Académique Documents

Professionnel Documents

Culture Documents

International Journal of Bank Marketing: Article Information

Transféré par

padmavathiTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

International Journal of Bank Marketing: Article Information

Transféré par

padmavathiDroits d'auteur :

Formats disponibles

International Journal of Bank Marketing

Investigating drivers of bank loyalty: the complex relationship between image, service quality and

satisfaction

Jose Bloemer Ko de Ruyter Pascal Peeters

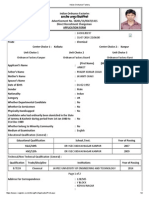

Article information:

To cite this document:

Jose Bloemer Ko de Ruyter Pascal Peeters, (1998),"Investigating drivers of bank loyalty: the complex relationship between

image, service quality and satisfaction", International Journal of Bank Marketing, Vol. 16 Iss 7 pp. 276 - 286

Permanent link to this document:

http://dx.doi.org/10.1108/02652329810245984

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

Downloaded on: 23 April 2016, At: 05:04 (PT)

References: this document contains references to 53 other documents.

To copy this document: permissions@emeraldinsight.com

The fulltext of this document has been downloaded 9883 times since 2006*

Users who downloaded this article also downloaded:

(2000),"An examination of the relationship between service quality, customer satisfaction, and store loyalty", International

Journal of Retail & Distribution Management, Vol. 28 Iss 2 pp. 73-82 http://dx.doi.org/10.1108/09590550010315223

(1984),"A Service Quality Model and its Marketing Implications", European Journal of Marketing, Vol. 18 Iss 4 pp. 36-44

http://dx.doi.org/10.1108/EUM0000000004784

(2002),"Customer satisfaction and retail banking: an assessment of some of the key antecedents of customer

satisfaction in retail banking", International Journal of Bank Marketing, Vol. 20 Iss 4 pp. 146-160 http://

dx.doi.org/10.1108/02652320210432936

Access to this document was granted through an Emerald subscription provided by emerald-srm:540251 []

For Authors

If you would like to write for this, or any other Emerald publication, then please use our Emerald for Authors service

information about how to choose which publication to write for and submission guidelines are available for all. Please

visit www.emeraldinsight.com/authors for more information.

About Emerald www.emeraldinsight.com

Emerald is a global publisher linking research and practice to the benefit of society. The company manages a portfolio of

more than 290 journals and over 2,350 books and book series volumes, as well as providing an extensive range of online

products and additional customer resources and services.

Emerald is both COUNTER 4 and TRANSFER compliant. The organization is a partner of the Committee on Publication

Ethics (COPE) and also works with Portico and the LOCKSS initiative for digital archive preservation.

*Related content and download information correct at time of download.

Investigating drivers of bank loyalty: the complex

relationship between image, service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

Jose Bloemer

Associate Professor of Marketing, Department of Applied Economics, Limburg

University Centre, Diepenbeek, Belgium

Ko de Ruyter

Associate Professor of Marketing, Faculty of Economics and Business

Administration, Maastricht University, Maastricht, The Netherlands

Pascal Peeters

Research Assistant, Faculty of Economics and Business Administration,

Maastricht University, Maastricht, The Netherlands

This article investigates how

image, perceived service

quality and satisfaction determine loyalty in a retail bank

setting at the global construct

level, as well as the level of

construct dimensions. At the

global level the results of a

large-scale empirical study

reveal that image is indirectly

related to bank loyalty via

perceived quality. In turn,

service quality is both directly

and indirectly related to bank

loyalty via satisfaction. The

latter has a direct effect on

bank loyalty. At the level of

the dimensions underlying

aforementioned constructs, it

becomes clear that reliability

(a quality dimension) and

position in the market (an

image dimension) are relatively important drivers of

retail bank loyalty.

International Journal of

Bank Marketing

16/7 [1998] 276286

MCB University Press

[ISSN 0265-2323]

[ 276 ]

Introduction

During the past decade, the financial services

sector has undergone drastic changes, resulting in a market place which is characterised

by intense competition, little growth in primary demand and increased deregulation. In

the new market place, the occurrence of committed and often inherited relationships

between a customer and his or her bank is

becoming increasingly scarce (Levesque and

McDougall, 1996). Several strategies have

been attempted to retain customers. In order

to increase customer loyalty, many banks

have introduced innovative products and

services (Meidan, 1996). However, as such

innovations are frequently followed by similar charges, it has been argued that a more

viable approach for banks is to focus on less

tangible and less easy-to-imitate determinants of customer loyalty such as customer

evaluative judgements like service quality

and satisfaction (Worcester, 1997; Yavas and

Shemwell, 1996). Surprisingly, however, while

there has been a large number of studies that

focused on service quality and satisfaction

issues (Lewis, 1993), research on the relationship between satisfaction, service quality and

loyalty in retail banking has remained limited. Yet, in the present environment of

increased competition with rapid market

entry of new service concepts and formats,

the challenge of increasing loyalty also presents a challenge of a more in-depth understanding of the complex relationship between

aforementioned types of customer evaluative

judgements and loyalty.

In addition, there is some evidence that

loyalty may also be determined by image

(Mazursky and Jacoby, 1986; Murphy, 1996;

Osman, 1993). Again, it has remained unclear

whether there is a direct relationship

between image and loyalty or whether this

relationship is mediated by, for instance,

satisfaction and perceived service quality. In

this article we address this issue. We propose

a model that describes the relationship

between service quality, satisfaction with a

bank and loyalty, taking into account the

effect of the image that a bank has in the

market.

Our article unfolds as follows. First of all,

we offer a brief outline of the construct of

loyalty. Next, we will differentiate conceptually between service quality and satisfaction

as determinants of customer loyalty. Subsequently, we will introduce the construct of

image and focus on the relationship between

image, satisfaction, service quality and loyalty by formulating a set of formal hypotheses. After dealing with the conceptual issues,

we will discuss the results of an empirical

study that was undertaken to test our

research hypotheses for the setting of retail

banking. In conclusion, we will address the

theoretical as well as the managerial implications of our findings on the relationship

between image, service quality, satisfaction

and loyalty.

Service loyalty

Research into customer loyalty has focused

primarily on product-related or brand loyalty,

whereas loyalty to service organisations has

remained underexposed (Gremler and

Brown, 1996). Frequently, a high positive

correlation between the constructs of satisfaction and quality and product loyalty is

reported. Likewise, with regards to service

loyalty, perceived service quality as well as

satisfaction have been identified as key

antecedents in banking as well as in other

service industries (Dick and Basu, 1994;

Lewis, 1993). However, there are a number of

reasons why findings in the field of product

loyalty cannot be generalised to service loyalty and more research into specific service

sectors is needed (Gremler and Brown, 1996;

Keaveney, 1995). Service loyalty is more

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

International Journal of

Bank Marketing

16/7 [1998] 276286

dependent on the development of interpersonal relationships as opposed to loyalty with

tangible products (Berry, 1983), for person-toperson interactions form an essential element in the marketing of services (Crosby et

al., 1990; Czepiel 1990; Czepiel and Gilmore,

1987; Surprenant and Solomon, 1987). Furthermore, the influence of perceived risk is

greater in the case of services, as customer

loyalty may act as a barrier to customer

switching behaviour (Guiltinan, 1989; Klemperer, 1987; Zeithaml, 1981). Indeed, it has

been demonstrated that loyalty is more prevalent among service customers than among

customers of tangible products (Snyder, 1986).

In the services context, intangible attributes

such as reliability and confidence may play a

major role in building or maintaining loyalty

(Dick and Basu, 1994).

As most research originated from the field

of packaged consumer goods (Jacoby and

Chestnut, 1978), a strong emphasis has been

on behavioural measures. In a services context, loyalty is frequently defined as observed

behaviour (Liljander and Strandvik, 1995).

