Académique Documents

Professionnel Documents

Culture Documents

123

Transféré par

Chan ZacharyCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

123

Transféré par

Chan ZacharyDroits d'auteur :

Formats disponibles

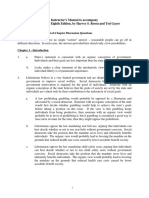

THE UNIVERSITY OF HONG KONG

FACULTY OF BUSINESS AND ECONOMICS

School of Economics and Finance

FINA0804/ FINA3323 Fixed Income Securities

GENERAL INFORMATION

Instructor: Dr. Huiyan QIU

Email: hqiu@hku.hk

Office: Room 917 K K Leung Building

Phone: 2859-1046

Consultation times: by appointments

Lecture: FINA0804A/ FINA3323A (Semester 1) Friday 14:30 17:20 in KKLG104

FINA0804B/ FINA3323B (Semester 2) Tuesday 13:30 16:20 in MB103

Pre-requisites: FINA0301/ FINA2322 Derivatives or STAT2820/ STAT3905 Introduction to financial derivatives

and FINA2802/ FINA2320 Investments and Portfolio Analysis or STAT2309/ STAT3609 The Statistics of

Investment Risk

Tutor: Mr. Clive HO, hoclive@hku.hk

Mutually exclusive: NA

Course Website: MOODLE via HKU portal

COURSE DESCRIPTION

This course is designed to provide a comprehensive introduction to fixed income securities by covering the

following broad topical areas: (a) the institutions and operations involved in the fixed income securities markets;

(b) the valuation and hedging of fixed income securities; (c) the term structure of interest rate; (d) the use and

application of interest rate derivatives in the areas of risk management and financial engineering; and (e) the

interest rate models.

COURSE OBJECTIVES

1. To help students develop a solid understanding of fixed income securities and fixed income markets.

2. To provide students with concepts and methods those are heavily used in practice.

COURSE LEARNING OUTCOMES

Course Learning Outcomes

CLO1.

CLO2.

CLO3.

CLO4.

CLO5.

Describe and interpret the general features of fixed income securities

including fixed income derivatives and understand the operations of fixed

income markets.

Apply techniques to price fixed income securities and be able to describe the

determinants of security prices.

Illustrate the term structure of interest rates and basic interest rate models.

Explain the characteristics of mortgage loans and mortgage-backed

securities.

Use interest rate derivatives like futures and options to manage risk and have

Aligned Faculty Goals

GOAL 1, 3, 5

GOAL 1, 2, 4, 5

GOAL 1, 2

GOAL 1, 2

GOAL 1, 2, 3, 5

1

CLO6.

general knowledge of other interest rate derivatives.

Be able to communicate with others on various issues of fixed income

securities.

GOAL 2, 3, 4, 5

COURSE TEACHING AND LEARNING ACTIVITIES

Course Teaching and Learning Activities

Expected

study

hour

Study Load

(% of study)

T&L1. Lectures

T&L2. Assignments

T&L3. Tutorials

T&L4. Self-study

33 hours

33 hours

10 hours

44 hours

27.5%

27.5%

8.33%

36.67%

120 hours

100%

Total

Assessment Methods

Weights

Aligned Course Learning Outcomes

A1. In-Class and Tutorial Performance

A2. Assignments

A3. Mid-term Examination

A4. Final Examination

5%

20%

25%

50%

CLO 1, 2, 3, 4, 5, 6

CLO 1, 2, 3, 4, 5, 6

CLO 1, 2, 3

CLO 1, 2, 3, 4, 5, 6

Total

100%

STANDARDS FOR ASSESSMENT

Course Grade Descriptors

A+, A, A-

Exhibited high level of understanding of the course materials through excellent performance in

class discussion, assignments and term tests.

B+, B, B-

Exhibited reasonably high level of understanding of the course materials through good

performance in class discussion, assignments, and term tests.

