the Dy. General Manager (IT), should be delivered on or

before 30.11.2009.

Bids have to be dropped in the Tender Box placed at the following address:

Oriental Bank of Commerce,

Department of Information Technology, Head Office

4th Floor, F-14, Competent House,

Connaught Place, New Delhi 110 001

In the event of the specified date for bid-submission being declared a holiday for the Bank,

the bids will be received up to the appointed time on the next working day.

9.2

Cost of Bidding

The bidder shall bear all costs associated with the preparation, submission of its bid and cost

of attending pre-bid meeting, conducting product walkthrough and the Bank will, in no case,

be responsible or liable for these costs, regardless of the conduct or outcome of the bidding

process.

9.3

Late Bids

Any bid received by the Bank after the last date for bid-submission will be rejected and

returned unopened to the bidder, if the bidder desires so.

9.4

Clarifications of RFP

A prospective bidder requiring clarification on any point mentioned in the RFP may notify

the Bank in writing or by fax/e-mail at the address indicated below:

Dy. General Manager (IT)

Oriental Bank of Commerce

F-14, 4th Floor, Competent House,

Connaught Place, New Delhi 110 001

Phone: 011 23325590, 23358467

Fax: 011-23310013

E-mail: dit@obc.co.in

RFP for Management Information System for Oriental Bank of Commerce

Pre Bid Meeting

Date:

Time:

Venue:

16.11.2009

11:00 AM

Dept. of Information Technology

Oriental Bank of Commerce

F-14, 4th Floor, Competent House,

Connaught Place, New Delhi 110 001

9.5

Amendment to RFP Contents

At any time prior to the last date for bid-submission, the Bank may, for any reason, whether

at its own initiative or in response to clarification(s) requested by a prospective bidder,

modify the RFP contents by amendment.

Amendment will be notified in writing or by fax/e-mail to all the prospective bidders or

published on Banks website, and will be binding on bidders. Publication of changes in

Banks web-site shall be deemed communication to all prospective Bidders. The Bank shall

not be liable for any communication gap.

In order to provide prospective bidders, reasonable time to take the amendment into

account for preparation of their bid, the Bank may, at its discretion, extend the last date for

bid-submission.

9.6

Two Stage Bidding Process

The bidder will submit its response to the RFP, packaged as a set of following envelopes:

Demand Draft / Pay order of Rs. 10,000/- as participation fee, in a sealed envelope

superscribed as Participation Fee;

Financial Bank Guarantee for Earnest Money Deposit of Rs. Five Lac, as per Annexure VI,

valid for six months from the last date of bid-submission, in a sealed envelope superscribed

as BG-EMD;

Technical Bid containing documents in a sealed envelope superscribed as Technical Bid; and

Commercial Bid containing documents in a sealed envelope superscribed as Commercial

Bid.

The Bank expects the bidder to carefully examine all instructions, forms, terms & conditions

etc., mentioned in this RFP. Failure to furnish all information required for submission of a

bid not substantially responsive to the RFP in every respect will be at the bidders risk and

may result in the rejection of its bid without any further reference to bidder.

First Stage of Bidding

In the first stage, only the Technical Bids will be opened in presence of a Technical Bids

Opening Committee, and bidders representatives who choose to attend, at the time, on the

date and at the place that will be communicated to them by the Bank. The bidders

representatives who are present shall sign a document evidencing their attendance.

Second Stage of Bidding

In the second stage, commercial bids of short-listed technically-qualified bidders displayed

on website (https://www.obcindia.co.in) shall be opened in presence of a Commercial Bids

RFP for Management Information System for Oriental Bank of Commerce

Opening Committee, and bidders representative who choose to attend, at the time, on the

date and at the place that will be communicated to them by the Bank. As above, the

bidders representatives who are present shall sign a document evidencing their

attendance. The L-1 bidder shall be determined as per the criterion given under commercial

evaluation.

9.7

Bid Features

9.7.1

Language of the Bid

All bids and supporting documentation must be in English only.

9.7.2 Bid Currency & Price Structure

Prices shall be expressed in the Indian Rupees only. The bidder must quote item-wise total

price inclusive of all duties and charges related to freight, insurance, forwarding, packing,

dispatch, installation etc. Value Added Tax, Sales Tax, Octroi and Local Taxes, if any, are

payable extra on actual

9.7.3 Validity Period

The Bids shall be valid for a period of six months from the last date for bid-submission. A bid

valid for a shorter period shall be rejected by the Bank as non-responsive.

9.7.4

Format & Signing of Bid

Each bid shall be made in the legal name of the bidder and each page of it shall be signed

and duly stamped by the bidder or a duly authorized person to sign on behalf of the Bidder.

Any interlineations, erasure or overwriting shall be valid only if these are initialed by the

person(s) signing the bid.

Executive(s) representing the bidder should be duly authorized to sign the bid, interacting

with the Bank for all sorts of communication as well as appearing in for price negotiation

meeting, in case the bidder emerges as L-1 as a result of commercial evaluation of all

technically qualified bids. A letter of this intent, issued by the Proprietor, CEO, Director, or

any top level executive, authorizing representing executive(s) should be submitted as part of

the Technical Bid.

9.8

Technical / Commercial Bid Essentials

9.8.1 The Technical Bid must contain the following:1.

Letter authorizing representing executive(s);

2.

Documents in support of meeting Bidders Eligibility Criteria;

3.

Bidders General Information (Annexure III-a and III-b);

4.

Point wise compliance with the Scope of Work, Functional Requirement, and

Technical Requirements.

