Académique Documents

Professionnel Documents

Culture Documents

Nes 124 - Quiz #6

Transféré par

Patrick0 évaluation0% ont trouvé ce document utile (0 vote)

674 vues2 pagesEngineering Economy problems

Titre original

NES 124 - QUIZ #6

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentEngineering Economy problems

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

674 vues2 pagesNes 124 - Quiz #6

Transféré par

PatrickEngineering Economy problems

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

ENGINEERING ECONOMY

QUIZ #2 - FINAL

Name:

Subject & Section:

Instructor:

Course:

Date:

I. Identification (Terms: 2 pts each) No

Erasures

1. it allows an entity to evaluate the benefits or gains from a project as against the

cost of investments.

2. is defined as the number of periods required to recover the cost of an investment

from net receipts.

3. Is equal to the sum of the first cost (FC) of the project, the

present worth of the annual costs of

operations and maintenance (COM), and the

present worth of the perpetual cost of replacement.

4. Is used to determine the

depreciation of property not as function of time, in years, but as a function of

use.

5. are expenses that remain stable within a specified range of production and sales

levels.

6. is the predetermined rate set by the business to measure the profitability of an

investment or project.

7. if the alternatives when evaluating an investment have different lives it is necessary

to get their ______ to extend cash flow to the same periods.

8. is a method widely used by investors basically because it expresses the interest

realized from an

investment in terms of a percentage.

9. is a method that converts all cash flows of a project or investment into an

II. Problem Solving

1. To increase production output, a manufacturing

company must adopt one of the following processes,

with estimated cash flows as shown:

Cost of

Equipment

Annual

Maintenance

Annual Revenue

Salvage Value

Process 1

Process 2

Process 3

P400 000

P550 000

P700 000

40 000

50 000

55 000

180 000

70 000

230 000

70 000

275 000

85 000

If the company uses 12% MARR and all equipment

life is estimated at 5 years, determine the best

process using PW analysis. (15 pts)

2. Using annual worth analysis, determine the

best process described in problem no.1 (10

pts)

3. A new equipment that will increase revenue by

P94 500 a year requires an investment of P430 000.

It is estimated to have a net salvage value of P50

000 at the end of 12 years, with annual expenses for

repairs and maintenance totaling to P15 000.

*The ratio of production bet. Pineapple and apple is

Determine if the investment is justified using

2:1. (15 pts)

future worth analysis and an 18% rate of return.

(10 pts)

4. The manager of a manufacturing plant is

evaluating a proposal for a new process that will

save the company P1.85M per year in labor and

operating expenses. Equipment for this process will

cost P14.7M and is estimated to have a salvage

value of P3M after 15 years. If the company uses

15% MARR, make your recommendation using

B/C ratio analysis. (10 pts)

5.

proposed

requires

an

five

year

equipment

development

investment

of

project

P24M.

Estimated annual profit is P12M; annual cost of

maintenance

and

taxes

is

P1.12M

with

the

equipment being sold at 40% of cost at the end of

the project. Applying SLM depreciation, determine

the payback period for this investment. (10

pts)

6. A suspension bridge was constructed for 24M.

The annual maintenance cost is P500 000. If the

rate of interest is 6%, compute the capitalized

cost of the bridge including maintenance. (10 pts)

7. PPAP industry, sells pineapples for P450.00 per

box and apples for P200.00 per box. It costs PPAP

P25 000.00 per year in preparation and packaging of

products. This sum includes man power costs,

packaging supplies, transportation expenses and

charges on equipment. If the cost to produce one

box of pineapple is P250.00 and apple for P150.00,

how many boxes of pineapple and apple must

be sold each year for PPAP industry to avoid taking a

loss?