C+, C, CD+, D

F

Exhibited fair level of understanding of the course materials.

Exhibited limited level of understanding of the course materials.

Exhibited low level of understanding of the course materials.

Assessment Rubrics for Each Assessment

A1 In-Class and Tutorial Performance

A+ A A-

B+ B B-

C+ C C-

D+ D

Extremely well

prepared for class

discussion, very

active in sharing

views and

attended almost all

lectures and

tutorials.

Partially prepared

for class

discussion, quite

active in sharing

views and

attended most of

the lectures and

tutorials

Not well prepared

for class

discussion, limited

active in sharing

views and

attended many of

the lectures and

tutorials.

Not well prepared

for class

discussion, no

sharing of views

and attended some

of the lectures and

tutorials

Poorly prepared

for class

discussion and no

sharing of views

and experience

and rarely

attended lectures

and tutorials.

2

A2 Assignments: for numerical questions/homework, please refer to the following table:

A+ A A-

B+ B B-

C+ C C-

D+ D

Submitted all

homework with

excellent

accuracy.

Submitted well

written homework

with good

accuracy.

Submitted

homework with

fair level accuracy.

Submitted

homework with

limited accuracy.

Poorly written

homework or no

submission.

A2 Assignments: for essay type problems, please refer to the following grading criteria:

Grade

Depth and breadth of Coverage, critical elements, structure, language and

conventions

A+,A, A-

All aspects were addressed and researched in great depth.

Demonstrated a clear understanding of and the ability to apply the theory, concepts and

issues relating to the topic.

Clearly identified the most critical aspects of the task and adopted a critical perspective.

Developed excellent argument and offered a logically consistent and well-articulated

analysis and insight into the subject.

Drew widely from the academic literature and elsewhere whilst maintaining relevance.

All aspects conformed to a high academic / professional standard.

B+, B, B-

Most aspects were addressed and researched in depth.

Demonstrated a good understanding and some application of the theory and issues relating

to the topic.

Identified critical aspects of the task and adopted a critical perspective.

Showed some evidence of analysis, supported by logical argument and insight into the

subject.

Drew on relevant academic and other material.

Most aspects conformed to a high academic / professional standard.

C+, C, C-

Most aspects were addressed and researched adequately.

Demonstrated a good understanding of the theory, concepts and issues relating to the topic

but limited application relating to the topic.

Some presented argument showed some insight but not always consistent and logical.

Drew upon an adequate range of academic and other material.

Most aspects conformed to an acceptable academic / professional standard.

D+, D

Basic aspects were addressed and researched adequately. Demonstrated mainly

description, showing basic understanding of the topic but no application.

Showed little evidence of analysis but no clear and logical argument relating to the

subject.

Drew primarily upon course materials.

Limited aspects conformed to academic / professional standards.

Basic aspects were superficial, inadequate or absent.

Demonstrated limited understanding of the topic and drew conclusions unrelated to the

topic.

The written work was not of an academic / professional standard.

A3 and A4 Midterm and Final Exam

Midterm and final exam may include three types of questions: multiple choice, calculation problems, and essay

questions. Multiple choice and calculation problems are graded according to the marks assigned to each

question. Essay questions are graded according to the following criteria:

A+ A A-

B+ B B-

C+ C C-

D+ D

Idea development

is insightful and

sophisticated;

Supporting

evidence is

convincing,

accurate and

detailed. Well

written with clear

focus.

Idea development

is clear and

thoughtful;

Supporting

evidence is

sufficient and

accurate.

Well written.

Idea development

is simplistic and

lacking in

relevance;

Supporting

evidence

insufficient but

accurate.

Somewhat well

written.

Idea development

is superficial and

ineffective;

Supporting

evidence is

insufficient and

inaccurate.

Writing is unclear.

Idea development

is absent;

Supporting

evidence is vague

or missing.

Poorly written.