5.

Acceptance of all Terms & Conditions mentioned in the RFP (Annexure II);

6.

Audited Balance Sheet and Profit & Loss Account documents for the last 3

years;

RFP for Management Information System for Oriental Bank of Commerce

7.

Bill of Material without Pricing Information (Annexure IV); It should be

replication of commercial bid without prices.

8.

Electronic copy (MS Word/Excel Format) of Technical Bid on a CD. (If there is

variation in hard copy and soft copy of the bids, hard copy will be treated as

final bid)

9.8.2 The Commercial Bid must contain the following:-

9.9

1.

Bill of Material with Pricing Information of all the items

2.

Chart for L1 determining commercial competitiveness (Annexure V); and

3.

Electronic copy (MS Word/Excel Format) of Commercial Bid burned on a CD.

If there is variation in hard copy and soft copy of the bids, hard copy will be

treated as final bid.

Bid Evaluation

The purpose of bid evaluation is to determine the technically compliant and commercially

lowest bid from amongst the substantially responsive bids received by the Bank. In order to

determine the lowest evaluated responsive bid, the Bank shall adopt a systematic

evaluation process comprising of following logical steps.

9.9.1 General Evaluation

The Bank will examine the bids against Bidders Eligibility Criteria mentioned in the RFP.

The Bank will examine the bids to determine whether they are complete, whether any

computational errors have been made, whether Participation fee, Earnest Money Deposit

and required sureties have been furnished, whether the documents have been properly

signed, and whether the bids are generally in order.

The Bank may waive any minor informality, nonconformity, or irregularity in a bid which

does not constitute a material deviation, provided such waiver does not prejudice or affect

the relative ranking of any bidder.

Prior to the detailed evaluation, the Bank will determine the substantial responsiveness of

each bid against this RFP. For purposes of these clauses, a substantially responsive bid is one

which conforms to all the terms and conditions of the RFP without material deviations.

During evaluation of the bids, the Bank may, at its discretion, ask the bidder for providing

clarification on any point mentioned in its bid. The request for clarification and the response

shall be in writing, and no change in the prices or substance of the bid shall be sought,

offered, or permitted.

9.9.2 Technical Evaluation

The technical bid containing all the documents mentioned in Section 6.8.1 Technical /

Commercial Bid Essentials shall be evaluated as per the criterion determined by the Bank.

The Bank will evaluate technical bids on the following broad criteria.

1.

Technical Completeness of the bid containing details of:

a)

Clear Process Flow/ Functionality of the entire solution

RFP for Management Information System for Oriental Bank of Commerce

b)

Platform being used

2.

Compliance with Scope of Work, Functional Requirements and Technical

Requirements.

3.

Bidders acceptance of Terms & Conditions as mentioned in the RFP.

4.

Bidders experience and ability to provide support

5.

Bidders experience in the Banks / Financial institution and ability to provide

complete solution.

6.

Evaluation of functional capabilities of the MIS Solution offered, through

product presentation, product walkthrough

Shortlisted Bidders will be required to make Presentation of the MIS Solution / Product,

Product Walk through and reference visits as part of the final technical evaluation

9.9.3 Commercial Evaluation

Commercial bids submitted by only those bidders, who have qualified the eligibility criterion

and technical evaluation will be opened, their price compared and the lowest quoting

bidder will be declared as L-1 based on the L-1 determination sheet (Annexure V).

Arithmetical errors will be rectified on the following basis. If there is a discrepancy between

the unit price and the total price that is obtained by multiplying the unit price and quantity,

the unit price shall prevail and the total price shall be corrected. If there is a discrepancy

between words and figures, the amount in words will prevail. If the bidder does not accept

the error-correction, its bid will be rejected, and its bid security may be forfeited.

9.10

Notification of Award

The acceptance of a bid, subject to contract, commercial considerations & compliance with

all terms and conditions will be communicated in writing by means of placing order at the

address supplied by the bidder in its bid. Any change of bidders address, should therefore

be promptly notified to:

The Dy. General Manager (IT)

Oriental Bank of Commerce,

Department of Information Technology,

th

4 Floor, F-14, Competent House,

Connaught Place, New Delhi 110 001

Phone: 011-23318423

Fax: 011-23310013

E-mail: dit@obc.co.in

9.11

Disqualification of the Bidder or Empanelled Vendor

Any bidder not complying with the bidding process is liable for disqualification at any stage.

Decision of the Bank in this regard shall be final, conclusive and binding on the bidder.

RFP for Management Information System for Oriental Bank of Commerce

ANNEXURE I

CALENDER OF STATEMENT AND REPORTS FOR BRANCHES

Periodicity wise list of Statements / Returns

Sl. Particulars

No.

Form No.

Periodicity

STM-1

Weekly(Each Friday)

ACCOUNTS DEPARTMENT

1

2

3

4

5

6

7

8

9

Statement of Weekly Affairs

Statement of Head Office Suspense Remittance Account

Statement of Clearing Adjustment Account(Dr./CR), separately for

a) Clearing Adjustment Account

b) LBC/MBC

c) ECS Entries

Bankers Reconciliation Statement

Statement of Profit & Loss Account

Statement of Suspense (Period Wise) O/S separately for Suspense,

General; Festival; Pension; FCNR; Court Cases / Frauds

Statement of Sundry Deposit Accounts

Statement of Counterfeit Notes detected by Banks

STM-9

Weekly

STM-7

Weekly

STM-10

Monthly (Last Friday)

STM-2

Monthly (Last Friday)

STM-8

Monthly

STM-22

Monthly

Monthly (by 3rd)

Formats

Balance sheet and Profit & Loss Accounts along with the Annexure viz.

a) Annexure VIII Segment Report

b) Annexure I Aggregate Average Advances of Rural Branches

c) Annexure VI Nature wise Break-up of O/S in Suspense Account-General

(as per

Quarterly/Half

Yearly/

Yearly

Closing

Yearly only

Circular)

d) Annexure VII Certificate of Cash, SFF (Quantitative), Stocks held as Security, etc

10

Yearly only

Yearly only

Half-yearly

March/Sept.

