Académique Documents

Professionnel Documents

Culture Documents

KAKRAPAR ANUMATHAK KARMACHARI Vs NUCLEAR POWER CORPORATION OF INDIA LTD.

Transféré par

rupesh.srivastavaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

KAKRAPAR ANUMATHAK KARMACHARI Vs NUCLEAR POWER CORPORATION OF INDIA LTD.

Transféré par

rupesh.srivastavaDroits d'auteur :

Formats disponibles

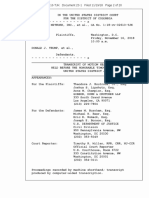

HC-NIC

C/SCA/28416/2007

JUDGMENT

IN THE HIGH COURT OF GUJARAT AT AHMEDABAD

SPECIAL CIVIL APPLICATION NO. 28416 of 2007

FOR APPROVAL AND SIGNATURE:

HONOURABLE MR.JUSTICE M.R. SHAH

and

HONOURABLE MR.JUSTICE A.S. SUPEHIA

Sd/Sd/-

==========================================================

Whether Reporters of Local Papers may be allowed

to see the judgment ?

YES

To be referred to the Reporter or not ?

YES

Whether their Lordships wish to see the fair copy of

the judgment ?

NO

Whether this case involves a substantial question of

law as to the interpretation of the Constitution of

India or any order made thereunder ?

NO

==========================================================

KAKRAPAR ANUMATHAK KARMACHARI SANGATHAN....Petitioner(s)

Versus

NUCLEAR POWER CORPORATION OF INDIA LTD. & 1....Respondent(s)

==========================================================

Appearance:

MR MP SHAH, ADVOCATE for the Petitioner(s) No. 1

MS. KRUTI M SHAH, ADVOCATE for the Petitioner(s) No. 1

MR JD AJMERA, ADVOCATE for the Respondent(s) No. 1 - 2

==========================================================

CORAM:HONOURABLE MR.JUSTICE M.R. SHAH

and

HONOURABLE MR.JUSTICE A.S. SUPEHIA

Date : 06/09/2016

Page 1 of 19

Page 1 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

ORAL JUDGMENT

(PER : HONOURABLE MR.JUSTICE M.R. SHAH)

1.00.

By way of this petition under Article 226 of the

Constitution of India, the petitioner -

Kakrapar Anumathak

Marmachari Sangathan, through its President has prayed for

appropriate writ, order and/or direction to quash and set aside

the

impugned

decision

representation dated

dated

16/10/2007,

whereby

20/7/2007 made by the

requesting not to recover

Tribal Area Allowance

the

petitioner

(TAA for

short) paid during the period from 1/4/2001 to 30/9/2006, has

been rejected. The petitioner has also prayed for appropriate

writ, order and/or direction to quash and set aside the

impugned order dated 3/4/2007

recover payment of TAA

whereby it was directed to

granted to the Supervisor and

Workman category of employees beyond 31/3/2001 in 45

installments.

2.00.

Heard the learned advocates appearing on behalf of

the respective parties at length.

2.01.

At the outset, it is required to be noted and it is not

in dispute that the

respective members of the petitioner

association employees from whom now TAA is sought to be

recovered for the period from

1/4/2001 to 30/9/2006, were

paid TAA during the aforesaid period, however, subsequently

the respondent stopped / discontinued payment of TAA and

sought recovery of payment of TAA made for the period from

1/4/2001 to 30/9/2006. The concerned employees were paid

TAA by mistake and/or through oversight. Therefore, the

respondent passed impugned order dated 3/4/2007 with a

Page 2 of 19

Page 2 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

direction to recover the same from the concerned employees

in 45 installments commencing from April, 2001. The same

was challenged by the petitioner

and other concerned

employees by way of filing Special Civil Application No. 10426

of 2007 with Special Civil Application Nos. 14705 to 15462 of

2007 and the learned

dated

5/7/2007

Single Judge

disposed

of

the

of this Court

aforesaid

by order

Special

Civil

Applications relegating the concerned employees to make

representation. Thereafter, representations were made which

have been rejected and therefore, the present petition.

3.00.

Heard Ms.Kruti Shah, learned advocate appearing

on behalf of the petitioner and Mr.J.D. Ajmera, learned

advocate appearing on behalf of the respondents.

3.01.

It is not in dispute and even according to the

respondents, the concerned employees were paid TAA for the

period from 1/4/2001 to 30/9/2006 by mistake and/or through

oversight

and

such

mistake

is

not

attributable

and/or

attributed to the concerned employees and/or any of the

employees

who

got the

benefit

of TAA.

However,

the

respondents sought recovery of the TAA paid by mistake for

the period from 1/4/2001 to 30/9/2006 on the ground that the

Government has discontinued the

concerned employees were not

TAA

and therefore, the

entitled to TAA. Therefore,

recovery was sought by the impugned order with respect to

TAA paid during the period from 1/4/2001 to 30/9/2006, which

according to the respondents was paid by mistake and/or

oversight.

3.02.

Having heard the learned advocates appearing on

Page 3 of 19

Page 3 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

behalf of the respective parties and considering the undisputed

facts narrated hereinabove and even it is not the case on

behalf of the respondents that the mistake in making the

payment of TAA during the period from 1/4/2001 to 30/9/2006

was attributable and/or attributed to any of the employees

and/or they were responsible for such mistake.

3.03.

