Académique Documents

Professionnel Documents

Culture Documents

Chapter 17: Mergers, Lbos, Divestitures, and Business Failure

Transféré par

JamilleTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 17: Mergers, Lbos, Divestitures, and Business Failure

Transféré par

JamilleDroits d'auteur :

Formats disponibles

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure205

Chapter17

Mergers,LBOs,Divestitures,

andBusinessFailure

.1

Learning Goals

1.

Understandmergerfundamentals,includingterminology,motivesformerging,andtypesof

mergers.

2.

Describetheobjectivesandproceduresusedinleveragedbuyouts(LBOs)anddivestitures.

3.

Demonstratetheproceduresusedtovaluethetargetcompany,anddiscusstheeffectofstockswap

transactionsonearningspershare.

4.

Discussthemergernegotiationprocess,holdingcompanies,andinternationalmergers.

5.

Understandthetypesandmajorcausesofbusinessfailureandtheuseofvoluntarysettlementsto

sustainorliquidatethefailedfirm.

6.

Explainbankruptcylegislationandtheproceduresinvolvedinreorganizingorliquidatingabankrupt

firm.

.2

TrueFalse

1.

Amergeroccurswhentwoormorefirmsarecombinedtoformacompletelynewcorporation.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:MergerBasics

2.

Theoverridinggoalformergingisthemaximizationoftheownerswealthasreflectedinthe

acquirersshareprice.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:MergerMotives

3.

Firmsmotivestomergeincludegrowthordiversification,synergy,fundraising,taxconsiderations,

anddefenseagainsttakeover.

Answer: TRUE

LevelofDifficulty:1

206GitmanPrinciplesofFinance,EleventhEdition

LearningGoal:1

Topic:MergerMotives

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure207

4.

Aconglomeratemergerisamergercombiningfirmsinunrelatedbusinesses.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:ConglomerateMergers

5.

Acongenericmergerisamergercombiningfirmsinunrelatedbusinesses.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:CongenericMergers

6.

Greatercontrolovertheacquisitionofnewmaterialsorthedistributionoffinishedgoodsisan

economicbenefitofhorizontalmerger.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:HorizontalMergers

7.

Verticalmergermayresultinexpansionofoperationsinanexistingproductlineandeliminationof

acompetitor.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:VerticalMergers

8.

Consolidationinvolvesthecombinationoftwoormorefirms,andtheresultingfirmmaintainsthe

identityofoneofthefirms.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:Consolidations

9.

Thecompaniescontrolledbyaholdingcompanyarenormallyreferredtoasitssubsidiaries.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:HoldingCompanies

10.

Thetakeovertargetsmanagementmaynotsupportaproposedtakeoverduetoaveryhightender

offer.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:TargetFirms

208GitmanPrinciplesofFinance,EleventhEdition

11.

Averticalmergerisamergeroftwofirmsinthesamelineofbusiness.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:VerticalMergers

12.

Ahorizontalmergerisamergerinwhichonefirmacquiresanotherfirminthesamegeneral

industrybutneitherinthesamelineofbusinessnorasupplierorcustomer.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:HorizontalMergers

13.

Acongenericmergerisamergerinwhichafirmacquiresasupplieroracustomer.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:CongenericMergers

14.

Tenderofferisaformaloffertopurchaseagivennumberofsharesofafirmsstockataspecified

price.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:TenderOffers

15.

Strategicmergersseektoachievevariouseconomiesofscalebyeliminatingredundantfunctions,

increasingmarketshare,andimprovingrawmaterialsourcingandfinishedproductdistribution.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:1

Topic:StrategicMergers

16.

Anoperatingmergeroccurswhentheoperationsoftheacquiringandtargetfirmsarecombinedin

ordertoachieveeconomiesandtherebycausetheperformanceofthemergedfirmtoexceedthatof

thepremergedfirm.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:OperatingMergers

17.

Aholdingcompanyisacorporationwhichiscontrolledbyoneormoreothercorporations.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:HoldingCompanies

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure209

18.

Financialmergersinvolvemergingfirmsinordertoachievevariouseconomiesofscaleby

eliminatingredundantfunctions,increasingmarketshare,andimprovingrawmaterialsourcingand

finishedproductdistribution.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:FinancialMergers

19.

Aconsolidationisacorporationthathasvotingcontrolofoneormoreothercorporations.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:Consolidations

20.

Financialmergerisamergertransactionundertakentoachieveeconomiesofscale.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:FinancialMergers

21.

Strategicmergerisamergertransactionundertakenwiththegoalofrestructuringtheacquired

companyinordertoimproveitscashflowandunlockitshiddenvalue.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:StrategicMergers

22.

Thesynergyofmergersistheeconomiesofscaleresultingfromthemergedfirmsloweroverhead.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:1

Topic:SynergyofMergers

23.

Thetaxlosscarryforwardbenefitscanbeusedinmergersbutcannotbeusedintheformationof

holdingcompanies.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:1

Topic:TaxLossCarrybackandCarryforward

24.

LBOsareanexampleofafinancialmergerundertakentocreateahighdebtprivatecorporationwith

improvedcashflowandvalue.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:2

Topic:LeveragedBuyoutBasics

210GitmanPrinciplesofFinance,EleventhEdition

25.

Anattractivecandidateforacquisitionthroughleveragedbuyoutmusthaveagoodpositioninits

industrywithasolidprofithistoryandreasonableexpectationforgrowth.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:2

Topic:LeveragedBuyoutCandidates

26.

Anattractivecandidateforacquisitionthroughleveragedbuyoutusuallyhasarelativelyhighlevel

ofdebtandalowlevelofbankableassets.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:2

Topic:LeveragedBuyoutCandidates

27.

Themotivefordivestitureisoftentogetridofaproductlineinordertogeneratecashforexpansion

ofotherproductlines.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:2

Topic:MotivesforDivestitures

28.

Thesellingofsomeofafirmsassetsforvariousstrategicmotivesiscalleddivestiture.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:2

Topic:MotivesforDivestitures

29.

Aspinoffisaformofdivestitureinwhichanoperatingunitbecomesanindependentcompanyby

issuingsharesinitonaproratabasistotheparentcompanysshareholders.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:SpinOffs

30.

Thesaleofaunitofafirmtoexistingmanagementisoftenachievedthroughaleveragedbuyout.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:LeveragedBuyouts

31.

Afirmthatwantstoexpandorextenditsoperationsinexistingornewproductareasmayavoid

manyoftherisksassociatedwiththedesign,manufacture,andsaleofadditionalornewproductand

removeapotentialcompetitorbyacquiringasuitablegoingconcern.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:3

Topic:MotivesforAcquisitions

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure211

32.

Thebasicdifficultyinapplyingthecapitalbudgetingapproachtotheacquisitionofagoingconcern

istheestimationofinitialcashflowsandcertainriskconsideration.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:3

Topic:AnalyzingAcquisitions

33.

Stockswaptransactionisanacquisitionmethodinwhichtheacquiringfirmexchangesitssharesfor

sharesofthetargetcompanyaccordingtoapredeterminedratio.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:3

Topic:StockSwapTransactions

34.

Ratioofexchangeinmarketpriceindicatesthemarketpricepershareoftheacquiringfirmpaidfor

eachdollarofmarketpricepershareofthetargetfirm.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:3

Topic:RatioofExchangeandAcquisitions

35.

Theactualratioofexchangeinastockexchangeacquisitionistheratiooftheamountpaidpershare

ofthetargetcompanytothepersharemarketpriceoftheacquiringfirm.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:3

Topic:RatioofExchangeandAcquisitions

36.

Theearningspershareofthemergedfirmaregenerallyabovethepremergerearningspershareof

onefirmandbelowthepremergerearningspershareoftheother,aftermakingthenecessary

adjustmentfortheratioofexchange.

Answer: TRUE

LevelofDifficulty:3

LearningGoal:3

Topic:RatioofExchangeandAcquisitions

37.

IfthePEpaidisgreaterthanthePEoftheacquiringcompany,onapostmergerbasisthetarget

firmsEPSincreasesandtheacquiringfirmsEPSdecreases.

Answer: TRUE

LevelofDifficulty:3

LearningGoal:3

Topic:PERatioandMergers

38.

Theownersofaholdingcompanycancontrolsignificantlylargeramountsofassetsthantheycould

acquirethroughmergers.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:4

Topic:HoldingCompanyBasics

212GitmanPrinciplesofFinance,EleventhEdition

39.

Theownersofaholdingcompanycancontrolsignificantlylargeramountsofassetsthantheycould

acquirethroughmergers.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:4

Topic:HoldingCompanyBasics

40.

Amajordisadvantageofholdingcompaniesistheincreasedriskresultingfromtheleverageeffect.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:4

Topic:DisadvantagesofHoldingCompanies

41.

Twotierofferisatenderofferinwhichthetermsofferedaremoreattractivetothosewhotender

sharesearly.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:4

Topic:TwoTierOffers

42.

Whiteknightisatakeoverdefenseinwhichafirmissuessecuritiesthatgivetheirholderscertain

rightsthatbecomeeffectivewhenatakeoverisattemptedandthatmakethetargetfirmless

desirabletoahostileacquirer.

