Académique Documents

Professionnel Documents

Culture Documents

RJR

Transféré par

liyulongTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

RJR

Transféré par

liyulongDroits d'auteur :

Formats disponibles

MEMO

RJR Nabisco

BY: Yuxiang Fan, Da Luo, Di Jia, Tiantao Zheng

Executive Summary

Three strategies of RJR Nabisco are presented by different acquirers. The following memo is

trying to work out the strategy that gives the highest valuation of the firm.

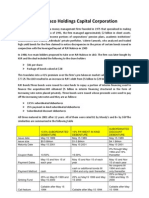

Values of RJR under Different Scenarios

In order to calculate the value of the company, we first need to unlever to derive beta asset or

return on asset. As the EBIT/Int. Exp. of RJR falls on BBB, the beta debt is 0.151 for both 1986 and 87.

So the beta asset can be given in the following table.

Year

1986

1987

D

E

V

Beta D

Beta E

Beta A

11389

5312

16701

0.151

1.24

0.497

10823

6038

16861

0.151

0.67

0.337

Average Beta Asset

0.417

Average Return on Asset

11.92%

Then we need to relever to calculate beta equity under different debt ratios across time, using

beta E=beta A + (beta A- beta D) D/E

We adopt WACC (APV can also be applied in this case, which is equivalent to WACC) to

calculate the value of RJR under the strategy given by pre-bid, Management Group, and KKR

respectively. After working out Rd and Re with CAPM, we use

WACC=Rd* (1-Tc) *D/V + Re*E/V

to calculate the different WACCs of each period. Here we have made an assumption that the corporate tax

rate is constant at 35%. We also estimate that there is an assumed debt of $5000 million in 1988. Then we

may use the WACCs to discount the FCFs of each period. The sum of the present values will be the total

value of company. We also work out the share prices given the growth rate of 0%, 2% and 4% after 1998.

The calculating process can be seen in the appendices.

Values of RJR Under Different Strategies ($/share)

Growth Rate

Pre-bid Strategy

Management Group Strategy

KKR Strategy

0%

115.02

118.48

115.63

2%

127.32

129.34

128.64

4%

145.83

145.81

148.22

The Reasons That Accounts for Differences

The differences in the value of the three operating plans are mainly from capital structure

and operating strategy used by two bidders. Both bidders believed that the value of stock was

undervalued by the market and the cash flow of RJR was strong and stable, which can utilize more

aggressive capital structure to save taxes and therefore increasing value of the company. Besides,

KKR and the Management Group thought that the operating strategy used by company could not

maximize the shareholders value. The Management Group believed that stock market undervalued

the strong and stable cash flow generated from tobacco business and market did not fully value its

food business since its connection with selling tobacco. In addition, during that time, food industry

was experiencing a major restructuring and revaluation and Johnson had experience selling food

assets. Therefore, the Management Groups strategy was to sell RJRs food business and take

tobacco business private. The Management Group believed that the new strategy would eliminate

undervaluation and generate more gains for shareholders. Moreover, this strategy was financed by

long term debt, which resulted in greater valuation because of tax shield. However, KKRs strategy

was to keep all of the tobacco business and most of food business because KKR thought that

retaining food business and operating it correctly would generate more value than just selling it.

Also, KKRs strategy took more debt, which led to higher tax shield and valuation. Thus, the

operating strategy and capital structure are the major drivers for the difference among three plans.

Evaluation of the Special Committees Auction

Special Committees use of an auction for the sale of RJR Nabisco is very reasonable and

protective to RJR Nabiscos shareholders. Such auction will benefit shareholders value by

allowing all potential buyers to compete with their highest bid offer. Moreover, this auction will

promote a quick and smooth buyout process as it gives a specific deadline to bid. This would

prevent the joint-bid case by KKR and Management Group that lasted for a year. If all parties are

privately negotiating with one another, the bidding process would be prolonged which would not

benefit shareholders interest. However, one drawback of such auction is that competition will

drive the valuation of RJR Nabisco very high, meaning that after the buyout, RJR Nabisco would

incur a significant amount of debt, which might damage remaining shareholders longer term

value.

Through our analysis, the operating strategy and capital structure are the major drivers for

the difference among three plans, since more debt would lead to higher tax shield and therefore

higher valuation.

