Académique Documents

Professionnel Documents

Culture Documents

Calculus Applications in Business3315

Transféré par

ИРадојичићTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

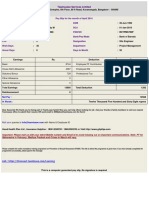

Calculus Applications in Business3315

Transféré par

ИРадојичићDroits d'auteur :

Formats disponibles

Sam Chang

Period 3

Calculus Applications in Business

As much as a student may hope to leave behind the high school AP calculus

course that plagued her so to pursue the field of business, one more commonly associated

with suits and briefcases rather than calculators and graph paper, she will never be able to

elude calculus and its applications. Math is everywhere, but it is especially prevalent in

the area of business; not only do colleges offer business mathematics, with business

calculus as one of the most popular courses, but graduates with math and science degrees

are shown to pioneer todays leading companies and corporations in greater proportions.

The two primary branches of calculus are differential calculus and integral

calculus. The first component studies the variation of a function respective to changes in

the variables. The derivative measures the change of a function with respect to a change

in its input; at a chosen value of input, the derivative depicts the linear approximation of

the function near the value. It can be applied to deal with optimization, stock market

curves, and other utilities valuable to a businesss success.

Optimization in the regular sense of the word is the use of

something at its most effective and advantageous state. To reach the

optimal condition of anything, it must be fully exhausted to either its

minimum or its maximum. Business-minded people seek to fully

optimize resources to achieve maximum sales, to optimize operations

to achieve maximum revenue and minimum costs, and to optimize

opportunities. Thus, applications of derivatives are indispensable in the

business world. The maximums and minimums of the curve of a

function have the slope of 0, so the derivative of the equation is set

equal to 0 to determine the input at the functions optimal state. For

example, in the case of an apartment complex company, a function

can be determined to find out the amount of money produced by the

number of apartment buildings sold, an equation of a simple

relationship. Keeping in mind the domain (the number of apartments

actually available), the functions derivative reveals the critical points

that can be determined to be absolute maximums, absolute

minimums, or neither with the reinsertion of the values into the original

function. The use of derivatives and their role in optimization reveals

that the maximum profit does not necessarily come from renting out

all the apartment buildings, as maintenance costs and other variables

need to be considered. Consequently, the analysis from the derivative

equations alerts the business owners to finding a means of raising rent

costs or lowering maintenance costs to get maximum profit to full

resource capacity. The economic principle of marginal analysis is

beneficial to break-even analysis and profit maximization. The profitmaximizing quantity of output is achieved at the point where marginal

cost, the extra cost of production of a single unit of output, and

marginal revenue, the extra revenue generated by the sale of an

additional unit of product, are equal. The marginal revenue is formally

defined as the change in total revenue over the change in one unit of

quantity and can be represented as a derivative. The total revenue is

equal to the price demanded multiplied by the quantity, so through the

product rule the marginal revenue is equal to the price demanded plus

the quantity times the derivative of the price demanded. With this

information, the owners of a firm can ascertain the profit-maximizing

quantity based on its role as a monopoly or a competitive firm and to

efficiently organize its factors of production and exercise specialization.

Because the derivative gives the slope of a curve, it can be

applied to the curves commonly utilized in the business conference

room: revenue and cost curves and stock market curves. A graph of a

firms total revenue for a period of time depicts changes in total

revenue while that of the cost depicts changes in costs with relation to

the level of output. The slope of the curve at a single value is

determined by the functions derivative, and it can be used to

determine an increase or decrease in sales and projections for the

future. The attainment of slopes and instantaneous rates of change

can be used for stock market curves as well. The price history curve for

a firm or corporation reveals the price of its shares at different points in

time, and the slope at a specific point indicates growth or decline,

further denoting the potential future success or failure of a business.

The same concept works for other curves relevant in the business

arena, such as yield curves, which capture the overall movement of interest rates on

bonds of different maturities. Curves can be evaluated by the important differential

calculus applications.

Business calculus can be applied to determine the equation and

graphical shape of a total cost curve, a functions derivative, and other

aspects necessary or convenient for a business to know. In addition to

measuring a functions change with respect to that of its input, a

derivative is also a financial instrument that plays a role in the stock

market. It is derived from an underlying asset, which is usually an

asset, event, index, or value. With the purchase of a stock comes the

ownership of a small part of the company, an ownership that provides

an intrinsic value. Derivatives traders over time exchange cash or

assets based upon the underlying asset, and they can inflate stock

values and increase their ostensible values.

