Académique Documents

Professionnel Documents

Culture Documents

E-Payment System On E-Commerce in India: Karamjeet Kaur, Dr. Ashutosh Pathak

Transféré par

dharshinee1961Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

E-Payment System On E-Commerce in India: Karamjeet Kaur, Dr. Ashutosh Pathak

Transféré par

dharshinee1961Droits d'auteur :

Formats disponibles

Karamjeet Kaur Int.

Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

RESEARCH ARTICLE

www.ijera.com

OPEN ACCESS

E-Payment System on E-Commerce in India

Karamjeet Kaur1, Dr. Ashutosh Pathak2

1

M.Phil in Computer Application (Research Scholar), University College of Computer Applications, Guru

Kashi University, Talwandi Sabo, Punjab, India

2

Assistant Professor, University College of Computer Applications, Guru Kashi University,Talwandi Sabo,

Punjab, India

ABSTRACT

E-commerce provides the capability of buying and selling products, information and services on the Internet and

other online environments. In an e-commerce environment, payments take the form of money exchange in an

electronic form, and are therefore called Electronic Payment. E-Payment system is secure there should be no

threat to the user credit card number, smart card or other personal detail, payment can be carried out without

involvement of third party, It makes E payment at any time through the internet directly to the transfer

settlement and form E-business environment. Studied have been carried out on E-Payment system .E-Payment

system an integral part of electronic commerce.An efficient payments system reduces the cost of exchanging

goods and services, and is indispensable to the functioning of the interbank, money, and capital markets.

Questions are related to E-Payment system in which given options are Agree, Disagree, Strongly disagree,

Strongly agree, Neutral. After analysis and comparison of various modes of electronic payment systems, it is

revealed that it is quite difficult, if not impossible, to suggest that which payment system is best. Some systems

are quite similar, and differ only in some minor details. Thus there are number of factors which affect the usage

of e-commerce payment systems. Among all these user base is most important success of e-commerce payment

systems also depends on consumer preferences, ease of use, cost, industry agreement, authorization, security,

authentication, non-refutability, accessibility and reliability and anonymity and public policy

Keywords-Credit card, Debit card, Digital Wallet, E-cheque, Smart Card

E-Payment system is secure .There should be no

threat to the user credit card number, smart card or

I.

INTRODUCTION

other personal detail, payment can be carried out

1.1 E-commerce and Electronic Payment

without involvement of third party, It makes E

Systems:payment at any time through the internet directly to

The most popular definition of E-Commerce is

the transfer settlement and form E-business

based on the online perspective of the conducted

environment(Hossein B,2002).[4]

business. E-commerce provides the capability of

buying and selling products, information and services

The

following steps are

carried

out

for

on the Internet and other online environments. As for

payments during online procedures:any trading activity, the issue of safe and reliable

1. The payment procedure is initiated by the

money exchange between transacting parties is

applicant. The applicant selects a bank.

essential. In an e-commerce environment, payments

2.

A payment request is sent to the bank that

take the form of money exchange in an electronic

contains an XML message with a redirection

form, and are therefore called Electronic Payment

URL that points to the government application.

(Abrazhevich D & Markopoulos,2009).[1]

In response, the bank opens a session and

The merchant sell the goods to customer and

forwards the user to the given URL.

customer pay the price with the help of E-Payment

3. The authoritys application forwards the

system .In offline world the payment are made with

applicant on to the online banking application

cash or through cheque .In online sales accepting

of his . bank. After he has been authenticated,

payment is a curial aspect of the transaction (Kaur

[2]

the payment transaction is carried out.

M,2012). \

4. Before the transaction is carried out, the bank

The spread of e-payment usage vary unevenly

checks if there is still a connection open

between countries partly due to differences in factors

between the bank and the authority.

such as quality of regulatory framework and

5. After the connection is confirmed by the

readiness of telecommunication infrastructure. New

authority, the bank carries out the money

payment services based on the Internet and mobile

transfer.

phones proliferate in the advanced economies.( Izhar

A, khan A,Sikandar M[3]

www.ijera.com

79 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

6.

7.

8.

A confirmation message is sent to the authority

stating

whether

the

payment

was

successful or not.

The

authority

responds

with

an

acknowledgement message.

The payment process is finalized and the

applicant is referred back to the authorities

application.

1.2 Types of E-payment system:1) Credit cards:A Credit card is a piece of plastic, 3-1/8inches by

2-1/8 inches in size, that carries information that

allow you to make purchase now pay for them later .