Meidan (1996, p. 31) argues that the degree of

loyalty in banking can be gauged by tracking customers accounts over a defined time

period and noting the degree of continuity in

patronage. However, behavioural measures,

such as repeat purchasing or visiting

sequence, have been criticised for a lack of a

conceptual basis and for having a narrow, i.e.

outcome-focused, view of what is in fact a

dynamic process (Day, 1969). For instance, a

low degree of repeat purchasing of a particular service may very well be the result of

situational factors such as non-availability,

variety seeking and lack of provider preference. Therefore, the behavioural approach to

loyalty may not yield a comprehensive

insight into the underlying reasons for loyalty, instead it is a consumers disposition in

terms of preferences or intentions that plays

an important role in determining loyalty

(Bloemer and Kasper, 1995; Jain et al., 1987).

Furthermore, repeat purchasing behaviour

may not even be based on a preferential disposition but on various bonds that act as switching barriers to consumers (Liljander and

Strandvik, 1995). We define bank loyalty as:

the biased (i.e. non random) behavioural

response (i.e. revisit), expressed over time, by

some decision-making unit with respect to

one bank out of a set of banks, which is a

function of psychological (decision-making

and evaluative) processes resulting in brand

commitment.

This definition is based on Jacoby and

Chestnut (1978). The critical part of our definition of bank loyalty is bank commitment. In

theories of interorganisational relationships

the concept of commitment plays a central

role (Morgan and Hunt, 1994; Shemwell et al.,

1994). Commitment in service provider-customer relationships has been defined as an

implicit or explicit pledge of relational continuity between exchange partners (Dwyer et

al., 1987, p. 19). Likewise, Moorman et al.

(1992) define commitment as an enduring

desire to maintain a valued relationship.

Parties identify commitment among

exchange partners as key to achieving valuable outcomes for themselves, and they

endeavour to develop and maintain this precious attribute in their relationship (Morgan

and Hunt, 1994). We propose that bank commitment is a necessary condition for bank

loyalty to occur. In case of absence of bank

commitment, a patron to a bank is merely

spuriously loyal, i.e. repeat visiting behaviour is directed by inertia (Dick and Basu,

1994).

We define bank commitment as: the pledging or binding of an individual to his/her

bank choice (Kiesler, 1968; Lastovicka and

Gardner, 1977). As a result of explicit and

extensive decision-making, as well as evaluative processes, a consumer becomes committed to the bank and therefore, by definition,

becomes bank loyal. When the decision-making and evaluative processes are not explicit

and very limited, the consumer will not

become committed to the bank and cannot be

bank loyal. Consumers whose patronage is

not based on bank loyalty may exhibit an

attachment to bank attributes and can easily

be lured away by competitors through, for

instance, pricing strategies. In our view, the

level of consumer commitment can differ

considerably. Therefore, we assume there is a

continuum of bank loyalty. At one end of the

continuum, one finds true bank loyalty; the

repeat visiting behaviour based on a maximum amount of commitment. At the other

end of the continuum, one finds spurious

bank loyalty; the repeat visiting of the bank

not based on any commitment at all. In this

way, bank commitment enables us to define a

degree of bank loyalty.

As mentioned above, service quality and

satisfaction have both been advanced as

antecedents of service loyalty. Therefore, in

the next section we will zoom in on these

concepts and the relationship between them.

Service quality and satisfaction

In most models of client evaluations of retail

banking services the focus has been on a

comparative judgement of expectations

versus perceived performance resulting in

the two major evaluative judgements of

[ 277 ]

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

International Journal of

Bank Marketing

16/7 [1998] 276286

[ 278 ]

perceived service quality and client satisfaction (Murphy, 1996; Smith, 1992). Both concepts have been frequently used and measured in the retail banking services area

(Lewis, 1993; Lewis and Mitchell, 1990; Smith,

1992). However, it has been argued that problems of definition, delineation and conceptualisation concerning these evaluative judgements still exist (De Ruyter et al., 1997). Much

of the confusion arises from the fact that both

forms of evaluative judgements are based on

comparable underlying constructs. Clients

form expectations prior to their encounter

with a bank (employee), they develop perceptions during the service delivery process and

subsequently they compare their perceptions

to their expectations in evaluating the outcome of the service encounter. While service

quality and satisfaction are concepts that

have a number of similar characteristics,

they have points of differentiation as well, as

becomes clear from major advances in the

services marketing literature (Patterson and

Johnson, 1993). In the first place, it is

frequently argued that in order to form a

satisfaction judgement, consumers must have

experienced a service, whereas perceived

service quality is generally viewed as being

not necessarily experience-based. Second, it

has been argued that the two concepts are

determined by different antecedents. Evidence exists regarding a number of cognitive

and affective processes (equity, attributions,

cost/benefit analyses) that influence satisfaction. The number of antecedents to service

quality is regarded as more limited (Oliver,

1993). Clearly the two types of evaluative

judgement are not perceived as isomorphic

and increasingly treated as separate constructs in research on services. There is a

growing consensus on the sequential order of

service quality and satisfaction. The latter is

increasingly regarded as the superordinate

construct based on conceptual work by Oliver

(1993) and Rust and Oliver (1994), and empirical evidence provided by Cronin and Taylor

(1992) and De Ruyter et al. (1997). Cronin and

Taylor (1992) undertook an empirical test of

the reciprocity between satisfaction and

quality across several service industries.

Using structural equation modelling, they

found that service quality can be seen as a

determinant of satisfaction which in turn

influences purchase intentions. Lately, however, it has been suggested that, in addition to

service quality and satisfaction, image is also

an important determinant of customer

patronage. We will discuss image in the next

section.

The relationship between

image, quality, satisfaction and

loyalty

It has been suggested recently that retail

banking has been suffering from an identity

crisis and that image research studies should

be undertaken with the objective of providing

information that is as strategically important

as financial performance data (Worcester,

1997). A favourable image is viewed as a critical aspect of a companys ability to maintain

its market position, as image has been related

to core aspects of organisational success such

as customer patronage (Granbois, 1981; Korgaonkar et al., 1985).

Many conceptualisations of image have

been advanced in the past (Doyle and Fenwick, 1974; James et al., 1976; Kunkel and

Berry, 1968). Image has been treated as a

gestalt, reflecting a customers overall

impression. Keaveney and Hunt (1992) have

argued that the image of a retail institution is

formed along the lines of category-based

processing theory, i.e. when a customer

encounters a bank, he or she will form a

mental picture as to whether the bank

matches any other categories of banks experienced in the past. According to the categorybased processing paradigm, it is proposed

that incoming information, as well as customer evaluation of attributes, will be judged

relative to the bank image.

The exact relationship between image and

loyalty has remained a matter of debate.

Sirgy and Samli (1989), for instance, report a

direct positive relationship between image

and loyalty. On the other hand, it has been

demonstrated that the link between image

and loyalty is mediated by customer evaluative judgements such as quality perceptions.

Moreover, in the product literature there is

ample evidence that image significantly

affects perceptions of quality (Darden and

Schwinghammer, 1985; Render and OConnor,

1976; Stafford and Enis, 1969). Therefore, we

propose that as customer evaluative judgements such as perceived service quality and

satisfaction are established in a process of

inference making of expectations, image will

precede customer evaluations, rather than

these evaluations being components of image

(Hildebrandt, 1988; Mazursky and Jacoby,

1986). That is, image determines the nature of

consumer expectations which, in turn, are a

decisive influence on the formation of quality

perceptions.

Based on our review of the literature we

formulate the following hypotheses:

H1: Image will have a direct positive effect

on loyalty.

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

International Journal of

Bank Marketing

16/7 [1998] 276286

H2: Image will have an indirect positive

effect on loyalty via satisfaction (i.e. a

mediator effect).

H3: Image will have an indirect positive

effect on loyalty via quality (i.e. a mediator

effect).

H4: Quality will have an indirect positive

effect on loyalty via satisfaction (i.e. a

mediator effect).

H5: Satisfaction will have a direct positive

effect on loyalty.

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

In the next section we will report the results

of an empirical study designed to test these

hypotheses.

An empirical study

Data collection

An empirical study was conducted among

customers of a major bank in The Netherlands in 1996. Nationwide, 2,500 existing private customers were interviewed by phone

with regard to their image of the bank, their

quality perception of the bank, their satisfaction with the bank and their loyalty towards

the bank. The sample was randomly drawn

and found to be representative for the banks

private customers by checking the customer

database. Moreover, the descriptive data gathered in the study were compared with demographic variables that were available from

previous market research studies within this

bank.

