Académique Documents

Professionnel Documents

Culture Documents

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Transféré par

Shyam SunderTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

TI,IEHTA INTEGRATEE

Cl

TIilAN(T [TD.

N N0:- 165910GJ1985P1C0076e1

To,

The Listing Department

Bombay Stock Exchange Ltd

P J Towers,

Date: 03/0812016

Dalal Street,

Mumbai-400001

SCRIP CODE: 511377

Sub: Outcome of Board Meeting held on 3'd August. 2016

Sir/Madam.

with Part A of Schedule III of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations,2015, we hereby inform you that the Board of Directors

at its meeting held on 3'd August, 2016Inter-alia has:

Pursuant to Regulation 30 read

1.

Considered and approved the Standalone Unaudited Financial Results of the Company

for the quafter ended on 3'd August, 2016 in terms of Regulation 33 of Listing

Regulations

2.

,2015.

Limited Review Report as issued by the statutory auditor of the Company and took the

same on record.

Kindly acknowledge the same.

Thanking You,

Integra

For,

Darsh

Manl

f;

ance

Ltd.

Mehta

g Director

(DIN:00483706)

Registered Office : 3, Law Garden Apt., Scheme-1, Opp. Law Garden, Eliisbridge, Ahmedabad - 380 006.

Phone : 091-79-2656 5566 / 67 Fax : (079) 26461513 Mobile : 93 77578519 E-mait : mifl_in@yahoo.com

MEHTA INTEGRATED FINANCE LTD.

OO3,

LAW GARDEN APPT., SCHEME-1,

LAW GARDEN, ELLISBRIDGE,

OPP.

AHMEDABAD-380006.

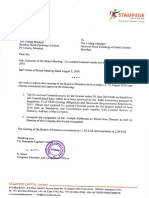

Standalone Unudited Financial Results for the Quarter ended 30th June 2016

lst QUARTER (01-04-2016 TO 30-06-2016)

Part-'l

(Rs. In Lakhs)

Statement ofStandalone Unaudited Financial Results for the Quarter ended 30th June 2016

Year Ended

Quarter Ended

Particulars

3 Months

Ended

Preceding 4

Months Ended#

Corresponding 3

Months Ended in

the previous

year^

Rel br Notes Below)

Previous year

ended

(19 Months)#

01.04.16

To

30.06.16

(Unaudited)

(Audited)

(Unaudited)

(Audited)

0.00

2.00

0.00

13.52

0.00

2.00

0.00

13.52

1.73

8.34

6.33

34.46

0.00

2.62

0.00

2.62

5.09

4.43

7.8s

23.66

6.82

15.39

14.18

60.74

(6.82)

(13.3e)

(14.18)

(47.22)

4.08

28.69

t4.42

I r 0.41

(2.74)

15.30

0.24

63.t6

0.00

0.00

0.00

0.04

(2.74)

15.30

0.24

63.16

0.00

0.00

0.00

0.00

r5.30

0.24

63.16

0.00

0.00

0.00

0.00

(2.74)

15.30

0.24

63.16

0r.12.15

0l .03.

To

31.03.16

To

3

1.05.15

r.09.14

To

3I.03.r6

Income from Operations

(a) Net Sales/Income from Operations(

Net of excise dutv )

b) Other Operating Income

Total Income from Operations(net)

2 Expenses

a) Cost of Material consumed

b) Purchase of stock-in-trade

(c) Changes in inventories offinished

goods, work-in-progress and stock-intrade

(d) Employee benefits expense

(e) Depreciation and amortisation

exDense

(f) Other exepenses(Any item

exceeding l0% ofthe total expenses

relating to continuing to be shown

seperately)

Iotal

3

Expenses

Profit / (Loss) from operations before

other income, finance costs and

exceptional item (l-2)

4 Jther Income

5

Profit / (Loss) from ordinary

activities Lrefore finance costs and

exceptional item (3!4)

6 Finance Costs

7

Profit / (Loss) from ordinary

activities after finance costs but

before exceptional item (5+6)

8 Exceptional Items

9

Profit / (Loss) from ordinary

activities before tax (7f8)

t0 Tax Expense

tl Net Profit/ (Loss) from ordinary

activites after tax (9+10)

(2.7

4)

iz\

)"r

(i

12 Extraordinary items (net of

tar

Rs.