Answer: FALSE

LevelofDifficulty:3

LearningGoal:4

Topic:WhiteKnightTakeoverDefense

43.

Poisonpillisatakeoverdefenseinwhichthetargetfirmfindsanacquirermoretoitslikingthanthe

initialhostileacquirerandpromptsthetwotocompetetotakeoverthefirm.

Answer: FALSE

LevelofDifficulty:3

LearningGoal:4

Topic:PoisonPillsTakeoverDefense

44.

Greenmailisatakeoverdefenseunderwhichthetargetfirmrepurchasesalargeblockofstockata

premiumfromoneormoreshareholdersinordertoendahostiletakeoverattemptbythose

shareholders.

Answer: TRUE

LevelofDifficulty:3

LearningGoal:4

Topic:GreenmailTakeoverDefense

45.

Pyramidingisanarrangementamongholdingcompanieswhereinonecompanycontrolsothers,

therebycausinganevengreatermagnificationofearningsandlosses.

Answer: TRUE

LevelofDifficulty:3

LearningGoal:4

Topic:PyramidingandHoldingCompanies

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure213

46.

Technicalinsolvencyoccurswhenafirmsliabilitiesexceedthefairmarketvalueofitsassets.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:5

Topic:TechnicalInsolvency

47.

Inavoluntarysettlement,compositionisanarrangementinwhichthecreditorcommitteereplaces

thefirmsoperatingmanagementandoperatesthefirmuntilallclaimshavebeensettled.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:5

Topic:VoluntarySettlements

48.

Chapter7oftheBankruptcyReformActof1978outlinestheproceduresforreorganizingafailed

(orfailing)firm,whetheritspetitionisfiledvoluntarilyorinvoluntarily.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:6

Topic:Chapter7Bankruptcy

49.

Underrecapitalization,debtsaregenerallyexchangedforequityorthematuritiesofexistingdebts

areextended.

Answer: TRUE

LevelofDifficulty:3

LearningGoal:6

Topic:Recapitalization

50.

OneoftheresponsibilitiesoftheDebtorinPossession(DIP)istheliquidationofthefirmsassets.

Answer: FALSE

LevelofDifficulty:3

LearningGoal:6

Topic:DebtorinPossession

51.

Inthebroadestsense,activitiesinvolvingexpansionorcontractionofafirmsoperationsorchanges

initsassetsorownershipstructurearecalledcorporaterestructuring.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:CorporateRestructuring

52.

Inthebroadestsense,activitiesinvolvingexpansionorcontractionofafirmsoperationsorchanges

initsassetsorownershipstructurearecalledcorporatemaneuvering.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:CorporateRestructuring

214GitmanPrinciplesofFinance,EleventhEdition

53.

Holdingcompaniessimplyarecorporationsthathavevotingcontrolofoneormoreother

corporationsandthecompaniestheycontrolareoftenreferredtoassubsidiaries.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:1

Topic:HoldingCompanies

54.

Subsidiarycompaniessimplyarecorporationsthathavevotingcontrolofoneormoreother

corporationsandthecompaniestheycontrolareoftenreferredtoasholdingcompanies.

Answer: FALSE

LevelofDifficulty:1

LearningGoal:1

Topic:HoldingCompanies

55.

Primarymotivesformergingincludegrowthordiversification,synergy,fundraising,increased

managerialskillortechnology,taxconsiderations,increasedownershipliquidity,anddefense

againsttakeovers.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:1

Topic:MotivesforMergers

56.

Primarymotivesformergingincludegrowthordiversification,synergy,fundraising,increased

managerialskillortechnology,taxconsiderations,increasedownershipliquidity,andacquiringnew

upperlevelmanagementpersonnel.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:1

Topic:MotivesforMergers

57.

ItisnotunusualforacquirersinLBOstobemembersofthefirmsexistingmanagementteam.

Answer: TRUE

LevelofDifficulty:1

LearningGoal:2

Topic:AcquirersinLBOs

58.

OneofthekeyattributesthatmakesafirmagoodcandidateforanLBOisthatithasstableand

predictablecashflowsthatareadequatetomeetinterestandprincipalpaymentsonthedebtand

provideadequateworkingcapital.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:KeyAttributesofLBOCandidates

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure215

59.

OneofthekeyattributesthatmakesafirmagoodcandidateforanLBOisthatithasarelatively

lowlevelofdebtandahighlevelofrelativelyliquidassetsthatcouldbeusedasloancollateral.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:KeyAttributesofLBOCandidates

60.

OneofthekeyattributesthatmakesafirmagoodcandidateforanLBOisthatithasarelatively

highlevelofdebtandalowlevelofrelativelyliquidassetsthatcouldbeusedasloancollateral.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:2

Topic:KeyAttributesofLBOCandidates

61.

OneofthekeyattributesthatmakesafirmagoodcandidateforanLBOisthatithasasolid

positionintheindustrywithreasonableexpectationsforfuturegrowth.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:KeyAttributesofLBOCandidates

62.

Unlikebusinessbankruptcyandbusinessfailure,divestitureisoftenundertakenforpositivemotives

suchastogeneratecashfortheexpansionofproductlines,togetridofpoorlyperforming

operations,tostreamlinethecompany,ortorestructurethebusinessthatisconsistentwiththefirms

strategicgoals.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:Divestitures

63.

Likebusinessbankruptcyandbusinessfailure,divestitureismostoftenundertakentorelieve

pressurebycreditorssuchasbondholdersandbanksduetothefirmsrelativelyhighdebtlevels.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:2

Topic:Divestitures

64.

Methodsofdivestitureincludethesaleofaproductlinetoanotherfirm,thesaleofaunittoexisting

management,spinoffs,andtheliquidationofassets.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:MethodsofDivesting

216GitmanPrinciplesofFinance,EleventhEdition

65.

Methodsofdivestitureincludethesaleofaproductlinetoanotherfirm,thesaleofaunittoexisting

management,thedonationofaunittoacharity,andtheliquidationofassets.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:2

Topic:MethodsofDivesting

66.

Thevalueofafirmmeasuredasthesumofthevaluesofitsoperatingunitsifeachweresold

separatelyisknownasafirmspartandparcelvalue.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:2

Topic:BreakupValueinDivestitures

67.

Thevalueofafirmmeasuredasthesumofthevaluesofitsoperatingunitsifeachweresold

separatelyisknownasafirmsbreakupvalue.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:2

Topic:BreakupValueinDivestitures

68.

Amethodofacquisitioninwhichtheacquiringfirmexchangesitssharesofstockforsharesofthe

targetcompanyaccordingtoapredeterminedratioiscalledastockswaptransaction.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:3

Topic:StockSwapTransactionsinAcquisitions

69.

Amethodofacquisitioninwhichtheacquiringfirmexchangesitssharesofstockforsharesofthe

targetcompanyaccordingtoapredeterminedratioiscalledaleveragedbuyout.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:3

Topic:StockSwapTransactionsinAcquisitions

70.

Acquisitionsareespeciallyattractivewhentheacquiredfirmsstockpriceishigh,becausefewer

sharesmustbeexchangedtoacquirethefirm.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:3

Topic:Acquisitions

71.

Acquisitionsareespeciallyattractivewhentheacquiringfirmsstockpriceishigh,becausefewer

sharesmustbeexchangedtoacquirethefirm.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:3

Topic:Acquisitions

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure217

72.

Populartakeoverdefensemethodsincludewhiteknights,poisonpills,greenmail,goldenparachutes,

andsharkrepellents.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:4

Topic:TakeoverDefenses

73.

Populartakeoverdefensemethodsincludewhiteknights,poisonpills,greenmail,financialsabotage,

andsharkrepellents.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:4

Topic:TakeoverDefenses

74.

TheU.S.approachesusedinhostiletakeoversisanaffectivemethodofchangingcorporatecontrol

andusedinmanyareasoftheworldincludingGreatBritain,China,andJapan.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:4

Topic:InternationalMergers

75.

TheU.S.approachesusedinhostiletakeoversispracticallynonexistentinmostothercountries

throughouttheworldincludingcontinentalEuropeandAsia.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:4

Topic:InternationalMergers

76.

Theprimarycausesofbusinessfailurearemismanagement,pooreconomicconditions,and

corporatematurity.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:5

Topic:InternationalMergers

77.

Theprimarycausesofbusinessfailureareinventorymismanagement,poormarketingcampaigns,

andcorporatetheft.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:5

Topic:InternationalMergers

78.

ThedebtorinpossessioninaChapter11bankruptcyproceedingisresponsibleforvaluingthefirm

bothintermsofitsliquidationvalueandasagoingconcern.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:6

Topic:Chapter11Bankruptcy

218GitmanPrinciplesofFinance,EleventhEdition

79.

ThecreditorinpossessioninaChapter12bankruptcyproceedingisresponsibleforvaluingthefirm

bothintermsofitsliquidationvalueandasagoingconcern.

Answer: FALSE

LevelofDifficulty:2

LearningGoal:6

Topic:Chapter11Bankruptcy

80.