(Kaur M,2012).[2]Credit cards from visa maser card

or any other network allow you to pay for purchase

or services by borrowing from the credit card

company. To purchase goods from merchant who

accept credit card such as merchant has credit card

reader to purchase the payment transaction to

withdraw cash from ATM. You then repay by

making monthly payment toward the amount

borrowed ,that is you dont have to repay the whole

borrowed amount in fill at one go. (Joseph P.T &

S.J,2008; Kumaga D, 2010).[5,6]

2) Debit Card:Debit card is a prepaid card and also known as

ATM card. An individual has to open an account

with the issuing bank which gives debit card with a

personal id number, when he makes a purchase he

enter his pin number on shop pin pad. When the card

is slurped through the electronic terminal it dial the

acquire a banking system either master card or visa

card that validate the pin and finds out from the

issuing bank whether to accept or decline the

transaction the customer can never overspend

because the system reject any transaction which

exceeds the balance in his account the bank never

face a default because the amount spent is debited

immediately from the customer account With almost

every bank account you are issued a debit card. (Kaur

M,2012; Joseph P.T& S.J,2008;

Kumaga

D,2010).[2,5,6]

3) Smart card:Smart card was first introduce in Europe most of

these method are known as stored value card .A

smart card is about the size of a credit card, made of a

plastic with an embedded microprocessor chip that

holds important financial and personal information.

The microprocessor chip is loaded with the relevant

information and periodically recharged. In addition to

these pieces of information, systems have been

developed to store cash onto the chip. The money on

the card is saved in an encrypted form and is

protected by a password to ensure the security of the

smart card solution. In order to pay via smart credit is

www.ijera.com

www.ijera.com

necessary to introduce the card into a hardware

terminal. The device requires a special key from the

issuing bank to start a money transfer in either

direction. Smart cards can be disposable or

rechargeable. (Kaur Manjot,2012; Joseph P.T &

S.J,2008; Kumaga D, 2010).[2,5,6]

4) Digital Wallet (Electronic wallet):Electronic wallets being very useful for frequent

online shoppers are commercially available for

pocket, palm-sized, handheld, and desktop PCs. They

offer a secure, convenient, and portable tool for

online shopping. They store personal and financial

information such as credit cards, passwords, PINs,

and much more(Kaur M ,2012) .To facilitate the

credit-card order process, many companies are

introducing electronic wallet services.E-wallets allow

you to keep track of your billing and shipping

information so that it can be entered with one click at

participating merchants' sites. E-wallets can also store

e checks, e-cash and your credit-card information for

multiple cards (Joseph P.T& S.J,2008; J yang,2009).

[5,6,7]

5) Electronic Cheque:Electronic cheque is messages that contain all the

information that is found on an ordinary Cheque but

it uses digital signature for signing and endorsing and

has digital certificate to authenticate bank account.

There are many websites that accept Electronic

Cheque.An electronic

payment

process that

resembles the function of paper cheques but offers

great security and more feature. Electronic checks

are typically used in orders processed online and are

governed by the same laws that apply to paper

checks. Electronic checks offer protective measures

such

as aunthentification

and

digital

signatures to safeguard digital transactions.(Kaur

M,2012; Joseph P.T & S.J,2008; J yang,2009). [5,2,7]

6) Electronic cash:Similar to regular cash, e-cash enables

transactions between customers without the need for

banks or other third parties. When used, e-cash is

transferred directly and immediately to the

participating merchants and vending machines.

Electronic cashes a secure and convenient alternative

to bills and coins. E-cash usually operates on a

smartcard,

which

includes

an

embedded

microprocessor chip. The microprocessor chip stores

cash value and the security features that make

electronic transactions secure. when e cash created

by one bank is accepted by other reconciliation must

occur without any problem cash must be storable and

receivable. Most E-cash is transferred directly from

the customer's desktop to the merchant's site.

Therefore, e-cash transactions usually require no

remote authorization or personal identification

80 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

number (PIN) codes at the point of sale. (Kaur

M,2012; Joseph P.T & S.J,2008; J yang ,2009;

Kalkota R,1997). [2,6,8.]

1.3 Limitations of traditional Payment Systems in

the context of online Payments:- several limitation

of traditional payment system in the context of e

commerce can be outlined.

a) Lack of usability

b) Lack of security

c) Lack of eligibility

d) High usage costs for customers and

merchants

e) Lack of efficiency

f) Lack of consistency

1.4 Digital payment requirement:For any digital payment system to succeed. The

criteria given in table ought to be satisfied.

Table 1.4

Criteria

Need for the criteria

Acceptabili Payment infrastructure need to be widely

accepted

ty

Anonymity Identify of the customer should be

protected.

Convertibi Digital money should be convertibility it

any type of fund

lity

Cost per transaction should be near to zero.

Efficiency

Integration

Security

Reliability

Usability

Scalability

www.ijera.com

1.5 Component of effective electronic payment

system:1. Consumer and browser:A consumer interact with the online commerce

system through a web browser typically a consumer

first accessing a shopping mall and then uses the

hyperlink from the mall to access the merchant home

page.

2. Shopping mall:A shopping mall is where most consumer first

visit for a shipping free there will be several shopping

malls and it may pay to enlist with one or more well

known mall.

3. Merchant systems:It consists of the home page and related software

to manage the business.

4. Banking network:it consist of several components there is bank

that processes the online financial transaction for the

given merchant the bank maintain the account for the

merchant authorize and processes the payment the

merchant bank also maintain a link with the

consumer bank for verifying the trans actions

Integration should be crated support

existing system.

Should flow financial transaction over open

network.

Should avoid single point of failure.

Payment should be easy as in the real word.

