Académique Documents

Professionnel Documents

Culture Documents

DSC2008 Tutorial 7

Transféré par

Ben ChongTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DSC2008 Tutorial 7

Transféré par

Ben ChongDroits d'auteur :

Formats disponibles

DSC2008 Business Analytics Data and Decisions

SEM 1, AY2016/2017

Tutorial 7

Question 1.

According to a Morgan Stanley report in March 2008, the annual demand for

hybrid cars in the US is expected to reach 1.2 million in 2015; this estimate

also included 250,000 plug-in-hybrid electric cars (PHEVs). In March 2009,

the US government, led by the President, Barack Obama, unveiled an energy

plan with an outlay of US$ 150 billion to develop alternative and clean energy

sources, with the government aiming to promote one million PHEVs by 2015.

As of 2009, many major automakers such as General Motors, Toyota Motor

Corporation, and Nissan were planning to mass produce electric cars by

2011.

The time series of the quarterly sales of hybrid cars including PHEVs of one

car dealer in the past years is displayed below.

Cars

1000

800

600

400

200

0

Analyst ABC has decided to use the ratio-to-moving-average method to

forecast the sales in Year 2013, where the long term trend is assumed to be

linear and the initial time point of quarter 1 in Year 2007 is set to 1.

The results are reported. However due to some technical problem, the

seasonal index as well as the Excel output for the deseasonalized data is

incomplete.

Seasonal

index

Q1

1.054

Q2

?

Q3

0.912

Q4

1.087

T7-1

DSC2008 Business Analytics Data and Decisions

SEM 1, AY2016/2017

SUMMARY OUTPUT

(rounding to 3 decimal places)

Regression Statistics

Multiple R

R Square

Adjusted R

Square

Standard

Error

Observations

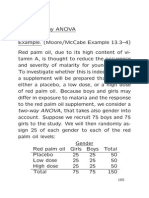

ANOVA

0.989

0.979

0.978

20.283

28

df

SS

MS

Regression

492836.42

7

1197.970

Residual

Total

26

27

492836.42

7

?

Intercept

Time

Coefficient

s

333.993

?

Significance

F

0.000

411.393

503532.640

Standard Error

t Stat

P-value

7.876

0.475

42.405

34.612

0.000

0.000

a) What is the missing seasonal index for quarter 2? Interpret its meaning.

Explain the seasonal impact on the sales.

b) What is the slope of the deseasonalized sales? Interpret its meaning.

Write down the fitted model of the deseasonalized sales. Use X t to

denote the deseasonalized sales in quarter t.

c) What is the root mean squared error?

d) Compute the point forecasts of sales in the 4th quarter of Year 2013.

e) Suppose the future sales are Normal distributed, report the 95% interval

forecast in the 4th quarter of Year 2013.

f) Interpret your forecast results.

Question 2.

American Express was founded in 1850. It is best known for its credit card,

charge card, and travelers cheque businesses. BusinessWeek and Interbrand

ranked American Express as the 22nd most valuable brand in the world,

estimating the brand to be worth US$14.97 billion. Fortune listed Amex as one

of the top 20 Most Admired Companies in the World. The company is also one

of the 30 components of the Dow Jones Industrial Average. (Wikipedia)

Consider the closing price data of American Express in the file T7_Amex.xlsx.

a. Create a time series plot of the data. Based on what you see, which of

the exponential smoothing models do you think should be appropriate?

Why?

T7-2

DSC2008 Business Analytics Data and Decisions

SEM 1, AY2016/2017

b. Use Holt's exponential smoothing to forecast these data, requesting 10

days of future forecasts. Use the default smoothing constants of 0.1.

(Hint: use the initial values of level = 48.30 (price on 2003/10/15) and

trend = 0.)

c. Repeat part b, optimizing the smoothing constants. How do you

interpret these smoothing constants? (Hint: Use excel solver to select

the optimizer of the smoothing constants that minimize MSE. Use the

GRG nonlinear algorithm in Solver. See http://www.youtube.com/watch?

v=zOGfG65ASdA for how to use solver.) Does it make much of an

improvement?

d. Suppose seasonal period is one week, i.e. M=5. Use Holt-Winters

exponential smoothing to forecast these data. Optimize the smoothing

constants that minimize the MSE. (Hint: Use the average value of the

first 5 observations as the initial value for level. Set the initial value of

trend to be zero. Use the ratio of the actual value to the level as the

initial values of seasons. Use the GRG nonlinear algorithm in Solver)

Interpret results.