COURSE CONTENT AND TENTATIVE TEACHING SCHEDULE

The following topics will be covered:

Introduction to Fixed Income Securities

Bond Valuation and Yield Measures

Bond Price Volatility

Bond Yield and Interest Rate Structure

Bonds with Other Features

Forward and Futures on Bonds

Options and Credit Derivatives

Bond Portfolio Management including Hedging

Interest Rate Models

Mortgages and Mortgage-Backed Securities

Roughly, one three-hour long session will be used to cover one topic. More detailed teaching schedule will be

provided in each semester when the course is offered.

REQUIRED/RECOMMENDED READINGS & ONLINE MATERIALS

1. Highly recommended textbook: Fabozzi, Frank J., Bond Markets, Analysis, and Strategies, Global

Edition, 8th Edition, 2012, (Pearson Education, Inc)

2. Reference book: Tuckman, Bruce and Angel Serrat, Fixed Income Securities: Tools for Todays Markets,

University Edition, 3rd Edition, 2012, (Wiley Finance)

3. Lecture notes prepared by the instructor, which will be available on course Moodle

4. Video clips on Youtube

5. Recommended reading articles

MEANS/PROCESSES FOR STUDENT FEEDBACK ON COURSE

Conducting the Student Evaluation of Teaching and Learning (SETL) around the end of the semester

Using Discussion Forum in the course Moodle to seek for students feedback throughout the semester

COURSE POLICY

Class Conduct

Students are required to attend all classes on time. If you miss a class, it is entirely your responsibility for what you

have missed. In case you have to leave the class early, please inform the instructor beforehand and leave quietly.

No use of mobile phone or chatting is allowed when the class is in session. Remember to turn off or mute the phone

before each session. The instructor has the discretion to give penalty in case of class misconduct.

Respect your instructors and your fellow students. Be considerate to others.

Academic Dishonesty

The University Regulations on academic dishonesty will be strictly enforced! Please check the University

Statement on plagiarism on the web: http://www.hku.hk/plagiarism/

Academic dishonesty is any act that misrepresents a persons own academic work or that compromises the

academic work of another. It includes (but not limited to) cheating on assignments or examinations; plagiarizing,

i.e., representing someone elses ideas as if they are ones own; sabotaging anothers work.

If you are caught in an act of academic dishonesty or misconduct, you will receive an F grade for the subject. The

relevant Board of Examiners may impose other penalty in relation to the seriousness of the offense.

ADDITIONAL COURSE INFORMATION

Announcements, assignments, and lecture slides will be posted on the course MOODLE website. Hard

copy of lecture notes will not be provided.

No late assignments will be accepted.

Additional course information like TAs information, class schedule and such will be available later.

Supplementary Information for FINA0804A/FINA3323A, 2016-2017

Instructor: Dr. Huiyan QIU

Office:

Room 917 KKL (2859-1046)

E-mail:

hqiu@hku.hk

Office Hours: By appointment

TA: Mr. Clive Man Chung HO

Office: Room 1026KKL (2857-8514)

Email: hoclive@hku.hk

Office Hours: TBA

Meeting Schedule: Friday 14:30-17:20, KKLG104

Hard copies of lecture notes and other course material will not be provided except under special

circumstances. It is students responsibility to download them from the course Moodle.

Additional information on assignment:

There will be five homework assignments which are designed to help students review some of the

basic concepts and to practice applying the concepts. Each assignment has to be turned in by its

due date. No later homework will be accepted. For grading policy on homework assignment, please

refer to the assignments section on the course Moodle page.

Additional information on exams:

The midterm exam is scheduled on Wednesday evening, October 26. No make-up exam will be

given. Any students not taking the midterm exam will automatically have the weight shifted to final

exam. Final exam is cumulative. Students are required to have a financial calculator for taking the

exams.

Access to course Moodle:

Students registered to the course have access to the course Moodle through hkuportal.