Questionnaire development

The design of the questionnaire was primarily based on multiple-item measurement

scales taken from previous research. The

items were adapted to the specific characteristics of our research setting. The image (IM)

of the bank was measured with a scale containing 17 four-point Likert-scale items, ranging from 1 = completely disagree, to 4 = completely agree. The scale was developed on the

basis of a qualitative research study

conducted prior to the quantitative data collection phase. This scale was also pre-tested

and found to be valid and reliable on the basis

of our study. The Cronbach alpha for this

scale was 0.83.

With regards to perceived service quality,

items were based on the service quality literature (e.g. Parasuraman et al., 1988) on the

results of a qualitative study for the bank

setting. The quality perception (QUA) of the

bank was measured with a scale containing

19 four-point Likert-scale items. The Cronbach alpha for this scale was 0.73.

In order to measure satisfaction, customers

were asked to state their satisfaction (SAT)

with the bank (how satisfied are you with

the bank, in terms of a scale varying from 1 to

10).

A commitment scale, together with the

chance of visiting the same bank again, was

used to determine bank loyalty (Bloemer and

Kasper, 1995). Customers had to rate the

intention to visit the same bank next time

they needed to visit a bank for personalised

service, in contrast with a visit to the automatic teller machine repeat visiting behaviour (RPB) ranging from 0 per cent to 100

per cent). Bank commitment (COM) was

measured with a scale containing four fourpoint Likert-scale items. The Cronbach alpha

for this scale was 0.76. This operationalisation concerns the behavioural as well as the

commitment aspect of loyalty. Therefore, it is

in line with our definition of bank loyalty

which stresses the two aspects. Non-Dutch

items were translated into Dutch via a procedure of double-back translation by a qualified

translator (Brislin, 1980).

Results

In Table I, we present an overview of the correlations between the variables: image, quality, satisfaction and loyalty[1].

Table I shows that all the correlation coefficients are significant (p < 0.001). Furthermore, there is a clear positive relationship

between image and quality (r = 0.59), image

and satisfaction (r = 0.44), image and loyalty

(r = 0.53), quality and satisfaction (r = 0.55),

quality and loyalty (r = 0.66) and satisfaction

and loyalty (r = 0.59).

Next, we used multivariate regression

analysis to gain additional insight into the

data and to test our hypotheses.

We expect a positive direct relationship

between the image of a bank and the loyalty

towards that bank. For this purpose we specify a model to test the relationship between

image and loyalty, and the effects of quality

and satisfaction on loyalty:

LOY = b0 + b1 * SAT + b2 * QUA +

b3 * IM + 1 (Model 1.1)

where SAT = satisfaction; QUA = quality

perceptions; IM = image; and LOY = loyalty of

the customers towards the bank. The results

of this analysis are shown in Table II.

Table II shows that both quality perception

and satisfaction have a positive impact on

loyalty (beta = 0.38 and beta = 0.42 respectively). Image has no significant influence on

loyalty. The explained variance of loyalty by

quality and satisfaction is 53 per cent.

We expect an indirect positive effect

between the image of a bank and the loyalty

towards that bank through satisfaction (i.e. a

mediator effect). For this purpose we specify

[ 279 ]

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Table I

Pearson correlations between the central

variables

International Journal of

Bank Marketing

16/7 [1998] 276286

QUA

IM

IM

QUA

SAT

LOY

0.59a

0.44a

0.53a

0.55a

0.66a

SAT

0.59a

Notes: IM = image; QUA = quality perceptions; SAT =

overall satisfaction; LOY = loyalty; a = one-tailed

significance < 0.001

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

Table II

Results of regressions analysis based on

model 1.1a

beta

Intercept

1.48

0.00

SAT

0.44

0.42

0.00

QUA

1.30

0.38

0.00

IMb

R2

0.53

Note: aLOY = bo + b1 * SAT + b2 * QUA + b3 * IM + 1;

b = not significant (p > 0.05); IM = image; QUA = quality

perceptions; SAT = overall satisfaction; LOY = loyalty

a model to test the relationship between

image and satisfaction, we also incorporated

the effects of quality.

SAT = b0 + b1 * QUA + b2 * IM + 1 (Model

1.2)

where SAT = satisfaction; QUA = quality

perceptions; and IM = the image of the bank.

The results of this analysis are shown in

Table III.

Table III shows that only quality perception

has a significant effect on the loyalty of the

customers towards this bank (beta = 0.55).

The explained variance of the loyalty of the

customer by the quality perception is 30 per

cent. Image seems to have no impact on loyalty here.

We expect an indirect positive effect

between the image of a bank and the loyalty

Table III

Results of regressions analysis based on

model 1.2a

beta

Intercept

0.92

0.00

QUA

1.85

0.55

0.00

IMb

R2

0.30

Notes: aSAT = b0 + b1 * QUA + b2 * IM + 1;

b = not significant (p > 0.05);

IM = image; QUA = quality perceptions; SAT = overall

satisfaction

[ 280 ]

towards that bank through quality (i.e. a

mediator effect). For this purpose we specify

a model to test the relationship between

image and quality.

QUA = b0 + b1 * IM + 1 (Model 1.3)

where QUA = quality perceptions; and IM =

the image of the bank. The results of this

analysis are shown in Table IV.

Table IV shows that the image of the bank

has a clear positive influence on the quality

perception (beta = 0.59). The explained variance is 34 per cent.

Furthermore, we expected that quality has

an indirect positive effect on loyalty via

satisfaction and that satisfaction will have a

direct positive effect on loyalty. Based on the

analysis presented above, we conclude that

indeed quality has an indirect effect via satisfaction (beta = 0.55) and that satisfaction has

a direct effect on loyalty (beta = 0.42).

The results of the former analyses in terms

of the significant beta coefficients are

depicted in Figure 1. Figure 1 shows image

does not have a direct positive effect on loyalty. Therefore, H1 has to be rejected. We also

found that no indirect effect of image through

satisfaction could be detected. We therefore

have to reject H2 too. In addition, we found

that quality has a direct and an indirect

impact on loyalty. The indirect influence is

via satisfaction. Altogether this implies that

although image has no indirect influence on

loyalty directly via satisfaction, it nevertheless has an impact on satisfaction via quality.

Next, Figure 1 shows the mediator effect of

the quality perception in the relationship

between image and loyalty. Therefore H3 can

be accepted. Likewise, H4 and H5 can be

accepted on the basis of our analysis.

As we developed a number of multi-dimensional scales to measure the constructs introduced above, we decided to perform a number

of additional analyses in order to gain a

deeper and more comprehensive insight into

the relationships between our variables.

These analyses were used to examine the

dimensional distinctiveness of both the

image and quality constructs. In fact, we used

exploratory factor analysis to determine the

Table IV

Results of regressions analysis based on

model 1.3a

beta

Intercept

0.44

QUA

0.47

0.59

R2

0.34

Notes: aQUA = b0 + b1 * IM + 1;

IM = image; QUA = quality perceptions

p

0.00

0.00

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

International Journal of

Bank Marketing

16/7 [1998] 276286

different dimensions of image and quality. In

each of the factor analyses, the number of

factors retained were those with eigenvalues

greater than 1. The results of those factor

analysis for the image items are shown in

Table V.

The overall pattern of rotated factor loadings suggested a six-dimensional solution,

accounting for 63.8 per cent of variance

extracted. We labelled the factors as following: customer contacts, advice, relationship

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

Figure 1

Model based on ordinary multivariate least squares analyses

= .59

QUA

= .38

= .55

IM

SAT

LOY

= .42

Table V

Result factor analysisa on image items

Item

Customer contacts (IFI)

8

5

7

10

Advice (IF2)

13

4

6

Relationship driven (IF3)

15

Description

Factor loadingsb

Little or no mistakes

Customer treated respectfully

Time arrangement

Time and attention to customer

0.76436

0.75255

0.64440

0.58235

Advice on investment funds

Advice on insurances

Expertise in advising

0.82671

0.68525

0.66151

Taking other than business aspects

into account

Efforts for local community

Own interest not on the first plan

0.77410

16

0.67089

17

0.62373

Position in the market (IF4)

1

New products or services

0.74323

9

Attractive advertisements

0.61260

11

Strongest financial institutions of

the world

0.51652

2

Modern

0.49383

Society-driven (IF5)

12

Financial institution for everyone

0.81116

14

Strong commitment to society

0.60782

Prices (IF6)

3

Reasonable prices

0.74857

Total explained variance

63.8%

Notes: a = Using principal axis factoring and varimax rotation; b = Factor loadings > 0.4

driven, position in the market, society-driven

and prices.

