Académique Documents

Professionnel Documents

Culture Documents

Accounting Prodigy BasicAcc1 Instructors Manual PDF

Transféré par

Precious Vercaza Del RosarioDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Accounting Prodigy BasicAcc1 Instructors Manual PDF

Transféré par

Precious Vercaza Del RosarioDroits d'auteur :

Formats disponibles

ACCOUNTING PRODIGY: BASIC ACCOUNTING 1

II. MULTIPLE CHOICE.

I. TRUE OR FALSE.

False 1.

False 2.

False 3.

False 4.

False 5.

True 6.

False 7.

True 8.

False 9.

False 10.

False 11.

False 12.

False 13.

False 14.

True 15.

False 16.

True 17,

True 18.

False 19.

The ledger is a chronological record of all

transactions.

In some transactions, the accounting

equation may not be maintained.

When a company hires a new employee, a

recordable event has occurred.

A debit means that an account has been

increased.

Liabilities are established with debits and

eliminated with credits.

Transposition errors are moving of the

decimal point while the slide is reversing the

order of numbers.

The T-account is sometimes called the book

of original entry.

A basic storage unit for accounting data is

the account.

Companies use the same standard set of

accounts.

The accounts in a chart of accounts are

normally listed in alphabetical order.

A credit has an unfavourable effect on an

account.

Another word for expense is debt.

Expenses represent the cash paid for goods

sold or services rendered in the process of

generating revenue.

Asset is a resource controlled by the

enterprise as a result of present events and

from which future economic benefits are

expected to flow to the enterprise.

The principle of objectivity includes the

concepts of verifiability.

The fundamental concepts of accounting are

entity concept, periodicity concept and

unstable monetary unit concept.

Financial reporting is only concerned the

information that is significant enough to

affect evaluations and decisions.

Goods should be recorded at their list price

less any trade discounts involved.

FOB shipping point means that the seller

incurs the shipping costs.

NATIONAL UNIVERSITY JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS

1. If accounts payable ha a debit postings of

P170 000, credit postings of P140 000 and

a normal ending balance of P60 000, which

of the following was its beginning balance?

A.

B.

C.

D.

P 30 000 Cr.

P 30 000 Dr.

P 90 000 Cr.

P 90 000 Dr.

2. Obligations which are expected to be

liquidated through the use of existing

current assets or the creation of other

current liabilities are called:

A.

B.

C.

D.

Current assets

Current liabilities

Long term liabilities

Unearned revenue

3. The matching rule relates the least to:

A. Accrual accounting

B. Systematic and rational allocation

C. Cash basis

4. The carrying value of a depreciable asset

equals:

A. The estimated amount for which the

asset could be sold

B. The estimated cost to replace the asset

C. The original cost minus accumulated

depreciation

D. The original cost minus depreciation

expense for the current period

5. Which of the following transactions is the

most difficult to assign to specific time

periods?

A.

B.

C.

D.

The accrual of interest

The expiration of insurance

The incurrence of salaries

The use of equipment

Page 1 of 5

6. Financial statement time periods should be

of equal length.

A. And should correspond with the

calendar year

B. And should end during the peak season

C. To comply with loan agreements

D. To make comparison meaningful

7. Which of the following transaction results in

the recognition of an expense?

A. Expiration of usefulness of equipment

during the accounting period

B. Payment of the principal of a loan

C. Payment of accounts payable

D. Withdrawal of cash by the owner

8. Which of the following situations involves a

deferral?

A.

B.

C.

D.

9.

Recording accrued interest

Recording depreciation

Recording unrecorded revenue

Recording unrecorded salaries

Which of the following assets is not subject

to depreciation?

A.

B.

C.

D.

Art equipment

Computers

Land

Store fixtures

10. Which of the following accounts could not

be credited in an adjusting entry?

A.

B.

C.

D.

Interest Receivable

Office supplies

Prepaid rent

Service revenues

11. The

principal

difference

between

depreciation and most other types of

expense is that depreciation:

A. Can be avoided if the asset is in good

condition as when it was purchased.