The issue involved in the present petition is

squarely covered by the recent decision of the Hon'ble

Supreme Court in the case of State of Punjab and others

Versus Rafiq Masih (White Washer) and others, reported

in (2015) 4 SCC 334. Identical question came to be

considered by the Hon'ble Supreme Court in the case of Rafiq

Masih (supra) and while considering the issue, whether

can

there be any recovery of any amount paid in excess any

without fault of the recipient, after considering various earlier

decisions of the Hon'ble Supreme Court

on the point, the

Hon'ble Supreme Court in the case of Rafiq Masih (supra) in

Paragraph Nos. 8 to 17 has observed and held as under :-

8.

As between two parties, if a determination

is rendered in favour of the party, which is the

weaker of the two, without any serious detriment

to the other (which is truly a welfare State), the

issue resolved would be in consonance with the

concept of justice, which is assured to the

citizens

of India, even in the preamble of the

Constitution

of

India.

The

right

to recover

being pursued by the employer, will have to be

compared, with the effect of the recovery on the

concerned employee.

If

the

effect

of

the

recovery from the concerned employee would be,

Page 4 of 19

Page 4 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

more unfair, more wrongful, more improper, and

more unwarranted, than the corresponding right

of

the employer to recover the amount, then it

would be iniquitous and arbitrary, to effect the

recovery.

right

In such a situation,

the

employee's

would outbalance, and therefore eclipse,

the right of the employer to recover.

9.

The doctrine of equality is a dynamic and

evolving concept having many dimensions. The

embodiment of the doctrine of equality, can

be

found in Articles 14 to 18, contained in Part III of

the

Constitution

of

"Fundamental Rights".

India,

These

dealing

Articles

with

of

the

Constitution, besides assuring equality before the

law and equal protection of

the

disallow, discrimination with the

achieving

equality,

laws; also

object

of

in matters of employment;

abolish untouchability, to upgrade the social

status of an ostracized section of the society; and

extinguish titles, to scale down the status of a

section of the society, with

such

appellations.

The embodiment of the doctrine of equality, can

also be found in Articles 38, 39, 39A, 43 and 46

contained in

Part

IV

of

the

Constitution

of

India, dealing with the "Directive Principles of

State Policy". These Articles of the Constitution

of

India

requiring

contain

it

mandate

to

the

State

to assure a social order providing

justice - social, economic and political, by inter

alia minimizing monetary inequalities, and by

securing

the

right to adequate means of

livelihood, and by providing for adequate wages

so

life,

as to ensure, an appropriate

and

by

promoting

standard

economic interests of

the weaker sections.

Page 5 of 19

Page 5 of 19

of

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

10.

In view of the aforestated constitutional

mandate,

equity

and

good conscience, in the

matter of livelihood of the people of this country,

has to be the basis of all governmental actions.

An

action

of

the

State, ordering a recovery

from an employee, would be in order, so long as

it

is not rendered iniquitous to the extent, that

the action of recovery would

more

wrongful,

unwarranted,

more

than

be more unfair,

improper,

and

more

the corresponding right of

the employer, to recover the

amount.

Or

in

other words, till such time as the recovery would

have

harsh

and

arbitrary effect on the

employee, it would be permissible in law.

passed

Orders

in given situations repeatedly, even in

exercise of the power vested in this Court under

Article 142 of the Constitution

of

India,

will

disclose the parameters of the realm of an action

of recovery (of an excess

amount

paid to an

employee) which would breach the obligations

of

the

State,

to citizens of this country, and

render the action

arbitrary,

and

therefore,

violative of the mandate contained in Article 14

of the Constitution of India.

11.

to

For the above determination, we shall refer

some

precedents of this Court wherein the

question of recovery of the excess amount paid

to employees, came up for consideration, and this

Court

disallowed

the

same.

These

are

situations, in which High Courts all over the

country,

repeatedly and

regularly

orders of recovery made on

the

set

aside

expressed

parameters.

Page 6 of 19

Page 6 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

12. Reference may first of all be made to the

decision in Syed Abdul Qadir v. State of Bihar,

(2009) 3 SCC 475, wherein this Court recorded

the following observation in paragraph 58 (SCC

P.491) :

"58. The relief against recovery is granted

by courts not because of any right in the

employees,

but

in

equity,

exercising

judicial discretion to relieve the employees

from the hardship that will be caused if

recovery is ordered. But, if in a given case,

it

is

proved

that

the

employee

had

knowledge that the payment received was

in excess of what was due or wrongly

paid, or in cases where the error is detected

or corrected within

a short time of wrong

payment, the matter being in the realm

of

judicial discretion, courts may, on the

facts and circumstances of any particular

case, order for recovery of the amount paid

in excess.

See

Sahib

Ram

v. State of

Haryana [1995 Supp. (1) SCC 18]; Shyam

Babu Verma v. Union of India [(1994) 2

SCC 521]; Union of India v. M. Bhaskar

[(1996) 4 SCC 416];

V. Ganga Ram v.

Director [(1997) 6 SCC 139]; Col. B.J. Akkara

(Retd.)

v.

Govt. of India [(2006) 11 SCC

709]; Purshottam Lal Das v. State of Bihar

[(2006) 11 SCC 492]; Punjab National Bank

v. Manjeet Singh [(2006) 8 SCC 647] and

Bihar SEB v. Bijay Bahadur [(2000) 10 SCC

99]."(emphasis is ours)

13.

First and foremost, it is pertinent to note,

Page 7 of 19

Page 7 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

that this Court in its judgment in Syed Abdul

Qadir's case (supra) recognized, that the issue

of

recovery

revolved

on

the

action

being

iniquitous. Dealing with the subject of the action

being iniquitous, it was sought to be concluded,

that

when the excess unauthorised payment is

detected within a short period of time, it would

be open for the employer to recover the same.

Conversely, if the payment had been made for a

long duration of time, it would be iniquitous to

make any recovery.

Interference because an

action

must really be perceived

is

iniquitous,

as, interference because the action is arbitrary.

