Académique Documents

Professionnel Documents

Culture Documents

Assessing Agricultural Insurance Agents Attitude Towards E-Learning Application in Teaching Them

Transféré par

Ana SueTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assessing Agricultural Insurance Agents Attitude Towards E-Learning Application in Teaching Them

Transféré par

Ana SueDroits d'auteur :

Formats disponibles

Available online at www.sciencedirect.

com

Procedia Social and Behavioral Sciences 15 (2011) 29232926

WCES-2011

Assessing agricultural insurance agents attitude towards e-learning

application in teaching them

Jafar Yaghoubi a *, Mohammad Eisa Shokri b, Javad Mohammad Gholiniy c

a

Zanjan University, P.O.Box 45195-313, Zanjan, Iran

Islamic Azad University, Abhar Branch, Abhar, Iran

c

Islamic Azad University, Abhar Branch, Abhar, Iran

Abstract

Agricultural sector provides over 75 percent of required food of Iran's population. It also contributes to 10.4 percent of Gross

Domestic Product (GDP), 23 percent of employment and a considerable amount of non-oil export. However, it highly depends on

the environmental issues and is usually affected by natural disasters, which make a huge damage to the livelihoods and annual

income of farmers. Since 2002, Agricultural Product Insurance Fund used a new approach through the Private Insurance Agents

(PIAs) which provide efficient and effective insurance services to farmers. Providing training courses for PIAs is associated with

many problems, because they are scattered in cities and villages. Considering the benefits of e-learning, its application in

teaching PIAs s can be useful. In this regard, development of effective e-learning in this section, regardless of analyzing

knowledge and attitude of PIAs is not possible. So, the aim of this study was analyze knowledge and attitudes of PIAs regarding

using the e-learning in their teaching. A descriptivecorrelation survey approach was used in this study. The population consisted

of PIAs in Zanjan province (n=77). The questionnaire was used for data collection in this study. The results showed that PIAs

attitude to e-learning is relatively positive. Results also showed that there is significant difference between Computer and Internet

skills, average hours worked with the Internet and computer, Experience in agricultural product Insurance and attitude towards elearning system. T-test result showed that there is a significant difference between the attitudes of people with experience in elearning courses with those without experience.

2011 Published by Elsevier Ltd. Open access under CC BY-NC-ND license.

Keywords: e-learning, agricultural product insurance, attitude, teaching;

1. Introduction

Since his creation, man has always changed the balance of nature and the Eco-system to his own benefit in order

to provide for food and shelter. Through time, the increase in population and limitations of natural resources on the

terrestrial globe has thus created irretrievable problems. In this respect, crop insurance is one remarkable solution to

the problem of maximum utilization of limited resources within the agricultural sector of an economy which is

based on agriculture as the main axis of development. Crop insurance may be regarded as the necessary means to

reach the ultimate goal in the agricultural sector, which is the increase of the total volume of crop, livestock, and

other agricultural productions, on the road to gradual gaining of self- sufficiency in the sector (Zia, 2010).

* Jafar Yaghoubi. Tel.:+98-241-5152349; fax: +98-241-2283202.

E-mail address: Yaghoubi@znu.ac.ir.

18770428 2011 Published by Elsevier Ltd. Open access under CC BY-NC-ND license.

doi:10.1016/j.sbspro.2011.04.215

2924

Jafar Yaghoubi et al. / Procedia Social and Behavioral Sciences 15 (2011) 29232926

Iran with amplitude of 165 million hectares has a noticeable variety of weather conditions, with enormous

changes of temperature, during different seasons of the year. Agricultural sector provides over 75 percent of

required food of Iran's population. It also contributes to 10.4 percent of Gross Domestic Product (GDP), 23 percent

of employment and a considerable amount of non-oil export. Therefore, it holds an appropriate ground for the

growth of various tropical, semi-tropical, and temperate productions. Variety in climate and weather conditions has

made agriculture, unlike any other economic activity, subject to unknown natural hazards which can neither be

predicted nor prevented. The insurance of agricultural products has been under consideration in Iran since 1970

when studies began by the former Ministry of Agricultural Production and Consumer Products(Zia, 2010).