Certificate showing O/S position of Refinance taken form NABARD/NHB/SIDIBI

TAXATION RELATED RETURNS / STATEMENTS

11

12

13

Monthly (by 15th)

Service Tax on Banking & other Financial Services & Service Tax Paid

Yearly (by 30th June)

Annual Return of Cash deposits exceeding Rs. 10 Lakh In a SB A/C during a FY

Interest earned from Long Term Finance etc. (u/s 36 (1) (VIII)

Yearly

COMPLIANCE CELL

14

Quarterly

Compliance Certificate regarding Statutory, Regulatory & other Compliance

CORPORATE STRATEGY & PLANNING DEPTT

15

16

17

Monthly Performance of the Branch

Non-Interest Income Report for Mutual Fund, Insurance (General / Life) & CMS

Non-Interest Income Report for ABB, RTGS, NEFT, Demat online trading, BG & LC

Format

Monthly

Annexure III

Monthly

Annexure IV

Monthly

Format

Fortnightly

Format

Monthly

Format

Monthly

Format

Monthly

STM 41

STM 41A

-------------STM 41B

STM 41C

Monthly

Monthly

----------------------As on the date of

accommodation

allowed

CREDIT ADMINISTRATION DEPARTMENT

18

19

20

21

22

23

Statement of EAS/SMA with Fund Based Facility of Rs.50.00 Lac and above

Position of Clean Overdrafts

Position of Unavailed Limits

Position of Advances of Specialized SME & MID Corporate Branches

Fresh SME & Mid Corporate advances sanctioned under Branch Powers

Sanctions under Branch Incumbents Discretionary Powers along with Certificate

a. Regular Loans & Advances

b. Daily temporary advances including Purchase / Discount of Cheques / Drafts,

accommodation against Uncleared Effects / Clearing

Letter seeking Confirmation for Advances allowed by Branch Incumbent beyond

his Discretionary Powers

a. Cheques / Bills etc. Purchased / Discounted, accommodation against Uncleared Effects /

Clearing

b. Advances other than above

Fortnightly

RFP for Management Information System for Oriental Bank of Commerce

24

25

26

27

28

29

30

31

32

33

34

35

36

37

Monthly

Disposal of Loan Proposals (both Fresh & Overdue Renewals)

Statement of,

a. L/C (Inland / Foreign) which have Devolved upon the Bank; and

b. Guarantees (Inland / Foreign) Invoked by the Beneficiaries

Position of NBFC accounts

Position of Advances against Shares/ Debentures

Monthly Data of Rescheduled/ Restructured Accounts

Monthly

Monthly

Monthly

Monthly

Monthly

Advances granted to Relative of Senior Officers (scale IV and above) of the Bank

Monthly

Loans extended to Firms/ Borrower related to the Directors of the Bank

Advance against Immovable Property

Statement showing Limit Sanctioned and Balance Outstanding (last Friday of

Quarter) in the borrowal accounts of the Parties having WC Limit & TL of Rs.10.00

Crore and above from entire Banking System

Format

prescribed

by RBI

Quarterly within 7

Dys

Quarterly within

7 Days

Accounts where Credit Rating has been downgraded during the Quarter.

Quarterly

Fund and Non-Fund Based (Guarantee) Limits sanctioned to Share Brokers &

Market Makers under Branch/RO/HO Powers

Statement of Limits due for Review / Renewal

Project Sanctioned Assistance (having Project Cost of Rs. 10.00 crore & above)

Quarterly

Statement of Restructured/Rescheduled Accounts

STM-17

Quarterly (Last day)

Half Yearly

AnnexureXVI

Yearly

HRD/ ESTABLISHMENT DEPARTMENT

38

39

40

41

42

Statement of Officiating Allowance

Statement of Leave Record

Statement of Establishment Expenses

Statement of Overtime Expenses

Monthly

STM-77

Monthly

STAM-4

Quarterly

STAM-6

Quarterly

Yearly, on Payment

Statement of Bonus Paid / Form D

FOREX TREASURY

43

Statement of Purchase/Sales of Shares/Debentures on behalf of FIIs under

Portfolio Scheme

44

Statement of Purchase/Sales of Shares/Debentures on behalf of NRI/OCB under

Portfolio Investment Scheme

R Returns (Authorised Forex branches only)

Statement of Overdue Merchant Contract

Trade Credit TC I and TCII

Gold/Silver/ Platinum Import

Booking Forward Contract on past performance basis

Details of Remittances made under Liberalized Remittance Scheme USD 200000

Forex Turnover, Forex commission & interest income

45

46

47

48

49

50

51

52

53

54

55

56

LEC (FII)

Daily

Daily

Fortnightly

STAT- 632

Fortnightly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

ORA Details of permission granted to Constituent for opening of Trading / NonTrading Office / Posting of Customer Representative abroad.