Infrastructure should not break down if new

customer and merchant join

1.6 Comparisons of E-Payment System:Comparisons of Credit Card, E-Cash ,ECheque, Smart card and Debit Card given below:feature

Credit Card

E-Cash

E-Cheque

Smart card

Paid later

Prepaid

Paid later

Prepaid

Actual

payment

time

Offline

Offline transfers

Online and Online

transactions

Online

transfers

offline

transactions

transactions

Debit card

Prepaid

Offline transfer

Bank

account

involvement

Credit

card

account makes the

payment

No

involvement

account makes

the payment

account makes the

payment

account makes the

payment

Users

Any

legitimate

credit card users

Anyone

Anyone with a

bank account

Anyone with a

bank or credit card

account

Anyone with a bank

or

credit

card

account

www.ijera.com

81 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

Party

to

which

payment is

made out

Small

payments

Distributing Bank

Store

Transaction costs

are high. Not

suitable for small

payments

Transaction

costs are low,

suitable

for

small

payments

Transaction

information

face value

Can be signed and

issued freely in

compliance with

the limit

Face value is

often set, and

cannot

be

changed

Limit

transfer

Depends on the

limit of the credit

card

Yes

Depends

on

how much is

prepaid

No

on

Mobility

1.7 Objectives of E-Payment system:a) To identify the area of quality customer service

with personal attention.

b) To establish strong relationship between bank

and customer.

c) It identify how online payment system work.

d) Understand different payment technology.

e) To fulfill the economical requirements of the

business.

II.

PROBLEM FORMULATION

The study involves a survey on the attitude of

people for not using E-Payment system even though

it is easy to access, quicker mode of transaction and

so on the following points on have been taken into

fray while carrying out the study : Innovative

Reliable technology

Effective business practice

smart marketing

promotion

good usability

carefully integration designs

E-Payments are growing at a highest rate ever.

Having card has been become the need of every

person. Nowadays everybody wants to use these

services. The need of the study is to find out Which

type of e payment most suitable? Present study

covers pursuing an interesting and daring task: user

acceptance of e-payment that their acceptance by

end users will be maximized, and the number of

joined users will justify the systems rollout and its

www.ijera.com

Store

Allows

stores

to accumulate

debts until it

reaches a limit

before paying

for it. Suitable

for

small

payments

Can be signed

and

issued

freely

in

compliance

with the limit

www.ijera.com

Store

Store

Transaction costs

are low. Allows

stores

to

accumulate debts

until it reaches a

limit before paying

for it. Therefore, it

is suitable for small

payments

Transaction

costs

are low. Allows

stores to accumulate

debts until it reaches

a limit before paying

for it. Therefore, it

is suitable for small

payments

Can be deducted

freely

in

compliance

with

the limit

Can be deducted

freely in compliance

with the limit

No limit

Depends on how Depends on how

much money is much money is

saved

saved

No

Yes

Yes

further development. Without ignoring the

importance of marketing, business and technological

factors, this research focuses on user acceptance epayment system(EPSs).The study to know the

factors which are supporting and which are opposing

while implementing a particular e-payment in India.

To analyze the emerging trends of e-payment. This

study

is also carried out the future outlook of epayment in India.

III.

RESEARCH METHODOLOGY

This studied have been carried out on EPayment System. Data used in this study collected

basically from the secondary sources. Primary data

also collected through personal interview method

conducting the person who is supposed to have

knowledge about the topic. Secondary data have

been collected from various sources including

websites, newspapers, various published and

unpublished article about pre-primary education etc.

3.1) Survey Instrument

Questionnaire sent to the person concerned with

request to answer the questions and return the

questionnaire. The questionnaire is sent

to

respondent who expected to read and understand the

question and write down the reply in the space

meant for the purpose in questionnaire itself. A

questionnaire consists of a number of questions

printed or typed in a definite order on a form or set

of forms. The respondent to have answered the

questions on their own. Objective type questions

have been designed in survey .Some responses have

82 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

been collected from people.

Like ( student

,Professional and others). The result of survey

shown in graphs. The questionnaire designed on EPayment System .Five points like Agree, Disagree,

Strongly disagree, Strongly agree, Neutral.

A survey Questionnaire is enclosed in table

www.ijera.com

collected based on e-payment system and which epayment type of most suitable.

IV.

DATA INTERPRETATION

Studied have been carried out on E-Payment

system Questions are related to E-Payment system in

which given options are Agree, Disagree, Strongly

disagree, Strongly agree, Neutral.

3.2) Data Analysis

The data collected were analyzed for the entire

sample.

3.3) Result

This is a descriptive research which has studied

the present conditions. The relevant data was

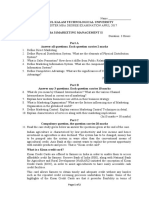

4.1 Overall Analysis of E-Payment System on the basis of Survey

Total Respondents:200

Questions

Agree Disagree

Strongly

disagree

Strongly

agree

Neutral

1.E-Payment System saves your time and

money.

2.E-Payment system is better than offline

payment system.

3.E-Payment system open 24 hours a day.

78

30

15

68

60

69

15

38

18

68

32

27

50

23

4.Exchange money from one location to

another location.

5.Large no. of user satisfied in this.