For those who havent registered, please first make sure you log out your hkuportal account and

then go to https://hkuportal.hku.hk/moodle/guest and log in by using

Username: _fina0804_3323_a_2016_guest

password: Sef3323A@

If you have any question on course registration, please contact Faculty office at

fbe.ugenquiry@hku.hk.

COURSE SCHEDULE (tentative and subject to change)

Week

Topic

Reading*

Overview of the Course

Week 1: Sep 2

Chapter 1

Introduction to Fixed Income Securities

Week 2: Sep 9

Bond Valuation and Yield Measures

Chapter 2, 3

Week 3: Sep 16

NO CLASS, Public Holiday

Week 4: Sep 23

Bond Price Volatility

Chapter 4

Week 5: Sep 30

Bond Yield and Interest Rate Structure

Chapter 5

Week 6: Oct 7

Bond with Other Features

Chapter 17, 19

Week 7: Oct 14

Forward and Futures on Bond

Chapter 26

Week 8: October 17 22 Reading Week

7 9 pm, Oct 26: midterm exam

Options and Other Fixed Income Derivatives

Chapter 27, 28,

29

Week 10: Nov 4

Bond Portfolio Management

Chapter 22

Week 11: Nov 11

Interest Rate Models

Chapter 16

Week 12: Nov 18

Interest Rate Models (contd)

Week 13: Nov 25

Mortgages and Mortgage-Backed Securities

Week 9: Oct 28

Chapter 10, 11,

12

*: The chapters indicated are from Fabozzis book. Please note that the reading list here is for

reference only. Some of the topics are across several chapters of Fabozzis book as well as

Tuckmans book. More detailed information about corresponding readings will be in the lecture note.

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- SGDE Example of A Clear Investment ThesisDocument10 pagesSGDE Example of A Clear Investment ThesisJohn Aldridge ChewPas encore d'évaluation

- Publicly Listed Infrastructure Mutual Fund (WDocument17 pagesPublicly Listed Infrastructure Mutual Fund (WRonaky123456Pas encore d'évaluation

- David WintersDocument8 pagesDavid WintersRui BárbaraPas encore d'évaluation

- Fixed Income Combined Notes Week 1 To 5Document283 pagesFixed Income Combined Notes Week 1 To 5Reiner SatrioPas encore d'évaluation

- Nike Inc - Case Solution (Syndicate Group 4) - FadhilaDocument13 pagesNike Inc - Case Solution (Syndicate Group 4) - FadhilaFadhila HanifPas encore d'évaluation

- Bloomberg Terminal Getting Started StudentsDocument38 pagesBloomberg Terminal Getting Started StudentsK Park80% (5)

- IridiumDocument20 pagesIridiumScarlet JohnsonPas encore d'évaluation

- 6fj3u Stochastic Calculus For FinanceDocument188 pages6fj3u Stochastic Calculus For FinanceVSōkrátēsRamessur100% (4)

- Book AnswersDocument138 pagesBook AnswersMartina Vassallo100% (1)

- Public Finance 8th Ed SolutionDocument92 pagesPublic Finance 8th Ed SolutionChan ZacharyPas encore d'évaluation

- Public Finance SolutionDocument24 pagesPublic Finance SolutionChan Zachary100% (1)

- Financial Statement AnalysisDocument16 pagesFinancial Statement AnalysisEllenPas encore d'évaluation

- HVS - Art Science of Hotel Valuation in An Economic DownturnDocument12 pagesHVS - Art Science of Hotel Valuation in An Economic DownturnSoftkillerPas encore d'évaluation

- A Study On Portfolio Construction/ManagementDocument81 pagesA Study On Portfolio Construction/ManagementAshickPas encore d'évaluation

- Money Would Be On The X and Organs On The YDocument2 pagesMoney Would Be On The X and Organs On The YChan Zachary100% (1)

- Chapter 1 SolutionsDocument5 pagesChapter 1 SolutionsChan ZacharyPas encore d'évaluation