No matter which occupational field a student is interested in,

calculus and mathematics in general will play a role, apparent or

implicit, in its success. So instead of hoping to leave that calculus class

and dismissing its teachings, one must embrace calculus

wholeheartedly. To have a competency in mathematics is to be armed

with the proper tools to thrive in any field.

BIBLIOGRAPHY

Business Applications. 17 Sept 2008. Pauls Online Math Notes. 25 Oct 2009

<http://tutorial.math.lamar.edu/Classes/CalcI/BusinessApps.aspx>.

Clayton, Gary E. Economics principles & practices. New York: Glencoe/McGraw-Hill,

2003.

Derivative. 2004. The Financial Dictionary. 25 Oct 2009 <http://financialdictionary.thefreedictionary.com/Derivative+calculus>.

Lane, Margaret. Interview. 25 Oct 2009.

Lau, Jeffrey. Total Revenue and Elasticity. 30 Jun 1998. University of Hawaii. 24 Oct

2009 <http://www2.hawaii.edu/~rpeterso/demand.htm>.

Tatum, Malcolm. What is a Derivatives Market? 11 Sept 2009. Wise Geek. 23 Oct

2009 <http://www.wisegeek.com/what-is-a-derivative-market.htm>.

Wagner, Hans. Bond Yield Curve and the Stock Market. 25 May 2009. Daily Markets.

23 Oct 2009 <http://www.dailymarkets.com/stocks/2009/05/24/bond-yield-curveand-the-stock-market/>.

Vous aimerez peut-être aussi

- Cashflow Models in ProjectDocument3 pagesCashflow Models in ProjectLiamRushPas encore d'évaluation

- Break Even AnalysisDocument16 pagesBreak Even Analysisapi-3723983100% (9)

- A Complete Example of A Short Term Plan Cambridge Primary Maths Guide p.32 33Document2 pagesA Complete Example of A Short Term Plan Cambridge Primary Maths Guide p.32 33ИРадојичић100% (5)

- Asservation For NativityDocument27 pagesAsservation For Nativityjohnadams552266Pas encore d'évaluation

- 'Cost Benefit Analysis': Dela Cruz, Alfredo Solomon Bsce-IiiDocument6 pages'Cost Benefit Analysis': Dela Cruz, Alfredo Solomon Bsce-IiiBen AdamsPas encore d'évaluation

- ArticleDocument3 pagesArticleNorul AzimPas encore d'évaluation

- Answer To Q No-1Document5 pagesAnswer To Q No-1MEHTA BINTE MASUDPas encore d'évaluation

- Cost Behavior Analysis: Reviewing The ChapterDocument5 pagesCost Behavior Analysis: Reviewing The ChapterralphalonzoPas encore d'évaluation

- First Module Financial ModellingDocument7 pagesFirst Module Financial ModellingSeba MohantyPas encore d'évaluation

- Activity Sheet in Business Enterprise SimulationDocument8 pagesActivity Sheet in Business Enterprise SimulationAimee Lasaca100% (1)

- Breakeven AnalysisDocument16 pagesBreakeven AnalysisAbhinandan GolchhaPas encore d'évaluation

- Financial Modelling NOTESDocument29 pagesFinancial Modelling NOTESmelvinngugi669Pas encore d'évaluation

- Merchandising CostingDocument11 pagesMerchandising CostingVishwajeet BhartiPas encore d'évaluation

- To Study Importance of Cost in Healthcare and To Analyze Break-Even Point For Spirometry in Pediatric DepartmentDocument15 pagesTo Study Importance of Cost in Healthcare and To Analyze Break-Even Point For Spirometry in Pediatric DepartmentarcherselevatorsPas encore d'évaluation

- Financial ModelingDocument6 pagesFinancial Modelingrajeshdhnashire100% (1)

- Week 7 Handout PDFDocument17 pagesWeek 7 Handout PDFkiks fernsPas encore d'évaluation

- CH 07Document14 pagesCH 07Kani LiPas encore d'évaluation

- Re Answers To The Questions of My ReportDocument9 pagesRe Answers To The Questions of My ReportFrancis Paul ButalPas encore d'évaluation

- Break Even AnalysisDocument14 pagesBreak Even AnalysisChitrank KaushikPas encore d'évaluation

- Application of Integration and DefferentiationDocument11 pagesApplication of Integration and DefferentiationSunday Ngbede ocholaPas encore d'évaluation

