Académique Documents

Professionnel Documents

Culture Documents

Continuing Cookie Chronicle Business

Transféré par

Toh Poh YeeDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Continuing Cookie Chronicle Business

Transféré par

Toh Poh YeeDroits d'auteur :

Formats disponibles

Continuing Cookie Chronicle

Continuing Cookie Chronicle

CCC1 Natalie Koebel spent much of her childhood learning the art of cookie-making from

her grandmother. They passed many happy hours mastering every type of cookie

imaginable and later creating new recipes that were both healthy and delicious. Now at the

start of her second year in college, Natalie is investigating various possibilities for starting

her own business as part of the requirements of the entrepreneurship program in which she

is enrolled.

A long-time friend insists that Natalie has to somehow include cookies in her business

plan. After a series of brainstorming sessions, Natalie settles on the idea of operating a

cookie-making school. She will start on a part-time basis and offer her services in peoples

homes. Now that she has started thinking about it, the possibilities seem endless. During the

fall, she will concentrate on holiday cookies. She will offer individual lessons and group

sessions (which will probably be more entertainment than education for the participants).

Natalie also decides to include children in her target market.

The first difficult decision is coming up with the perfect name for her business. In the

end, she settles on Cookie Creations and then moves on to more important issues.

Instructions

(a) What form of business organizationproprietorship, partnership, or corporation do

you recommend that Natalie use for her business? Discuss the benefits and

weaknesses of each form and give the reasons for your choice.

(b) Will Natalie need accounting information? If yes, what information will she need and

why? How often will she need this information?

(c) Identify specific asset, liability, and equity accounts that Cookie Creations will likely

use to record its business transactions.

(d) Should Natalie open a separate bank account for the business? Why or why not?

2 Continuing Cookie Chronicle

CCC2 After researching the different forms of business organization, Natalie Koebel decides

to operate Cookie Creations as a corporation. She then starts the process of getting the

business running. In November 2014, the following activities take place.

Nov.8

8

11

13

14

16

17

20

25

30

Natalie cashes her government bonds and receives $520, which she deposits in

her personal bank account.

She opens a bank account under the name Cookie Creations and transfers

$500 from her personal account to the new account in exchange for ordinary

shares.

Natalie pays $65 to have advertising brochures and posters printed. She plans

to distribute these as opportunities arise. (Hint: Use Advertising Expense.)

She buys baking supplies, such as flour, sugar, butter, and chocolate chips, for

$125 cash.

Natalie starts to gather some baking equipment to take with her when teaching

the cookie classes. She has an excellent top-of-the-line food processor and

mixer that originally cost her $750. Natalie decides to start using it only in her

new business. She estimates that the equipment is currently worth $300. She

invests the equipment in the business in exchange for ordinary shares.

Natalie realizes that her initial cash investment is not enough. Her grandmother

lends her $2,000 cash, for which Natalie signs a note payable in the name of the

business. Natalie deposits the money in the business bank account. (Hint: The

note does not have to be repaid for 24 months. As a result, the notes payable

should be reported in the accounts as the last liability and also on the

statement of financial position as a non-current liability.)

She buys more baking equipment for $900 cash.

She teaches her first class and collects $125 cash.

Natalie books a second class for December 4 for $150. She receives $30 cash in

advance as a down payment.

Natalie pays $1,320 for a one-year insurance policy that will expire on

December 1, 2015.

Instructions

(a) Prepare journal entries to record the November transactions.

(b) Post the journal entries to general ledger accounts.

(c) Prepare a trial balance at November 30.

Continuing Cookie Chronicle

CCC3 It is the end of November and Natalie has been in touch with her grandmother. Her

grandmother asked Natalie how well things went in her first month of business. Natalie, too,

would like to know if the company has been profitable or not during November. Natalie

realizes that in order to determine Cookie Creations income, she must first make

adjustments.

Natalie puts together the following additional information.

1. A count reveals that $35 of baking supplies were used during November.

2. Natalie estimates that all of her baking equipment will have a useful life of 5 years

or 60 months and no salvage value. (Assume Natalie decides to record a full

months worth of depreciation, regardless of when the equipment was obtained by

the business.)

3. Natalies grandmother has decided to charge interest of 6% on the note payable

extended on November 16. The loan plus interest is to be repaid in 24 months.

(Assume that half a month of interest accrued during November.)

4. On November 30, a friend of Natalies asks her to teach a class at the neighborhood

school. Natalie agrees and teaches a group of 35 first-grade students how to make

Santa Claus cookies. The next day, Natalie prepares an invoice for $300 and leaves

it with the school principal. The principal says that he will pass the invoice along to

the head office, and it will be paid sometime in December.

5. Natalie receives a utilities bill for $45. The bill is for utilities consumed by Natalies

business during November and is due December 15.

Instructions

Using the information that you have gathered through Chapter 2, and based on the new

information above, do the following.

(a) Prepare and post the adjusting journal entries.

(b) Prepare an adjusted trial balance.

(c) Using the adjusted trial balance, calculate Cookie Creations net income or net loss for

the month of November. Do not prepare an income statement.

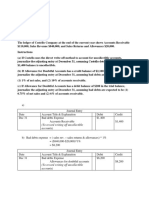

4 Continuing Cookie Chronicle

CCC4 Natalie had a very busy December. At the end of the month, after journalizing and

posting the December transactions and adjusting entries, Natalie prepared the following

adjusted trial balance.