- Principles of Macroeconomics, 9e - TB1 (Case/Fair/Oster) : The MPC IsDocument138 pagesPrinciples of Macroeconomics, 9e - TB1 (Case/Fair/Oster) : The MPC IsChan ZacharyPas encore d'évaluation

- Pre-Math Tutorial Outline: LU Futao September 8, 2014Document2 pagesPre-Math Tutorial Outline: LU Futao September 8, 2014Chan ZacharyPas encore d'évaluation

- Chapter 9Document3 pagesChapter 9Chan ZacharyPas encore d'évaluation

- Year 3 TimetableDocument2 pagesYear 3 TimetableChan ZacharyPas encore d'évaluation

- International Finance TestDocument15 pagesInternational Finance TestChan ZacharyPas encore d'évaluation

- Presentation 1Document1 pagePresentation 1Chan ZacharyPas encore d'évaluation

- Year 3 TimetableDocument2 pagesYear 3 TimetableChan ZacharyPas encore d'évaluation

- L1 Course OverviewDocument7 pagesL1 Course OverviewChan ZacharyPas encore d'évaluation

- Credibility Theory and Loss DistributionDocument1 pageCredibility Theory and Loss DistributionChan ZacharyPas encore d'évaluation

- O Pojmu SekjuritizacijeDocument33 pagesO Pojmu SekjuritizacijeСветислав КондићPas encore d'évaluation

- Fina2802 NotesDocument2 pagesFina2802 NotesChan ZacharyPas encore d'évaluation

- 4 Bond Valuation - PPT PDFDocument79 pages4 Bond Valuation - PPT PDFJocel LactaoPas encore d'évaluation

- Arbel 1990Document6 pagesArbel 1990sendano 0Pas encore d'évaluation

- BondsDocument22 pagesBondsSuchit Backup1Pas encore d'évaluation

- Peso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Document2 pagesPeso Asia Pacific Property Income Fund - Fund Fact Sheet - October - 2020Jayr LegaspiPas encore d'évaluation

- Gma Financial Ratio CompileDocument5 pagesGma Financial Ratio CompileVan Errl Nicolai SantosPas encore d'évaluation

- Ca Final SFM - New Scheme - Dawn 2022 - TheoryDocument28 pagesCa Final SFM - New Scheme - Dawn 2022 - TheoryAnkur SoniPas encore d'évaluation

- Interest Rates, Exchange Rates and Inflation: A PrimerDocument26 pagesInterest Rates, Exchange Rates and Inflation: A PrimerBhavya ShahPas encore d'évaluation

- Suggested Product List & Ready Reckoner - Aug'19Document32 pagesSuggested Product List & Ready Reckoner - Aug'19Pawan ShroffPas encore d'évaluation

- Financial Analysis AssignmentDocument12 pagesFinancial Analysis AssignmentDushan Chamidu50% (2)

- Interest Rate Answer by BrighamDocument15 pagesInterest Rate Answer by BrighamBrandon LumibaoPas encore d'évaluation

- CBRE Multifamily Client Call - 112718Document29 pagesCBRE Multifamily Client Call - 112718SukkMidickPas encore d'évaluation

- Manual For Discounting Oil and Gas IncomeDocument9 pagesManual For Discounting Oil and Gas IncomeCarlota BellésPas encore d'évaluation

- Chap 10-11 PDFDocument41 pagesChap 10-11 PDFmnwongPas encore d'évaluation

- Lec 10Document26 pagesLec 10danphamm226Pas encore d'évaluation

- Chapter 8 - 9 - 11Document99 pagesChapter 8 - 9 - 11Koey TsePas encore d'évaluation

- MCQ 5Document21 pagesMCQ 5Dương Hà LinhPas encore d'évaluation

- Fin4002 MCDocument10 pagesFin4002 MCYMC SOEHKPas encore d'évaluation

- FIN3244 Sample TestDocument9 pagesFIN3244 Sample TestDarling Jonathan WallacePas encore d'évaluation