B. Does not require an immediate cash

outlay

C. Is not deductible if it will cause a loss

D. Is

subject

to

more

precise

measurements

NATIONAL UNIVERSITY JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS

12. Amount deducted from the catalog price for

an item of merchandise:

A.

B.

C.

D.

Customer discount

Purchases discount

Sales discount

Trade discount

13. The purchase of prepaid insurance policy

would initially be recorded as:

A.

B.

C.

D.

A deferred expense

A deferred revenue

An accrued expense

An accrued revenue

14. The accountant may spread the cost of a

building over many years primarily

because:

A.

B.

C.

D.

Fiscal year assumption

Going concern assumption

Periodicity assumption

Periodicity assumption and

concern assumption

going

15. If a P4 700 cash purchase of supplies is

recorded as a P5 700 debit to supplies

expense and a P5 700 credit to cash, the

result will be that:

A. Supplies expense will be overstated

and cash will be understated

B. The cash account will be overstated

C. The supplies account will be

understated

D. The trial balance will be out of balance

16. Which of the following errors will not cause

the debit and credit columns of the trial

balance to be unequal?

A. A debit entry was recorded in the wrong

account

B. A debit was entered in an account as a

credit

C. The account balance was carried to the

wrong column of the trial balance

D. The balance of an account was

incorrectly computed

Page 2 of 5

17. It is the ability to bring together for the

purpose of noting similarities and

dissimilarities.

A.

B.

C.

D.

Comparability

Cost and benefit

Materiality

Timeliness

18. It is the capacity of information to make a

difference by helping users evaluate past,

present, or future events, or confirming or

correcting their past evaluations.

A.

B.

C.

D.

III.

PROBLEMS.

1. A business pays weekly salaries of P200 000

on Friday for a five-day week ending on that

day. If the fiscal period ends on Wednesday,

the adjusting entry is:

Salary expense

P 120 000**

Accrued Salary payable

P120 000

**P200 000 x (3/5)

2.

Comparability

Relevance

Neutrality

Understandability

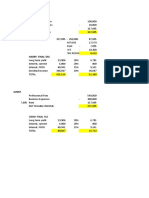

If accounts receivable has a debit postings of

P580 000, credit postings of P440 000 and a

normal ending balance of P480 000, what was

its beginning balance?

19. The accounting concept justifies the usage

of accruals and deferrals:

Beg.

Accounts Receivable

340 000

580 000

A.

B.

C.

D.

Consistency

Materiality

Going concern

Stable monetary unit

20. According to the conceptual framework, the

usefulness of providing information in

financial statements is subject to the

constraint of:

A.

B.

C.

D.

Consistency

Faithful representation

Cost

Timeliness

440 000

Ending 480 000

3.

XYZ

sells

one-year

and

two-year

subscriptions for its electronic book of the

month download business. Subscription are

collected in advance and credited to Sales. An

analysis of the recorded sales activity

revealed the following:

Sales

Less:

Cancellations

2013

P 420 000

2014

P 500 000

20 000

30 000

P 400 000

P 470 000

Subscription Expirations:

2013

P 120 000

2014

155 000

2015

125 000

2016

P 130 000

200 000

140 000

(A) In XYZ Dec 31, 2013 balance sheet, the

balance for unearned subscription revenues

should be:

2013 Sales, net of cancellations

P400 000

Less: 2013 Subscription expiration

120 000

Unearned Revenue, Dec 31, 2013 P280 000

NATIONAL UNIVERSITY JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS

Page 3 of 5

(B) In XYZ Dec 31, 2014 balance sheet, the balance

for unearned subscription revenues should be:

Unearned Revenue, Dec 31, 2013

P280 000

Add: 2014 Sales, net of cancellations 470 000

Total

P 750 000

Less: 2014 Subscription Expirations

(P 155 000 + P 130 000)

285 000

Unearned Revenue, Dec 31 2014

P 465 000

4. An analysis of Joy Lopez Companys unadjusted

prepaid expense account at December 31, 2014

revealed the following:

An opening balance at P15 000 for Joy

Lopezs comprehensive insurance policy. Joy

Lopez paid an annual premium of P30 000 on

July 1, 2013.

