Académique Documents

Professionnel Documents

Culture Documents

Actividad Clase 6 Bond Valuation

Transféré par

Nacho Trujillo MazorraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Actividad Clase 6 Bond Valuation

Transféré par

Nacho Trujillo MazorraDroits d'auteur :

Formats disponibles

Bond Valuation

Robert Black and Carol Alvarez are vice-presidents of Western Money Management and codirectors of the

companys pension fund management division. A major new client, the California League of Cities, has

requested that Western present an investment seminar to the mayors of the represented cities, and Black and

Alvarez, who will make the actual presentation, have asked you to help them by answering the following

questions.

a. What are the key features of a bond?

b. What are call provisions and sinking fund provisions? Do these provisions make bonds more or less risky?

c. How is the value of any asset whose value is based on expected future cash flows determined?

d. How is the value of a bond determined? What is the value of a 10-year, $1,000 par value bond with a 10

percent annual coupon if its required rate of return is 10 percent?

e. (1) What would be the value of the bond described in part d if, just after it had been issued, the expected

inflation rate rose by 3 percentage points, causing investors to require a 13 percent return? Would we now

have a discount or a premium bond?

(2) What would happen to the bonds value if inflation fell, and kd declined to 7 percent? Would we now have a

premium or a discount bond?

(3) What would happen to the value of the 10-year bond over time if the required rate of return remained at 13

percent, or if it remained at 7 percent?

f. (1) What is the yield to maturity on a 10-year, 9 percent, annual coupon, $1,000 par value bond that sells for

$887.00? That sells for $1,134.20? What does the fact that a bond sells at a discount or at a premium tell you

about the relationship between kd and the bonds coupon rate?

(2) What are the total return, the current yield, and the capital gains yield for the discount bond? (Assume the

bond is held to maturity and the company does not default on the bond.)

g. What is interest rate (or price) risk? Which bond has more interest rate risk, an annual payment 1-year bond

or a 10-year bond? Why?

h. What is reinvestment rate risk? Which has more reinvestment rate risk, a 1-year bond or a 10-year bond?

i. How does the equation for valuing a bond change if semiannual payments are made? Find the value of a 10year, semiannual payment, 10 percent coupon bond if nominal kd ! 13

j. Suppose you could buy, for $1,000, either a 10 percent, 10-year, annual payment bond or a 10 percent, 10year, semiannual payment bond. They are equally risky. Which would you prefer? If $1,000 is the proper price

for the semiannual bond, what is the equilibrium price for the annual payment bond?

k. Suppose a 10-year, 10 percent, semiannual coupon bond with a par value of $1,000 is currently selling for

$1,135.90, producing a nominal yield to maturity of 8 percent. However, the bond can be called after 4 years

for a price of $1,050.

(1) What is the bonds nominal yield to call (YTC)?

(2) If you bought this bond, do you think you would be more likely to earn the YTM or the YTC? Why?

l. Does the yield to maturity represent the promised or expected return on the bond?

m. These bonds were rated AA$ by S&P. Would you consider these bonds investment grade or junk bonds?

n. What factors determine a companys bond rating?

o. If this firm were to default on the bonds, would the company be immediately liquidated? Would the

bondholders be assured of receiving all of their promised payments?

Vous aimerez peut-être aussi

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- CH 2 Answer KeyDocument4 pagesCH 2 Answer KeyImanuel YogaPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- BBA SubjectsDocument28 pagesBBA SubjectsAditya SharmaPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Complete Set of Notes CompressedDocument76 pagesComplete Set of Notes CompressedsaumyaPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The IMF and The World Bank How Do They Differ?: David D. DriscollDocument15 pagesThe IMF and The World Bank How Do They Differ?: David D. DriscollNeil NeilsonPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- 16.financial Merchandise ManagementDocument41 pages16.financial Merchandise ManagementSumaiyah Alifah67% (3)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Lajpat Rai Law College: Amount of Bank Draft To Be Sent With Downloaded Application FormDocument9 pagesLajpat Rai Law College: Amount of Bank Draft To Be Sent With Downloaded Application FormDolamani RohidasPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Lorax o NomicsDocument4 pagesLorax o NomicsJohn JohnsonPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Role of Innovative Entrepreneurship in Economic DevelopmentDocument9 pagesThe Role of Innovative Entrepreneurship in Economic DevelopmentZain Ahmad KhanPas encore d'évaluation