Cookie Creations

Adjusted Trial Balance

December 31, 2014

Debit

Cash

$1,180

Accounts Receivable

875

Supplies

350

Prepaid Insurance

1,210

Equipment

1,200

Accumulated DepreciationEquipment

Accounts Payable

Salaries and Wages Payable

Notes Payable

Unearned Service Revenue

Interest Payable

Share Capital-Ordinary

Dividends

500

Service Revenue

Salaries and Wages Expense 1,006

Utilities Expense

125

Advertising Expense

165

Supplies Expense

1,025

Depreciation Expense

40

Insurance Expense

110

Interest Expense

15

$7,801

Credit

75

56

2,000

300

15

800

$ 40

4,515

$7,801

Instructions

Using the information in the adjusted trial balance, do the following.

(a) Prepare an income statement and a retained earnings statement for the 2 months

ended December 31, 2014, and a classified statement of financial position at

December 31, 2014. The note payable has a stated interest rate of 6%, and the

principal and interest are due on November 16, 2016.

(b) Natalie has decided that her year-end will be December 31, 2014. Prepare closing

entries as of December 31, 2014.

(c) Prepare a post-closing trial balance.

Continuing Cookie Chronicle

CCC5 Because Natalie has had such a successful first few months, she is considering other

opportunities to develop her business. One opportunity is the sale of fine European mixers.

The owner of Kzinski Supply Co. has approached Natalie to become the exclusive distributor

of these fine mixers in her state. The current cost of a mixer is approximately $575, and

Natalie would sell each one for $1,150. Natalie comes to you for advice on how to account

for these mixers. Each appliance has a serial number and can be easily identified.

Natalie asks you the following questions.

1. Would you consider these mixers to be inventory? Or should they be classified as

supplies or equipment?

2. Ive learned a little about keeping track of inventory using both the perpetual and

the periodic systems of accounting for inventory. Which system do you think is

better? Which one would you recommend for the type of inventory that I want to

sell?

3. How often do I need to count inventory if I maintain it using the perpetual system?

Do I need to count inventory at all?

In the end, Natalie decides to use the perpetual inventory system. The following transactions

happen during the month of January.

Jan. 4

6

7

8

12

14

14

17

18

20

28

28

30

31

31

Bought five deluxe mixers on account from Kzinski Supply Co. for $2,875, FOB

shipping point, terms n/30.

Paid $100 freight on the January 4 purchase.

Returned one of the mixers to Kzinski because it was damaged during shipping.

Kzinski issues Cookie Creations credit for the cost of mixer plus $20 for the cost

of freight that was paid on January 6 for one mixer.

Collected $375 of the accounts receivable from December 2014.

Three deluxe mixers are sold on account for $3,450, FOB destination, terms

n/30. (Cost of goods sold is $595 per mixer.)

Paid the $75 of delivery charges for the three mixers that were sold on January

12.

Bought four deluxe mixers on account from Kzinski Supply Co. for $2,300, FOB

shipping point, terms n/30.

Natalie is concerned that there is not enough cash available to pay for all of the

mixers purchased. She invests an additional $1,000 cash in Cookie Creations in

exchange for ordinary shares.

Paid $80 freight on the January 14 purchase.

Sold two deluxe mixers for $2,300 cash. (Cost of goods sold is $595 per mixer.)

Natalie issued a check to her assistant for all the help the assistant has given

her during the month. Her assistant worked 20 hours in January and is also paid

the $56 owed at December 31, 2014. Ignore payroll taxes. (Natalies assistant

earns $8 an hour.)

Collected the amounts due from customers for the January 12 transaction.

Paid a $145 utility bill ($75 for the December 2014 account payable and $70 for

the month of January).

Paid Kzinski all amounts due.

Cash dividends of $750 are paid.

As of January 31, the following adjusting entry data is available.

1. A count of baking supplies reveals that none were used in January.

2. Another months worth of depreciation needs to be recorded on the baking

equipment bought in November. (Recall that the baking equipment has a useful life

of 5 years or 60 months and no salvage value.)

3. An additional months worth of interest on her grandmothers loan needs to be

accrued. (The interest rate is 6%.)

6 Continuing Cookie Chronicle

4.

5.

6.

During the month, $110 of insurance has expired.

An analysis of the unearned service revenue account reveals that Natalie has not

had time to teach any of these lessons this month because she has been so busy

selling mixers. As a result, there is no change to the unearned service revenue

account. Natalie hopes to complete the remaining lessons in February.

An inventory count of mixers at the end of January reveals that Natalie has three

mixers remaining.

Instructions

Using the information from previous chapters and the new information above, do the

following.

(a) Answer Natalies questions.

(b) Prepare and post the January 2015 transactions.

(c) Prepare a trial balance.

(d) Prepare and post the adjusting journal entries required.

(e) Prepare an adjusted trial balance.

(f) Prepare an income statement for the month ended January 31, 2015.

Continuing Cookie Chronicle

CCC6 Natalie is busy establishing both divisions of her business (cookie classes and mixer

sales) and completing her business degree. Her goals for the next 11 months are to sell one

mixer per month and to give two to three classes per week.

The cost of the fine European mixers is expected to increase. Natalie has just negotiated

new terms with Kzinski that include shipping costs in the negotiated purchase price (mixers

will be shipped FOB destination). Assume that Natalie has decided to use a periodic

inventory system and now must choose a cost flow assumption for her mixer inventory.

The following transactions occur in February to May 2015.

Feb.2

Natalie buys two deluxe mixers on account from Kzinski Supply Co. for $1,200

($600 each), FOB destination, terms n/30.

16

She sells one deluxe mixer for $1,150 cash.

25

She pays the amount owed to Kzinski.

Mar.2

She buys one deluxe mixer on account from Kzinski Supply Co. for $618, FOB

destination, terms n/30.

30

Natalie sells two deluxe mixers for a total of $2,300 cash.

31

She pays the amount owed to Kzinski.

Apr. 1

She buys two deluxe mixers on account from Kzinski Supply Co. for $1,224

($612 each), FOB destination, terms n/30.