A P32 000 annual insurance premium

payment made July 1, 2014.

A P20 000 advance rental payment for a

warehouse leased for one year beginning

January 1, 2015.

6. Julius Company owns an office building and leases

the office under a variety of rental agreements

involving rent paid in advance monthly or annually.

Not all tenants make timely payments of their rent.

Julius balance sheet contains the following data:

Rental Receivable

Unearned Rental

2014

P 248 000

480 000

During 2014, Julius Company received P1 600 000

from tenants. What amount of rental revenues

should Julius Company record for 2014?

Cash received 2014

Rental Receivable, Dec 31 2013

Unearned Rental, Dec 31 2013

Total

Rental Receivable, Dec 31 2014

Unearned Rental, Dec 31 2014

Rental Revenue for 2014

7.

In its Dec 31, 2014 balance sheet, what amount

should Joy Lopez report as prepaid expenses?

P1 600 000

( 192 000)

640 000

P2 048 000

248 000

( 480 000)

P1 816 000

Salaries payable were P3 500 at the end of

September and P2 800 at the end of October.

Salaries expense for October was P18 000. How

much cash was paid for salaries during October?

Prepaid Expense

Beg

2013

P 192 000

640 000

Salaries Payable

P15 000

P 3 500

P15 000 *

32 000

P 18 700

16 000 **

18 000

20 000

P 2 800

End

P36 000

(*) Insurance expense from Jan 1 to June 30, 2014

P 30 000 x (6/12)

(**) Insurance expense from July 1 to Dec 31, 2014

P 32 000 x (6/12)

8.

2013 end

2014 end

Oct, end

Office supplies were P 9 000 at the end of January

and P 11 400 at the end of February. During

February, Office supplies expense was P3 000.

How much cash was paid for office supplies during

February?

Office Supplies

Jan, end

5. Surfers Company has P1 500 of supplies on hand

at end of 2013. During 2014, P2 750 of supplies

were purchased. A count of supplies on hand at

the end of 2014 found an inventory of P875. What

was the amount of supplies expense for 2014?

Sept, end

P9 000

5 400

P3 000

Feb, end P11 400

Supplies

P1 500

P3 375

2 750

P 875

NATIONAL UNIVERSITY JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS

Page 4 of 5

9. Unearned revenue was P6 000 at the end of

February and P7 500 at the end of March. Service

revenue was P42 000 for the month of March.

How much cash was received for services

provided during March?

The company received a P36 000

advance payment during the year on

services still to be performed. By the end

of the year, one fourth of the services had

been performed.

Unearned Revenue

Liability Method:

P 6 000

Feb, end

Unearned revenue

Service revenue

P 42 000

P9 000

P9 000

43 500

Revenue Method

P 7 500

IV.

March, end

Service revenue

P27 000

Unearned revenue

P27 000

ADJUSTING ENTRIES

The following information

ENYUDYEYPIYA Company.

pertains

to

Accrued interest on a note receivable

amounted to P1 000.

The companys supplies account showed

a beginning debit balance of P2 000 and

supplies purchased of P8 000; P3 000 of

supplies were on hand at year end.

Accrued Interest receivable P1 000

Interest Income

P1 000

Supplies expense

Supplies

P7 000

P7 000

A 1-year insurance policy was purchased

for P20 000. Three months have passed

since the purchase.

Asset Method:

Insurance expense

Prepaid Insurance

P5 000**

P5 000

Expense Method:

Prepaid Insurance

Insurance Expense

P15 000

P15 000

** P20 000 x (3/12)

On April 1 2012, the company bought a

building that costs P560 000 and with a

scrap value of P25 000. As of Dec 31

2014, the said building having an

economic life of 14 years, has been used

by the company for 2 3/4 years since it

was acquired. What is the depreciation for

2014?

