Académique Documents

Professionnel Documents

Culture Documents

International Financial Management

Transféré par

K-Ayurveda WelexCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

International Financial Management

Transféré par

K-Ayurveda WelexDroits d'auteur :

Formats disponibles

International financial management

1. 1. International FinancialManagement

2. 2. Introduction The main objective of internationalfinancial management is to

maximiseshareholder wealth. Adam Smith wrote in his famous title,Wealth of Nations

that if a foreigncountry can supply us with a commodityCheaper than we ourselves can

make it,better buy it of them with some part ofthe produce of our own in which we

havesome advantage.

3. 3. Basic Functions Acquisition of funds (financing decision) This function involves

generating funds from internal aswell as external sources. The effort is to get funds at

the lowest cost possible. Investment decision It is concerned with deployment of the

acquired funds in amanner so as to maximize shareholder wealth. Other decisions

relate to dividend payment, workingcapital and capital structure etc. In addition, risk

management involves both financing andinvestment decision.

4. 4. Nature & Scope Finance function of a multinational firm has twofunctions namely,

treasury and control. The treasurer is responsible for financial planning analysis fund

acquisition investment financing cash management investment decision and risk

management Controller deals with the functions related to external reporting tax

planning and management management information system financial and management

accounting budget planning and control, and accounts receivables etc.

5. 5. Environment at International Level the knowledge of latestchanges in forex rates

instability in capitalmarket interest rate fluctuations macro level charges micro level

economicindicators savings rate consumption pattern investment behaviour

ofinvestors export and import trends Competition banking sectorperformance

inflationary trends demand and supplyconditions etc.International financial management

practitioners arerequired the knowledge in the following fields.

6. 6. International financial manager willinvolve the study of exchange rate and currency

markets theory and practice of estimating future exchange rate various risks such as

political/country risk, exchangerate risk and interest rate risk various risk management

techniques cost of capital and capital budgeting in internationalcontext working capital

management balance of payment, and international financial institutions etc.

7. 7. Features of International Finance Foreign exchange risk Political risk Expanded

opportunity sets Market imperfections

8. 8. Foreign exchange risk In a domestic economy this risk is generally ignoredbecause a

single national currency serves as the mainmedium of exchange within a country. When

different national currencies are exchanged foreach other, there is a definite risk of

volatility in foreignexchange rates. The present International Monetary System set up

ischaracterised by a mix of floating and managedexchange rate policies adopted by each

nation keepingin view its interests. In fact, this variability of exchange rates is

widelyregarded as the most serious international financialproblem facing corporate

managers and policy makers.

9. 9. Political risk Political risk ranges from the risk of loss (or gain) fromunforeseen

government actions or other events of apolitical character such as acts of terrorism to

outrightexpropriation of assets held by foreigners. For example, in 1992, Enron

Development Corporation,a subsidiary of a Houston based Energy Company,signed a

10.

11.

12.

13.

14.

15.

16.

17.

18.

19.

contract to build Indias longest power plant.Unfortunately, the project got cancelled in

1995 by thepoliticians in Maharashtra who argued that India didnot require the power

plant. The company had spentnearly $ 300 million on the project.

10. Expanded Opportunity Sets When firms go global, they also tend tobenefit from

expanded opportunities whichare available now. They can raise funds in capital markets

wherecost of capital is the lowest. The firms can also gain from greatereconomies of

scale when they operate on aglobal basis.

11. Market Imperfections domestic finance is that world markets todayare highly

imperfect differences among nations laws, taxsystems, business practices and

generalcultural environments

12. International Trade Theories Theory of Mercantilism Theory of Absolute Cost

Advantage Theory of Comparative Cost Advantage

13. Theory of Mercantilism This theory is during the sixteenth to the three-fourths of the

eighteenth centuries. It beliefs in nationalism and the welfare of the nationalone,

planning and regulation of economic activitiesfor achieving the national goals, restriction

importsand promoting exports. It believed that the power of a nation lied in itswealth,

which grew by acquiring gold from abroad.Cont

14. Theory of Mercantilism Mercantilists failed to realize that simultaneous

exportpromotion and import regulation are not possible in allcountries, and the mere

control of gold does not enhance thewelfare of a people. Keeping the resources in the

form of gold reduces theproduction of goods and services and, thereby, lowers welfare.

It was rejected by Adam Smith and Ricardo by stressing theimportance of individuals,

and pointing out that their welfarewas the welfare of the nation.