13

She sells three deluxe mixers for a total of $3,450 cash.

30

Natalie pays the amounts owed to Kzinski.

May4

She buys three deluxe mixers on account from Kzinski Supply Co. for $1,875

($625 each), FOB destination, terms n/30.

27

She sells one deluxe mixer for $1,150 cash.

Instructions

(a) Determine the cost of goods available for sale. Recall from Chapter 5 that at the end

of January, Cookie Creations had three mixers on hand at a cost of $595 each.

(b) (i) Calculate the ending inventory under the FIFO and average cost methods,

(ii) Calculate the cost of goods sold under the FIFO and average cost methods,

(iii) Calculate the gross profit under the FIFO and average cost methods, and

(iv) Calculate the gross profit rate under the FIFO and average cost methods.

8 Continuing Cookie Chronicle

CCC7 Part 1 Natalie is struggling to keep up with the recording of her accounting

transactions. She is spending a lot of time marketing and selling mixers and giving her

cookie classes. Her friend John is an accounting student who runs his own accounting

service. He has asked Natalie if she would like to have him do her accounting.

John and Natalie meet and discuss her business. John suggests that he do the following

for Natalie.

1.

2.

3.

4.

5.

6.

7.

8.

Hold cash until there is enough to be deposited. (He would keep the cash locked up

in his vehicle). He would also take all of the deposits to the bank at least twice a

month.

Write and sign all of the checks.

Record all of the deposits in the accounting records.

Record all of the checks in the accounting records.

Prepare the monthly bank reconciliation.

Transfer all of Natalies manual accounting records to his computer accounting

program. John maintains all of the accounting information that he keeps for his

clients on his laptop computer.

Prepare monthly financial statements for Natalie to review.

Write himself a check every month for the work he has done for Natalie.

Instructions

Identify the weaknesses in internal control that you see in the system John is recommending.

Can you suggest any improvements if Natalie hires John to do the accounting?

CCC7 Part 2 Natalie decides that she cannot afford to hire John to do her accounting. One

way that she can ensure that her cash account does not have any errors and is accurate and

up-to-date is to prepare a bank reconciliation at the end of each month.

Natalie would like you to help her. She asks you to prepare a bank reconciliation for June

2015 using the following information.

GENERAL LEDGERCOOKIE CREATIONS

Cash

Date

2015

June 1

1

3

3

8

9

13

20

28

28

Explanat

ion

Ref.

Debit

Credi

t

Balan

ce

625

2,657

3,407

2,782

95

2,687

56

2,631

425

3,681

3,256

297

3,411

3,114

Balance

750

Check

#600

Check

#601

Check

#302

1,050

Check

#603

155

Check

#604

110

3,224

Continuing Cookie Chronicle

10 Continuing Cookie Chronicle

PREMIER BANK

Statement of AccountCookie Creations

June 30, 2015

Date

May 31

June 1

6

6

8

9

10

10

14

20

23

28

30

Explanation

Balance

Deposit

Check #600

Check #601

Check #602

Deposit

NSF Check

NSF Fee

Check #603

Deposit

EFT Telus

Check #599

Bank charges

Checks

and

Other

Debits

Deposits

750

625

95

56

1,050

100

35

452

125

85

361

13

Balance

3,256

4,066

3,381

3,286

3,230

4,280

4,180

4,145

3,693

3,818

3,733

3,372

3,359

Additional information:

1. On May 31, there were two outstanding checks: #595 for $238 and #599 for $361.

2. Premier Bank made a posting error to the bank statement: check #603 was issued

for $425, not $452.

3. The deposit made on June 20 was for $125 that Natalie received for teaching a

class. Natalie made an error in recording this transaction.

4. The electronic funds transfer (EFT) was for Natalies utilities expense.

5. The NSF check was from Ron Black. Natalie received this check for teaching a class

to Rons children. Natalie contacted Ron, and he assured her that she will receive a

check in the mail for the outstanding amount of the invoice and the NSF bank

charge.

Instructions

(a) Prepare Cookie Creations bank reconciliation for June 30.

(b) Prepare any necessary adjusting entries at June 30.

(c) If a statement of financial position is prepared for Cookie Creations at June 30, what

balance will be reported as cash in the current assets section?

Continuing Cookie Chronicle

11

CCC8 One of Natalies friends, Curtis Lesperance, runs a coffee shop where he sells

specialty coffees and prepares and sells muffins and cookies. He is eager to buy one of

Natalies fine European mixers, which would enable him to make larger batches of muffins

and cookies. However, Curtis cannot afford to pay for the mixer for at least 30 days. He asks

Natalie if she would be willing to sell him the mixer on credit.

Natalie comes to you for advice. She asks the following questions.

1. Curtis has given me a set of his most recent financial statements. What

calculations should I make with the data from these statements, and what

questions should I ask him after I have analyzed the statements? How will this

information help me decide if I should extend credit to Curtis?

2. Is there an alternative other than extending credit to Curtis for 30 days?

3. I am thinking seriously about being able to have my customers use credit cards.

What are some of the advantages and disadvantages of letting my customers pay

by credit card?

The following transactions occurred in June through August 2015.

June 1 After much thought, Natalie sells a mixer to Curtis on credit, terms n/30, for

$1,150 (cost of mixer $620).

30

Curtis calls Natalie. He is unable to pay the amount outstanding for another

month, so he signs a one-month, 8.25% note receivable.

July 31 Curtis calls Natalie. He indicates that he is unable to pay today but hopes to

have a check for her at the end of the week. Natalie prepares the journal entry

to record the dishonoring of the note. She assumes she will be paid within a

week.

Aug. 7 Natalie receives a check from Curtis in payment of his balance owed.