Statement showing Overdue Export Bills equivalent of USD 50000 and above

Progress report on Realization of XOS Bills

Statement of Diplomatic Bond / Store Account

Monthly

Monthly

Monthly

Foreign Currencies Notes held and Import Bills debited to Nostro Account but not

crystallized

STAT- 645

Monthly

57

Monthly Declaration under Whole Turnover Packing Guarantee / Credit Whole

Turnover Post Shipment Guarantee

STAT- 641

Monthly

58

Statement of inflow/outflow details on account of remittances received/made in

connection with transfer of shares/convertible debentures-FC-TRS

Reporting under FDI Scheme-FC-GPR

59

Monthly

Monthly

RFP for Management Information System for Oriental Bank of Commerce

60

61

62

63

64

65

66

67

68

69

70

71

72

73

ECGC (Lodged, Pending, Rejected, Settled, Withdrawn)

Unhedged Foreign Currency Exposure of Corporate

Statement of outstanding Merchant Forward Purchase / Sale Contract

Monthly

STAT- 632

Monthly

Statement of Foreign Guarantees / Letter of Undertaking / Letter of Comfort,

Issued / Invoked

Forwards Contracts booked by SME and Individuals

Facilities to NRIs, PIOs and Foreign Nationals - Liberalization Statement of

Remittances from NRO Accounts

Export Credit & Issuance of Gold Card - Form C

Unhedged Foreign Currency Exposure of Corporates USD 25 mn and above

Statements of Trade Related Advance from EEFC

Statement E (Link Branch Overseas, Panchkuian Road, New Delhi)

Quarterly

Quarterly

STAT- 638

Statements of Outstanding Export Bills -XOS

75

Statement of Receipts of Foreign contribution by various Associations /

Organizations in India under FERA 1976

WTPCG / WTPSG (Renewals)

Hedging of Commodity Price Risk in International Commodity Exchanges and

Markets

Statement of Control Documents (Specimen Signature, Test Key if any )

Annual Performance Report of the functioning of India Joint Venture/Wholly

owned subsidiary

Quarterly

Quarterly

AEEFC

Quarterly

Quarterly

Monthly

Rupee / Foreign Currency Vostro Accounts of Exchange Houses Statement A, C & D

Rupee / Foreign Currency Vostro Accounts of Exchange Houses Statement B

EWB-Statement of Export Bills allowed to be written off

Details of Imports in which documentary evidence of Import has not been received

from the Importer

78

79

Monthly

Quarterly

74

76

77

STAT- 642

Half-Yearly

Half-Yearly

XOS- 623 TO

628

BEF/629

Half-Yearly

Half-Yearly

Half-Yearly

(March / Sept)

Yearly

Yearly

STAT- 634

Yearly

Yearly

INSPECTION AND CONTROL DEPARTMENT

80

81

82

83

Statement of Balancing of Books

Bills Purchased & Discounted, received back unpaid

Position of Complaints

Format

Monthly

STM-13

Monthly

Format

Monthly

Status / Certificates regarding Implementation of,

a) KYC Compliance Certificate

STM-11

Format

b) Manager's Certificate

c) Ghosh Committee Recommendations on Frauds & Malpractices in Banks

d) Recommendations of Committee headed by Sh. Amitabh Ghosh

e) Recommendations on Internal Control and Inspection/Audit System headed by Sh. Rashid

Jilani as its convener

Annexure- IX

Monthly

Quarterly (Last Fridy)

Quarterly

Annexure- X

Yearly

early

Format

Quarterly (last day)

STM-25

Monthly

DSB-4i

Monthly

Format

Monthly

OFFICIAL LANGUAGE DEPARTMENT

84

Progress Report Regarding use of Hindi in Bank

PROVIDENT FUND DEPARTMENT

85

Provident Fund Deductions along with Officiating Statement of previous Month

RECOVERY & LAW DEPARTMENT

86

87

88

89

90

Statement of Exposure to Sensitive Sector

Sick Nurtured Accounts

Statement of NPA accounts settled under RO power during the month

Statement of DRT cases

Statement of Suit Filed & Decreed Cases (Annexure I, II & III)

Format

Monthly

Format

Monthly

3 Annexure

Monthly

RFP for Management Information System for Oriental Bank of Commerce

91

Age-wise/Amount-wise/Progress (letter no HO/Law/ Peri/Decreed

09.01.04),

a) Position of Decreed Cases Age-wise & Amount-wise

b) Position of Suit Filed Cases Age-wise & Amount-wise

c) Progress Report of Decreed Cases

d) DRT wise Position of Decreed Cases with present legal position

dated

92

Progress of Notices under Securitization & Reconstruction of Financial Assets &

Enforcement of Security Interest Act, 2002

Format

Quarterly

Quarterly

Quarterly

Monthly (Last day)

Quarterly

93

Statement of Contingent Liabilities - Guarantees and Letters of Credit (REC/OSS/

RBI/DSB-IIA/117)

DSB IIA

Quarterly

94

Summary Statement of Loans and Advances (REC/OSS/RBI/DSB-IIB/118 &

Annexure I, II & III)

DSB IIB & 3

Annexure

Quarterly

95

Loans and Advances: Quality Profile of Loan Assets - Changes in Current Quarter Assets Classification (REC/OSS/RBI/DSB-4A/112 & Annexure to Statement)

DSB-4A &

Annexure

Quarterly

DSB 4B

Quarterly (Last Day)

DSB 4C

Quarterly (Last Day)

DSB 4D

Quarterly (Last Day)

Loans and Advances to Officers in Scale VI and above (other than under Staff Loan