Since 2002, Agricultural Product Insurance Fund used a new approach through the Private Insurance Agents

(PIAs) which provide efficient and effective insurance services to farmers. Providing training courses for PIAs is

associated with many problems, because they are scattered in cities and villages. Considering the benefits of elearning, its application in teaching PIAs s can be useful. In this regard, development of effective e-learning in this

section, regardless of analyzing knowledge and attitude of PIAs is not possible. So, the aim of this study was

analyze knowledge and attitudes of PIAs regarding using the e-learning in their teaching

Survey of effective factors on adoption of crop insurance among farmers in Behbahan County, Iran showed that

there are positive correlation among age, experience in agricultural activities, literacy, extension participatory, and

amount of dry lands and satisfaction of insurance.(Sadati, Ghobadi, Mohamadi, Sharifi, & Asakereh, 2010).

An evaluation of the crop insurance program in India through the multi-peril yield-based National Agricultural

Insurance Scheme reveals that while it has done well on equity grounds, the coverage and indemnity payments are

biased towards a few regions and crops, and there are delays in settlement of claims. And while the emergence of

weather-based insurance as an alternative has addressed several limitations of traditional insurance, it is faced by

challenges of a different kind. Both these forms of insurance must thus be looked upon as complementary to each

other in order to evolve an efficient mechanism for dealing with natural disaster risks in agriculture.(Reshmy, 2010)

Assessing factors affecting crop insurance purchase decisions by farmers in northern Illinois showed that price

had the most significant effect on crop insurance purchase decisions. While acres farmed had statistically significant

impact on most of the crop insurance purchase decisions, different factors played a role in purchase decisions based

on types of insurance and types of crops covered(Ginder, Spaulding, Tudor, & Winter, 2009).

Assessing Farmers' preferences for alternative crop and health insurance subsidy showed that Farmers prefer

higher levels of coverage and are price sensitive. A sample of farmers did not prefer the subsidy switch. However,

the subsidy switch is preferred by older farmers, those with higher health care spending, and farmers who have

experienced major health problems (Nganje, Hearne, Gustafson, & Orth, 2008). Evaluating the effect of crop

insurance on technical efficiency of wheat farmers in Kermanshah Province indicated that crop insurance has a

positive impact on temperate and tropical regions. However, the difference in production between insured and

uninsured farmers in cold region was insignificant(Agahi, Zarafshani, & Behjat, 2008). An investigation of

educational needs of agricultural crop insurance specialists showed that among personal characteristics at the 95%

alpha level, level of education, years of experience and monthly income in regard to insurance; showed a negative

significant relationship. However, a significant relationship was found between the participation in extension

training classes and the level of educational needs. There was no significant relationship found between age and

years of experience in extension activities. There was a significant relationship between the independent variable of

various educational majors and the dependent variable educational needs(Chizari, Sadeghi, & Noroozi, 2006).

2. Methods and Data Sources

The purpose of this study was to analyze the knowledge and attitudes of PIAs regarding using the e-learning in

their education. Seventy-seven PIAs from Zanjan province participated in this study by using stratified

randomization method. The research design used for this study was a descriptive survey method.

On the basis of review of the literature, a questionnaire was developed to collect the necessary data. The

questionnaire had two sections. The first section included demographic data on agents. The second section

2925

Jafar Yaghoubi et al. / Procedia Social and Behavioral Sciences 15 (2011) 29232926

comprised knowledge and attitude regard application of e-learning in training PIAs with a 5- point Likert-type

response scale. Content and face validity were established by a panel of faculties in Zanjan University and

agricultural insurance specialists in Agricultural Bank of Zanjan.