Depreciation

P 38 214**

Accumulated Depreciation

P 38 214

** (P 560 000 25 000) / 14 years

NATIONAL UNIVERSITY JUNIOR PHILIPPINE INSTITUTE OF ACCOUNTANTS

Page 5 of 5

Vous aimerez peut-être aussi

- Glenda Lee Resume 2Document2 pagesGlenda Lee Resume 2api-516194049Pas encore d'évaluation

- Advanced Product Quality Planning (APQP)Document22 pagesAdvanced Product Quality Planning (APQP)mjapmgPas encore d'évaluation

- The 60 Minute Startup PDFDocument3 pagesThe 60 Minute Startup PDFtawatchai limPas encore d'évaluation

- #Test Bank - Cpar SalesDocument40 pages#Test Bank - Cpar SalesChristian Blanza Lleva83% (18)

- CASH TO ACCRUAL SINGLE ENTRY With ANSWERSDocument8 pagesCASH TO ACCRUAL SINGLE ENTRY With ANSWERSRaven SiaPas encore d'évaluation

- Human Resource PlanningDocument16 pagesHuman Resource PlanningSiddharth Jain100% (1)

- Cpar NegoDocument20 pagesCpar NegoChristian Blanza Lleva67% (3)

- CH 07Document99 pagesCH 07baldoewszxc80% (5)

- MIT Student ResumesDocument26 pagesMIT Student ResumesIvan Vargas100% (1)

- Review of The Accounting ProcessDocument4 pagesReview of The Accounting ProcessMichael Vincent Buan Suico100% (1)

- Test Bank Accounting 26th Edition Warren Reeve Duchac (PDFDrive)Document96 pagesTest Bank Accounting 26th Edition Warren Reeve Duchac (PDFDrive)Lyca SorianoPas encore d'évaluation

- Law On Sales and Agency CPARDocument12 pagesLaw On Sales and Agency CPARChristian Blanza LlevaPas encore d'évaluation

- Operational Auditing A Complete Guide - 2021 EditionD'EverandOperational Auditing A Complete Guide - 2021 EditionPas encore d'évaluation

- Financial Accounting and Reporting Solution Manual PDFDocument192 pagesFinancial Accounting and Reporting Solution Manual PDFJHEYPas encore d'évaluation

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionD'EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionPas encore d'évaluation

- Assessment Test 2nd Cash&RecDocument6 pagesAssessment Test 2nd Cash&RecMellowPas encore d'évaluation

- Test Bank - PNC CPARDocument6 pagesTest Bank - PNC CPARChristian Blanza LlevaPas encore d'évaluation

- Law On Sales Testbank CPARDocument13 pagesLaw On Sales Testbank CPARChristian Blanza Lleva92% (13)

- Test Bank Law 1 CparDocument26 pagesTest Bank Law 1 CparJoyce Kay Azucena73% (22)

- Summary BMKT 525 Marketing ManagementDocument112 pagesSummary BMKT 525 Marketing ManagementSobhi BraidyPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- ReiceivablesDocument27 pagesReiceivablesrivaceline100% (3)

- Acca F5Document133 pagesAcca F5Andin Lee67% (3)

- TEST BANK - LAW 1-DiazDocument14 pagesTEST BANK - LAW 1-DiazChristian Blanza Lleva100% (3)

- FAR Prelim 1st Quarter Answer KeyDocument4 pagesFAR Prelim 1st Quarter Answer KeypehikPas encore d'évaluation

- Chapter 1: History, Development and Functions of The Standard-Setting BodiesDocument58 pagesChapter 1: History, Development and Functions of The Standard-Setting BodiesPatricia San Pablo100% (1)

- Chap 1 Gen. Prin 2013Document3 pagesChap 1 Gen. Prin 2013Quennie Jane Siblos100% (6)

- Set A Review Quiz QuestionsDocument7 pagesSet A Review Quiz QuestionsJan Allyson BiagPas encore d'évaluation

- GroupeAriel S.ADocument3 pagesGroupeAriel S.AEina GuptaPas encore d'évaluation

- Accounting GeniusDocument9 pagesAccounting Geniusryan angelica allanicPas encore d'évaluation

- Financial Management Cabrera Solution ManualDocument2 pagesFinancial Management Cabrera Solution ManualKeith Stephanie AngelesPas encore d'évaluation