All arbitrary actions are truly, actions in violation

of Article 14 of the Constitution of India. The

logic of the action in

the

instant

situation, is

iniquitous, or arbitrary, or violative of Article 14

of the Constitution of India, because it would be

almost impossible for an employee to bear

the

financial burden, of a refund of payment received

wrongfully

apparent,

for

that

long span of time.

government

It is

employee

is

primarily dependent on his wages, and if a

deduction is to be made from his/her wages, it

should not be a deduction which would make it

difficult

for

the employee to provide for the

needs of his family.

Besides food, clothing and

shelter, an employee has to cater, not only to the

education needs of those dependent upon him,

but

also

their

medical

requirements,

and

variety of sundry expenses. Based on the above

consideration,

mistake of

we

making

are

a

of the view, that if the

wrongful

payment

is

detected within five years, it would be open to

the employer to recover the same. However, if

the payment is made for a period in excess of five

Page 8 of 19

Page 8 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

years,

even though it would be open to the

employer to correct the mistake, it would

be

extremely iniquitous and arbitrary to seek a

refund of the payments mistakenly made to the

employee.

14.

In this context,

reference

may

also

be

made to the decision rendered by this Court in

Shyam Babu Verma v. Union

of India (1994) 2

SCC 521, wherein this Court observed as under

(SCC PP. 525-26 Para 11):

"11.

Although we have held that the

petitioners were entitled only

scale

of

Rs

330-480

recommendations

of

in

to

terms

the

the pay

of

Third

the

Pay

Commission w.e.f. January 1, 1973 and only

after the period of 10 years, they became

entitled to the pay scale of Rs 330-560

but as they have received the scale of Rs

330-560 since 1973 due to no fault

theirs

of

and that scale is being reduced in

the year 1984 with effect from January 1,

1973,

it shall only be just and proper not

to recover any excess amount which has

already been paid to them. Accordingly, we

direct

that

no

steps should be taken to

recover or to adjust any excess amount

paid to the petitioners due to the fault of

the respondents, the petitioners being in

no

way

responsible

for

the

same."

(emphasis supplied)

It is apparent, that in Shyam Babu Verma's case

(supra), the higher pay- scale commenced to be

paid erroneously in 1973. The same was sought

Page 9 of 19

Page 9 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

to

JUDGMENT

be recovered in 1984, i.e., after a period of

11 years.

In the aforesaid circumstances, this

Court felt that the recovery after several years of

the implementation of the pay-scale would not be

just and proper.

We

therefore hereby hold,

recovery of excess payments discovered after five

years would be iniquitous and arbitrary, and as

such, violative of Article 14 of the Constitution

of India.

15.

in

Examining a similar proposition, this Court

Col.

B.J.

Akkara

v. Government of India,

(2006) 11 SCC 709, observed as under (SCC PP.

728-29 Para 28):

"28. Such relief, restraining back recovery

of excess payment,

is

granted by courts

not because of any right in the employees,

but

in

equity,

in exercise of judicial

discretion to relieve the employees from

the

hardship

that

will

be

recovery is implemented.

servant, particularly one

caused

if

A government

in

the

lower

rungs of service would spend whatever

emoluments he receives for the upkeep of

his

family.

If

he

receives

an excess

payment for a long period, he would spend

it,

genuinely believing that he is entitled

to it. As any subsequent action to recover

the

excess payment will cause undue

hardship to him, relief is granted in that

behalf.

But

knowledge

where

that

the

the

employee had

payment

received

was in excess of what was due or wrongly

paid, or where the error

is

detected

corrected within a short time

of

wrong

Page 10 of 19

Page 10 of 19

or

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

payment,

courts

will

against recovery.

the

realm

of

grant relief

The matter being in

judicial discretion, courts

may on the facts

any

not

and

circumstances

of

particular case refuse to grant such

relief

against

recovery."

(emphasis

supplied)

A perusal of the aforesaid observations made by

this

Court

in

reveals a

Col.

B.J. Akkara's case (supra)

reiteration of

the

legal

position

recorded in the earlier judgments rendered by

this Court, inasmuch as, it was again affirmed,

that the right to recover would be sustainable so

long as the same was not iniquitous or arbitrary.

In the observation

extracted

above, this Court

also recorded, that recovery from employees in

lower

rung

of service,

extreme hardship to

would

them.

result

The

in

apparent

explanation for the aforesaid conclusion is, that

employees in lower rung of service would spend

their entire earnings in the upkeep and welfare

of their family, and if such excess payment is

allowed to

cause

be

them

recovered

far

reciprocal

gains

therefore

satisfied

more

from them, it would

hardship,

than

to the employer.

in

concluding,

the

We are

that

such

recovery from employees belonging to the lower

rungs (i.e., Class-III and Class-IV

- sometimes

denoted as Group 'C' and Group 'D') of service,

should not be subjected to the ordeal of any

recovery,

even

though

they

were

beneficiaries of receiving higher emoluments,

than were due to them.

Such recovery would be

iniquitous and arbitrary and therefore would also

Page 11 of 19

Page 11 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

breach the mandate contained in Article 14 of the

Constitution of India.

16.

Bihar

This Court in Syed Abdul Qadir v. State of

(supra)

held as follows (SSS PP.491-92

Para 59):

"59. Undoubtedly, the excess amount that

has been paid to the appellant teachers

was not because of any misrepresentation

or fraud on their part and the appellants

also had no knowledge that

that

was

the

being paid to them was more

than what they were entitled to.

not be

the

amount

It would

out of place to mention here that

Finance

Department

had,

in

its

counter- affidavit, admitted that it was a

bona fide

mistake

on

their

part.