Data collected were analyzed using the Statistical Package for the Social Sciences (SPSS16). Appropriate

statistical procedures for description (frequencies, percent, means, and standard deviations) and inference were used.

3. Results

3.1. Demographic Characteristics

The Field of Study of 46.8 percent of the respondents was agronomy, 22.78 percent horticulture, 10.13 percent

Agricultural Mechanization and another 20.29 percent were other fields. 83.5 percent of the respondents had a BS

degree, 15.3 percent had a M.S degree and only 1.3 percent had a PhD degree. The majority (74.4%) of respondents

had 1 to 5 years of work experience in agricultural crops insurance. Mean age of PIAs was 28.41 years. Youngest

respond was 23 and oldest student was 35 years of age. 58.23% of them were male and 41.77% were female. In

terms of employment, 43 percent of respondents already had no another job other than insurance, but 51 percent

have a part-time employment and 6 percent were employed full-time. Average computer usage of respondents was

18.97 hours per week with a standard deviation of 13.68 hour.

3.2. Agricultural Insurance Agents Attitude Towards e-learning Application in teaching them

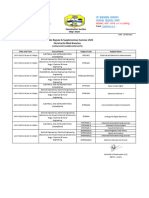

To determine attitudes of PIAs towards e-learning, 15item with 5- point Likert-type response scale was used. The

results is shown in Table 1.

Table 1. Agricultural Insurance Agents Attitude Towards e-learning

Item

I can actively learn in the electronic learning environment.

E-learning environments help to effective learning.

E-learning environment is useful for teaching1

E-learning help to application of problem solving method in teaching.

When using the Internet, I feel sure.

When using the computer training I am feeling confident.

E-learning environment will improve my intellectual skills.

I intend to use the E-learning for my learning.

I enjoy when using computer.

Electronic learning environment increases my solving problem skills.

I feel satisfied through using electronic learning environment.

Virtual education can increase learning motivation.

There are many opportunities for knowledge creation in e-learning.

Mean

4.16

3.87

3.81

3.66

3.75

3.74

3.77

3.81

4.04

3.58

3.75

3.69

3.76

SD

0.67

0.65

0.74

0.73

0.76

0.78

0.79

0.83

0.88

0.79

0.87

0.87

0.67

C.V.

0.161

0.168

0.194

0.200

0.203

0.208

0.209

0.218

0.218

0.222

0.231

0.236

0.161

As can be seen in Table 1, from the viewpoint of PIAs, mean of all items is higher than 3. So, this result showed

that PIAs attitude to e-learning is relatively positive.

3.3. Relationship between attitudes to e-learning and independent variables

In order to investigate the relationship between attitude toward e-learning and independent variables, considering

the scale of variables and normal distribution of data, Pearson correlation coefficient was used. The results are

presented in Table2.

Table 2. Relationship between attitude toward e-learning and independent variables

Independent Variables

Respondents age

Education Level

0.185

0.239

0.13

0.05

2926

Jafar Yaghoubi et al. / Procedia Social and Behavioral Sciences 15 (2011) 29232926

The average hours computer work

The average hours Internet usage

Experience in agricultural insurance

0.275*

0.340**

0.074*

0.02

0.005

0.04

0.01:** p 0.05:*

There was a significant relationship found between hours of Internet use, hours of computer use and experience in

agricultural insurance. Relationship between attitude toward e-learning and other variables were not significant.

3.4. Comparison of attitude toward e-learning approach and its effectiveness

T-test used to comparison of attitude toward e-learning approach and its effectiveness among male and female

agents, livestock and agronomy PIAs, PIAs with other jobs and no job(other than insurance brokerage) cultural

affairs and respondents with experience in e-learning courses with those without experience. The results showed that

there is a significant difference between the attitudes of people with experience in e-learning courses with those

without experience. In other cases, a significant difference between groups does not exist.