6.Get quick response in this.

7.Reduce paper work.

8.It is reliable service.

9.Hacker can access to digitized information

and record of E-payment.

10.Customer has to be alert, he must deal

with secure site in which using E-Payment

system.

11.Need internet and E-Payment system use

experience.

12.Gateway play important role in Epayment system.

13.Chance of making mistakes.

14.A greater choice for consumer and

merchant in the way they send and receive

payment.

15.The trend is buying goods and services

over the internet from online shop.

16.Consumer can transfer money easily

without having to visit a bank.

17.The debit card had slow started and

there growth only took off in last three year.

18.Consumers and suppliers can be directly

approached over the Internet.

19.Customer can easily used only payment

syste12m convenient and immediate access

to fund

deposit via debit card.

20.Transaction costs are hidden from user.

70

43

11

64

12

52

54

97

73

95

50

30

20

47

7

21

22

14

49

6

52

74

63

23

73

25

20

6

8

10

83

106

85

56

15

37

70

112

93

94

43

26

14

20

32

37

18

23

93

19

68

16

92

12

18

42

36

78

14

77

28

68

33

78

15

56

52

36

40

16

88

31

20

31

30

www.ijera.com

83 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

21.It provides a legal record of business

communications.

22.To reach out to global consumers easily

and is also cost effective.

23.E-Payment is not simple anywhere and

in any currency thus matching the global

reach of the internet.

24.E- Payment system is not used directly

by individual to make the payments to other

individual.

25.E-Payment provide greater freedom to

individual in paying their taxes , licenses,

fee, funds etc.

26.E-cheque clearance is not easier than

paper cheque.

27.Problem will not arise if your debit card

lost or stolen.

28.E- Payment system can be easily

understood and readily adopted.

29.E-Cash Payment system bank issue

tokens to the customer.

30.Smart card is not helpfully for small

transaction.

www.ijera.com

98

12

62

20

57

31

36

59

17

55

49

52

36

21

44

108

15

12

100

22

65

78

34

63

18

65

27

29

70

64

42

27

55

12

90

108

13

61

108

10

4.2 :-Observation and finding

Fig.4.2.1:-Overall analysis of E-Payment System

on the basis of survey

Maximum no. of people(100) Agree on Q no.25

E-Payment provide greater freedom to individual in

paying their taxes , licenses, fee, funds etc.Mostly

people agree on time saving ,24 hour open, get quick

response. Minimum no. of people (13) Agree on Q

no.30 Smart card is not helpful for carrying out

small transaction. Lesser number of people are

satisfied with e-payment mode of transaction.

Fig 4.2.3.-Graph represented the number of

people Disagreed is shown-:

Fig no.1:-Overall analysis

The given graph reveals the five options

i.e.(Agree, Disagree, Strongly agree, Strongly

disagree, Neutral).

Fig.4.2.2.-Graph represented the number of

people agreed is shown-:

Fig no.2:-Agree

www.ijera.com

Fig no.3:-Disagree

Maximum no. of people (69) Disagree on Q

no.2 E-Payment system is better than offline

payment system. Mostly people disagree on

transaction cost hidden, satisfaction of user, smart

card helpfully for small transaction. Minimum no. of

people(4) Disagree on Q no.29 In E-Cash Payment

system bank issue tokens to the customer. Less no.

of people disagree on legal record of business

communication. Many people think that e payment

system is not reliable, in which many mistakes can

occur.

84 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

Fig 4.2.4.-Graph represented the number of

people Strongly disagreed is shown-:

Fig no.4:-Strongly disagree

Maximum no. of people (108,108) Strongly

disagree on Q no.24 &Qno. 30. Payment system is

not used directly by individual to make the payments

to other individual. Smart card is not helpfully for

small transaction mostly people strongly disagree on

cheque clearance easier than paper cheque.

Minimum no. of people (3)Strongly disagree on Q

no.17 The debit card had slow started and there

growth only took off in last three year .less no of

people strongly disagree on easily understood, .

Security is the big issue in e payment system, hacker

can access account

Information.

Fig 4.2.5.-Graph represented the number of

people Strongly agreed is shown-:

Fig no.5:-Strongly agree

Maximum no. of people(113) Strongly agree on

Q no.12 Gateway play important role in E-payment

system. Mostly people strongly agree on save time,

reduce paper work, exchange money etc .Minimum

no. of people(7) Strongly agree on Q no.26 E-cheque

clearance is not easier than paper cheque. Lesser no

of people strongly agree on e-payment system is not

safe.

Fig 4.2.6.-Graph represented the number of

people Neutral is shown-:

Maximum no. of people Neutral on Q no.25 EPayment provide greater freedom to individual in

paying their taxes , licenses, fee, funds etc. Mostly

people are Neutral on adoption easily, lost or stolen

card .Minimum no. of people Neutral on Q no.29

and 10 In E-Cash Payment system bank issue

tokens to the customer. Customer has to be alert, he

must deal with secure site in which using E-Payment

system. Lesser no. of people neutral on experience

of using payment system need internet and pc

experience.