0.00

0.00

0.00

0.00

(2.74)

15.30

0.24

63.16

NA

NA

NA

NA

NA

NA

NA

NA

(2.74)

15.30

0.24

63.16

500

500

500

500

Rs. 10/-

Rs. l0/-

Rs. 10/-

Rs. 10/-

(0.05)

0.3 r

0.00

1.26

0.00

0.31

0.00

1.26

a) Basic

(0.05)

0.31

0.00

0.3 r

0.00

0.00

1.26

b) Diluted

Expense

Lakhs)

l3

Net

14

lhare of Profit/ (Loss) of associates*

Profit/ (Loss) for the period

/lt+tzl

l5 Minority Interest*

t6 \et Profit/ (Loss) after taxes,

ninority interest and share ofprofit/

iloss) of associates(13+14+15)*

l7

?aid up Equity share capital

(Face Value

ofthe share shall be

indicated)

18 Reserve excluding Revaluation

Reserves as per balance sheet

l9

of

previous accounting vear

i. Earning Per Share (before

extraordinary items)

'ofRs. 10/- each) (not annualised):

(a) Basic

(b) Diluted

ii Earning Per Share (after

extraordinarv items)

ofRs. 10/- each) (not annualised):

See

1.26

accompanying note to the Financial

Results

* Applicable in case ofconsolidated results

Note:

The above unaudited results have been reviewed by the Audit Committee and approved by the Board of Directors in

their respective meetings held on 3rd August, 2016 and have been subjected to Limited Review by the Statutory

Auditors.

)

#

Further Note That:

The Financial Year ofthe Company ending on 3 lst August, 201 5 has been extended upto 3 1st March, 20 16 in order to align the

period of f,inancial year commencing from I st April and ending on 3 lst March every yoar in accordance with provisions of Section

2 (41) of Companies Act, 2013. Therefore, the Financial Year of the Company was commenced from 1st September, 2014 and

ended on

3lst March,,20l6 i.e. 19 months. Thus, the last quarter is of 4 months.

As per above explanation, the previous year ended was of 19 months from l st September, 2014 to 3 1st March, 2016 and therefore

the current quarter ended 30th June, 2016 figures and previous financial year quarler ended 3 1st May, 2015 figures are not

comparable.

Before compliance of section 2(41) of Companies Act, 2013, the Financial year of the Company was starting from 1st September

and ending on 3 lst August every year.

Date:0310812016

Place : Ahmedabad

ro.. vl.r,tiltegrated

\1"

Fina

Y\t,/

Darsh{n

l)fiehta

ManaeiDd Director

(DIN:00483706)

r'

Ltd.

DINESH K. SHAH & CO,

CHARTERED ACCOUNTANTS

Dinesh K. Shah

B.Com. L.L.B. FCA

507, Hemkoot Complex,

Bih. L.I.C. Building,

Ashram Road, Ahmedabad-38O 009.

Tel. # :079-26584450

Email : dkshah43@hotmail.com.

Limited Review Report

To Board of Directors

Mehta Integrated Finance

Ltd

We have reviewed the accompanying statement of unaudited financial results of Mehta Integrated

Finance Ltd for the period ended 30tr'June, 2016. This statement is the responsibility of the

Company's Management and has been approved by the Board of Directors. Our responsibility is to

issue a report on these financial statements based on our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) 2400,

Engagements to Review Financial Statements issued by the lnstitute of Chartered Accountants of

India. Tliis standard requires that we plan and perform the review to obtain moderate assurance as to

whether the financial statements are free of material misstatement. A review is limited primarily to

inquiries of company personnel and an analytical procedure applied to financial data and thus

provides less assurance than an audit. We have not performed an audit and accordingly, we do not

express an audit opinion.

Based on our review conducted as above, nothing has come to our attention that causes us to believe

that the accompanying statement of unaudited financial results prepared in accordance with applicable

accounting standards and other recognized accounting practices and policies has not disclosed the

information required to be disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015 including the manner in which it is to be disclosed, or

that it contains any material misstatement.