Schemes and against Liquid Assets) (REC/OSS/RBI/DSB-6A/113)

DSB 6A

Quarterly (Last Day)

100 Loans and Advances to 'Interests' (Relatives) of Officers in Scale VI and above

DSB 6B

Quarterly (Last Day)

DSB 4H

Quarterly

96

97

98

99

101

102

103

104

105

106

107

108

109

110

111

112

113

114

115

116

117

Statement of Loans and Advances - Portfolio Analysis (REC/OSS/RBI/DSB-4B/121)

Sector-wise Loans and Advances - Sectoral Analysis (REC/OSS/RBI/DSB-4C/119)

Statement of Recorded Interest & Other Charges (REC/OSS/RBI/DSB-4D/116)

(other than against Liquid Assets) (REC/OSS/RBI/DSB-6B/113)

Loans & Advances: Industry-wise Exposure (REC/OSS/RBI/DSB-4B/143)

Closing Statements - Loans & Advances (fund based/Non-Fund based)

Annexure I

Annexure II

Annexure III

a) Statement of Demand Loans /CC/ OD/ Packing Credit

STM-46A

Quarterly

b) Statement of Term Loans

STM-46B

Quarterly

c) Statement of Bills Purchased/ Discounted

STM-47

Quarterly

Quarterly

d) Statement of Protested Bills/ Suit Field/ Decreed Accounts

e) Summary of Classification of Advances

STM-21

A,B,C

STM-83

f) Provision Sheet for Sub-standard Accounts

STM-79

Quarterly

g) Provision Sheet for Doubtful Accounts

STM-80

Quarterly

h) Provision Sheet for Loss Assets

i) Statement of Letters of Credit-Inland/Foreign

STM-81

Quarterly

STM-18

Quarterly

j) Statement of Guarantees

STM-19

Quarterly

k) Statement of changes in NPA Profile (Movement of NPA)

STM-88

Statement of Claims against the Bank not acknowledged as Debt

Loans to Staff Members of the Bank excluding against Liquid Assets

Details of Advances covered by ECGC

STM-85

Monthly/Quarterly/

Half Yearly / Yearly

Quarterly

Details of Advances covered by Credit Guarantee Fund Trust for Small Industries

Bills Purchased/ Discounted/ Negotiated under LCs or otherwise outstanding

List of NPA Accounts with outstanding above Rs. 1 Crore

Classification of Advances by degree of Risk / Amount Restructured

Statement of Credit Concentration

Statement of Rating wise distribution of Standard Advances

Statement of Loans Sales & Securitization

Statement of Exposure to Banks

Sick SME of NCT (Delhi & New Delhi)

Statement of Sector-wise NPA

Details of Suit Filed & Decreed Accounts

SME (Sick) Accounts

Quarterly

STM-87

Quarterly

STM-86

Quarterly

STM- 89

Quarterly

STM-90

Quarterly

DSB-4G

Quarterly (last day)

DSB-4-J

Quarterly

DSB-4-M

Quarterly

DSB-4-N

Quarterly

DSB-4-O

Quarterly

DSB-5-A

Quarterly

Format

Quarterly

DSB-13-A

Quarterly

DSB-13-B

Quarterly

Format

Quarterly

RFP for Management Information System for Oriental Bank of Commerce

118 Unrealized Interest of Previous Year reversed by the Branch during the Current

Format

Yearly

STM-82

Yearly

Year in respect of Advances classified as NPA for the first time during the year.

119 Advances secured by Bank Deposits/NSCs/IVPs/KVPs/LIC Policies held as

120

121

Primary/Collateral Security in CC/OD/DL/TL and Bill Accounts

DICGC Audit Certificate (HO/REC/N/137)

Statements for select eGTB Branches,

a) Account-wise details of not readily available assets

b) Other expenses incurred & recorded in memorandum of NRRAs

c) Recovery of Advances written off before/after amalgamation & Recorded

Interest thereon

d) Salary (including perks, if any) incurred for monitoring of NRRSs

Yearly

Format I

Quarterly

Format II

Quarterly

Format III

Quarterly

Format IV

Quarterly

RISK MANAGEMENT CELL

Quarterly (last day)

122 Borrowal Accounts availing Credit Facilities (FB+NFB) of Rs.5 Crore & above

(Rating-wise/ Industry-wise)

RDRPSC DEPARTMENT

123

124

125

\126

127

128

129

130

131

132

Statement of Retail Credit Schemes

Flash Data of Priority Sector Advances

Sectoral Deployment of Funds (Annexure IA, IIA, & IIIA)

BSR-III

Provision of Credit to Agriculture (Doubling of Agri. credit)

Oriental Green Card & Oriental Kisan Credit Card Progress Report

Agri. Advances against Gold & Jewellary / Ornaments to Farmers

Golden Jubilee Rural Housing Finance Scheme

State of 2 Million Houses Program under National Housing Agenda

Sanction/Disbursal of Housing Loans (other than Staff Housing Loans)

133

134

135

136

137

138

139

140

141

142

143

144

145

146

147

148

149

Advances under Bank Education Scheme (ELI)

Progress Report of Retail Hub

Progress in Financial Inclusion

Credit flow to women (CFWI & CFWII)

Advances to Women under different Schemes

Swarn Jayanti Gramin Rozgar Yojana (SGSY)- Part A & B (Part B - Quarterly )

Prime Minister Rojgar Yojana (PMRY) for Educated Unemployed Youth

Statement of Agriculture Advances

Progress of Annual Action Plan

Statewise/ Activitywise Disbursement of Agriculture Advances

Gramin Project- Project Implementation (By Implementing branches only)