The

excess payment made was the result of

wrong interpretation of the Rule that was

applicable

to

appellants

cannot

Rather,

the

because

of

them,

be

for

which

the

held responsible.

whole

confusion

was

inaction, negligence and

carelessness of the officials concerned of

the Government of Bihar. Learned counsel

appearing

on

behalf

of

the

appellant

teachers submitted that majority of the

beneficiaries have either retired or are on

the verge of it. Keeping in view the peculiar

facts

and

circumstances

of the case at

hand and to avoid any hardship to

the

appellant teachers, we are of the view that

no recovery of the amount that has been

paid in

excess to the appellant teachers

should be made." (emphasis supplied)

Page 12 of 19

Page 12 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

Premised on the legal proposition considered

above, namely, whether

equity and

on

the touchstone

arbitrariness, the

extract of

of

the

judgment reproduced above, culls out yet another

consideration, which would make the process of

recovery iniquitous and

apparent

from

arbitrary.

It

is

the conclusions drawn in Syed

Abdul Qadir's case (supra), that recovery of

excess payments, made from employees who

have retired from service, or are close to their

retirement,

would

entail

extremely

harsh

consequences outweighing the monetary gains by

the employer.

It cannot be forgotten, that a

retired employee or an employee about to retire,

is a class apart from those who have sufficient

service to their credit, before their retirement.

Needless to mention, that at retirement, an

employee is past his youth, his needs are far in

excess

of

what

younger.

they

Despite

were

that,

substantially dwindled

when

his

(or

he

earnings

was

have

would substantially

be reduced on his retirement).

Keeping the

aforesaid circumstances in mind, we are satisfied

that recovery would be iniquitous and arbitrary,

if it is sought to be made after the date of

retirement,

period

or soon before

within

one

year

retirement.

from

the

date

A

of

superannuation, in our considered view, should

be

accepted

recovery

as

should

the

be

period during which the

treated

as

iniquitous.

Therefore, it would be justified to treat an order

of recovery, on account of wrongful payment

made

to

an

employee,

recovery is sought

to

as

arbitrary,

if

the

be made after the

employee's retirement, or within one year of the

Page 13 of 19

Page 13 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

date of his retirement on superannuation.

17.

Last of all, reference may be made to the

decision in Sahib Ram

(1995) Supp. 1

Verma v. Union of India,

SCC

18,

wherein

it

was

concluded as under (SCC PP.19-20 paras 4-5):

"4.

Mr. Prem Malhotra, learned counsel

for the appellant,

contended

that the

previous scale of Rs 220-550 to which the

appellant was entitled became Rs 700-1600

since the appellant had been granted that

scale

of

pay

in relaxation of

the

educational qualification. The High Court

was, therefore, not right in dismissing the

writ petition. We do not find any force

in this contention.

Government in

It is seen that the

consultation

with

University Grants Commission had

the

revised

the pay scale of a Librarian working in

the

colleges

insisted

to

upon

Rs

the

700-1600

but

they

minimum educational

qualification of first or second class M.A.,

M.Sc., M.Com. Plus a first or second class

B.Lib.

Science or a

Diploma

in

Library

Science. The relaxation given was only as

regards obtaining first or second class

the

prescribed

but

not

educational

relaxation

in

in

qualification

the educational

qualification itself.

5.

Admittedly the appellant does not

possess

the

qualifications.

required

Under

the

educational

circumstances

Page 14 of 19

Page 14 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

the

appellant would not

the

relaxation.

granting

him

The

be entitled to

Principal

erred

the relaxation.

Since the

date of relaxation the appellant had

paid

his salary on the

in

revised

been

scale.

However, it is not on account of any

misrepresentation made by the appellant

that the benefit of the

higher

pay scale

was given to him but by wrong construction

made by the

Principal

for which the

appellant cannot be held to be at fault.

Under the

circumstances the amount paid

till date may not be recovered from the

appellant.

equal

The principle of equal pay

work

would

not

apply

for

to

the

scales prescribed by the University Grants

Commission. The appeal is allowed partly

without any order as to costs." (emphasis

supplied)

It would

be

pertinent

to

mention,

that

Librarians were equated with Lecturers, for the

grant of the pay scale of

above

Rs.700-1600.

pay parity would extend to

The

Librarians,

subject to the condition that they possessed

the prescribed minimum educational qualification

(first or second class M.A., M.Sc., M.Com. plus a

first or second class B.Lib. Science or a Diploma

in

Library

Science

For

Science,

being

those

the

degree

a preferential

Librarians

of

M.Lib.

qualification).

appointed

prior

to

3.12.1972, the educational qualifications were

relaxed.

In Sahib Ram Verma's case (supra), a

mistake was committed by wrongly extending to

the appellants the revised pay scale, by relaxing

the

prescribed

educational qualifications, even

Page 15 of 19

Page 15 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

though the concerned appellants were ineligible

for the same.

The concerned appellants were

held not eligible

for

the

higher scale, by

applying the principle of "equal pay for equal

work".

did

This Court, in the above circumstances,

not allow the recovery of

the

excess

payment. This was apparently done because

this Court felt that the employees were entitled

to wages, for the post against which they had

discharged their duties. In the above view of the

matter, we are of the opinion, that it would be

iniquitous and

arbitrary

for

an

employer to

require an employee to refund the wages of a

higher post, against

which

he had wrongfully

been permitted to work, though he should have

rightfully been required to work against an

inferior post.

3.04.

That

thereafter

the

Hon'ble

Supreme

Court

summarized in para 18 in the aforesaid decision as under :18.