4. Conclusions

PIAs mean age (28.4) shows that most of them are young. Considering the more favourable youth attitudes and

skills in using the Internet and computer, can be inferred that the implementation of E-learning in in-service training

of this group is more easily done. Results of this study showed that l majority of PIAs have jobs other than the

insurance work. This finding shows agricultural insurance income is inadequate. So for better motivation of these

people, increase their incomes through the expansion of agricultural insurance is recommendedd.

Considering the results obtained from research, 98.7 percent of respondents had bachelor and master degrees. So,

according results of studies such as Waits & Lewis (2003), Vogel et al., (2001), Chassie (2002) and Wang (2004),

can be predicted acceptance of virtual education among this group is more comfortable.

References

Agahi, H., Zarafshani, K., & Behjat, A. M. (2008). The effect of crop insurance on technical efficiency of wheat farmers in Kermanshah

Province: a corrected ordinary least square approach. Journal of Applied Sciences, 8(5), 891-894.

Chizari, M., Sadeghi, L., & Noroozi, O. (2006). An investigation of educational needs of agricultural crop insurance specialists. Journal of

Agricultural Sciences - Islamic Azad University, 12(3), 501-511.

Ginder, M., Spaulding, A. D., Tudor, K. W., & Winter, J. R. (2009). Factors affecting crop insurance purchase decisions by farmers in northern

Illinois. Agricultural Finance Review, 69(1), 113-125.

Nganje, W., Hearne, R., Gustafson, C., & Orth, M. (2008). Farmers' preferences for alternative crop and health insurance subsidy. Review of

Agricultural Economics, 30(2), 333-351.

Reshmy, N. (2010). Crop insurance in India: changes and challenges. Economic and Political Weekly, 45(6), 19-22.

Sadati, S. A., Ghobadi, F. R., Mohamadi, Y., Sharifi, O., & Asakereh, A. (2010). Survey of effective factors on adoption of crop insurance among

farmers: A case study of Behbahan County. African Journal of Agricultural Research, 5(16), 2237-2242.

Zia, E. (2010). Agricultural Insurance of Iran. Retrieved from http://knol.google.com/k/agricultural-insurance-of-iran#

Vogel, D. R., van Genuchten, M., Lou, D., Verveen, S., van Eekout, M., & Adams, A. (2001). Exploratory research on the role of national and

professional cultures in a distributed learning project. IEEE Transactions on Professional Communication, 44, 114-125.

Vous aimerez peut-être aussi

- 09 WA500-3 Shop ManualDocument1 335 pages09 WA500-3 Shop ManualCristhian Gutierrez Tamayo93% (14)

- Week 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student HandoutDocument3 pagesWeek 8: ACCG3001 Organisational Planning and Control Tutorial In-Class Exercise - Student Handoutdwkwhdq dwdPas encore d'évaluation

- Methodical Pointing For Work of Students On Practical EmploymentDocument32 pagesMethodical Pointing For Work of Students On Practical EmploymentVidhu YadavPas encore d'évaluation

- A Study On Awareness, Purchase Benefits and Satisfaction Level Towards Crop InsuranceDocument8 pagesA Study On Awareness, Purchase Benefits and Satisfaction Level Towards Crop Insurancekeenu23Pas encore d'évaluation

- tmpBCED TMPDocument8 pagestmpBCED TMPFrontiersPas encore d'évaluation

- Journal Issaas v20n2 03 Abdullah - EtalDocument12 pagesJournal Issaas v20n2 03 Abdullah - EtalDANAR DONOPas encore d'évaluation

- Industry PartnershipDocument21 pagesIndustry Partnershipkehinde uthmanPas encore d'évaluation

- Awareness - About - Crop - Insurance - in - India MukharjeeDocument24 pagesAwareness - About - Crop - Insurance - in - India MukharjeePooja SiddeshPas encore d'évaluation

- Farmers' Perceptions of Agricultural Extension Agents' Performance in Sub-Saharan African Communities PDFDocument12 pagesFarmers' Perceptions of Agricultural Extension Agents' Performance in Sub-Saharan African Communities PDFDr. Olayemi Sennuga, PhDPas encore d'évaluation