Performance under Hi-tech Dairy Scheme of all Regions of Punjab & Haryana

Progress under Agriculture Credit Camp

Progress under Formation of Farmers Club

Progress under Scheme for settingup of Agriclinic & Agribusiness Centers (ACABC)

Prime Minister Rojgar Yojna (PMRY) for Educated Unemployed Youth

Prime Minister Rojgar Yojna (PMRY) for Educated Unemployed Youth Subsidy

Utilization / Requirement Statement

Advances to Minority Communities

150

151

152

153

154

PS Advance to member of Specified Minority Communities

PS Advance to member of Specified Minority Communities (Identified Town)

Report on Minority Community: Recommendation of Sachar Committee

Lending to Minority Community under Prime Ministers 15 Point Programme

RC-1

Fortnightly

Format

Monthly (Last Friday)

Annexure

Monthly (Last Friday)

STM-57

Monthly (Last Friday)

Part B

Monthly

Monthly (Last Day)

Monthly

Monthly (Last Friday)

Monthly

Part A

Part B

Part C

Format

Monthly (Last Day)

Monthly (Last Day)

Monthly (Last Day)

Monthly

Monthly

Monthly

Monthly

Monthly

Part A

Monthly

Monthly (Last Day)

STM-14

Quarterly

Quarterly

SACP

Quarterly

Quarterly (Last Day)

Quarterly

Quarterly

Quarterly

Quarterly

Quarterly

Quarterly

Quarterly

Annexure IV

Quarterly

Quarterly

Format

Quarterly

Format

Quarterly

RFP for Management Information System for Oriental Bank of Commerce

155

156

157

158

159

160

161

162

163

164

165

166

Quarterly Statement of Retail Credit Schemes

Education Loan Quarterly Information for IBA

Educational loan to Students in Private/Professional Colleges

Education Loan Repayment Information

Data on Housing Loan & Education Loan

Details for Calculation of Provision for Standard Assets

Statement of Recovery position of Priority Sector Advances

Recovery Performance under Govt Sponsored Schemes

Advances to SC/ST

Finance to Self Help Groups

Micro Finance Progress Report

Swarn jayanti Gramin Swarozgar Yojana (SGSY)

RC-2

Quarterly

Format

Quarterly

Quarterly

Quarterly

Quarterly

AnnexureXIII

Half Yearly (Jul/Dec)

Half Yearly (Sep/Mar)

Half Yearly (Sep/Mar)

Half Yearly (Sep/Mar)

Half Yearly

Part C

170

171

172

173

174

175

176

Last Friday of June)

Statement of Recovery Position of Priority Sector Advances

Disbursal of Advance to Priority Sector/Weaker Sections in Priority Sector (Special

Return-III) (as on Last Friday of June)

BSR-1 A and 1 B (as on 31st March)

BSR-II (Part I to V)

BSR IV

Prime Minister's Rojgar Yojna (PMRY) for Educated Unemployed Youth Subsidy

Audited Certificate

Details in respect of advances allowed under Prime Ministers Rozgar Yojna (PMRY)

st

for the year ended 31 March

Half Yearly (Sep/Mar)

Half Yearly (Sep/Mar)

Financial Assistance granted by Scheduled Commercial Banks under the category

167 Housing Finance (as on Sept 30/ March 31)

168 Interest Subvention on Short Term Agriculture Credit

169 Loans and Advances to Agriculture and Allied activities (Direct Finance) (SR-I)(as on

Quarterly

Half Yearly (Sep/Mar)

STM-58

Yearly (June last

Friday)

SR II

Yearly (June)

STM-60

Yearly (June last

Friday)

STM -54 &

55

STM-56

Yearly

Yearly

Yearly

Yearly

Annexure- IV

Yearly

177 Service Area Approach / Lead Bank Statements (to be sent to Lead Bank through

District Coordinator / Coordinating Branch with CC to Regional Office & SAP to

RDRPCS, HO as well)

a) Scheme for Rehabilitation of Manual Scavengers (SLRs)

b) Swarn Jayanti Shahri Rozgar Yojana (SJSRY)

c) Credit Disbursal Semi urban/Urban Branches (Non-Service Area) C.D.U.

d) Service Area Recovery and Outstanding Statement

e) Recovery, Outstanding Semi-urban/Urban Branches (Non-Service Area) ROU

f) Service Area Credit Plan (SAP)

g) Credit Plan Semi-Urban branches (Non Service Area) CPU

h) Service Area Credit Disbursal Scroll (SAS)

Format

Monthly (last day)

Format

Monthly (last day)

LBR-U2

Quarterly (last day)

LBR-U3

Quarterly

LBR-U3

Quarterly

LBR-1

Yearly (by 28th Feb)

LBR-U-1

Yearly

LBR-2

Yearly

STM-75

Monthly

SECURITY DEPARTMENT

178 Managers Monthly Certificate of Security Arrangement at Branches

RFP for Management Information System for Oriental Bank of Commerce

DEPARTMENT-WISE CALENDER OF RETURNS OF REGIONAL OFFICES

PART A Periodicity wise list of Statements / Returns

Sl. Particulars

No.

Form No.