Instructions

(a) Answer Natalies questions.

(b) Prepare journal entries for the transactions that occurred in June, July, and August.

(The company uses a perpetual inventory system). Round calculations to nearest

dollar.

12 Continuing Cookie Chronicle

CCC9 Natalie is thinking of buying a van that will be used only for business. The cost of the

van is estimated at $36,500. Natalie would spend an additional $2,500 to have the van

painted. In addition, she wants the back seat of the van removed so that she will have lots of

room to transport her mixer inventory as well as her baking supplies. The cost of taking out

the back seat and installing shelving units is estimated at $1,500. She expects the van to

last about 5 years, and she expects to drive it for 200,000 miles. The annual cost of vehicle

insurance will be $2,400. Natalie estimates that at the end of the 5-year useful life the van

will sell for $7,500. Assume that she will buy the van on August 15, 2015, and it will be ready

for use on September 1, 2015.

Natalie is concerned about the impact of the vans cost on her income statement and

statement of financial position. She has come to you for advice on calculating the vans

depreciation.

Instructions

(a) Determine the cost of the van.

(b) Prepare three depreciation tables for 2015, 2016, and 2017: one for straight-line

depreciation (similar to the one in Illustration 9-9), one for double-declining balance

depreciation (Illustration 9-13), and one for units-of-activity depreciation (Illustration

9-11). For units-of activity, Natalie estimates she will drive the van as follows: 15,000

miles in 2015; 45,000 miles in 2016; 50,000 miles in 2017; 45,000 miles in 2018;

35,000 miles in 2019; and 10,000 miles in 2020. Recall that Cookie Creations has a

December 31 year-end.

(c) What impact will the three methods of depreciation have on Natalies statement of

financial position at December 31, 2015? What impact will the three methods have on

Natalies income statement in 2015?

(d) What impact will the three methods of depreciation have on Natalies income

statement over the vans total 5-year useful life?

(e) What method of depreciation would you recommend Natalie use?

Continuing Cookie Chronicle

13

CCC10Natalie is thinking of repaying all amounts outstanding to her grandmother. Recall

that Cookie Creations borrowed $2,000 on November 16, 2014, from Natalies grandmother.

Interest on the note is 6% per year, and the note plus interest was to be repaid in 24

months. Recall that a monthly adjusting journal entry was prepared for the months of

November 2014 (1/2 month), December 2014, and January 2015.

Instructions

(a) Calculate the interest payable that was accrued and recorded to July 31, 2015,

assuming monthly adjusting entries were made.

(b) Prepare the journal entry at August 31, 2015, to record one months accrued interest.

(c) Natalie repays her grandmother on September 15, 201510 months after her

grandmother extended the loan to Cookie Creations. Prepare the journal entry for the

loan repayment.

14 Continuing Cookie Chronicle

CCC11Natalie and her friend Curtis Lesperance decide that they can benefit from joining

Cookie Creations and Curtiss coffee shop. In the first part of this problem, they come to you

with questions about setting up a corporation for their new business. In the second part of

the problem, they want your help in preparing financial information following the first year of

operations of their new business, Cookie & Coffee Creations.

CCC11Part 1 Curtis has operated his coffee shop for 2 years. He buys coffee, muffins, and

cookies from a local supplier. Natalies business consists of giving cookie-making classes and

selling fine European mixers. The plan is for Natalie to use the premises Curtis currently

rents to give her cooking- making classes and demonstrations of the mixers that she sells.

Natalie will also hire, train, and supervise staff to bake the cookies and muffins sold in the

coffee shop. By offering her classes on the premises, Natalie will save on travel time going

from one place to another. Another advantage is that the coffee shop will have one central

location for selling the mixers.

The current market values of the assets of both businesses are as follows.

Curtiss Coffee Cookie Creations

Cash

$7,500

$11,630

Accounts receivable

100

800

Inventory

450

1,200

Equipment

2,500

1,000*

*Cookie Creations decided not to buy the delivery van considered in Chapter

9.

Combining forces will also allow Natalie and Curtis to pool their resources and buy a few

more assets to run their new business venture.

Curtis and Natalie then meet with a lawyer and form a corporation on November 1, 2015,

called Cookie & Coffee Creations Inc. The articles of incorporation state that there will be two

classes of shares that the corporation is authorized to issue: ordinary shares and preference

shares. They authorize 100,000 no-par shares of ordinary shares, and 10,000 no-par shares

of preference shares with a $0.50 non-cumulative dividend.

The assets held by each of their businesses will be transferred into the corporation at

current market value. Curtis will receive 10,550 ordinary shares, and Natalie will receive

14,630 ordinary shares in the corporation. Therefore, the shares have a fair value of $1 per

share.

Natalie and Curtis are very excited about this new business venture. They come to you

with the following questions:

1. Curtiss dad and Natalies grandmother are interested in investing $5,000 each in

the business venture. We are thinking of issuing them preference shares. What

would be the advantage of issuing them preference shares instead of ordinary

shares?

2. Our lawyer has sent us a bill for $750.When we discussed the bill with her, she

indicated that she would be willing to receive ordinary shares in our new

corporation instead of cash for her services. We would be happy to issue her

shares, but were a bit worried about accounting for this transaction. Can we do

this? If so, how do we determine how many shares to give her?

Instructions

(a) Answer their questions.

(b) Prepare the journal entries required on November 1, 2015, the date when Natalie and

Curtis transfer the assets of their respective businesses into Cookie & Coffee Creations

Inc.