Vous aimerez peut-être aussi

- Applied Corporate Finance. What is a Company worth?D'EverandApplied Corporate Finance. What is a Company worth?Évaluation : 3 sur 5 étoiles3/5 (2)

- Career Change From Real Estate to Oil and Gas ProjectsD'EverandCareer Change From Real Estate to Oil and Gas ProjectsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Yaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Document7 pagesYaniza, Regine Mae L. - ULO 3A Let's Check: Situation 01Regine Mae Lustica Yaniza100% (1)

- Basic Methods ModuleDocument12 pagesBasic Methods ModuleSarTomPas encore d'évaluation

- Capital Budgeting Problems and ExercisesDocument7 pagesCapital Budgeting Problems and ExercisesRobert RamirezPas encore d'évaluation

- Break Win AnalysisDocument14 pagesBreak Win Analysiskian obdinPas encore d'évaluation

- Activity - Capital Investment AnalysisDocument5 pagesActivity - Capital Investment AnalysisKATHRYN CLAUDETTE RESENTEPas encore d'évaluation

- GRC FinMan Capital Budgeting ModuleDocument10 pagesGRC FinMan Capital Budgeting ModuleJasmine FiguraPas encore d'évaluation

- Multiple Choice Theory: Choose The Best Answer. 1 Point EachDocument9 pagesMultiple Choice Theory: Choose The Best Answer. 1 Point EachPao SalvadorPas encore d'évaluation

- Capital Budgeting Problems SolvedDocument4 pagesCapital Budgeting Problems SolvedLiana Monica Lopez0% (1)

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloPas encore d'évaluation

- Practice Problems - Capital Budgeting PDFDocument2 pagesPractice Problems - Capital Budgeting PDFRamainne RonquilloPas encore d'évaluation

- MODULE 8 Capital BudgetingDocument9 pagesMODULE 8 Capital BudgetingLumingPas encore d'évaluation

- Capital BudgetingDocument4 pagesCapital BudgetingYaj CruzadaPas encore d'évaluation

- Finman MidtermDocument4 pagesFinman Midtermmarc rodriguezPas encore d'évaluation

- End of Term Assignment For The Course: Corporate FinanceDocument2 pagesEnd of Term Assignment For The Course: Corporate FinanceLê Thị Minh HươngPas encore d'évaluation

- F 9Document32 pagesF 9billyryan1100% (2)

- Set B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OneDocument15 pagesSet B Instructions: Choose The BEST Answer For Each of The Following Items. Mark Only OnePamela SantosPas encore d'évaluation

- Results For Item 2Document26 pagesResults For Item 2Kath LeynesPas encore d'évaluation

- Capital Investment Decisions GuideDocument5 pagesCapital Investment Decisions GuideIvan BendiolaPas encore d'évaluation

- 6 - Basic Methods For Making Economy StudiesDocument25 pages6 - Basic Methods For Making Economy StudiesChu KathPas encore d'évaluation

- PPDE_CB407_P4Document25 pagesPPDE_CB407_P4Ujjwal AnandPas encore d'évaluation

- Capital BudgetingDocument7 pagesCapital Budgetingmiss independentPas encore d'évaluation

- 3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveDocument4 pages3-1 Scenario Analysis: Project Risk Analysis-ComprehensiveMinh NguyenPas encore d'évaluation

- Capital Budgeting Problems For Fin102Document2 pagesCapital Budgeting Problems For Fin102Marianne AgunoyPas encore d'évaluation

- 4 Capital Budgeting - DTI UP PDFDocument35 pages4 Capital Budgeting - DTI UP PDFEarthAngel OrganicsPas encore d'évaluation

- MCQ - Capital BudgetingDocument2 pagesMCQ - Capital BudgetingRamainne Ronquillo0% (1)

- Tute 6 PDFDocument4 pagesTute 6 PDFRony RahmanPas encore d'évaluation

- Learning Packet Template No. 3 Capital BudgetingDocument7 pagesLearning Packet Template No. 3 Capital BudgetingsamanthaPas encore d'évaluation