- From Conceptual To Executable BPMN Process ModelsDocument49 pagesFrom Conceptual To Executable BPMN Process ModelsAlbertiPas encore d'évaluation

- REVIEWERDocument9 pagesREVIEWERHanns Lexter PadillaPas encore d'évaluation

- The Need For AdjustmentDocument5 pagesThe Need For AdjustmentAnna CharlottePas encore d'évaluation

- Principles of AccountingDocument6 pagesPrinciples of AccountingGian Karlo PagariganPas encore d'évaluation

- Financial Accounting and Reporting Retained EarningsDocument68 pagesFinancial Accounting and Reporting Retained EarningsRic Cruz0% (1)

- PartnershipDocument9 pagesPartnershipChariz Audrey100% (1)

- Strategic CMDocument7 pagesStrategic CMMjhayePas encore d'évaluation

- 20 x12 ABC CDocument8 pages20 x12 ABC CAG R OhcnaPas encore d'évaluation

- CH 07Document18 pagesCH 07James Hurst100% (1)

- Local Media8011400976913649007Document16 pagesLocal Media8011400976913649007Ivan dela CruzPas encore d'évaluation

- Cost Accounting Practice Set (L. Payongayong)Document60 pagesCost Accounting Practice Set (L. Payongayong)rocketkaye100% (2)

- Acctg CycleDocument13 pagesAcctg Cyclefer maPas encore d'évaluation

- Qualifying Exam - 1Document5 pagesQualifying Exam - 1Eleazer Ego-oganPas encore d'évaluation

- Chapter 5 Accounting For Merchandising Operations PDFDocument36 pagesChapter 5 Accounting For Merchandising Operations PDFJed Riel BalatanPas encore d'évaluation

- Revised BSA Curriculum Approved by CHED Technical PanelDocument42 pagesRevised BSA Curriculum Approved by CHED Technical PanelLei100% (2)

- PAS 7 and PAS 41 SummaryDocument5 pagesPAS 7 and PAS 41 SummaryCharles BarcelaPas encore d'évaluation

- CHAPTER 6 - Adjusting EntriesDocument25 pagesCHAPTER 6 - Adjusting EntriesMuhammad AdibPas encore d'évaluation

- 6 BudgetingDocument2 pages6 BudgetingClyette Anne Flores BorjaPas encore d'évaluation

- Lease ProblemsDocument15 pagesLease ProblemsArvigne DorenPas encore d'évaluation

- Business Combinations - Net Asset AcquisitionDocument15 pagesBusiness Combinations - Net Asset AcquisitionLyca Mae CubangbangPas encore d'évaluation

- MODULE 3 - The Adjusting ProcessDocument41 pagesMODULE 3 - The Adjusting ProcessFRANCES JEANALLEN DE JESUSPas encore d'évaluation

- Ch01 Introduction To Accounting and BusinessDocument51 pagesCh01 Introduction To Accounting and BusinessGelyn Cruz50% (2)

- Client Selection and RetentionDocument20 pagesClient Selection and RetentionJurie MayPas encore d'évaluation

- EXERCISE ON ADJUSTING ENTRIES - Corrected VersionDocument2 pagesEXERCISE ON ADJUSTING ENTRIES - Corrected VersionRoy BonitezPas encore d'évaluation

- Financial Accounting and Key Concepts of HRDocument4 pagesFinancial Accounting and Key Concepts of HRarslanshani50% (2)

- Pract 1 - Exam2Document2 pagesPract 1 - Exam2Sharmaine Rivera MiguelPas encore d'évaluation

- Sample Final Exam With SolutionDocument17 pagesSample Final Exam With SolutionYevhenii VdovenkoPas encore d'évaluation

- Practical Accounting 1 Conrado Valix Free Download PDFDocument3 pagesPractical Accounting 1 Conrado Valix Free Download PDFAnalie Mendez0% (2)

- Fundamentals of Abm 2.2Document6 pagesFundamentals of Abm 2.2Jasmine ActaPas encore d'évaluation

- Ppsas 27 in Comparison With Ias 41Document2 pagesPpsas 27 in Comparison With Ias 41Lia SyPas encore d'évaluation