The results of the factor analysis for the

quality items are shown in Table VI.

The overall pattern of rotated factor loadings suggested a seven-dimensional solution,

accounting for 58.7 per cent of variance

extracted. The factors found could be called

reliability, empathy, efficiency, interest rates,

procedures, expertise and access to money.

Next, we used again multivariate regression analysis to gain additional insight into

the data in terms of the importance of the

different image and quality dimensions in

relation to loyalty. According to the outcome

of the factor analysis we specify a new model

to test the relationship between loyalty, satisfaction, quality and image dimensions. On

the basis of factor analyses we are now able to

zoom in on the relationships between determinants of loyalty.

LOY = b0 + b1 * SAT + b2 * QF1... b8 * QF7

+ b9 * IF1+...+ b14 * IF6 + 1 (Model 2.1)

where SAT = satisfaction; QF1 = factor scores

quality perceptions first factor etc.; QI1 =

image factor scores first factor and LOY =

loyalty of the customers towards the bank.

The results of this analysis are shown in

Table VII.

Table VII shows that satisfaction (beta =

0.38), reliability (beta = 0.36), efficiency (beta

= 0.18) and position in the market (beta = 0.30)

have a significant positive impact on loyalty.

The total explained variance of the model

rises significantly from 53 per cent to 58 per

cent, as compared to the original model that

did not include the different factors for quality and image.

According to the outcome of the factor

analysis we also specify a model to test the

relationship between image and satisfaction.

Here we incorporated the effects of quality:

SAT = b0 + b1 * QF1... b7 * QF7+ b8 * IF1

+...+ b13 * IF6 + 1 (Model 2.2)

where SAT = satisfaction; QF1 = factor scores

quality perceptions first factor etc.; and QI1 =

image factor scores first factor of the bank.

The results of this analysis are shown in

Table VIII.

Table VIII shows that only reliability and

empathy have a significant positive impact on

satisfaction (beta = 0. 39 and beta = 0.32

respectively, explained variance is 25 per

cent).

We also expected an indirect positive effect

between the image factor scores of a bank and

the loyalty towards that bank through quality

(i.e. a mediator effect). For this purpose we

specify a model to test the relationship

between image and quality.

[ 281 ]

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

International Journal of

Bank Marketing

16/7 [1998] 276286

QF1 = b0 + b1 * IF1 + ... + b6 * IF6 + 1

(Model 2.3)

QF2 = b0 + b1 * IF1 + ... + b6 * IF6 + 1

(Model 2.4)

QF3 = b0 + b1 * IF1 + ... + b6 * IF6 + 1

(Model 2.5)

where QF1 = factor scores quality perceptions first factor etc.; and IF1 = factor scores

image of the bank first factor etc. The results

of this analysis are shown in Table IX.

Table IX shows that customer contacts have

a significant positive influence on reliability

(beta = 0.32; explained significant variance 11

per cent); that customer contacts and societydriven have a significant positive influence

on empathy (beta = 0.20 and beta = 0.18

respectively, explained significant variance

seven per cent) and that position in the market has a significant positive impact on efficiency (beta = 0.16, explained significant

variance three per cent).

The results of the former analyses in terms

of the significant beta coefficients are

depicted in Figure 2.

Figure 2 shows that, from most to least

important, the major determinants of loyalty

Table VI

Result factor analysisa on quality items

Item

Description

Factor loadingsb

Reliability (QFI)

10

Accuracy of employees

0.69945

7

Expertise of employees

0.59682

6

Handling complaints

0.57773

16

Personalised consulting

0.57432

14

Privacy at the office

0.40249

18

Proactive suggestions

Empathy (QF2)

17

Attention of employees

0.74234

9

Kindness of employees

0.73697

13

Efforts for the customer

0.58296

11

Recognition by employees

0.40747

Efficiency (QF3)

15

Queuing time at the office

0.79880

8

Speed of handling at the office

0.75316

Interest rates (QF4)

4

Level of savings rates

0.75083

5

Level of mortgage rates

0.74595

Procedures (QF5)

1

Sending invoices

0.76423

3

Cost of using an account

0.66828

Expertise (QF6)

19

Expertise on investment funds

0.86090

Access to money (QF7)

2

Hours of opening

0.73091

12

Trouble-free cash dispenser

0.55281

Total explained variance

58.7%

Notes: a = Using principal axis factoring and varimax rotation; b = Factor loadings > 0.4

[ 282 ]

are: reliability (beta = 0.51), satisfaction (beta

= 0.38), position in the market (beta = 0.30),

efficiency (beta = 0.18), customer contacts

(beta = 0.16), empathy (beta = 0.12) and society-driven (beta = 0.02) (taking into account

both direct and indirect effects).

Table VII

Results of regressions analysis with factor

scores according to model 2.1a

beta

Intercept

0.54

0.05

SAT

0.38

0.38

0.00

QF1

0.36

0.36

0.00

QF2

not significant (p > 0.05)

QF3

0.14

0.18

0.01

QF4

not significant (p > 0.05)

QF5

not significant (p > 0.05)

QF6

not significant (p > 0.05)

QF7

not significant (p > 0.05)

IF1

not significant (p > 0.05)

IF2

not significant (p > 0.05)

IF3

not significant (p > 0.05)

IF4

0.27

0.30

0.00

IF5

not significant (p > 0.05)

IF6

not significant (p > 0.05)

R2

0.58

Notes: aLOY = bo + b1 * SAT + b2 * QF1 + ...+ b8 * QF7

+ b9 * IF1 + ... + b14 * IF6 + 1;

IF1 ... IF6 = factor scores image; QF1 ... QF6 = factor

scores of quality perceptions; SAT = overall satisfaction;

LOY = loyalty

Table VIII

Results of regressions analysis with factor

scores according to model 2.2a

beta

Intercept

3.51

0.00

QF1

0.39

0.39

0.00

QF2

0.32

0.32

0.00

QF3

not significant (p > 0.05)

QF4

not significant (p > 0.05)

QF5

not significant (p > 0.05)

QF6

not significant (p > 0.05)

QF7

not significant (p > 0.05)

IF1

not significant (p > 0.05)

IF2

not significant (p > 0.05)

IF3

not significant (p > 0.05)

IF4

not significant (p > 0.05)

IF5

not significant (p > 0.05)

IF6

not significant (p > 0.05)

R2

0.25

Notes: aSAT = b0 + b1 * QF1 + ... + b7 * QF7 + b8 * IF1

+ ... + b13 * IF6 + 1;

IF1 ... IF6 = factor scores image; QF1 ... QF6 = factor

scores of quality perceptions; SAT = overall satisfaction

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

International Journal of

Bank Marketing

16/7 [1998] 276286

Table IX

Results of regressions analysis with factor

scores according to models 2.3a, 2.4b and 2.5c

b

Model 2.3a

Intercept

IF1

IF2

IF3

IF4

IF5

IF6

R2

Model 2.4b

Intercept

IF1

IF2

IF3

IF4

IF5

IF6

R2

Model 2.5c

Intercept

IF1

IF2

IF3

IF4

IF5

IF6

R2

beta

not significant (p > 0.05)

0.32

0.32

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

0.11

not significant (p > 0.05)

0.18

0.20

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

0.15

0.18

not significant (p > 0.05)

0.07

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

not significant (p > 0.05)

0.18

0.16

not significant (p > 0.05)

not significant (p > 0.05)

0.03

0.00

0.01

0.02

0.03

Notes:

aQF1 = b + b * IF1 + ... + b * IF6 + ;

0

1

6

1

bQF2 = b + b * IF1 + ... + b * IF6 + ;

0

1

6

1

cQF3 = b + b * IF1 + ... + b * IF6 + ;

0

1

6

IF1 ... IF6 = factor scores image;

QF1 ... QF6 = factor scores of quality perceptions

Theoretical implications

An important implication of our results is

that analysis on the level of the various

underlying dimensions of elusive and difficult to operationalise constructs like image

and quality provides additional insight into

the relationship among them. Our analysis

shows that, although we did not find a direct

relationship between the overall image construct and loyalty, one distinct dimension

(position in the market) has a direct positive

effect on customer loyalty. Likewise, in

addition to the direct positive effect of the

overall quality construct, we are now able to

nuance that finding as it becomes clear that

specifically reliability and efficiency could be

viewed as important determinants of loyalty.