InaChapter7liquidationbankruptcyproceeding,theorderofpriorityofsatisfyingclaimsis

securedcreditors,unsecuredcreditors,andthenequityholders.

Answer: TRUE

LevelofDifficulty:2

LearningGoal:6

Topic:Chapter7Bankruptcy

.3

Multiple Choice Questions

1.

Businesscombinationsareusedbyfirmstoexternallyexpandinordertoachieveallofthe

followingobjectivesEXCEPT

(a) toincreaseproductivecapacity.

(b) toincreaseliquidity.

(c) toincreasecommonstockoutstanding.

(d) toacquireneededassets.

Answer: C

LevelofDifficulty:1

LearningGoal:1

Topic:MotivesforBusinessCombinations

2.

CommonformsofbusinesscombinationincludeallofthefollowingEXCEPT

(a) congenericformation.

(b) consolidations.

(c) mergers.

(d) holdingcompanies.

Answer: A

LevelofDifficulty:1

LearningGoal:1

Topic:FormsofBusinessCombinations

3.

Thecombinationoftwoormorecompaniestoformacompletelynewcorporationisa

(a) congenericformation.

(b) consolidation.

(c) merger.

(d) holdingcompany.

Answer: B

LevelofDifficulty:1

LearningGoal:1

Topic:Consolidations

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure219

4.

Acombinationofcompanieswheretheformercorporationsceasetoexistis

(a) acongenericformation.

(b) aconsolidation.

(c) amerger.

(d) aholdingcompany.

Answer: B

LevelofDifficulty:1

LearningGoal:1

Topic:Consolidations

5.

Thecombinationoftwoormorecompanieswhichresultsinthefirmmaintainingtheidentityofone

ofthefirmsis

(a) congenericformation.

(b) consolidation.

(c) merger.

(d) holdingcompany.

Answer: C

LevelofDifficulty:1

LearningGoal:1

Topic:Mergers

6.

Thefirminamergertransactionthatattemptstomergeortakeoveranothercompanyiscalledthe

(a) targetcompany.

(b) holdingcompany.

(c) acquiringcompany.

(d) conglomerate.

Answer: C

LevelofDifficulty:1

LearningGoal:1

Topic:AcquiringCompany

7.

Thefirminamergertransactionthatisbeingpursuedasatakeoverpotentialiscalledthe

(a) acquiringcompany.

(b) targetcompany.

(c) holdingcompany.

(d) conglomerate.

Answer: B

LevelofDifficulty:1

LearningGoal:1

Topic:TargetCompany

220GitmanPrinciplesofFinance,EleventhEdition

8.

Thecombinationoftwoormorecompanieswhichresultsinoneofthecorporationshavingavoting

controlofoneormoreoftheothercompaniesisa

(a) congenericformation.

(b) consolidation.

(c) merger.

(d) holdingcompany.

Answer: D

LevelofDifficulty:1

LearningGoal:1

Topic:AcquiringCompany

9.

_________resultsfromthecombinationoffirmsinthesamelineofbusiness.

(a) Congenericgrowth

(b) Conglomeratediversification

(c) Horizontalgrowth

(d) Verticalgrowth

Answer: C

LevelofDifficulty:1

LearningGoal:1

Topic:HorizontalGrowth

10.

_________resultswhenafirmacquiresasupplieroracustomer.

(a) Congenericmerger

(b) Conglomeratemerger

(c) Horizontalmerger

(d) Verticalmerger

Answer: D

LevelofDifficulty:1

LearningGoal:1

Topic:VerticalMergers

11.

_________involvesthecombinationoffirmsinunrelatedbusinesses.

(a) Congenericmerger

(b) Conglomeratemerger

(c) Horizontalmerger

(d) Verticalmerger

Answer: B

LevelofDifficulty:1

LearningGoal:1

Topic:ConglomerateMergers

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure221

12.

Generally,acombinationoftwofirmsofunequalsizeiscalled

(a) acongenericformation.

(b) aconsolidation.

(c) amerger.

(d) aholdingcompany.

Answer: C

LevelofDifficulty:1

LearningGoal:1

Topic:Mergers

13.

Mostfirmsseekingmergerpartnerswillhiretheservicesof

(a) acommercialbanker.

(b) aninvestmentbroker.

(c) aprivatecontractor.

(d) aninvestmentbanker.

Answer: D

LevelofDifficulty:1

LearningGoal:1

Topic:InvestmentBankersRoleinMergers

14.

Thecombinationofadressmanufacturerandacreditbureauisanexampleof

(a) congenericmerger.

(b) conglomeratemerger.

(c) horizontalmerger.

(d) verticalmerger.

Answer: B

LevelofDifficulty:2

LearningGoal:1

Topic:ConglomerateMergers

15.

Greatercontrolovertheacquisitionofrawmaterialsorthedistributionoffinishedgoodsisan

economicbenefitof

(a) congenericmerger.

(b) conglomeratemerger.

(c) horizontalmerger.

(d) verticalmerger.

Answer: D

LevelofDifficulty:2

LearningGoal:1

Topic:VerticalMergers

222GitmanPrinciplesofFinance,EleventhEdition

16.

_________mayresultinexpansionofoperationsinanexistingproductlineandeliminationofa

competitor.

(a) Congenericmerger

(b) Conglomeratemerger

(c) Horizontalmerger

(d) Verticalmerger

Answer: C

LevelofDifficulty:2

LearningGoal:1

Topic:HorizontalMergers

17.

Typically,reasonsforundertakingmergersare

(a) onlyfinancial.

(b) onlystrategic.

(c) strategicorfinancial.

(d) inconflictwithwealthmaximization.

Answer: C

LevelofDifficulty:2

LearningGoal:1

Topic:MotivesforMergers

18.

Whenafirmundertakesamergerinordertoeliminateredundantfunctionsorincreasemarketshare,

thisisanexampleof

(a) financialmerger.

(b) hostiletakeover.

(c) friendlymerger.

(d) strategicmerger.

Answer: D

LevelofDifficulty:2

LearningGoal:1

Topic:StrategicMergers

19.

Whenafirmundertakesamergertoimproveitssourcesandsupplyofrawmaterials,thisisan

exampleofa

(a) financialmerger.

(b) hostiletakeover.

(c) friendlymerger.

(d) strategicmerger.

Answer: D

LevelofDifficulty:2

LearningGoal:1

Topic:StrategicMergers

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure223

20.

_________isachievedbyacquiringacompanyinthesamegeneralindustry,butneitherinthesame

lineofbusinessnorasupplieroracustomer.

(a) Congenericmerger

(b) Conglomeratemerger

(c) Horizontalmerger

(d) Verticalmerger

Answer: A

LevelofDifficulty:2

LearningGoal:1

Topic:CongenericMergers

21.

Theabilitytousethesamesalesanddistributionchannelstoreachcustomersofbothbusinessesisa

benefitof

(a) congenericmerger.

(b) conglomeratemerger.

(c) horizontalmerger.

(d) verticalmerger.

Answer: A

LevelofDifficulty:2

LearningGoal:1

Topic:CongenericMergers

22.

Oneofthekeymotivesforcombinationsisthetaxbenefitof

(a) reducingthemarginaltaxrate.

(b) takingadvantageoftheotherfirmstaxlosscarryforward.

(c) usingcapitalgains.

(d) increasingadditionalrecaptureddepreciation.

Answer: B

LevelofDifficulty:2

LearningGoal:1

Topic:MotivesforCombinations

23.

AllofthefollowingarereasonsformergersEXCEPT

(a) increasingmanagerialskills.

(b) taxconsiderations.

(c) synergism.

(d) monopolycontrolofthemarkets.

Answer: D

LevelofDifficulty:2

LearningGoal:1

Topic:MotivesforMergers

224GitmanPrinciplesofFinance,EleventhEdition

24.

A_________occurswhentheoperationsoftheacquiringandtargetfirmsarecombinedinorderto

achieveeconomiesandtherebycausetheperformanceofthemergedfirmtoexceedthatofthepre

mergedfirm.

(a) financialmerger

(b) hostiletakeover

(c) operatingmerger

(d) strategicmerger

Answer: D

LevelofDifficulty:3

LearningGoal:1

Topic:StrategicMergers

25.

AfriendlymergertransactionistypicallyconsummatedthroughallofthefollowingEXCEPT

(a) acashpurchase.

(b) anexchangeoftheacquirersstock.

(c) atenderoffer.

(d) anexchangeoftheacquirersstockandbonds.

Answer: C

LevelofDifficulty:3

LearningGoal:1

Topic:FriendlyMergers

26.

Ahostilemergeristypicallyaccomplishedthrough

(a) acashpurchase.

(b) anexchangeoftheacquirersstock.

(c) atenderoffer.

(d) anexchangeoftheacquirersstocksandbonds.

Answer: C

LevelofDifficulty:3

LearningGoal:1

Topic:HostileMergers

27.

A(n)_________isundertakenwiththegoalofrestructuringtheacquiredcompanyinorderto

improveitscashflowandunlockitshiddenvalue.