15. Theory of Absolute Cost Advantage This theory was propounded by Adam Smith

(1776),arguing that the countries gain from trading, if theyspecialise according to their

production advantages. The pre-trade exchange ratio in Country I would be2A=1B and in

Country II IA=2B.Cont

16. If it is nearer to Country I domestic exchange ratiothen trade would be more

beneficial to Country IIand vice versa. Assuming the international exchange ratio

isestablished IA=IB. The terms of trade between the trading partnerswould depend upon

their economic strength and thebargaining power.Theory of Absolute Cost Advantage

17. Theory of Comparative Cost Advantage Ricardo (1817), though adhering to the

absolute costadvantage principle of Adam Smith, pointed out thatcost advantage to both

the trade partners was not anecessary condition for trade to occur. According to Ricardo,

so long as the other country isnot equally less productive in all lines of

production,measurable in terms of opportunity cost of eachcommodity in the two

countries, it will still bemutually gainful for them if they enter into trade.Cont

18. In the example given, the opportunity cost of oneunit of A in country I is 0.89

(80/90) unit of good Band in country II it is 1.2 (120/100) unit of good B. On the other

hand, the opportunity cost of oneunit of good B in country I is 1.125 (90/80)units ofgood

A and 0.83 (100/120) unit of good A, incountry II.Theory of Comparative Cost

AdvantageCont

19. The opportunity cost of the two goods are different in boththe countries and as long

as this is the case, they will havecomparative advantage in the production of either, good

A orgood B, and will gain from trade regardless of the fact thatone of the trade partners

may be possessing absolute costadvantage in both lines of production. Thus, country I

has comparative advantage in good A as theopportunity cost of its production is lower in

this country ascompared to its opportunity cost in country II which hascomparative

advantage in the production of good B on thesame reasoning.Theory of Comparative

Cost Advantage

20. 20. International Business Methods Licensing Franchising Subsidiaries and

Acquisitions Strategic Alliances Exporting

Vous aimerez peut-être aussi

- Research MethodologyDocument55 pagesResearch MethodologyK-Ayurveda WelexPas encore d'évaluation

- Shippers's Certifications For Non-Hazardous Cargo: 1 CartonDocument12 pagesShippers's Certifications For Non-Hazardous Cargo: 1 CartonK-Ayurveda Welex100% (2)

- Forms of EMHDocument33 pagesForms of EMHK-Ayurveda WelexPas encore d'évaluation

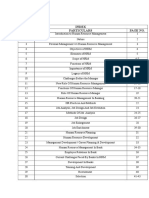

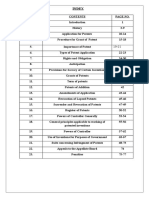

- Index SR - NO. Particulars Page NoDocument7 pagesIndex SR - NO. Particulars Page NoK-Ayurveda WelexPas encore d'évaluation

- Investment EnvironmentDocument25 pagesInvestment EnvironmentK-Ayurveda WelexPas encore d'évaluation

- A Project Report On Strategic Managemant of Reliance EnergyDocument46 pagesA Project Report On Strategic Managemant of Reliance EnergyK-Ayurveda WelexPas encore d'évaluation

- Non DG DeclarationDocument12 pagesNon DG DeclarationK-Ayurveda WelexPas encore d'évaluation

- Current Good Manufacturing Practices (GMP) CertificatesDocument71 pagesCurrent Good Manufacturing Practices (GMP) CertificatesK-Ayurveda WelexPas encore d'évaluation

- Tata Memmorial HospitalDocument22 pagesTata Memmorial HospitalK-Ayurveda WelexPas encore d'évaluation

- Corporate Advisory Services: Determining Financial Structure Portfolio ManagementDocument3 pagesCorporate Advisory Services: Determining Financial Structure Portfolio ManagementK-Ayurveda WelexPas encore d'évaluation

- Sr. No. Particulars Appendix 1 Packaging Specifications and Product CompositionDocument1 pageSr. No. Particulars Appendix 1 Packaging Specifications and Product CompositionK-Ayurveda WelexPas encore d'évaluation

- Request Letter For BonafideDocument1 pageRequest Letter For BonafideK-Ayurveda WelexPas encore d'évaluation

- Index SR - NO. Particulars Page NoDocument7 pagesIndex SR - NO. Particulars Page NoK-Ayurveda WelexPas encore d'évaluation

- CBM Human Resource ManagementDocument48 pagesCBM Human Resource ManagementK-Ayurveda WelexPas encore d'évaluation

- ProjectDocument7 pagesProjectK-Ayurveda WelexPas encore d'évaluation

- Consolidation of Financial Statments Final ProjectDocument35 pagesConsolidation of Financial Statments Final ProjectK-Ayurveda WelexPas encore d'évaluation

- Introduction To Human Resource Management and EnvironmentDocument138 pagesIntroduction To Human Resource Management and EnvironmentK-Ayurveda Welex100% (2)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Resources Policy: Md. Aminul Haque, Erkan Topal, Eric LilfordDocument9 pagesResources Policy: Md. Aminul Haque, Erkan Topal, Eric LilfordYhoan Miller Lujan GomezPas encore d'évaluation