- Break Even Point ThesisDocument5 pagesBreak Even Point ThesisGhostWriterCollegePapersUK100% (2)

- Chapter One Cost-Volume-Profit (CVP) Analysis: Learning ObjectivesDocument19 pagesChapter One Cost-Volume-Profit (CVP) Analysis: Learning ObjectivesTESFAY GEBRECHERKOSPas encore d'évaluation

- Neo PriceDocument11 pagesNeo Pricelaxave8817Pas encore d'évaluation

- Material No. 4Document10 pagesMaterial No. 4rhbqztqbzyPas encore d'évaluation

- Valuation of BusinessDocument9 pagesValuation of BusinessShiv SharmaPas encore d'évaluation

- Short Notes 510 1 Set Question CommonDocument9 pagesShort Notes 510 1 Set Question CommonSHAFI Al MEHEDIPas encore d'évaluation

- Chapter 1Document13 pagesChapter 1Beam KPas encore d'évaluation

- Word Manaerial EcoDocument12 pagesWord Manaerial Ecopawanijain96269Pas encore d'évaluation

- Break Even Analysis ThesisDocument7 pagesBreak Even Analysis Thesisangeljordancincinnati100% (2)

- (A) - How Feasibility Analysis Helps Entrepreneurs in Assessing The Viability of A New Venture. AnswerDocument5 pages(A) - How Feasibility Analysis Helps Entrepreneurs in Assessing The Viability of A New Venture. AnswerMuhammad Muzamil HussainPas encore d'évaluation

- Foro 5 Conta AdministrativaDocument2 pagesForo 5 Conta AdministrativaOscar RodríguezPas encore d'évaluation

- Assignmnet 6. CHAPTER 4Document19 pagesAssignmnet 6. CHAPTER 4Regan Muammar NugrahaPas encore d'évaluation

- Literature Review On Cost Volume Profit AnalysisDocument8 pagesLiterature Review On Cost Volume Profit Analysisafmzfsqopfanlw100% (1)

- Example Cost Benefit AnalysisDocument6 pagesExample Cost Benefit AnalysisMohammad FaizanPas encore d'évaluation

- PUTRI ROUDINA MAS'UD - 041411331084 Accounting English ClassDocument8 pagesPUTRI ROUDINA MAS'UD - 041411331084 Accounting English ClassChoi MinriPas encore d'évaluation

- Application of Break Even AnalysisDocument6 pagesApplication of Break Even AnalysisSamarjit Chatterjee0% (1)

- Cost Volume Profit AnalysisDocument22 pagesCost Volume Profit AnalysisKirai Kiraikenks100% (1)

- Break Even Analysis FMDocument6 pagesBreak Even Analysis FMRahul RajwaniPas encore d'évaluation

- Management Accounting AssignmentDocument21 pagesManagement Accounting AssignmentAadi KaushikPas encore d'évaluation

- Management Accounting AssignmentDocument21 pagesManagement Accounting AssignmentAadi KaushikPas encore d'évaluation

- Management Accounting AssignmentDocument21 pagesManagement Accounting AssignmentAadi KaushikPas encore d'évaluation

- Arbaminch University: Colege of Business and EconomicsDocument13 pagesArbaminch University: Colege of Business and EconomicsHope KnockPas encore d'évaluation

- Cost Volume Profit AnalysisDocument35 pagesCost Volume Profit AnalysisChairul AnamPas encore d'évaluation

- Management Accountring Unit 3Document38 pagesManagement Accountring Unit 3Vishwas AgarwalPas encore d'évaluation

- Midterm - Basic Micro Economics - Lesson 1Document11 pagesMidterm - Basic Micro Economics - Lesson 1Nhiel Bryan BersaminaPas encore d'évaluation

- Break Even Analysis in ProductionDocument17 pagesBreak Even Analysis in Productionyashwant4043994Pas encore d'évaluation

- Sales Management: L3. Salesforce Size, Budgeting and CompensationsDocument18 pagesSales Management: L3. Salesforce Size, Budgeting and CompensationsKENMOGNE TAMO MARTIALPas encore d'évaluation

- CH 03Document38 pagesCH 03Albert CruzPas encore d'évaluation

- Multiple ApproachDocument9 pagesMultiple Approachkanwal preetPas encore d'évaluation

- CVP AnalysisDocument12 pagesCVP AnalysisKamini Satish SinghPas encore d'évaluation