- A Study On Knowledge and Attitude Levels of Beneficiaries and Non-Beneficiaries of Pmfby in Tumkur District of KarnatakaDocument11 pagesA Study On Knowledge and Attitude Levels of Beneficiaries and Non-Beneficiaries of Pmfby in Tumkur District of KarnatakaIJAR JOURNALPas encore d'évaluation

- Study On Crop Insurance in Rural AreaDocument7 pagesStudy On Crop Insurance in Rural Areaakshadashelke00Pas encore d'évaluation

- Anju Duhan and Satbir SinghDocument7 pagesAnju Duhan and Satbir SinghDeepikaPas encore d'évaluation

- Economies 07 00103Document13 pagesEconomies 07 00103Idelphonse SALIOUPas encore d'évaluation

- Research ArticleDocument9 pagesResearch ArticlebejarhasanPas encore d'évaluation

- Influence of Extension CommunicationDocument11 pagesInfluence of Extension CommunicationAnn PaschalPas encore d'évaluation

- Owombo Et Al.Document8 pagesOwombo Et Al.JynxPas encore d'évaluation

- Saudi PunyaDocument24 pagesSaudi Punyanada anandaPas encore d'évaluation

- Rabindra GhimireDocument22 pagesRabindra GhimireRajendra LamsalPas encore d'évaluation

- Sciencedirect: Is The Crop Insurance Program Effective in China? Evidence From Farmers Analysis in Five ProvincesDocument12 pagesSciencedirect: Is The Crop Insurance Program Effective in China? Evidence From Farmers Analysis in Five Provincesjeffrey aldayaPas encore d'évaluation

- Poultry Farmers Willingness To Pay For Agricultural Insurance Policy in Kogi State, NigeriaDocument10 pagesPoultry Farmers Willingness To Pay For Agricultural Insurance Policy in Kogi State, NigeriaMamta AgarwalPas encore d'évaluation

- 2019 Article 4091Document7 pages2019 Article 4091bejarhasanPas encore d'évaluation

- Intervention Framework For AgriculturalDocument17 pagesIntervention Framework For AgriculturalLiza Laith LizzethPas encore d'évaluation

- Goshu Et Al Food Security in EthiopiaDocument12 pagesGoshu Et Al Food Security in EthiopiaibsaPas encore d'évaluation

- Jurnal Budi1Document11 pagesJurnal Budi1deviPas encore d'évaluation

- JETIR2304B63Document9 pagesJETIR2304B63dr.fulanikyarama21Pas encore d'évaluation

- 343 PDFDocument5 pages343 PDFAnuranjani DhivyaPas encore d'évaluation

- Literature Review On Agriculture in NigeriaDocument6 pagesLiterature Review On Agriculture in Nigeriagw1357jx100% (1)

- 2 50 1589343468 3ijasrjun20203Document8 pages2 50 1589343468 3ijasrjun20203TJPRC PublicationsPas encore d'évaluation

- Analysis of Rural Households Food Security Status in Dibatie District, Western EthiopiaDocument11 pagesAnalysis of Rural Households Food Security Status in Dibatie District, Western EthiopiaPremier PublishersPas encore d'évaluation

- Socio-Economics Factors Affecting The Non-Paddy Farm Income of Paddy Households in East Kalimantan, IndonesiaDocument9 pagesSocio-Economics Factors Affecting The Non-Paddy Farm Income of Paddy Households in East Kalimantan, IndonesiaThanh Liem ToPas encore d'évaluation

- Bulgarian Journal - Social Economic Factors That Affect Cattle Farmer's Willingness To Pay ForDocument7 pagesBulgarian Journal - Social Economic Factors That Affect Cattle Farmer's Willingness To Pay FornurfadhilahPas encore d'évaluation