Therefore, our initial rejection of H1 could be

revoked on the basis of the multi-dimensional

approach that was taken subsequently. Thus,

we are able to obtain a more detailed insight

into the relationship between image and

quality on the one hand and loyalty on the

other. In essence, our conclusion is that all

three constructs (i.e. image, quality and satisfaction) exert an influence on customer loyalty with banks. Furthermore, we encountered a relatively strong relationship between

reliability and satisfaction. This points to the

relative importance of the reliability factor in

retail banking. Finally, we found that factors

like society-driven, empathy and customer

contacts have an indirect effect on loyalty via

satisfaction and quality. It should also be

noted that customer contacts have a direct

impact on empathy.

A number of theoretical shortcomings

follow from our research, suggesting a number of issues that merit further research.

First of all, it seems important to validate the

distinction between image and quality in

other financial services settings (e.g. insurance, corporate banking) and to verify

whether the multi-dimensional approach

taken here is valid for these settings. Second,

this study was limited to loyalty as an expression of consumer preference. Future research

should focus on other attitudinal and behavioural outcomes, such as word-of-mouth communication, the compositions of the evoked

set and information search behaviour, and

investigate whether dimensions of satisfaction also has an effect on these consequences.

Additional research is needed to investigate

whether a distinction can be made between

cognitive and affective dimensions of satisfaction. Third, the literature on customer-firm

relationships has suggested various types of

commitment, such as affective, calculative

and moral commitment (Allen and Meyer,

1990; Kumar et al., 1994). The obvious implication would be to investigate whether the type

of commitment to a bank can further nuance

the satisfaction-image-quality-loyalty relationship. Fourth, as our study replicates and

extends findings from the consumer product

literature to bank image, bank quality and

bank satisfaction and loyalty, additional

research is required to test our model in business-to-business relationships. Obviously, the

external validity of our findings needs additional attention in terms of the replication of

our study in a similar research setting. Fifth,

although we found significant relationships,

it should be taken into account that the levels

of variance explained are relatively modest.

Further research is needed to gain additional

insight into the explanation of bank loyalty.

Finally, all constructs were measured at one

point in time, thus essentially from a static

perspective. It may be worthwhile to study

bank loyalty over time, in order to be able to

[ 283 ]

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

International Journal of

Bank Marketing

16/7 [1998] 276286

Figure 2

Model based on factor analyses in combination with ordinary multivariate least squares analyses

= .18

Society

driven

= .32

Empathy

Satisfaction

= .20

= .38

Loyalty

= .39

= .32

Customer

contacts

= .36

Reliability

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

= .18

Efficiency

= .30

= .16

Position in

the market

take into account the dynamics in consumer

patronage behaviour. Should such an

approach be taken, then measures of actual

behaviour and bank objective performance

(e.g. switching behaviour, vulnerability to

price competition, turnover, relative market

share), in addition to perceptual gauges,

could be taken into account.

Managerial implications

In terms of the practical relevance of our

research, a number of managerial implications may be derived. First of all, reliability

seems to be the most important factor influencing customer loyalty with banks. Looking

at the individual indicators of this quality

dimension, it follows that banks should invest

in monitoring employees in order to make a

trustworthy impression on the customers,

both in the case of the general service

encounter, as well as in the handling of customer complaints. In the dialogue with bank

customers, management and employees

should strive to find out what customers

expect in terms of accuracy, expertise, complaint handling and proactive suggestions.

This implies an extensive and continuous

training program.

Following from the importance of the reliability dimension, customers apparently look

for external cues in order to be able to

[ 284 ]

evaluate the bank in terms of the relative

position it has within the market place. After

all, retail banking is very much a service

depending on credence properties. Therefore,

the use of corporate advertising creating the

perception of a strong financial institution,

with innovative products and services and

modern facilities, seems important for the

establishment of customer loyalty in retail

banking.

A third managerial implication is that

satisfaction is not the sole determinant of

customer loyalty in retail banking. Many

banks have a customer satisfaction measurement program, providing customer feedback.

Our study shows that although there is a

direct positive relationship between satisfaction and loyalty, other determinants play an

important role too. Just focusing on satisfaction may result in overlooking other important drivers of customer loyalty.

Fourth, efficiency, i.e. queuing time and

speed of handling, has a direct influence on

loyalty. Customers are not willing to spend

their valuable time waiting for services.

Banks that take this into account promote

loyalty among their customers. Although

customer contacts, empathy and societydriven seem to be of lower order importance,

they still have an indirect effect on customer

loyalty and should be handled with

customer care. Finally, caution should be

taken with regards to the impact of image,

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

International Journal of

Bank Marketing

16/7 [1998] 276286

which seems to be a construct that has a relatively low direct impact on bank loyalty, especially when one considers the influence of the

individual dimensions of image.

Note

1. Additional information on the data set may be

obtained from the authors.

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

References

Allen, N.J. and Meyer, J.P. (1990), The measurement and antecedents of affective, continuance, and normative commitment to the organization, Journal of Occupational

Psychology, Vol. 63, pp. 1-18.

Berry, L.L. (1983), Relationship marketing, in

Berry, L.L., Shostack, G.L. and Upah, G.D.

(Eds), Perspectives on Services Marketing,

American Marketing Association, Chicago,

IL.

Bloemer, J.M.M. and Kasper, J.D.P. (1995), The

complex relationship between consumer

satisfaction and brand loyalty, Journal of

Economic Psychology, Vol. 16, pp. 311-29.

Brislin, R. W. (1980), Translation and content

analysis of oral and written materials, in

Triandis, H.C. and Berry, J.W. (Eds), Handbook

of Cross-Cultural Psychology: Methodology,

Volume 2, Allyn & Bacon, Boston, MA.

Cronin, J.J. and Taylor, S.A. (1992), Measuring

service quality: a re-examination and extension, Journal of Marketing, Vol. 56, pp. 55-68.

Crosby, L.A., Evans, K.R. and Cowles, D. (1990),

Relationship quality in services selling: an

interpersonal influence perspective, Journal

of Marketing, Vol. 54, pp. 68-81.

Czepiel, J.A. (1990), Service encounters and

service relationships: implications for

research, Journal of Business Research, Vol.

20, pp. 13-21.

Czepiel, J.A. and Gilmore, R. (1987), Exploring

the concept of loyalty in services, in

Czepiel, J. A., Congram, C.A. and Shanahan, J.

(Eds), The Services Marketing Challenge: Integrating for Competitive Advantage, AMA,

Chicago, IL, pp. 91-4.

Darden, W.R. and Schwinghammer, J.K.L. (1985),

The influence of social characteristics on

perceived quality in patronage choice behavior, in Jacoby, J. and Olson, J. (Eds), Perceived

Quality: How Consumers View Stores and Merchandise, Lexington Books, Lexington, MA,

pp. 161-72.

Day, G.S. (1969), A two-dimensional concept of

brand loyalty, Journal of Advertising

Research, Vol. 9, pp. 29-36.

De Ruyter, J.C., Bloemer, J.M.A. and Peters, P.

(1997), Merging service quality and service

satisfaction: an empirical test of an integrative

framework, Journal of Economic Psychology,

Vol. 18, pp. 387-406.

Dick, A.S. and Basu, K. (1994), Customer loyalty:

toward an integrated conceptual framework,

Journal of the Academy of Marketing Science,

Vol. 22, pp. 99-113.

Doyle, P. and Fenwick, I. (1974), Shopping habits

in grocery chains, Journal of Retailing, Vol.

50, pp. 39-52.

Dwyer, R.F., Schurr, P.H. and Oh, S. (1987), Developing buyer-seller relationships, Journal of

Marketing, Vol. 51, pp. 11-27.