Fig 4.2.7.-Overall analysis on Credit Card, Debit

card, Smart Card,E-Cash, E-Cheque given

below:-

Fig no.7:-Overall analysis

On the basis of present study, first remark is that

despite the existence of variety of e-commerce

payment systems, credit cards are the most dominant

payment system. This is consequences of

advantageous characteristics, most importantly the

long established networks and very wide users

base. Second, alternative e-commerce payment

systems on debit cards. In fact, like many other

studies, present study also reveals that the smart card

based e-commerce payment system is best and it is

expected that in the future smart cards will

eventually replace the other electronic payment

systems. Fourth , given the limited users bases, ecash is not a feasible payment option. Fifth ECheque are quite cost effective for companies that

have to deal with huge volume of cheques Thus,

there are number of factors which affect the usage of

e-commerce payment systems. Among all these user

base is most important. Make it difficult to choose

an appropriate payment system. On the basis of

analysis it is concluded that, smart cards based

electronic payment system is best. It has numerous

advantages over the other electronic payment

systems.

V.

Fig no.6:-Neutral

www.ijera.com

www.ijera.com

CONCLUSIONS & FUTURE

SCOPE

5.1 Conclusion

Technology has arguably made our lives easier.

One of the technological innovations in banking,

85 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

finance and commerce is the Electronic Payments.

Electronic Payments (e-payments) refers to the

technological breakthrough that enables us to

perform financial transactions electronically, thus

avoiding long lines and other hassles. Electronic

Payments provides greater freedom to individuals in

paying their taxes, licenses, fees, fines and purchases

at unconventional locations and at whichever time of

the day, 365 days of the year. After analysis and

comparison of various modes of electronic payment

systems, it is revealed that it is quite difficult, if not

impossible, to suggest that which payment system is

best. Some systems are quite similar, and differ only

in some minor details. Thus there are number of

factors which affect the usage of e-commerce

payment systems. Among all these user base is most

important. Added to this, success of e-commerce

payment systems also depends on consumer

preferences, ease of use, cost, industry agreement,

authorization,

security,

authentication,

nonrefutability, accessibility and reliability and

anonymity and public policy. The Reliable and

Cashless payment system oers immunity against

theft of paper and e-money, and adopting e-payment

solutions or systems for different reasons. In

addition to cost reduction, reference was made to a

number of other benefits, including improved

customer service, improved working capital,

increased operational efficiencies and cycle times,

processing efficiencies and enhanced compliance to

organizational policies and procedures .This

opportunities e-payment operation increases

different levels of risks for marketing. More than ten

Years of Internet marketing research have yielded a

set of important findings. Based on our review of

these findings, it is clear that the Internet is playing a

more and more important role in the field of epayment .peoples are becoming aware of the need to

measure the collaborative effects of e-payment The

study reveals that the peoples were not aware and

educated. They have not any knowledge of epayment. The study is based on survey .The

respondent have to answer the questions on their

own. Some people satisfy with our views. But some

peoples are not satisfies with us. This study states

that Online e-payment provides greater reach to

customers. Feedback can be obtained easily as

internet is virtual in nature. Customer loyalty can be

gain. Personal attention can be given by bank to

customer also quality service can be served.

we came to know various strengths of epayment System such as quality customer service,

greater reach, time saving customer loyalty, easy

access to information, 24 hours access, reduce paper

work ,no need to carry cash easy online applications

etc.

www.ijera.com

www.ijera.com

5.2 Future Scope

Throughout our experience researching online

payment systems we have learned about many recent

trends and new technologies involving these

systems, such as using PayPal, or using Safety Pays

Online Cash Payment Platform. You ask yourself,

what are some future trends of online payment

systems? We have researched and discovered that

credit and debit cards will become obsolete, because

we see the increasing development of mobile

technology and the internet industry. We see the

development of new online mobile payment

technologies, which will help make your mobile

device extremely flexible, because you will be able

to store credit and debit card information on your

SIM card. How will a consumer be able to use this

technology to purchase from a certain website?

When you reach the payment page on the website,

your mobile device recognizes it and suggests a type

a payment. After you pick your payment choice,

authorization of the transaction is done by

fingerprint recognition software on your mobile

device, and a few security questions, which will help

prevent someone from stealing your banking or

personal information if your device was lost or

stolen. Why would using your mobile device make

transaction easier? By having your credit or debit

card information already stored on your Smartphone,

it will save many steps in the purchasing process on

any website you choose to purchase from. Also, at

the same time everyone is very comfortable with

their mobile device, and by having the choice to

purchase a product from your smart phone, helps the

company finish the sale. Most customers want to go

with the transaction process that has the least amount

of steps, and by having your banking information

programmed into your SIM card and it only taking a

press on the Buy Now button, this takes away

many of the steps that customers have to go through

now to purchase something online. Future direction

of research could be to formulate a system with

similar features that supports person to person

settlement as well.

REFERENCE

[1]

[2]

[3]

Denis Abrazhevich. Electronic Payment

Systems:a User-Centered Perspective and

Interaction Design, Proefschrift. -ISBN

90-386-1948-0NUR 788, 2004.

Kaur Manjot, E-Commerce, Kalyani

Publcation, New Delhi(2012).