- Compound Interest Previous YearDocument16 pagesCompound Interest Previous YearPrem KumarPas encore d'évaluation

- Group Dynamics: Introduction To The ORIX GroupDocument40 pagesGroup Dynamics: Introduction To The ORIX GroupSophiya PrabinPas encore d'évaluation

- Assumption of Mortgage....Document1 pageAssumption of Mortgage....kardel sharpeyePas encore d'évaluation

- Primary and Secondary Evidence H. D. Kneedler vs. Simon PaternoDocument4 pagesPrimary and Secondary Evidence H. D. Kneedler vs. Simon PaternoRandy RanranPas encore d'évaluation

- Note On Financial Ratio AnalysisDocument9 pagesNote On Financial Ratio Analysisabhilash831989Pas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument3 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalancesatyagireeshPas encore d'évaluation

- Glossary of Terms - Indian Real EstateDocument9 pagesGlossary of Terms - Indian Real EstatealistairdsaPas encore d'évaluation

- Attempts All Questions From Part I and Any Five Questions From Part IIDocument1 pageAttempts All Questions From Part I and Any Five Questions From Part IINimesh GoyalPas encore d'évaluation

- Project Report For A Broiler Poultry Farm (500 Birds A Week)Document3 pagesProject Report For A Broiler Poultry Farm (500 Birds A Week)Rajesh Jangir100% (1)

- Ga Power Company Application Part 2Document177 pagesGa Power Company Application Part 2Southern Alliance for Clean EnergyPas encore d'évaluation

- CH 12Document3 pagesCH 12vivien0% (1)

- Achievers Akure Cooperative Multipurpose Union LimitedDocument5 pagesAchievers Akure Cooperative Multipurpose Union LimitedAlexPas encore d'évaluation

- After THE Storm: Philippine CollegianDocument12 pagesAfter THE Storm: Philippine CollegianPhilippine CollegianPas encore d'évaluation

- 67-1-3 Accountancy PDFDocument28 pages67-1-3 Accountancy PDFamnxiPas encore d'évaluation

- Hedge Fund Symposium Discount (Absolute Return + Alpha 2009)Document12 pagesHedge Fund Symposium Discount (Absolute Return + Alpha 2009)marketfolly.comPas encore d'évaluation

- Preparation of Gross - Net Value Added Statement For CompaniesDocument6 pagesPreparation of Gross - Net Value Added Statement For CompaniesKamal JoshiPas encore d'évaluation

- Cole Harris IndictmentDocument14 pagesCole Harris IndictmentJennifer Van LaarPas encore d'évaluation

- United States Bankruptcy Court Eastern District of Michigan Southern DivisionDocument93 pagesUnited States Bankruptcy Court Eastern District of Michigan Southern DivisionChapter 11 DocketsPas encore d'évaluation

- IAS 23 Borrowing CostsDocument11 pagesIAS 23 Borrowing Costsksmuthupandian2098Pas encore d'évaluation

- Examination - 2020 Subject: Financial ManagementDocument5 pagesExamination - 2020 Subject: Financial ManagementhareshPas encore d'évaluation

- Estudio Nuevos RicosDocument30 pagesEstudio Nuevos RicosEl DestapePas encore d'évaluation

- I Bet You Thought - Ny FedDocument36 pagesI Bet You Thought - Ny FedK100% (2)

- 5-10 Resolution For Borrowing MoneyDocument1 page5-10 Resolution For Borrowing MoneyDaniel93% (14)

- RCBC vs. Ca Kapunan, J. - G.R. No. 133107 - March 25, 1999 FactsDocument2 pagesRCBC vs. Ca Kapunan, J. - G.R. No. 133107 - March 25, 1999 FactsMark Hiro NakagawaPas encore d'évaluation

- The Blacker The Berry, The Sweeter The Juice: Management Guidance 270Document3 pagesThe Blacker The Berry, The Sweeter The Juice: Management Guidance 270maxmueller15Pas encore d'évaluation

- 7 Lizaso V Amante G.R. No. 2019Document6 pages7 Lizaso V Amante G.R. No. 2019John JurisPas encore d'évaluation

- Business Correspondant Model in FI-ProjectDocument51 pagesBusiness Correspondant Model in FI-ProjectcprabhashPas encore d'évaluation

- Instructions For Completing Uniform Residential Loan Application-Instructions Freddie Mac Form 65 - Fannie Mae Form 1003Document15 pagesInstructions For Completing Uniform Residential Loan Application-Instructions Freddie Mac Form 65 - Fannie Mae Form 1003larry-612445Pas encore d'évaluation

- Co Act On Loans Accepted & GivenDocument43 pagesCo Act On Loans Accepted & GivendkdineshPas encore d'évaluation