Granbois, D. (1981), An integrated view of the

store choice/patronage process, in

Monroe, K.B. (Ed.), Advances in Consumer

Research, Vol. 8, Association for Consumer

Research, Ann Arbor, MI, pp. 693-5.

Gremler, D.D. and Brown, S.W. (1996), Service

loyalty; its nature, importance and implications, in Edvardsson, B., Brown, S.W., Johnston, R. and Scheuing, E. (Eds), QUIS V:

Advancing Service Quality: A Global Perspective, ISQA, New York, NY, pp. 171-81.

Guiltinan, J.P. (1989), A classification of switching costs with implications for relationship

marketing, in Childers, T.L. and Bagozzi, R.P.

(Eds), Proceedings of AMA Winter Educators

Conference: Marketing Theory and Practice,

AMA, Chicago, IL, pp. 216-20.

Hildebrandt, L. (1988), Store image and the prediction of performance on retailing, Journal

of Business Research, Vol. 17, pp. 91-100.

Jacoby, J.W. and Chestnut, R.W. (1978), Brand

Loyalty Measurement and Management,

John Wiley & Sons, New York, NY.

Jain, A.K., Pinson, C. and Malhotra, N.K. (1987),

Customer loyalty as a construct in the marketing of bank services, International Journal of Bank Marketing, Vol. 5 No. 3, pp. 48-72.

James, D.L., Durand, R.M. and Dreves, R.A. (1976),

The use of a multi-attributes attitudes model

in a store image study, Journal of Retailing,

Vol. 52, pp. 23-32.

Keaveney, S.M. (1995), Customer switching

behaviour in service industries: an

exploratory study, Journal of Marketing,

Vol. 59, pp. 71-82.

Keaveney, S.M. and Hunt, K.A. (1992), Conceptualization and operationalization of retail store

image: a case of rival middle-level theories,

Journal of the Academy of Marketing Science,

Vol. 20 No. 2, pp. 165-75.

Kiesler, C.A. (1968), Commitment, in

Abelson, P.A. et al. (Eds), Theories of Cognitive

Consistency: a Source Book, Rand Mc Nally,

Chicago, IL.

Klemperer, P. (1987), Markets with consumer

switching costs, The Quarterly Journal of

Economics, Vol. 102, pp. 375-94.

Korgaonkar, P.K., Lund, D. and Price, B. (1985), A

structural equations approach toward examination of store attitude and store patronage

behavior, Journal of Retailing, Vol. 61, Summer, pp. 39-60.

Kumar, N., Hubbard, J.D. and Stern, L.W. (1994),

The Nature and Consequences of Marketing

[ 285 ]

Jose Bloemer, Ko de Ruyter

and Pascal Peeters

Investigating drivers of bank

loyalty: the complex

relationship between image,

service quality and

satisfaction

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

International Journal of

Bank Marketing

16/7 [1998] 276286

[ 286 ]

Channel Intermediary Commitment, No. 94-115,

Marketing Science Institute, Cambridge.

Kunkel, J.H. and Berry, L.L. (1968), A behavioral

conception of retail image, Journal of Marketing, Vol. 32, pp. 21-7.

Lastovicka, J.L. and Gardner, D.M. (1977), Components of involvement, in Maloney, J.C. and

Silverman, B. (Eds), Attitude Research Plays

for High Stakes, American Marketing Association, Chicago, IL.

Levesque, T. and McDougall, G.H.C. (1996), Determinants of customer satisfaction in retail

banking, International Journal of Bank Marketing, Vol. 14 No. 7, pp. 12-20.

Lewis, B.R. (1993), Service quality: recent developments in financial services, International

Journal of Bank Marketing, Vol. 11 No. 6, pp.

19-25.

Lewis, B.R. and Mitchell, V-W. (1990), Defining

and measuring the quality of customer service, Marketing Intelligence and Planning,

Vol. 8 No. 6, pp. 11-17.

Liljander, V. and Strandvik, T. (1995), The nature

of customer relationships in services, in

Swartz, T.A., Bowen, D. and Brown, S.W. (Eds),

Advances in Services Marketing Management,

Vol. 4, pp. 141-67.

Mazursky, D. and Jacoby, J. (1986), Exploring the

development of store images, Journal of

Retailing, Vol. 62, pp. 145-65.

Meidan, A. (1996), Marketing Financial Services,

MacMillan Press, Houndmills.

Moorman, C., Zaltman, G. and Despande, R.

(1992), Relationships between providers and

users of marketing research: the dynamics of

trust within and between organizations,

Journal of Marketing Research, Vol. 29,

pp. 314-29.

Morgan, R.M. and Hunt, S.D. (1994), The commitment-trust theory of relationship marketing,

Journal of Marketing, Vol. 58, pp. 20-38.

Murphy, J.A. (1996), Retail banking, in Buttle, F.

(Ed.), Relationship Marketing, Theory and

Practice, Paul Chapman, London, pp. 74-90.

Oliver, R.L. (1993), A conceptual model of service

quality and service satisfaction: compatible

goals, different concepts, in Swartz, A.T.,

Bowen D.E. and Brown, S.W. (Eds), Advances in

Services Marketing Management, Vol. 2, JAI

Press, Greenwich, CT, pp. 68-85.

Osman, M.Z. (1993), A conceptual model of retail

image influences on loyalty patronage behavior, The International Review of Retail, Distribution and Consumer Research, Vol. 31, pp. 149-66.

Parasuraman, A., Zeithaml, V. and Berry, L. (1988),

SERVQUAL: a multiple-item scale for measuring consumer perceptions of service quality,

Journal of Retailing, Vol. 64, Spring, pp. 12-40.

Patterson, P.G. and Johnson, L.W. (1993), Disconfirmation of expectations and the gap model of

service quality: an integrated paradigm,

Journal of Consumer Satisfaction, Dissatisfaction and Complaining Behavior, Vol. 6, pp. 90-9.

Render, B. and OConnor, T.S. (1976), The influence of price, store name and brand name on

perception of product quality, Journal of the

Academy of Marketing Science, Vol. 4, Fall,

pp. 722-30.

Rust, R.T. and Oliver, R.L. (1994), Service quality:

insights and managerial implications from the

frontier, in Rust, R.T. and Oliver, R.L. (Eds),

Service Quality: New Directions in Theory and

Practice, Sage, London, pp. 1-19.

Shemwell, D.J., Cronin, J.J. and Bullard, W.R.

(1994), Relational exchange in services: an

empirical investigation of ongoing customer

service-provider relationships, International

Journal of Service Industry Management, Vol. 5,

pp. 57-68.

Sirgy, M.J. and Samli, A.C. (1989), A path analytic

model of store loyalty involving self-concept,

store image, geographic loyalty, and socioeconomic status, Journal of the Academy of Marketing Science, Vol. 13 No. 3, pp. 265-91.

Smith, A.M. (1992), The consumers evaluation of

service quality: some methodological issues,

in Whitelock, J. (Ed.), Proceedings of the 1992

Annual Conference, MEG, University of Salford,

Marketing in the New Europe and B eyond, pp.

633-48.

Snyder, D.R. (1986), Service loyalty and its measurement: a preliminary investigation, in

Venkatesan, M., Schmalensee, D.M. and Marshall, C. (Eds), Creativity in Service Marketing:

Whats New, What Works, Whats Developing,

AMA, Chicago, IL, pp. 44-8.

Stafford, J.E. and Enis, B.M. (1969), The pricequality relationship: an extension, Journal of

Marketing Research, Vol. 6, November, pp. 456-8.

Surprenant, C.F. and Solomon, M.R. (1987), Predictability and personalization in the service

encounter, Journal of Marketing, Vol. 51,

pp. 86-96.

Worcester, R.M. (1997), Managing the image of

your bank: the glue that binds, International

Journal of Bank Marketing, Vol. 15 No. 5,

pp. 146-52.

Yavas, U. and Shemwell, D.J. (1996), Bank image:

exposition and illustration of correspondence

analysis, International Journal of Bank Marketing, Vol. 14 No. 1, pp. 15-21.