(c) Assume that Cookie & Coffee Creations Inc. issues 1,000 $0.50 non-cumulative

preference shares to Curtiss dad and the same number to Natalies grandmother, in

Continuing Cookie Chronicle

(d)

15

both cases for $5,000. Also assume that Cookie & Coffee Creations Inc. issues 750

ordinary shares to its lawyer. Prepare the journal entries for each of these

transactions. They all occurred on November 1.

Prepare the opening statement of financial position for Cookie & Coffee Creations Inc.

as of November 1, 2015, including the journal entries in (b) and (c) above.

16 Continuing Cookie Chronicle

CCC11Part 2 After establishing their companys fiscal year-end to be October 31, Natalie

and Curtis begin operating Cookie & Coffee Creations Inc. on November 1, 2015. On that

date, after the issuance of shares, the equity section of the companys statement of financial

position is as follows.

Equity

Share capital - preference, $0.50 non-cumulative, no par value,

10,000 shares authorized, 2,000 issued

Share capital - ordinary, no par value, 100,000 shares

authorized, 25,930 issued

$10,000

25,930

Cookie & Coffee Creations then has the following selected transactions during its first year of

operations.

Dec. 1

Apr.30

Issues an additional 800 preference shares to Natalies brother for $4,000.

Declares a semiannual dividend to the preference shareholders of record on

May 15, payable on June 1.

June30 Repurchases 750 ordinary shares issued to the lawyer, for $500. Recall that

these were originally issued for $750. The lawyer had decided to retire and

wanted to liquidate all of her assets.

Oct.31 The company has had a very successful first year of operations. It earned

revenues of $462,500 and incurred expenses of $364,050 (including $750 legal

fee, but excluding income tax).

31 Records income tax expense. (The company has a 20% income tax rate.)

31 Declares a semiannual dividend to the preference shareholders of record on

November15, payable on December 1.

Instructions

(a) Prepare the journal entries to record the above transactions.

(b) Prepare the retained earnings statement for the year.

(c) Prepare the equity section of the statement of financial position as of October 31.

(d) Prepare closing entries.

(e) Calculate the earnings per share. Assume weighted-average shares of 25,680.

Continuing Cookie Chronicle

17

CCC12Natalie has been approached by Ken Thornton, a shareholder in The Beanery Coffee

Inc. Ken wants to retire and would like to sell his 1,000 shares in The Beanery Coffee, which

represent 30% of all shares issued. The Beanery is currently operated by Kens twin

daughters, each of whom owns 35% of the ordinary shares. The Beanery not only operates a

coffee shop but also roasts and sells beans to retailers, under the name Rocky Mountain

Beanery.

The business has been operating for approximately five years. In the last two years Ken

has lost interest and left the day-to-day operations to his daughters. Both daughters at times

find the work at the coffee shop overwhelming. They would like to have a third shareholder

involved to take over some of the responsibilities of running a small business. Both feel that

Natalie and Curtis are entrepreneurial in spirit and that their expertise would be a welcome

addition to the business operation. The twins have also said that they plan to operate this

business for another ten years and then retire.

Ken has met with Curtis and Natalie to discuss the business operation. They have

concluded that there would be many advantages for Cookie & Coffee Creations Inc. to

acquire an interest in The Beanery Coffee. One of the major advantages would be volume

discounts for purchases of the coffee bean inventory.

Despite the apparent advantages, Natalie and Curtis are still not convinced that they

should participate in this business venture. They come to you with the following questions.

1. We are a little concerned about how much influence we would have in the

decision-making process for The Beanery Coffee. Would the amount of influence we

have affect how we would account for this investment?

2. Can you think of other advantages of going ahead with this investment?

3. Can you think of any disadvantages of going ahead with this investment?

Instructions

(a) Answer Natalie and Curtiss questions.

(b) Assume that Ken wants to sell his 1,000 shares of The Beanery Coffee for $15,000.

Prepare the journal entry required if Cookie & Coffee Creations Inc. buys Kens shares.

(c) Assume that Cookie & Coffee Creations Inc. buys the shares and in the following year,

The Beanery Coffee earns $50,000 net income and pays $25,000 in dividends. Prepare

the journal entries required under both the cost method and the equity method of

accounting for this investment.

(d) Identify where this investment would be classified on the statement of financial

position of Cookie & Coffee Creations Inc. and explain why. What amount would

appear on the statement of financial position under each of the methods of

accounting for the investment?

18 Continuing Cookie Chronicle

CCC13Natalie has prepared the statement of financial position and income statement of

Cookie & Coffee Creations Inc. for the first year of operations, but does not understand how

to prepare the cash flow statement. The income statement and statement of financial

position appear below. Recall that the company started operations on November 1, 2015, so

all of the opening balances are zero.

Additional information:

1. The company bought kitchen equipment (a commercial oven) for $17,000 on

November 1, 2015, and signed a $12,000 note payable to help pay for it. The terms

provide for semiannual fixed principal payments of $2,000 on May 1 and November

1 of each year, plus interest of5%.All other furniture, fixture, and equipment were

purchased during the year for cash.

2. Recall from Chapter 11 that the company originally issued 25,930 ordinary shares

for $25,930, of which 750 shares were repurchased from the lawyer for $500.

COOKIE & COFFEE CREATIONS INC.

Income Statement

Year Ended October 31, 2016

Sales

$462,500

Cost of goods sold

231,250

Gross profit

231,250

Operating expenses

Salaries and wages expense$92,500

Depreciation expense

3,900

Other operating expenses 35,987

132,387

Income from operations

98,863

Interest expense

413

Income before income tax

98,450

Income tax expense

19,690

Net income

$ 78,760

COOKIE & COFFEE CREATIONS INC.