(a) operatingmerger.

(b) strategicmerger.

(c) financialmerger.

(d) hostiletakeover.

Answer: C

LevelofDifficulty:3

LearningGoal:1

Topic:FinancialMergers

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure225

28.

Amajorimpetusfuelingfinancialmergersduringthe1980swas

(a) highinterestrates.

(b) hightaxrates.

(c) highcashbalancesthatcouldbeutilizedfortakeovers.

(d) readyavailabilityofjunkbondfinancing.

Answer: D

LevelofDifficulty:3

LearningGoal:1

Topic:FinancialMergers

29.

Amergerofapapermanufacturerandaloggingcompanyisanexampleof

(a) congenericmerger.

(b) conglomeratemerger.

(c) horizontalmerger.

(d) verticalmerger.

Answer: D

LevelofDifficulty:3

LearningGoal:1

Topic:VerticalMergers

30.

Thereductionofriskresultingfromcombiningfirmswithdifferingseasonalorcyclicalpatternsof

salesorearningsisakeybenefitof

(a) congenericmerger.

(b) conglomeratemerger.

(c) horizontalmerger.

(d) verticalmerger.

Answer: B

LevelofDifficulty:3

LearningGoal:1

Topic:ConglomerateMergers

31.

Afinancialmergerisundertakentoincrease

(a) operatingefficiency,whichisusedtoincreasecashflows.

(b) cashflows,whichareusedtoincreasedividendstoshareholders.

(c) marketshare,whichisusedtomaximizeshareholderwealth.

(d) cashflows,whichareusedtoservicethedebttypicallyincurredtofinancethemerger

transaction.

Answer: D

LevelofDifficulty:4

LearningGoal:1

Topic:FinancialMergers

226GitmanPrinciplesofFinance,EleventhEdition

32.

Anattempttogaincontrolofthefirmbybuyingsufficientsharesofthetargetfirminthe

marketplaceisknownasa_________andistypicallyaccomplishedthrougha_________.

(a) friendlytakeover;tenderoffer

(b) hostiletakeover;merger

(c) friendlytakeover;merger

(d) hostiletakeover;tenderoffer

Answer: D

LevelofDifficulty:4

LearningGoal:1

Topic:TenderOffersandHostileTakeovers

33.

Amergerinvolvingthepurchaseofaspecificproductline,ratherthanthewholecompanyis

(a) anoperatingmerger.

(b) afinancialmerger.

(c) aselectivelinesmerger.

(d) avariationofthestrategicmerger.

Answer: D

LevelofDifficulty:4

LearningGoal:1

Topic:StrategicMergers

34.

Theuseofalargeamountofdebttofinancetheacquisitionofotherfirmsisa

(a) conglomeratemerger.

(b) leveragedbuyout.

(c) hostilemerger.

(d) congenericbuyout.

Answer: B

LevelofDifficulty:1

LearningGoal:2

Topic:LeveragedBuyouts

35.

Theacquisitionofacashrichcompanyallowstheacquiringcompany

(a) toreapgreatertaxbenefits.

(b) toreduceleverageandtoincreaseborrowingpower.

(c) todevelopbettermanagers.

(d) toachieveeconomiesofscaleinsomephaseofthebusiness.

Answer: B

LevelofDifficulty:1

LearningGoal:2

Topic:MotivesforAcquisitions

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure227

36.

Thesaleofaunitofafirmtoexistingmanagementisoftenachievedthrough

(a) alimitedpartnership.

(b) aleveragedbuyout.

(c) anemployeestockoption.

(d) acashexchange.

Answer: B

LevelofDifficulty:1

LearningGoal:2

Topic:LeveragedBuyouts

37.

Thesellingofsomeofafirmsassetsiscalled

(a) businessfailure.

(b) verticalsegmentation.

(c) reversemerger.

(d) divestiture.

Answer: D

LevelofDifficulty:1

LearningGoal:2

Topic:Divestitures

38.

Adivestiturewhichresultsinanoperatingunitbecominganindependentcompanyisa

(a) saleofalineofbusiness.

(b) saleofaunittoexistingmanagement.

(c) spinoffofanoperatingunit.

(d) leveragedbuyout.

Answer: C

LevelofDifficulty:2

LearningGoal:2

Topic:SpinOffDivestitures

39.

ThegoalsofdivestitureincludeallofthefollowingEXCEPT

(a) raisingfunds.

(b) focusingoperations.

(c) enhancingprofitability.

(d) expandingoperations.

Answer: D

LevelofDifficulty:2

LearningGoal:2

Topic:GoalsofDivestitures

228GitmanPrinciplesofFinance,EleventhEdition

40.

Aformofdivestitureinwhichanoperatingunitbecomesanindependentcompanybyissuingshares

initonaproratabasistotheparentcompanysshareholdersiscalled

(a) leveragebuyout.

(b) employeestockoption.

(c) spinoff.

(d) merger.

Answer: C

LevelofDifficulty:2

LearningGoal:2

Topic:SpinOffDivestitures

41.

Aspinoffresultsinthedivestedunit

(a) beingsoldtoexistingmanagementresultinginnewowners.

(b) becominganindependentcompanywithnewowners.

(c) becominganindependentcompanywiththesameownersastheparentcompany.

(d) beingmanagedindependently,butstillundertheownershipoftheparentcompany.

Answer: C

LevelofDifficulty:3

LearningGoal:2

Topic:SpinOffDivestitures

42.

Theresultofspinofftotheparentcompanyis

(a) additionalstocktotheparent.

(b) additionalcashfromthesale.

(c) additionaldebtbytheparent.

(d) noadditionalcashorstocktotheparent.

Answer: D

LevelofDifficulty:3

LearningGoal:2

Topic:SpinOffDivestitures

43.

A_________isamethodofstructuringafinancialmerger,whereasa_________involvesthesale

ofthefirmsassets.

(a) leveragedbuyout;bankruptcy

(b) congenericbuyout;divestiture

(c) horizontalmerger;leverageddivestiture

(d) leveragedbuyout;divestiture

Answer: D

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure229

44.

Leveragedbuyoutsareclearexamplesof

(a) strategicmergers.

(b) verticalmergers.

(c) financialmergers.

(d) congenericmergers.

Answer: C

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

45.

Thecreationofahighdebt,privatecorporationwithimprovedcashflowandvalueisthegoalin

(a) issuingjunkbonds.

(b) afinancialmerger.

(c) aconglomeratemerger.

(d) aleveragedbuyout.

Answer: D

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

46.

Typicallyinaleveragedbuyoutapproximately_________percent(ifnotmore)ofthepurchase

priceisfinancedwithdebt.

(a) 30

(b) 50

(c) 70

(d) 90

Answer: D

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

47.

Anattractivecandidateforacquisitionthroughaleveragedbuyoutshouldpossessallofthe

followingcharacteristicsEXCEPT

(a) asolidprofithistoryandreasonableexpectationsforgrowth.

(b) lowfixedassets.

(c) alowlevelofdebt.

(d) stableandpredictablecashflows.

Answer: B

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

230GitmanPrinciplesofFinance,EleventhEdition

48.

Aleveragedbuyoutneedstobecarriedoutthrough

(a) ahostiletakeover.

(b) afriendlymerger.

(c) averticalmerger.

(d) aconglomeratemerger.

Answer: B

LevelofDifficulty:3

LearningGoal:2

Topic:LeveragedBuyouts

49.

ThemotivefordivestitureislikelytobeallofthefollowingEXCEPT

(a) togeneratecashforexpansionofotherproductlines.

(b) togetridofpoorlyperformingoperations.

(c) toheadoffbankruptcy.

(d) tostreamlinethecorporation.

Answer: C

LevelofDifficulty:3

LearningGoal:2

Topic:MotivesforDivestitures

50.

Anattractivecandidateforacquisitionthroughleveragedbuyoutshouldpossesswhichofthe

followingcharacteristics?

(a) Agoodpositioninitsindustrywithasolidprofithistoryandreasonableexpectationsofgrowth.

(b) Arelativelylowlevelofdebt.

(c) Arelativelyhighlevelofbankableassetsthatcanbeusedasloancollateral.

(d) Stableandpredictablecashflowsthatareadequatetomeetinterestandprincipalpaymentson

thedebtandprovideadequateworkingcapital.

(e) Alloftheabove.

Answer: E

LevelofDifficulty:4

LearningGoal:2

Topic:LeveragedBuyouts

51.

Cashacquisitionsofgoingconcernsarebestanalyzedusing

(a) aninvestmentopportunityschedule.

(b) ratioanalysis.

(c) capitalbudgetingtechniques.

(d) theweightedmarginalcostofcapitaltheory.

Answer: C

LevelofDifficulty:1

LearningGoal:3

Topic:AcquisitionAnalysis

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure231

52.

Normally,theacquiringfirmpaysapricethatisapremiumabovethemarketpriceoftheacquired

firm.Thismeansthattheratioofexchangeinmarketpriceis

(a) alwayslessthan1.

(b) alwaysgreaterthan1.

(c) usuallynegative.

(d) equalto1.