- Ch06 Income TaxesDocument6 pagesCh06 Income Taxesralphalonzo100% (1)

- Pre Finals Manacc 1Document8 pagesPre Finals Manacc 1Gesselle Acebedo0% (1)

- SQE First Year Answer KeDocument7 pagesSQE First Year Answer KeClarise AugiaPas encore d'évaluation

- 01 PartnershipDocument6 pages01 Partnershipdom baldemorPas encore d'évaluation

- Semi FinalDocument17 pagesSemi FinalJane TuazonPas encore d'évaluation

- Mas 1405Document12 pagesMas 1405Alvin AgullanaPas encore d'évaluation

- Financial Accounting Valix and Peralta Volume Three - 2008 Edition 1Document27 pagesFinancial Accounting Valix and Peralta Volume Three - 2008 Edition 1jamilahpanantaon83% (12)

- College of Business and Management: Central Mindanao University Department of AccountancyDocument11 pagesCollege of Business and Management: Central Mindanao University Department of AccountancyErwin Dave M. DahaoPas encore d'évaluation

- Adjusting EntriesDocument7 pagesAdjusting Entrieshello hayaPas encore d'évaluation

- Name - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sDocument11 pagesName - Course & Yr. - Schedule - Score - Test I. Multiple Choice. Encircle The Letter of The Best Answer in Each of The Given Question/sAtty CpaPas encore d'évaluation

- GlobalisationDocument9 pagesGlobalisationMark Joseph TadeoPas encore d'évaluation

- FAR Practice ProblemsDocument34 pagesFAR Practice ProblemsJhon Eljun Yuto EnopiaPas encore d'évaluation

- 2ND Online Quiz Level 1 Set B (Answers)Document5 pages2ND Online Quiz Level 1 Set B (Answers)Vincent Larrie Moldez100% (1)

- Fsa Questions FBNDocument34 pagesFsa Questions FBNsprykizyPas encore d'évaluation

- Roockies CupsDocument75 pagesRoockies CupsPeterpaul SilacanPas encore d'évaluation

- Accounting Review Week 2Document13 pagesAccounting Review Week 2Janine IgdalinoPas encore d'évaluation

- Boa Tos FarDocument6 pagesBoa Tos FarMr. CopernicusPas encore d'évaluation

- Company Practices PDFDocument1 pageCompany Practices PDFPrecious Vercaza Del RosarioPas encore d'évaluation

- Learnings On Company PracticesDocument2 pagesLearnings On Company PracticesPrecious Vercaza Del RosarioPas encore d'évaluation

- Boa Tos AfarDocument5 pagesBoa Tos AfarMr. CopernicusPas encore d'évaluation

- Boa Tos Auditing.Document4 pagesBoa Tos Auditing.Mr. CopernicusPas encore d'évaluation

- BOA TOS TaxDocument2 pagesBOA TOS TaxMr. CopernicusPas encore d'évaluation

- Knowing The ProductDocument12 pagesKnowing The ProductPrecious Vercaza Del RosarioPas encore d'évaluation

- Boa Tos RFBTDocument6 pagesBoa Tos RFBTMr. CopernicusPas encore d'évaluation

- Barton Enron CaseDocument9 pagesBarton Enron CaseMohammad Delowar HossainPas encore d'évaluation

- Boa Tos MSDocument3 pagesBoa Tos MSMr. CopernicusPas encore d'évaluation

- Albano NegoDocument9 pagesAlbano NegoCELRennPas encore d'évaluation

- Practicum Recommendation LetterDocument3 pagesPracticum Recommendation LetterPrecious Vercaza Del RosarioPas encore d'évaluation

- Rick Abram V. Del Rosario: Educational BackgroundDocument1 pageRick Abram V. Del Rosario: Educational BackgroundPrecious Vercaza Del RosarioPas encore d'évaluation

- Practicum Recommendation LetterDocument3 pagesPracticum Recommendation LetterPrecious Vercaza Del RosarioPas encore d'évaluation

- Knowing The ProductDocument12 pagesKnowing The ProductPrecious Vercaza Del RosarioPas encore d'évaluation