Statement of Financial Position

October 31, 2016

Assets

Property, plant, and equipment

Furniture and fixtures

Accumulated depreciation

furniture and fixtures

Computer equipment

Accumulated depreciation

computer equipment

Kitchen equipment

Accumulated depreciation

kitchen equipment

Current assets

Prepaid expenses

Inventory

Accounts receivable

Cash

$12,500

(1,250)

4,200

11,250

(600)

29,000

3,600

(2,050)

26,950 $ 41,800

$ 6,300

17,897

3,250

79,919

107,366

Continuing Cookie Chronicle

Total assets

19

$149,166

Equity and Liabilities

Equity

Share capital - preference, 2,800 shares

issued, and outstanding

$ 14,000

Share capital - ordinary, 25,930 shares

issued, 25,180 outstanding

25,930

39,930

Retained earnings

64,760

Less: Treasury sharesordinary (750 shares), at cost

500

Total equity

104,190

Non-current liabilities

Note payablelong-term portion

$ 6,000

Current liabilities

Note payablecurrent portion

$ 4,000

Accounts payable

5,848

Income tax payable

19,690

Dividends payable

7,000

Salaries and wages payable

2,250

Interest payable

188

38,976

Total liabilities

44,976

Total equity and liabilities

$149,166

3.

4.

Recall from Chapter 11 that the company declared a semiannual dividend to the

preference shareholders on April 30, and the dividend was paid on June 1. The

second semiannual dividend was declared to the preference shareholders on

October 31, to be paid on December 1.

Prepaid expenses relate only to operating expenses.

Instructions

(a) Prepare a statement of cash flows for Cookie & Coffee Creations Inc. for the year

ended October 31, 2016, using the indirect method.

(b) Prepare a statement of cash flows for Cookie & Coffee Creations Inc. for the year

ended October 31, 2016, using the direct method.

20 Continuing Cookie Chronicle

CCC14The statement of financial position and income statement of Cookie & Coffee

Creations Inc. for its first year of operations, the year ended October 31, 2016, follows.

COOKIE & COFFEE CREATIONS INC.

Statement of Financial Position

October 31, 2016

Assets

Property, plant, and equipment

Furniture and fixtures

Accumulated depreciation

furniture and fixtures

Computer equipment

Accumulated depreciation

computer equipment

Kitchen equipment

Accumulated depreciation

kitchen equipment

Current assets

Prepaid expenses

Inventory

Accounts receivable

Cash

Total assets

$12,500

(1,250)

4,200

11,250

(600)

29,000

3,600

(2,050)

26,950 $ 41,800

$ 6,300

17,897

3,250

79,919

107,366

$149,166

Equity and Liabilities

Equity

Share capital - preference, 2,800 shares

issued and outstanding

$ 14,000

Share capital - ordinary, 25,930 shares

issued, 25,180 outstanding

25,930

39,930

Retained earnings

64,760

Less: Treasury sharesordinary (750 shares), at cost

500

Total equity

104,190

Non-current liabilities

Note payablelong-term portion

$ 6,000

Current liabilities

Note payablecurrent portion

$ 4,000

Accounts payable

5,848

Income tax payable

19,690

Dividends payable

7,000

Salaries and wages payable

2,250

Interest payable

188

38,976

Total liabilities

44,976

Total equity and liabilities

$149,166

Continuing Cookie Chronicle

21

COOKIE & COFFEE CREATIONS INC.

Income Statement

Year Ended October 31, 2016

Sales

$462,500

Cost of goods sold

231,250

Gross profit

231,250

Operating expenses

Salaries and wages expense$92,500

Depreciation expense

3,900

Other operating expenses 35,987

132,387

Income from operations

98,863

Interest expense

413

Income before income tax

98,450

Income tax expense

19,690

Net income

$ 78,760

Instructions

(a) 1. Calculate the current ratio

6.

2. Calculate the receivables turnover

3. Calculate the inventory turnover

4. Calculate the debt to total assets

5. Calculate the times interest earned

shareholders equity

Calculate the gross profit rate

7. Calculate the profit margin

8. Calculate the asset turnover

9. Calculate the return on assets

10. Calculate the return on ordinary

Round calculations to the nearest one decimal place.

(b)

(c)

(d)

Comment on your findings from part (a).

Based on your analysis in parts (a) and (b), do you think a bank would lend Cookie &

Coffee Creations Inc. $20,000 to buy the additional equipment? Explain your

reasoning.

What alternatives could Cookie & Coffee Creations consider instead of bank

financing?

Vous aimerez peut-être aussi

- MC3 Matcha Creations: (For Instructor Use Only)Document2 pagesMC3 Matcha Creations: (For Instructor Use Only)Reza eka PutraPas encore d'évaluation

- Group Assigment CA MATCHA CREATIONSDocument8 pagesGroup Assigment CA MATCHA CREATIONSHoàng Hải Quyên100% (1)

- Chapter 3 ExercisesDocument11 pagesChapter 3 ExercisesNguyen VyPas encore d'évaluation

- Jawaban PR Pertemuan 4Document30 pagesJawaban PR Pertemuan 4ninarizkitaPas encore d'évaluation

- Assignment 2Document4 pagesAssignment 2Sultan LimitPas encore d'évaluation

- Be16 P16 2aDocument7 pagesBe16 P16 2aLisa Hammerle ClarkPas encore d'évaluation

- Answer For Case AIS2Document15 pagesAnswer For Case AIS2Nurliyana Syazwani100% (4)

- Hassellhouf Company Unrecorded Transactions and Financial Statements CP9Document3 pagesHassellhouf Company Unrecorded Transactions and Financial Statements CP9Rahul100% (1)

- My Brothers:) (2) For A Start, They Don't Look Alike. Nick's Got Blond Hair andDocument1 pageMy Brothers:) (2) For A Start, They Don't Look Alike. Nick's Got Blond Hair androckefsPas encore d'évaluation