Ailya Izhar, Aihab khan, Malik Sikandar

Hayat Khiyal, 4Wajeeh Javed and Shiraz

Baig, Designing and implementation of

Electronic Payment gateway for developing

countries, journal of Theoretical and

applied information technology, vol, 26 No.

230 April 2011.

86 | P a g e

Karamjeet Kaur Int. Journal of Engineering Research and Applications

ISSN : 2248-9622, Vol. 5, Issue 2, ( Part -1) February 2015, pp.79-87

[4]

[5]

[6]

[7]

[8]

www.ijera.com

Hossein

Bidgoli

(2002).Electronic

commerce. Acadmic press. Ed. California:

USA

Joseph P.T, S.J (2008) An Indian

perspective, 3rd edition, E-Commerce, by

PHI learning private limited.

Delali Kumaga Dec 2010 The challenges of

implementing Electronic Payment Systems

The Case of Ghanas E-zwich Payment

System

Yang Jing, On-line Payment and Security

of E-commerce.Proceedings of the 2009

International

Symposium

on

Web

Information Systems and Applications

(WISA09)Nanchang, P. R. China, May

22-24, 2009, pp. 046-050

Kalkota Ravi, Electronic Commerce,

Pubished by arrangement with Pearson

Education ,Lnc and Dorling Kindersley

Publishing lnc(1997).

www.ijera.com

87 | P a g e

Vous aimerez peut-être aussi

- DPG - Manual Debit Single Message GuideDocument85 pagesDPG - Manual Debit Single Message GuideFernando NiscaPas encore d'évaluation

- Extreme PrivacyDocument32 pagesExtreme PrivacyTruco El Martinez75% (4)

- E Payment System Assign PDFDocument9 pagesE Payment System Assign PDFShafique Ahmed ArainPas encore d'évaluation

- Electronic Payment SystemDocument20 pagesElectronic Payment SystemTsz Yeung YipPas encore d'évaluation

- E Payment 120927112113 Phpapp02Document38 pagesE Payment 120927112113 Phpapp02sagarg94gmailcomPas encore d'évaluation

- The Study of Electronic Payment SystemsDocument4 pagesThe Study of Electronic Payment SystemsasalihovicPas encore d'évaluation

- BBA-108 - E-Commerce Unit THREE & FOURDocument34 pagesBBA-108 - E-Commerce Unit THREE & FOURA1cyb CafePas encore d'évaluation

- E Comm - Unit 3Document8 pagesE Comm - Unit 3prashanttendolkarPas encore d'évaluation

- E Marketing Unit 2 e ComDocument18 pagesE Marketing Unit 2 e ComjayPas encore d'évaluation

- MisDocument3 pagesMisDevanshi AroraPas encore d'évaluation

- Unit-3 Electronic Payment SystemDocument12 pagesUnit-3 Electronic Payment SystemNezuko KamadoPas encore d'évaluation

- E Commerce PresentationDocument30 pagesE Commerce PresentationRajiv Ranjan100% (1)

- Chapter-6 Electronic Payment PDFDocument40 pagesChapter-6 Electronic Payment PDFSuman BhandariPas encore d'évaluation

- Electronic Payment Systems (Eps)Document16 pagesElectronic Payment Systems (Eps)Navneet VishnoiPas encore d'évaluation

- 2018 - Dr. M. Julias Ceasar - 10-12-2019 - 4Document10 pages2018 - Dr. M. Julias Ceasar - 10-12-2019 - 4Prachi SinghPas encore d'évaluation

- Lesson 7: Online Monetary Transactions: 7.2 Specific ObjectivesDocument7 pagesLesson 7: Online Monetary Transactions: 7.2 Specific ObjectivesRichard KarumePas encore d'évaluation

- Electronic Payment System: Presented byDocument43 pagesElectronic Payment System: Presented bysheetal28svPas encore d'évaluation

- Web Technology and Commerce Unit-4 by Arun Pratap SinghDocument60 pagesWeb Technology and Commerce Unit-4 by Arun Pratap SinghArunPratapSinghPas encore d'évaluation

- E Commerce Notes Chapter 5-10Document5 pagesE Commerce Notes Chapter 5-10Taniya Bhalla100% (1)

- Chapter 7 E PaymentDocument62 pagesChapter 7 E PaymentAashis BkPas encore d'évaluation

- Communication BbaDocument33 pagesCommunication BbaParmeet KaurPas encore d'évaluation

- E Payments Modes and MethodsDocument52 pagesE Payments Modes and MethodsHarshithPas encore d'évaluation

- Im Mini ProjectDocument10 pagesIm Mini Projectsrividya balajiPas encore d'évaluation

- Mobile Payment Method Based On Public KeDocument12 pagesMobile Payment Method Based On Public KeDEVANG PARABPas encore d'évaluation

- ELECTRONIC PAYMENT SYSTEMS GUIDEDocument47 pagesELECTRONIC PAYMENT SYSTEMS GUIDEMilan Jain100% (1)

- A Review: Secure Payment System For Electronic TransactionDocument8 pagesA Review: Secure Payment System For Electronic Transactioneditor_ijarcssePas encore d'évaluation