It is not possible to postulate all situations of

hardship,

which would govern employees

on

the

issue of recovery, where payments have mistakenly

been made by the employer, in excess of

entitlement.

their

Be that as it may, based on the decisions

referred to herein above, we may,

as a

ready

reference, summarise the following few

situations,

wherein

would

recoveries

by

the

employers,

be

impermissible in law:

(i) Recovery from employees belonging to Class-III

and Class-IV service (or Group 'C' and Group 'D'

service).

(ii)Recovery from retired employees, or employees

Page 16 of 19

Page 16 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

who are

due

to

retire within one year, of the

order of recovery.

(iii)Recovery

from employees, when the

excess

payment has been made for a period in excess

of five years, before the order of recovery is

issued.

(iv)Recovery

in

cases

where

an

employee

has

wrongfully been required to discharge duties of

a higher post, and has been paid accordingly,

even though he should have rightfully been

required to work against an inferior post.

(v)In any other case, where the Court arrives at the

conclusion,

employee,

arbitrary

that recovery if made

would

to

be

such

an

iniquitous

extent,

or

as

from

harsh

would

the

or

far

outweigh the equitable balance of the employer's

right to recover.

3.05.

Considering the facts of the case on hand, the case

of the petitioner

- concerned employees of the petitioner

association would fall under category (I) and (iii) of para 18 of

the aforesaid judgement of the the Hon'ble Supreme Court in

the case of Rafiq Masih (supra).

3.06.

Under the circumstances, the impugned order of

recovery of TAA paid to the concerned employees - members

of the petitioner association for the period from 1/4/2001 to

30/9/2006 cannot be sustained and therefore, the same

deserves to be quashed and set aside.

3.07.

At

this

stage,

Mr.Ajmera,

learned

advocate

Page 17 of 19

Page 17 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

appearing on behalf of the respondents has pointed out that in

the meantime, some of the offices have

repaid amount of

TAA paid during the period from 1/4/2001 to 30/9/2006 by

installments. Therefore, he has requested to make suitable

observation that the case of those officers who have already

made payment of TAA for the period from 1/4/2001 to

30/9/2006 in installments, their cases may not be reopened

and/or the respondents may not have to refund the amount

which is already recovered from such officers.

4.00.

In view of the above and for the reasons stated

above, present petition succeeds and the impugned orders

dated 16/10/2007 and 3/4/2007 rejecting the representation

and seeking recovery to get amount of TAA paid for the period

from 1/4/2001 to 30/9/2006, are hereby quashed and set

aside. However, it is clarified that the benefit of the present

judgement and order shall be given to only those employees

who have yet not repaid the amount of TAA paid for the period

from 1/4/2001 to 30/9/2006 and cases of those officers who

had already reported to have paid the amount of TAA by

installments shall not be reopened. Rule is made absolute to

the aforesaid extent. In the facts and circumstances of the

case, there shall be no order as to costs.

Sd/-

(M.R.SHAH, J.)

Sd/-

(A. S. SUPEHIA, J.)

Rafik.

Page 18 of 19

Page 18 of 19

Created On Tue Oct 18 13:33:00 IST 2016

HC-NIC

C/SCA/28416/2007

JUDGMENT

Page 19 of 19

Page 19 of 19

Created On Tue Oct 18 13:33:00 IST 2016

Vous aimerez peut-être aussi

- Dishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintD'EverandDishonour of Cheques in India: A Guide along with Model Drafts of Notices and ComplaintÉvaluation : 4 sur 5 étoiles4/5 (1)

- All India List of Registered Valuers of Different Classes of AssetsDocument92 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument92 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- Paul Clement - Balance Billing Constitutional Implications (June 2019)Document17 pagesPaul Clement - Balance Billing Constitutional Implications (June 2019)Peter SullivanPas encore d'évaluation

- A Short History of Orange County NY - Malcolm BoothDocument34 pagesA Short History of Orange County NY - Malcolm BoothSteve Skye100% (1)

- RECOVERY OF EXCESS PAYMENTS FROM GOVERNMENT EMPLOYEES Dated 2nd Mar 2016Document3 pagesRECOVERY OF EXCESS PAYMENTS FROM GOVERNMENT EMPLOYEES Dated 2nd Mar 2016Heartwin Amaladhas PushpadassPas encore d'évaluation

- 1 MergedDocument122 pages1 MergedShivam MishraPas encore d'évaluation

- 1 MergedDocument67 pages1 MergedShivam MishraPas encore d'évaluation

- High Court JudgementDocument9 pagesHigh Court JudgementpatelsumaiyaPas encore d'évaluation

- D SaibabaDocument6 pagesD SaibabaRupali KondedeshmukhPas encore d'évaluation

- C A NO.6770/2013 at SLP (CL No. 1427 of 2009Document16 pagesC A NO.6770/2013 at SLP (CL No. 1427 of 2009SUSHIL KUMARPas encore d'évaluation

- SC Judgement On Pension 14-8-13Document16 pagesSC Judgement On Pension 14-8-13Kabul DasPas encore d'évaluation

- Tax Ni Act 487903Document17 pagesTax Ni Act 487903f.i.sindhiPas encore d'évaluation

- Versus: Efore HA AND InghDocument8 pagesVersus: Efore HA AND InghKrishna KumarPas encore d'évaluation

- Cs 11321010Document11 pagesCs 11321010varun v sPas encore d'évaluation

- State of Maharashtra v. Madhukar Balkrishna PDFDocument7 pagesState of Maharashtra v. Madhukar Balkrishna PDFSandeep Kumar VermaPas encore d'évaluation

- Case Study: State of Haryana and Others V/s Charanjit Singh and OthersDocument14 pagesCase Study: State of Haryana and Others V/s Charanjit Singh and Othersvarun v sPas encore d'évaluation