- Teaching Secondary School Agriculture at The Psychomotor DomainDocument22 pagesTeaching Secondary School Agriculture at The Psychomotor DomainAbdoul Wahab LyPas encore d'évaluation

- Influence of Plant Health Clinic Diagnostic Services On Potato Production Among Smallholder Farmers of Molo Sub-CountyDocument12 pagesInfluence of Plant Health Clinic Diagnostic Services On Potato Production Among Smallholder Farmers of Molo Sub-CountyTJPRC PublicationsPas encore d'évaluation

- 04-Eliciting Farmers - Preferences Towards Agriculture Education in Northern IrelandDocument26 pages04-Eliciting Farmers - Preferences Towards Agriculture Education in Northern IrelandDivya MPas encore d'évaluation

- Ability To Report Emergency at Farmers I 83983b9fDocument7 pagesAbility To Report Emergency at Farmers I 83983b9fderisonmarsinovabakaraPas encore d'évaluation

- Resilient Agricultural PracticesDocument13 pagesResilient Agricultural PracticesbadrazanaPas encore d'évaluation

- G.G. Patel, Et AlDocument6 pagesG.G. Patel, Et Alggpatel68Pas encore d'évaluation

- Farm RisksDocument13 pagesFarm RisksFolasade AminuPas encore d'évaluation

- Impact of Improved Sorghum Variety (Melkam) A Doption On Smallholder Farmers Food Security in Babile District, Eastern EthiopiaDocument18 pagesImpact of Improved Sorghum Variety (Melkam) A Doption On Smallholder Farmers Food Security in Babile District, Eastern EthiopiaCrystal LoganPas encore d'évaluation

- ExamDocument6 pagesExamJovertPas encore d'évaluation

- 789Document8 pages789TalhaPas encore d'évaluation

- MalawiDocument37 pagesMalawilegendacPas encore d'évaluation

- Paper On 'Assessment of Agricultural Students of Uds Intention To Take Up Sef Employment in AgribusinessDocument15 pagesPaper On 'Assessment of Agricultural Students of Uds Intention To Take Up Sef Employment in AgribusinessHudu ZakariaPas encore d'évaluation

- The Role of Governance in TheDocument15 pagesThe Role of Governance in TheHuy Lê ThanhPas encore d'évaluation

- Sutrisno 2023 IOP Conf. Ser. Earth Environ. Sci. 1200 012064Document9 pagesSutrisno 2023 IOP Conf. Ser. Earth Environ. Sci. 1200 012064Hilda Anugrah PutriPas encore d'évaluation

- Awotide-Impact of Access To Credit On Agricultural Productivity-71-2 PDFDocument35 pagesAwotide-Impact of Access To Credit On Agricultural Productivity-71-2 PDFMunazza WardagPas encore d'évaluation

- Satisfaction Levelof Insured Farmersabout CropDocument8 pagesSatisfaction Levelof Insured Farmersabout CropKunal LodhiPas encore d'évaluation

- His 2Document253 pagesHis 2Anjum100% (3)

- 2IJELS 108202049 Literacy PDFDocument4 pages2IJELS 108202049 Literacy PDFIJELS Research JournalPas encore d'évaluation

- Do Investments in Agricultural Extension Deliver Positive Benefits To Health, Trade and Industry, Water and Environment?Document22 pagesDo Investments in Agricultural Extension Deliver Positive Benefits To Health, Trade and Industry, Water and Environment?Premier PublishersPas encore d'évaluation

- Dilla, Ethiopia May, 2018 Chapter One 1 1.1. Background of The StudyDocument84 pagesDilla, Ethiopia May, 2018 Chapter One 1 1.1. Background of The StudyKindhun TegegnPas encore d'évaluation

- Attachment 1 PDFDocument5 pagesAttachment 1 PDFAninditta PutriPas encore d'évaluation

- Determinants of Households Vulnerability To Food Insecurity inDocument11 pagesDeterminants of Households Vulnerability To Food Insecurity inHAMZA AYUBPas encore d'évaluation