Appendix

Vous aimerez peut-être aussi

- RJRJRJJRJRJRJJR111111Document4 pagesRJRJRJJRJRJRJJR111111John Paul Chua57% (7)

- Valuing Leveraged Buyouts with the Adjusted Present Value ApproachDocument5 pagesValuing Leveraged Buyouts with the Adjusted Present Value ApproachFelipe Kasai MarcosPas encore d'évaluation

- M&a Assignment - Syndicate C FINALDocument8 pagesM&a Assignment - Syndicate C FINALNikhil ReddyPas encore d'évaluation

- Calculating The NPV of The AcquisitionDocument23 pagesCalculating The NPV of The Acquisitionkooldude1989100% (1)

- Why the 3 Operating Plans for RJR Nabisco Differed in ValuationDocument1 pageWhy the 3 Operating Plans for RJR Nabisco Differed in ValuationSatyajeet SenapatiPas encore d'évaluation

- Cases RJR Nabisco 90 & 91 - Assignment QuestionsDocument1 pageCases RJR Nabisco 90 & 91 - Assignment QuestionsBrunoPereiraPas encore d'évaluation

- Kraft Foods Case SummaryDocument2 pagesKraft Foods Case Summaryrkodo1126Pas encore d'évaluation

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationKrishna Chaitanya KothapalliPas encore d'évaluation

- RJR Nabisco Pre-Bid Valuation AnalysisDocument13 pagesRJR Nabisco Pre-Bid Valuation AnalysisMohit Khandelwal100% (1)

- RJR Nabisco ValuationDocument38 pagesRJR Nabisco ValuationJCPas encore d'évaluation

- RJR Nabisco 1Document6 pagesRJR Nabisco 1gopal mundhraPas encore d'évaluation

- RJR Nabisco Holdings Capital CorporationDocument3 pagesRJR Nabisco Holdings Capital CorporationManogana RasaPas encore d'évaluation

- Clarkson Lumber Analysis - TylerDocument9 pagesClarkson Lumber Analysis - TylerTyler TreadwayPas encore d'évaluation

- RJR Nabisco Valuation Under Different StrategiesDocument18 pagesRJR Nabisco Valuation Under Different StrategiesHarsha Vardhan100% (1)

- RJR NabiscoDocument22 pagesRJR Nabiscokriteesinha100% (2)

- In-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDocument5 pagesIn-Class Project 2: Due 4/13/2019 Your Name: Valuation of The Leveraged Buyout (LBO) of RJR Nabisco 1. Cash Flow EstimatesDinhkhanh NguyenPas encore d'évaluation

- Case Analysis - Compania de Telefonos de ChileDocument4 pagesCase Analysis - Compania de Telefonos de ChileSubrata BasakPas encore d'évaluation

- RJR 1987 Annual ReportDocument94 pagesRJR 1987 Annual Reportmilken466100% (1)

- The Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationDocument24 pagesThe Relative Pricing of High-Yield Debt: The Case of RJR Nabisco Holdings Capital CorporationAhsen Ali Siddiqui100% (1)

- Case Assignment - RJR NabiscoDocument1 pageCase Assignment - RJR NabiscoMuhammad Rehan NasirPas encore d'évaluation

- Student SpreadsheetDocument14 pagesStudent SpreadsheetPriyanka Agarwal0% (1)

- RJR Nabisco Special Committee Members and AdvisorsDocument13 pagesRJR Nabisco Special Committee Members and AdvisorsRattan Preet Singh25% (4)

- In Re RJR Nabisco Inc.Document3 pagesIn Re RJR Nabisco Inc.viva_33Pas encore d'évaluation

- RJR Nabisco ValuationDocument33 pagesRJR Nabisco ValuationShivani Bhatia100% (4)

- RJR Nabisco ValuationDocument7 pagesRJR Nabisco ValuationAnil Kotaga0% (1)

- Buckeye Bank CaseDocument7 pagesBuckeye Bank CasePulkit Mathur0% (2)

- Marriott Cost of Capital Analysis for Lodging DivisionDocument3 pagesMarriott Cost of Capital Analysis for Lodging DivisionPabloCaicedoArellanoPas encore d'évaluation

- MFIN Case Write-UpDocument7 pagesMFIN Case Write-UpUMMUSNUR OZCANPas encore d'évaluation

- RJR Nabisco Board Committee Members and ResponsibilitiesDocument10 pagesRJR Nabisco Board Committee Members and ResponsibilitiesSurajPas encore d'évaluation

- Butler Lumber CoDocument2 pagesButler Lumber Cokumarsharma123Pas encore d'évaluation