- Supreme Court Judgments-Disciplinary ActionDocument25 pagesSupreme Court Judgments-Disciplinary Actionmmnamboothiri0% (1)

- 7628 2017 Judgement 07-Jan-2019Document9 pages7628 2017 Judgement 07-Jan-2019Nandani AnandPas encore d'évaluation

- Ram Singh V State of U.PDocument13 pagesRam Singh V State of U.PABHINAV DEWALIYAPas encore d'évaluation

- Ashok Kumar Gupta V State of Uttar Pradesh (1997) 5SCC201Document8 pagesAshok Kumar Gupta V State of Uttar Pradesh (1997) 5SCC201ArushiPas encore d'évaluation

- Binny Case AnalysisDocument9 pagesBinny Case AnalysisAdv Aiswarya UnnithanPas encore d'évaluation

- Case CommentDocument13 pagesCase CommentSheela AravindPas encore d'évaluation

- Gazettes 1690984228162Document32 pagesGazettes 1690984228162Director APPas encore d'évaluation

- 237 Jayashree V Director Collegiate Education 22 Feb 2022 411076Document8 pages237 Jayashree V Director Collegiate Education 22 Feb 2022 411076simar kaurPas encore d'évaluation

- Dulichand Finance and Leasing Limited Vs State of WB2019260320165054366COM14257Document6 pagesDulichand Finance and Leasing Limited Vs State of WB2019260320165054366COM14257YouTube PremiumPas encore d'évaluation

- SC Judgment Laying No Reservation in Promotions For SC-STDocument49 pagesSC Judgment Laying No Reservation in Promotions For SC-STLatest Laws TeamPas encore d'évaluation

- Order Sheet in The Lahore High Court Lahore Judicial DepartmentDocument8 pagesOrder Sheet in The Lahore High Court Lahore Judicial DepartmentJamSaifPas encore d'évaluation

- Deepak Sibal, J.: Equiv Alent Citation: 2015 (2) SC T631 (P&H)Document7 pagesDeepak Sibal, J.: Equiv Alent Citation: 2015 (2) SC T631 (P&H)Ishank GuptaPas encore d'évaluation

- Penalty On EPF Delay PaymentDocument8 pagesPenalty On EPF Delay PaymentAnand ChaudharyPas encore d'évaluation

- Article On Condonation of Delay, Restoration of Suit, and Seetting Aside Exparte Orders - YSRDocument16 pagesArticle On Condonation of Delay, Restoration of Suit, and Seetting Aside Exparte Orders - YSRY.Srinivasa RaoPas encore d'évaluation

- Alchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174Document19 pagesAlchemist LTD Vs Dinesh Chandra Tripathi and Ors 0UP2019170120155449324COM901174ranjanjhallbPas encore d'évaluation

- J 2018 SCC OnLine Bom 9667 Sachingupta Dhirassociatescom 20230413 141646 1 3Document3 pagesJ 2018 SCC OnLine Bom 9667 Sachingupta Dhirassociatescom 20230413 141646 1 3PUBG FEVERPas encore d'évaluation

- 1 MergedDocument97 pages1 MergedShivam MishraPas encore d'évaluation

- ComparativeDocument29 pagesComparativeSaurabh KumarPas encore d'évaluation

- Jayaram Thakra Vs Sabitri Thakra and Ors 28031991 o910351COM449464Document3 pagesJayaram Thakra Vs Sabitri Thakra and Ors 28031991 o910351COM449464Geetansh AgarwalPas encore d'évaluation

- Ilr April 2013 PDFDocument202 pagesIlr April 2013 PDFsnkulkarni_indPas encore d'évaluation

- % Orders Dictated On: 11: in The High Court of Delhi at New Delhi + W.P. (C) No.26 of 1995Document10 pages% Orders Dictated On: 11: in The High Court of Delhi at New Delhi + W.P. (C) No.26 of 1995SatyaKamPas encore d'évaluation

- Wa0000.Document24 pagesWa0000.Deepak RathorePas encore d'évaluation

- Second Division: Republic of The Philippines Court of Tax Appeals Quezon CityDocument11 pagesSecond Division: Republic of The Philippines Court of Tax Appeals Quezon CityMark Lord Morales BumagatPas encore d'évaluation

- Acedera vs. International Container Terminal Services, IncDocument6 pagesAcedera vs. International Container Terminal Services, IncClaudia Rina LapazPas encore d'évaluation

- Ditto 1Document7 pagesDitto 1Daya RamPas encore d'évaluation

- G.R. No. 123169 November 4, 1996 DANILO E. PARAS, Petitioner, COMMISSION ON ELECTIONS, RespondentDocument13 pagesG.R. No. 123169 November 4, 1996 DANILO E. PARAS, Petitioner, COMMISSION ON ELECTIONS, RespondentHerrieGabicaPas encore d'évaluation

- Umadevi Versus Karnataka2Document22 pagesUmadevi Versus Karnataka2abidansarialiPas encore d'évaluation

- Case DigDocument7 pagesCase DigLenette LupacPas encore d'évaluation

- AshuDocument13 pagesAshuVipul KumarPas encore d'évaluation

- Name - Pooja Singh. Class - Bcom LLB 9 SEM Section - D ROLL NO. - 181/16 University Roll No. - 14697 Assigned Teacher - Sanjeev SirDocument13 pagesName - Pooja Singh. Class - Bcom LLB 9 SEM Section - D ROLL NO. - 181/16 University Roll No. - 14697 Assigned Teacher - Sanjeev SirpoojaPas encore d'évaluation