- E-Business Application: Benefits of E-Cash, E-Cheque and Smart CardsDocument21 pagesE-Business Application: Benefits of E-Cash, E-Cheque and Smart CardsYashi BokrePas encore d'évaluation

- E-Payment Systems ExplainedDocument10 pagesE-Payment Systems ExplainedAakash RegmiPas encore d'évaluation

- On-Line Payment SercurityDocument5 pagesOn-Line Payment SercurityAvleen KhuranaPas encore d'évaluation

- Adrit Main FileDocument65 pagesAdrit Main Filevishwas mishraPas encore d'évaluation

- OrangeDocument19 pagesOrangeprabin ghimirePas encore d'évaluation

- Definition of Electronic Payment SystemDocument9 pagesDefinition of Electronic Payment Systemdharshinee1961Pas encore d'évaluation

- Chapter 1Document22 pagesChapter 1Ketan ShahPas encore d'évaluation

- 7 Amazing Benefits of E-PaymentsDocument114 pages7 Amazing Benefits of E-PaymentsAman SinghPas encore d'évaluation

- CH-6 E MarketingDocument17 pagesCH-6 E Marketingabdelamuzemil8Pas encore d'évaluation

- E-Payments in CommerceDocument9 pagesE-Payments in CommerceSatyam RajPas encore d'évaluation

- Epayment SeminarDocument5 pagesEpayment Seminardheeraj_ddPas encore d'évaluation

- Cyber Unit 2 Lecture 4Document21 pagesCyber Unit 2 Lecture 4VijayPas encore d'évaluation

- E Payment SystemDocument56 pagesE Payment SystemAnkiTwilightedPas encore d'évaluation

- Chintan Project MBA-4Document69 pagesChintan Project MBA-4Pruthviraj RathorePas encore d'évaluation

- June 2022 Vol 2 Issue I - JJ - 2204Document9 pagesJune 2022 Vol 2 Issue I - JJ - 2204Sushmita DevkotaPas encore d'évaluation

- Electronic Payment SystemDocument12 pagesElectronic Payment SystemBhavya LambaPas encore d'évaluation

- E-Commerce & Web designing-IIDocument10 pagesE-Commerce & Web designing-IISatya SaiPas encore d'évaluation

- Electronic Payment SystemDocument20 pagesElectronic Payment SystemThe PalettePas encore d'évaluation

- Shubham Kumar Chachan CIA - 1Document12 pagesShubham Kumar Chachan CIA - 1AYUSH TREHAN 20215023Pas encore d'évaluation

- Electronic Payment Systems: An OverviewDocument6 pagesElectronic Payment Systems: An OverviewKirti ParkPas encore d'évaluation

- Online Payment SystemDocument30 pagesOnline Payment SystemDjks YobPas encore d'évaluation

- Electronic Payment SystemDocument23 pagesElectronic Payment SystemSongs Punjabi SharePas encore d'évaluation

- E-Payment in India PDFDocument6 pagesE-Payment in India PDFM GouthamPas encore d'évaluation

- Proposal 3Document11 pagesProposal 3Eyerus MulugetaPas encore d'évaluation

- Chapter 1Document89 pagesChapter 1Sachin chinnuPas encore d'évaluation

- Factors Affecting Customers' Adoption of Electronic Payment: An Empirical AnalysisDocument15 pagesFactors Affecting Customers' Adoption of Electronic Payment: An Empirical Analysisprabin ghimirePas encore d'évaluation

- E Payment SystemDocument47 pagesE Payment SystemNamrata KshirsagarPas encore d'évaluation

- E - Business Unit-III, 2020Document15 pagesE - Business Unit-III, 2020Sourabh SoniPas encore d'évaluation

- Banking Industry Electronic Payment Systems ReportDocument35 pagesBanking Industry Electronic Payment Systems ReportNitish BhardwajPas encore d'évaluation

- What is an E-Payment SystemDocument76 pagesWhat is an E-Payment SystemRahul DesuPas encore d'évaluation

- Phase 1Document6 pagesPhase 1Akshit AggarwalPas encore d'évaluation

- E Commerce AssignmentDocument6 pagesE Commerce AssignmenthassankitwangoPas encore d'évaluation

- Cse - 18cs013 Lm15 - Bit WikiDocument3 pagesCse - 18cs013 Lm15 - Bit WikiFor My YouTubePas encore d'évaluation

- Electronic Payment System: Presented By: Richa Somvanshi (85) Sachin Goel (68) Sahar AiromDocument43 pagesElectronic Payment System: Presented By: Richa Somvanshi (85) Sachin Goel (68) Sahar AiromSiti Zalikha Md JamilPas encore d'évaluation

- e commers 2Document23 pagese commers 220B81A1235cvr.ac.in G RUSHI BHARGAVPas encore d'évaluation

- Evaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersD'EverandEvaluation of Some Online Payment Providers Services: Best Online Banks and Visa/Master Cards IssuersPas encore d'évaluation

- Measurement of Scalilng TechniquesDocument15 pagesMeasurement of Scalilng Techniquesdharshinee1961Pas encore d'évaluation