- Digital AgricultureDocument9 pagesDigital AgricultureemesethPas encore d'évaluation

- GCRural Youth Empowermentand Participationin Integrated Farmers Schemein Akwa Ibom State NigeriaDocument11 pagesGCRural Youth Empowermentand Participationin Integrated Farmers Schemein Akwa Ibom State NigeriaEt'z Alex John DraftPas encore d'évaluation

- Farmers Attitude On Sustainable AgricultureDocument6 pagesFarmers Attitude On Sustainable AgricultureRobert de la SernaPas encore d'évaluation

- Awareness of National Health Insurance Scheme (NHIS) Activities Among Employees of A Nigerian UniversityDocument9 pagesAwareness of National Health Insurance Scheme (NHIS) Activities Among Employees of A Nigerian UniversitySiva KalimuthuPas encore d'évaluation

- Irlaem Working Paper 18-01Document10 pagesIrlaem Working Paper 18-01Achille Dargaud FofackPas encore d'évaluation

- Tunji 12345Document235 pagesTunji 12345Ayeni-Akeke Tunji LaurentPas encore d'évaluation

- Deepak Gangil, Et Al PDFDocument9 pagesDeepak Gangil, Et Al PDFHimanshu GargPas encore d'évaluation

- Tamansiswa Accounting Journal International: Volume 2, No 1, July 2021D'EverandTamansiswa Accounting Journal International: Volume 2, No 1, July 2021Pas encore d'évaluation

- Effects of AgriculturalDocument15 pagesEffects of AgriculturalAmanda FionaPas encore d'évaluation

- Measuring Agricultural Knowledge and Adoption: Policy Research Working Paper 7058Document35 pagesMeasuring Agricultural Knowledge and Adoption: Policy Research Working Paper 7058RebinPas encore d'évaluation

- 6Wxghqwvc, Vodplf3Huvrqdolw/Rq, Edgdk$6Wuxfwxudo0Rghoolqj $ssurdfkDocument7 pages6Wxghqwvc, Vodplf3Huvrqdolw/Rq, Edgdk$6Wuxfwxudo0Rghoolqj $ssurdfkAna SuePas encore d'évaluation

- Systematic Steps in Teaching and Learning Islamic Education in The ClassroomDocument6 pagesSystematic Steps in Teaching and Learning Islamic Education in The ClassroomAna SuePas encore d'évaluation

- Sciencedirect: Surul Shahbudin Bin Hassan, Dr. Muhammad Azhar Bin ZailainiDocument9 pagesSciencedirect: Surul Shahbudin Bin Hassan, Dr. Muhammad Azhar Bin ZailainiAna SuePas encore d'évaluation

- The Perception and Method in Teaching and Learning Islamic EducationDocument10 pagesThe Perception and Method in Teaching and Learning Islamic EducationAna SuePas encore d'évaluation

- Stories in The Qur'an: Aims, Characteristics, Types and Educational Importance Intisar G. MustafehDocument10 pagesStories in The Qur'an: Aims, Characteristics, Types and Educational Importance Intisar G. MustafehAna SuePas encore d'évaluation

- Teaching Methodologies in A Weekend Madrasah: A Study at Jamiyah Education Centre, SingaporeDocument23 pagesTeaching Methodologies in A Weekend Madrasah: A Study at Jamiyah Education Centre, SingaporeAna SuePas encore d'évaluation

- Application of Theory and Practice of Educational Technology To The Teaching and Learning of Islamic StudiesDocument12 pagesApplication of Theory and Practice of Educational Technology To The Teaching and Learning of Islamic StudiesAna SuePas encore d'évaluation

- Jurnal Teknologi: Penghayatan Adab Dan Akhlak Terhadap Alam Sekitar Dalam Kalangan Pelajar SekolahDocument11 pagesJurnal Teknologi: Penghayatan Adab Dan Akhlak Terhadap Alam Sekitar Dalam Kalangan Pelajar SekolahAna SuePas encore d'évaluation