- AssignmentDocument21 pagesAssignmentSol-sanam QadirPas encore d'évaluation

- JKL HC Compulsory 440304Document7 pagesJKL HC Compulsory 440304Ashok MahidaPas encore d'évaluation

- Lawteller June 2022Document52 pagesLawteller June 2022bjornPas encore d'évaluation

- M.M. Mirdhe, J.: Equiv Alent Citation: 1992 (Suppl) C Ivilc C 436Document3 pagesM.M. Mirdhe, J.: Equiv Alent Citation: 1992 (Suppl) C Ivilc C 436Shreyansh RathiPas encore d'évaluation

- Case Notes of MCD vs. Shanti DeviDocument28 pagesCase Notes of MCD vs. Shanti DeviWWWEEEEPas encore d'évaluation

- Vasantlal Maganbhai Sanjanwala Vs The State of Boms600288COM377301Document11 pagesVasantlal Maganbhai Sanjanwala Vs The State of Boms600288COM377301Sean MuthuswamyPas encore d'évaluation

- Rwodzi V Municipality of Chegutu (HH 86 of 2003) 2003 ZWHHC 86 (3 June 2003)Document5 pagesRwodzi V Municipality of Chegutu (HH 86 of 2003) 2003 ZWHHC 86 (3 June 2003)Panganayi JamesPas encore d'évaluation

- CDJ 2001 SC 788: Court: Case No: JudgesDocument3 pagesCDJ 2001 SC 788: Court: Case No: JudgesUV TunesPas encore d'évaluation

- Delhi High Court Order Dated 28.01.2020 WPC 756 of 2020Document6 pagesDelhi High Court Order Dated 28.01.2020 WPC 756 of 2020Project Manager IIT Kanpur CPWD100% (2)

- Brief - State of Bihar V Bihar Pensioners SamajDocument4 pagesBrief - State of Bihar V Bihar Pensioners SamajAditi BanerjeePas encore d'évaluation

- Bic Division (FFW) v. Romero That The Decisions or Awards of The Voluntary Arbitrators InvolvingDocument4 pagesBic Division (FFW) v. Romero That The Decisions or Awards of The Voluntary Arbitrators InvolvingFelyDiloyPas encore d'évaluation

- High Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 10/02/2022 at 02:40:49 PM)Document13 pagesHigh Court of Judicature For Rajasthan Bench at Jaipur: (Downloaded On 10/02/2022 at 02:40:49 PM)ParasPas encore d'évaluation

- Narendra Kumar Tripathi Vs State of U P and 3 Others On 20 January 2021Document9 pagesNarendra Kumar Tripathi Vs State of U P and 3 Others On 20 January 2021Deepak KunwarPas encore d'évaluation

- Mcdowell & CoDocument17 pagesMcdowell & Cosudhy009Pas encore d'évaluation

- Inland Water TransportDocument72 pagesInland Water TransportRk VaitlaPas encore d'évaluation

- ReplyDocument22 pagesReplyRadhika SharmaPas encore d'évaluation

- Drafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsD'EverandDrafting Applications Under CPC and CrPC: An Essential Guide for Young Lawyers and Law StudentsÉvaluation : 5 sur 5 étoiles5/5 (4)

- Canada Federal CourtDocument27 pagesCanada Federal Courtrupesh.srivastavaPas encore d'évaluation

- Canadian Imperial Bank of CommerceDocument86 pagesCanadian Imperial Bank of Commercerupesh.srivastavaPas encore d'évaluation

- MODERN TRANSPORTATION CONSULTATION SERVICES PVT. LTD. & ANR Vs CENTRAL PROVIDENT FUND COMMISSIONER EMPLOYEES PROVIDENT FUND ORGANISATION & ORSDocument30 pagesMODERN TRANSPORTATION CONSULTATION SERVICES PVT. LTD. & ANR Vs CENTRAL PROVIDENT FUND COMMISSIONER EMPLOYEES PROVIDENT FUND ORGANISATION & ORSrupesh.srivastavaPas encore d'évaluation

- M S Geodis India PVT LTDDocument2 pagesM S Geodis India PVT LTDrupesh.srivastavaPas encore d'évaluation

- Definition of "Employee" U/s 2 (F) of The EPF ActDocument17 pagesDefinition of "Employee" U/s 2 (F) of The EPF Actrupesh.srivastavaPas encore d'évaluation

- The Professional Courier Vs Employees Provident Fund AppellateDocument16 pagesThe Professional Courier Vs Employees Provident Fund Appellaterupesh.srivastavaPas encore d'évaluation

- Karnataka - Formation of Export Promotion CellsDocument4 pagesKarnataka - Formation of Export Promotion Cellsrupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument11 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- M/s Shiv Vani Oil & Gas Exploration Services LTD Vs Income Tax Office (ITO)Document21 pagesM/s Shiv Vani Oil & Gas Exploration Services LTD Vs Income Tax Office (ITO)rupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument55 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument292 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastava50% (2)

- Registered Valuers of Agricultural Land - All India List of Registered Valuers of Different Classes of Assets Registered Valuers of Agricultural LandDocument4 pagesRegistered Valuers of Agricultural Land - All India List of Registered Valuers of Different Classes of Assets Registered Valuers of Agricultural Landrupesh.srivastavaPas encore d'évaluation

- List of Valuers of CCIT Surat Charge - All India List of Registered Valuers of Different Classes of AssetsDocument3 pagesList of Valuers of CCIT Surat Charge - All India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument55 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- All India List of Registered Valuers of Different Classes of AssetsDocument292 pagesAll India List of Registered Valuers of Different Classes of Assetsrupesh.srivastava50% (2)