- Break-Even (Or Cost-Volume Profit) AnalysisDocument3 pagesBreak-Even (Or Cost-Volume Profit) AnalysisPankaj2cPas encore d'évaluation

- Chapter 3 Accounting and Finance For ManagersDocument17 pagesChapter 3 Accounting and Finance For ManagersSiraj MohammedPas encore d'évaluation

- Basic Definitions: Profit MaximizationDocument5 pagesBasic Definitions: Profit MaximizationAdrianna LenaPas encore d'évaluation

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageD'EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Finance for Non-Financiers 2: Professional FinancesD'EverandFinance for Non-Financiers 2: Professional FinancesPas encore d'évaluation

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationD'EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationPas encore d'évaluation

- Management Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesD'EverandManagement Accounting Strategy Study Resource for CIMA Students: CIMA Study ResourcesPas encore d'évaluation

- Benchmarking for Businesses: Measure and improve your company's performanceD'EverandBenchmarking for Businesses: Measure and improve your company's performancePas encore d'évaluation

- Financial Statement Analysis: Business Strategy & Competitive AdvantageD'EverandFinancial Statement Analysis: Business Strategy & Competitive AdvantageÉvaluation : 5 sur 5 étoiles5/5 (1)

- Management Control with Integrated Planning: Models and Implementation for Sustainable CoordinationD'EverandManagement Control with Integrated Planning: Models and Implementation for Sustainable CoordinationPas encore d'évaluation

- Untitled 1Document1 pageUntitled 1ИРадојичићPas encore d'évaluation

- Untitled 3Document1 pageUntitled 3ИРадојичићPas encore d'évaluation

- Waves in CommunicationDocument2 pagesWaves in CommunicationИРадојичићPas encore d'évaluation

- Od Četvrtka: Dekorativna Solarna SvetiljkaDocument2 pagesOd Četvrtka: Dekorativna Solarna SvetiljkaИРадојичићPas encore d'évaluation

- Untitled 5Document2 pagesUntitled 5ИРадојичићPas encore d'évaluation

- Ovom Proizvodu Iz Lidla!: 82% Ispitanika Srbije Je Reklo DA"Document3 pagesOvom Proizvodu Iz Lidla!: 82% Ispitanika Srbije Je Reklo DA"ИРадојичићPas encore d'évaluation

- Od Ponedeljka: Šablon Za Tiplovanje Ili Stega Set Tipli Sa BurgijomDocument2 pagesOd Ponedeljka: Šablon Za Tiplovanje Ili Stega Set Tipli Sa BurgijomИРадојичићPas encore d'évaluation

- Untitled 2Document3 pagesUntitled 2ИРадојичићPas encore d'évaluation

- Prelep Ambijent: U Tvojoj BaštiDocument3 pagesPrelep Ambijent: U Tvojoj BaštiИРадојичићPas encore d'évaluation

- Od Četvrtka: LED Solarne SvetiljkeDocument2 pagesOd Četvrtka: LED Solarne SvetiljkeИРадојичићPas encore d'évaluation

- OD ČET. 02.09. DO SRE. 08.09.: Bebi PuderDocument3 pagesOD ČET. 02.09. DO SRE. 08.09.: Bebi PuderИРадојичићPas encore d'évaluation

- Za Slatke Snove: Udoban OdmorDocument11 pagesZa Slatke Snove: Udoban OdmorИРадојичићPas encore d'évaluation

- Exercises: 1 Real FunctionsDocument1 pageExercises: 1 Real FunctionsИРадојичићPas encore d'évaluation

- DynamicsDocument5 pagesDynamicsИРадојичићPas encore d'évaluation

- Sveska Sa Spiralom A4: Kom. KomDocument7 pagesSveska Sa Spiralom A4: Kom. KomИРадојичићPas encore d'évaluation

- Suva Šunka Alpska Dimljena Šunka U Komadu: Od ČetvrtkaDocument9 pagesSuva Šunka Alpska Dimljena Šunka U Komadu: Od ČetvrtkaИРадојичићPas encore d'évaluation

- Day 22 The Price Tag Principle PDFDocument1 pageDay 22 The Price Tag Principle PDFИРадојичићPas encore d'évaluation

- (BS EN 61746 - 2001) - Calibration of Optical Time-Domain ReflectometersDocument70 pages(BS EN 61746 - 2001) - Calibration of Optical Time-Domain ReflectometersИРадојичићPas encore d'évaluation