- POL 341-Political Economy of Pakistan-Hassan JavidDocument5 pagesPOL 341-Political Economy of Pakistan-Hassan JavidFaizan AhmadPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- P3 - 10land Use DeterminantsDocument2 pagesP3 - 10land Use DeterminantsDimple guyPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Richard Werner - A Lost Century in Economics. Three Theories of Banking and The Conclusive EvidenceDocument19 pagesRichard Werner - A Lost Century in Economics. Three Theories of Banking and The Conclusive EvidenceTREND_7425100% (2)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Chapter 11 PDFDocument8 pagesChapter 11 PDFJulie HuynhPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Thesis AgribusinessDocument5 pagesThesis AgribusinessElizabeth Williams100% (2)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Urban Studies Uk 2009Document28 pagesUrban Studies Uk 2009Tiago R. CorreiaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- CVP Analysis Theory QuizDocument3 pagesCVP Analysis Theory QuizHazel Ann PelarePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Finance Capital TodayDocument323 pagesFinance Capital Todayalromer100% (1)

- Rstudio Project PDFDocument16 pagesRstudio Project PDFNataly ShihabiPas encore d'évaluation

- BCTRDC Strategic PlanDocument7 pagesBCTRDC Strategic PlanbalondojeremyPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Unit 6 - DiversificationDocument31 pagesUnit 6 - DiversificationSasha MacPas encore d'évaluation

- Essay About GlobalizationDocument5 pagesEssay About GlobalizationJackelin Salguedo FernandezPas encore d'évaluation

- Ch. Charan Singh University Meerut: Regular & Self-Financed CoursesDocument88 pagesCh. Charan Singh University Meerut: Regular & Self-Financed CoursesAmit KumarPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Silabus Matematika Keuangan 260221Document5 pagesSilabus Matematika Keuangan 260221Garcia ZarathustraPas encore d'évaluation

- Portfolio Management Process (Condensed)Document17 pagesPortfolio Management Process (Condensed)sadamPas encore d'évaluation

- ECON 203 Midterm 2012W AncaAlecsandru SolutionDocument8 pagesECON 203 Midterm 2012W AncaAlecsandru SolutionexamkillerPas encore d'évaluation

- Maharashtra State Board of Secondary and Higher Secondary Education, PuneDocument10 pagesMaharashtra State Board of Secondary and Higher Secondary Education, PuneKashyap PatelPas encore d'évaluation

- (CMA Fundamentals) Brian Hock, Lynn Roden - CMA Fundamentals Economics and Statistics 1 (2017)Document298 pages(CMA Fundamentals) Brian Hock, Lynn Roden - CMA Fundamentals Economics and Statistics 1 (2017)humanity firstPas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

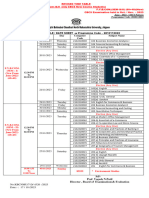

- Revised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Document5 pagesRevised Time Table of FY-SY-TYBCom Sem I To VI New Old CBCS-CGPA Exam - To Be Held in Oct Nov-2023Viraj SharmaPas encore d'évaluation

- The Eco-Toursim Value of A National Park A Case From The PhilippinesDocument32 pagesThe Eco-Toursim Value of A National Park A Case From The PhilippinesIsmael CortezPas encore d'évaluation

- Transparency and Nordic Openness in Finland IdeatiDocument22 pagesTransparency and Nordic Openness in Finland IdeatiKenio FilhoPas encore d'évaluation

- Soil and Land Management in A Circular Economy PDFDocument6 pagesSoil and Land Management in A Circular Economy PDFAdelina96Pas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)