- List of Valuers of CCIT Surat Charge - All India List of Registered Valuers of Different Classes of AssetsDocument3 pagesList of Valuers of CCIT Surat Charge - All India List of Registered Valuers of Different Classes of Assetsrupesh.srivastavaPas encore d'évaluation

- Guidelines - 35 (2AB) OF IT ACT 1961 - May2014Document29 pagesGuidelines - 35 (2AB) OF IT ACT 1961 - May2014rupesh.srivastavaPas encore d'évaluation

- Registered Valuers of Agricultural Land - All India List of Registered Valuers of Different Classes of Assets Registered Valuers of Agricultural LandDocument4 pagesRegistered Valuers of Agricultural Land - All India List of Registered Valuers of Different Classes of Assets Registered Valuers of Agricultural Landrupesh.srivastavaPas encore d'évaluation

- US Tax Court An Historical AnalysisDocument953 pagesUS Tax Court An Historical Analysisrupesh.srivastavaPas encore d'évaluation

- Fatca Ides Technical FaqsDocument17 pagesFatca Ides Technical Faqsrupesh.srivastavaPas encore d'évaluation

- M/s Kassar Innovative Foods VS. EPFODocument3 pagesM/s Kassar Innovative Foods VS. EPFOrupesh.srivastavaPas encore d'évaluation

- Public Information OfficerDocument10 pagesPublic Information Officerrupesh.srivastavaPas encore d'évaluation

- 97 Disini Vs SOJDocument1 page97 Disini Vs SOJAngel AmarPas encore d'évaluation

- CD - 2. Ebralinag V Division Supt. of Cebu 219 SCRA 256 (1993)Document1 pageCD - 2. Ebralinag V Division Supt. of Cebu 219 SCRA 256 (1993)Myka LlagunoPas encore d'évaluation

- JEFFRIES v. UNIVERSITY OF MAINE GRADUATE SCHOOL Et Al - Document No. 5Document3 pagesJEFFRIES v. UNIVERSITY OF MAINE GRADUATE SCHOOL Et Al - Document No. 5Justia.comPas encore d'évaluation

- 119042-2003-City of Caloocan v. AllardeDocument11 pages119042-2003-City of Caloocan v. AllardeAriel MolinaPas encore d'évaluation

- Denr MGB PDFDocument30 pagesDenr MGB PDFGabi TimbancayaPas encore d'évaluation

- NHRC GNLU MemorialDocument20 pagesNHRC GNLU MemorialKaushik NanduriPas encore d'évaluation

- Citizenship in EthiopiaDocument3 pagesCitizenship in Ethiopiamamuka kassaPas encore d'évaluation

- Economically Weaker SectionDocument3 pagesEconomically Weaker SectionChaudhary Arpit TkdPas encore d'évaluation

- Judicial Appointment of JudgesDocument10 pagesJudicial Appointment of JudgesSuman Mahajan100% (1)

- Critical CommentDocument4 pagesCritical Commentvarun v sPas encore d'évaluation

- DOL Amended Complaint & Evidentiary Table QSDocument17 pagesDOL Amended Complaint & Evidentiary Table QSQueen SearlesPas encore d'évaluation

- Banco Nacional de Cuba v. Sabbatino, 376 U.S. 398 (1964)Document22 pagesBanco Nacional de Cuba v. Sabbatino, 376 U.S. 398 (1964)Jumen Gamaru TamayoPas encore d'évaluation

- Llave Vs RepublicDocument2 pagesLlave Vs RepublicMarie TitularPas encore d'évaluation

- Mactan Cebu International Airport Authority vs. MarcosDocument8 pagesMactan Cebu International Airport Authority vs. MarcosJose IbarraPas encore d'évaluation

- Juan Dulalia Vs CruzDocument1 pageJuan Dulalia Vs CruzCatherine MerillenoPas encore d'évaluation

- CNN and Acosta v. Trump - Transcript of TRO Decision, November 16, 2018Document19 pagesCNN and Acosta v. Trump - Transcript of TRO Decision, November 16, 2018Legal InsurrectionPas encore d'évaluation

- Memorial On Behalf of The RespondentDocument35 pagesMemorial On Behalf of The RespondentShahbaz MalbariPas encore d'évaluation

- Ch09 PDF Official Sat Study Guide Sample Reading Test QuestionsDocument32 pagesCh09 PDF Official Sat Study Guide Sample Reading Test QuestionsyawahabPas encore d'évaluation

- Feeder International Line VDocument5 pagesFeeder International Line VJo Ann Saballero100% (1)

- Alteration in Object Clause-50Document5 pagesAlteration in Object Clause-50Divesh GoyalPas encore d'évaluation

- Stat Con CasesDocument45 pagesStat Con CasesGirlie SandiganPas encore d'évaluation

- Support File For Elcc Standard 6Document1 pageSupport File For Elcc Standard 6api-277190928Pas encore d'évaluation

- Ang Ladlad LGBT Party v. Comelec, G.R. 190582, April 8, 2010Document11 pagesAng Ladlad LGBT Party v. Comelec, G.R. 190582, April 8, 2010Ryan ChristianPas encore d'évaluation

- Right To Information Act2Document32 pagesRight To Information Act2Prasad TdnPas encore d'évaluation

- Moot Problems I (Constitutional Law)Document9 pagesMoot Problems I (Constitutional Law)Ankit MishraPas encore d'évaluation

- Commission On Human RightsDocument7 pagesCommission On Human RightsMa Tiffany CabigonPas encore d'évaluation

- GDN 8 NovDocument24 pagesGDN 8 NovFaisal MumtazPas encore d'évaluation

- Constitution of India - Law and EngineeringDocument3 pagesConstitution of India - Law and EngineeringDr Shekhar KesharvaniPas encore d'évaluation