- OSFAF32008Document0 pageOSFAF32008Marinel VillaneraPas encore d'évaluation

- Mico EconomicsDocument18 pagesMico EconomicsPrecious Vercaza Del RosarioPas encore d'évaluation

- Resume Ni RickboyDocument3 pagesResume Ni RickboyPrecious Vercaza Del RosarioPas encore d'évaluation

- Resume FinalDocument2 pagesResume FinalPrecious Vercaza Del RosarioPas encore d'évaluation

- Pup F4 PDFDocument1 pagePup F4 PDFPrecious Vercaza Del RosarioPas encore d'évaluation

- PUP Enrollment Payment Voucher PDFDocument3 pagesPUP Enrollment Payment Voucher PDFPrecious Vercaza Del RosarioPas encore d'évaluation

- Rick Abram V. Del Rosario: Educational BackgroundDocument1 pageRick Abram V. Del Rosario: Educational BackgroundPrecious Vercaza Del RosarioPas encore d'évaluation

- w27 UpdatesDocument9 pagesw27 UpdatesRafayPas encore d'évaluation

- Income Taxation Quick NotesDocument3 pagesIncome Taxation Quick NotesKathPas encore d'évaluation

- C4 - OverheadDocument23 pagesC4 - OverheadSITI NUR LYANA YAHYAPas encore d'évaluation

- Bodie Investments 12e IM CH23Document3 pagesBodie Investments 12e IM CH23lexon_kbPas encore d'évaluation

- Chapter ThreeDocument20 pagesChapter Threehenokt129Pas encore d'évaluation

- Business Ethics - Nature & Scope - 123939423Document25 pagesBusiness Ethics - Nature & Scope - 123939423Ramalingam ChandrasekharanPas encore d'évaluation

- PNC Annual RPT 2020 LowresDocument229 pagesPNC Annual RPT 2020 LowresShehani ThilakshikaPas encore d'évaluation

- Alliecovello ResumeDocument2 pagesAlliecovello Resumeapi-310731929Pas encore d'évaluation

- Senior Project Engineering Manager in Chicago IL Resume Richard PrischingDocument2 pagesSenior Project Engineering Manager in Chicago IL Resume Richard PrischingRichardPrischingPas encore d'évaluation

- Swot Analysis PepsiDocument14 pagesSwot Analysis Pepsivmd35sbsbPas encore d'évaluation

- Delta Group New Catalogue 2018Document22 pagesDelta Group New Catalogue 2018AlmaPas encore d'évaluation

- Case Study Analysis Graphic OrganizerDocument3 pagesCase Study Analysis Graphic OrganizerAshwinKumarPas encore d'évaluation

- C1H021021 - Almas Delian - Resume MIS Bab 1Document2 pagesC1H021021 - Almas Delian - Resume MIS Bab 1Almas DelianPas encore d'évaluation

- Principles of Marketing SLM Week12Document6 pagesPrinciples of Marketing SLM Week12Ash SatoshiPas encore d'évaluation

- Damodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityDocument17 pagesDamodaram Sanjivayya Sabbavaram, Visakhapatnam, Ap., India.: National Law UniversityJahnavi GopaluniPas encore d'évaluation

- SUMANTRA SENGUPTA - 7/1/2004: The Top Ten Supply Chain MistakesDocument7 pagesSUMANTRA SENGUPTA - 7/1/2004: The Top Ten Supply Chain MistakesMohit LalchandaniPas encore d'évaluation

- A Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseDocument6 pagesA Winning Formula: Debrief For The Asda Case (Chapter 14, Shaping Implementation Strategies) The Asda CaseSpend ThriftPas encore d'évaluation

- HCLT108 1 Jul Dec2023 FA2 IM V.2 29052023Document7 pagesHCLT108 1 Jul Dec2023 FA2 IM V.2 29052023sylvesterPas encore d'évaluation

- Management Accounting Summer 20091Document18 pagesManagement Accounting Summer 20091MahmozPas encore d'évaluation

- Management Skills & Attributes #1Document13 pagesManagement Skills & Attributes #1Mr Akash100% (1)