- 2-4 2004 Jun QDocument11 pages2-4 2004 Jun QAjay TakiarPas encore d'évaluation

- PRINT Final Exam in Managerial Accounting 3Document2 pagesPRINT Final Exam in Managerial Accounting 3Rhan JoPas encore d'évaluation

- CA 51014 - Strategic Cost Management Capital BudgetingDocument9 pagesCA 51014 - Strategic Cost Management Capital BudgetingMark FloresPas encore d'évaluation

- Cap BudDocument29 pagesCap BudJorelyn Joy Balbaloza CandoyPas encore d'évaluation

- FDHDFGSGJHDFHDSHJDDocument8 pagesFDHDFGSGJHDFHDSHJDbabylovelylovelyPas encore d'évaluation

- Spring2022 (July) Exam-Fin Part2Document4 pagesSpring2022 (July) Exam-Fin Part2Ahmed TharwatPas encore d'évaluation

- 3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsDocument3 pages3 - 0607 - Making Capital Investment Decisions. Risk Analysis, Real OptionsPham Ngoc VanPas encore d'évaluation

- Capital Budgeting 1 - 1Document103 pagesCapital Budgeting 1 - 1Subhadeep BasuPas encore d'évaluation

- Hind Petrochemicals Investment DecisionDocument3 pagesHind Petrochemicals Investment Decisiondiksha dagaPas encore d'évaluation

- Applied Science University: Faculty of Engineering Mechanical and Industrial EngineeringDocument4 pagesApplied Science University: Faculty of Engineering Mechanical and Industrial EngineeringMahmoud AlswaitiPas encore d'évaluation

- MANAGEMENT ACCOUNTING PART 2 CAPITAL BUDGETING COSTDocument5 pagesMANAGEMENT ACCOUNTING PART 2 CAPITAL BUDGETING COSTCris Joy BiabasPas encore d'évaluation

- Module 4 CFMADocument36 pagesModule 4 CFMAk 3117Pas encore d'évaluation

- Feasibility StudyDocument8 pagesFeasibility StudymuhaPas encore d'évaluation

- Capital BudgetingDocument15 pagesCapital BudgetingJoshua Naragdag ColladoPas encore d'évaluation

- Capital Budgeting Report FinalDocument15 pagesCapital Budgeting Report FinalCezar SabladPas encore d'évaluation

- Fin701 Module3Document22 pagesFin701 Module3Krista CataldoPas encore d'évaluation

- Tutorial 2 - Principles of Capital BudgetingDocument3 pagesTutorial 2 - Principles of Capital Budgetingbrahim.safa2018Pas encore d'évaluation

- Depreciation: ConceptDocument6 pagesDepreciation: ConceptEdna OrdanezaPas encore d'évaluation

- 6 Comparing AlternativesDocument49 pages6 Comparing AlternativesTrimar DagandanPas encore d'évaluation

- This Study Resource Was: Financial Management Part IiDocument8 pagesThis Study Resource Was: Financial Management Part Iiaj dumpPas encore d'évaluation

- Capital Budgeting - Phase 2Document39 pagesCapital Budgeting - Phase 2Julie Ann PiliPas encore d'évaluation

- Concept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainDocument11 pagesConcept of Capital Budgeting: Capital Budgeting Is A Process of Planning That Is Used To AscertainLeena SachdevaPas encore d'évaluation

- Midterm Quiz No 1 Relevant Costing and Capital BudgetingDocument2 pagesMidterm Quiz No 1 Relevant Costing and Capital BudgetingLian GarlPas encore d'évaluation

- Paper P4 Advanced Financial Management: Tuition Mock Examination June 2012 Answer GuideDocument21 pagesPaper P4 Advanced Financial Management: Tuition Mock Examination June 2012 Answer Guideseemi_ariesPas encore d'évaluation

- Learning Activity 4Document1 pageLearning Activity 4zyx xyzPas encore d'évaluation

- Capital BudgetingDocument12 pagesCapital BudgetingFrankline RickyPas encore d'évaluation