- AirThread Valuation SheetDocument11 pagesAirThread Valuation SheetAngsuman BhanjdeoPas encore d'évaluation

- RJR Nabisco ValuationDocument40 pagesRJR Nabisco ValuationEdisonCaguanaPas encore d'évaluation

- A Note On Leveraged RecapitalizationDocument5 pagesA Note On Leveraged Recapitalizationkuch bhiPas encore d'évaluation

- Ethodology AND Ssumptions: B B × D EDocument7 pagesEthodology AND Ssumptions: B B × D ECami MorenoPas encore d'évaluation

- Debt Policy at UST IncDocument5 pagesDebt Policy at UST Incggrillo73Pas encore d'évaluation

- Apache Corporation's Acquisition of MW Petroleum Corp DCF ValuationDocument20 pagesApache Corporation's Acquisition of MW Petroleum Corp DCF ValuationasmaPas encore d'évaluation

- KOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedDocument30 pagesKOHLR &co (A&B) : Asish K Bhattacharyya Chairperson, Riverside Management Academy Private LimitedmanjeetsrccPas encore d'évaluation

- HP Case Competition PresentationDocument17 pagesHP Case Competition PresentationNatalia HernandezPas encore d'évaluation

- Team 9A Case Analysis of Harris Seafoods Cash Flows and ValuationDocument2 pagesTeam 9A Case Analysis of Harris Seafoods Cash Flows and ValuationNadia Iqbal100% (1)

- Butler Lumber CompanyDocument4 pagesButler Lumber Companynickiminaj221421Pas encore d'évaluation

- ACC to Acquire AirThread for $7.5 BillionDocument16 pagesACC to Acquire AirThread for $7.5 Billionbtlala0% (1)

- UST IncDocument16 pagesUST IncNur 'AtiqahPas encore d'évaluation

- XLS EngDocument26 pagesXLS EngcellgadizPas encore d'évaluation

- Sneaker Excel Sheet For Risk AnalysisDocument11 pagesSneaker Excel Sheet For Risk AnalysisSuperGuyPas encore d'évaluation

- DC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsDocument4 pagesDC 51: Busi 640 Case 3: Valuation of Airthread ConnectionsTunzala ImanovaPas encore d'évaluation

- Debt Policy at Ust IncDocument18 pagesDebt Policy at Ust InctutenkhamenPas encore d'évaluation

- Tuckefeller - Discussion Materials On Pinkerton - VfinalDocument27 pagesTuckefeller - Discussion Materials On Pinkerton - VfinalBo Wang100% (1)

- Hill Country Snack Foods CompanyDocument14 pagesHill Country Snack Foods CompanyVeni GuptaPas encore d'évaluation

- Questions - Linear Technologies CaseDocument1 pageQuestions - Linear Technologies CaseNathan Toledano100% (1)

- UK Gilt Bond Analysis and RecommendationsDocument6 pagesUK Gilt Bond Analysis and RecommendationsMayuresh D PradhanPas encore d'évaluation

- Finance Assignment HelpDocument4 pagesFinance Assignment HelpJane AustinPas encore d'évaluation

- Mariott Wacc Cost of Capital DivisionalDocument6 pagesMariott Wacc Cost of Capital DivisionalSuprabhat TiwariPas encore d'évaluation

- Quality Metal Case FinalDocument9 pagesQuality Metal Case FinalCynthia Anggi Maulina100% (2)

- FinanceDocument31 pagesFinanceMythili MuthappaPas encore d'évaluation

- Case 7Document3 pagesCase 7Shaarang BeganiPas encore d'évaluation

- Business Strategy+Black+Bay+Project+-+Group+28Document2 pagesBusiness Strategy+Black+Bay+Project+-+Group+28rithvik royPas encore d'évaluation

- Great Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByDocument6 pagesGreat Eastern Shipping Company Limited (Case Study) : Submitted To:-Submitted ByAbhishek ChaurasiaPas encore d'évaluation

- Marriot Corp. Finance Case StudyDocument5 pagesMarriot Corp. Finance Case StudyJuanPas encore d'évaluation

- Lex CaseDocument8 pagesLex CaseAshlesh MangrulkarPas encore d'évaluation

- Marriott Corporation The Cost of Capital Case Study AnalysisDocument21 pagesMarriott Corporation The Cost of Capital Case Study AnalysisvasanthaPas encore d'évaluation

- Paper On Society1 Modernity PDFDocument13 pagesPaper On Society1 Modernity PDFferiha goharPas encore d'évaluation