- Lahore Business School Accounting 2 Assignment 3 on Statement of Cash FlowsDocument3 pagesLahore Business School Accounting 2 Assignment 3 on Statement of Cash Flowsmrs adilPas encore d'évaluation

- HW 7Document2 pagesHW 7Mishalm96Pas encore d'évaluation

- Arya Bima Putra - 215020300111071 - CH - Tugas1Document3 pagesArya Bima Putra - 215020300111071 - CH - Tugas1Arya Bima PutraPas encore d'évaluation

- Soal Myob PT DinamikaDocument5 pagesSoal Myob PT DinamikaRaden Andini AnggreaniPas encore d'évaluation

- Pertemuan 14 - Investasi Saham (20% - 50%) PDFDocument17 pagesPertemuan 14 - Investasi Saham (20% - 50%) PDFayu utamiPas encore d'évaluation

- Fundamentals of Accounting-I WorksheetDocument7 pagesFundamentals of Accounting-I WorksheetLee HailuPas encore d'évaluation

- 3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênDocument76 pages3, Fa1 Question Book 2021 (Gen 5) - G I Cho Sinh ViênHoàng Vũ HuyPas encore d'évaluation

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionPas encore d'évaluation

- Ch13 Current Liabilities, Provisions and ContingenciesDocument100 pagesCh13 Current Liabilities, Provisions and ContingenciesمريمالرئيسيPas encore d'évaluation

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDocument1 pageBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaPas encore d'évaluation

- 1 Intermediate Accounting IFRS 3rd Edition-554-569Document16 pages1 Intermediate Accounting IFRS 3rd Edition-554-569Khofifah SalmahPas encore d'évaluation

- A. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalanceDocument5 pagesA. Hercules Poirot, P.I., Sa Worksheet For The Quarter Ended March 31, 2017 Account Titles Trial Balance Adjustmnets Adjusted Trial BalancevaldaPas encore d'évaluation

- Comprehensive Problems Solution Answer Key Mid TermDocument5 pagesComprehensive Problems Solution Answer Key Mid TermGabriel Aaron DionnePas encore d'évaluation

- Review CH 08Document7 pagesReview CH 08Martin Putra100% (1)

- The Bell StoryDocument1 pageThe Bell StoryHara HaraPas encore d'évaluation

- Achievement Test 3.chapters 5&6Document9 pagesAchievement Test 3.chapters 5&6Quỳnh Vũ100% (1)

- Homework Chapter 8Document10 pagesHomework Chapter 8Trung Kiên Nguyễn0% (1)

- Tugas Pengantar Akuntansi-1Document23 pagesTugas Pengantar Akuntansi-1Wiedya fitrianaPas encore d'évaluation

- Assigment 14Document8 pagesAssigment 14cecilia angelPas encore d'évaluation

- CH08SOLSDocument23 pagesCH08SOLSMiki TiendaPas encore d'évaluation

- Week 3 Accounting HelpDocument4 pagesWeek 3 Accounting HelpGiuseppe Mccoy100% (1)

- Module 9 Problems - MrnakDocument9 pagesModule 9 Problems - MrnakJenny MrnakPas encore d'évaluation

- Tugas Individu Akuntansi TM3Document1 pageTugas Individu Akuntansi TM3Yuni ArtaPas encore d'évaluation

- Intermediate Accounting III Homework Chapter 18Document15 pagesIntermediate Accounting III Homework Chapter 18Abdul Qayoum Awan100% (1)

- Tug AsDocument5 pagesTug Asihalalis5202100% (2)

- 2.1 (Usefulness, Objective of Financial Reporting) Indicate Whether TheDocument8 pages2.1 (Usefulness, Objective of Financial Reporting) Indicate Whether TheKinanti PutriPas encore d'évaluation

- Chapter 16Document6 pagesChapter 16YasirPas encore d'évaluation

- Week 4 Practice Questions 1Document17 pagesWeek 4 Practice Questions 1Gabriel Abdillah100% (1)

- ACC 557 Week 4 Chapter 6 E6 1 E6 10 E6 14 P6 3ADocument7 pagesACC 557 Week 4 Chapter 6 E6 1 E6 10 E6 14 P6 3Atswag2014Pas encore d'évaluation

- Zulfitri Handayani - A031191125 (Akkeu P15-3)Document6 pagesZulfitri Handayani - A031191125 (Akkeu P15-3)RismayantiPas encore d'évaluation

- 1 Completing The Accounting Cycle-1Document17 pages1 Completing The Accounting Cycle-1Toshi PrataPas encore d'évaluation

- Bab 2 Cost Concept and The Cost Accounting Information SystemDocument5 pagesBab 2 Cost Concept and The Cost Accounting Information SystemFransiskusSinagaPas encore d'évaluation

- Tutorial Laporan Arus KasDocument17 pagesTutorial Laporan Arus KasRatna DwiPas encore d'évaluation

- Soal Asistensi AK1 Pertemuan 7Document3 pagesSoal Asistensi AK1 Pertemuan 7Afrizal WildanPas encore d'évaluation

- Accounting 1Document11 pagesAccounting 1Audie yanthiPas encore d'évaluation

- 6-GL and FR CycleDocument6 pages6-GL and FR Cyclehangbg2k3Pas encore d'évaluation

- Working 3Document6 pagesWorking 3Hà Lê DuyPas encore d'évaluation

- Soln SSP S1Document12 pagesSoln SSP S1Marjorie PalmaPas encore d'évaluation

- Tugas 1Document2 pagesTugas 1sella50% (2)

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroPas encore d'évaluation

- Latihan 3Document3 pagesLatihan 3Radit Ramdan NopriantoPas encore d'évaluation

- 3512 Chapter 23 Cash Flows HW Exercises ProblemsDocument12 pages3512 Chapter 23 Cash Flows HW Exercises ProblemsM MustafaPas encore d'évaluation