Answer: B

LevelofDifficulty:2

LearningGoal:3

Topic:AcquisitionAnalysisandtheRatioofExchange

53.

MarketingConcepts,Inc.isconsideringtheacquisitionofManagementTheories,Inc.atacashprice

of$1.5million.ManagementTheories,Inc.hasshorttermliabilitiesof$500,000.Asaresultof

acquiringManagementTheories,Inc.,MarketingConcepts,Inc.wouldacquirethecopyrightstoa

nationalbestsellerwhichwouldprovideanestimatedcashflowof$300,000forthenextfiveyears.

Thefirmhasacostofcapitalof20percent.Theapproximatenetpresentvalueofthisacquisitionis

(a) $500,000.

(b) $480,800.

(c) $102,700.

(d) $1,102,700.

Answer: D

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysis

54.

Theactualratioofexchangeinastockexchangeacquisitionistheratioofthe

(a) amountpaidpershareofthetargetcompanytothepersharebookvalueoftheacquiringfirm.

(b) bookvaluepershareofthetargetcompanytothepersharemarketpriceoftheacquiringfirm.

(c) marketvaluepershareofthetargetcompanytothepersharemarketpriceoftheacquiringfirm.

(d) amountpaidpershareofthetargetcompanytothepersharemarketpriceoftheacquiringfirm.

Answer: D

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandtheRatioofExchange

232GitmanPrinciplesofFinance,EleventhEdition

55.

Whentheratioofexchangeinamergerisequaltooneandboththeacquiringandthetarget

companieshavethesamepremergerearningspershare,themergedfirmsearningspersharewill

initially

(a) decline.

(b) remainconstant.

(c) increase.

(d) droptozero.

Answer: B

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandtheRatioofExchange

56.

Whentheratioofexchangeinamergerisequaltooneandboththeacquiringandthetarget

companieshavethesamepremergerearningspershare,boththeacquiringandthetargetcompanies

havethesame

(a) debtratio.

(b) bookvaluepershare.

(c) returnonequity.

(d) PEratio.

Answer: D

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandtheRatioofExchange

57.

IfthePEpaidisgreaterthanthePEoftheacquiringcompany,theeffectontheearningspershare

oftheacquiredcompanywillbe

(a) positive.

(b) neutral.

(c) negative.

(d) uncorrelated.

Answer: A

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandthePERatio

58.

IfthePEpaidisequaltothePEoftheacquiringcompany,theeffectontheearningspershareof

theacquiredcompanywillbe

(a) positive.

(b) neutral.

(c) negative.

(d) uncorrelated.

Answer: B

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandthePERatio

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure233

59.

IfthePEpaidislessthanthePEoftheacquiringcompany,theeffectontheearningspershareof

theacquiredcompanywillbe

(a) positive.

(b) neutral.

(c) negative.

(d) uncorrelated.

Answer: C

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandthePERatio

60.

Theoverridinggoalformergingisto

(a) increasecashflows.

(b) maximizeshareholderwealthasreflectedintheacquirersshareprice.

(c) maximizeshareholderwealthasreflectedinthesharepriceofthetargetfirm.

(d) maximizeoperatingefficiency.

Answer: B

LevelofDifficulty:3

LearningGoal:3

Topic:MotivesforMerging

61.

Whenmakingacashacquisitionofagoingconcern,theacquiringcorporationmustbecertain

(a) toadjustaftertaxcashflows.

(b) torecognizedifferentaccountingtechniques.

(c) toadjustthediscountrateforriskdifferences.

(d) toconsidertheproblemsofassimilatingtheacquiredmanagement.

Answer: C

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysis

62.

Thelongruneffectontheearningspershareofthemergedfirmdependslargelyon

(a)

(b)

(c)

(d)

thepremergerPEratio.

theratioofexchange.

thesynergyofthemergedfirm.

thetaxconsiderations.

Answer: C

LevelofDifficulty:3

LearningGoal:3

Topic:MotivationforMerging

234GitmanPrinciplesofFinance,EleventhEdition

63.

Firmatron,Inc.isevaluatingtheacquisitionofHealthoMatic,Inc.,whichhadalosscarryforward

of$3.75million,resultingfromearlieroperations.FirmatroncanpurchaseHealthoMaticfor$4.5

millionandliquidatetheassetsfor$3.25million.Firmatronexpectsearningsbeforetaxesinthe

threeyearsfollowingtheacquisitiontobeasfollows:

Year

1

2

3

EarningsbeforeTaxes

$1,270,000

1,662,400

1,275,000

(Theseearningsareassumedtofallwithintheannuallimitlegallyallowedforapplicationofatax

losscarryforwardresultingfromtheproposedacquisition.)Firmatronhasa40percenttaxrateanda

costofcapitalof15percent.TheapproximatemaximumcashpriceFirmatronwouldbewillingto

payforHealthoMaticis

(a) $4,750,000.

(b) $4,500,000.

(c) $4,410,000.

(d) $3,750,000.

Answer: C

LevelofDifficulty:4

LearningGoal:3

Topic:AcquisitionAnalysisandTaxLossCarryforward

64.

Maxi,Inc.isevaluatingtheacquisitionofMini,Inc.,whichhadalosscarryforwardof$2.75million

whichresultedfromearlieroperations.MaxicanpurchaseMinifor$3.5millionandliquidatethe

assetsfor$1.25million.Maxiexpectsearningsbeforetaxesinthethreeyearsfollowingthe

acquisitiontobeasfollows:

Year

1

2

3

EarningsbeforeTaxes

$800,000

850,000

900,000

(Theseearningsareassumedtofallwithinthelimitlegallyallowedforapplicationofataxloss

carryforwardresultingfromtheproposedacquisition.)Maxihasa40percenttaxrateandacostof

capitalof10percent.Thetotalpresentvalueoftaxadvantageoftheacquisitioninthefollowing

threeyearsis

(a) $440,000.

(b) $842,000.

(c) $1.1million.

(d) $2.75million.

Answer: B

LevelofDifficulty:4

LearningGoal:3

Topic:AcquisitionAnalysisandTaxLossCarryforward

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure235

65.

Aformalproposaltopurchaseagivennumberofsharesofafirmsstockataspecifiedpriceisa

(a) warrant.

(b) stockpurchaseoption.

(c) right.

(d) tenderoffer.

Answer: D

LevelofDifficulty:1

LearningGoal:4

Topic:TenderOffers

66.

Thestakeholdersintargetedtakeovercompaniesincludethe

(a) customers.

(b) creditors.

(c) employees.

(d) stockholders.

(e) alloftheabove.

Answer: E

LevelofDifficulty:1

LearningGoal:4

Topic:Stakeholders

67.

Theprimaryadvantageofaholdingcompany,thatpermit(s)thefirmtocontrolalargeamountof

assetswitharelativelysmalldollarinvestmentisknownas

(a) theleverageeffect.

(b) taxeffects.

(c) administrativecosts.

(d) riskprotection.

Answer: A

LevelofDifficulty:1

LearningGoal:4

Topic:AdvantagesofHoldingCompanies

68.

AllofthefollowingaredisadvantagesofholdingcompaniesEXCEPT

(a) increasedrisk.

(b) doubletaxation.

(c) highcostofadministration.

(d) legalresponsibilityforsubsidiaries.

Answer: D

LevelofDifficulty:1

LearningGoal:4

Topic:DisadvantagesofHoldingCompanies

236GitmanPrinciplesofFinance,EleventhEdition

69.

Mostfirmsseekingmergerpartnerswillhiretheservicesof

(a) acommercialbanker.

(b) aninvestmentbroker.

(c) aprivatecontractor.

(d) aninvestmentbanker.

Answer: D

LevelofDifficulty:1

LearningGoal:4

Topic:InvestmentBankersRoleinMergers

70.

AllofthefollowingmaybetrueabouttenderoffersEXCEPT

(a) theymayaddpressuretoexistingmergernegotiations.

(b) managementhastheexclusiverighttoaccepttheoffer.

(c) defensivetacticsmaybetakentowardofftheoffer.

(d) theymaybemadewithoutwarningasanabruptattemptatacorporatetakeover.

Answer: B

LevelofDifficulty:3

LearningGoal:4

Topic:TenderOffers

71.

Indefendingagainstahostiletakeover,thestrategythatinvolvesthetargetfirmfindingamore

suitableacquirerandpromptingittocompetewiththeinitialhostileacquirertotakeoverthefirmis

calledthe_________strategy.

(a) poisonpill

(b) whiteknight

(c) goldenparachute

(d) greenmail

Answer: B

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

72.

Indefendingagainstahostiletakeover,thestrategythatinvolvesthetargetfirmcreatingsecurities

thatgivetheirholderscertainrightsthatbecomeeffectivewhenatakeoverisattemptediscalledthe

_________strategy.

(a) sharkrepellent

(b) greenmail

(c) poisonpill

(d) goldenparachute

Answer: C

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure237

73.

Indefendingagainstahostiletakeover,thestrategythatinvolvesthefirmrepurchasingthrough

negotiationalargeblockofstockatapremiumfromoneormoreshareholdersinordertoendthose

shareholdershostiletakeoverattemptisknownasthe_________strategy.