- Canada Application SummaryDocument6 pagesCanada Application SummaryCarlos FdezPas encore d'évaluation

- Chapter 3 Introduction To Taxation: Chapter Overview and ObjectivesDocument34 pagesChapter 3 Introduction To Taxation: Chapter Overview and ObjectivesNoeme Lansang100% (1)

- Kathi Raning Rawat V State of SaurashtraDocument2 pagesKathi Raning Rawat V State of SaurashtraLucas KanePas encore d'évaluation

- Legal Ethics Oral Examination 2018Document13 pagesLegal Ethics Oral Examination 2018Telle MariePas encore d'évaluation

- 3 - Supplemental Counter-AffidavitDocument3 pages3 - Supplemental Counter-AffidavitGUILLERMO R. DE LEON100% (1)

- JAL Vs CA Case Digest For Transpo LawDocument2 pagesJAL Vs CA Case Digest For Transpo LawgielitzPas encore d'évaluation

- WEEK 5 ACCT444 Group Project 14-34Document6 pagesWEEK 5 ACCT444 Group Project 14-34Spencer Nath100% (2)

- Install Bucket ElevatorsDocument77 pagesInstall Bucket ElevatorsYhanePas encore d'évaluation

- 2016 Gcrsport enDocument398 pages2016 Gcrsport enDeewas PokhPas encore d'évaluation

- History of Agrarian ReformDocument3 pagesHistory of Agrarian ReformMaria Ferlin Andrin MoralesPas encore d'évaluation

- Got - Hindi S04 480pDocument49 pagesGot - Hindi S04 480pT ShrinathPas encore d'évaluation

- Revised Guidelines PD 851Document4 pagesRevised Guidelines PD 851Abegail LeriosPas encore d'évaluation

- ADR R.A. 9285 CasesDocument9 pagesADR R.A. 9285 CasesAure ReidPas encore d'évaluation

- Final Sociology Project - Dowry SystemDocument18 pagesFinal Sociology Project - Dowry Systemrajpurohit_dhruv1142% (12)

- Icao Annex 10 Aeronauticaltelecommunicationsvolumeiv-SurveillancDocument220 pagesIcao Annex 10 Aeronauticaltelecommunicationsvolumeiv-SurveillancrdpereirPas encore d'évaluation

- Legal Framework Supporting Public LibrariesDocument2 pagesLegal Framework Supporting Public LibrariesJaden CallanganPas encore d'évaluation

- To Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyDocument22 pagesTo Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyInstitute for Research on Public Policy (IRPP)Pas encore d'évaluation

- Licensing AgreementDocument9 pagesLicensing AgreementberrolawfirmPas encore d'évaluation

- DPB50123 HR Case Study 1Document7 pagesDPB50123 HR Case Study 1Muhd AzriPas encore d'évaluation

- Connections: Mls To Sw1Document12 pagesConnections: Mls To Sw1gautamdipendra968Pas encore d'évaluation

- Pro Proctor Guide v2Document16 pagesPro Proctor Guide v2Agnes BofillPas encore d'évaluation

- Tar Ge T 100: JS AccountancyDocument33 pagesTar Ge T 100: JS Accountancyvishal joshiPas encore d'évaluation

- Item Analysis Repost Sy2022Document4 pagesItem Analysis Repost Sy2022mjeduriaPas encore d'évaluation

- Oxford Research Encyclopedia of Latin American History: CloseDocument21 pagesOxford Research Encyclopedia of Latin American History: CloseemirohePas encore d'évaluation

- Understanding Cyber Ethics and Responsible Online BehaviorDocument16 pagesUnderstanding Cyber Ethics and Responsible Online BehaviorDeepali RaniPas encore d'évaluation

- Kashmir Highway sports club membership formDocument2 pagesKashmir Highway sports club membership formSarah HafeezPas encore d'évaluation

- CS201 Assignment 2 Matrix Addition SolutionDocument8 pagesCS201 Assignment 2 Matrix Addition SolutionTauqeer AwanPas encore d'évaluation

- Barangay Hearing NoticeDocument2 pagesBarangay Hearing NoticeSto Niño PagadianPas encore d'évaluation

- Faculty - Business Management - 2023 - Session 1 - Pra-Diploma Dan Diploma - Eco211Document16 pagesFaculty - Business Management - 2023 - Session 1 - Pra-Diploma Dan Diploma - Eco2112021202082Pas encore d'évaluation