Periodicity

ACCOUNTS DEPARTMENT

R1

Consolidated Statement of Weekly Affairs

STM-1

Weekly

R2

Statement of Profit & Loss Account

STM-2

Monthly (last

Friday)

R3

Consolidated Period-wise Statement of outstanding Entries of,

a) Suspense - General; Festival; Pension; FCNR; Court Cases / Frauds

STM-8

Monthly (last

Friday)

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly (Last

Friday)

b) Rs.50000/- and above in Suspense Account for more than 06 Months

c) Suspense Remittance outstanding for more than 07 Days

d) Bankers Reconciliation Accounts for more than 03 Months

e) Sundry Deposit Account

f) Rs.50000/- and above in Sundry Account for more than 06 Months

g) Clearing Adjustment Account (Dr./CR), separately for, i) Clearing Adjustment

STRO-8

STRO-9

STRO-10

STRO-22

STRO-22

STM-7

Account; ii) LBC/MBC; and iii) ECS Entries

R4

R5

R6

R7

R8

R9

R10

Statement of Counterfeit Notes Detected By Banks

Quarterly / Half Yearly / Yearly Annual Accounts (Balance Sheet and Profit

& Loss Account) and Annexure as per Closing Circular

Statement of SFF

Consolidated Statement of Inoperative Accounts over 10 years

TAXATION RELATED RETURNS / STATEMENTS

Service Tax on Banking & Other Financial Services& Service Tax Paid

Annual Information Report in respect of Cash Deposits exceeding Rs. 10

Lakh in a Savings Account during Financial Year

Interest earned from Long Term Finance etc. (u/s 36 (1) (VIII)

Format

STM-48

Monthly

Quarterly / Half

Yearly / Yearly

Yearly

Yearly

Format

Monthly

Yearly

Annex.A

Yearly

COMPLIANCE CELL

R11

Quarterly

Compliance Certificate: Statutory, Regulatory & other Compliances

CORPORATE STRATEGY & PLANNING DEPTT

R12

R13

R14

R15

R16

R17

Observance of Customer day

Statement to Claim JV Business Incentive

Monthly Performance Review

Branch-wise Non-Interest Income Report for,

a) Mutual Fund, Insurance (General / Life) & CMS Business

b) ABB, RTGS, NEFT, Demat, On-line Trading, BG & LC Business

Minutes of Meeting of Regional Office Customer Service Committee

Advertising Expenses incurred by RO

Monthly

Monthly

Monthly

Annexure I

Annexure II

Monthly

Monthly

Quarterly

Quarterly

Format

Fortnightly

Format

STRO-16,

16A, 16B

Fortnightly

Monthly (Last Day)

CREDIT ADMINISTRATION DEPARTMENT

R18

R19

R20

R21

Statement of EAS/SMA with Fund Based Facility of Rs.50.00 lac and above

Position of Clean Overdrafts

Limits Sanctioned by Regional Head during the month alongwith

Certificate of Discretionary Advances

Advance against Immovable Property

Monthly

RFP for Management Information System for Oriental Bank of Commerce

R22

R23

R24

R25

R26

R27

R28

R29

R30

R31

R32

R33

R34

R35

R36

R37

R38

R39

R40

R41

R42

R43

R44

R45

Statement of,

a) L/Cs which have devolved upon the Bank

b) Guarantees invoked upon the Bank

Statement of Disposal of Loan Proposals both Fresh & Overdue Renewals

Monthly

Monthly

Monthly

Annexure

Monthly

Monthly

Monthly

Monthly (Last Day)

Monthly (Last Day)

Monthly

Loans extended to Directors / Directors related Firms / Borrowers

Advances granted under Consortium Arrangement

Advances granted under Multiple Banking Arrangement

Advances Sanctioned against Shares/Debentures, Bonds etc. of Rs. 5.00

Lac and above

Real Estate Advances of Rs.1.00 Crore & above

Limit Sanctioned and o/s (last Friday of Quarter) in the Borrowal Accounts

of the Parties having WC & TL Limit of Rs.10.00 Crore and above from the

entire Banking System in Form A prescribed by RBI

Monitoring Officers Report for Fund + Non Fund Limits of

a. Rs. 1.00 Crore & above in case of Standard Assets

b. Rs. 0.50 Crore & above in case of EAS / SMA

Position of submission of BCC in Cases under the Powers of BM/RO/HO

Annexure

Annexure

Annexure

Annexure

Monthly

Quarterly

Quarterly

Quarterly

Annexure

Form A

Quarterly

Quarterly

Position of Stock Audit

Quarterly Return VI-A on Prime Lending Rate

Accounts where Credit Rating has been down graded during the year

Statement of o/s Guarantees wherein there were defaults by the

Constituents and/ or Claims on Bank by beneficiaries have arisen, Part A:

Deferred Payment Guarantees; Part B; Financial Guarantees; Part C:

Performance Guarantees; and Part D; Bills Co-aacepted, which have not

been paid on Due Date

Project Sanctioned assistance having Project Cost of Rs. 10 Crore & above

Particulars of Advances Sanctioned Orally (Telephonically)

Fund & Non-Fund based (Guarantee) Limits sanctioned to Share Brokers &

Market Makers under BO/RO/HO Powers

BGs issued during the FY on behalf of Share Brokers & Market Makers

Annexure

Format

Annexure

Annexure

Quarterly

Monthly

Quarterly (Last

Day)

Quarterly

Quarterly

Quarterly

Quarterly

Position of Unavailed Limits

Position of Advances of Specialised SME& MID Corporate Branches

Fresh SME & Mid Corp Advances Sanctioned under Branch & RO Powers

Position of Advances against Shares/ Debentures

Monthly Data of Rescheduled/ Restructured Accounts

Advances granted to Relatives of Officers (Scale IV and above) of the Bank

Format

Format

Format

Half Yearly

Annexure

Annexure

Yearly

yearly

Annexure

Yearly

DEPARTMENT OF INFORMATION TECHNOLOGY (DIT)

R46

R47

Purchase/Contract related to Computer Hardware / Software, UPS

Systems, MICR Coder etc amounting Rs. 3 Lac & above.