Zeithaml, V.A. (1981), How consumer evaluation

processes differ between goods and services,

in Donnelly, J.H. and George, W.R. (Eds), Marketing of Services, AMA, Chicago, IL.

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

This article has been cited by:

1. Jin-Ju Park, Jin-Woo Park. 2016. Investigating the effects of service recovery quality elements on passengers' behavioral

intention. Journal of Air Transport Management 53, 235-241. [CrossRef]

2. Muslim Amin King Saud University Riyadh Saudi Arabia Hooman Estelami Fordham University New York United States

Kent Eriksson Stanford University Palo Alto United States . 2016. Internet banking service quality and its implication on ecustomer satisfaction and e-customer loyalty. International Journal of Bank Marketing 34:3. . [Abstract] [PDF]

3. Hlia Gonalves Pereira, Maria de Ftima Salgueiro, Paulo Rita. 2016. Online purchase determinants of loyalty: The mediating

effect of satisfaction in tourism. Journal of Retailing and Consumer Services 30, 279-291. [CrossRef]

4. Naehyun Jin, Sangmook Lee. 2016. The Impact of Restaurant Experiences on Mature and Nonmature Customers: Exploring

Similarities and Differences. International Journal of Hospitality & Tourism Administration 17, 1-26. [CrossRef]

5. Raditha Hapsari, Michael Clemes, David Dean. 2016. The Mediating Role of Perceived Value on the Relationship between

Service Quality and Customer Satisfaction: Evidence from Indonesian Airline Passengers. Procedia Economics and Finance

35, 388-395. [CrossRef]

6. Jamaliah Mohd. Yusof, Shahira Ariffin. 2016. The Influence of Self-Congruity, Functional Image, and Emotional Attachment

on Loyalty. Procedia Economics and Finance 37, 350-357. [CrossRef]

7. Stefan Markovic, Oriol Iglesias, Jatinder Jit Singh, Vicenta Sierra. 2015. How does the Perceived Ethicality of Corporate

Services Brands Influence Loyalty and Positive Word-of-Mouth? Analyzing the Roles of Empathy, Affective Commitment,

and Perceived Quality. Journal of Business Ethics . [CrossRef]

8. Jose Wong, Hung-Che Wu, Ching-Chan Cheng. 2015. An Empirical Analysis of Synthesizing the Effects of Festival Quality,

Emotion, Festival Image and Festival Satisfaction on Festival Loyalty: A Case Study of Macau Food Festival. International

Journal of Tourism Research 17:10.1002/jtr.v17.6, 521-536. [CrossRef]

9. Youngran Shin, Vinh V. Thai. 2015. The Impact of Corporate Social Responsibility on Customer Satisfaction, Relationship

Maintenance and Loyalty in the Shipping Industry. Corporate Social Responsibility and Environmental Management 22,

381-392. [CrossRef]

10. Daniel Belanche Gracia, Luis V. Casal Ario, Miguel Guinalu Blasco. 2015. The effect of culture in forming e-loyalty

intentions: A cross-cultural analysis between Argentina and Spain. BRQ Business Research Quarterly 18, 275-292. [CrossRef]

11. C. Calvo-Porral, J.-P. Lvy-Mangin. 2015. Smooth operators? Drivers of customer satisfaction and switching behavior in

virtual and traditional mobile services. Revista Espaola de Investigacin en Marketing ESIC 19, 124-138. [CrossRef]

12. Christer Strandberg, Olof Wahlberg, Peter hman. 2015. Effects of commitment on intentional loyalty at the person-toperson and person-to-firm levels. Journal of Financial Services Marketing 20, 191-207. [CrossRef]

13. Goytom Abraha Kahsay, Margaret Samahita. 2015. Pay-What-You-Want pricing schemes: A self-image perspective. Journal

of Behavioral and Experimental Finance 7, 17-28. [CrossRef]

14. Alok Kumar Singh Department of Management Studies, Uttarakhand Technical University, Dehradun, India . 2015.

Modeling passengers future behavioral intentions in airline industry using SEM. Journal of Advances in Management Research

12:2, 107-127. [Abstract] [Full Text] [PDF]

15. Heekyung Sung, Woojin Lee. 2015. The Effect of Basic, Performance and Excitement Service Factors of a Convention Center

on Attendees' Experiential Value and Satisfaction: A Case Study of the Phoenix Convention Center. Journal of Convention

& Event Tourism 16, 175-199. [CrossRef]

16. Magdalena Bekk, Matthias Sprrle, Rebekka Hedjasie, Rudolf Kerschreiter. 2015. Greening the competitive advantage:

antecedents and consequences of green brand equity. Quality & Quantity . [CrossRef]

17. Mohammad Alamgir Hossain, Yogesh K. Dwivedi, Sarah Binte Naseem. 2015. Developing and validating a hierarchical model

of service quality of retail banks. Total Quality Management & Business Excellence 26, 534-549. [CrossRef]

18. Zanna van der Aa, Jose Bloemer, Jrg Henseler. 2015. Using customer contact centres as relationship marketing instruments.

Service Business 9, 185-208. [CrossRef]

19. Veljko Marinkovic Management and Business Administration, Economics, University of Kragujevac, Kragujevac, Serbia.

Vladimir Obradovic Faculty of Economics, University of Kragujevac, Kragujevac, Serbia . 2015. Customers emotional

reactions in the banking industry. International Journal of Bank Marketing 33:3, 243-260. [Abstract] [Full Text] [PDF]

20. Bekir Bora Dedeolu Tourism and Hospitality Management, Faculty of Economics and Administrative Sciences, Nevsehir

University, Nevsehir, Turkey Halil Demirer Institute of Social Sciences, Mustafa Kemal University, Hatay, Turkey . 2015.

Differences in service quality perceptions of stakeholders in the hotel industry. International Journal of Contemporary

Hospitality Management 27:1, 130-146. [Abstract] [Full Text] [PDF]

21. Raphal K. Akamavi, Elsayed Mohamed, Katharina Pellmann, Yue Xu. 2015. Key determinants of passenger loyalty in the

low-cost airline business. Tourism Management 46, 528-545. [CrossRef]

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

22. Laszlo Sajtos University of Auckland Business School, The University of Auckland, Auckland, New Zealand Henning Kreis

Marketing Department, Free University of Berlin, Berlin, Germany Roderick Brodie University of Auckland Business School,

The University of Auckland, Auckland, New Zealand . 2015. Image, brand relationships and customer value. Journal of Service

Theory and Practice 25:1, 51-74. [Abstract] [Full Text] [PDF]

23. Sabina Takar Beloglavec, Urban ebjan. 2015. Is Trust in Banks in Slovenia Put to the Test?. Nae gospodarstvo/Our economy

61. . [CrossRef]

24. Gyaneshwar Singh Kushwaha, Shiv Ratan Agrawal. 2015. An Indian customer surrounding 7Ps of service marketing. Journal

of Retailing and Consumer Services 22, 85-95. [CrossRef]

25. Jinhua Zhao, Valerie Webb, Punit Shah. 2014. Customer Loyalty Differences Between Captive and Choice Transit Riders.

Transportation Research Record: Journal of the Transportation Research Board 2415, 80-88. [CrossRef]

26. Beln Ruiz, gueda Esteban, Santiago Gutirrez. 2014. Determinants of reputation of leading Spanish financial institutions

among their customers in a context of economic crisis. BRQ Business Research Quarterly 17, 259-278. [CrossRef]

27. Akram Mahmoud Al-jazzazi School of Business and Law, Central Queensland University, Rockhampton, Australia Parves

Sultan School of Business and Law, Central Queensland University, Rockhampton, Australia . 2014. Banking service quality

in the Middle Eastern countries. International Journal of Bank Marketing 32:7, 688-700. [Abstract] [Full Text] [PDF]

28. W. Schlesinger, A. Cervera, H. Caldern. 2014. El papel de la confianza, la imagen y los valores compartidos en la creacin de

valor y lealtad: aplicacin a la relacin egresado-universidad. Revista Espaola de Investigacin en Marketing ESIC 18, 126-139.