T7-3

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- 8 Mediation Stages (CHB)Document34 pages8 Mediation Stages (CHB)Ben ChongPas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- DSC2008 Tutorial 6Document1 pageDSC2008 Tutorial 6Ben ChongPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- DSC2008 Tutorial 8Document3 pagesDSC2008 Tutorial 8Ben ChongPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- DSC2008 Tutorial 3Document4 pagesDSC2008 Tutorial 3Ben ChongPas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- DSC2008 Tutorial 5Document5 pagesDSC2008 Tutorial 5Ben ChongPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- DSC2008 Tutorial 4 (Answer)Document11 pagesDSC2008 Tutorial 4 (Answer)Ben ChongPas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- DSC2008 Tutorial 4Document9 pagesDSC2008 Tutorial 4Ben ChongPas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- CBM ReportDocument11 pagesCBM ReportBen ChongPas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Outline of NCM ProjectDocument1 pageOutline of NCM ProjectBen ChongPas encore d'évaluation

- Mark Twain QuotesDocument1 pageMark Twain QuotesBen ChongPas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Research AgendaDocument2 pagesResearch AgendaalyssaPas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Sta404 Chapter 03Document85 pagesSta404 Chapter 03Ibnu IyarPas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- R Programming For Statistics by DR. SOURAV DASDocument8 pagesR Programming For Statistics by DR. SOURAV DASDr. Sourav Das100% (7)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Lecture 1 Multivariate Analysis PDFDocument28 pagesLecture 1 Multivariate Analysis PDFTania Farzana KeyaPas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Interpreting CorrelationDocument13 pagesInterpreting CorrelationAnonymous AQ9cNmPas encore d'évaluation

- Using Heteroskedasticity-Consistent Standar Error Estimators in OLS RegressionDocument14 pagesUsing Heteroskedasticity-Consistent Standar Error Estimators in OLS RegressionCrsitina BolívarPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- STATS 2nd Quarter TutorDocument3 pagesSTATS 2nd Quarter TutorMarisol PoncePas encore d'évaluation

- Introduction To Data Science With PythonDocument2 pagesIntroduction To Data Science With PythonMuhammad AsifPas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Maha Akhtar M57Document11 pagesMaha Akhtar M57maha AkhtarPas encore d'évaluation

- Factors That Contribute To The Effectiveness of Internal Auditing in Public Sectors in Tanzania. A Case of Ubungo District CouncilDocument12 pagesFactors That Contribute To The Effectiveness of Internal Auditing in Public Sectors in Tanzania. A Case of Ubungo District CouncilgrimmPas encore d'évaluation

- 2 Way AnovaDocument20 pages2 Way Anovachawlavishnu100% (1)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Anova - Stats Quiz - AnswerDocument4 pagesAnova - Stats Quiz - AnswerIaiaiaiPas encore d'évaluation

- Quantitative Analysis For Management Ch04Document71 pagesQuantitative Analysis For Management Ch04Qonita Nazhifa100% (1)

- "Financial Performance Analysis of The Axis Bank LTD": A Summer Training Report OnDocument5 pages"Financial Performance Analysis of The Axis Bank LTD": A Summer Training Report OnDinesh ChahalPas encore d'évaluation

- Key Roles and Life CycleDocument4 pagesKey Roles and Life CycleAmanPas encore d'évaluation

- Dmbi FileDocument31 pagesDmbi Fileharnek singhPas encore d'évaluation

- A Rule of Thumb Is ThatDocument4 pagesA Rule of Thumb Is ThatKurabachew GetuPas encore d'évaluation

- Time Series Analysis Using e ViewsDocument131 pagesTime Series Analysis Using e ViewsNabeel Mahdi Aljanabi100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Perform Exploratory Data AnalysisDocument3 pagesPerform Exploratory Data AnalysisJEMILA ROSE R. ITPas encore d'évaluation

- FormulaSheet APStatDocument2 pagesFormulaSheet APStatJulie StevensonPas encore d'évaluation

- Reliability Scale: All Variables Case Processing SummaryDocument5 pagesReliability Scale: All Variables Case Processing SummaryAmsal NasutionPas encore d'évaluation

- SAT ReportDocument117 pagesSAT ReportjamilPas encore d'évaluation

- Sequential Mixed Model Research DesignDocument15 pagesSequential Mixed Model Research DesignDzawo GilbertPas encore d'évaluation

- Unisdrmeframeworkver1.0Document26 pagesUnisdrmeframeworkver1.0Joeban R. Paza100% (1)

- A Study On Financial Statement Analysis ofDocument106 pagesA Study On Financial Statement Analysis ofArjun SinghPas encore d'évaluation

- Andrew Hayes (Process Macro)Document9 pagesAndrew Hayes (Process Macro)Bilal JavedPas encore d'évaluation

- Gold Plus SIP-final 2Document57 pagesGold Plus SIP-final 2Anubhav KumarPas encore d'évaluation

- Final Assignment Business AnalyticsDocument10 pagesFinal Assignment Business AnalyticsSharoar Jahan SakibPas encore d'évaluation

- Viii Sem B.arch. (CBCS - 2018 Scheme) - Detailed SyllabusDocument20 pagesViii Sem B.arch. (CBCS - 2018 Scheme) - Detailed Syllabusbhuneshwar paswanPas encore d'évaluation

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Forecasting 1649193154Document147 pagesForecasting 1649193154Ahmed ElwaseefPas encore d'évaluation