- Quiz Advance AccountingDocument5 pagesQuiz Advance AccountingGeryPas encore d'évaluation

- Subsidiary Preferred Stock CalculationsDocument3 pagesSubsidiary Preferred Stock CalculationsAlya Sufi IkrimaPas encore d'évaluation

- AnswerDocument2 pagesAnswertouya hibikiPas encore d'évaluation

- Tugas PA 2Document2 pagesTugas PA 2Fadhilah HazimahPas encore d'évaluation

- Unit 4 Personal AccountsDocument12 pagesUnit 4 Personal Accountsprisca pebriyaniPas encore d'évaluation

- Wey Ifrs 2e CCCDocument19 pagesWey Ifrs 2e CCCAnonymous 1SUDEbgFPas encore d'évaluation

- CH 05Document2 pagesCH 05kid50% (2)

- Tugas Mata Kuliah: Akuntansi Pengantar - Bab 2Document2 pagesTugas Mata Kuliah: Akuntansi Pengantar - Bab 2Riani AzkiaPas encore d'évaluation

- Kendle Case AnalysisDocument12 pagesKendle Case AnalysisVivek Durairaj100% (3)

- Indus Motor Ratio AnalysisDocument4 pagesIndus Motor Ratio AnalysisNabil QaziPas encore d'évaluation

- Elements of Financial StatementsDocument7 pagesElements of Financial StatementsJennifer EdwardsPas encore d'évaluation

- (Holy Balance Sheet) Jones Electrical DistributionDocument29 pages(Holy Balance Sheet) Jones Electrical DistributionVera Lúcia Batista SantosPas encore d'évaluation

- SFL Final Prospectus-CompressedDocument434 pagesSFL Final Prospectus-Compressedsethirupal20013837Pas encore d'évaluation

- Data Collection of JustDialDocument36 pagesData Collection of JustDialPrashu171091100% (1)

- RBI FIRMS User Manual for Business UsersDocument114 pagesRBI FIRMS User Manual for Business UsersJaya DurgaPas encore d'évaluation

- The Perfection of The Narcissistic Self A Qualitative Study On Luxury Consumption and Customer EquityDocument7 pagesThe Perfection of The Narcissistic Self A Qualitative Study On Luxury Consumption and Customer EquityPablo Castro SalgadoPas encore d'évaluation

- Sample Paper Accountancy 12, Set-1, 2022-23Document9 pagesSample Paper Accountancy 12, Set-1, 2022-23Atharva GhugePas encore d'évaluation

- Financial Ratio Analysis of Dabur India LTDDocument11 pagesFinancial Ratio Analysis of Dabur India LTDHarshit DalmiaPas encore d'évaluation

- SEO-Optimized Title for Partnership Firm Accounting DocumentDocument11 pagesSEO-Optimized Title for Partnership Firm Accounting DocumentMerlin KPas encore d'évaluation

- The Complete Guide To Careers in Business & FinanceDocument37 pagesThe Complete Guide To Careers in Business & FinanceJakePas encore d'évaluation

- Entrepreneurship: Chapter Four: From The Business Plan To Funding The VentureDocument6 pagesEntrepreneurship: Chapter Four: From The Business Plan To Funding The VentureScarlet TaverioPas encore d'évaluation

- Abc Analysis of Ca Final FR For May 2022 ExamsDocument4 pagesAbc Analysis of Ca Final FR For May 2022 ExamsYuva LakshmiPas encore d'évaluation

- Maria Hernandez and AssociatesDocument2 pagesMaria Hernandez and AssociatesManisha SahuPas encore d'évaluation

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsPas encore d'évaluation

- ACCCOUNTING EQUATION With Answers by AlagangWencyDocument7 pagesACCCOUNTING EQUATION With Answers by AlagangWencyHello KittyPas encore d'évaluation

- Business Plan TemplateDocument19 pagesBusiness Plan Templateloganathan89Pas encore d'évaluation

- FABM2 Module 05 (Q1-W6)Document12 pagesFABM2 Module 05 (Q1-W6)Christian ZebuaPas encore d'évaluation

- May 21Document253 pagesMay 21sachin kumarPas encore d'évaluation

- ValuationDocument69 pagesValuationSivasankariPas encore d'évaluation

- How Does The Stock Market WorkDocument16 pagesHow Does The Stock Market WorkAl-MuktadirPas encore d'évaluation

- BHARATH SfinalDocument66 pagesBHARATH Sfinalaurorashiva1Pas encore d'évaluation

- Reporting and Analyzing InvestmentsDocument50 pagesReporting and Analyzing InvestmentsDang ThanhPas encore d'évaluation

- CAFES MONTE BIANCO profit plan analysisDocument5 pagesCAFES MONTE BIANCO profit plan analysisTanisha AgarwalPas encore d'évaluation

- Client Assistance ScheduleDocument9 pagesClient Assistance SchedulesefanitPas encore d'évaluation

- Fin 440 Course Outline Fall 2017Document4 pagesFin 440 Course Outline Fall 2017Tasnim Mahmud Rana 1921142630Pas encore d'évaluation

- Finance Case Study 1Document2 pagesFinance Case Study 1kazi A.R RafiPas encore d'évaluation

- Navigating The Paper Trail: What Are The Key Subjects in The Franchise Agreement?Document4 pagesNavigating The Paper Trail: What Are The Key Subjects in The Franchise Agreement?Silvano Richelle VentoleroPas encore d'évaluation

- Advance AccountingDocument7 pagesAdvance AccountingPutri anjjarwatiPas encore d'évaluation