[CrossRef]

29. Dr Kristina Heinonen Gustav Medberg CERS Centre for Relationship Marketing and Service Management and Department

of Marketing, Hanken School of Economics, Helsinki, Finland Kristina Heinonen CERS Centre for Relationship Marketing

and Service Management and Department of Marketing, Hanken School of Economics, Helsinki, Finland . 2014. Invisible

value formation: a netnography in retail banking. International Journal of Bank Marketing 32:6, 590-607. [Abstract] [Full

Text] [PDF]

30. Apostolos N. Giovanis, Dimitris Zondiros, Petros Tomaras. 2014. The Antecedents of Customer Loyalty for Broadband

Services: The Role of Service Quality, Emotional Satisfaction and Corporate Image. Procedia - Social and Behavioral Sciences

148, 236-244. [CrossRef]

31. Shalom Levy Graduate School of Business Administration, Ariel University Center, Ariel, Israel . 2014. Does usage level of

online services matter to customers bank loyalty?. Journal of Services Marketing 28:4, 292-299. [Abstract] [Full Text] [PDF]

32. Stella Kladou School of Social Sciences, Hellenic Open University, Patras, Greece John Kehagias School of Social Sciences,

Hellenic Open University, Patras, Greece . 2014. Developing a structural brand equity model for cultural destinations. Journal

of Place Management and Development 7:2, 112-125. [Abstract] [Full Text] [PDF]

33. M.A.H. Farquad, Vadlamani Ravi, S. Bapi Raju. 2014. Churn prediction using comprehensible support vector machine: An

analytical CRM application. Applied Soft Computing 19, 31-40. [CrossRef]

34. Myria Ioannou, Nikolaos Boukas, Evi Skoufari. 2014. Examining the role of advertising on the behaviour of co-operative

bank consumers. Journal of Co-operative Organization and Management 2, 24-33. [CrossRef]

35. Ugur Yavas Department of Management and Marketing, East Tennessee State University, Johnson City, Tennessee, USA

Emin Babakus Department of Marketing and Supply Chain Management, University of Memphis, Memphis, Tennessee,

USA George D. Deitz Department of Marketing and Supply Chain Management, University of Memphis, Memphis,

Tennessee, USA Subhash Jha Indian Institute of Management, Udaipur, India . 2014. Correlates of customer loyalty to

financial institutions: a case study. Journal of Consumer Marketing 31:3, 218-227. [Abstract] [Full Text] [PDF]

36. Johra Kayeser Fatima School of Business, Curtin University, Sarawak, Malaysia Mohammed Abdur Razzaque School of

Marketing, University of New South Wales, Sydney, Australia . 2014. Service quality and satisfaction in the banking sector.

International Journal of Quality & Reliability Management 31:4, 367-379. [Abstract] [Full Text] [PDF]

37. Monireh Salehnia, Maryam Saki, Alireza Eshaghi, Nafiseh SalehniaA model of E-Loyalty and word-of-mouth based on etrust in E-banking services (case study: Mellat Bank) 1-7. [CrossRef]

38. Ruchi Garg Department of Management, Indian Institute of Technology, Roorkee, India Zillur Rahman Department of

Management, Indian Institute of Technology, Roorkee, India M.N. Qureshi Faculty of Technology and Engineering, The

M.S. University of Baroda, Vadodara, India . 2014. Measuring customer experience in banks: scale development and validation.

Journal of Modelling in Management 9:1, 87-117. [Abstract] [Full Text] [PDF]

39. Medha Srivastava, Alok Kumar Rai. 2014. An investigation into service qualitycustomer loyalty relationship: the moderating

influences. DECISION 41, 11-31. [CrossRef]

40. Ajimon George, G. S. Gireesh Kumar. 2014. Impact of service quality dimensions in internet banking on customer satisfaction.

DECISION 41, 73-85. [CrossRef]

41. Ali Dehghan Business & Economics, Wesleyan College, Macon, Georgia, USA John Dugger School of Technology Studies,

Eastern Michigan University, Ypsilanti, Michigan, USA David Dobrzykowski Rutgers Business School, Rutgers, The State

Downloaded by Indian Institute of Technology at Madras At 05:04 23 April 2016 (PT)

University of New Jersey, Newark and New Brunswick, New Jersey, USA Anne Balazs Marketing, Eastern Michigan

University, Ypsilanti, Michigan, USA . 2014. The antecedents of student loyalty in online programs. International Journal of

Educational Management 28:1, 15-35. [Abstract] [Full Text] [PDF]

42. Wen-Jung Chen, Mei-Liang Chen. 2014. Factors Affecting the Hotel's Service Quality: Relationship Marketing and

Corporate Image. Journal of Hospitality Marketing & Management 23, 77-96. [CrossRef]

43. Abdullahi Hassan Gorondutse, Haim Hilman. 2014. Mediation effect of customer satisfaction on the relationships between

service quality and customer loyalty in the Nigerian foods and beverages industry: Sobel test approach. International Journal

of Management Science and Engineering Management 9, 1-8. [CrossRef]

44. Lisa Qixun Siebers, Tao Zhang, Fei Li. 2013. Retail positioning through customer satisfaction: an alternative explanation to

the resource-based view. Journal of Strategic Marketing 21, 559-587. [CrossRef]

45. Sam Thomas. 2013. Linking customer loyalty to customer satisfaction and store image: a structural model for retail stores.

DECISION 40, 15-25. [CrossRef]

46. Jung-Hwan Kim, Minjeong Kim, Jay Kandampully. 2013. The Impact of E-Retail Environment Characteristics on ESatisfaction and Purchase Intent. International Journal of Service Science, Management, Engineering, and Technology 2:10.4018/

jssmet.20110701, 1-19. [CrossRef]

47. David Muturi and Jackline Sagwe Daniel Kipkirong Tarus School of Business and Economics, Moi University, Eldoret, Kenya

Nicholas Rabach School of Business and Economics, Moi University, Eldoret, Kenya . 2013. Determinants of customer loyalty

in Kenya: does corporate image play a moderating role?. The TQM Journal 25:5, 473-491. [Abstract] [Full Text] [PDF]

48. I Gede Mahatma Yuda BaktiIndonesian Institute of Sciences, Tangerang Selatan, Indonesia Sik SumaediIndonesian Institute

of Sciences, Tangerang Selatan, Indonesia. 2013. An analysis of library customer loyalty. Library Management 34:6/7, 397-414.

[Abstract] [Full Text] [PDF]

49. So-Hyun Lee, Seung-Eui Noh, Hee-Woong Kim. 2013. A mixed methods approach to electronic word-of-mouth in the

open-market context. International Journal of Information Management 33, 687-696. [CrossRef]

50. Gary Howat, Guy Assaker. 2013. The hierarchical effects of perceived quality on perceived value, satisfaction, and loyalty:

Empirical results from public, outdoor aquatic centres in Australia. Sport Management Review 16, 268-284. [CrossRef]

51. Volker SeilerEconomics, University of Paderborn, Paderborn, Germany Markus RudolfFinance, WHU Otto Beisheim

School of Management, Vallendar, Germany Tim KrumeFinance, WHU Otto Beisheim School of Management, Vallendar,

Germany. 2013. The influence of sociodemographic variables on customer satisfaction and loyalty in the private banking

industry. International Journal of Bank Marketing 31:4, 235-258. [Abstract] [Full Text] [PDF]

52. Elissavet KeisidouDepartment of Business Administration, Technological Educational Institute of Kavala, Kavala, Greece

Lazaros SarigiannidisDepartment of Business Administration, Technological Educational Institute of Kavala, Kavala, Greece

Dimitrios I. MaditinosDepartment of Business Administration, Technological Educational Institute of Kavala, Kavala,

Greece Eleftherios I. ThalassinosDepartment of Maritime Studies, University of Piraeus, Piraeus, Greece. 2013. Customer

satisfaction, loyalty and financial performance. International Journal of Bank Marketing 31:4, 259-288. [Abstract] [Full Text]

[PDF]

53. Juan Carlos Fandos RoigBusiness Administration and Marketing, Universitat Jaume I of Castelln (Spain), Castelln,

Spain Marta Estrada GuillnBusiness Administration and Marketing, Universitat Jaume I of Castelln (Spain), Castelln,

Spain Santiago Forgas CollEconomy and Business Organization, Universitat de Barcelona, Barcelona, Spain Ramon Palau i