- Lesson 7 Complementary Investment Studies and Break Even AnalysisDocument25 pagesLesson 7 Complementary Investment Studies and Break Even Analysisfathima camangianPas encore d'évaluation

- MA PresentationDocument6 pagesMA PresentationbarbaroPas encore d'évaluation

- MN20501 Lecture 9 Review ExerciseDocument3 pagesMN20501 Lecture 9 Review Exercisesamvrab1919Pas encore d'évaluation

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsD'EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsPas encore d'évaluation

- Investment Appraisal: A Simple IntroductionD'EverandInvestment Appraisal: A Simple IntroductionÉvaluation : 4 sur 5 étoiles4/5 (6)

- Page 0001Document1 pagePage 0001PatrickPas encore d'évaluation

- Duct Size CalculatorDocument1 pageDuct Size CalculatorVictor Valencia100% (1)

- IndustrialVentilation MachineRoom PDFDocument4 pagesIndustrialVentilation MachineRoom PDFHassan KhanPas encore d'évaluation

- Location Plan & DetailsDocument3 pagesLocation Plan & DetailsPatrickPas encore d'évaluation

- Rentable Storage Unit PlansDocument1 pageRentable Storage Unit PlansPatrickPas encore d'évaluation

- S Curve SampleDocument2 pagesS Curve SamplePatrickPas encore d'évaluation

- Proposed Car Parking 87 Slots: Access Room Exhaust Room Exhaust RoomDocument1 pageProposed Car Parking 87 Slots: Access Room Exhaust Room Exhaust RoomPatrickPas encore d'évaluation

- TWS Layout Part 1-5-22-2017Document1 pageTWS Layout Part 1-5-22-2017PatrickPas encore d'évaluation

- Suburban Sheet Metal LTD SPECSDocument43 pagesSuburban Sheet Metal LTD SPECSAv Raham B. AriasPas encore d'évaluation

- Department StoreDocument4 pagesDepartment StorePatrickPas encore d'évaluation

- PR To Follow UpDocument1 pagePR To Follow UpPatrickPas encore d'évaluation

- SMCF Chiller Plant PhotosDocument1 pageSMCF Chiller Plant PhotosPatrickPas encore d'évaluation

- Canopy ProposalDocument1 pageCanopy ProposalPatrickPas encore d'évaluation

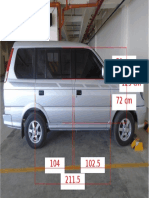

- Car DimensionsDocument1 pageCar DimensionsPatrickPas encore d'évaluation

- Flaglets DesignDocument1 pageFlaglets DesignPatrickPas encore d'évaluation

- Air ConditioningDocument23 pagesAir ConditioningMohammed Ahmed KhanPas encore d'évaluation

- Insular Life FormDocument1 pageInsular Life FormPatrickPas encore d'évaluation

- Steel Plate Street Signs w/ Name Stickers Fig 1-4Document1 pageSteel Plate Street Signs w/ Name Stickers Fig 1-4PatrickPas encore d'évaluation

- GBusiSBG11 PDFDocument168 pagesGBusiSBG11 PDFkemime100% (2)

- Lesson 19 - Preparation of Capital Statement and Balance SheetDocument6 pagesLesson 19 - Preparation of Capital Statement and Balance SheetMayeng MonayPas encore d'évaluation

- GCEMP 2021 PPT Participants Part1Document54 pagesGCEMP 2021 PPT Participants Part1Deepu MannatilPas encore d'évaluation

- Relative ValuationDocument26 pagesRelative ValuationRAKESH SINGHPas encore d'évaluation

- Questus Global Capital Markets On GXGDocument3 pagesQuestus Global Capital Markets On GXGlcdcomplaintPas encore d'évaluation

- Market EfficiencyDocument55 pagesMarket Efficiencyjeet_singh_deepPas encore d'évaluation