(a) poisonpill

(b) greenmail

(c) goldenparachute

(d) sharkrepellent

Answer: B

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

74.

Indefendingagainstahostiletakeover,thestrategyinvolvingthepaymentofalarge,debtfinanced,

cashdividendisthe_________strategy.

(a) sharkrepellent

(b) goldenparachute

(c) leveragedrecapitalization

(d) whiteknight

Answer: C

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

75.

Indefendingagainsthostiletakeoverattempts,acompanywillincludeprovisionsinthe

employmentcontractsofkeyexecutivesthatprovidethemwithsizablecompensationifthefirmis

takenover.Thisiscalledthe_________strategy.

(a) sharkrepellent

(b) whiteknight

(c) greenmail

(d) goldenparachute

Answer: D

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

76.

Indefendingagainsthostiletakeoverattempts,acompanywillapproveantitakeoveramendments

tothecorporatecharterthatconstrainthefirmsabilitytotransfermanagerialcontrolofthefirmasa

resultofamerger.Thisiscalledthe_________strategy.

(a) goldenparachute

(b) greenmail

(c) poisonpill

(d) sharkrepellent

Answer: D

LevelofDifficulty:3

LearningGoal:4

Topic:HostileTakeoverDefenseStrategies

238GitmanPrinciplesofFinance,EleventhEdition

77.

Akeyconsiderationintheholdingcompanydecisionis

(a) theriskreturntradeoffduetotheleverageeffect.

(b) thegreaterdistancebetweentoplevelandoperatingmanagement.

(c) theriskofthedominoeffectifonecompanyintheholdingcompanyfails.

(d) theriskfromtheseparatecompaniesintheholdingcompanybeingclassedasonecompany.

Answer: A

LevelofDifficulty:3

LearningGoal:4

Topic:AdvantagesofHoldingCompanies

78.

AllofthefollowingareadvantagesofholdingcompaniesEXCEPT

(a) possiblestatetaxbenefitsrealizedbyeachsubsidiaryinitsstateofincorporation.

(b) sinceeachsubsidiaryisaseparatecorporation,thefailureofonecompanyshouldcostthe

holdingcompanynomorethanitsinvestmentinthatsubsidiary.

(c) reducedfederalcorporatetaxesduetotheholdingcompanystatus.

(d) lawsuitsorlegalactionsagainstasubsidiarywillnotthreatentheremainingcompanies.

Answer: C

LevelofDifficulty:3

LearningGoal:4

Topic:AdvantagesofHoldingCompanies

79.

BusinessfailuremaybecausedbyallofthefollowingEXCEPT

(a) lowornegativereturns.

(b) technicalinsolvency.

(c) bookvalueofassetsthatexceedliabilities.

(d) liabilitiesthatexceedmarketvalueofassets.

Answer: C

LevelofDifficulty:1

LearningGoal:5

Topic:CausesofBusinessFailure

80.

BusinessfailuremaybecausedbyallofthefollowingEXCEPT

(a) corporatematurity.

(b) mismanagement.

(c) economicdownturns.

(d) increasingliquidity.

Answer: D

LevelofDifficulty:1

LearningGoal:5

Topic:CausesofBusinessFailure

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure239

81.

_________isanarrangementinitiatedbythedebtorfirmtonegotiatewiththecreditorsaboutaplan

forsustainingorliquidatingthefirm.

(a) Aninvoluntaryreorganization

(b) Aninvoluntaryliquidation

(c) AfilingofChapterSevenoftheBankruptcyReformActof1978

(d) Avoluntarysettlement

Answer: D

LevelofDifficulty:1

LearningGoal:5

Topic:VoluntarySettlements

82.

_________isanarrangementwherebythefirmscreditorsreceivefullpayment,althoughnot

immediately.

(a) Acomposition

(b) Acreditorcontrolagreement

(c) Anextension

(d) Aliquidation

Answer: C

LevelofDifficulty:1

LearningGoal:5

Topic:ExtensionsinVoluntarySettlements

83.

_________isaproratacashsettlementofcreditorclaims.

(a) Acomposition

(b) Acreditorcontrolagreement

(c) Anextension

(d) Aliquidation

Answer: A

LevelofDifficulty:1

LearningGoal:5

Topic:CompositionsinVoluntarySettlements

84.

_________mayreplacetheoperatingmanagementwithaselectedcreditor.

(a) Acomposition

(b) Acreditorcontrolagreement

(c) Anextension

(d) Aliquidation

Answer: B

LevelofDifficulty:1

LearningGoal:5

Topic:CreditorControlAgreementsinVoluntarySettlements

240GitmanPrinciplesofFinance,EleventhEdition

85.

Inavoluntarysettlement,eachcreditorwillbepaid20centsonthedollarin120days.The

remaining80centsonthedollarwillbepaidwithinanadditional60days.Thisisanexampleof

(a) acomposition.

(b) acombinationofacompositionandextension.

(c) anextension.

(d) aliquidation.

Answer: C

LevelofDifficulty:3

LearningGoal:5

Topic:ExtensionsinVoluntarySettlements

86.

Inavoluntarysettlement,eachcreditorwillbepaidonly45centsonthedollarimmediately.Thisis

anexampleof

(a) acomposition.

(b) acombinationofacompositionandextension.

(c) anextension.

(d) aliquidation.

Answer: A

LevelofDifficulty:1

LearningGoal:5

Topic:CompositionsinVoluntarySettlements

87.

Inavoluntarysettlement,onegroupofcreditorshavingclaimsof$1,000,000willbeimmediately

paid95centsonthedollar.Theremainderofthecreditorswillpostponepaymentanadditional

60days.Thisisanexampleof

(a) acomposition.

(b) acombinationofacompositionandextension.

(c) anextension.

(d) aliquidation.

Answer: B

LevelofDifficulty:3

LearningGoal:5

Topic:CompositionsandExtensionsinVoluntarySettlements

88.

In_________,anassignmentmaybemadebythecreditorstoathirdpartywhothenhasthepower

toliquidatethefirmsassets.

(a) avoluntaryprivateliquidation

(b) aninvoluntaryprivateliquidation

(c) aninvoluntaryliquidationunderChapterSevenoftheBankruptcyReformActof1978

(d) avoluntaryliquidationunderChapterSevenoftheBankruptcyReformActof1978

Answer: A

LevelofDifficulty:3

LearningGoal:5

Topic:VoluntaryPrivateLiquidations

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure241

89.

AreorganizationplanmustmeetallofthefollowingcriteriaEXCEPT

(a) itmustbefairandequitable.

(b) itmustbefeasible.

(c) itmaintainstheprioritiesofthecontractualclaimsofallparties.

(d) themarketvalueofthefirmsassetsmustexceedthestatedliabilities.

Answer: D

LevelofDifficulty:2

LearningGoal:6

Topic:ReorganizationPlans

90.

Aninvoluntarypetitionforreorganizationmaybefiledagainstafirmifanyoneofthefollowing

conditionsaremetEXCEPT

(a) thebookvalueofthefirmsassetsislessthanthestatedliabilities.

(b) pastduedebtsof$5,000ormore.

(c) threeormorecreditorswhocanproveaggregateclaimsof$5,000againstthefirm.

(d) insolvency.

Answer: A

LevelofDifficulty:3

LearningGoal:6

Topic:InvoluntaryReorganizationinChapter11Bankruptcy

91.

TheresponsibilitiesofthedebtorinpossessionincludeallofthefollowingEXCEPT

(a) thevaluationofthefirmasagoingconcern.

(b) drawingupaplanofreorganization.

(c) recommendingarecapitalizationplan.

(d) liquidatingtheassetsofthefirm.

Answer: D

LevelofDifficulty:3

LearningGoal:6

Topic:DebtorinPossessioninChapter11Bankruptcy

92.

Animportantaspectofthefirmsreorganizationplanistherecapitalizationofthefirmscapital

structure.ThegoalofrestructuringthefirmsdebtincludesallofthefollowingEXCEPT

(a) providingareasonablelevelofearningsfortheowners.

(b) exchangingdebtforequity.

(c) reducingthefixedpaymentobligations.

(d) decreasingthetimesinterestearnedratio.

Answer: D

LevelofDifficulty:3

LearningGoal:6

Topic:RecapitalizationinChapter11Bankruptcy

242GitmanPrinciplesofFinance,EleventhEdition

93.

ThepriorityofclaimsestablishedbyChapterSevenoftheBankruptcyReformActof1978gives

priorityto

(a) unpaidemployeebenefitplancontributionsoverunsecuredcustomerdeposits.

(b) commonstockholdersovertaxes.

(c) taxesoverexpensesofadministeringthebankruptcy.

(d) preferredstockholdersoverclaimsofsecuredcreditors.

Answer: A

LevelofDifficulty:3

LearningGoal:6

Topic:PriorityofClaimsinChapter7Bankruptcy

94.

ThepriorityofclaimsestablishedbyChapterSevenoftheBankruptcyReformActof1978gives

prioritytoclaimsof

(a) unsecuredcreditorsoverclaimsofsecuredcreditors.