- Ions & Ionic Bonds (Multiple Choice) QPDocument7 pagesIons & Ionic Bonds (Multiple Choice) QPИРадојичић100% (1)

- Unit 1 - Tutoring HoursDocument2 pagesUnit 1 - Tutoring HoursИРадојичићPas encore d'évaluation

- Logaritmi BocconiDocument4 pagesLogaritmi BocconiИРадојичићPas encore d'évaluation

- The Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiDocument25 pagesThe Following Is A Research Assignment Made by Harsh Vagal On Financial Management of The Copanies Tata Motors VS Maruti SuzukiHarsh VagalPas encore d'évaluation

- Bret 7 UDocument31 pagesBret 7 UQuint WongPas encore d'évaluation

- CS Section: Consulting ServicesDocument7 pagesCS Section: Consulting ServicesTyra Joyce RevadaviaPas encore d'évaluation

- Impact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelDocument6 pagesImpact of Internet Banking On Customer Satisfaction and Loyalty: A Conceptual ModelYusuf HusseinPas encore d'évaluation

- Accommodation Party Crisologo Jose vs. CADocument2 pagesAccommodation Party Crisologo Jose vs. CAMica GalvezPas encore d'évaluation

- Marketing Concepts For Bank ExamsDocument24 pagesMarketing Concepts For Bank Examssunny_dear003Pas encore d'évaluation

- PrepmateDocument69 pagesPrepmatevishal pathaniaPas encore d'évaluation

- A161 Tutorial 4 - Annual Report Fin AnalysisDocument10 pagesA161 Tutorial 4 - Annual Report Fin AnalysisAmeer Al-asyraf MuhamadPas encore d'évaluation

- Name: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCADocument3 pagesName: Group: Date:: Chap 1 Practice Questions Lecturer: Christine Colon, ACCASuy YanghearPas encore d'évaluation

- Negotiable Instruments Law CasesDocument39 pagesNegotiable Instruments Law CasesAgui S. AugusthinePas encore d'évaluation

- Unit 14Document28 pagesUnit 14Ajeet KumarPas encore d'évaluation

- Switzerland Crypto Innovation 2018Document13 pagesSwitzerland Crypto Innovation 2018Theplaymaker508Pas encore d'évaluation

- Cyber Receipt PDFDocument1 pageCyber Receipt PDFprince_rahul_159Pas encore d'évaluation

- Development of A Business PlanDocument18 pagesDevelopment of A Business Plansisay2001Pas encore d'évaluation

- Surya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Document3 pagesSurya Semesta Internusa Tbk. (S) : Company Report: January 2015 As of 30 January 2015Halim RachmatPas encore d'évaluation

- An Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedDocument32 pagesAn Evaluation of The Digital Marketing Operations of AL-Arafah Islami Bank LimitedNafiz FahimPas encore d'évaluation

- April 2016 - PaySlipDocument1 pageApril 2016 - PaySlipMedi Srikanth NethaPas encore d'évaluation

- Kamran Acca f1 Mcqs.Document96 pagesKamran Acca f1 Mcqs.Renato Wilson67% (3)

- The Budget Hole Has Been Known ForDocument110 pagesThe Budget Hole Has Been Known ForThe PitchPas encore d'évaluation

- Becamex Presentation - Full Version 4Document34 pagesBecamex Presentation - Full Version 4Trường Hoàng XuânPas encore d'évaluation

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaPas encore d'évaluation

- Circular Flow of EconomyDocument19 pagesCircular Flow of EconomyAbhijeet GuptaPas encore d'évaluation

- Fin e 280 2011Document4 pagesFin e 280 2011Kannan M KannanPas encore d'évaluation

- GCG MC 2017-02, Interim PES For The GOCC SectorDocument4 pagesGCG MC 2017-02, Interim PES For The GOCC SectorbongricoPas encore d'évaluation

- HotelDocument2 pagesHotelSagar KattimaniPas encore d'évaluation

- Gov. Rick Perry 2007 TaxesDocument60 pagesGov. Rick Perry 2007 TaxesHouston ChroniclePas encore d'évaluation

- Initiative of National Housing PolicyDocument4 pagesInitiative of National Housing PolicyMuhaimin RohizanPas encore d'évaluation

- CSEC Principles of AccountsDocument6 pagesCSEC Principles of AccountsNatalie0% (1)

- Nature and Form of The Contract: Atty. DujuncoDocument9 pagesNature and Form of The Contract: Atty. DujuncoShaiPas encore d'évaluation