- Economic Survey 2018-19: Key HighlightsDocument468 pagesEconomic Survey 2018-19: Key HighlightsAmit JaiswalPas encore d'évaluation

- TermProj assignMutFund 2019 SpringDocument1 pageTermProj assignMutFund 2019 Springjl123123Pas encore d'évaluation

- Divis Laboratories Stock Performance Over 3 YearsDocument19 pagesDivis Laboratories Stock Performance Over 3 YearsAbhishekKumarPas encore d'évaluation

- Assignment On Padma Islami Life Insurance Co. Ltd.Document21 pagesAssignment On Padma Islami Life Insurance Co. Ltd.Muktadirhasan100% (3)

- 1 Ddim 2019 Slides Gimede PDFDocument105 pages1 Ddim 2019 Slides Gimede PDFfabriPas encore d'évaluation

- Eagle Capital Management PresentationDocument23 pagesEagle Capital Management Presentationturnbj75Pas encore d'évaluation

- Introduction to Business Policy ChapterDocument7 pagesIntroduction to Business Policy ChapterMazumder Suman100% (1)

- Long Term Investment Decision at Kesoram CementDocument10 pagesLong Term Investment Decision at Kesoram CementMOHAMMED KHAYYUMPas encore d'évaluation

- ExxonMobil Analysis ReportDocument18 pagesExxonMobil Analysis Reportaaldrak100% (2)

- Axelum Resources Corp Preliminary ProspectusDocument198 pagesAxelum Resources Corp Preliminary ProspectusEmil Victor Medina MasaPas encore d'évaluation

- Cash FlowDocument24 pagesCash FlowMadhupriya DugarPas encore d'évaluation

- 12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFDocument20 pages12 She Accessibility Based Business Models For Peer To Peer Markets - en PDFAlexis Gonzalez PerezPas encore d'évaluation

- Capital Structure Theories VivaDocument43 pagesCapital Structure Theories VivaPuttu Guru PrasadPas encore d'évaluation

- Tanzania'S Oil and Gas Contract Regime, Investments and MarketsDocument45 pagesTanzania'S Oil and Gas Contract Regime, Investments and Marketssamwel danielPas encore d'évaluation

- UAE's Management of Global Economic ChallengesDocument26 pagesUAE's Management of Global Economic ChallengesEssa SmjPas encore d'évaluation

- Richard Branson's Adversity Led to Virgin Business OpportunitiesDocument25 pagesRichard Branson's Adversity Led to Virgin Business OpportunitiesjayannaparkPas encore d'évaluation

- GLOBAL COMPETITIOeuropean Auto IndustryDocument25 pagesGLOBAL COMPETITIOeuropean Auto IndustryMaria SverneiPas encore d'évaluation

- 0823.HK The Link REIT 2008-2009 Annual ReportDocument201 pages0823.HK The Link REIT 2008-2009 Annual ReportwalamakingPas encore d'évaluation

- Personal Income Tax in Poland 2010Document21 pagesPersonal Income Tax in Poland 2010Agnieszka GryskaPas encore d'évaluation

- 2 Taxation of International TransactionsDocument7 pages2 Taxation of International TransactionssumanmehtaPas encore d'évaluation

- Gold As An Investment Option-2206 PDFDocument4 pagesGold As An Investment Option-2206 PDFPreethu IndhiraPas encore d'évaluation

- Kaveri Seed Company: IPO Fact SheetDocument4 pagesKaveri Seed Company: IPO Fact Sheetrahulrai001Pas encore d'évaluation

- A Summer Training Project Report: A Study On Behavioral Finance in Investment Decisions of Investors in Delhi NCRDocument75 pagesA Summer Training Project Report: A Study On Behavioral Finance in Investment Decisions of Investors in Delhi NCRsandeepPas encore d'évaluation

- Minister Gigaba's Response To The Guptas' NaturalisationDocument22 pagesMinister Gigaba's Response To The Guptas' NaturalisationTiso Blackstar GroupPas encore d'évaluation