(b) preferredstockholdersoverclaimsofunsecuredcreditors.

(c) wagespayableoverclaimsofunsecuredcreditors.

(d) farmersingrainstorageoverexpensesofadministeringthebankruptcy.

Answer: C

LevelofDifficulty:3

LearningGoal:6

Topic:PriorityofClaimsinChapter7Bankruptcy

95.

WhiteandWong,Inc.recentlyhashadfinancialdifficultyandisbeingliquidatedbytheFederal

BankruptcyCourt.Thefirmhasaliquidationvalueof$1,000,000$400,000fromthefixedassets

thatservedascollateralforthemortgagebondsand$600,000fromallotherassets(allpriorclaims

havebeensatisfied).Thefirmscurrentcapitalstructureisasfollows:

SourceofCapital

Unsecuredbonds

Mortgagebonds

Preferredstock

Commonstock

Amount

$500,000

400,000

100,000

500,000

Thecommonstockholderswillreceive_________intheliquidation.

(a) $500,000

(b) $333,333

(c) $198,000

(d) $0

Answer: D

LevelofDifficulty:4

LearningGoal:6

Topic:Chapter7BankruptcyAnalysis

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure243

96.

TangshanMiningisconsideringtheacquisitionofZhengsenMiningatacashpriceof$6,000,000.

TheprimarymotivationforTangshanspurchaseofZhengsenisforaspecialpieceofdrilling

equipmentthatitbelieveswillgenerateaftertaxcashflowsif$2,000,000peryearduringthenext

5years.ZhengsenMininghasliabilitiesof$9,000,000andTangshanestimatesthatitcansellthe

remainingassets$6,500,000.Tangshanwillusea15percentcostofcapitalforevaluatingthe

acquisition.Basedonthisinformation,whatisthenetvalueofthespecialdrillingequipment?

(a) $1,795,690

(b) $1,500,000

(c) ($1,795,690)

(d) ($1,500,000)

Answer: C

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysis

97.

TangshanMiningisconsideringtheacquisitionofZhengsenMiningatacashpriceof$6,000,000.

TheprimarymotivationforTangshanspurchaseofZhengsenisforaspecialpieceofdrilling

equipmentthatitbelieveswillgenerateaftertaxcashflowsof$2,000,000peryearduringthenext

5years.ZhengsenMininghasliabilitiesof$9,000,000andTangshanestimatesthatitcansellthe

remainingassets$6,500,000.Tangshanwillusea15percentcostofcapitalforevaluatingthe

acquisition.Basedonthisinformation,whatisthenetvalueofthespecialdrillingequipment?

CalculatethenetvalueofasecondalternativethatwouldallowTangshantopurchaseabetter

qualityassetfor$12,000,000thatwouldprovidea$2,600,000inaftertaxinflowsforthenext5

years.Whichalternativewouldyouchoose?

(a) $1,795,690,$3,284,396,both

(b) $1,500,000,$4,500,000,both

(c) ($1,795,690),($3,284,396),neither

(d) ($1,795,690),($4,500,000),neither

Answer: C

LevelofDifficulty:4

LearningGoal:3

Topic:AcquisitionAnalysis

244GitmanPrinciplesofFinance,EleventhEdition

98.

TangshanMiningisattemptingtoacquireZhengsenMining.Selectedfinancialdataispresentedfor

bothcompaniesinthetablebelow:

Item

Earningsavailableforcommonstock

Numberofsharesofstockoutstanding

Marketpricepershare

TangshanMining

$100,000

100,000

$60

ZhengsenMining

$40,000

20,000

$120

TangshanMininghassufficientauthorizedbutunissuedsharestocarryouttheproposedmerger.If

theratioofexchangeis1.8,whatwillbetheEPSofthemergedfirm?

(a) $1.00

(b) $1.029

(c) $1.078

(d) $2.00

Answer: B

LevelofDifficulty:4

LearningGoal:3

Topic:RatioofExchangeandEPS

99.

KeyadvantagesofholdingcompaniesincludeallofthefollowingEXCEPT

(a) theypermitafirmtocontrolalargeamountofassetswithrelativelysmalldollarinvestment.

(b) theyhelpintermsofriskprotectionbecausethefailureofoneofthecompaniesdoesnotresult

inthefailureoftheentirefirm.

(c) lawsuitsorlegalactionsagainstasubsidiarydonotthreatentheremainingcompanies.

(d) Alloftheaboveareadvantages.

Answer: D

LevelofDifficulty:2

LearningGoal:4

Topic:AdvantagesofHoldingCompanies

100. KeydisadvantagesofholdingcompaniesincludeallofthefollowingEXCEPT

(a) theyresultinincreasedriskbecauseoftheleverageeffect.

(b) theyresultintripletaxation.

(c) theyaredifficulttoanalyze.

(d) theyarecostlytoadminister.

Answer: B

LevelofDifficulty:2

LearningGoal:4

Topic:DisadvantagesofHoldingCompanies

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure245

.4

Essay Questions

1.

BakersOvenManufacturingisevaluatingtheacquisitionofCuisinaireKitchenApplianceCo.

Cuisinairehasalosscarryforwardof$1.5millionwhichresultedfromearlieroperations.Bakers

OvencanpurchaseCuisinairefor$1.8millionandliquidatetheassetsfor$1.3million.Bakers

Ovenexpectsearningsbeforetaxesinthefiveyearsfollowingtheacquisitiontobeasfollows:

Year

1

2

3

4

5

EarningsbeforeTaxes

$108,000

288,000

324,000

425,000

425,000

(Theseearningsareassumedtofallwithintheannuallimitlegallyallowedforapplicationofthetax

losscarryforwardresultingfromtheproposedacquisition.)BakersOvenisinthe40percenttax

bracketandhasacostofcapitalof17percent.

(a) WhatisthetaxadvantageoftheacquisitioneachyearforBakersOven?

(b) WhatisthemaximumcashpriceBakersOvenwouldbewillingtopayforCuisinaire?

(c) Doyourecommendtheacquisition?Whyorwhynot?

Answers:

Year EarningsbeforeTaxes

1

$0

2

0

3

0

4

0

5

70,000

Taxes

0

0

0

0

28,000

TaxRelief

$43,200

115,200

129,600

170,000

142,000

Totaltaxrelief$1,500,0000.40$600,000

(b)

Year

1

2

3

4

5

TotalPVoftaxbenefits

TaxBenefit

$43,200

115,200

129,600

170,000

142,000

Liquidationvalueofassets

PVoftaxbenefits

MaximumPrice

PVIF,17%,n

0.855

0.731

0.624

0.534

0.456

$36,936

84,211

80,870

90,780

64,752

$357,549

$1,300,000

357,549

$1,657,549

(c) No,thePVofthebenefitsislessthanthepurchasepriceoftheacquisition

($1.8million).

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysisandTaxLossCarryforward

246GitmanPrinciplesofFinance,EleventhEdition

2.

GeneralElectronics,Inc.isconsideringtheacquisitionofDatamatic,Inc.atacashpriceof

$5,000,000.Datamatic,Inc.hasshorttermliabilitiesof$1,500,000.Asaresultofacquiring

Datamatic,Inc.,GeneralElectronicswouldalsoacquirerightstoonemajorpatentwhichwould

provideanestimatedcashinflowof$1,800,000peryearforthenexteightyears.Thefirmhasacost

ofcapitalof12percent.Wouldyourecommendthecashacquisition?

Answer:

PVIF,12%,n

CFO($5,000,000)

CF1($1,500,000)*$1,800,000

CF28$1,800,000

0.893

(4.9680.893)

PVofCF

($5,000,000)

267,900

7,335,000

NPV$2,602,900

*AssumedshorttermliabilitieswerepaidoffinfirstyearsincetheNPV>0,theGeneral

ElectronicsshouldacquireDatamatic,Inc.

LevelofDifficulty:3

LearningGoal:3

Topic:AcquisitionAnalysis

3.

HolidayTanningSystemshasanestimatedliquidationvalue(afterallpriorclaimshavebeen

satisfied)of$3,000,000;$1,500,000fromfixedassetsand$1,500,000fromcurrentassets.The

firmsvalueasagoingconcernis$4,000,000.Thefirmscurrentcapitalstructureisasfollows:

Debentures

$5,000,000

Mortgagebonds*

2,000,000

Preferredstock

1,000,000

Commonstock

4,000,000

Total

$12,000,000

*Securedbyfixedassets.

Prepareatableindicatingtheamount,ifany,tobedistributedtoeachclaimant,intheeventof

liquidation.

Chapter17Mergers,LBOs,Divestitures,andBusinessFailure247

Answer:

SourceofCapital

Debentures55.5($1,500,000)

Mortgagebonds0.55.5($1,500,000)$1,500,000**

Preferredstock

Commonstock

Claim

$1,363,636

1,636,364

0

0

Afterpaymenttothemortgagebondholdersfromthe$1,500,000proceedsfromthesaleof

thefixedassets,theremainingdebtis($7,000,0001,500,000)$5,500,000.