- Jurnal Kepimpinan PendidikanDocument10 pagesJurnal Kepimpinan PendidikanAna Sue0% (1)

- Richards Laura - The Golden WindowsDocument147 pagesRichards Laura - The Golden Windowsmars3942Pas encore d'évaluation

- SND Kod Dt2Document12 pagesSND Kod Dt2arturshenikPas encore d'évaluation

- Tanzania Finance Act 2008Document25 pagesTanzania Finance Act 2008Andrey PavlovskiyPas encore d'évaluation

- Oracle Exadata Database Machine X4-2: Features and FactsDocument17 pagesOracle Exadata Database Machine X4-2: Features and FactsGanesh JPas encore d'évaluation

- Oracle FND User APIsDocument4 pagesOracle FND User APIsBick KyyPas encore d'évaluation

- Introduce Letter - CV IDS (Company Profile)Document13 pagesIntroduce Letter - CV IDS (Company Profile)katnissPas encore d'évaluation

- Transparency Documentation EN 2019Document23 pagesTransparency Documentation EN 2019shani ChahalPas encore d'évaluation

- Microsoft Word - Claimants Referral (Correct Dates)Document15 pagesMicrosoft Word - Claimants Referral (Correct Dates)Michael FouriePas encore d'évaluation

- ARUP Project UpdateDocument5 pagesARUP Project UpdateMark Erwin SalduaPas encore d'évaluation

- Arduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash GuptaDocument3 pagesArduino Based Voice Controlled Robot: Aditya Chaudhry, Manas Batra, Prakhar Gupta, Sahil Lamba, Suyash Guptaabhishek kumarPas encore d'évaluation

- GL 186400 Case DigestDocument2 pagesGL 186400 Case DigestRuss TuazonPas encore d'évaluation

- Mid Term Exam 1Document2 pagesMid Term Exam 1Anh0% (1)

- Maths PDFDocument3 pagesMaths PDFChristina HemsworthPas encore d'évaluation

- 48 Volt Battery ChargerDocument5 pages48 Volt Battery ChargerpradeeepgargPas encore d'évaluation

- Electricity 10thDocument45 pagesElectricity 10thSuryank sharmaPas encore d'évaluation

- 4th Sem Electrical AliiedDocument1 page4th Sem Electrical AliiedSam ChavanPas encore d'évaluation

- Web Technology PDFDocument3 pagesWeb Technology PDFRahul Sachdeva100% (1)

- Danby Dac5088m User ManualDocument12 pagesDanby Dac5088m User ManualElla MariaPas encore d'évaluation

- Droplet Precautions PatientsDocument1 pageDroplet Precautions PatientsMaga42Pas encore d'évaluation

- Laporan Praktikum Fisika - Full Wave RectifierDocument11 pagesLaporan Praktikum Fisika - Full Wave RectifierLasmaenita SiahaanPas encore d'évaluation

- COOKERY10 Q2W4 10p LATOJA SPTVEDocument10 pagesCOOKERY10 Q2W4 10p LATOJA SPTVECritt GogolinPas encore d'évaluation

- PC210 8M0Document8 pagesPC210 8M0Vamshidhar Reddy KundurPas encore d'évaluation

- 4 Bar LinkDocument4 pages4 Bar LinkConstance Lynn'da GPas encore d'évaluation

- Allan ToddDocument28 pagesAllan ToddBilly SorianoPas encore d'évaluation

- Schmidt Family Sales Flyer English HighDocument6 pagesSchmidt Family Sales Flyer English HighmdeenkPas encore d'évaluation

- 06-Apache SparkDocument75 pages06-Apache SparkTarike ZewudePas encore d'évaluation

- CSEC Jan 2011 Paper 1Document8 pagesCSEC Jan 2011 Paper 1R.D. KhanPas encore d'évaluation