- Lecture 4Document18 pagesLecture 4Ashish AgnihotriPas encore d'évaluation

- Definition of Electronic Payment SystemDocument9 pagesDefinition of Electronic Payment Systemdharshinee1961Pas encore d'évaluation

- Job Application LetterDocument2 pagesJob Application Letterdharshinee1961Pas encore d'évaluation

- Entrepreneurial CompetenciesDocument13 pagesEntrepreneurial Competenciesdharshinee1961Pas encore d'évaluation

- Disaster ManagementDocument98 pagesDisaster ManagementNUNNAVENKATESHPas encore d'évaluation

- Training and Development MethodsDocument16 pagesTraining and Development Methodsdharshinee1961Pas encore d'évaluation

- Disaster ManagementDocument98 pagesDisaster ManagementNUNNAVENKATESHPas encore d'évaluation

- Disaster ManagementDocument98 pagesDisaster ManagementNUNNAVENKATESHPas encore d'évaluation

- e-Ticket Booking Reference GuideDocument2 pagese-Ticket Booking Reference GuideIslam MarufPas encore d'évaluation

- Earn IndiGo flights with Kotak Ka-ching Credit CardsDocument12 pagesEarn IndiGo flights with Kotak Ka-ching Credit CardsSahal RizviPas encore d'évaluation

- Staff ReimbursementDocument2 pagesStaff ReimbursementAinaPas encore d'évaluation

- ComputerassistedaudittechniquesDocument7 pagesComputerassistedaudittechniquesRinokukunPas encore d'évaluation

- BNPL Literature Review Examines Pay Later ImpactDocument1 pageBNPL Literature Review Examines Pay Later ImpactRISHAV RAJ GUPTAPas encore d'évaluation

- Cashback Redemption FormDocument1 pageCashback Redemption FormAshmita JainPas encore d'évaluation

- DownloadDocument21 pagesDownloadaishujoshi951Pas encore d'évaluation

- United States v. Pervaz, 1st Cir. (1997)Document70 pagesUnited States v. Pervaz, 1st Cir. (1997)Scribd Government DocsPas encore d'évaluation

- Test Bank For Personal Finance 5 e 5th Edition Jeff MaduraDocument22 pagesTest Bank For Personal Finance 5 e 5th Edition Jeff Madurathomasburgessptrsoigxdk100% (19)

- Tech Functional Requmt A6e19aDocument136 pagesTech Functional Requmt A6e19aAnkit SinghPas encore d'évaluation

- Marketing Management II Trimester III Mba Ktu 2017Document2 pagesMarketing Management II Trimester III Mba Ktu 2017Ben MathewsPas encore d'évaluation

- Unit 5Document26 pagesUnit 5Prateek VarshneyPas encore d'évaluation

- Iexpenses and IsupplierDocument81 pagesIexpenses and IsupplierkrishnaPas encore d'évaluation

- f8 June 2009 Question PaperDocument6 pagesf8 June 2009 Question PaperathararainPas encore d'évaluation

- Financial Statement AnalysisDocument75 pagesFinancial Statement Analysissaur1Pas encore d'évaluation

- Study - Id116072 - Digital Payments in Vietnam PDFDocument44 pagesStudy - Id116072 - Digital Payments in Vietnam PDFhà thànhPas encore d'évaluation

- CSX Offer Factsheet en PDFDocument9 pagesCSX Offer Factsheet en PDFKarl LabagalaPas encore d'évaluation

- Python 2Document13 pagesPython 2Sainadh Reddy Syamala AP21110010703Pas encore d'évaluation

- BM Module 1 CommissionsDocument15 pagesBM Module 1 CommissionsHp laptop sorianoPas encore d'évaluation

- Credit Card Release Report FileformatsDocument6 pagesCredit Card Release Report FileformatsNikhatFarooqKhanPas encore d'évaluation

- Adm Reasons CodesDocument15 pagesAdm Reasons CodesMr ProdipPas encore d'évaluation

- InvoiceDocument3 pagesInvoiceAriel Humberto Velasquez GodoyPas encore d'évaluation

- Comparative Analysis of Direct Banking Services of Kotak With Other BanksDocument105 pagesComparative Analysis of Direct Banking Services of Kotak With Other Bankssuruchiathavale221234Pas encore d'évaluation

- FABM2 Module 7 Darl DelimaDocument27 pagesFABM2 Module 7 Darl DelimaFaye LañadaPas encore d'évaluation

- Bruce Megarr SaipanDocument19 pagesBruce Megarr Saipanapi-26784019Pas encore d'évaluation

- Gmail - Booking Confirmation On IRCTC, Train - 12837, 11-Sep-2023, SL, HWH - BBSDocument1 pageGmail - Booking Confirmation On IRCTC, Train - 12837, 11-Sep-2023, SL, HWH - BBSGargi BanerjeePas encore d'évaluation

- Ugc Care ListDocument4 pagesUgc Care Listrikaseo rikaPas encore d'évaluation

- Denali Individual Dental All Other States - AETNADocument10 pagesDenali Individual Dental All Other States - AETNAJohn BerkowitzPas encore d'évaluation