**Mortgagebondreceives$1,500,000fromfixedassetsliquidationandthenjoins

liquidationasageneralcreditor.

LevelofDifficulty:4

LearningGoal:5

Topic:Chapter7BankruptcyAnalysis

4.

Afirmscurrentstructureisasfollows:

Debentures

$5,000,000

Mortgagebonds*

2,000,000

Preferredstock

1,000,000

Commonstock

4,000,000

Total

$12,000,000

*Securedbyfixedassets.

Suggestarecapitalizedcapitalstructurethatwouldreducethedebtequityratio(severalsolutionsare

feasible).Calculatethederatiofortheprereorganizationcapitalstructureandthepost

reorganizationcapitalstructure.

Answer: Asuggestedrecapitalizationplan:

Debentures

Mortgagebonds

Preferredstock

Commonstock

5,000,000

2,000,000

1,000,000

4,000,000

Debentures

Mortgagebonds

Incomebonds

Preferredstock

Commonstock

12,000,000

DE1.40

1,500,000

500,000

500,000

500,000

1,000,000

4,000,000

DE1.00*

*Incomebonds,preferredstockandcommonstockareincludedinstockholdersequity.

LevelofDifficulty:4

LearningGoal:6

Topic:Chapter11BankruptcyAnalysisandRecapitalization

248GitmanPrinciplesofFinance,EleventhEdition

5.

TangshanMiningisattemptingtoacquireZhengsenMining.Selectedfinancialdataispresentedfor

bothcompaniesinthetablebelow:

Item

Earningsavailableforcommonstock

Numberofsharesofstockoutstanding

Marketpricepershare

TangshanMining

$10,000,000

1,000,000

$100

ZhengsenMining

$1,000,000

50,000

$120

TangshanMininghassufficientauthorizedbutunissuedsharestocarryouttheproposedmerger.

(a) CalculatetheEPSofTangshanMiningandZhengsenMiningbeforethemerger.

(b) Iftheratioofexchangeis1.8,whatwillbetheearningspershareofthemergedcompany?

(c) Repeatpart(a)iftheratioofexchangeis2.0.

(d) Repeatpart(a)iftheratioofexchangeis2.2

(e) discusstheprincipalillustratedbyyouranswerstoparts(a)through(d)

Answers:

(a) Priortothemerger,theEPSofTangshanis$10.00andtheEPSofZhengsenis$20.

(b) Iftheratioofexchangeis1.8,thenTangshanwillgiveZhengsen1.8ofitssharesfor

Zhengsens50,000sharesor90,000shares.Thecombinedearningsofthetwo

companiesare$11,000,000.ThetotalnumberofsharesofTangshanwillnowbe

1,090,000.Therefore,EPSforthecombinedcompanywillbe$11,000,000

1,090,000$10.09.

(c) Iftheratioofexchangeis2.0,thenTangshanwillgiveZhengsen2.0ofitssharesfor

Zhengsens50,000sharesor1,090,000shares.Thecombinedearningsofthetwo

companiesare$11,000,000.ThetotalnumberofsharesofTangshanwillnowbe

1,100,000.Therefore,EPSforthecombinedcompanywillbe$11,000,000

1,100,000$10.00.ThisisthesamevalueforTangshanasbeforethemerger.

(d) Iftheratioofexchangeis2.2,thenTangshanwillgiveZhengsen2.2ofitssharesfor

Zhengsens50,000sharesor110,000shares.Thecombinedearningsofthetwo

companiesare$11,000,000.ThetotalnumberofsharesofTangshanwillnowbe

1,110,000.Therefore,EPSforthecombinedcompanywillbe$11,000,000

1,110,000$9.91.

(e) Thisshowsthatthegreatertheratioofexchange,thelowerwillbetheEPSofthe

combinedfirmafterthemerger.

LevelofDifficulty:4

LearningGoal:3

Topic:RatioofExchangeandEPS

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Problem and Its BackgroundDocument33 pagesThe Problem and Its BackgroundJamillePas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

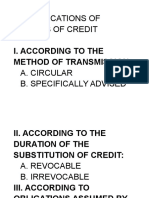

- Classifications of Letters of Credit: I. According To The Method of TransmissionDocument4 pagesClassifications of Letters of Credit: I. According To The Method of TransmissionJamillePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Good Housekeeping & TQMDocument3 pagesGood Housekeeping & TQMJamille50% (2)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Chapter 7Document7 pagesChapter 7JamillePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Assessment On Philippine National Railway For System Efficiency, Service Improvements and Future DevelopmentsDocument1 pageAssessment On Philippine National Railway For System Efficiency, Service Improvements and Future DevelopmentsJamillePas encore d'évaluation

- Communication IsDocument3 pagesCommunication IsJamillePas encore d'évaluation

- The Communication Noise ModelDocument2 pagesThe Communication Noise ModelJamillePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- WorldCom Was Founded in 1983 As Long Distance Discount Services PDFDocument3 pagesWorldCom Was Founded in 1983 As Long Distance Discount Services PDFJamillePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Pakistan 3Document26 pagesPakistan 3syedqamarPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Working Capital FinancingDocument11 pagesWorking Capital FinancingShaRiq KhAnPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- General Banking Activities of EXIM Bank LTDDocument18 pagesGeneral Banking Activities of EXIM Bank LTDtarique al ziad100% (1)

- Bil Tee - Harsh VirkDocument18 pagesBil Tee - Harsh Virkharsh virkPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Acknowledgement of DebtDocument2 pagesAcknowledgement of DebttaskforcestfPas encore d'évaluation

- University Tower Sample ComputationDocument4 pagesUniversity Tower Sample ComputationDexter AlilinPas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- HDFC Mukesh Statement Jan 2017Document2 pagesHDFC Mukesh Statement Jan 2017MEEN SPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Digital Wallet Platform in Europe PDFDocument2 pagesDigital Wallet Platform in Europe PDFAnand KrishnaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- A Case Study in Ethical Approaches To BankingDocument15 pagesA Case Study in Ethical Approaches To BankingLeonardo LealPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Examiners Report 2013-2018 - Level BDocument13 pagesExaminers Report 2013-2018 - Level BZubair RafiquePas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Finance Rti ManualDocument45 pagesFinance Rti ManualNABARDPas encore d'évaluation

- Types of OrdersDocument4 pagesTypes of OrdersHania SaeedPas encore d'évaluation

- A Summer Training Project Report (Reliance Life Insurance)Document52 pagesA Summer Training Project Report (Reliance Life Insurance)Bhatzada Zahid Jameel100% (3)

- Ketan Parekh ScamDocument13 pagesKetan Parekh ScamUttam Kr PatraPas encore d'évaluation

- Hong Dar Impex Co., LTD.: Lten NoDocument2 pagesHong Dar Impex Co., LTD.: Lten NoSegundo Modesto Romero MallaPas encore d'évaluation

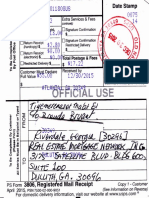

- Acceptance&Discharge-REAL ESTATE MORTGAGE NETWORKDocument13 pagesAcceptance&Discharge-REAL ESTATE MORTGAGE NETWORKTiyemerenaset Ma'at El86% (22)

- Internship Report On Agroni Bank by Shaikh Al Amin - 2n: 1.1 Background of The ReportDocument16 pagesInternship Report On Agroni Bank by Shaikh Al Amin - 2n: 1.1 Background of The ReportDiomedes DiomedesPas encore d'évaluation

- How To File A 1096 and 1099 and 1099oid To Pay Utility BillsDocument10 pagesHow To File A 1096 and 1099 and 1099oid To Pay Utility BillsTitle IV-D Man with a plan99% (87)

- Snap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKDocument1 pageSnap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKners fatmaPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Photographer NH&MP Application FormDocument3 pagesPhotographer NH&MP Application FormATHARPas encore d'évaluation

- Recent Trends and Development of Banking System in IndiaDocument5 pagesRecent Trends and Development of Banking System in Indiavishnu priya v 149Pas encore d'évaluation

- Google Pixel Select Stores TnCsDocument96 pagesGoogle Pixel Select Stores TnCsRahul AhujaPas encore d'évaluation

- ACCO 30073 Audit of Specialized Industries 2021 2Document107 pagesACCO 30073 Audit of Specialized Industries 2021 2Axl Ilao100% (2)

- What Is Electronic Funds Transfer (EFT) ?Document2 pagesWhat Is Electronic Funds Transfer (EFT) ?Philemon Wishikoti SawonoPas encore d'évaluation

- Chapter - 2Document31 pagesChapter - 2Maruf Ahmed100% (1)

- ACF 103 Tutorial 6 Solns Updated 2015Document18 pagesACF 103 Tutorial 6 Solns Updated 2015Carolina SuPas encore d'évaluation

- 6 International Parity Relationships and Forecasting Foreign Exchange RatesDocument57 pages6 International Parity Relationships and Forecasting Foreign Exchange Ratesreena2412Pas encore d'évaluation

- Treasury Management CourseDocument10 pagesTreasury Management Coursenick21_347Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)