Place:Ahmedabad

Date: 03.08.2016

For, Dinesh K. Shah & Co.,

t;i

!,

\,

"

(Dinesh K Shah-Partner)

(M.No.10477)'

Vous aimerez peut-être aussi

- Incident Management TrainingDocument30 pagesIncident Management TrainingUsman Hamid100% (1)

- Operations PurchasingDocument5 pagesOperations PurchasingMinato RamiezPas encore d'évaluation

- Digital Marketing Master WorksheetsDocument41 pagesDigital Marketing Master WorksheetsPrem KumarPas encore d'évaluation

- Gebiz SUPPLY HeadsDocument14 pagesGebiz SUPPLY HeadsYam BalaoingPas encore d'évaluation

- Najeeb Other Business ModelDocument13 pagesNajeeb Other Business ModelMuhammad NajeebPas encore d'évaluation

- Stock Market Course ContentDocument12 pagesStock Market Course ContentSrikanth SanipiniPas encore d'évaluation

- Determine Maintenance Strategy Level IV: Unit of CompetenceDocument22 pagesDetermine Maintenance Strategy Level IV: Unit of CompetenceAnonymous kv6awfY80% (5)

- Business Plan I. Business TitleDocument3 pagesBusiness Plan I. Business TitleClaire Macaraeg100% (1)

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- Insur XDocument15 pagesInsur XJuan CumbradoPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Document4 pagesAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document7 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document15 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document8 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document5 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- 06-Infra & Property DevelopmentDocument9 pages06-Infra & Property Developmentmadhura_454Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document8 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Siddharth Arya - DIW - Individual Assignment 1 PDFDocument13 pagesSiddharth Arya - DIW - Individual Assignment 1 PDFSiddhartha AryaPas encore d'évaluation

- Standard Costing: A Standard Cost Is A Carefully - Unit Cist Which Is Prepared For Each Cost UnitDocument23 pagesStandard Costing: A Standard Cost Is A Carefully - Unit Cist Which Is Prepared For Each Cost UnitHarshPas encore d'évaluation

- ATOM Ride-Hailing AgreementDocument7 pagesATOM Ride-Hailing AgreementRaedPas encore d'évaluation

- Intellectual Property Rights - Question BankDocument14 pagesIntellectual Property Rights - Question BankKarthikPas encore d'évaluation

- Steel in The European Union Vera Trappmann PDFDocument21 pagesSteel in The European Union Vera Trappmann PDFaashima chopraPas encore d'évaluation

- Jinnah University For Women: Department: EnglishDocument4 pagesJinnah University For Women: Department: EnglishHurain ZahidPas encore d'évaluation

- Mittal School of BusinessDocument17 pagesMittal School of BusinessAnkitPas encore d'évaluation

- Chapter 7 DepreciationDocument50 pagesChapter 7 Depreciationpriyam.200409Pas encore d'évaluation

- Industrial Visit)Document10 pagesIndustrial Visit)ZISHAN ALI-RM 21RM966Pas encore d'évaluation

- CONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEDocument11 pagesCONCEPTUAL FRAMEWORK and ACCOUNTING STANDARD - OUTLINEBABAPas encore d'évaluation

- 0 0 0 15000 0 15000 SGST (0006)Document2 pages0 0 0 15000 0 15000 SGST (0006)Pruthiv RajPas encore d'évaluation

- Report On Dutch Bangla Bank & Ratio AnalysisDocument32 pagesReport On Dutch Bangla Bank & Ratio Analysisolidurrahman33% (3)

- 201 - MM - Unit-3,4,5 MCQsDocument19 pages201 - MM - Unit-3,4,5 MCQsDilip PawarPas encore d'évaluation

- Authorisation and Declaration 20230313Document1 pageAuthorisation and Declaration 20230313VikramPas encore d'évaluation

- Advance Financial Management - Stocks Valuation Self Test ProblemDocument2 pagesAdvance Financial Management - Stocks Valuation Self Test ProblemWaqar AhmadPas encore d'évaluation

- Planning, Implementation and Control in Business MarketingDocument26 pagesPlanning, Implementation and Control in Business MarketingTanya Naman SarafPas encore d'évaluation

- CUZL226 Business Law ModuleDocument96 pagesCUZL226 Business Law ModuleKakumbi Shukhovu ChitiPas encore d'évaluation

- Industrial Relocation Effort To Minimize Environmental PollutionDocument77 pagesIndustrial Relocation Effort To Minimize Environmental PollutionTushar All RounderPas encore d'évaluation

- Cambridge O Level: Accounting 7707/21 May/June 2020Document18 pagesCambridge O Level: Accounting 7707/21 May/June 2020Jack KowmanPas encore d'évaluation

- Inspection and TestingDocument5 pagesInspection and TestingAhmed Elhaj100% (1)

- Liberty Mutual Insurance GroupDocument14 pagesLiberty Mutual Insurance GroupNazish SohailPas encore d'évaluation