Progress of Computerisation in Public Sector Banks

Monthly

Format

Quarterly

HRD / ESTABLISHMENT DEPARTMENT

R48

R49

R50

R51

R52

Staff Strength of Region along with Staff Strength of Regional Office.

Staff Attendance in Surprise Checks conducted by Regional Office

Statements of Establishment Expenses

Report: Measures to improve Economic Condition of Minorities Training

and Recruitment

Statement of Overtime

Monthly (Last Day)

Quarterly (Last

Day)

Quarterly

Quarterly

Half - Yearly

RFP for Management Information System for Oriental Bank of Commerce

R53

R54

R55

R56

R57

R58

R59

R60

R61

R62

Staff Strength of SC/ST/OBC/PH/Ex-Servicemen & General under Officers/

Clerical & Subordinate Staff in the Region

Details of State-wise Recruitment made in Clerical, Subordinate Cadre and

also Recruitment of Part-time Sweepers.

Statement indicating Reservations made for and the Number selected

from amongst the Physically Handicapped Persons.

Statement showing the details of Ex-Servicemen employed (Retutn No 5

and Return V (A&B)

Returns in respect of Recruitment of SC/ST/OBC/Physically Handicapped/

Ex-Servicemen in Officer, Clerical and Subordinate Cadres.

State-wise Promotions made from Senior Clerks to Officers Cadre on the

basis of selection

Statement of Conversions made from Part-time Sweeper to Full-time

basis.

Inspection Report of Liaison Officer in respect to SC/ ST Employees.

Half Yearly / Yearly

Half Yearly / Yearly

(Last Day)

Half Yearly / Yearly

(Last Day)

Return 5,

V(A&B)

Half Yearly (Last

Day)

Half Yearly / Yearly

Half Yearly / Yearly

Half-yearly / Yearly

Return

No.9

Half-Yearly / Yearly

Yearly on 31st

March

Statement of Workmen Staff posted at Branch/Office for 5 Years and more

& Officers with 3 Years and more

Statements of Bonus Paid

Yearly

FOREX TREASURY

R63

R64

R65

R66

R67

R68

R69

R70

R71

R72

R73

R74

R75

R76

R77

R78

R79

R80

R81

R82

R83

R84

R85

Statement of overdue Merchant Contract

Trade Credit TC I and TC II

Gold/Silver/Platinum Import

Booking Forward Contract on past performance basis

Remittances made under Liberalized Remittance Scheme USD 200000

Forex Turnover, Forex Commission and Interest Income

Progress report on Realization of XOS bills

Position of Foreign Currencies Notes held and Import Bills debited to

Nostro Account but not Crystallized

Statement of Inflow/Outflow on account of Remittances Received/made

in connection with transfer of Shares/Convertible Debentures-FC-TRS

ECGC Claims (Lodged Pending, Rejected, Settled, Withdrawn)

Reporting under FDI Scheme-FC-GPR

Unhedged Foregn Currency Exposure of Corporates

Forex Guarantees/Letter of Undertaking/Letter of Comfort issued/invoked

Forwards Contracts booked by SME and Individuals

Facilities to NRIs,PIOs and Foreign Nationals -Liberalization Statement of

Remittances from NRO Accounts

Export Credit and Issuance of Gold Card to Exporters -Form C

Unhedged Foreign Currency Exposure of Corporates USD 25 million &

above

Statements of Trade Related Advance from EEFC

Statement of outstanding Merchant Forward purchase /sale contract

Details of Imports in which Documentary Evidence of Import has not been

received from the Importer

Statement of Particulars of Export bills outstanding beyond prescribed

period XOS

Statement of Receipts of Foreign contribution by various Associations/

Organizations in India under FERA 1976 (March/Sept)

WTPCG/WTPSG (Renewals)

STAT- 632

STAT- 645

Fortnightly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

Monthly

STAT- 642

Monthly

Monthly

Monthly

Quarterly

Quarterly

Quarterly

STAT- 638

Quarterly

Quarterly

AEEFC

STAT- 632

Quarterly

Quarterly

Half Yearly

Half-Yearly

Half-Yearly

Yearly

RFP for Management Information System for Oriental Bank of Commerce

R86

R87

R88

Hedging of Commodity Price Risk in the International Commodity

Exchanges and Markets

Statement of Control Documents (Specimen Signature ,Test Key if any )

Annual Performance Report of the functioning of India Joint

Venture/Wholly Owned Subsidiary

Yearly

STAT- 634

Yearly

Yearly

Monthly (Last

Day)

Monthly

Monthly

Monthly

INSPECTION & CONTROL DEPARTMENT

R89

Statement of Regional Office Expenses

STRO-5

R90

Position of Complaints

Recovery Position in Fraud cases

Revenue Leakage Detected & Recovered by, a) Revenue Auditors; b)

Internal Auditors; and c) Concurrent Auditors

Monthly Status Report (including KYC Annexure A & B)

Compliance of KYC Norms

Statement of Balancing of Books

Implementation of Ghosh Committee Recommendations relating to

Frauds & Malpractices in the Bank - Status Report

Closure of Concurrent Audit Report

Outstanding Guarantees wherein Defaults by Constituents and/or Claim